Surfactant Eor Market Report

Published Date: 02 February 2026 | Report Code: surfactant-eor

Surfactant Eor Market Size, Share, Industry Trends and Forecast to 2033

This market report provides an in-depth analysis of the Surfactant Enhanced Oil Recovery (EOR) market from 2023 to 2033, including market size, trends, segmentation, and forecasts. It aims to deliver insights to better understand market dynamics and growth opportunities in this sector.

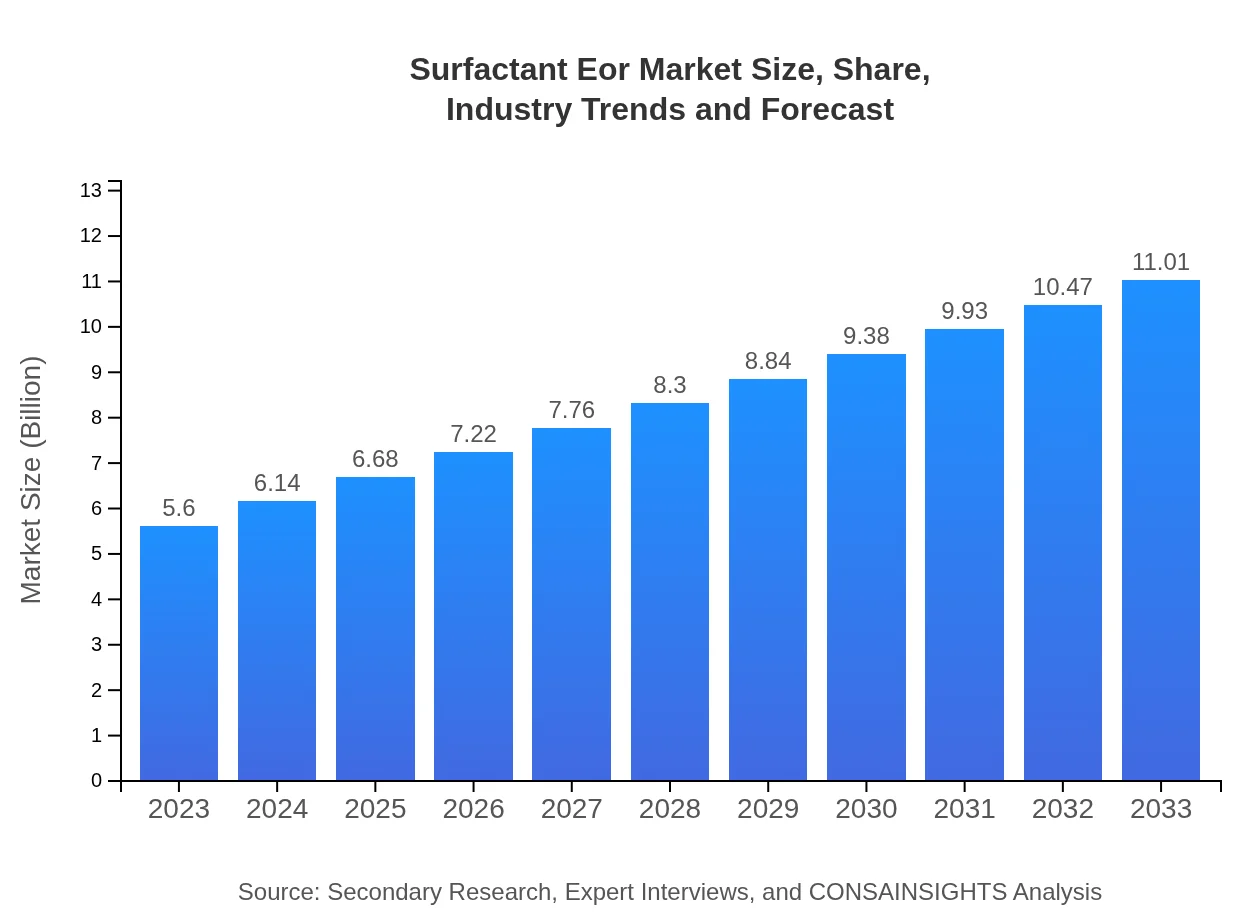

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $11.01 Billion |

| Top Companies | BASF SE, Huntsman Corporation, Clariant AG, DuPont |

| Last Modified Date | 02 February 2026 |

Surfactant Eor Market Overview

Customize Surfactant Eor Market Report market research report

- ✔ Get in-depth analysis of Surfactant Eor market size, growth, and forecasts.

