Vehicle Power Distribution Market Report

Published Date: 02 February 2026 | Report Code: vehicle-power-distribution

Vehicle Power Distribution Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Vehicle Power Distribution market, including market size, growth rates, and key trends from 2023 to 2033. It also offers insights into industry segmentation, regional dynamics, and leading market players.

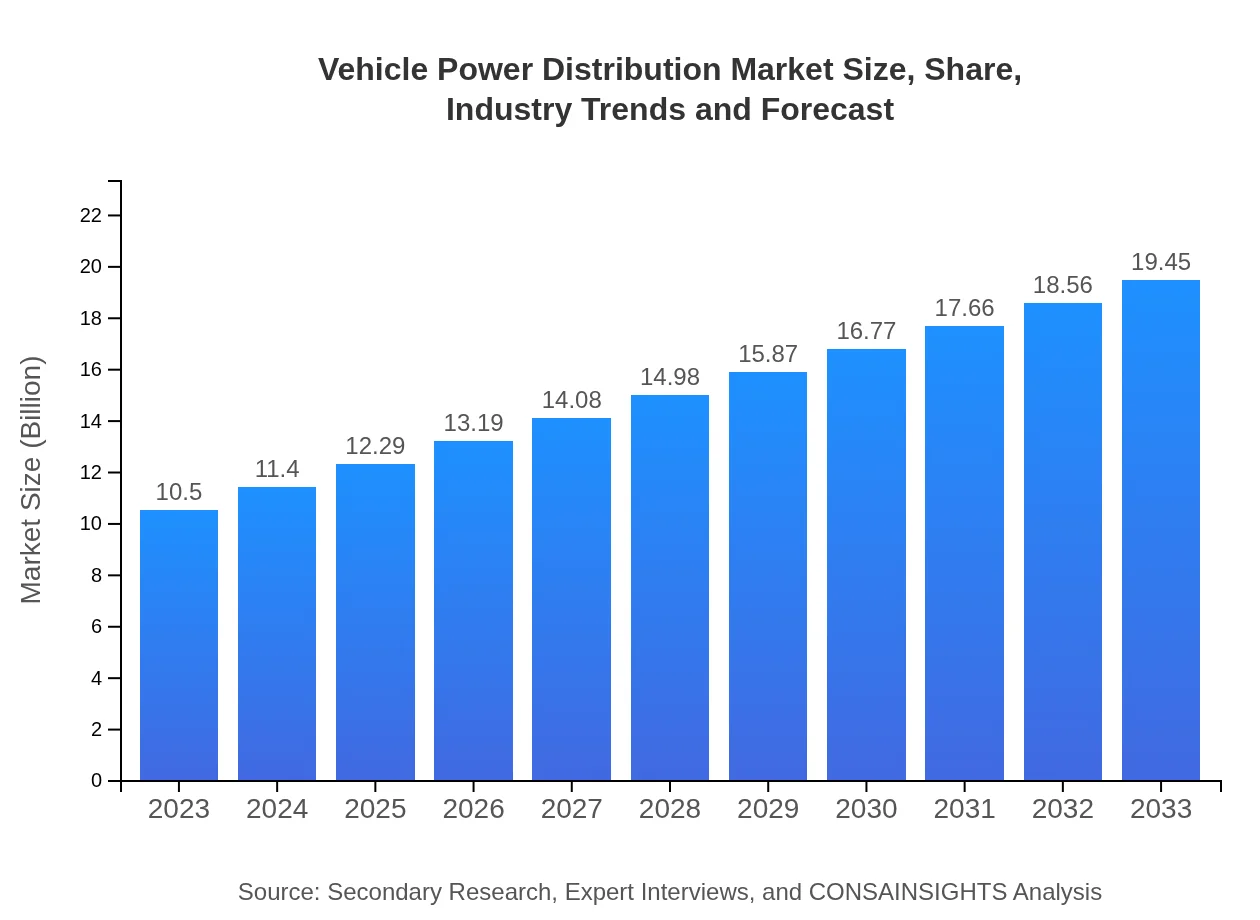

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $19.45 Billion |

| Top Companies | Robert Bosch GmbH, Continental AG, Delphi Technologies, Denso Corporation |

| Last Modified Date | 02 February 2026 |

Vehicle Power Distribution Market Overview

Customize Vehicle Power Distribution Market Report market research report

- ✔ Get in-depth analysis of Vehicle Power Distribution market size, growth, and forecasts.

