Open Banking Platforms

Published Date: 02 February 2026 | Report Code: open-banking-platforms

Open Banking Platforms Market Size, Share, Industry Trends and Forecast to 2033

This detailed report on Open Banking Platforms provides comprehensive insights into market dynamics, trends, technological innovations, and regional developments. Covering the forecast period from 2024 to 2033, it offers a deep dive into market size, growth drivers, segmentation, and competitive landscapes, assisting industry stakeholders in informed decision making and strategic planning.

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

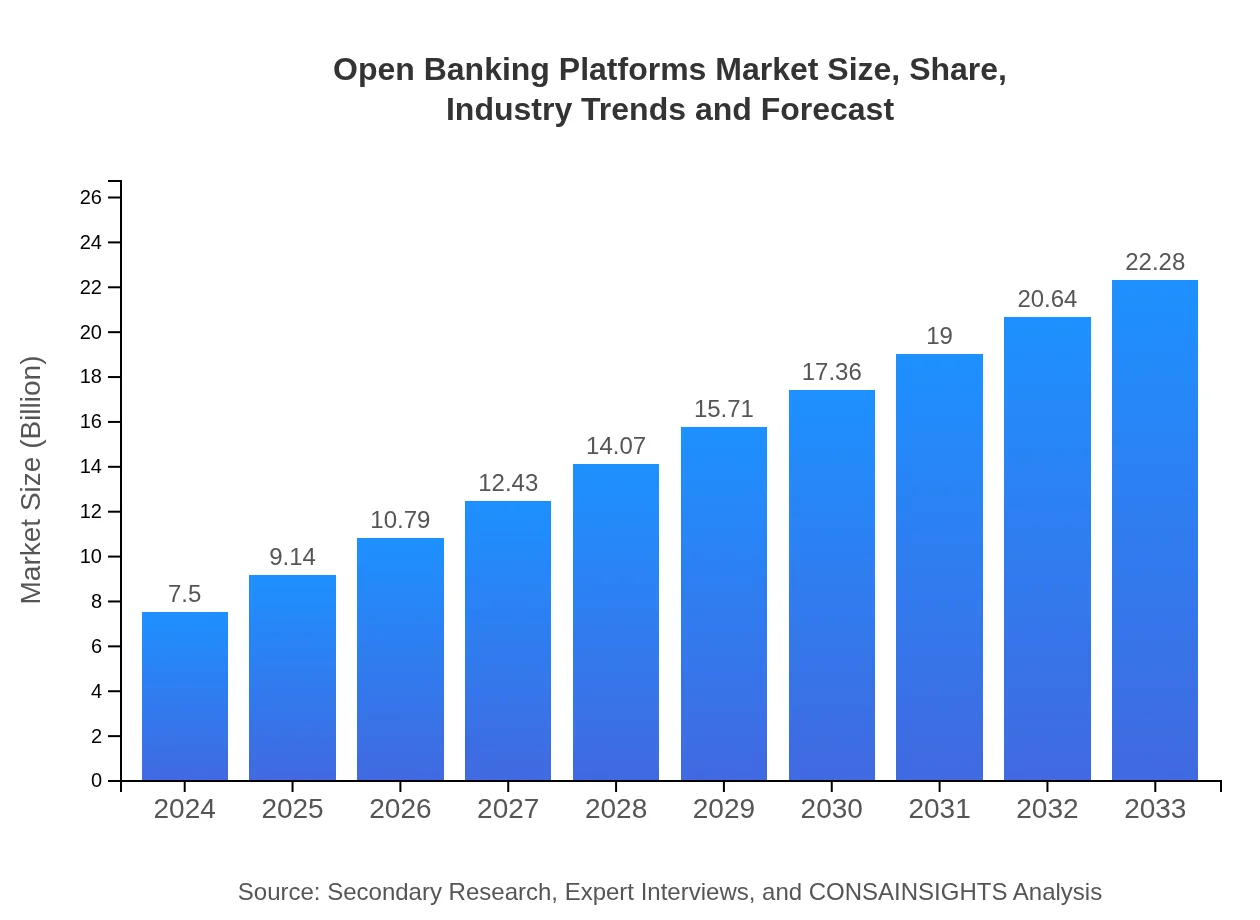

| 2024 Market Size | $7.50 Billion |

| CAGR (2024-2033) | 12.3% |

| 2033 Market Size | $22.28 Billion |

| Top Companies | FinTech Innovations Inc., Secure BankTech Solutions, Global API Connect |

| Last Modified Date | 02 February 2026 |

Open Banking Platforms Market Overview

Customize Open Banking Platforms market research report

- ✔ Get in-depth analysis of Open Banking Platforms market size, growth, and forecasts.

