Liquid Packaging Market Report

Published Date: 02 February 2026 | Report Code: liquid-packaging

Liquid Packaging Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Liquid Packaging market, detailing its current state and projected growth from 2023 to 2033. Insights include market size, industry trends, technological advancements, regional analysis, and significant players within the sector.

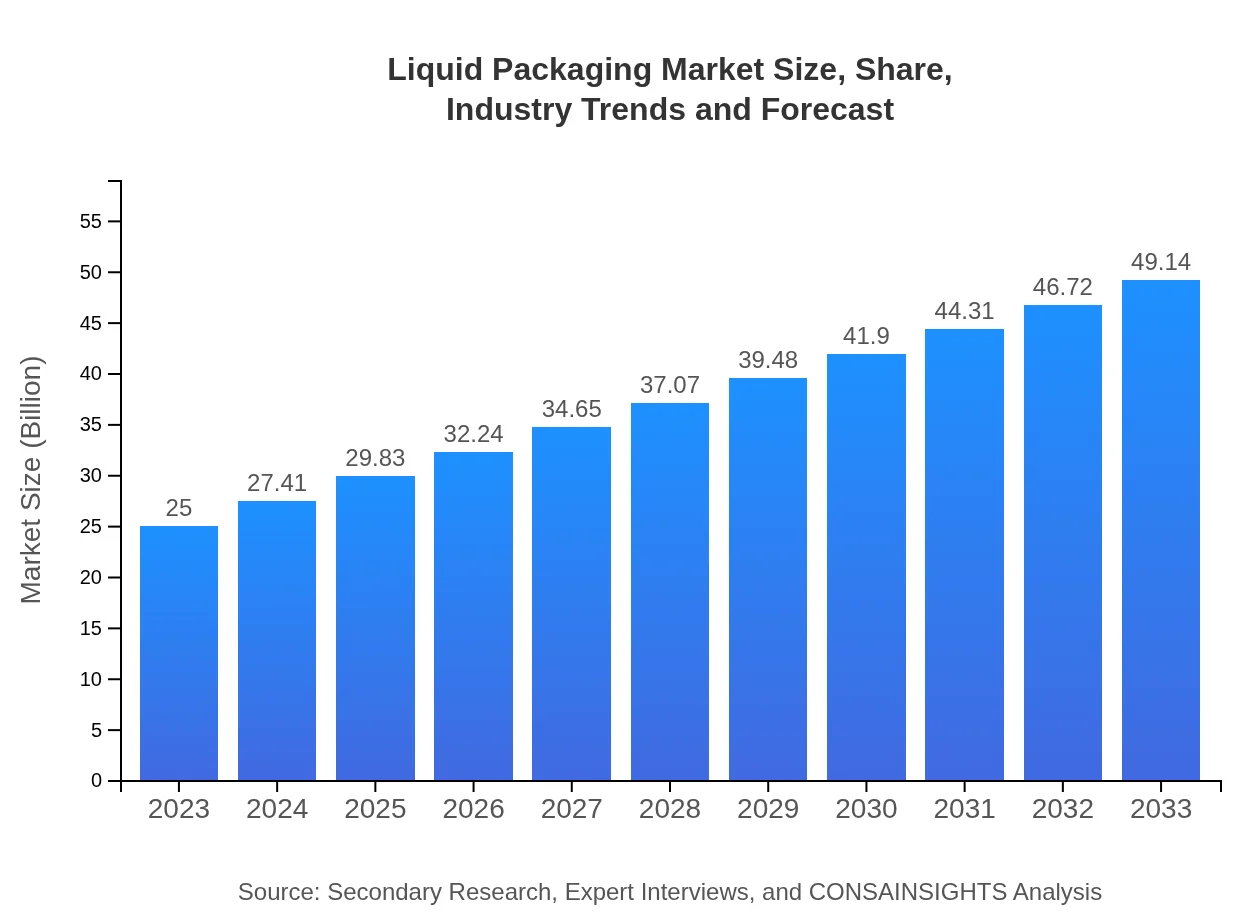

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $25.00 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $49.14 Billion |

| Top Companies | Tetra Pak, Nestlé S.A., Coca-Cola Company, Amcor Limited, Ball Corporation |

| Last Modified Date | 02 February 2026 |

Liquid Packaging Market Overview

Customize Liquid Packaging Market Report market research report

- ✔ Get in-depth analysis of Liquid Packaging market size, growth, and forecasts.