- ✔ Understand Surfactant Eor's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Surfactant Eor

What is the Market Size & CAGR of Surfactant Eor market in 2023?

Surfactant Eor Industry Analysis

Surfactant Eor Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Surfactant Eor Market Analysis Report by Region

Europe Surfactant Eor Market Report:

The European market is poised to grow from USD 1.49 billion in 2023 to USD 2.93 billion by 2033. This region is focusing on adopting enhanced recovery methods to improve production from small and mature fields. Further, regulations fostering sustainability and reduced environmental impact drive companies to leverage surfactants as vital agents in oil recovery processes.Asia Pacific Surfactant Eor Market Report:

In the Asia Pacific region, the market for Surfactant EOR is expected to grow from USD 1.22 billion in 2023 to USD 2.40 billion by 2033. This growth is driven by rapidly expanding economies such as China and India, where oil consumption continues to rise. There is a growing emphasis on enhanced recovery techniques to maximize output in existing oil fields. Additionally, government policies promoting the use of advanced technologies in oil extraction feed the market growth.North America Surfactant Eor Market Report:

North America, particularly the United States, represents a dominant player in the Surfactant EOR market, with growth anticipated from USD 2.00 billion in 2023 to USD 3.93 billion by 2033. The surge in shale oil production and advanced extraction technologies have fostered a favorable environment for surfactant applications. The region’s extensive investment in R&D aids in creating innovative surfactants tailored for specific recovery techniques.South America Surfactant Eor Market Report:

The South American market for Surfactant EOR is projected to see an increase from USD 0.46 billion in 2023 to USD 0.91 billion by 2033. Countries like Brazil and Argentina hold substantial oil reserves, making the demand for EOR surfactants necessary for maintaining production levels. The region faces unique challenges including regulatory hurdles and fluctuating investments but remains crucial due to its significant oil assets.Middle East & Africa Surfactant Eor Market Report:

In the Middle East and Africa, the market for Surfactant EOR is projected to expand from USD 0.42 billion in 2023 to USD 0.83 billion by 2033. The region’s existing oil reserves encourage the use of EOR techniques to prolong the life of oil fields. Regional players are investing in EOR technologies, indicating a growing acceptance and necessity for surfactants in oil extraction.Tell us your focus area and get a customized research report.

