United Sates Automotive Eps Market Report

Published Date: 02 February 2026 | Report Code: united-sates-automotive-eps

United Sates Automotive Eps Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the United States Automotive Electric Power Steering (EPS) market from 2023 to 2033. It covers market size, growth forecasts, trends, regional analysis, and insights into key industry players and segments.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

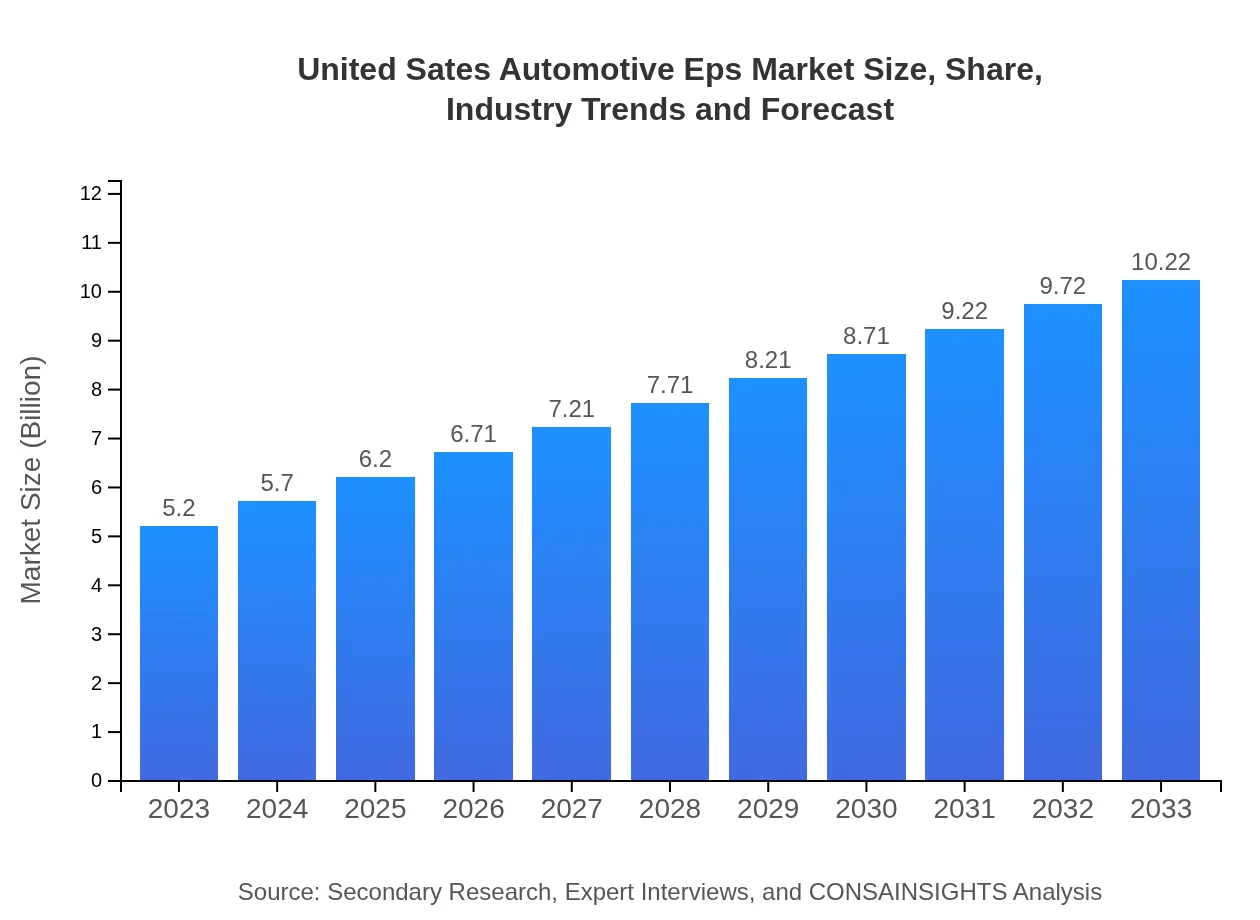

| 2023 Market Size | $5.20 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $10.22 Billion |

| Top Companies | Robert Bosch GmbH, JTEKT Corporation, ZF Friedrichshafen AG, Nexteer Automotive, Mando Corporation |

| Last Modified Date | 02 February 2026 |

United States Automotive EPS Market Overview

Customize United Sates Automotive Eps Market Report market research report

- ✔ Get in-depth analysis of United Sates Automotive Eps market size, growth, and forecasts.