- ✔ Understand Vehicle Power Distribution's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Vehicle Power Distribution

What is the Market Size & CAGR of Vehicle Power Distribution market in 2023?

Vehicle Power Distribution Industry Analysis

Vehicle Power Distribution Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Vehicle Power Distribution Market Analysis Report by Region

Europe Vehicle Power Distribution Market Report:

Europe’s Vehicle Power Distribution market is expected to expand from $2.68 billion in 2023 to $4.96 billion in 2033, largely due to the stringent emission regulations and strong consumer preferences for electric and hybrid vehicles.Asia Pacific Vehicle Power Distribution Market Report:

The Asia Pacific region is set to witness significant growth, with the market size anticipated to increase from $2.15 billion in 2023 to $3.97 billion by 2033. This region is characterized by robust automotive manufacturing and increasing investment in electric vehicle infrastructure.North America Vehicle Power Distribution Market Report:

The North American market is projected to grow from $3.69 billion in 2023 to $6.83 billion in 2033, supported by an increase in electric vehicle adoption and a strong focus on enhancing vehicle efficiency and performance.South America Vehicle Power Distribution Market Report:

In South America, the Vehicle Power Distribution market is expected to grow from $0.93 billion in 2023 to $1.71 billion by 2033, driven by rising demand for vehicles with advanced electrical systems and ongoing economic improvements.Middle East & Africa Vehicle Power Distribution Market Report:

The Middle East and Africa are expected to see a market increase from $1.06 billion in 2023 to $1.97 billion by 2033, with growth fueled by rising automotive sales in urban areas and investment in vehicle automation technologies.Tell us your focus area and get a customized research report.

