Main Battle Tank Market Report

Published Date: 03 February 2026 | Report Code: main-battle-tank

Main Battle Tank Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Main Battle Tank market, covering market dynamics, segmentation, key players, and trends from 2023 to 2033, along with regional insights and future forecasts.

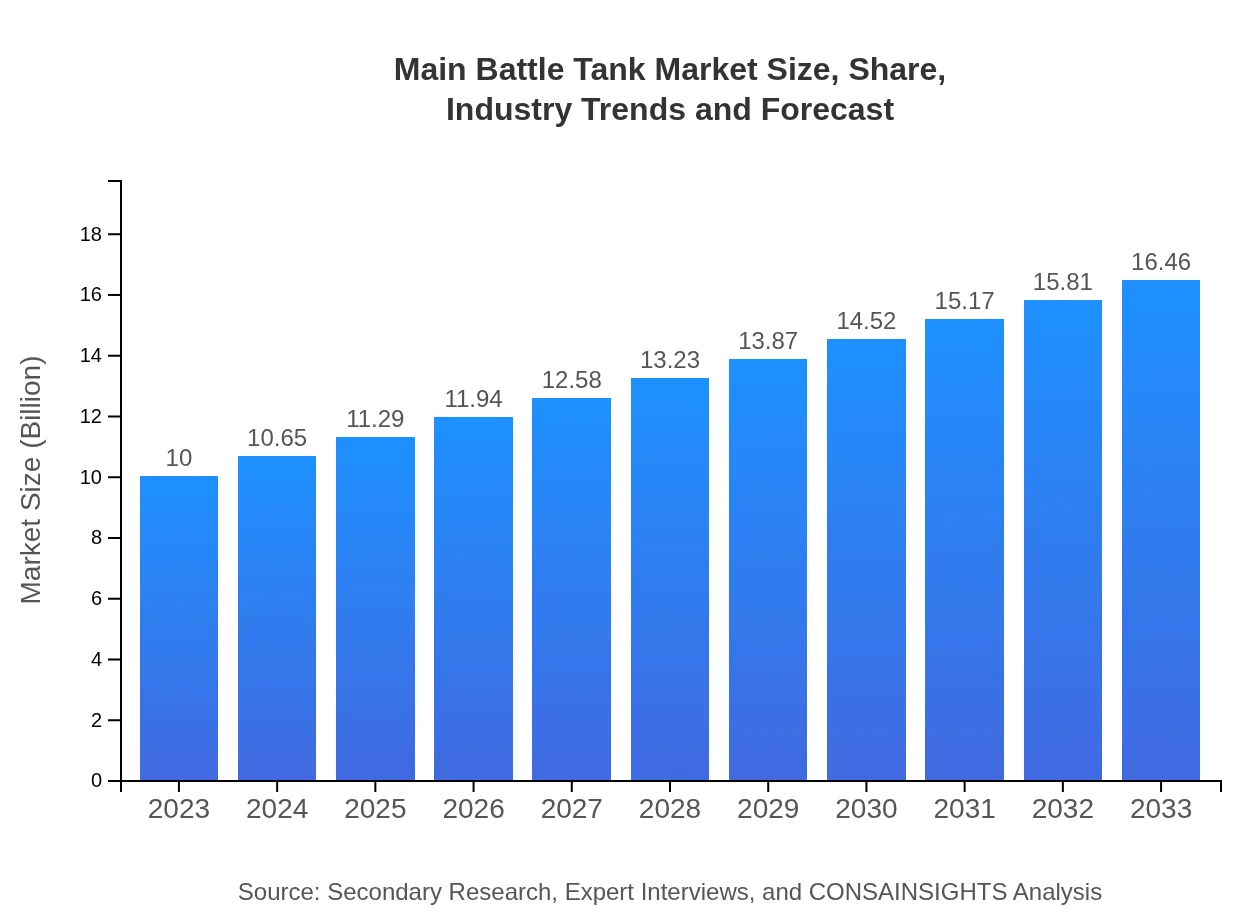

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $16.46 Billion |

| Top Companies | General Dynamics Land Systems, BAE Systems, Rheinmetall AG, KMW |

| Last Modified Date | 03 February 2026 |

Main Battle Tank Market Overview

Customize Main Battle Tank Market Report market research report

- ✔ Get in-depth analysis of Main Battle Tank market size, growth, and forecasts.