- ✔ Understand United Sates Automotive Eps's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in United Sates Automotive Eps

What is the Market Size & CAGR of United States Automotive EPS market in 2023?

United States Automotive EPS Industry Analysis

United States Automotive EPS Market Segmentation and Scope

Tell us your focus area and get a customized research report.

United States Automotive EPS Market Analysis Report by Region

Europe United Sates Automotive Eps Market Report:

The European market is projected to grow from $1.61 billion in 2023 to $3.17 billion by 2033. The region's focus on reducing vehicle emissions and the increasing popularity of electric vehicles are key growth drivers.Asia Pacific United Sates Automotive Eps Market Report:

The Asia Pacific region holds a significant share of the EPS market, valued at approximately $1.08 billion in 2023, projected to grow to $2.13 billion by 2033. This growth is driven by robust automotive manufacturing in countries like Japan and China and the rising demand for electric and hybrid vehicles.North America United Sates Automotive Eps Market Report:

North America, which includes the United States, shows a market size of approximately $1.71 billion in 2023, anticipated to rise to $3.37 billion in 2033. This growth is supported by stringent regulatory requirements for vehicle emissions and safety.South America United Sates Automotive Eps Market Report:

In South America, the market for EPS is comparatively smaller, with a current value of $0.29 billion in 2023, expected to reach $0.57 billion by 2033. Key factors influencing growth include increasing automotive production and improvements in infrastructure.Middle East & Africa United Sates Automotive Eps Market Report:

The EPS market in the Middle East and Africa is expected to increase from $0.50 billion in 2023 to $0.98 billion by 2033, bolstered by rising automotive production and investments in transportation infrastructure.Tell us your focus area and get a customized research report.

