Ai In Banking Market Size

Published Date: 24 January 2026 | Report Code: ai-in-banking-market-size

Ai In Banking Market Size Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report delves into the evolving landscape of the AI in Banking Market Size from 2024 to 2033. It examines key drivers, competitive dynamics, and technological innovations shaping the industry. With rigorous insights into market size, segmentation, regional performance, and product trends, the report equips stakeholders with actionable data for strategic decision-making in a rapidly digitalizing banking environment.

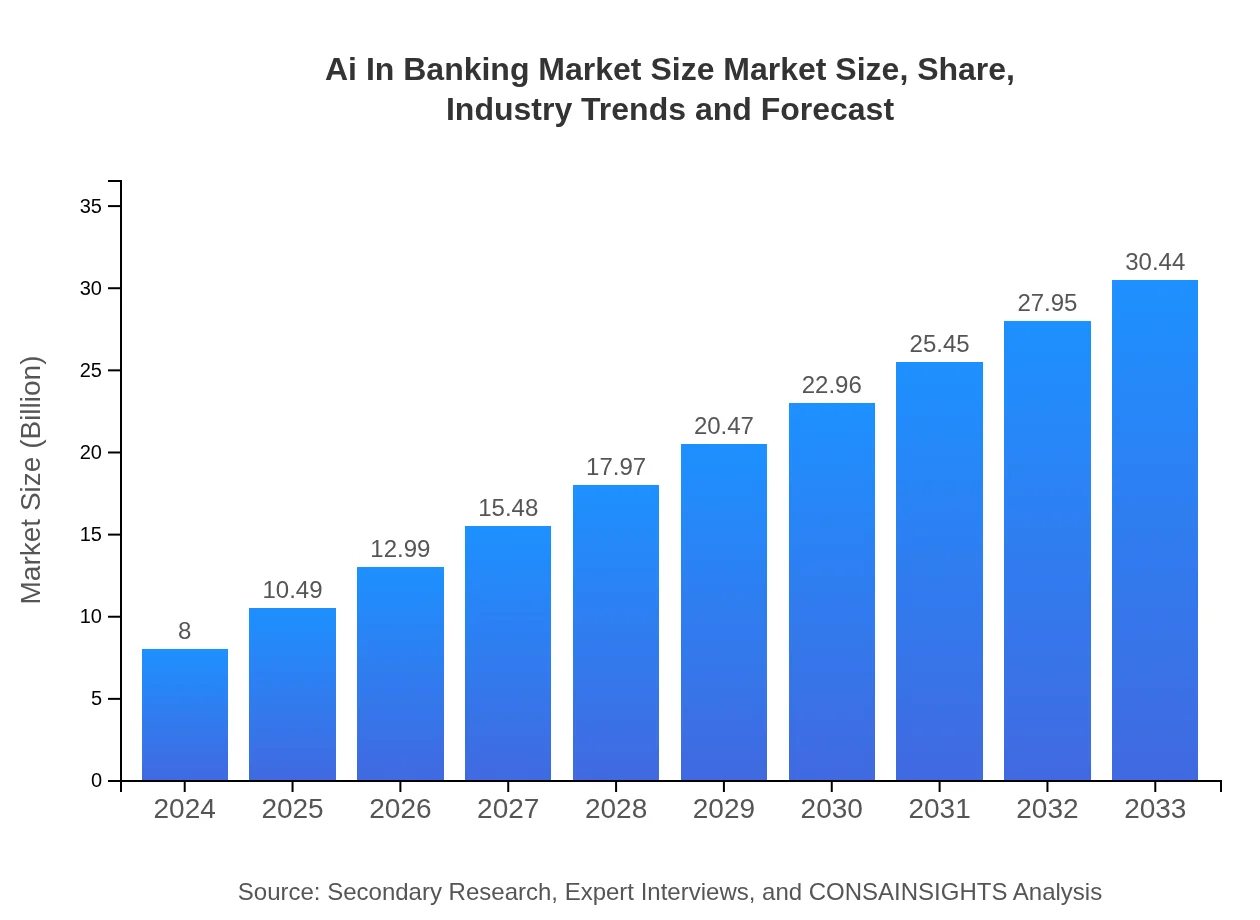

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

| 2024 Market Size | $8.00 Billion |

| CAGR (2024-2033) | 15.2% |

| 2033 Market Size | $30.44 Billion |

| Top Companies | TechBank Solutions, FinAI Innovations |

| Last Modified Date | 24 January 2026 |

Ai In Banking Market Size Market Overview

Customize Ai In Banking Market Size market research report

- ✔ Get in-depth analysis of Ai In Banking Market Size market size, growth, and forecasts.

- ✔ Understand Ai In Banking Market Size's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ai In Banking Market Size

What is the Market Size & CAGR of Ai In Banking Market Size market in 2024?

Ai In Banking Market Size Industry Analysis

Ai In Banking Market Size Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ai In Banking Market Size Market Analysis Report by Region