- ✔ Understand Liquid Packaging's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Liquid Packaging

What is the Market Size & CAGR of Liquid Packaging market from 2023 to 2033?

Liquid Packaging Industry Analysis

Liquid Packaging Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Liquid Packaging Market Analysis Report by Region

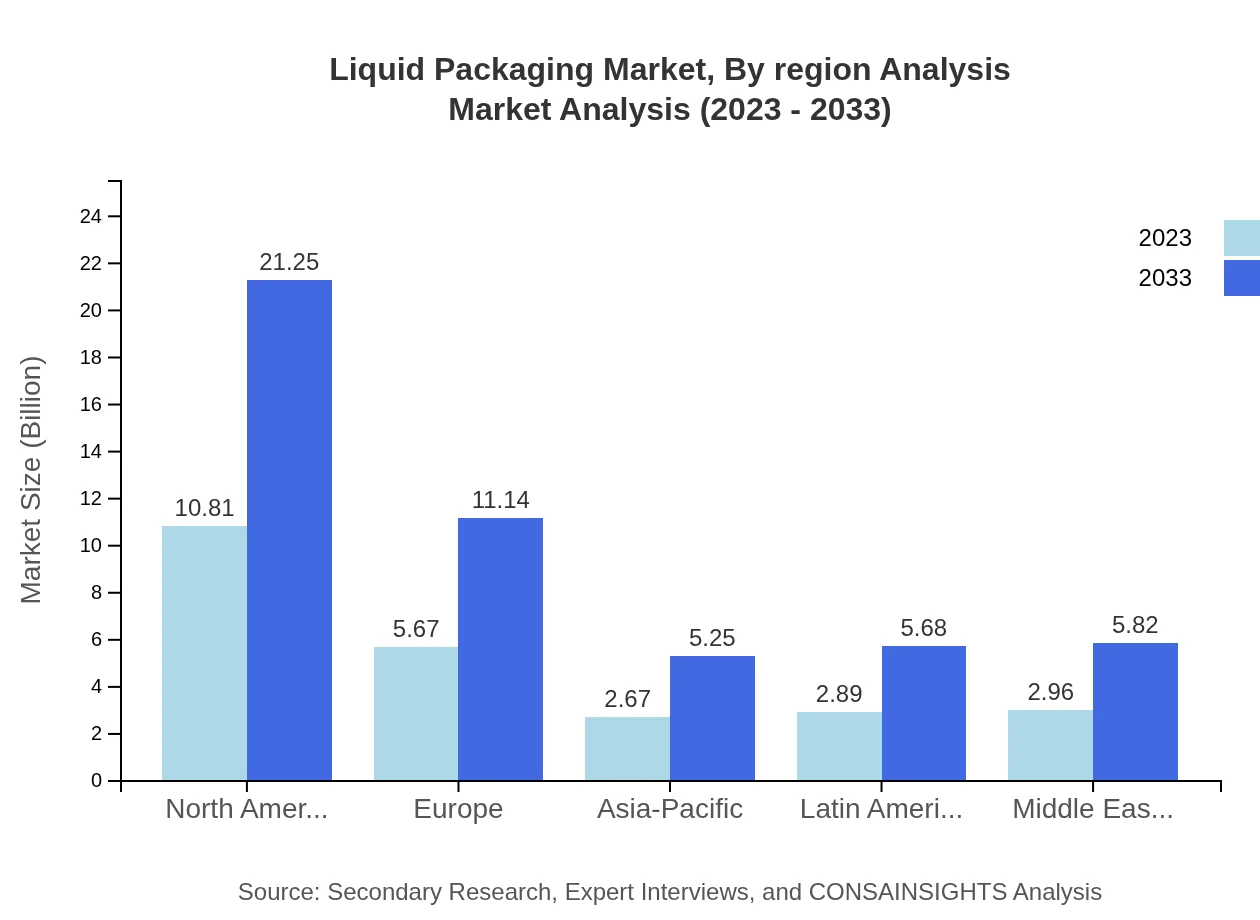

Europe Liquid Packaging Market Report:

In Europe, the market size is anticipated to grow significantly from 7.26 billion USD in 2023 to 14.26 billion USD by 2033. Factors such as stringent environmental regulations and a strong push towards sustainable packaging are propelling the market forward. Additionally, consumer preferences for premium packaged goods foster innovation and competition in this sector.Asia Pacific Liquid Packaging Market Report:

The Asia Pacific region is witnessing rapid growth in the Liquid Packaging market, with a valuation of approximately 4.93 billion USD in 2023, expected to rise to 9.68 billion USD by 2033. This growth is attributed to increasing urbanization, changing consumer lifestyles, and rising disposable incomes, particularly in developing countries like India and China. Innovations in eco-friendly packaging and growing e-commerce platforms are further boosting market demand.North America Liquid Packaging Market Report:

The North American Liquid Packaging market is projected to grow from 8.61 billion USD in 2023 to 16.92 billion USD by 2033, supported by robust consumption patterns in beverages and a strong inclination towards advanced packaging technologies. Sustainability initiatives and regulatory compliance are also pivotal in this region, pushing companies to adopt innovative solutions and materials.South America Liquid Packaging Market Report:

In South America, the Liquid Packaging market is forecasted to grow from 1.65 billion USD in 2023 to 3.24 billion USD by 2033. The region's growth is driven by expanding food and beverage industries, coupled with increasing demand for convenient packaging solutions. However, challenges such as political instability and economic fluctuations may hinder consistent growth.Middle East & Africa Liquid Packaging Market Report:

The Middle East and Africa region is expected to increase its market presence, growing from 2.56 billion USD in 2023 to 5.02 billion USD by 2033. This growth is driven by improvements in supply chain efficiencies and burgeoning demand for packaged goods, particularly in the fast-moving consumer goods (FMCG) sector.Tell us your focus area and get a customized research report.

