Smart Glass And Smart Window Market Report

Published Date: 31 January 2026 | Report Code: smart-glass-and-smart-window

Smart Glass And Smart Window Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Smart Glass and Smart Window market from 2023 to 2033, offering insights on market size, trends, segmentation, and key players in the industry.

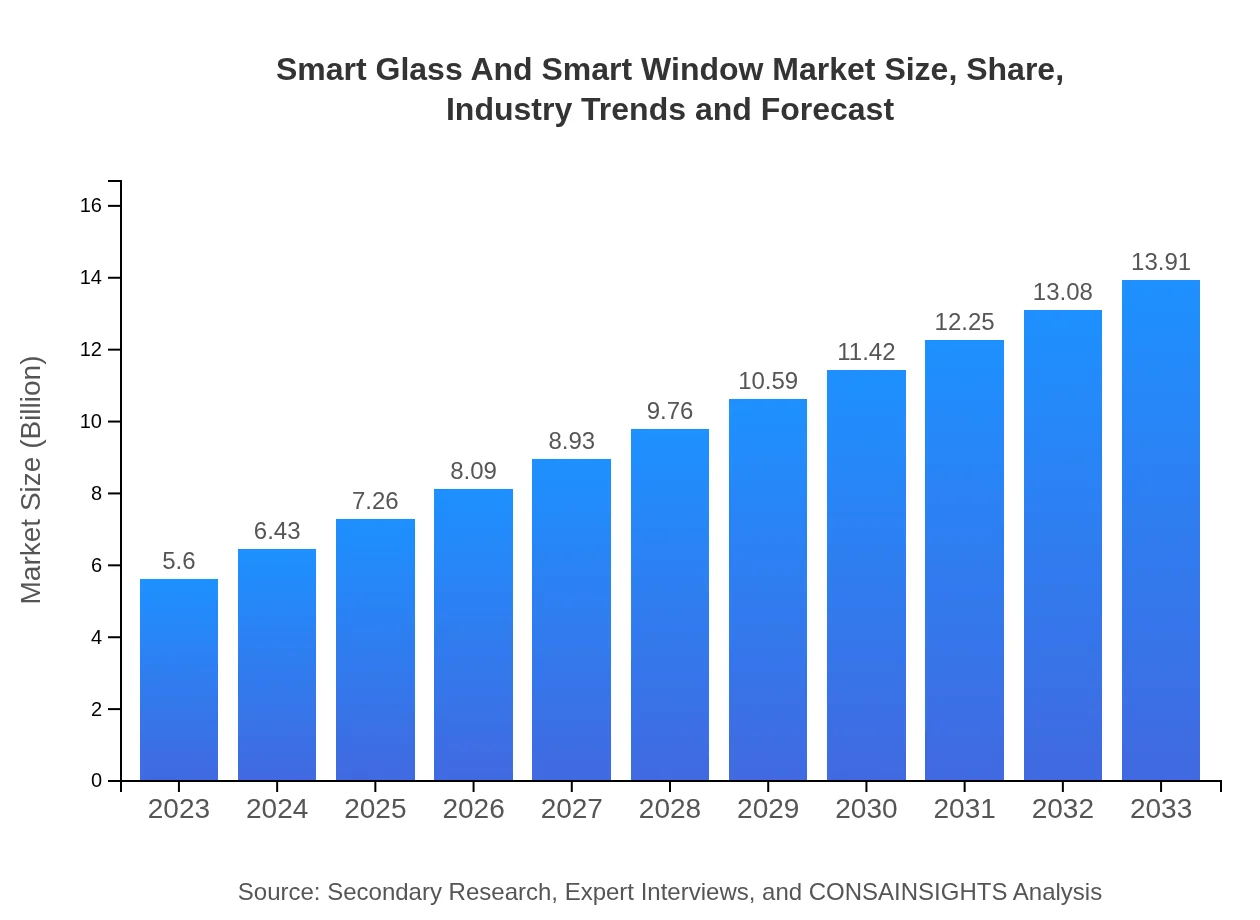

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $13.91 Billion |

| Top Companies | Saint-Gobain, AGC Inc., Gentex Corporation, View Inc. |

| Last Modified Date | 31 January 2026 |

Smart Glass And Smart Window Market Overview

Customize Smart Glass And Smart Window Market Report market research report

- ✔ Get in-depth analysis of Smart Glass And Smart Window market size, growth, and forecasts.