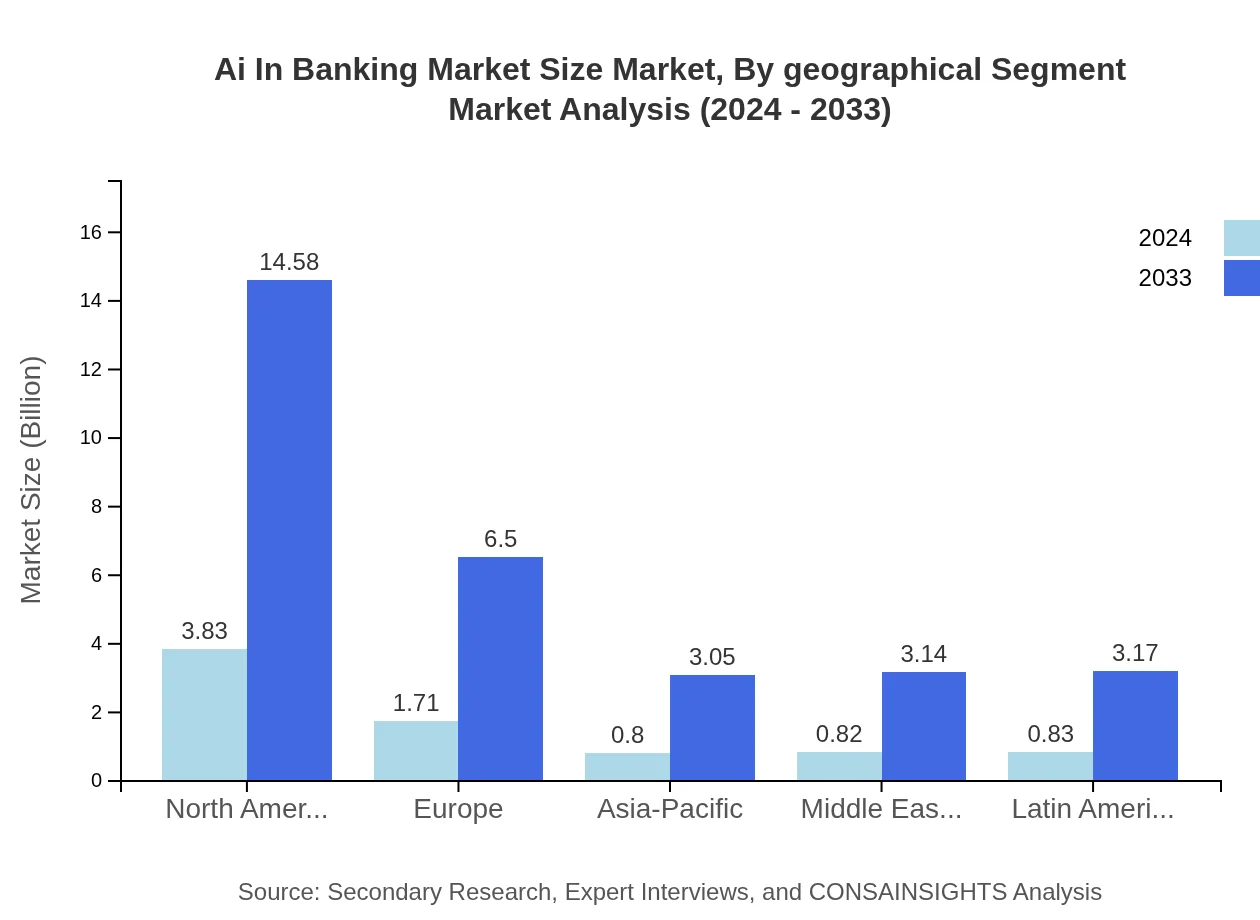

Europe Ai In Banking Market Size:

Europe's market is also rapidly evolving, with AI in Banking solutions witnessing strong growth. The region’s market size in 2024 stands at 2.30 and is expected to surge to 8.74 by 2033. Regulatory support, advanced banking infrastructure, and strategic investments in AI innovations remain the primary growth catalysts in this region.Asia Pacific Ai In Banking Market Size:

In the Asia Pacific region, the AI in Banking market is witnessing a rapid adoption curve owing to strong digital infrastructure growth and supportive government policies. The market in 2024 is estimated at 1.43, growing to 5.42 by 2033, driven by increased investment in digital banking solutions and heightened focus on operational efficiency through automation.North America Ai In Banking Market Size:

North America remains one of the dominant regions with robust market performance. With a market size of 3.08 in 2024 projected to expand to 11.72 by 2033, the region benefits from high consumer demand for AI-driven financial services, significant investments in fintech innovations, and an early majority adoption rate of cutting-edge technologies.South America Ai In Banking Market Size:

South America, represented in this report as Latin America, shows promising potential with a market size of approximately 0.49 in 2024, which is expected to increase to 1.86 by 2033. The growth here is attributed to improving technological adoption in banking, modernization of legacy systems, and strategic collaborations between local banks and technology providers.Middle East & Africa Ai In Banking Market Size:

The Middle East and Africa region, though smaller in market size with 0.71 in 2024, is poised for significant growth by reaching 2.70 by 2033. Strategic government initiatives, improved digital connectivity, and investment in technology-driven banking transformation are key drivers contributing to this upward trajectory.Tell us your focus area and get a customized research report.