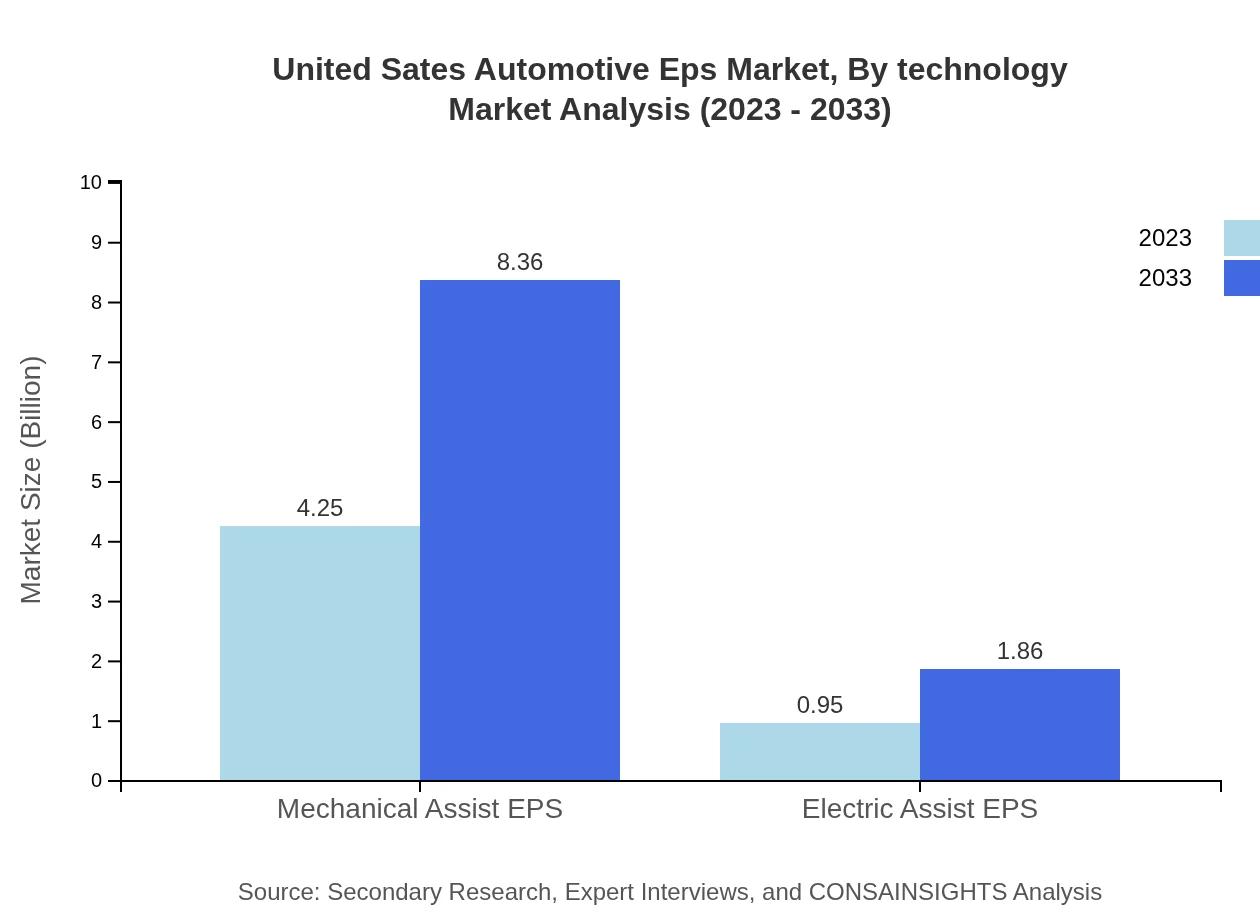

United Sates Automotive Eps Market Analysis By Product Type

The product type analysis reveals that Mechanical Assist EPS dominates the market, standing at $4.25 billion in 2023 and expected to reach $8.36 billion by 2033. Electric Assist EPS, while smaller, continues to gain traction, moving from $0.95 billion to $1.86 billion in the same period.