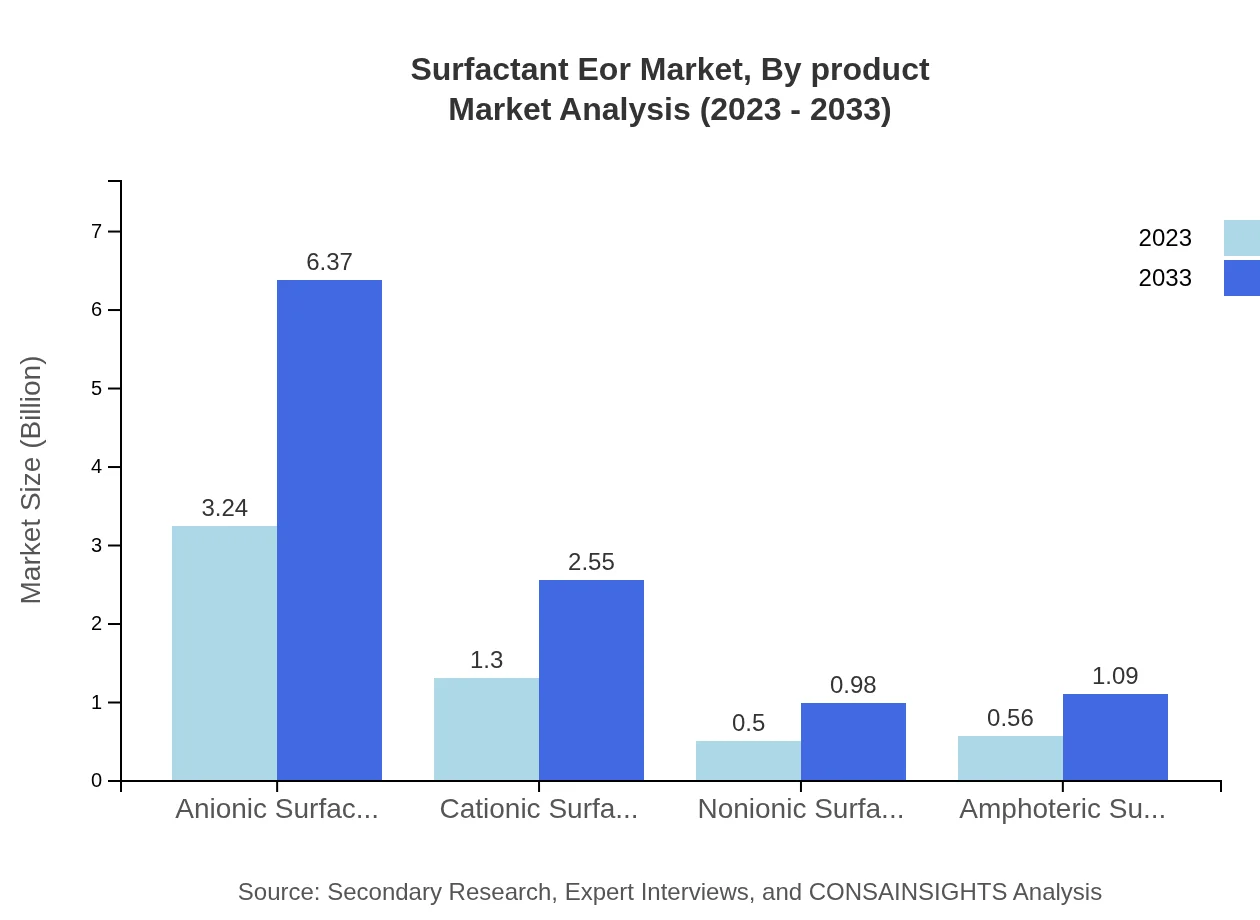

Surfactant Eor Market Analysis By Product

The segment analysis reveals a significant increase in the usage of Anionic surfactants, expected to escalate from USD 3.24 billion in 2023 to USD 6.37 billion by 2033, maintaining a market share of about 57.91%. Cationic surfactants will also witness growth from USD 1.30 billion to USD 2.55 billion, holding a 23.21% share in this segment. Meanwhile, Nonionic and Amphoteric surfactants are projected to increase from USD 0.50 billion and USD 0.56 billion respectively, demonstrating their growing importance in specific applications.