- ✔ Understand Open Banking Platforms's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Open Banking Platforms

What is the Market Size & CAGR of Open Banking Platforms market in 2024?

Open Banking Platforms Industry Analysis

Open Banking Platforms Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Open Banking Platforms Market Analysis Report by Region

Europe Open Banking Platforms:

Europe is at the forefront of the open banking revolution, where a market size of 2.04 in 2024 is set to expand to 6.05 by 2033. Stringent regulatory measures such as PSD2 have catalyzed the transition towards more transparent and secure banking practices. European countries are leveraging strong digital infrastructures and a culture of innovation to drive market expansion. Collaborative ecosystem models between traditional banks and fintech providers are a standout trend, facilitating rapid development of scalable, secure, and customer-friendly banking solutions.Asia Pacific Open Banking Platforms:

In the Asia Pacific region, the market is experiencing strong growth, driven by rapid digital transformation and increasing adoption of fintech solutions. In 2024, the market was valued at 1.48, growing to an estimated 4.39 by 2033. The region’s rising smartphone penetration, supportive government policies, and innovative startup ecosystem are key contributors. In addition, the willingness of traditional banks to embrace open banking frameworks further propels market expansion and improves competitive dynamics globally.North America Open Banking Platforms:

North America remains one of the leading regions in the adoption of Open Banking Platforms, with a market size growing from 2.68 in 2024 to an estimated 7.96 by 2033. This growth is largely fueled by a mature financial ecosystem, significant R&D investments, and an accelerated pace in technology innovation. Major banks and fintech companies in the region are actively collaborating to develop robust API infrastructures, enhancing customer experiences and operational efficiencies. These factors collectively support a stable yet competitive market environment.South America Open Banking Platforms:

South America presents promising opportunities as local financial institutions and digital banks increasingly adopt open banking principles. With a starting market size of 0.44 in 2024 and projected growth to 1.31 by 2033, the region has seen rising consumer awareness and regulatory initiatives that encourage interoperability. Challenges such as infrastructure limitations and uneven regulatory environments remain; however, ongoing investments in technology and partnerships with fintech innovators are expected to drive significant improvements.Middle East & Africa Open Banking Platforms:

The Middle East and Africa region is emerging as a new frontier for Open Banking Platforms, with market valuations rising from 0.86 in 2024 to an anticipated 2.57 by 2033. Despite challenges such as fragmented regulatory frameworks and varying technological adoption rates, the region is experiencing a surge as governments and financial institutions prioritize digital transformation. Initiatives aimed at fostering financial inclusion and modernizing legacy systems are gradually laying the groundwork for substantial growth and increased competitiveness on a global scale.Tell us your focus area and get a customized research report.

