Long Fiber Thermoset Composites Market Report

Published Date: 02 February 2026 | Report Code: long-fiber-thermoset-composites

Long Fiber Thermoset Composites Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Long Fiber Thermoset Composites market, covering insights on market size, growth trends, segmentation, and regional performance from 2023 to 2033.

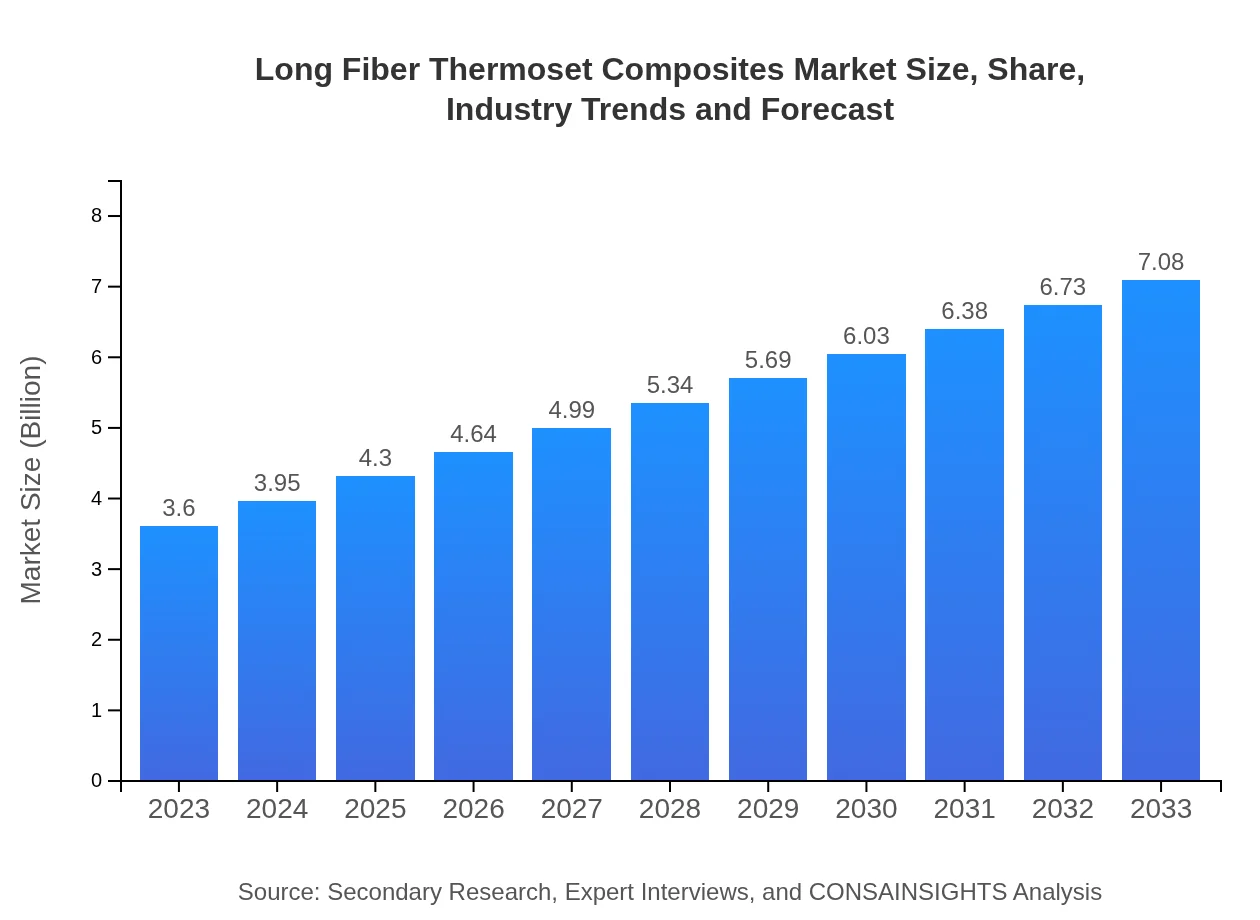

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.60 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $7.08 Billion |

| Top Companies | Toray Industries, Inc., SABIC, Solvay S.A., Hexion, Inc. |

| Last Modified Date | 02 February 2026 |

Long Fiber Thermoset Composites Market Overview

Customize Long Fiber Thermoset Composites Market Report market research report

- ✔ Get in-depth analysis of Long Fiber Thermoset Composites market size, growth, and forecasts.