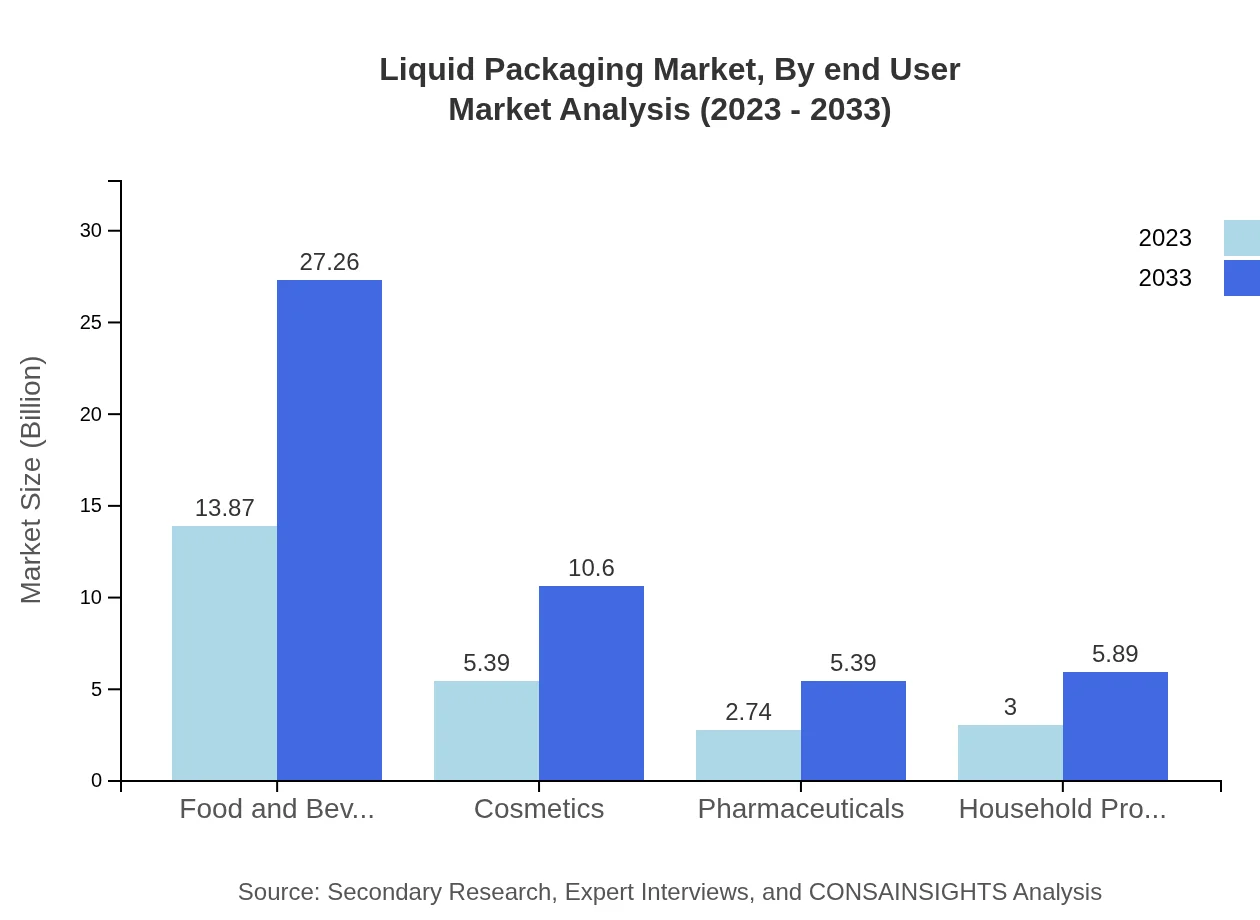

Liquid Packaging Market Analysis By End User

The end-user segments of the Liquid Packaging market include: Food and Beverage, with a market size of 13.87 billion USD in 2023, expected to reach 27.26 billion USD by 2033. Cosmetics accounts for 5.39 billion USD in 2023, with projected growth to 10.60 billion USD by 2033. The Pharmaceuticals segment starts at 2.74 billion USD, estimated to double to 5.39 billion USD within the forecast period. Household Products are anticipated to grow from 3.00 billion USD to 5.89 billion USD by 2033.

