Ai In Investment Market Size

Published Date: 24 January 2026 | Report Code: ai-in-investment-market-size

Ai In Investment Market Size Market Size, Share, Industry Trends and Forecast to 2033

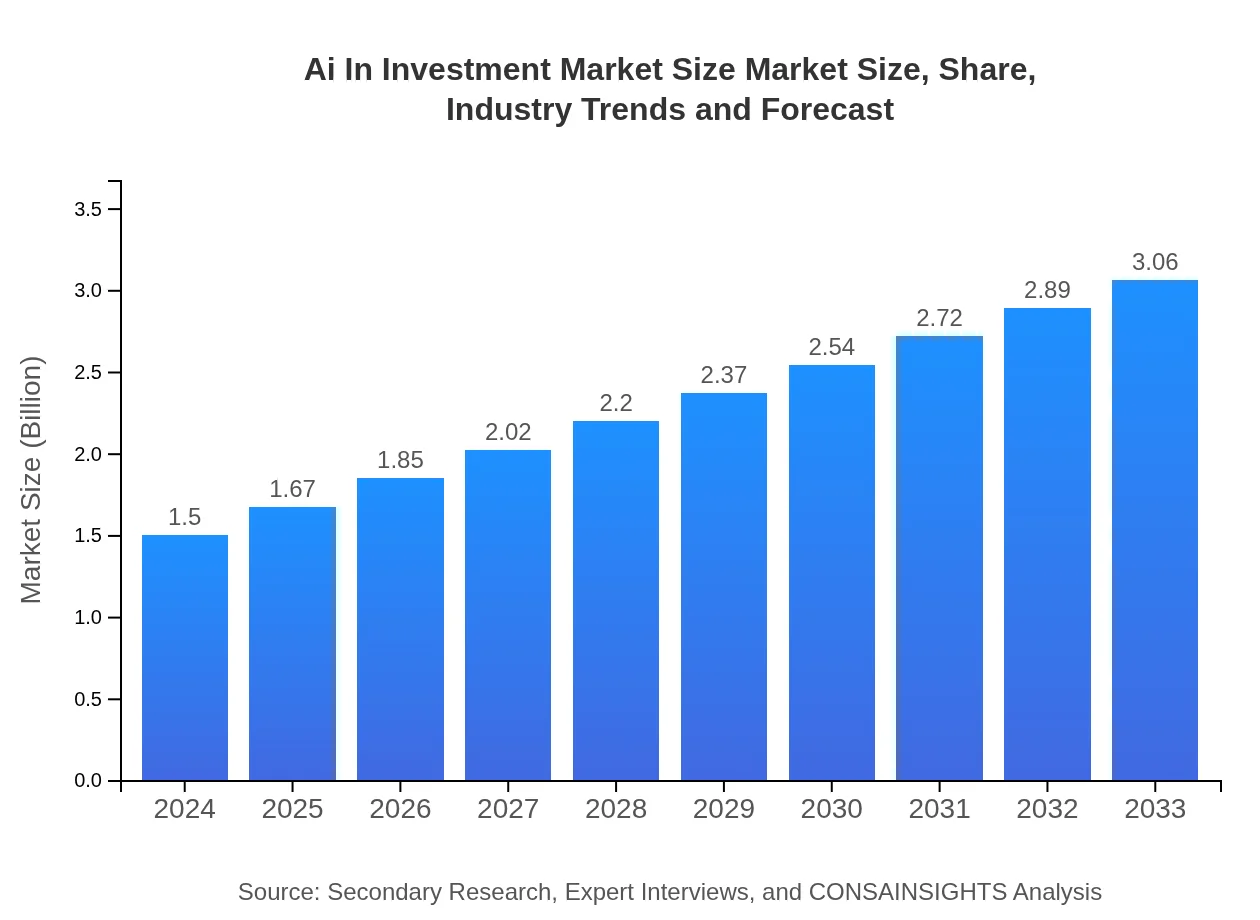

This comprehensive report delves into the current dynamics and growth prospects of the Ai In Investment Market Size. It presents a blend of quantitative data, qualitative insights, and predictive forecasts covering the period from 2024 to 2033. The report offers valuable perspectives on market size, CAGR, segmentation, regional analysis, technological trends, and industry-leading players, equipping stakeholders with essential intelligence for strategic decision-making.

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

| 2024 Market Size | $1.50 Billion |

| CAGR (2024-2033) | 8.0% |

| 2033 Market Size | $3.06 Billion |

| Top Companies | Alpha Analytics, Beta Investments, Gamma Fintech |

| Last Modified Date | 24 January 2026 |

Ai In Investment Market Size Market Overview

Customize Ai In Investment Market Size market research report

- ✔ Get in-depth analysis of Ai In Investment Market Size market size, growth, and forecasts.

- ✔ Understand Ai In Investment Market Size's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ai In Investment Market Size

What is the Market Size & CAGR of Ai In Investment Market Size market in 2024?