- ✔ Understand Smart Glass And Smart Window's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Smart Glass And Smart Window

What is the Market Size & CAGR of Smart Glass And Smart Window market in 2023?

Smart Glass And Smart Window Industry Analysis

Smart Glass And Smart Window Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Smart Glass And Smart Window Market Analysis Report by Region

Europe Smart Glass And Smart Window Market Report:

Europe’s market size is forecasted to increase from $1.40 billion in 2023 to $3.48 billion by 2033, propelled by the European Union’s green initiatives and strong regulatory frameworks aimed at reducing carbon footprints.Asia Pacific Smart Glass And Smart Window Market Report:

In the Asia Pacific region, the Smart Glass and Smart Window market is projected to grow from $1.18 billion in 2023 to $2.94 billion by 2033, driven by significant investment in green building projects and increasing urbanization in countries such as China and India.North America Smart Glass And Smart Window Market Report:

North America is anticipated to dominate the market, escalating from $1.94 billion in 2023 to $4.82 billion by 2033, supported by stringent building codes promoting energy efficiency and widespread adoption of smart technologies.South America Smart Glass And Smart Window Market Report:

The South American market is expected to experience growth from $0.53 billion in 2023 to $1.33 billion in 2033, as the region witnesses a rise in awareness regarding sustainable constructions and energy-saving products.Middle East & Africa Smart Glass And Smart Window Market Report:

The Middle East and Africa market is expected to grow from $0.54 billion in 2023 to $1.35 billion by 2033, as developments in the construction sector and increased focus on energy efficiency drive the adoption of smart glass technologies.Tell us your focus area and get a customized research report.