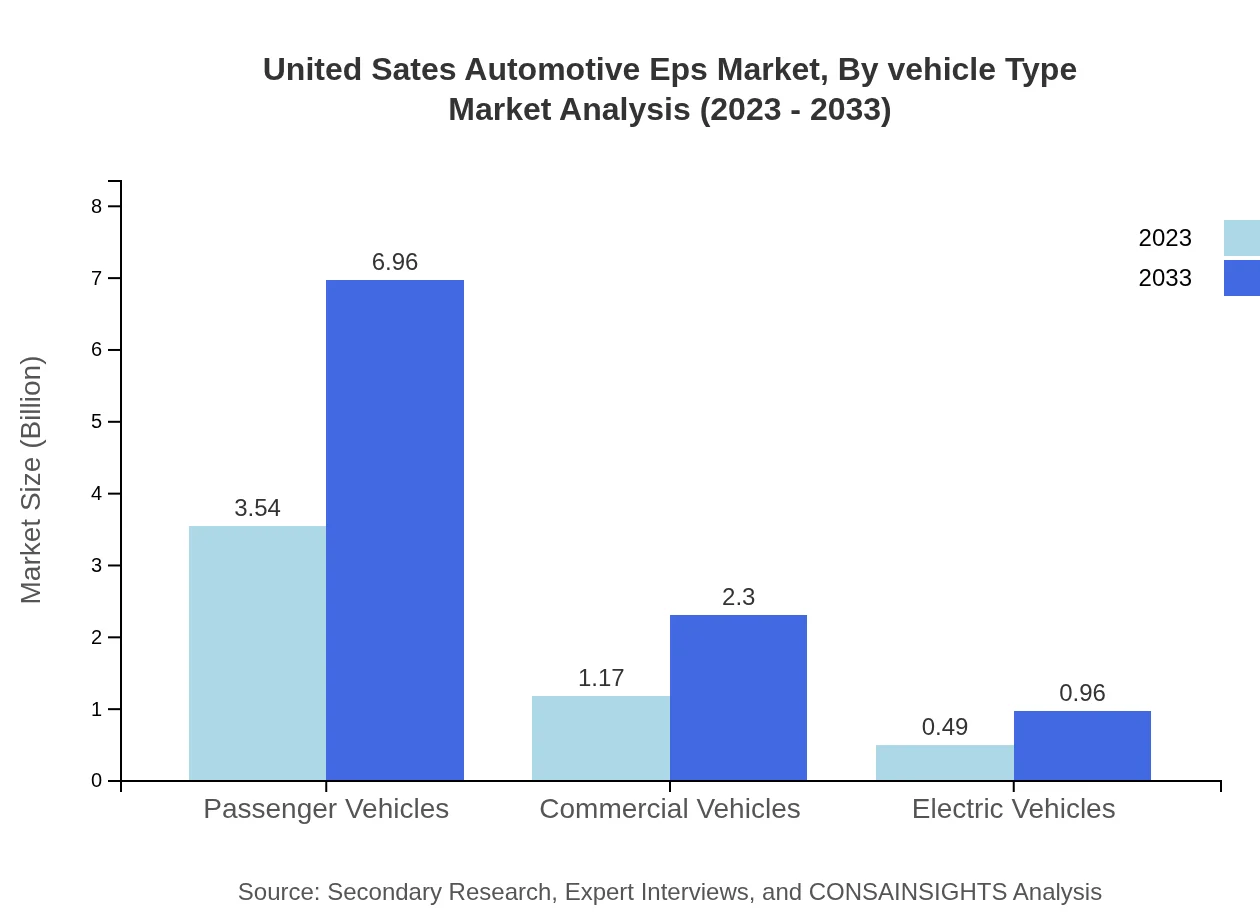

United Sates Automotive Eps Market Analysis By Vehicle Type

Passenger vehicles represent the majority market share at 68.14% in 2023, with a projected growth from $3.54 billion to $6.96 billion by 2033. Commercial vehicles are also critical, expected to grow from $1.17 billion to $2.30 billion by 2033.