Ai In Investment Market Size Industry Analysis

Ai In Investment Market Size Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ai In Investment Market Size Market Analysis Report by Region

Europe Ai In Investment Market Size:

Europe, valued at 0.36 in 2024 and expected to grow to 0.74 by 2033, is characterized by strong regulatory frameworks and a deep commitment to technological advancement. The region’s emphasis on data security, compliance, and ethical AI deployment underpins its market strategies. Coupled with a focus on sustainable growth and innovation, Europe is well-poised for robust expansion in the near and long term.Asia Pacific Ai In Investment Market Size:

Asia Pacific is emerging as a vital market with significant technological investments and a supportive regulatory framework. In 2024, the market was valued at 0.30, growing to 0.61 by 2033. The region’s dynamic financial sectors, coupled with rapid digital adoption and innovation, are attracting considerable capital inflows that are predicted to propel market expansion in the coming decade.North America Ai In Investment Market Size:

North America remains a leading market, characterized by its mature financial industry and high adoption rates of AI technology. With a market value of 0.58 in 2024 reaching 1.18 by 2033, the region benefits from substantial R&D investments, innovation hubs, and a preference for advanced trading technologies. The North American market is anticipated to maintain its competitive edge through continuous technological integration.South America Ai In Investment Market Size:

South America, though smaller in comparison, demonstrates consistent growth and strong potential for digital financial transformation. Market developments in the region are marked by increased investments in AI-driven analytics and a burgeoning fintech ecosystem. Economic reforms and an increasing demand for data-centric investment solutions are expected to drive market improvements from 2024 through 2033.Middle East & Africa Ai In Investment Market Size:

The Middle East and Africa region is experiencing rapid modernization in its financial sectors. Starting at a market value of 0.17 in 2024 and projected to reach 0.34 by 2033, the region is witnessing an accelerated pace of AI integration driven by government initiatives and rising investor awareness. Despite challenges such as infrastructural constraints and regulatory adjustments, the region is expected to display steady growth fueled by technology-driven transformations.Tell us your focus area and get a customized research report.