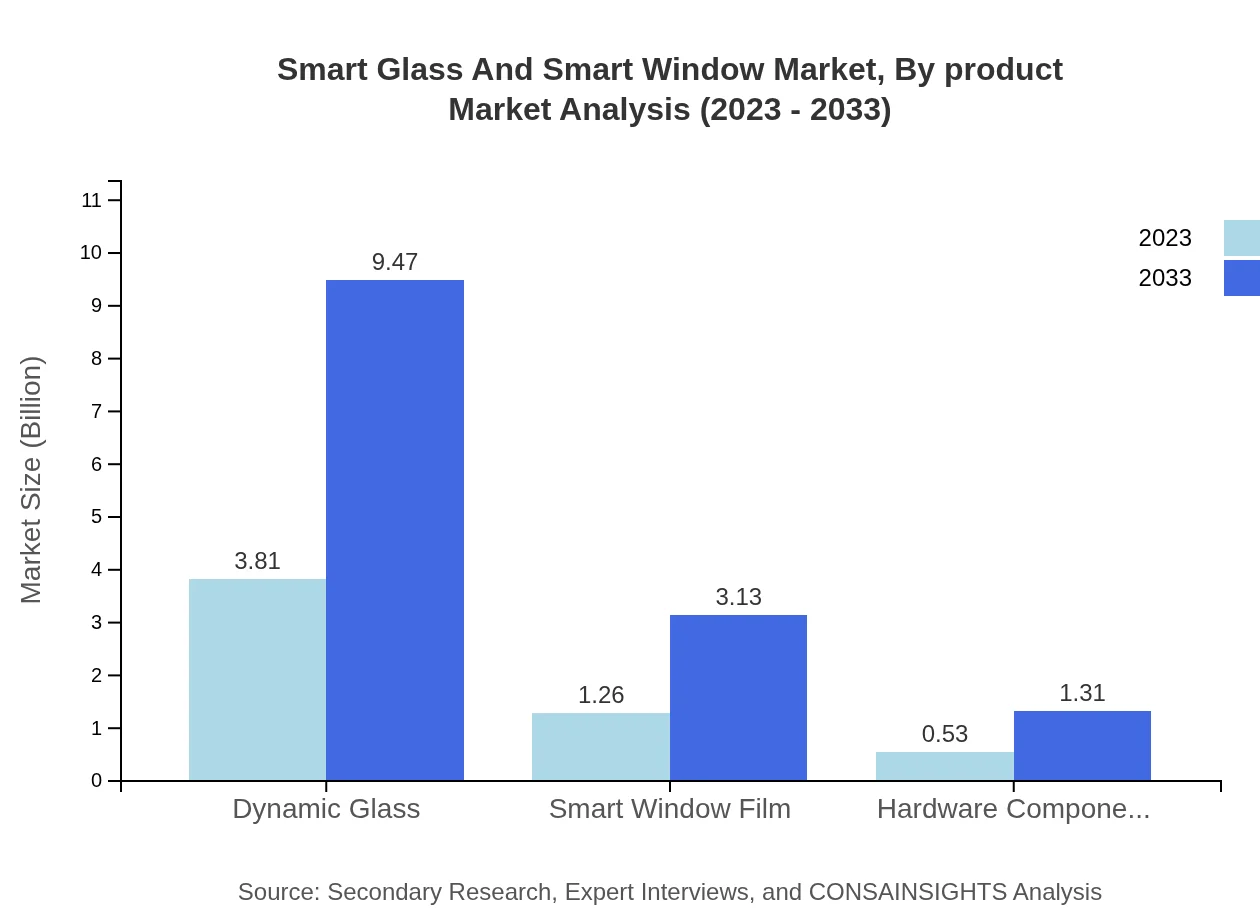

Smart Glass And Smart Window Market Analysis By Product

Dynamic glass dominates the market, showcasing a significant market size from $3.81 billion in 2023, expected to increase to $9.47 billion by 2033, holding a substantial market share of 68.04%. Smart window film is also noteworthy, projected to grow from $1.26 billion to $3.13 billion, representing 22.53% of the market share. Hardware components, while smaller, are still expected to expand from $0.53 billion to $1.31 billion, contributing 9.43% to the market.