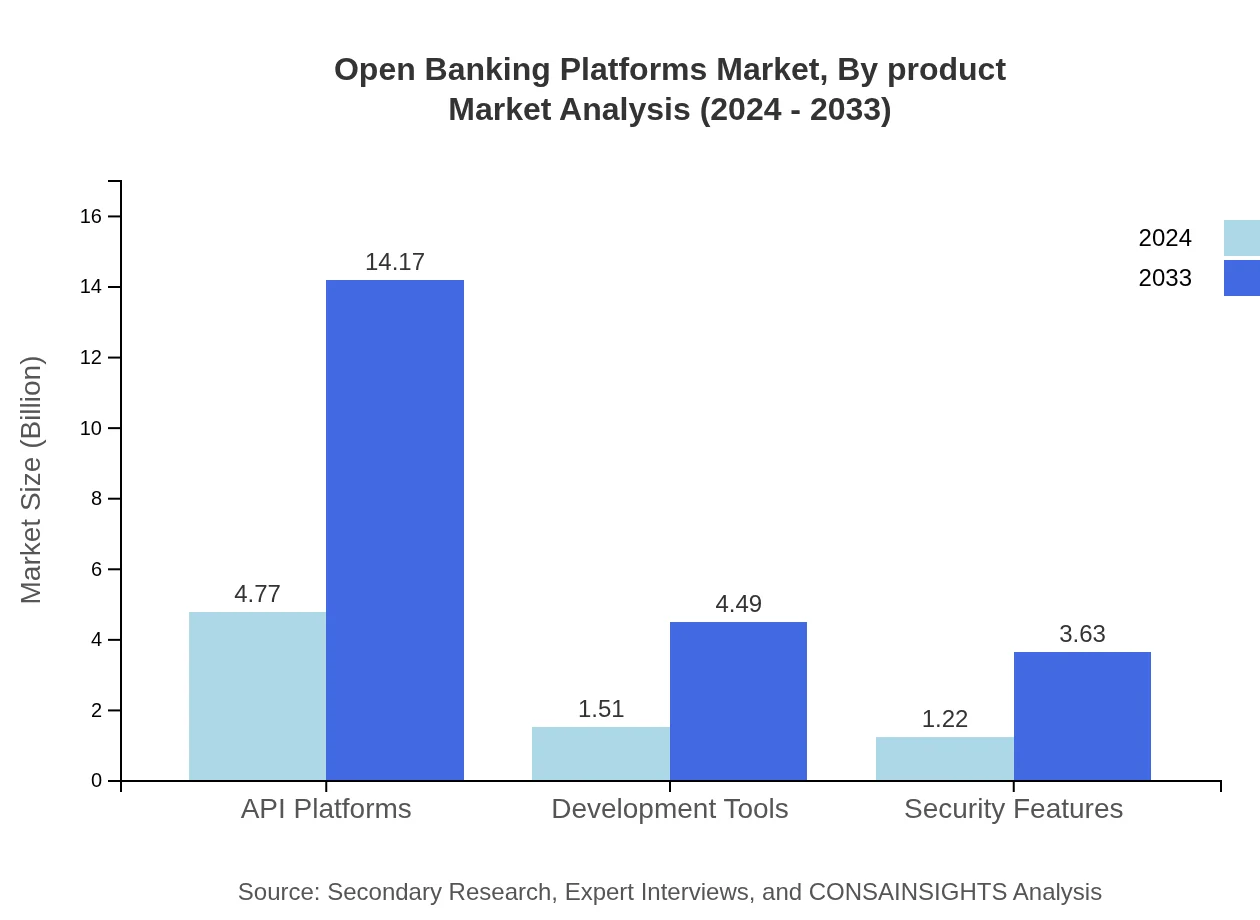

Open Banking Platforms Market Analysis By Product

The product segmentation of the Open Banking Platforms market includes API Platforms, Development Tools, and Security Features. API Platforms exhibit significant dominance and act as the core element enabling connectivity between banks and third-party providers. Development Tools cater to the operational aspects, assisting in efficient platform creation and management, while Security Features ensure that all transactions and data exchanges are safeguarded. Each product segment has shown consistent growth over the forecast period, underscoring the importance of technical robustness for future market expansion. The alignment between product innovation and customer security requirements is a key driver across this segment.