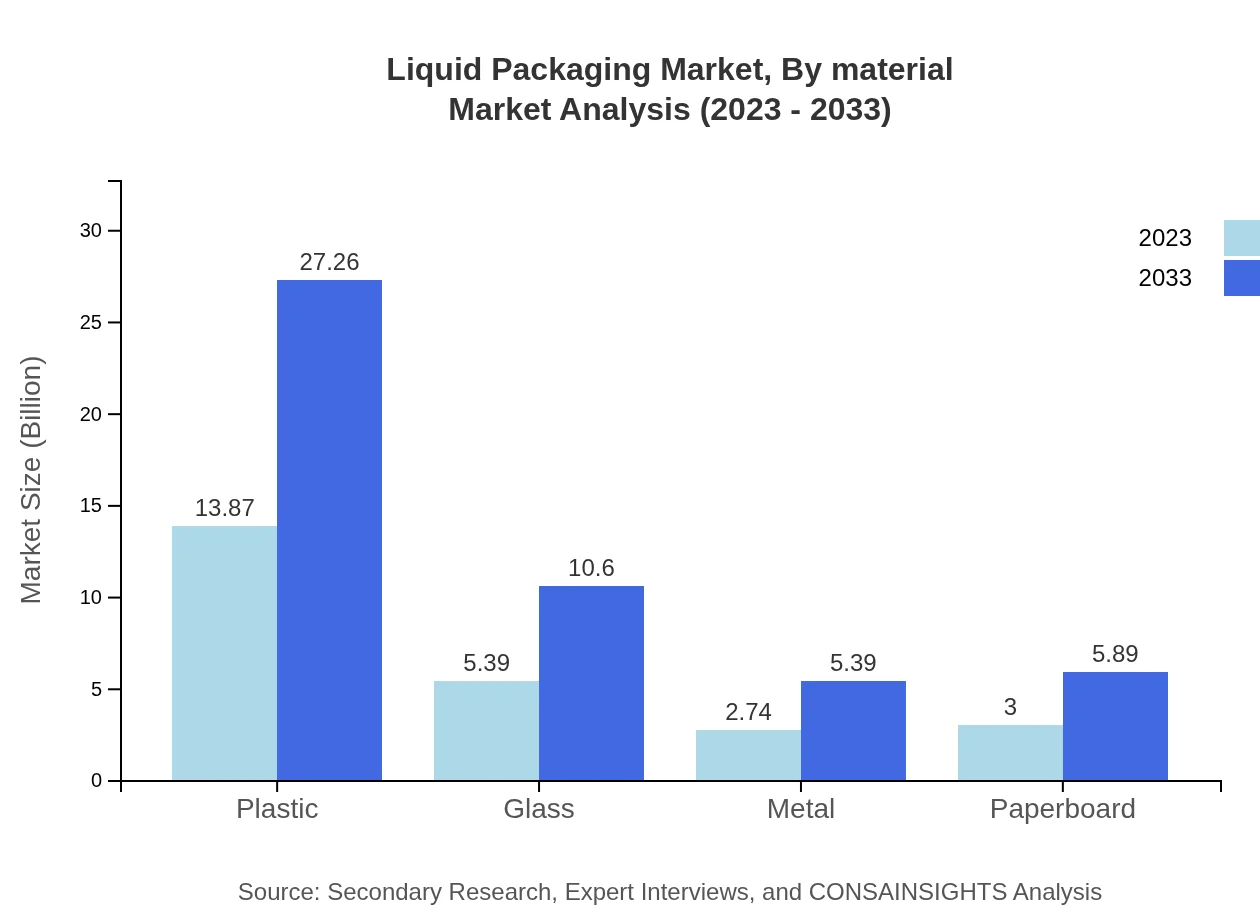

Liquid Packaging Market Analysis By Material

The market segmentation by material includes Plastic, valued at 13.87 billion USD in 2023, projected to climb to 27.26 billion USD by 2033. Glass follows with a value of 5.39 billion USD, anticipated to grow to 10.60 billion USD. Metal and Paperboard also contribute notable figures, starting at 2.74 billion USD and expected to reach 5.39 billion USD, and beginning at 3.00 billion USD with a projection to 5.89 billion USD respectively.