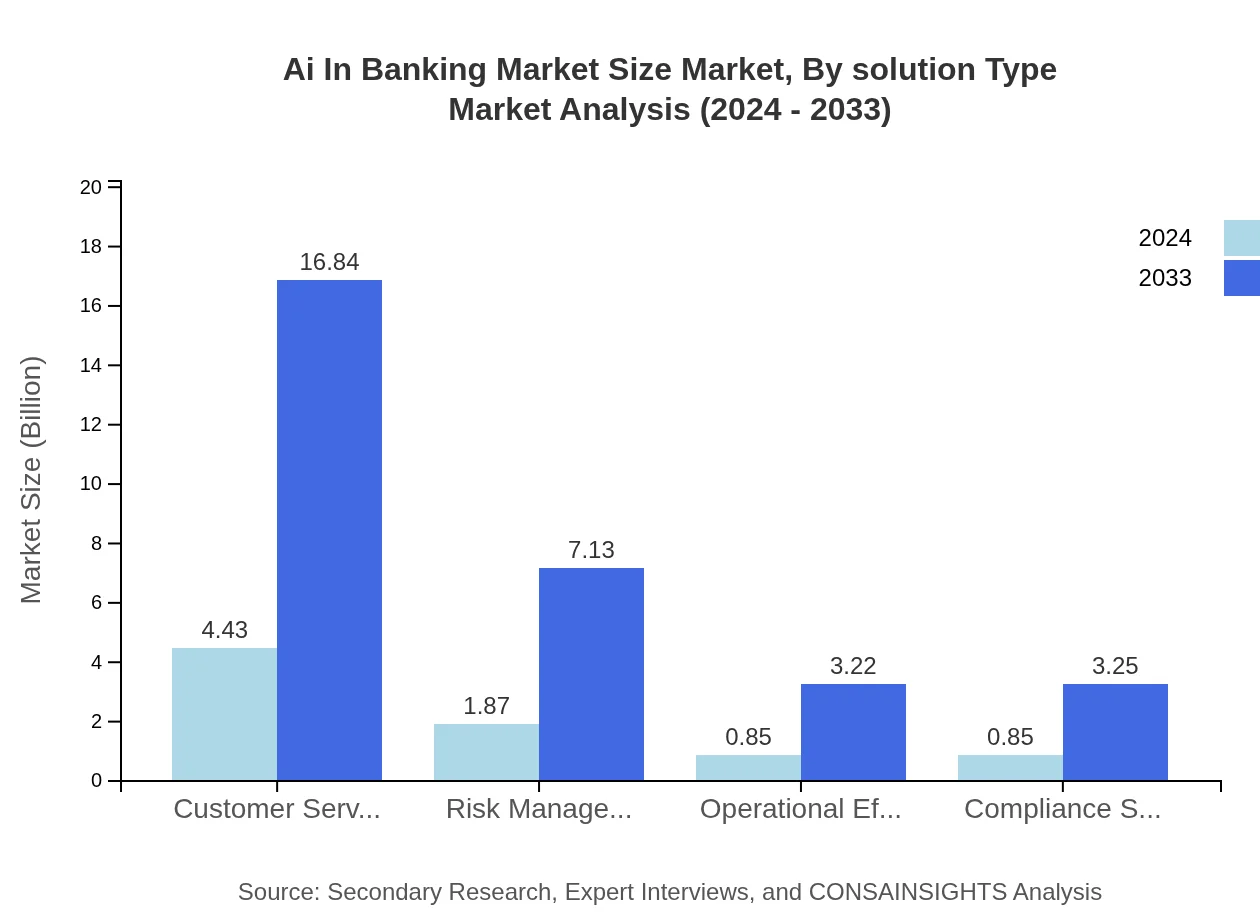

Ai In Banking Market Size Market Analysis By Solution Type

The solution type segmentation in the AI in Banking sector distinguishes between various software solutions that address multiple banking functions. Solutions such as risk management, fraud detection, and customer relationship management are leading the drive towards digital transformation. This segment emphasizes how technology integration can optimize operations, reduce manual intervention, and provide analytical insights that contribute to strategic decision-making. Financial institutions are deploying these solutions to improve compliance, boost efficiency, and ensure a secure transaction process in an ever-evolving regulatory landscape.

