Poultry Packaging Market Report

Published Date: 01 February 2026 | Report Code: poultry-packaging

Poultry Packaging Market Size, Share, Industry Trends and Forecast to 2033

This market report delves into the Poultry Packaging industry, providing comprehensive insights, data, and forecasts from 2023 to 2033, including market dynamics, growth predictions, and key players.

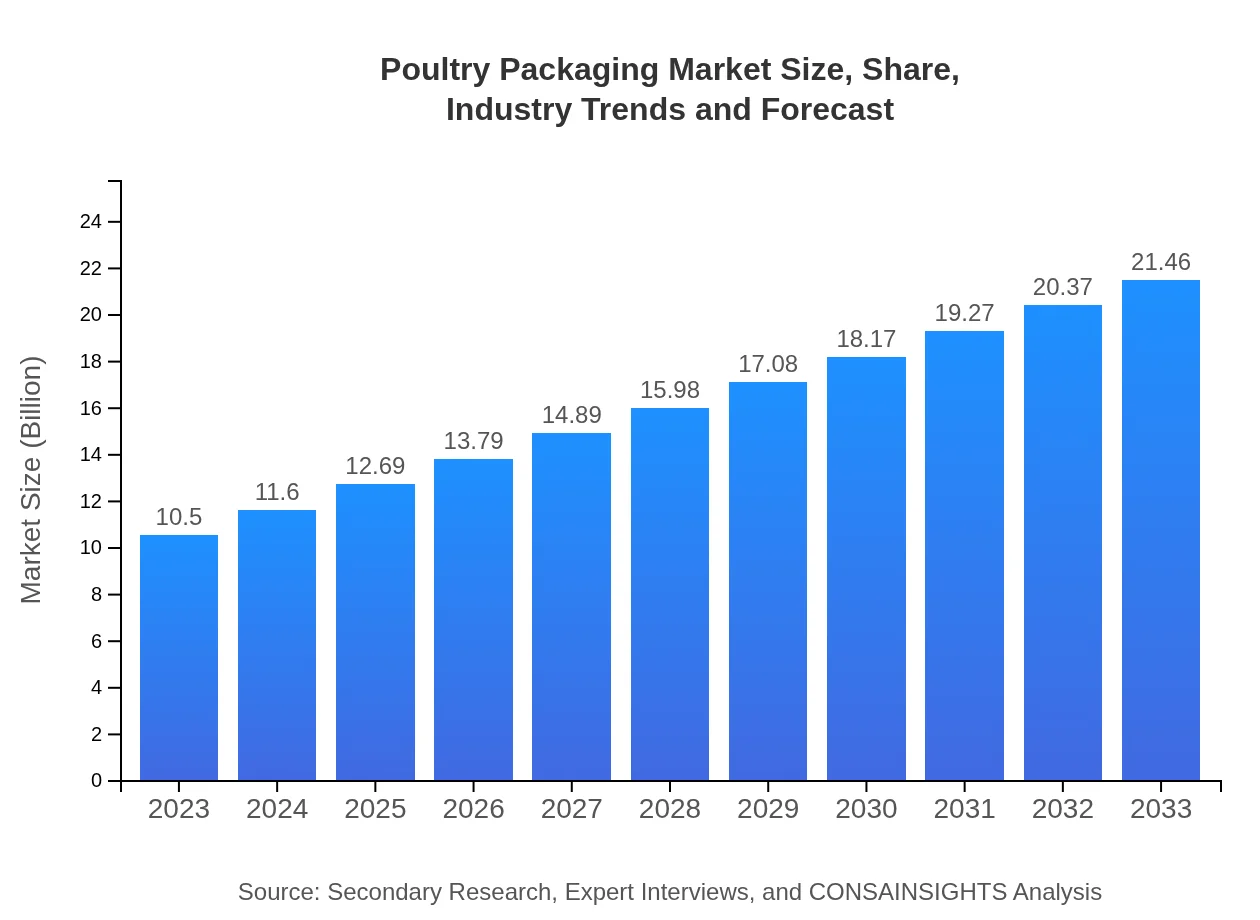

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $21.46 Billion |

| Top Companies | Sealed Air Corporation, Amcor Plc, Berry Global Inc., Crown Holdings Inc. |

| Last Modified Date | 01 February 2026 |

Poultry Packaging Market Overview

Customize Poultry Packaging Market Report market research report

- ✔ Get in-depth analysis of Poultry Packaging market size, growth, and forecasts.