- ✔ Understand Main Battle Tank's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Main Battle Tank

What is the Market Size & CAGR of Main Battle Tank market in 2023?

Main Battle Tank Industry Analysis

Main Battle Tank Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Main Battle Tank Market Analysis Report by Region

Europe Main Battle Tank Market Report:

The European market is projected to expand significantly from $2.58 billion in 2023 to $4.25 billion by 2033, supported by NATO's emphasis on collective defense and the enhancement of armored capabilities across member countries amid escalating tensions with Russia.Asia Pacific Main Battle Tank Market Report:

In the Asia-Pacific region, the Main Battle Tank market is projected to grow from $2.10 billion in 2023 to $3.45 billion by 2033, reflecting a robust CAGR fueled by increasing military budgets and modernization programs in countries like India and China. Enhanced defense collaborations and regional tensions drive investments in MBT procurements.North America Main Battle Tank Market Report:

North America leads the market, with a substantial increase from $3.58 billion in 2023 to $5.89 billion by 2033. This growth is primarily driven by the U.S. military's ongoing modernization initiatives and the replacement of aging tank fleets to maintain strategic superiority.South America Main Battle Tank Market Report:

South America’s market for Main Battle Tanks, growing from $0.63 billion in 2023 to $1.03 billion in 2033, is modest yet promising. Countries like Brazil are focused on upgrading their armored fleets amidst rising security concerns, particularly regarding border security and terrorism.Middle East & Africa Main Battle Tank Market Report:

In the Middle East and Africa, the market will grow from $1.12 billion in 2023 to $1.84 billion by 2033. The ongoing conflicts in the region and the desire for enhanced homeland security motivate countries to invest in advanced MBT technologies.Tell us your focus area and get a customized research report.