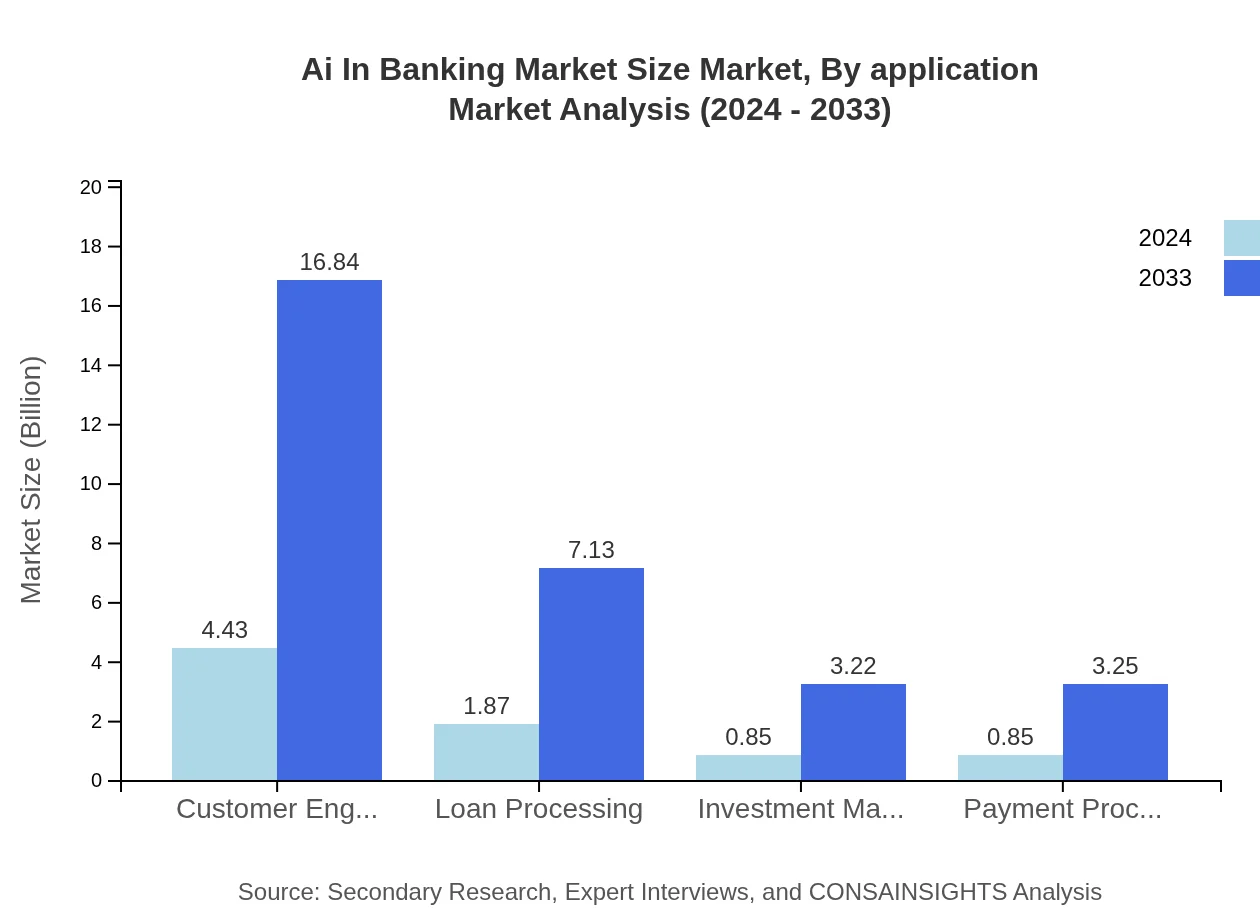

Ai In Banking Market Size Market Analysis By Application

Application segmentation focuses on the diverse uses of AI in banking, such as commercial banking, investment banking, credit unions, and neobanks. More detailed applications include customer engagement, loan processing, investment management, and payment processing. Each application area has been developed to cater to specific operational challenges, whether it’s reducing processing times or enhancing the quality of customer service. The insights gleaned from this segmentation provide stakeholders with a granular view of where to invest for maximum efficiency and growth.