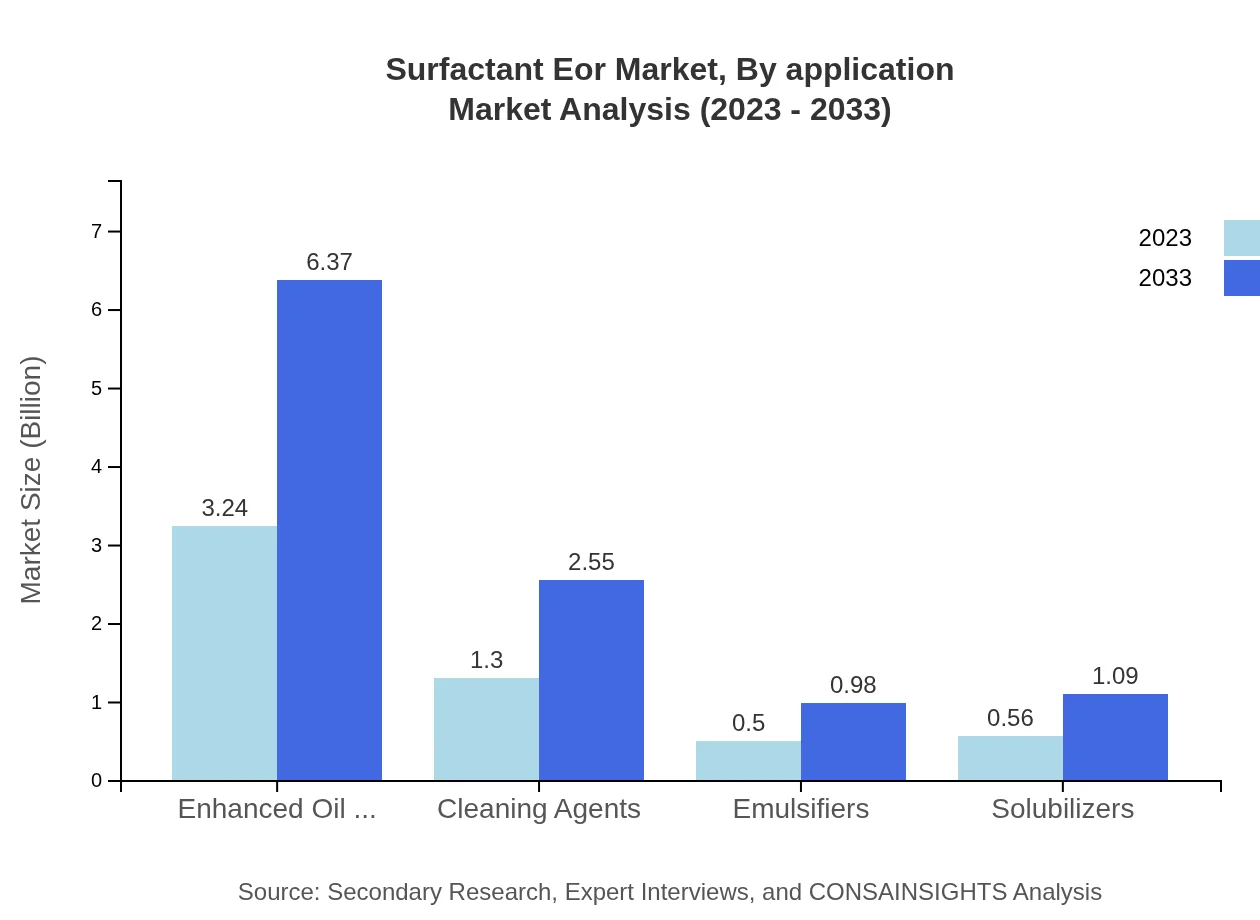

Surfactant Eor Market Analysis By Application

The primary applications of Surfactant EOR are within the Oil & Gas Industry, poised to expand from USD 3.24 billion in 2023 to USD 6.37 billion by 2033, showcasing the efficacy of surfactants in increasing oil recovery rates. Chemical Manufacturing is anticipated to grow from USD 1.30 billion to USD 2.55 billion, with Cleaning Agents also maintaining relevance as the market demands higher production efficiency using surfactants.