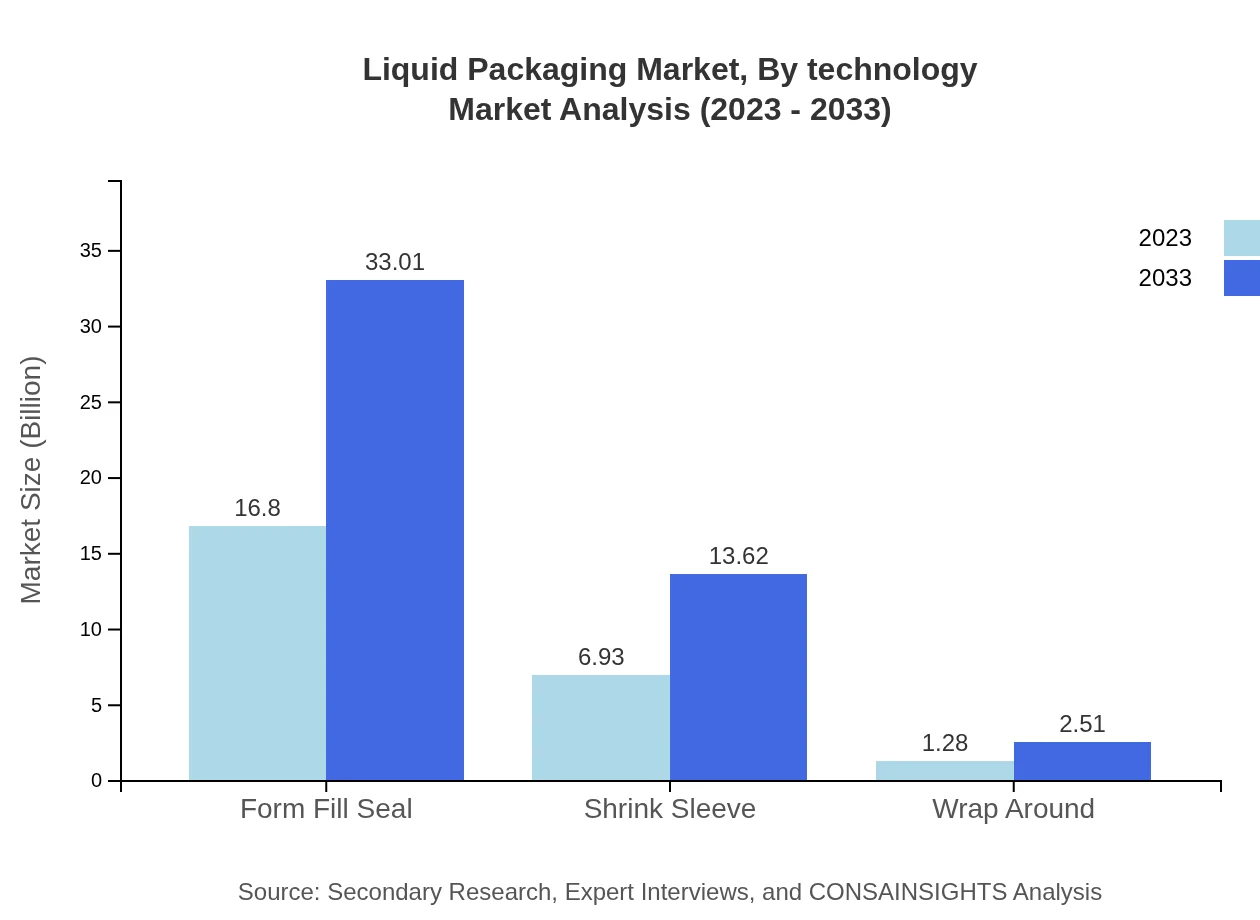

Liquid Packaging Market Analysis By Technology

In Liquid Packaging, the dominant technologies include Form Fill Seal, contributing a market size of 16.80 billion USD in 2023 and expected to grow to 33.01 billion USD by 2033. Shrink Sleeve technology has a current valuation of 6.93 billion USD, projected to reach 13.62 billion USD. Various technological innovations further enhance efficiency and product-driven solutions.