- ✔ Understand Poultry Packaging's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Poultry Packaging

What is the Market Size & CAGR of Poultry Packaging market in 2023 and 2033?

Poultry Packaging Industry Analysis

Poultry Packaging Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Poultry Packaging Market Analysis Report by Region

Europe Poultry Packaging Market Report:

In Europe, the market is expected to climb from USD 3.01 billion in 2023 to USD 6.16 billion by 2033, fueled by stringent packaging regulations and a shift towards sustainable packaging solutions that align with consumer preferences for environmentally friendly products.Asia Pacific Poultry Packaging Market Report:

The Asia Pacific region is poised to exhibit significant growth in the Poultry Packaging market, expected to rise from USD 2.00 billion in 2023 to USD 4.08 billion by 2033. This growth is driven by increasing population and economic growth in countries like China and India, which are major consumers of poultry products.North America Poultry Packaging Market Report:

North America represents a significant share of the Poultry Packaging market, with projections of growth from USD 3.87 billion in 2023 to USD 7.91 billion by 2033. The market growth is driven by high demand for convenient packaging and innovative preservation technologies.South America Poultry Packaging Market Report:

In South America, the Poultry Packaging market is projected to grow from USD 0.33 billion in 2023 to USD 0.68 billion by 2033. Rising domestic consumption of poultry meat and expanding retail networks in countries like Brazil are key factors contributing to this growth.Middle East & Africa Poultry Packaging Market Report:

The Middle East and Africa region are set to see market growth from USD 1.29 billion in 2023 to USD 2.63 billion by 2033, backed by increasing poultry consumption and rapid urbanization, which boosts demand for accessible and safe packaging.Tell us your focus area and get a customized research report.