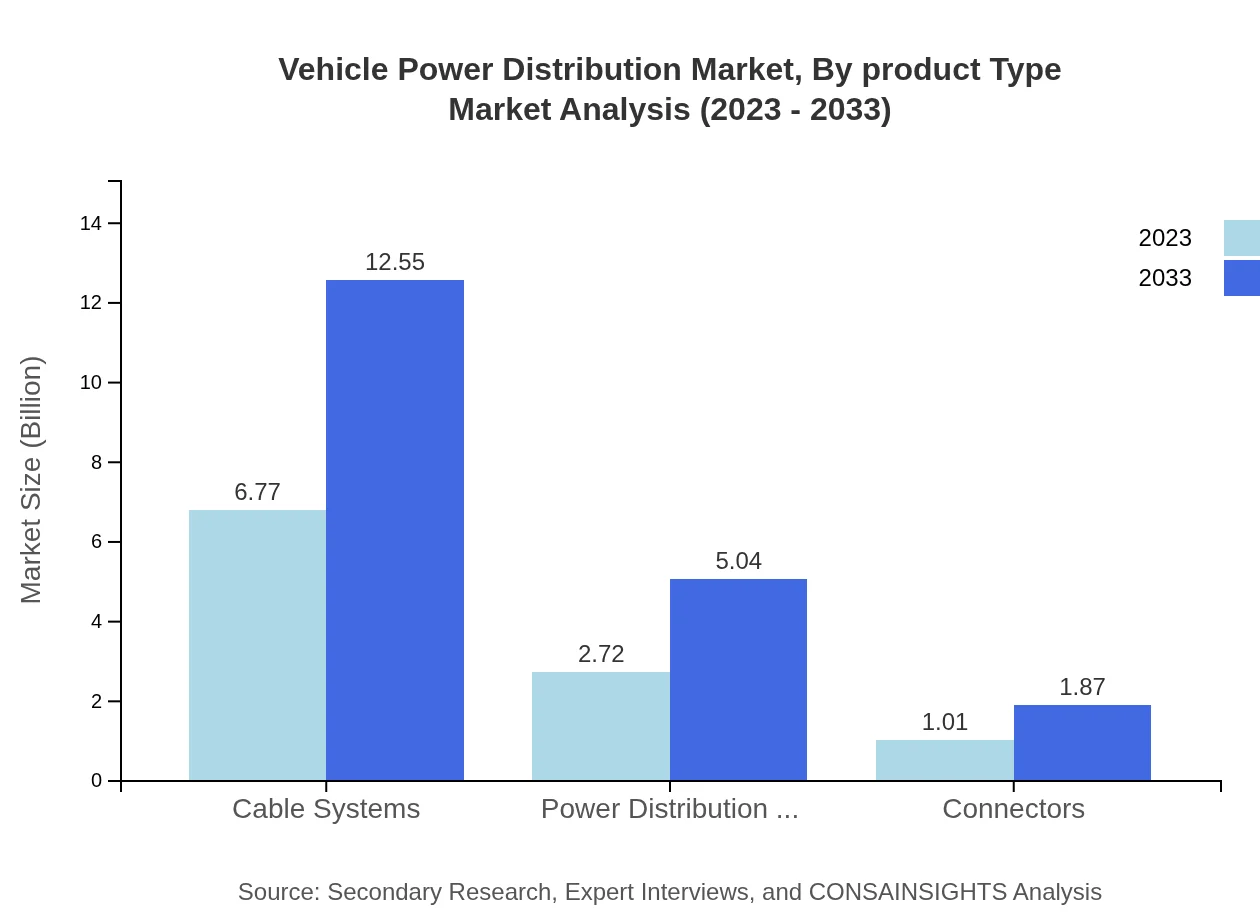

Vehicle Power Distribution Market Analysis By Product Type

The Vehicle Power Distribution market, segmented by product type, includes components such as power distribution modules, connectors, and cable systems. Power distribution modules dominate the segment, projected to grow from $2.72 billion in 2023 to $5.04 billion by 2033, reflecting the increasing complexity of electrical systems in modern vehicles.