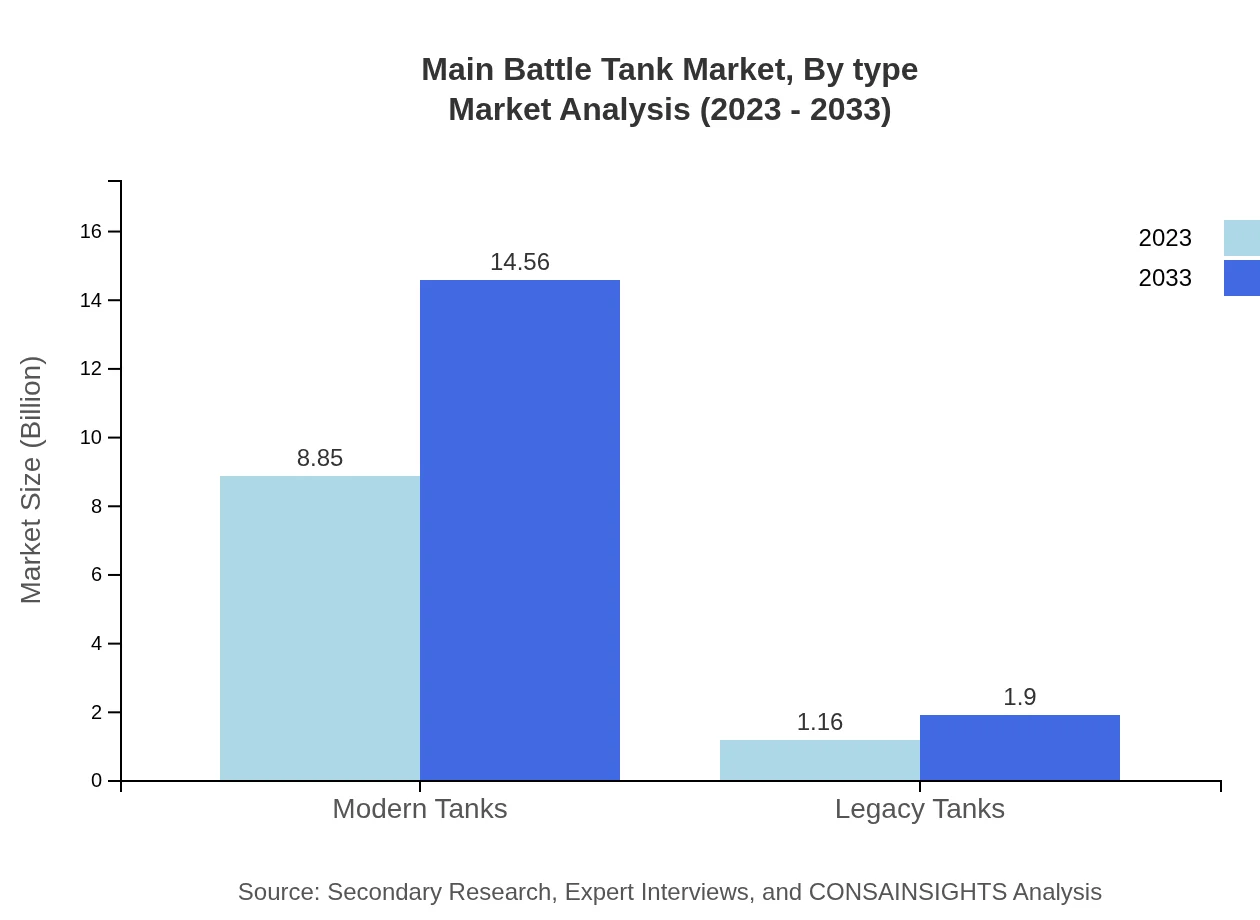

Main Battle Tank Market Analysis By Type

The segment analysis highlights the dominance of Modern Tanks in the market, with market size projected to grow from $8.85 billion in 2023 to $14.56 billion by 2033, accounting for 88.45% of the market share. Legacy Tanks represent a smaller segment, growing from $1.16 billion to $1.90 billion at a share of 11.55%. The trend indicates a clear pivot towards advanced, technologically superior systems.