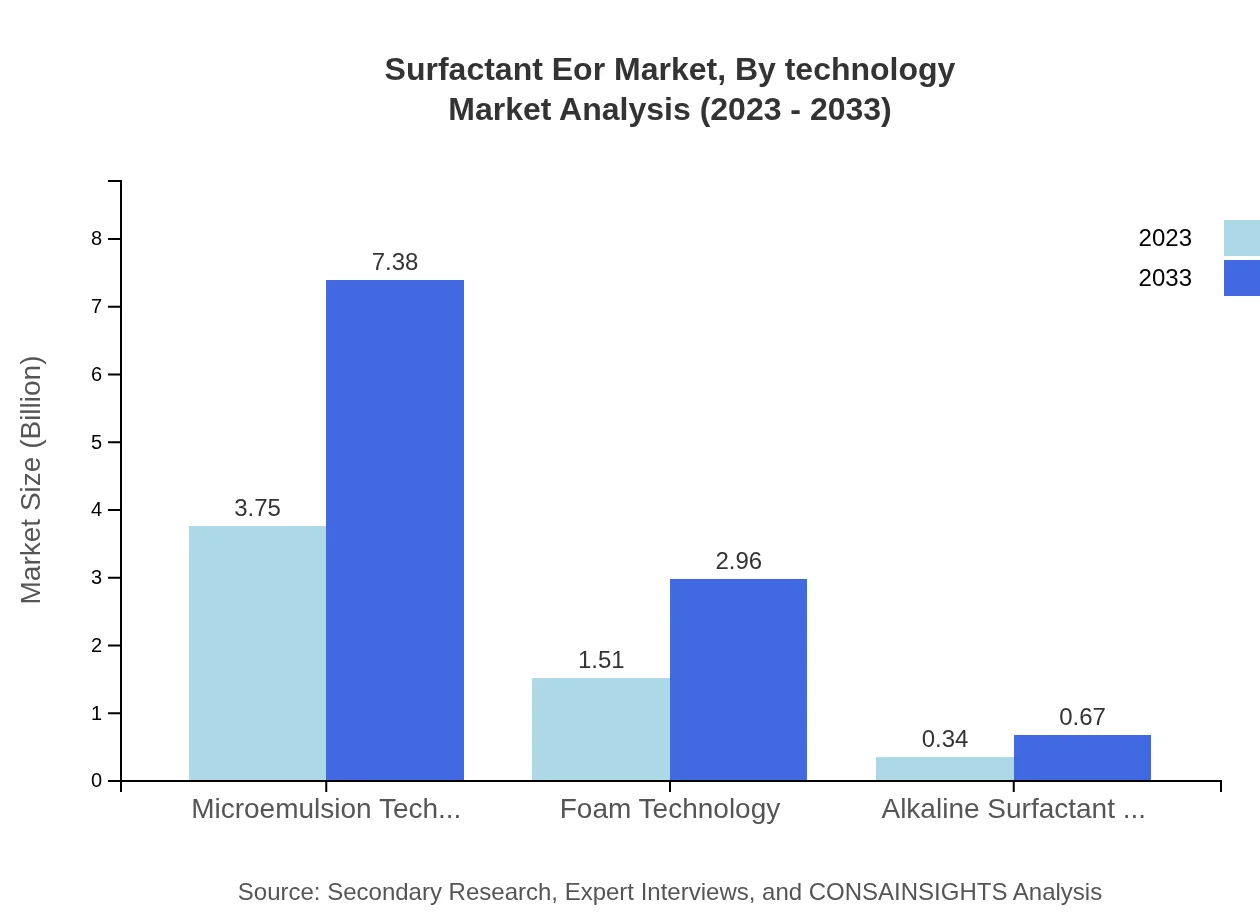

Surfactant Eor Market Analysis By Technology

Technological advancements in the Surfactant EOR market highlight Microemulsion technology leading the market with a size anticipated to double from USD 3.75 billion in 2023 to USD 7.38 billion by 2033, dominating with a 67.04% market share. Foam Technology and Alkaline Surfactant Polymer Injection also show promising growth, with market sizes projected to rise significantly, reflecting the innovation in surfactant applications for oil recovery.