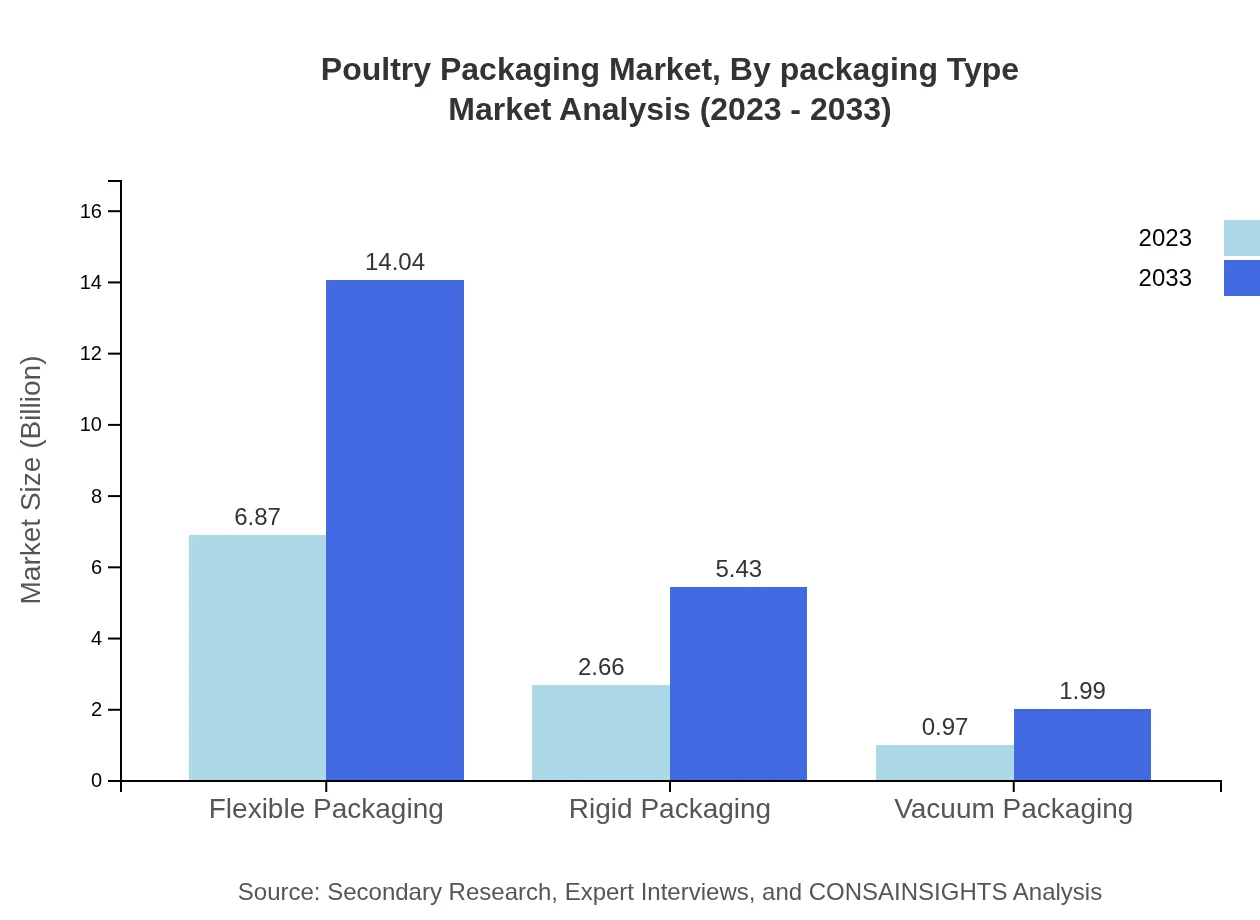

Poultry Packaging Market Analysis By Packaging Type

The Poultry Packaging market is dominated by flexible packaging, projected to grow from USD 6.87 billion in 2023 to USD 14.04 billion in 2033, maintaining about 65.41% market share. Rigid packaging is also significant, expanding from USD 2.66 billion to USD 5.43 billion. Innovations in flexible packaging technologies that support product freshness and usability will continue to drive this segment.