- ✔ Understand Long Fiber Thermoset Composites's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Long Fiber Thermoset Composites

What is the Market Size & CAGR of Long Fiber Thermoset Composites market in 2023?

Long Fiber Thermoset Composites Industry Analysis

Long Fiber Thermoset Composites Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Long Fiber Thermoset Composites Market Analysis Report by Region

Europe Long Fiber Thermoset Composites Market Report:

Europe is forecasted to grow from $1.01 billion in 2023 to $1.99 billion by 2033. The region's stringent regulations regarding emissions and environmental impact propel the demand for advanced composite materials, particularly in the automotive and aerospace sectors.Asia Pacific Long Fiber Thermoset Composites Market Report:

In the Asia Pacific region, the Long Fiber Thermoset Composites market is projected to grow from $0.76 billion in 2023 to $1.50 billion by 2033, driven by increasing automotive production and rising demand for lightweight materials in various applications. Countries like China and India are significant contributors, focusing on advanced manufacturing capabilities and innovation.North America Long Fiber Thermoset Composites Market Report:

North America's market for Long Fiber Thermoset Composites is anticipated to expand from $1.18 billion in 2023 to $2.31 billion by 2033. This growth is largely attributed to the aerospace and automotive industries, which emphasize lightweighting and performance enhancement as key strategies.South America Long Fiber Thermoset Composites Market Report:

The South American market, although smaller, is expected to double from $0.24 billion in 2023 to $0.46 billion by 2033. Growing investments in the construction and automotive sectors are driving demand, supported by an increasing shift towards sustainable materials.Middle East & Africa Long Fiber Thermoset Composites Market Report:

The Middle East and Africa market is expected to progress from $0.41 billion in 2023 to $0.80 billion by 2033. Growth in construction and automotive demand, alongside increasing awareness of composite materials' benefits, is expected to drive market expansion in this region.Tell us your focus area and get a customized research report.