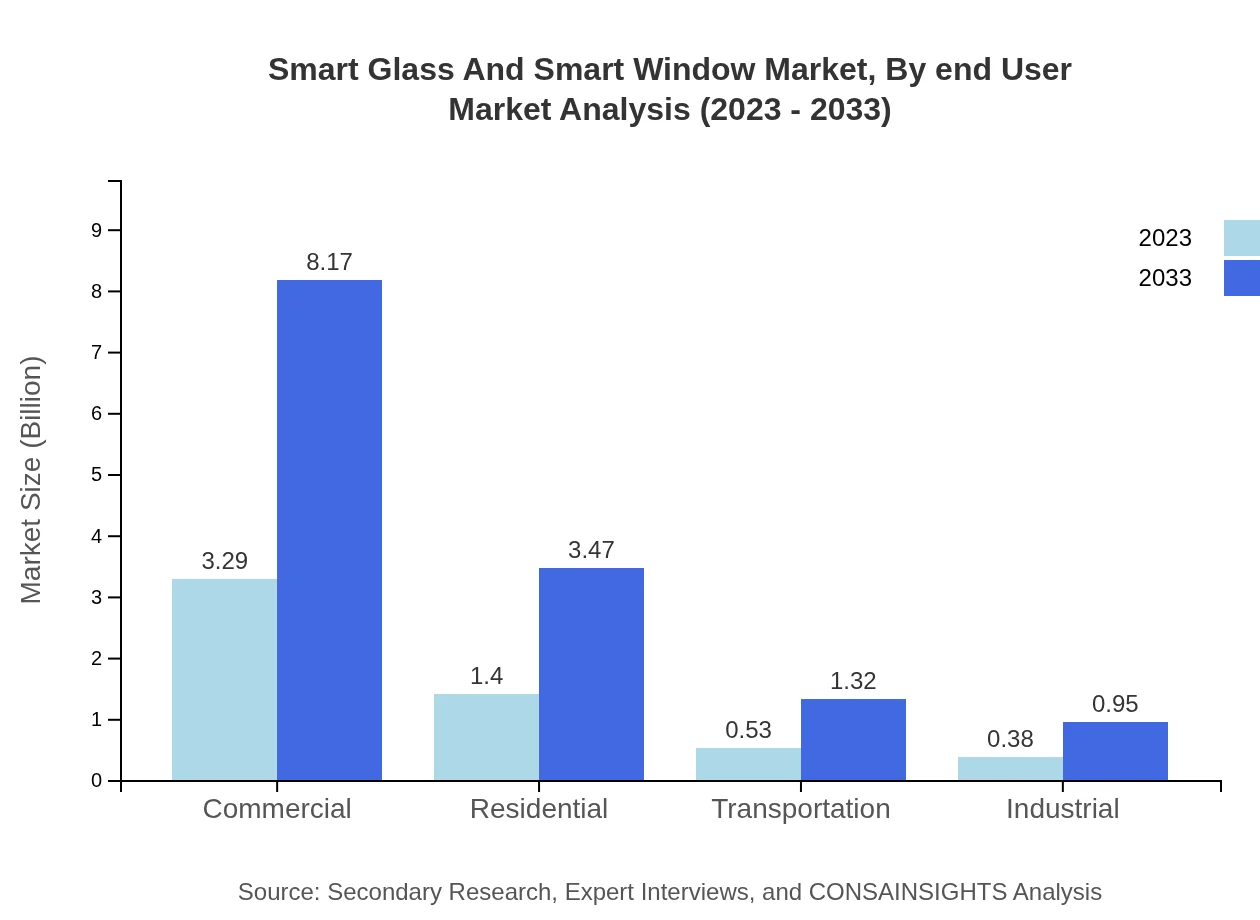

Smart Glass And Smart Window Market Analysis By Application

In application segmentation, commercial use leads with a size of $3.29 billion in 2023, growing to $8.17 billion by 2033 (58.71% share). Residential applications follow, estimated at $1.40 billion expanding to $3.47 billion (24.93% share). Other segments like transportation and industrial applications are smaller but are projected to grow steadily, supported by increased awareness regarding energy efficiency.