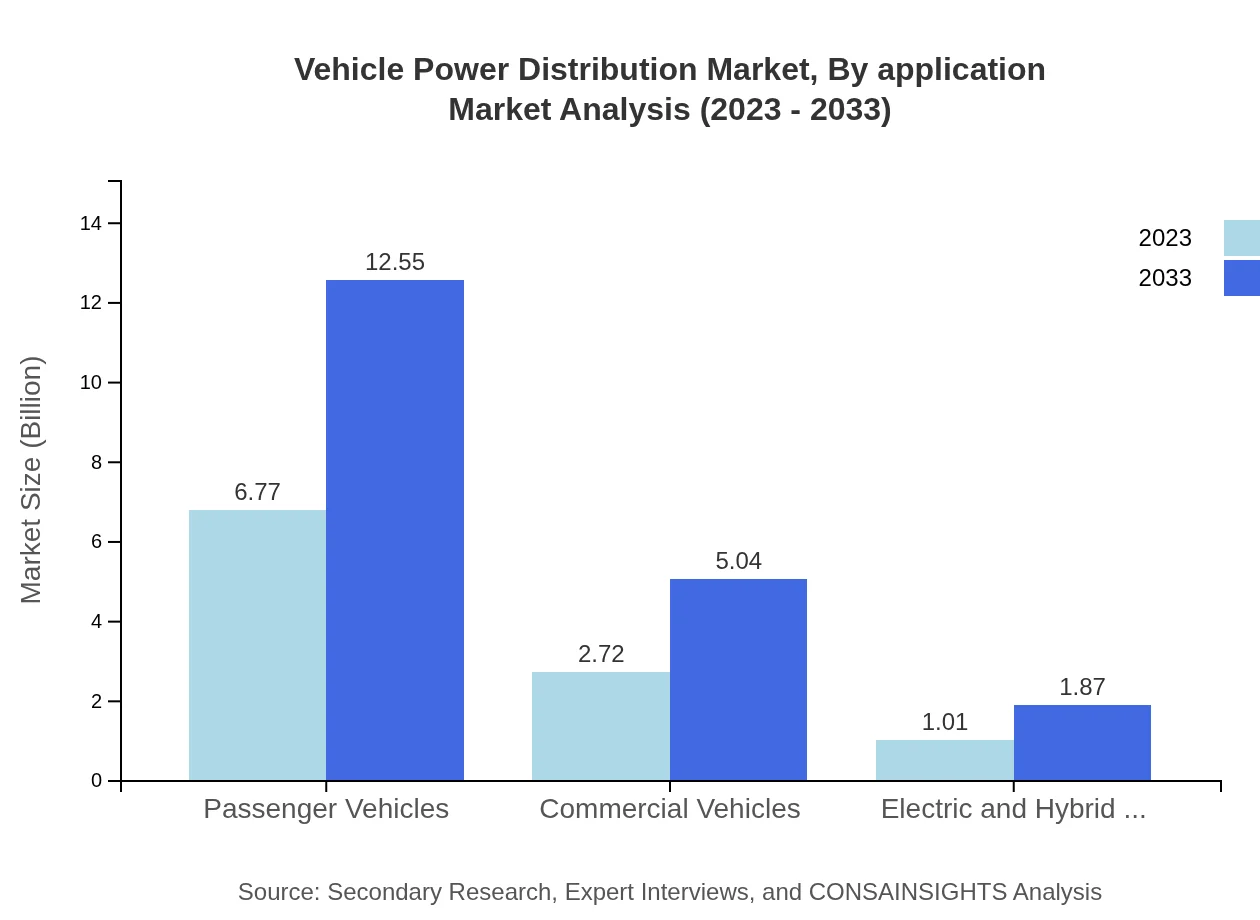

Vehicle Power Distribution Market Analysis By Application

Segmented by application, the Vehicle Power Distribution market includes passenger vehicles, commercial vehicles, and electric/hybrid vehicles. Passenger vehicles account for the largest share, expected to grow from $6.77 billion in 2023 to $12.55 billion by 2033, highlighting the need for effective power distribution in mainstream vehicles.