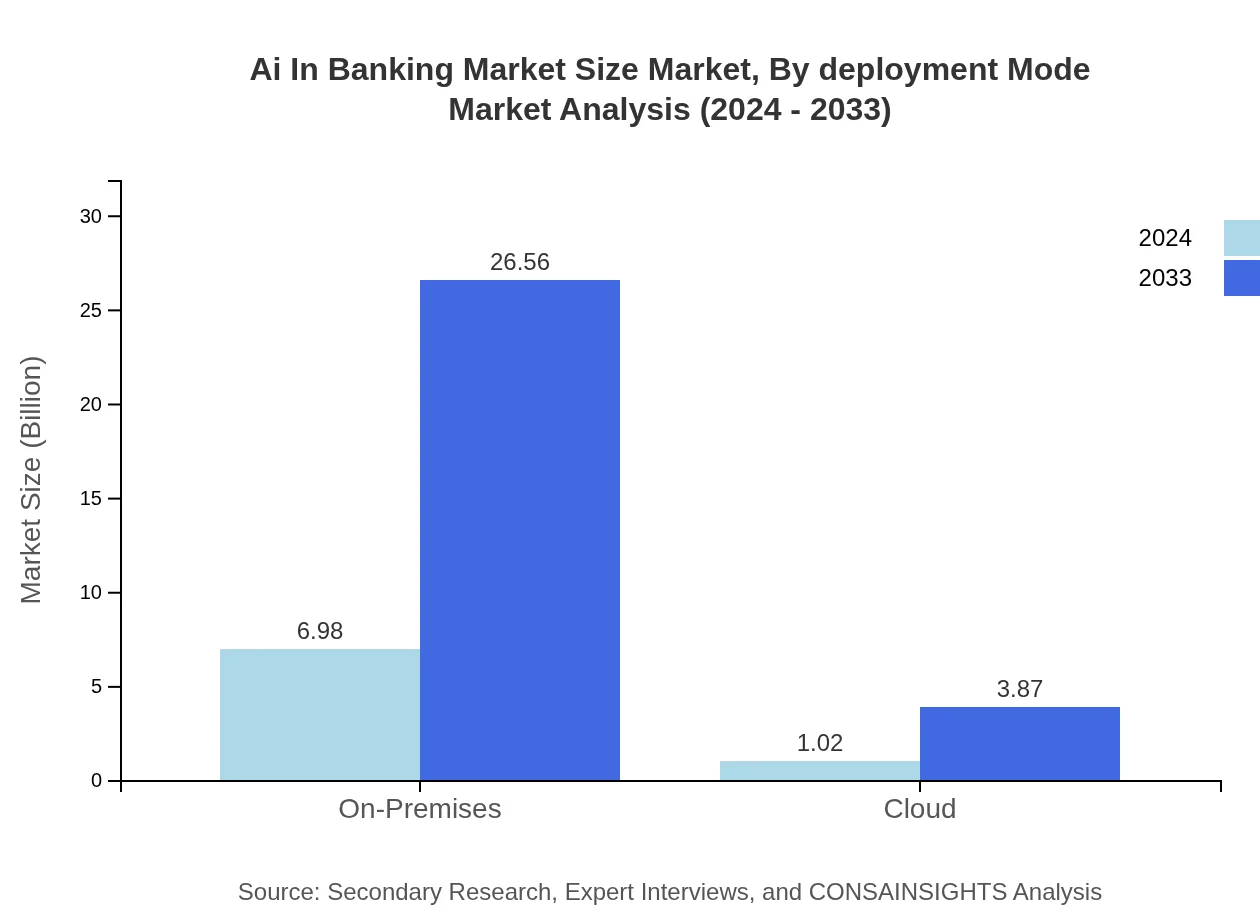

Ai In Banking Market Size Market Analysis By Deployment Mode

Deployment mode segmentation distinguishes between on-premises and cloud-based solutions. On-premises solutions currently hold a dominant position with market sizes significantly higher due to legacy integration and security preferences, while cloud-based solutions are rapidly gaining traction due to scalability, cost effectivity, and ease of deployment. The analysis indicates that while traditional on-premises models provide stability and control, the future direction points towards a hybrid integration where cloud capabilities enhance overall system performance.