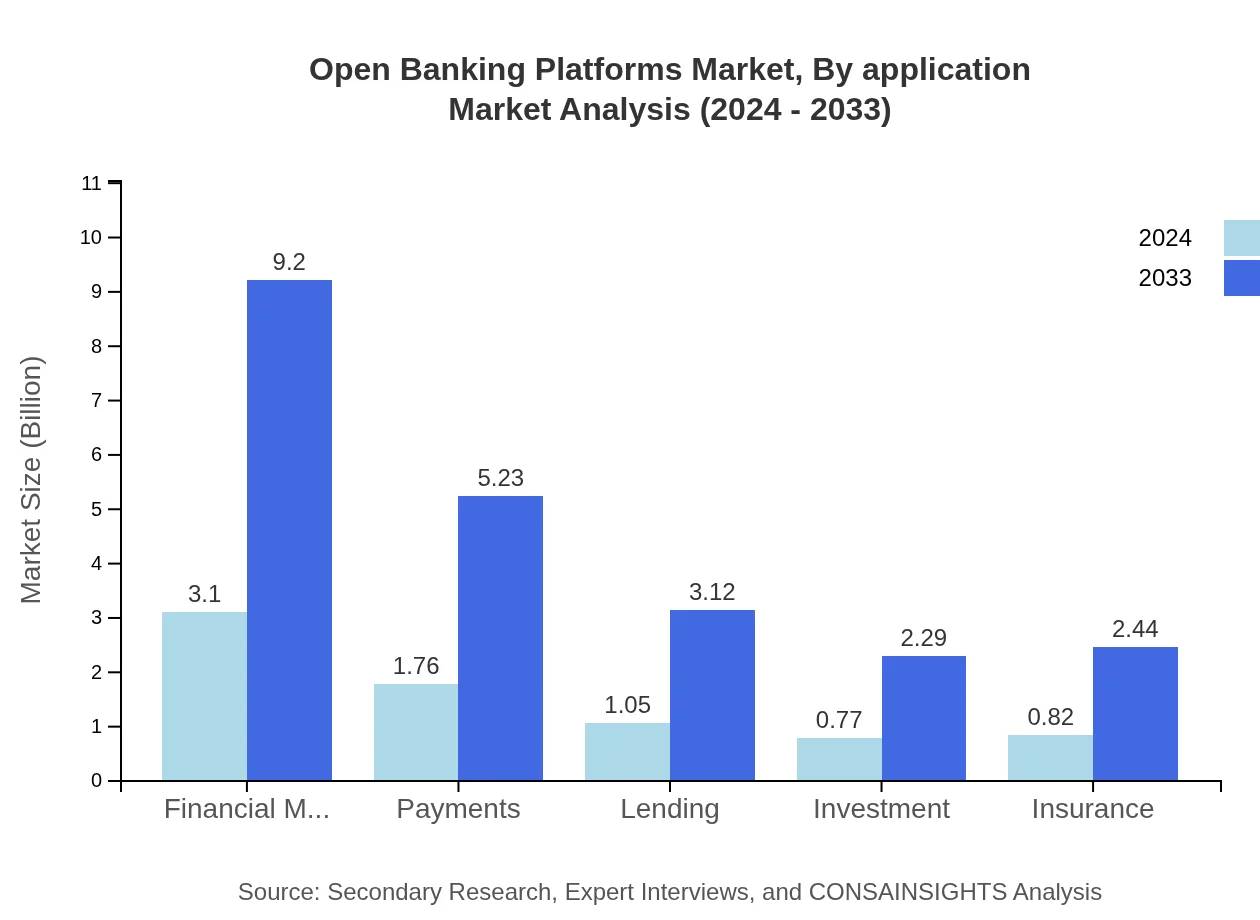

Open Banking Platforms Market Analysis By Application

The application landscape is segmented into traditional financial services such as Banking and Financial Management, along with emerging areas including Fintech, E-Commerce, Insurance Companies, and Others. Among these, Banking and Financial Management continue to command larger market shares by leveraging robust API interactions to support their services. Fintech and E-Commerce applications, on the other hand, are continuously evolving, driving demand for more agile, adaptable, and secure platforms. Each application segment is adapting to meet increasing user demands for real-time processing, enhanced security, and improved interoperability, thereby fostering a competitive ecosystem that promotes continuous innovation.