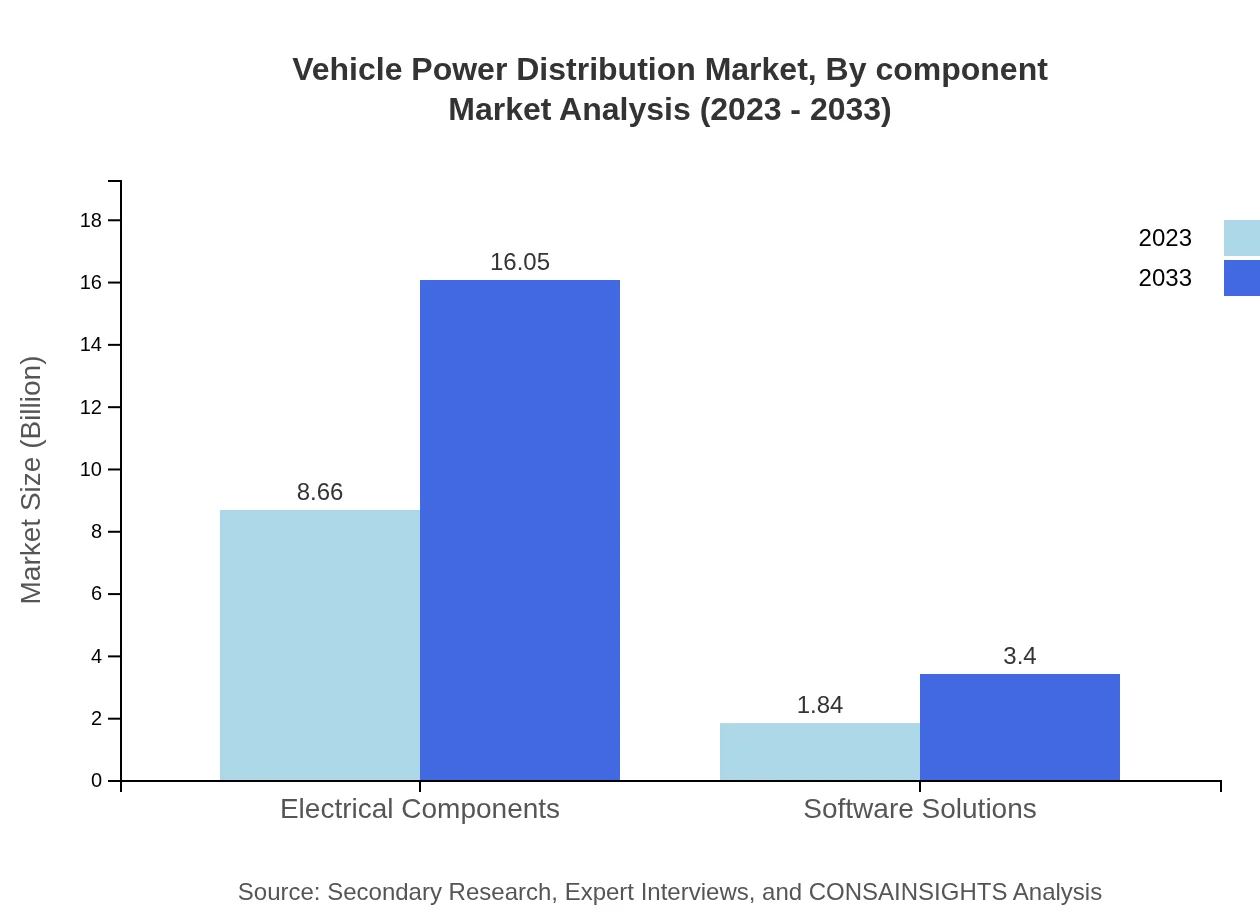

Vehicle Power Distribution Market Analysis By Component

When analyzed by components, the market includes electrical components, software solutions, and traditional vs. smart power distribution technologies. Electrical components hold a substantial market size at $8.66 billion in 2023, predicted to rise to $16.05 billion by 2033, reflecting their vital role in vehicle power management.