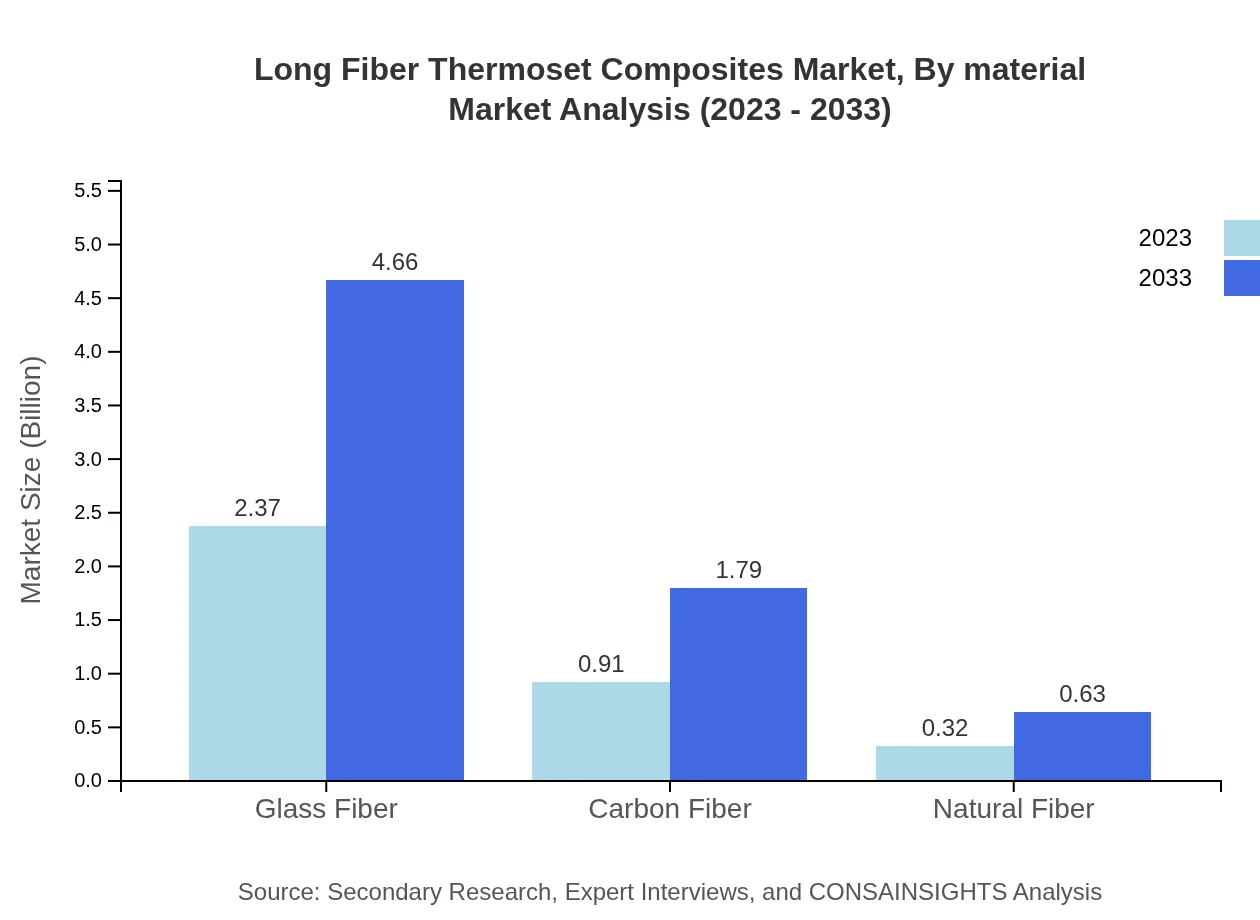

Long Fiber Thermoset Composites Market Analysis By Material

In 2023, the market for glass fiber dominates with a size of $2.37 billion, accounting for a 65.79% share. By 2033, it is expected to reach $4.66 billion. Carbon fiber, valued at $0.91 billion in 2023 with a 25.31% share, will grow to $1.79 billion by 2033. Natural fiber will see an increase from $0.32 billion to $0.63 billion, holding an 8.9% market share.