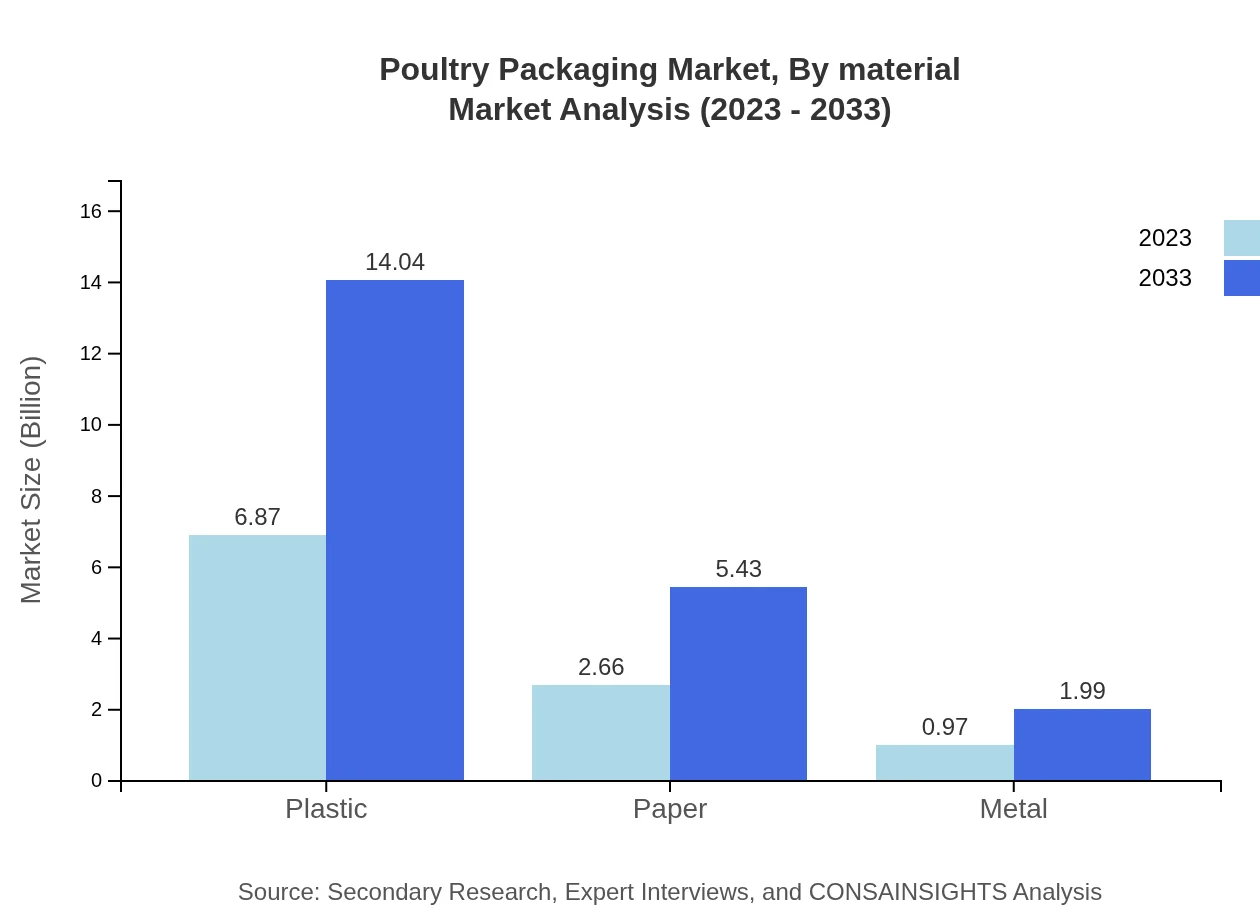

Poultry Packaging Market Analysis By Material

Plastics remain the most widely used material in Poultry Packaging, accounting for 65.41% market share in 2023, with a projected increase in market size from USD 6.87 billion to USD 14.04 billion by 2033. Paper and metal are also relevant, with paper packaging expected to grow from USD 2.66 billion to USD 5.43 billion, showcasing a trend toward more sustainable materials.