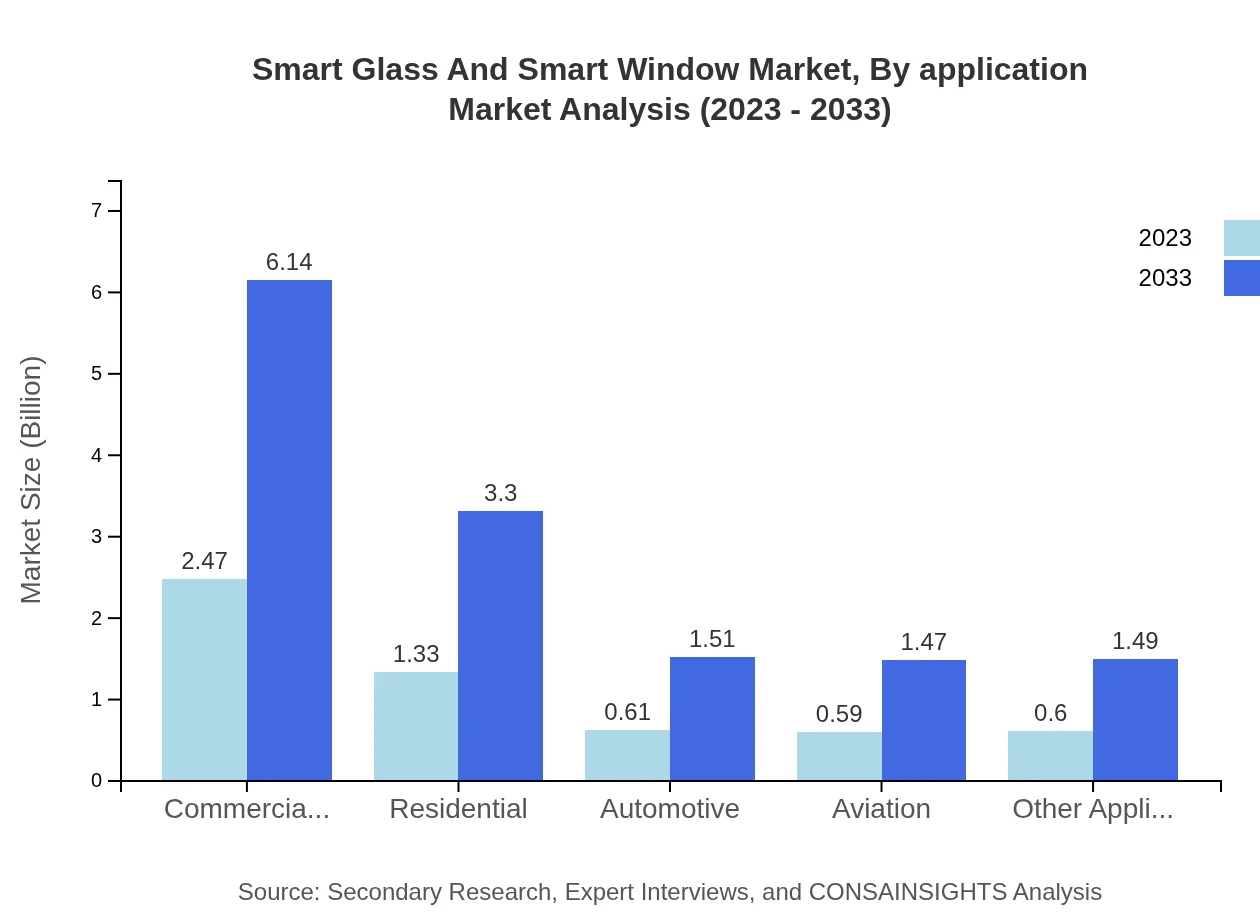

Smart Glass And Smart Window Market Analysis By End User

End-user industries such as commercial buildings account for a significant market share, estimated at $2.47 billion in 2023 and reaching $6.14 billion by 2033 (44.13% share). In residential applications, the market is sized at $1.33 billion, anticipated to grow to $3.30 billion (23.69% share). Automotive applications represent promising growth trends due to rising adoption of smart technologies in vehicles.