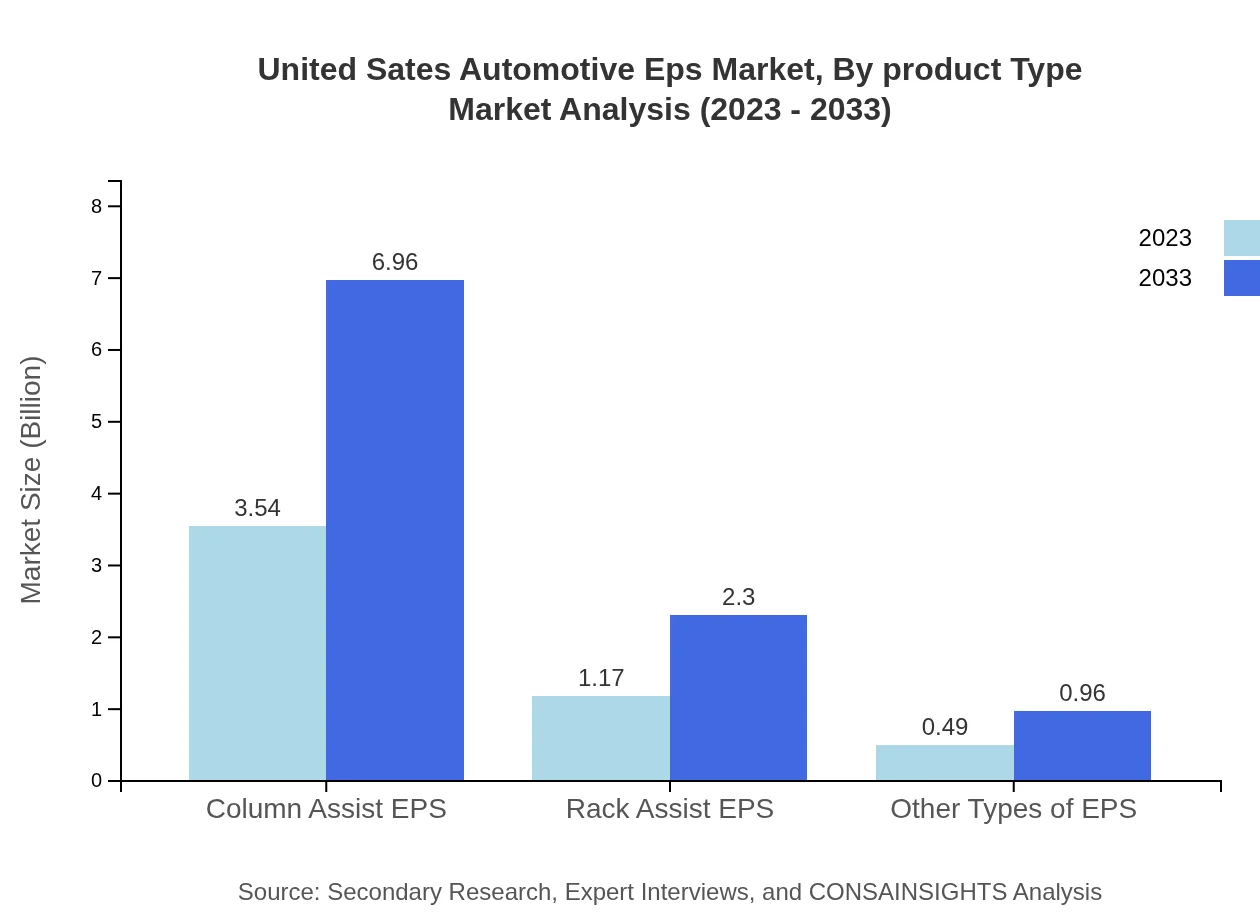

United Sates Automotive Eps Market Analysis By Technology

The technology segment shows the dominance of Column Assist EPS, progressing from $3.54 billion in 2023 to $6.96 billion by 2033, followed by Rack Assist EPS, which forecasts growth from $1.17 billion to $2.30 billion. Electric Assist and Mechanical Assist EPS are also gaining market traction.