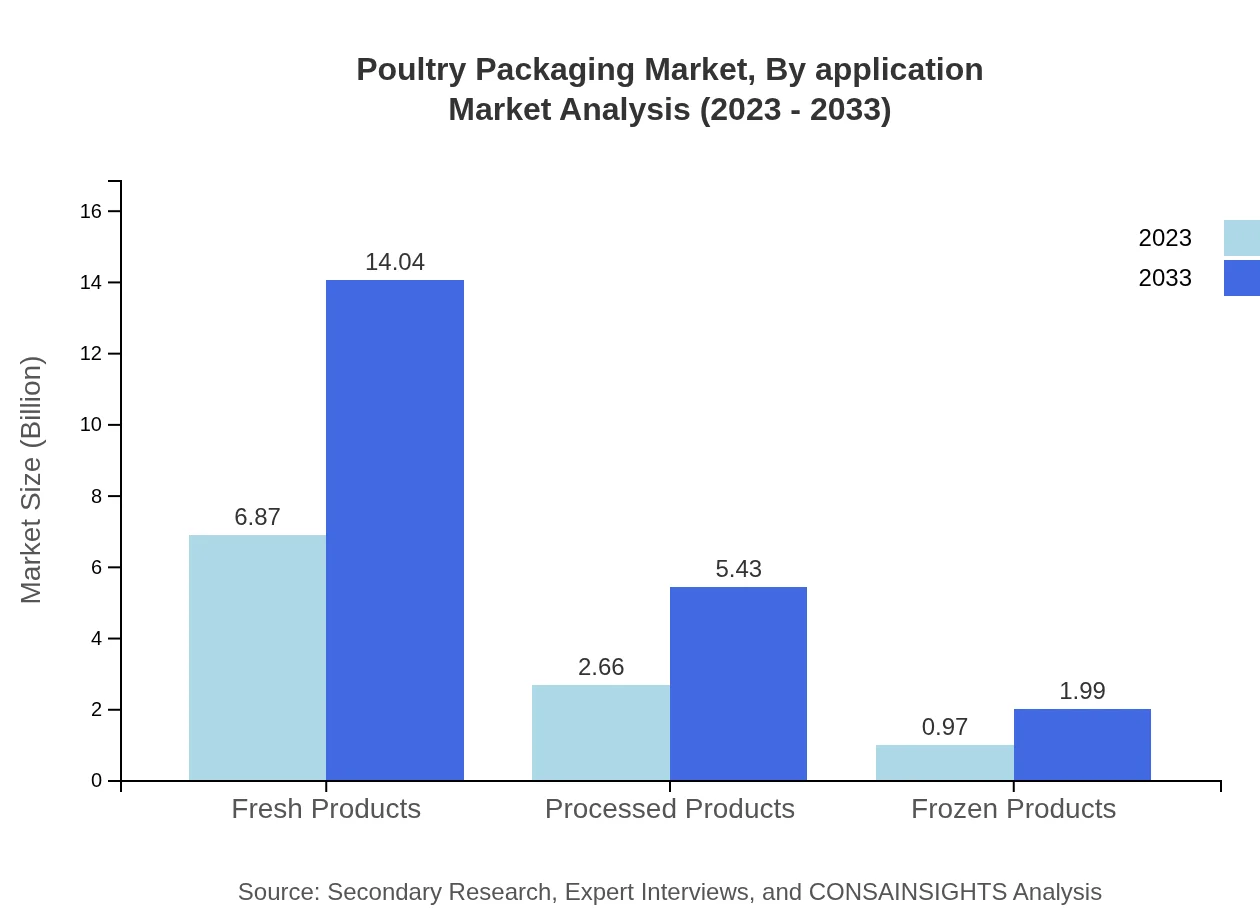

Poultry Packaging Market Analysis By Application

The application of packaging for fresh products is dominating, reflecting a growth from USD 6.87 billion in 2023 to USD 14.04 billion by 2033. Processed products and frozen products follow suit, with noteworthy increases indicative of changing consumer eating habits and increased demand for convenience.