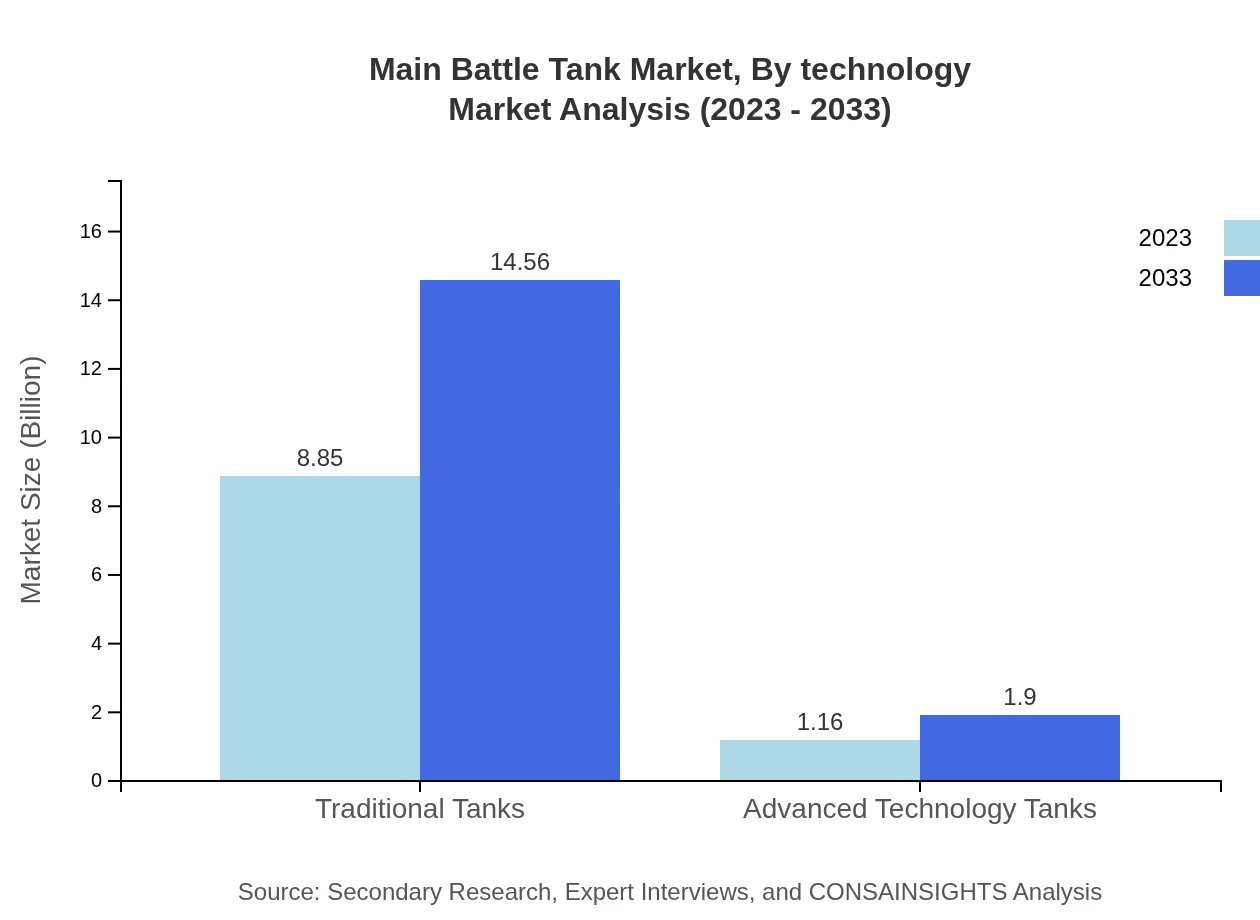

Main Battle Tank Market Analysis By Technology

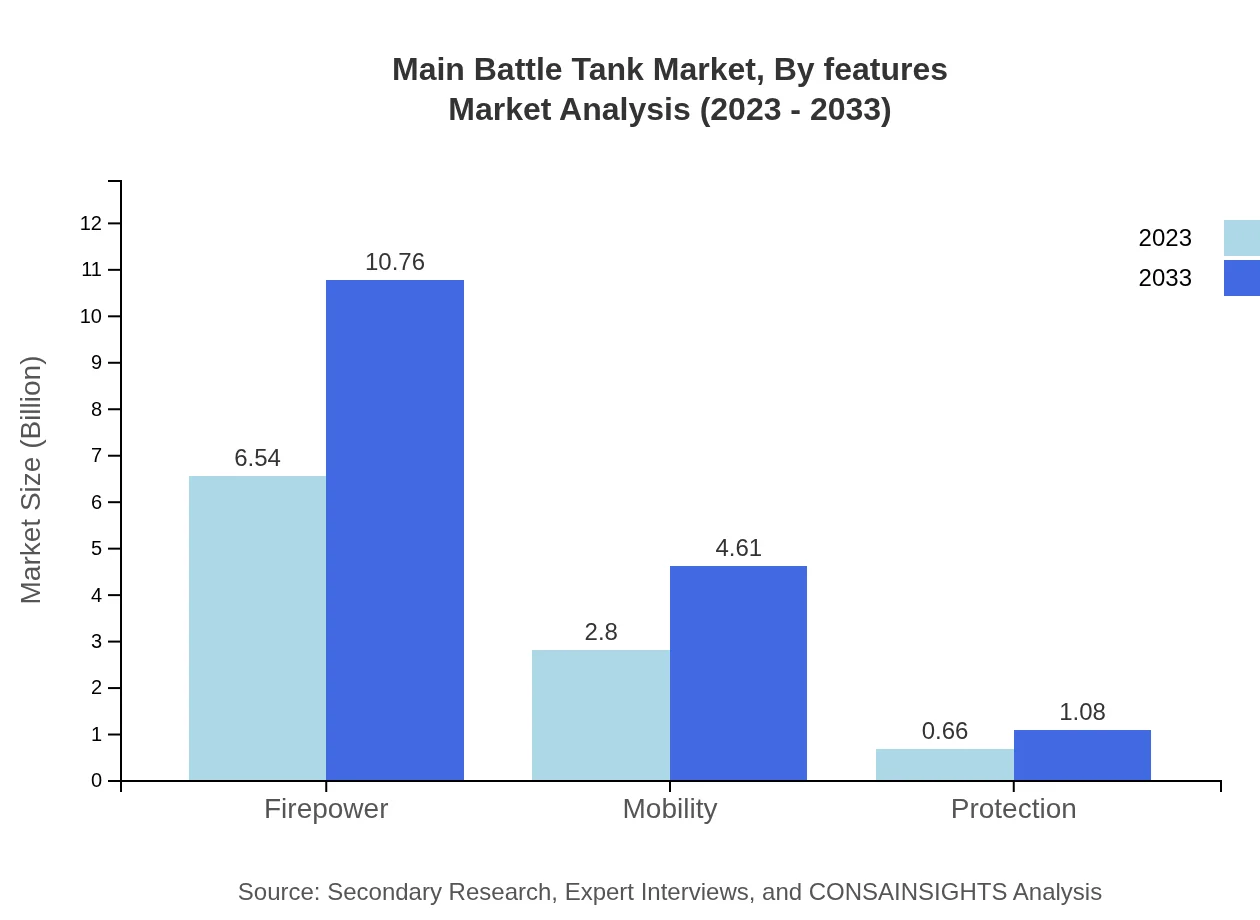

Technological advancements in the MBT sector significantly impact market dynamics. The Firepower segment, inclusive of advanced weapon systems, is projected to reach $10.76 billion by 2033 from $6.54 billion in 2023, representing 65.39% market share. The Mobility and Protection segments are also critical, showing a steady increase as militaries prioritize maneuverability and armored protection in modern combat scenarios.