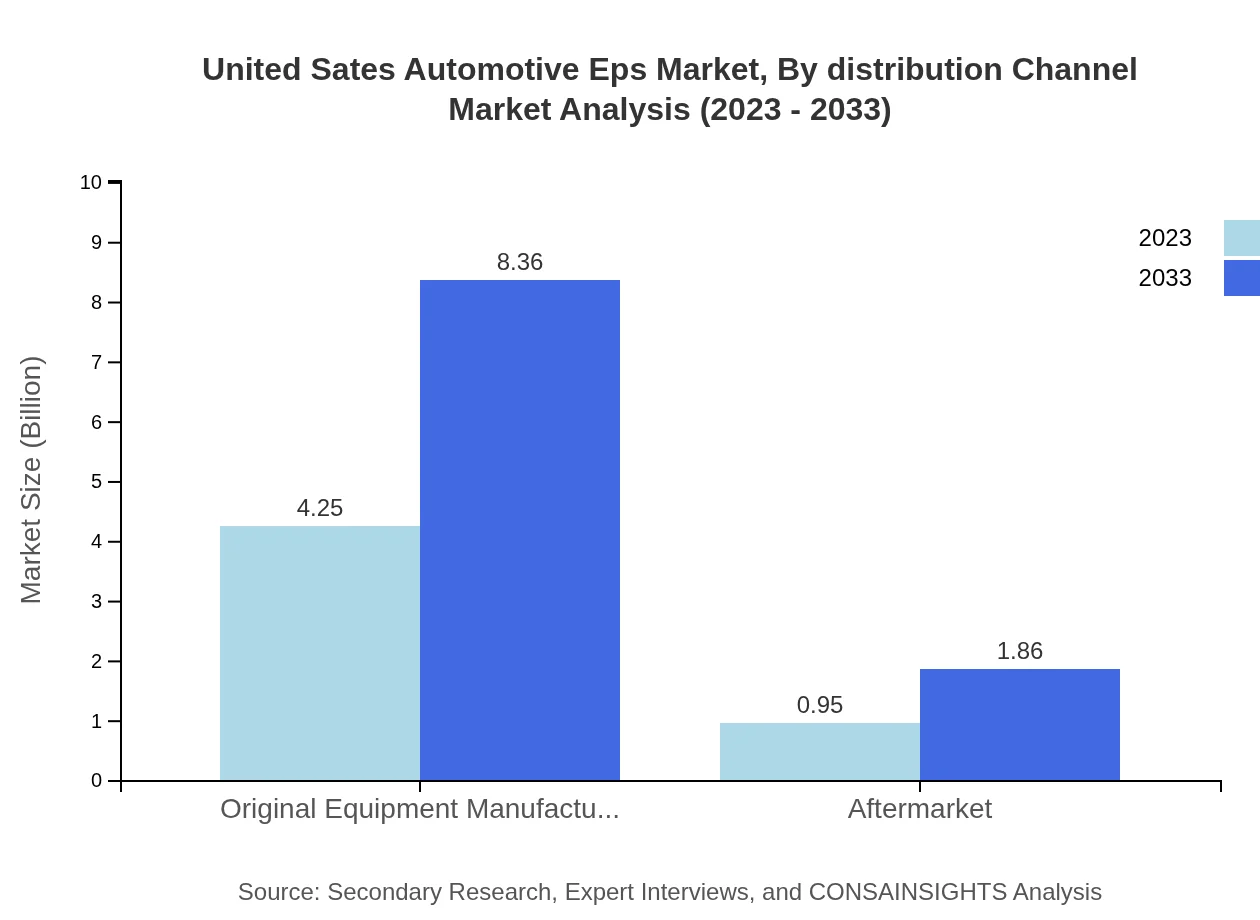

United Sates Automotive Eps Market Analysis By Distribution Channel

Distribution analysis indicates OE manufacturers contribute significantly to the market, showcasing a share of 81.76%. The aftermarket segment, albeit smaller, is projected to expand from $0.95 billion to $1.86 billion by 2033.