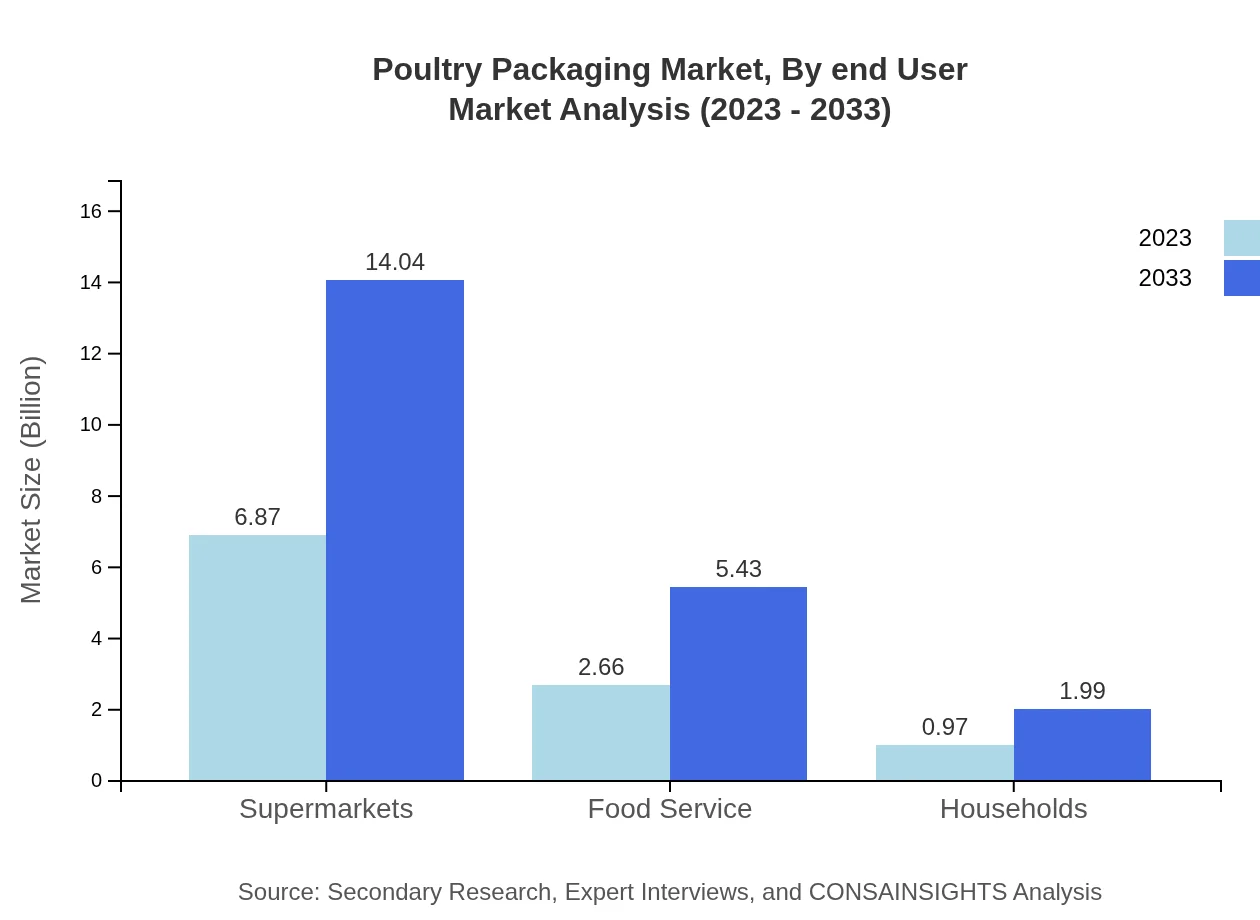

Poultry Packaging Market Analysis By End User

Supermarkets hold the largest market share, with expected growth from USD 6.87 billion to USD 14.04 billion between 2023 and 2033. Food service and household sectors are also anticipated to grow, reflecting varying consumer preferences in purchasing and consuming poultry products.