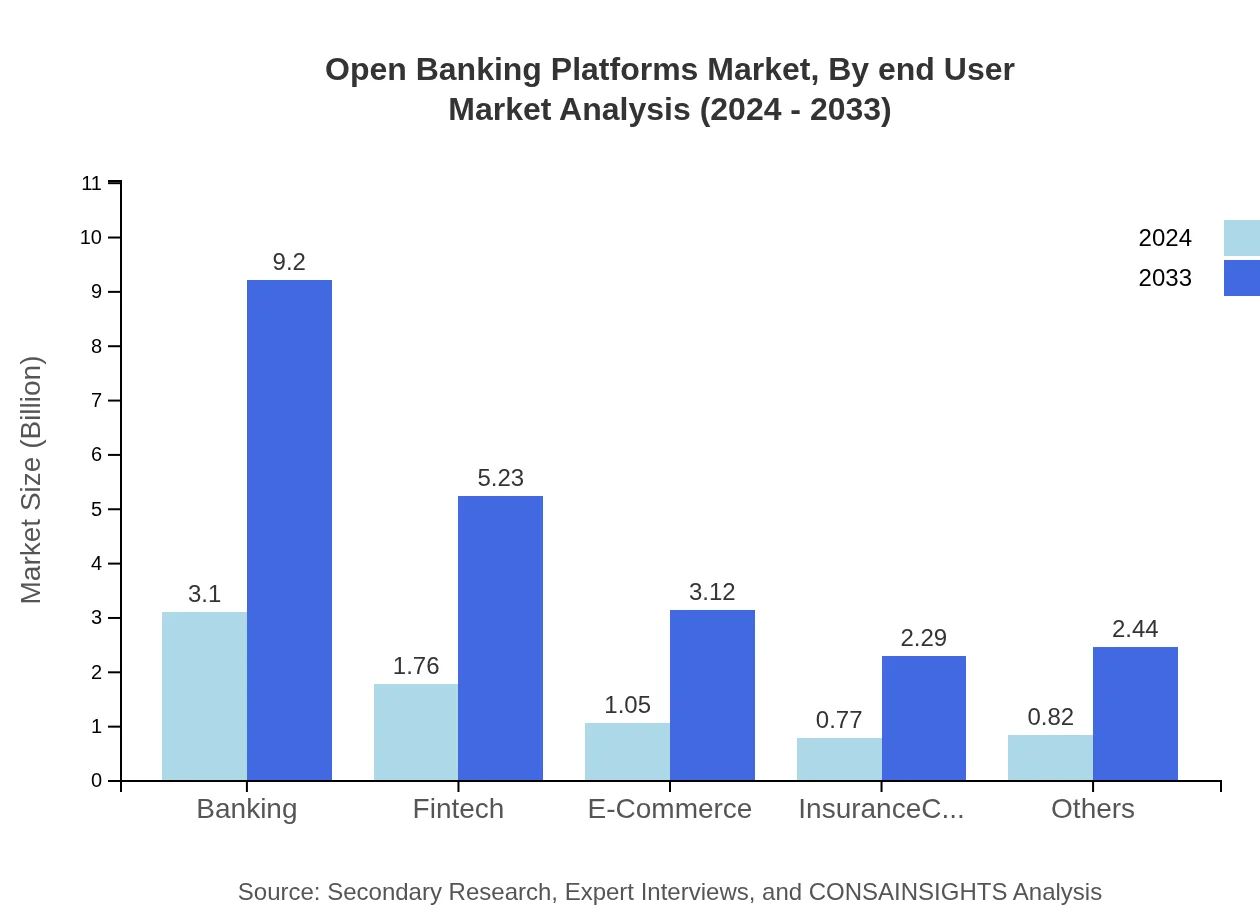

Open Banking Platforms Market Analysis By End User

End-user segmentation reveals that financial institutions, technology vendors, and end customers are central to the market’s success. Traditional banks are increasingly embracing open banking due to the demonstrated benefits in customer engagement and operational efficiencies. Additionally, non-banking sectors such as retail and insurance are also adopting these platforms to benefit from secure data exchange and innovative service delivery. Each end-user segment effectively capitalizes on the potential of open APIs to offer personalized financial services and create new revenue streams. The deep integration of digital technology within these end-user industries supports market resilience and long-term growth objectives, reinforcing end-user confidence in the open banking framework.