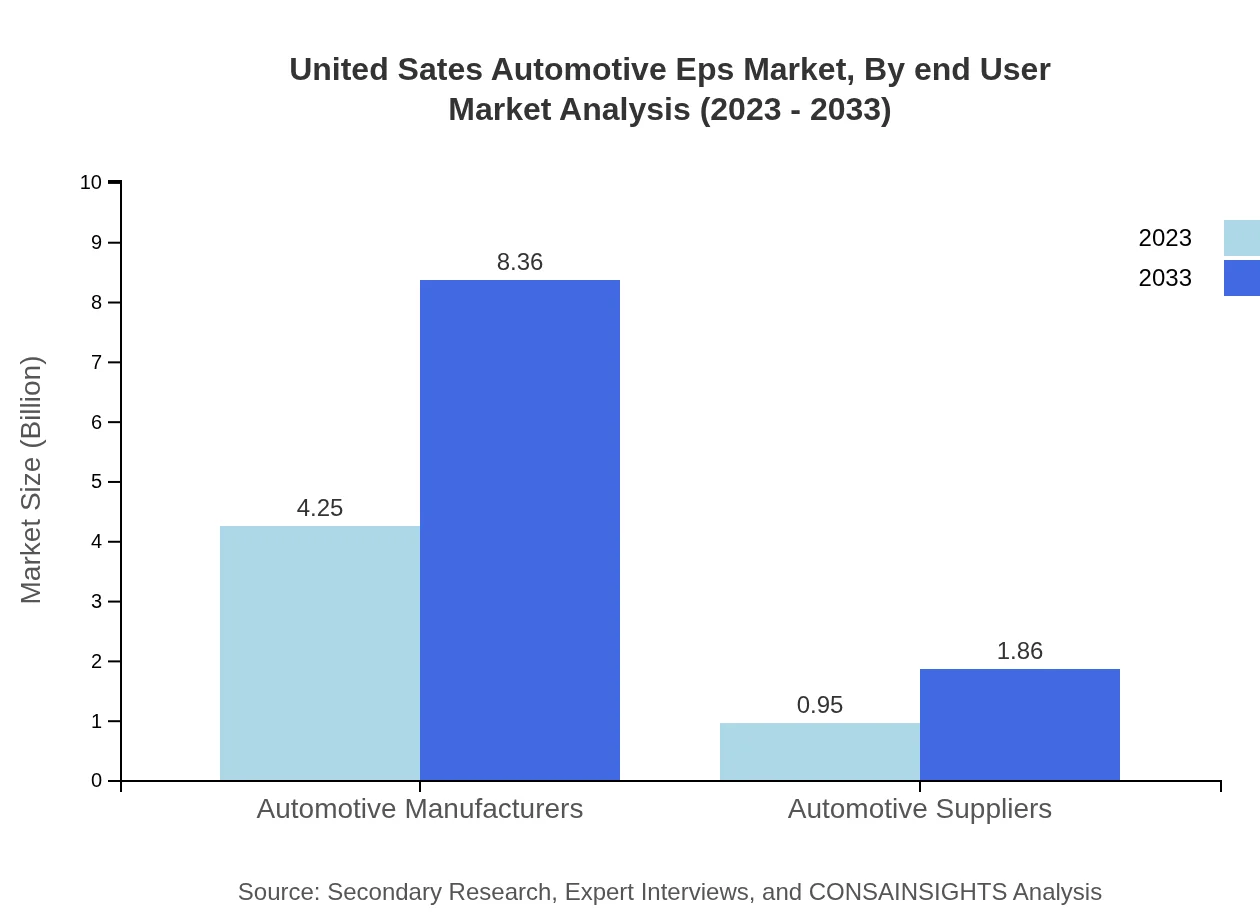

United Sates Automotive Eps Market Analysis By End User

The market for OEMs remains dominant, with a size of $4.25 billion in 2023, projected to grow to $8.36 billion by 2033, driven by the increasing demand for innovative steering technologies from automotive manufacturers.

United States Automotive EPS Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in United States Automotive EPS Industry

Robert Bosch GmbH:

A leading global supplier of technology and services, Bosch specializes in automotive systems, including advanced EPS technologies for enhanced vehicle performance and safety.JTEKT Corporation:

JTEKT is a prominent player in steering technologies, offering innovative EPS solutions that support the growing demand for electric vehicles and improve driving comfort.ZF Friedrichshafen AG:

ZF is a global leader in driveline and chassis technology, renowned for its cutting-edge EPS systems that enhance vehicle dynamics and safety.Nexteer Automotive:

Nexteer specializes in steering and driveline systems, providing highly efficient and reliable EPS solutions for a wide range of vehicles.Mando Corporation:

Mando develops advanced automotive systems including EPS, focusing on innovations that drive performance and safety in modern vehicles.We're grateful to work with incredible clients.

FAQs

What is the market size of united States Automotive Eps?

The United States automotive EPS market is valued at approximately $5.2 billion in 2023, with a projected CAGR of 6.8%, indicating steady growth and increased adoption within the automotive sector over the next decade.

What are the key market players or companies in this united States Automotive Eps industry?

Key players in the U.S. automotive EPS market include major automotive manufacturers and suppliers who specialize in producing steering systems, particularly electric power steering technologies. Their innovative contributions drive the evolution of EPS offerings.

What are the primary factors driving the growth in the united States Automotive Eps industry?

The growth of the U.S. automotive EPS market is primarily fueled by advancements in electric vehicles, increasing focus on fuel efficiency, and consumer demand for enhanced driving experiences, alongside regulatory pressures for reduced emissions.

Which region is the fastest Growing in the united States Automotive Eps?

The fastest-growing region in the U.S. automotive EPS market is North America, expected to expand from $1.71 billion in 2023 to $3.37 billion by 2033, driven by technological adoption and growing electric vehicle sales.

Does ConsaInsights provide customized market report data for the united States Automotive Eps industry?

Yes, ConsaInsights offers customized market report data tailored to the unique needs of clients in the U.S. automotive EPS industry, ensuring access to relevant insights for informed decision-making.

What deliverables can I expect from this united States Automotive Eps market research project?

From the U.S. automotive EPS market research project, clients can expect comprehensive reports including market size data, growth forecasts, competitive analysis, and insights on key industry trends and customer preferences.

What are the market trends of united States Automotive Eps?

Current trends in the U.S. automotive EPS market include increased adoption of electric assist systems, innovation in steering technology, and a shift towards integrating autonomous vehicle features, shaping the future of automotive design.