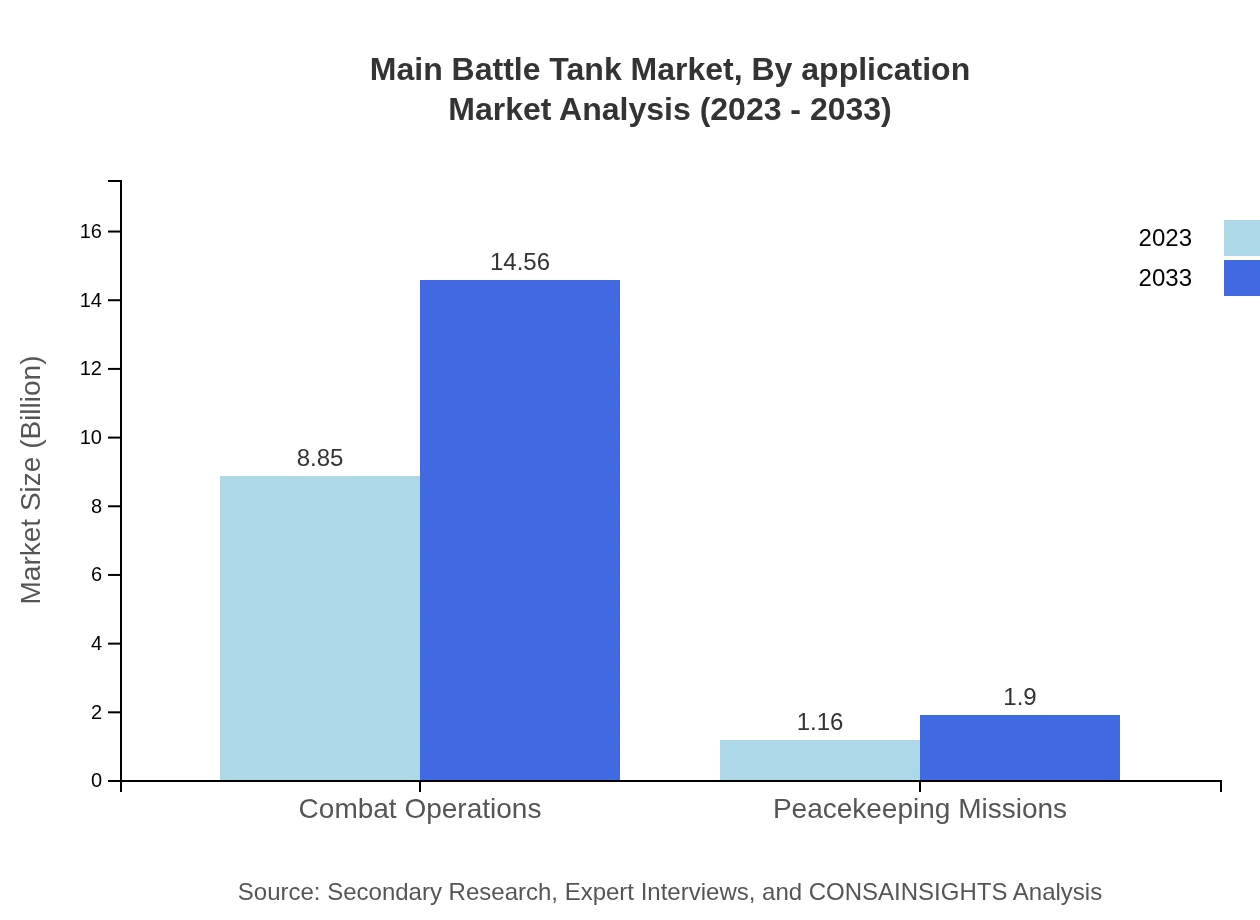

Main Battle Tank Market Analysis By Application

Analysis showcases that Combat Operations represent a vital application area for MBTs, with a market size of $8.85 billion in 2023 expected to climb to $14.56 billion by 2033, denoting 88.45% of market share. Peacekeeping Missions also reflect steady growth, moving from $1.16 billion to $1.90 billion, illustrating the dual role of tanks in active conflict scenarios and stabilization operations.

Main Battle Tank Market Analysis By Features

In market analysis by features, tanks with superior technology aimed at Combat Operations exhibit substantial growth. Traditional Tanks dominate the market with a size of $8.85 billion in 2023 to $14.56 billion in 2033 whereas Advanced Technology Tanks focus on innovations and new features grow moderately at a size of $1.16 billion to $1.90 billion over the same period.

Main Battle Tank Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Main Battle Tank Industry

General Dynamics Land Systems:

A key player in the MBT market, General Dynamics has developed the M1 Abrams, a highly advanced tank known for its firepower and protection capabilities.BAE Systems:

This British defense, security and aerospace company produces the Challenger 2 tank and focuses on modernization projects for existing MBT systems.Rheinmetall AG:

Rheinmetall specializes in the development of advanced mobility and logistics solutions, producing various artillery systems integrated into their main battle tanks.KMW:

Krauss-Maffei Wegmann is notable for the Leopard 2 main battle tank, used by many NATO countries, contributing to international armored capabilities.We're grateful to work with incredible clients.

FAQs

What is the market size of Main Battle Tank?

The global market size for Main Battle Tanks is valued at USD 10 billion in 2023 and is projected to reach USD 16.3 billion by 2033, with a CAGR of 5% over the period.

What are the key market players or companies in this Main Battle Tank industry?

Key players in the Main Battle Tank market include leading manufacturers such as BAE Systems, General Dynamics Corporation, and Rheinmetall AG, which drive innovation and technology in armored vehicle production.

What are the primary factors driving the growth in the Main Battle Tank industry?

Factors driving growth in the Main Battle Tank market include increasing defense budgets worldwide, rising geopolitical tensions, and the need for advanced armored capabilities by modern military forces.

Which region is the fastest Growing in the Main Battle Tank?

The fastest-growing region in the Main Battle Tank market is North America, anticipated to grow from USD 3.58 billion in 2023 to USD 5.89 billion by 2033, reflecting a strategic emphasis on military readiness.

Does ConsaInsights provide customized market report data for the Main Battle Tank industry?

Yes, ConsaInsights offers customized market research reports tailored to specific needs, encompassing detailed insights, forecasts, and analyses specific to the Main Battle Tank industry.

What deliverables can I expect from this Main Battle Tank market research project?

Deliverables from the Main Battle Tank market research project typically include comprehensive reports, detailed statistical data, analysis of trends, competitive landscape evaluations, and actionable insights.

What are the market trends of Main Battle Tank?

Current trends in the Main Battle Tank market include the shift towards modern tanks, increased focus on advanced technologies like AI and automation, and a growing emphasis on mobility and protection capabilities.