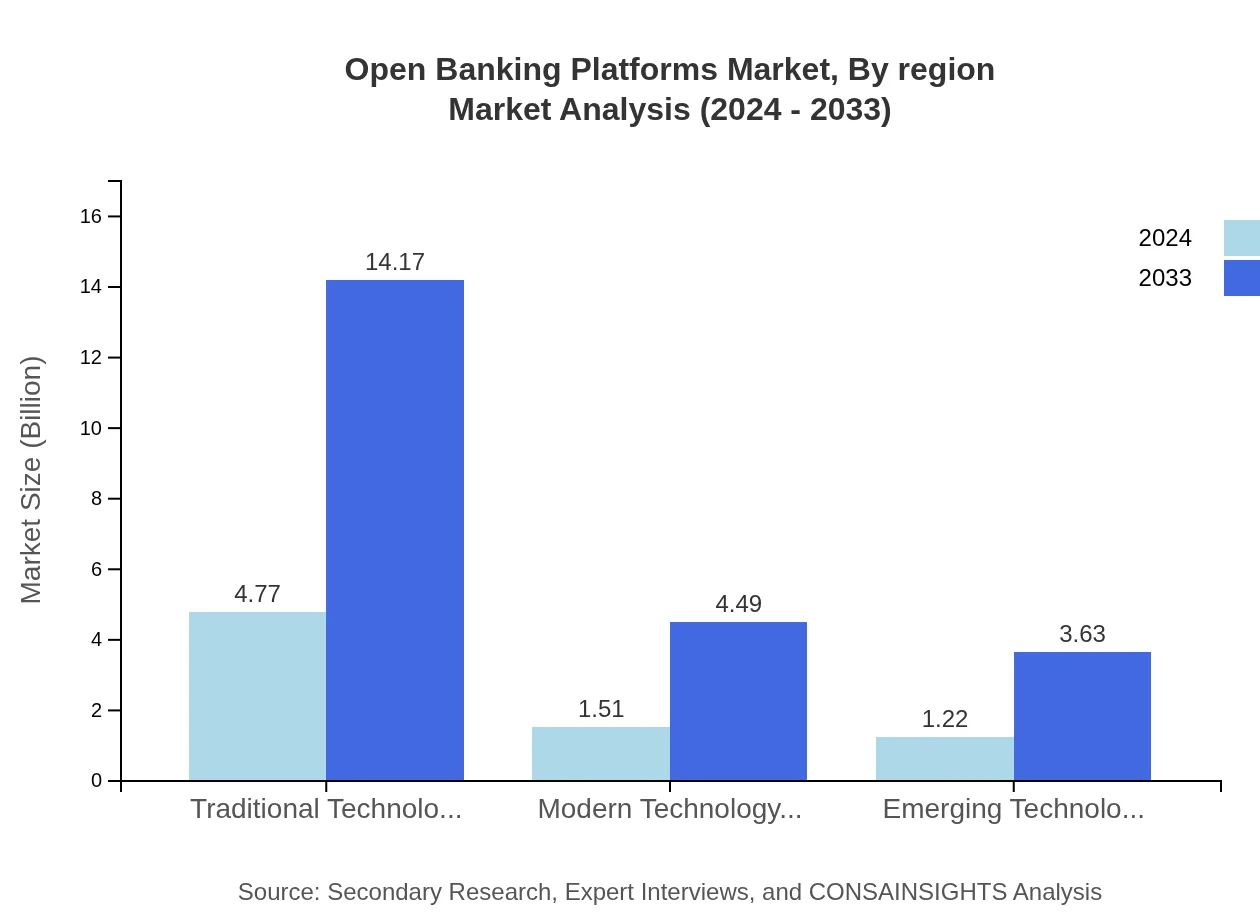

Open Banking Platforms Market Analysis By Region

Technology adoption in the open banking sector is classified into Traditional Technology Adoption, Modern Technology Adoption, and Emerging Technology Adoption. The traditional approach, while maintaining a steady market share, focuses on established protocols and legacy system enhancements; Modern Technology Adoption emphasizes scalable, agile infrastructures that integrate cloud computing and real-time analytics; and Emerging Technology Adoption looks to future innovations such as AI-driven insights and blockchain-based security. The balanced evolution across these categories ensures that market players can cater to diverse needs, driving both performance improvements and new product innovations. The consistent demand for upgrade across all technology tiers signifies an industry-wide commitment to technological advancement and customer-centric service delivery.

Open Banking Platforms Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Open Banking Platforms Industry

FinTech Innovations Inc.:

FinTech Innovations Inc. is at the forefront of the open banking revolution, offering state-of-the-art API platforms and security solutions that empower banks to safely share financial data with third-party providers. The company is known for its cutting-edge research and strong global partnerships.Secure BankTech Solutions:

Secure BankTech Solutions specializes in the development of robust, scalable open banking infrastructures. Their focus on data protection and system interoperability has cemented their reputation as a trusted partner for banks and fintech companies worldwide.Global API Connect:

Global API Connect delivers innovative tools that enhance connectivity between banks and fintech firms. With advanced technological integrations and a customer-first approach, the company continues to drive significant market advancements in the open banking space.We're grateful to work with incredible clients.