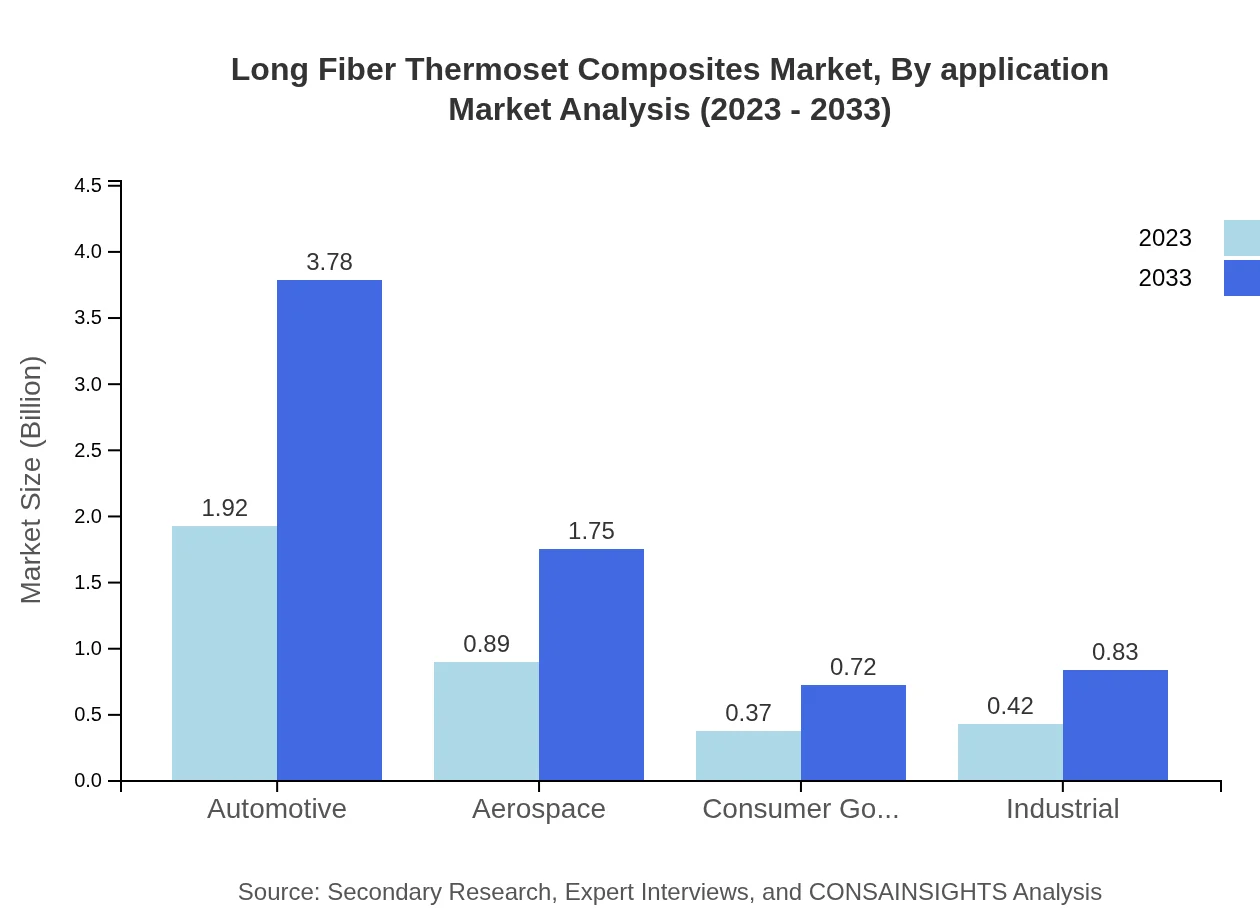

Long Fiber Thermoset Composites Market Analysis By Application

The automotive application leads with a market size of $1.92 billion in 2023 and projected growth to $3.78 billion by 2033, representing a 53.43% share. The aerospace application follows, starting at $0.89 billion and increasing to $1.75 billion (24.68% share). Consumer goods and industrial applications also contribute, with sizes of $0.37 billion to $0.72 billion (10.16% share) and $0.42 billion to $0.83 billion (11.73% share), respectively.