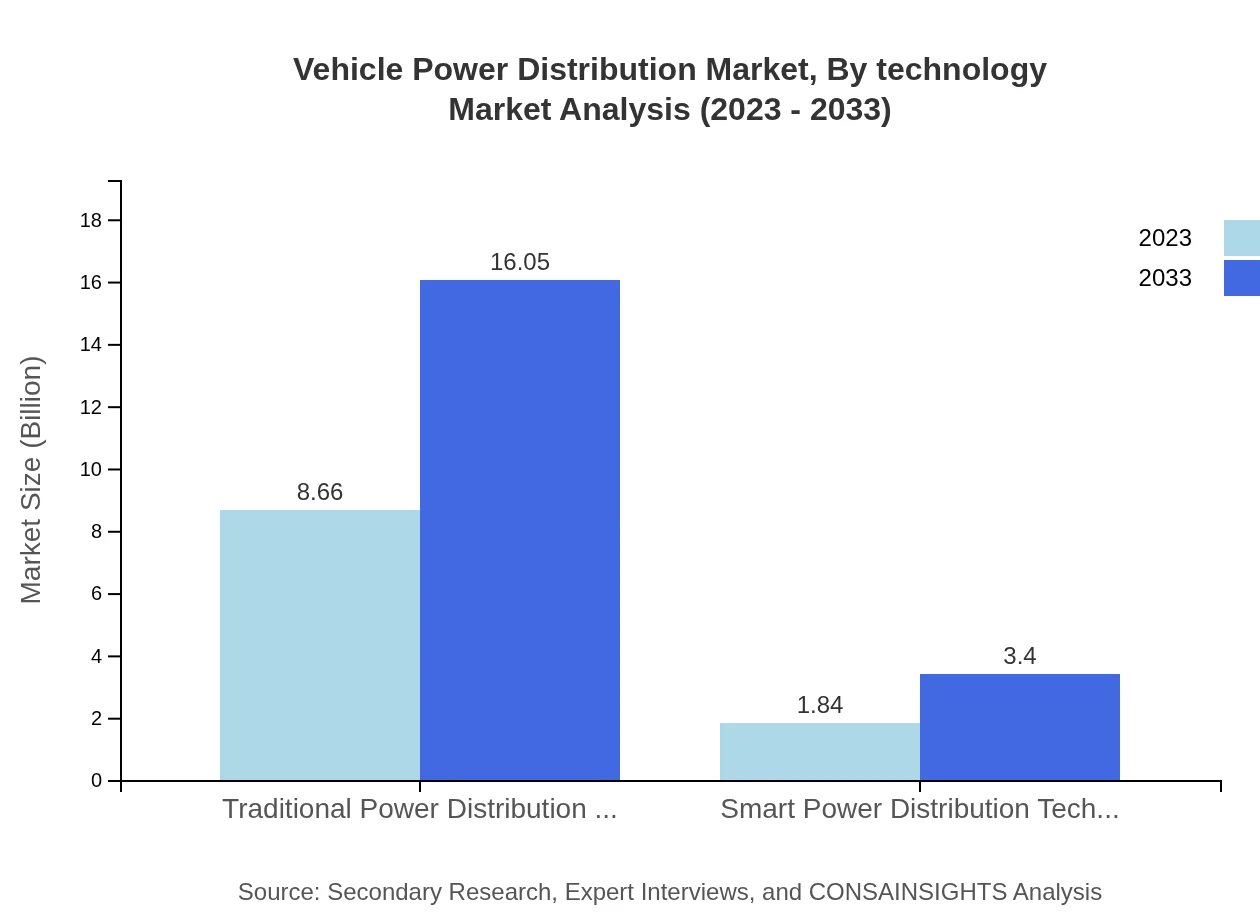

Vehicle Power Distribution Market Analysis By Technology

The market analysis by technology highlights the shift from traditional to smart power distribution technologies, with smart technologies projected to grow from $1.84 billion in 2023 to $3.40 billion by 2033. This shift illustrates the industry's trend toward more integrated and autonomous vehicle systems.