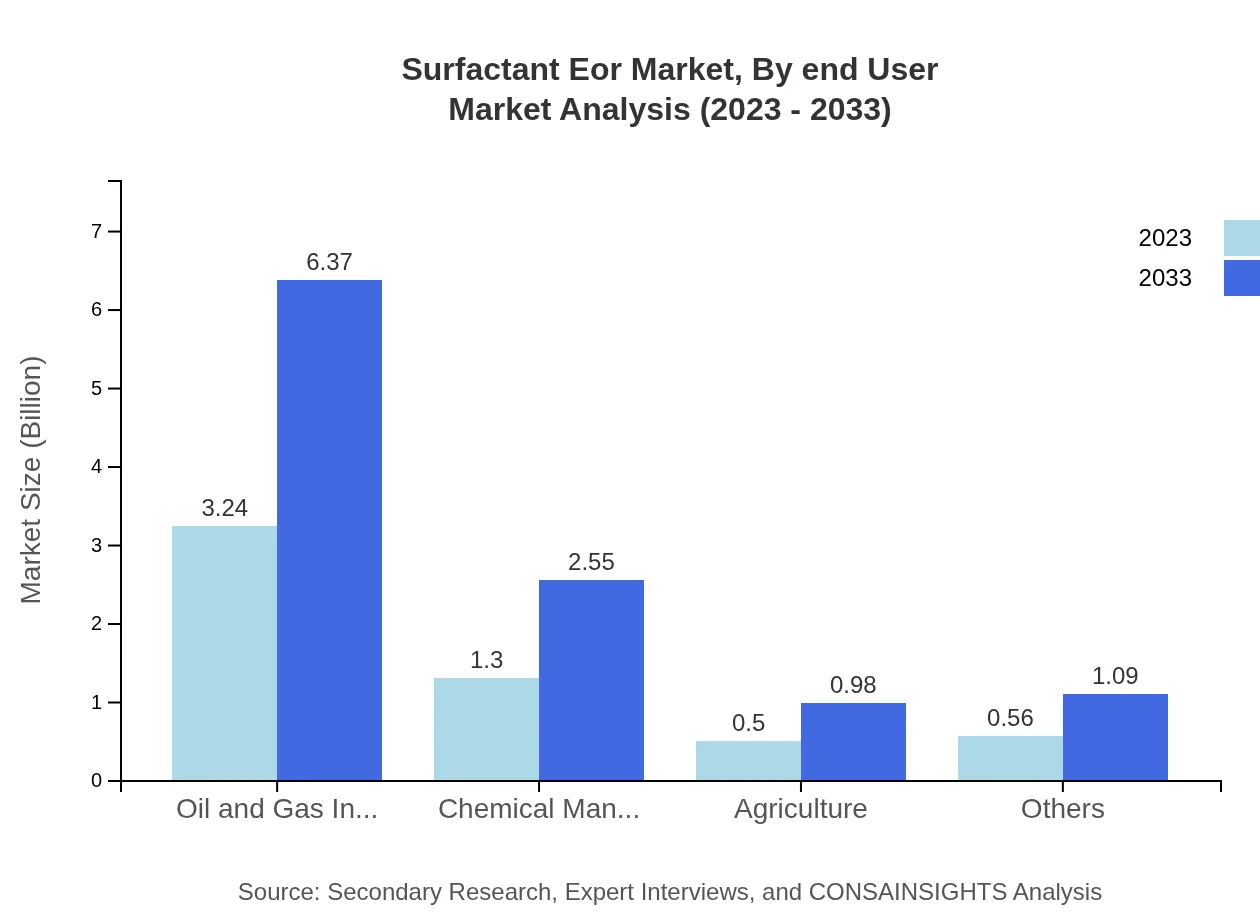

Surfactant Eor Market Analysis By End User

The Oil and Gas sector remains the largest end-user for Surfactant EOR, with market size expected to increase from USD 3.24 billion to USD 6.37 billion, sustaining a consistent share of 57.91%. Chemical Manufacturing and Agricultural sectors are also key contributors, with requirements growing for enhanced recovery methods and product efficacy.

Surfactant Eor Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Surfactant Eor Industry

BASF SE:

BASF SE is a leading global chemical company that supplies surfactants for a range of applications, including enhanced oil recovery. Their commitment to innovation and sustainability has led to the development of environmentally friendly surfactant products.Huntsman Corporation:

Huntsman Corporation specializes in differentiated chemicals and has a significant presence in the surfactant market for oil recovery. Their focus on research and development supports the production of advanced surfactant formulations.Clariant AG:

Clariant AG is known for its specialty chemicals and surfactants that enhance oil recovery processes in mature fields. They prioritize sustainable practices and advanced technological solutions in their offerings.DuPont:

DuPont delivers innovative solutions through its high-performance surfactants for EOR, contributing to improved efficiency in oil extraction and sustainability in operations.We're grateful to work with incredible clients.

FAQs

What is the market size of Surfactant EOR?

The Surfactant EOR market is currently valued at approximately $5.6 billion. It is expected to grow at a CAGR of 6.8% over the forecast period, indicating a strong upward trajectory for investment and innovation within this sector.

What are the key market players or companies in the Surfactant EOR industry?

Key players in the Surfactant EOR industry include major chemical manufacturers and oil recovery specialists. These companies are pivotal in driving technological advancements and expanding operational capacities in the surfactant market.

What are the primary factors driving the growth in the Surfactant EOR industry?

Primary drivers for growth in the Surfactant EOR industry include increasing global energy demands, advancements in extraction technologies, and the growing need for enhanced oil recovery methods to maximize recovery from existing wells.

Which region is the fastest Growing in the Surfactant EOR?

The fastest-growing region in the Surfactant EOR market is projected to be North America, with market expansions from $2.00 billion in 2023 to $3.93 billion by 2033, followed closely by Europe and Asia Pacific.

Does ConsaInsights provide customized market report data for the Surfactant EOR industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the Surfactant EOR industry, ensuring stakeholders receive relevant insights and detailed analysis pertinent to their business objectives.

What deliverables can I expect from this Surfactant EOR market research project?

Deliverables from the Surfactant EOR market research project include comprehensive market analyses, regional performance data, competitive landscape reports, and insights into emerging trends, segmented by technology and application.

What are the market trends of Surfactant EOR?

Current market trends in the Surfactant EOR sector include increasing adoption of microemulsion technology, growing investment in advanced surfactant formulations, and a shift towards sustainable practices in enhanced oil recovery.