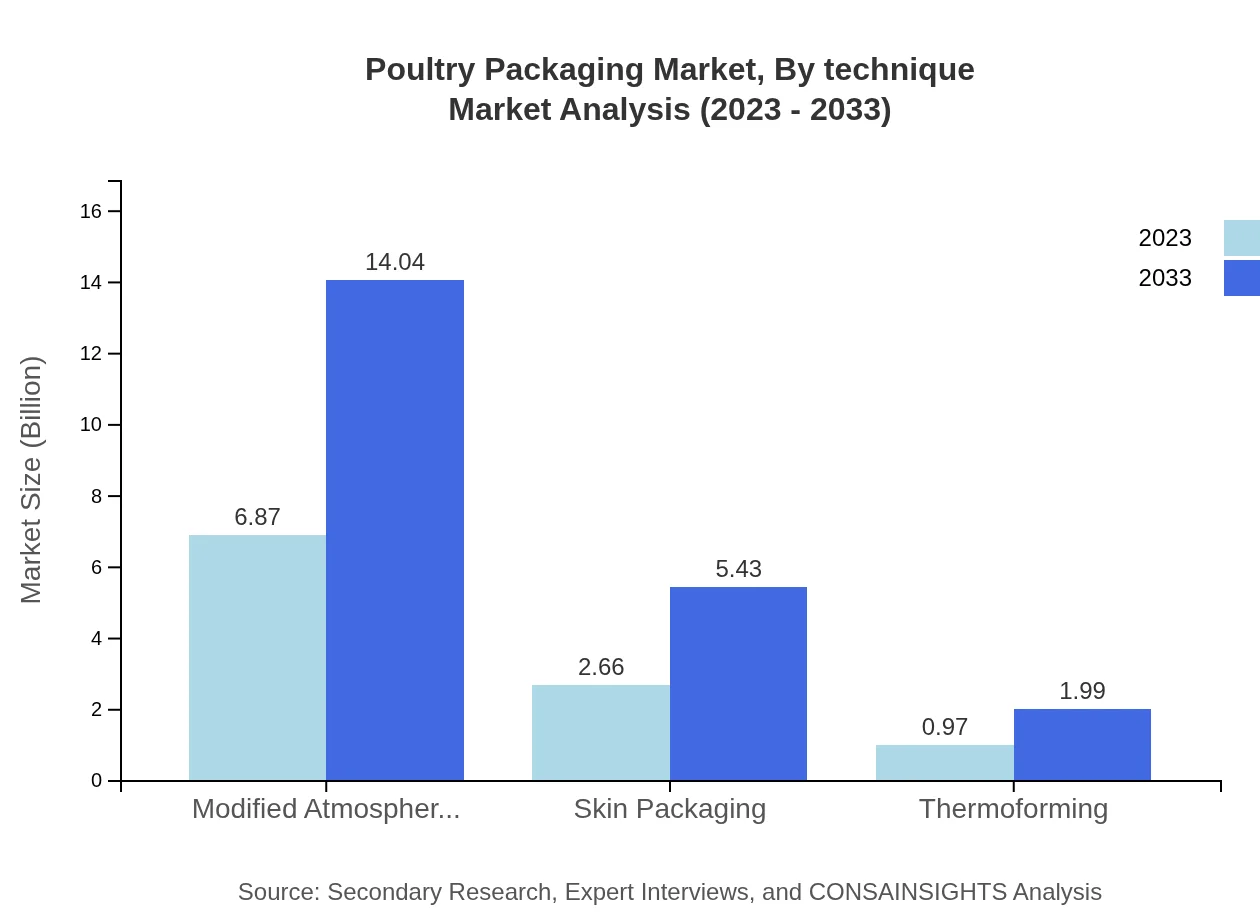

Poultry Packaging Market Analysis By Technique

Modified atmosphere packaging (MAP) is currently leading in terms of market preference, expected to rise significantly from USD 6.87 billion in 2023 to USD 14.04 billion by 2033. Other techniques, such as vacuum and skin packaging, are also gaining traction as they're associated with improved shelf life and product freshness.

Poultry Packaging Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Poultry Packaging Industry

Sealed Air Corporation:

A leader in food packaging solutions, Sealed Air specializes in innovative products and technologies that enhance food safety and freshness.Amcor Plc:

A global packaging company, Amcor produces a wide range of packaging solutions for various products, including poultry, focusing on sustainable practices.Berry Global Inc.:

Berry Global provides plastic packaging solutions and is committed to sustainability and innovation in packaging technologies.Crown Holdings Inc.:

A leader in metal packaging, Crown provides solutions that enhance product shelf life and safety while addressing sustainability concerns.We're grateful to work with incredible clients.

FAQs

What is the market size of poultry packaging?

The global poultry packaging market is valued at approximately $10.5 billion in 2023, with a projected growth rate (CAGR) of 7.2% from 2023 to 2033. This growth is expected to significantly increase the market size over the next decade.

What are the key market players or companies in the poultry packaging industry?

The poultry packaging industry is characterized by the presence of major players such as Amcor Plc, Sealed Air Corporation, Bemis Company, and Huhtamaki Group. These companies innovate and adapt to meet the growing demand for sustainable and efficient packaging solutions.

What are the primary factors driving the growth in the poultry packaging industry?

Key drivers of growth in the poultry packaging industry include increasing consumer demand for processed poultry products, rising health consciousness, advancements in packaging technologies, and the focus on reducing food wastage through better preservation methods.

Which region is the fastest Growing in the poultry packaging market?

The fastest-growing region in the poultry packaging market is Asia Pacific, showing a substantial increase from $2.00 billion in 2023 to $4.08 billion by 2033. This growth is driven by rising urbanization and increasing poultry consumption in the region.

Does ConsaInsights provide customized market report data for the poultry packaging industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the poultry packaging industry. This includes detailed insights on market trends, regional performance, and product segments to support targeted business strategies.

What deliverables can I expect from this poultry packaging market research project?

Expect comprehensive deliverables including a detailed market report, segmentation analysis, forecasts, competitive landscape overview, and insights into market trends and consumer behavior specific to the poultry packaging industry.

What are the market trends of poultry packaging?

Key market trends in poultry packaging include the growing demand for sustainable materials, innovations in modified atmosphere packaging, increased use of flexible packaging solutions, and an emphasis on convenience for consumers in purchasing fresh and processed poultry.