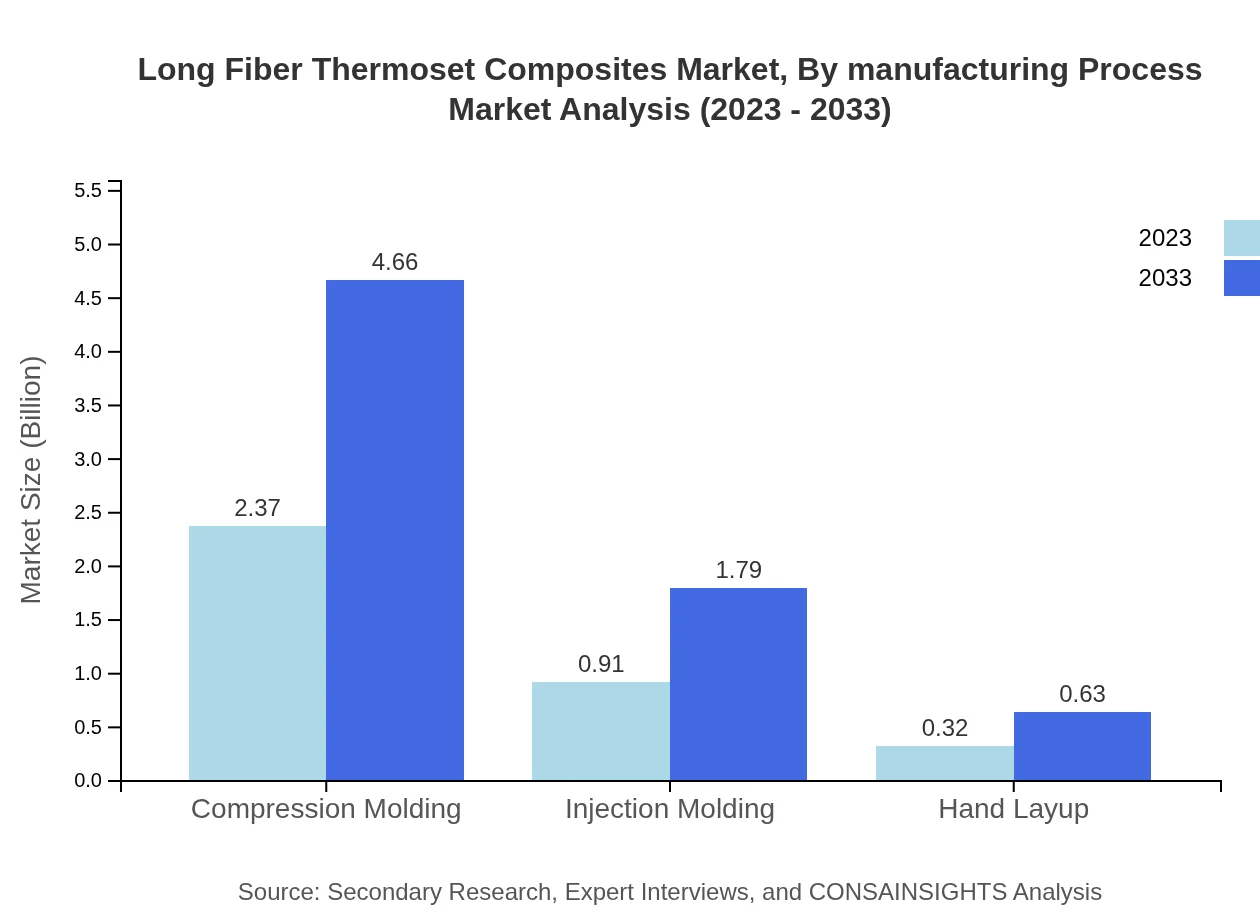

Long Fiber Thermoset Composites Market Analysis By Manufacturing Process

Compression molding leads the manufacturing process with a size of $2.37 billion in 2023, projected to reach $4.66 billion by 2033, holding a 65.79% market share. Injection molding follows with $0.91 billion in 2023, growing to $1.79 billion (25.31% share). Hand layup is expected to grow from $0.32 billion to $0.63 billion (8.9% share) in the same period.