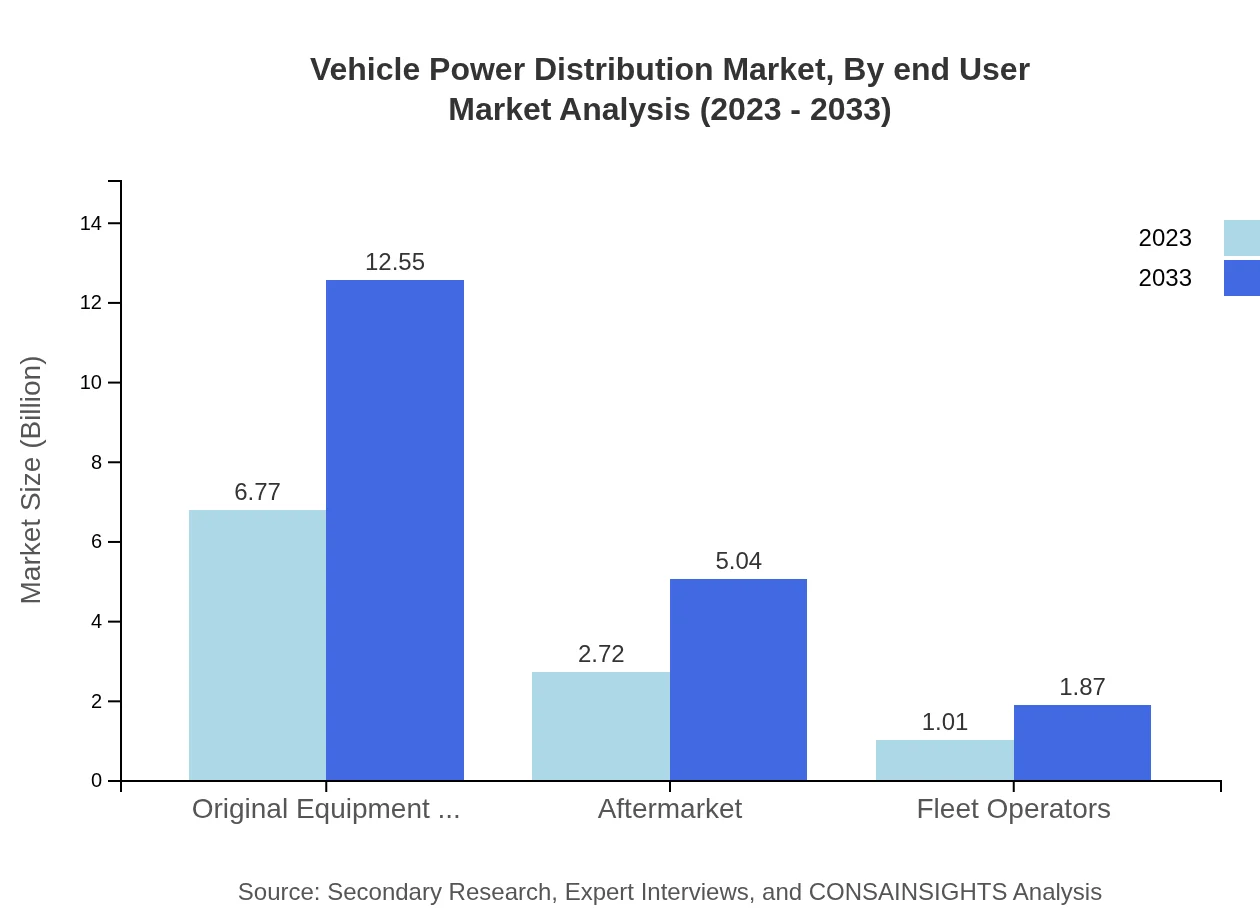

Vehicle Power Distribution Market Analysis By End User

End-user segmentation reveals that OEMs significantly dominate the market, contributing approximately $6.77 billion in 2023 and expected to grow to $12.55 billion by 2033. The aftermarket also shows substantial growth potential, with a predicted rise from $2.72 billion to $5.04 billion during the same timeframe.

Vehicle Power Distribution Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Vehicle Power Distribution Industry

Robert Bosch GmbH:

A leading global supplier in the automotive industry, Bosch focuses on innovative power distribution technologies and efficient power management solutions for vehicles.Continental AG:

Continental is known for its advanced automotive electronics and systems, driving innovations in Vehicle Power Distribution and enhancing vehicle connectivity.Delphi Technologies:

Delphi specializes in advanced vehicle technology and power management solutions, playing a crucial role in the optimization of energy systems within vehicles.Denso Corporation:

Denso is a global automotive components manufacturer that provides cutting-edge technologies in energy management and electrical systems to improve vehicle performance.We're grateful to work with incredible clients.

FAQs

What is the market size of vehicle Power Distribution?

The Vehicle Power Distribution market is projected to reach a size of approximately $10.5 billion by 2033, growing at a CAGR of 6.2% from its current valuation. This growth indicates a robust demand driven by evolving automotive technologies.

What are the key market players or companies in this vehicle Power Distribution industry?

Key players in the vehicle power distribution market include major OEMs, automotive component manufacturers, and electronics firms specializing in power distribution systems. Their innovation and strategic collaborations are pivotal in shaping industry standards and capabilities.

What are the primary factors driving the growth in the vehicle Power Distribution industry?

Factors driving growth in the vehicle power distribution market include the increasing adoption of electric and hybrid vehicles, advancements in electrical components, and heightened demand for smart power distribution technologies. Additionally, stringent regulations promote energy efficiency.

Which region is the fastest Growing in the vehicle power distribution?

North America is identified as the fastest-growing region for vehicle power distribution, projected to grow from $3.69 billion in 2023 to $6.83 billion by 2033. Europe and Asia Pacific also show significant growth due to technological advancements.

Does ConsaInsights provide customized market report data for the vehicle power distribution industry?

Yes, ConsaInsights offers customized market reports tailored specifically to the vehicle power distribution industry. Clients can obtain detailed insights and analyses catered to their business needs and operational strategies.

What deliverables can I expect from this vehicle power distribution market research project?

Deliverables from the vehicle power distribution market research project include comprehensive market analysis, growth projections, competitive landscape insights, regional market evaluations, and strategic recommendations based on current trends and data.

What are the market trends of vehicle power distribution?

Current trends in the vehicle power distribution market highlight a shift towards smart power distribution technologies and enhanced electrical components, driven by the rise of electric vehicles and sustainability initiatives. The focus is on energy efficiency and integrated systems.