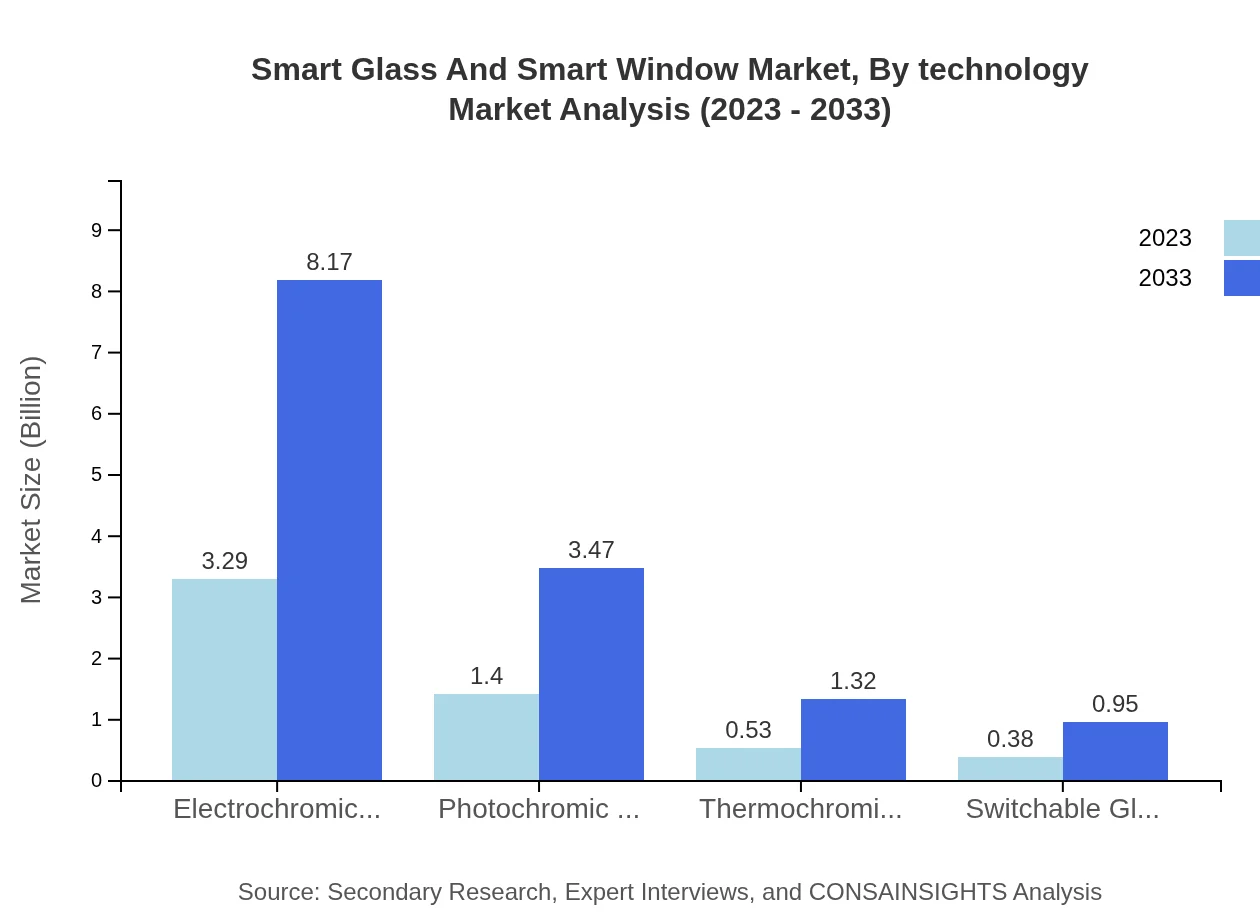

Smart Glass And Smart Window Market Analysis By Technology

Electrochromic technology leads the market segment with a size of $3.29 billion in 2023, expected to rise to $8.17 billion by 2033, holding a market share of 58.71%. Photochromic and thermochromic technologies are also significant, projected to grow from $1.40 billion to $3.47 billion and from $0.53 billion to $1.32 billion, respectively.

Smart Glass And Smart Window Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Smart Glass And Smart Window Industry

Saint-Gobain:

A global leader in building materials, providing innovative glass solutions including smart glass technologies.AGC Inc.:

A prominent glass manufacturer known for its advanced glass products, including dynamic glass applications.Gentex Corporation:

Specializes in auto-dimming mirrors and smart glass technologies enhancing vehicle safety and energy efficiency.View Inc.:

A frontrunner in smart window technology, offering products that significantly reduce energy costs and improve comfort.We're grateful to work with incredible clients.

FAQs

What is the market size of Smart Glass and Smart Window?

The Smart Glass and Smart Window market size is estimated to reach $5.6 billion by 2033, growing at a CAGR of 9.2% from 2023 to 2033. This growth reflects increased adoption across various sectors like commercial, residential, and automotive.

What are the key market players or companies in the Smart Glass and Smart Window industry?

Key market players in the Smart Glass and Smart Window industry include major manufacturers and innovators who lead in technology and production. They typically focus on advancements in electrochromic, thermochromic, and photochromic technologies, enhancing product functionalities and market reach.

What are the primary factors driving the growth in the Smart Glass and Smart Window industry?

Factors driving growth in the Smart Glass and Smart Window industry include rising demand for energy-efficient buildings, advancements in smart technologies, and increasing awareness of sustainable solutions. Regulatory support for green buildings further propels industry expansion, alongside urbanization trends boosting construction activities.

Which region is the fastest Growing in the Smart Glass and Smart Window?

The Asia Pacific region is the fastest-growing for Smart Glass and Smart Window, projected to expand from $1.18 billion in 2023 to $2.94 billion by 2033. This growth is driven by rapid urbanization, increasing construction activities, and a rising focus on energy efficiency.

Does ConsaInsights provide customized market report data for the Smart Glass and Smart Window industry?

Yes, ConsaInsights offers customized market report data tailored to specific requirements in the Smart Glass and Smart Window industry. Clients can request specialized insights based on parameters such as regional focus, technology trends, or market segments to support informed decision-making.

What deliverables can I expect from this Smart Glass and Smart Window market research project?

From the Smart Glass and Smart Window market research project, expect detailed reports containing market size, growth forecasts, competitive landscape analysis, and segment insights. Additional deliverables include regional data, emerging trends, and recommendations for strategic market entry.

What are the market trends of Smart Glass and Smart Window?

Market trends for Smart Glass and Smart Window include increasing adoption of smart technologies, growing demand for energy-efficient products, and innovations in electrochromic and switchable glass technologies. Sustainability and regulatory pressures also reinforce the demand for such advanced solutions across various sectors.