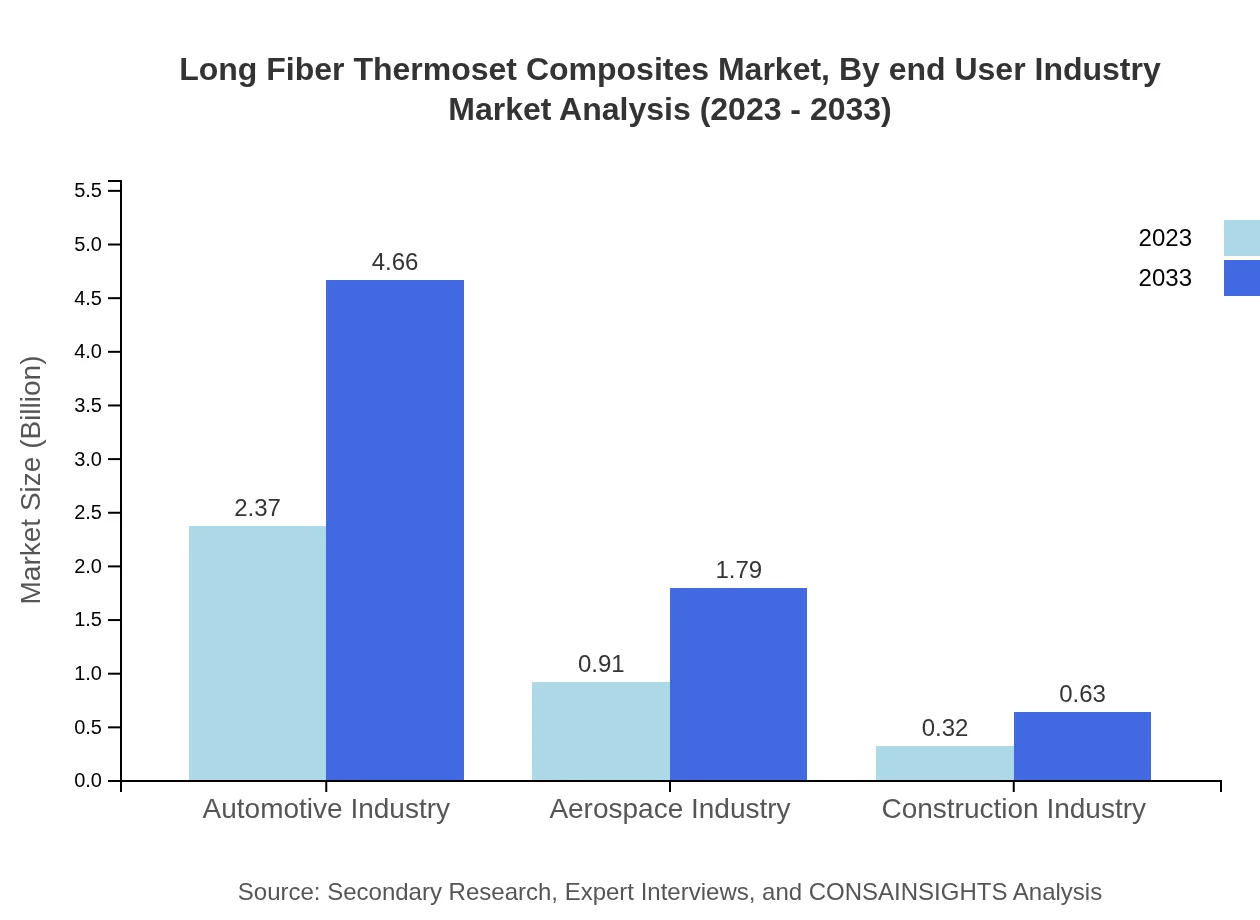

Long Fiber Thermoset Composites Market Analysis By End User Industry

In 2023, the automotive industry accounts for $2.37 billion with an impressive 65.79% share, set to increase to $4.66 billion by 2033. Aerospace stands at $0.91 billion (25.31% share), projected to reach $1.79 billion. The construction industry shows potential growth from $0.32 billion to $0.63 billion (8.9% share).

Long Fiber Thermoset Composites Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Long Fiber Thermoset Composites Industry

Toray Industries, Inc.:

A global leader in carbon fiber production and advanced composites, Toray emphasizes sustainable manufacturing practices to enhance product performance and ecological impact.SABIC:

Specializing in innovative plastics and composites, SABIC focuses on developing high-performance materials for diverse industries, including automotive and consumer goods.Solvay S.A.:

A key player in advanced materials, Solvay provides innovative solutions in composites, catering to the aerospace and automotive sectors.Hexion, Inc.:

Hexion leads in thermoset resin technologies, producing materials used in various composites to enhance mechanical properties and performance.We're grateful to work with incredible clients.

FAQs

What is the market size of Long-Fiber-Thermoset-Composites?

The Long Fiber Thermoset Composites market is valued at approximately $3.6 billion in 2023, with a projected CAGR of 6.8% leading to significant growth by 2033.

What are the key market players or companies in this Long-Fiber-Thermoset-Composites industry?

Key market players in the Long Fiber Thermoset Composites industry include major manufacturers and suppliers specializing in composite materials, automotive applications, and aerospace technologies, contributing to advancements in production and innovation.

What are the primary factors driving the growth in the Long-Fiber-Thermoset-Composites industry?

Growth in the Long Fiber Thermoset Composites industry is driven by increasing demand in the automotive and aerospace sectors, advancements in manufacturing processes, and a growing preference for lightweight, high-strength materials.

Which region is the fastest Growing in the Long-Fiber-Thermoset-Composites?

The fastest-growing region for Long Fiber Thermoset Composites is North America, projected to grow from $1.18 billion in 2023 to $2.31 billion by 2033, closely followed by Europe and Asia Pacific.

Does ConsaInsights provide customized market report data for the Long-Fiber-Thermoset-Composites industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs within the Long Fiber Thermoset Composites industry, allowing clients to gain unique insights and data applicable to individual business goals.

What deliverables can I expect from this Long-Fiber-Thermoset-Composites market research project?

Deliverables from the Long Fiber Thermoset Composites market research project typically include detailed reports, analytical insights, market forecasts, segment analysis, and strategic recommendations to support decision-making processes.

What are the market trends of Long-Fiber-Thermoset-Composites?

Key market trends in Long Fiber Thermoset Composites include a shift towards sustainable materials, innovations in manufacturing techniques such as compression and injection molding, and increased applications across various industries like automotive and aerospace.