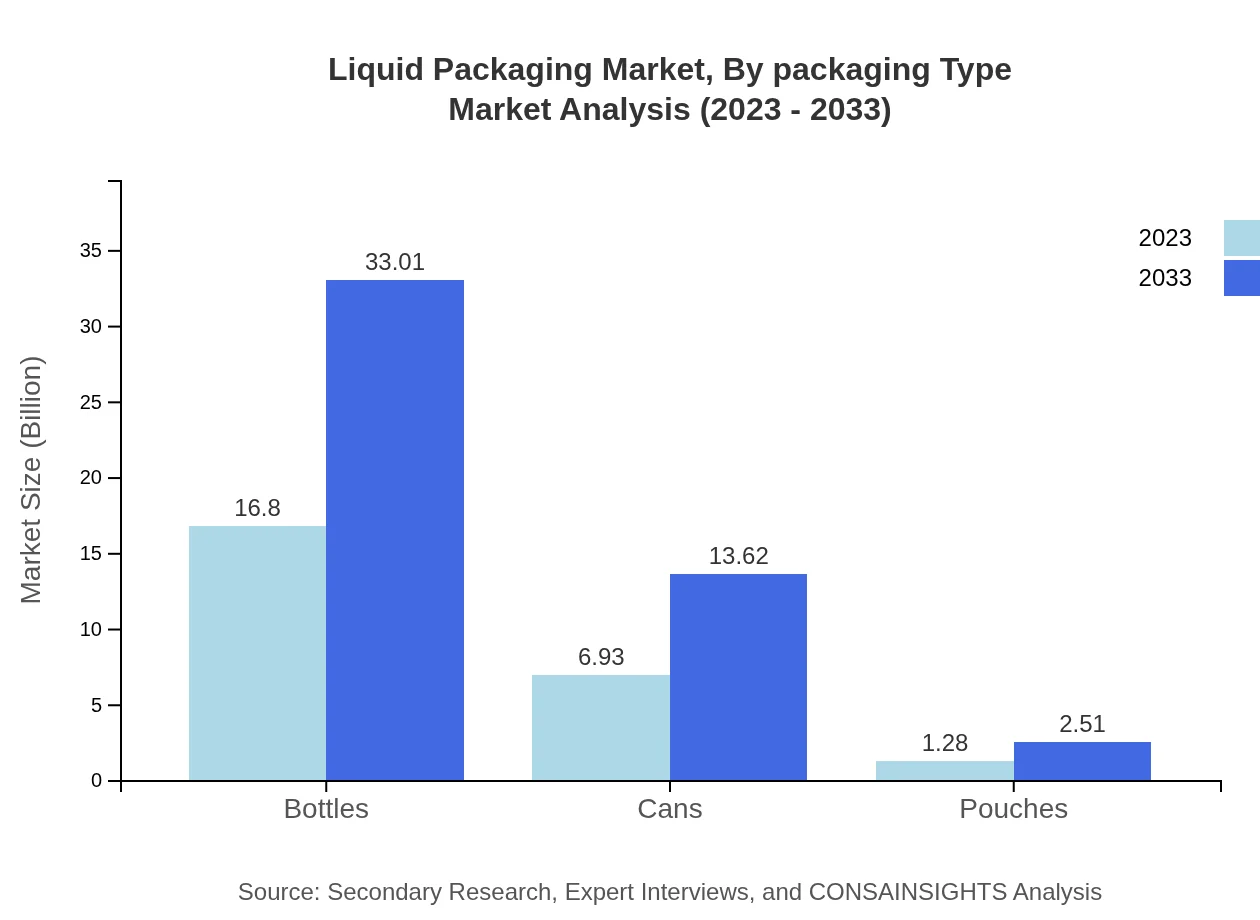

Liquid Packaging Market Analysis By Packaging Type

The primary packaging types include Bottles, which hold a significant portion of the market at 16.80 billion USD in 2023 and 33.01 billion USD by 2033. Cans currently stand at 6.93 billion USD, with growth projected to 13.62 billion USD. Pouches, although smaller, also show potential, growing from 1.28 billion USD to 2.51 billion USD by 2033. These trends reflect consumer preferences toward convenience and portability.

Liquid Packaging Market Analysis By Region Analysis

The analysis of regional markets provides key insights into the unique driver factors including cultural consumption habits, regulatory influences, and technological advancements that impact local demand for liquid packaging. Observing and adapting to these elements will be critical for companies seeking to penetrate or expand within specific markets.

Liquid Packaging Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Liquid Packaging Industry

Tetra Pak:

A leader in liquid food processing and packaging solutions, Tetra Pak invests heavily in sustainability and innovative packaging technologies.Nestlé S.A.:

A global food and beverage leader, Nestlé integrates sustainable liquid packaging across its product lines, bolstering consumer demand.Coca-Cola Company:

Renowned for beverages, Coca-Cola employs diverse packaging solutions, emphasizing sustainability and innovation.Amcor Limited:

A global packaging company providing flexible and rigid packaging solutions, Amcor prioritizes ecological considerations in liquid packaging.Ball Corporation:

Specializing in metal packaging for beverages, Ball Corporation leads in innovation, offering environmentally friendly packaging solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of liquid Packaging?

The liquid packaging market is projected to reach approximately $25 billion by 2033, growing at a CAGR of 6.8% from 2023 to 2033.

What are the key market players or companies in this liquid Packaging industry?

Key players in the liquid packaging market include major companies such as Amcor plc, Tetra Pak International S.A., Crown Holdings Inc., and Sealed Air Corporation, among others.

What are the primary factors driving the growth in the liquid Packaging industry?

The growth in the liquid packaging industry is driven by increasing demand for convenience in packaging, growth in the food and beverage sector, and a rising focus on sustainable packaging solutions.

Which region is the fastest Growing in the liquid Packaging?

The Asia Pacific region is the fastest-growing market for liquid packaging, expected to grow from $4.93 billion in 2023 to $9.68 billion by 2033.

Does ConsaInsights provide customized market report data for the liquid Packaging industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the liquid packaging industry, providing detailed insights and analysis.

What deliverables can I expect from this liquid Packaging market research project?

Deliverables from the liquid packaging market research project include comprehensive market analysis, trend reports, segment data, and regional insights to help inform business strategies.

What are the market trends of liquid Packaging?

Current market trends in liquid packaging include innovation in eco-friendly materials, increased automation in packaging processes, and rising demand for smart packaging solutions.