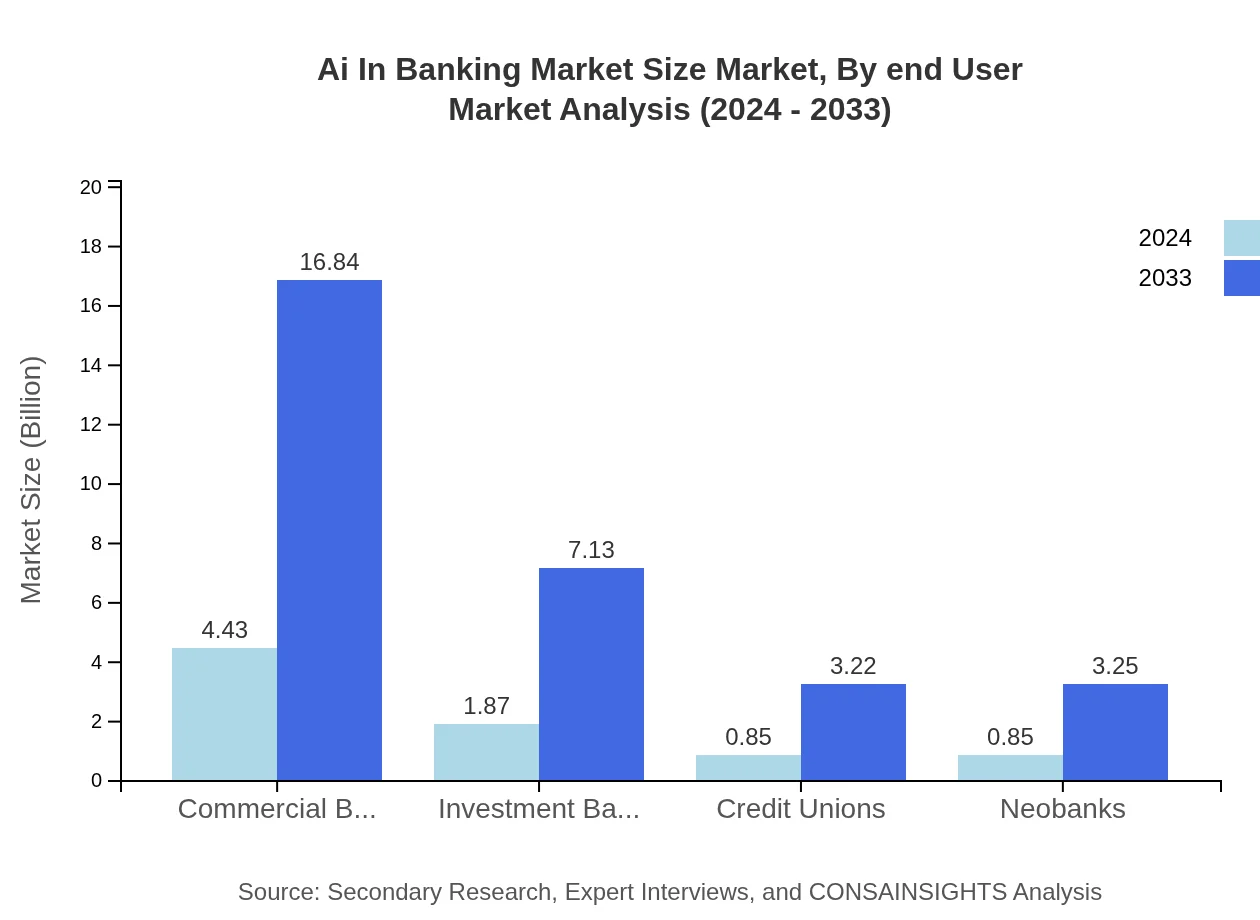

Ai In Banking Market Size Market Analysis By End User

The end-user segmentation categorizes the market according to the type of banking institutions leveraging AI technologies. This includes commercial banks, investment banks, credit unions, and emerging neobanks. Each category uses AI to manage diverse tasks—from customer service solutions to risk management and operational efficiency. This segmentation provides insight into investment priorities and highlights the areas in banking that are most poised for digital transformation. Tailored AI applications are enhancing service delivery, reducing turnaround times, and improving overall customer satisfaction.

Ai In Banking Market Size Market Analysis By Geographical Segment

Geographical segmentation offers a panoramic view of regional performance and growth potential. This segment analyzes the implementation of AI across different regions such as Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa. By comparing regional market sizes and growth trajectories, stakeholders can better understand variations in technological adoption, regulatory impacts, and local economic dynamics. This detailed geographical perspective aids in identifying high-growth regions and tailoring market strategies to capitalize on unique regional opportunities.

Ai In Banking Market Size Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ai In Banking Market Size Industry

TechBank Solutions:

TechBank Solutions is at the forefront of integrating advanced AI systems within the banking landscape. The company specializes in risk management, fraud detection, and customer relationship platforms, thereby helping financial institutions optimize operations and enhance security.FinAI Innovations:

FinAI Innovations leverages state-of-the-art artificial intelligence and machine learning technologies to transform traditional banking services. Their solutions focus on automating complex processes and delivering data-driven insights which have made them a trusted partner in digital banking transformation.We're grateful to work with incredible clients.