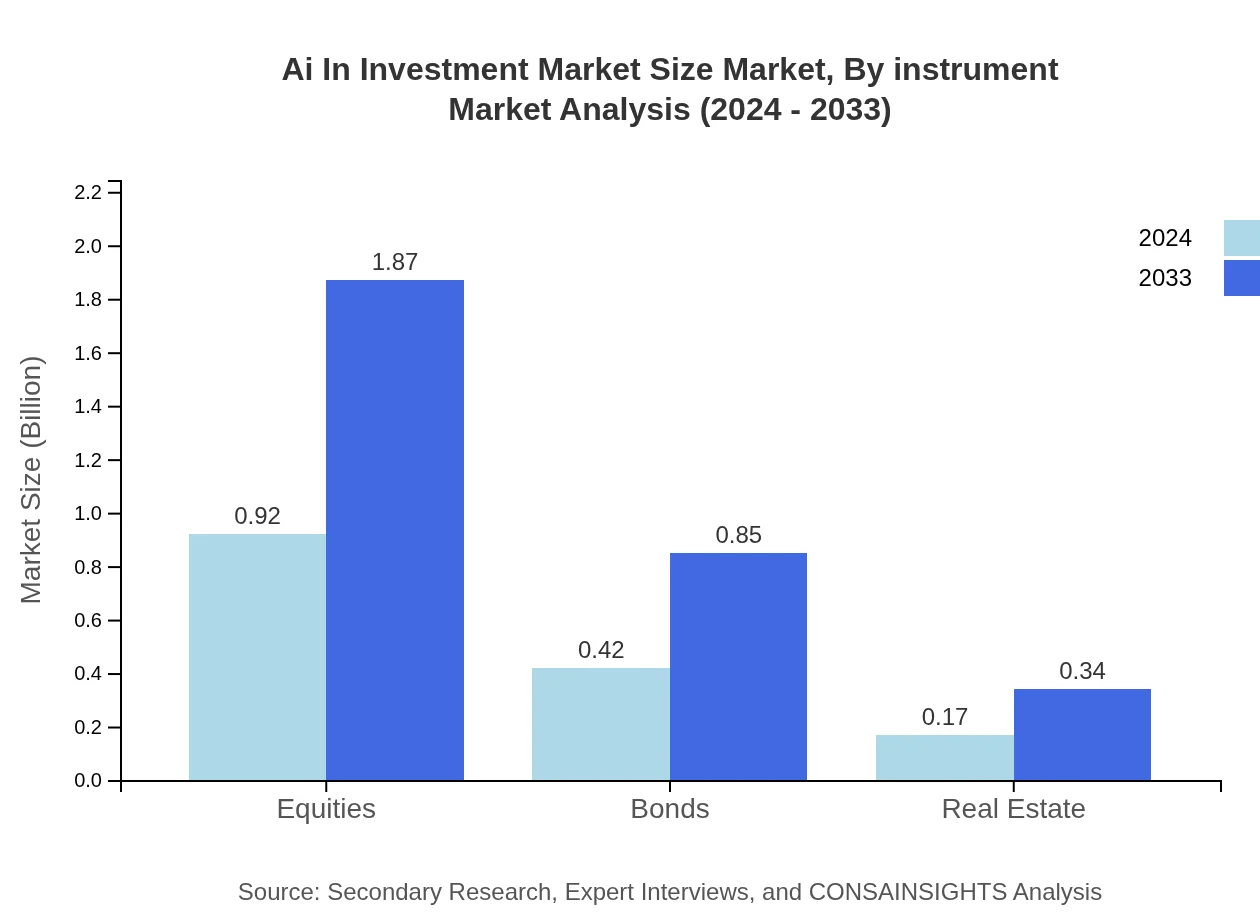

Ai In Investment Market Size Market Analysis By Instrument

The by-instrument analysis covers key financial products including equities, bonds, and real estate. Within this segmentation, equities dominate with a significant share, driven by high liquidity and investor interest. Bonds and real estate follow, offering stability and long-term growth prospects. The segment benefits from enhanced data analytics that refine investment decision-making. As AI-powered tools become more sophisticated, the performance and precision in tracking market trends in each instrument category are expected to improve substantially.

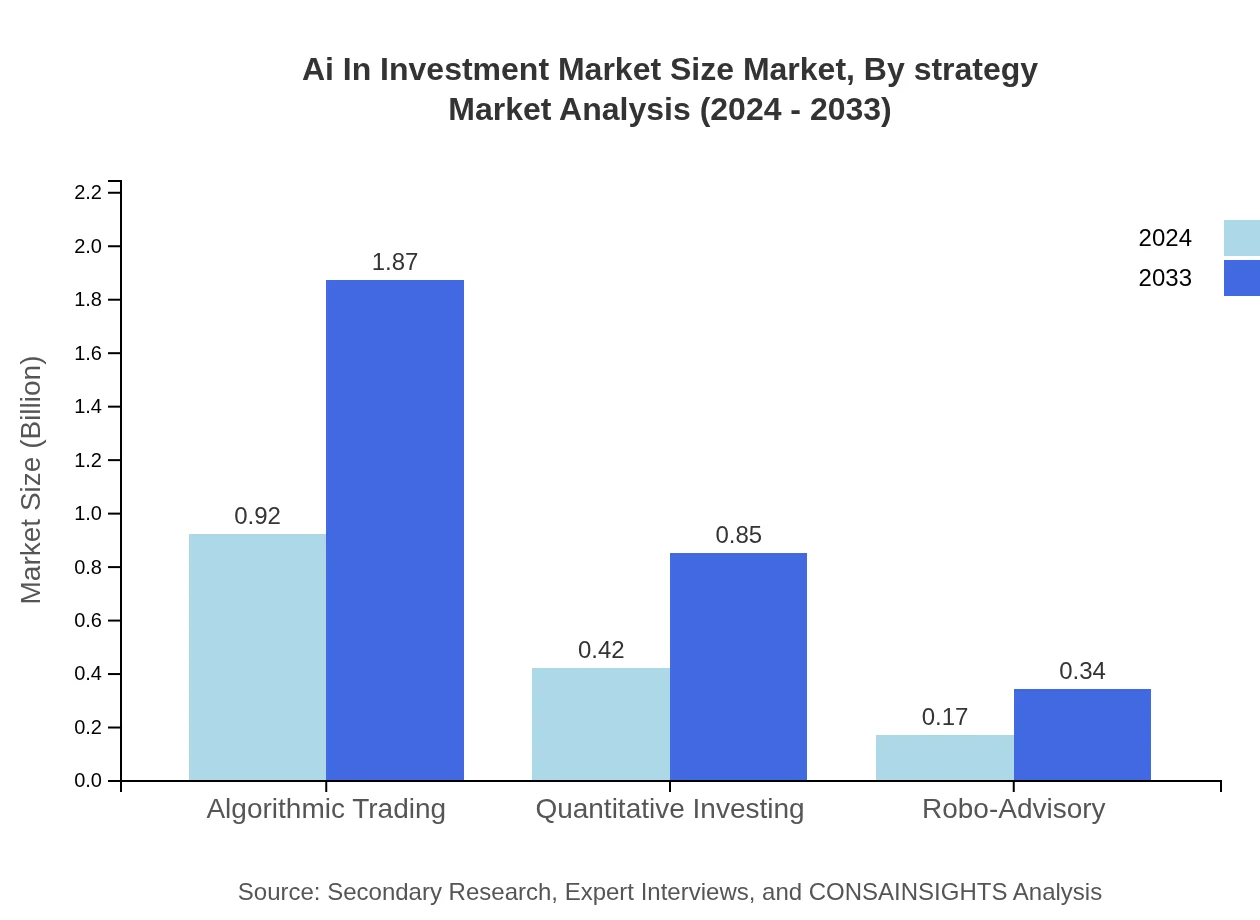

Ai In Investment Market Size Market Analysis By Strategy

In the by-strategy segment, advanced methodologies such as algorithmic trading and quantitative investing are at the forefront. These strategies leverage high-speed data processing and predictive analytics to optimize trading outcomes. The market dynamics are influenced by a shift towards automated decision-making systems, which deliver consistent returns and reduce human error. As the industry evolves, the strategic implementation of AI in trading and investment is set to enhance efficiency, risk management and foster greater market opportunities for investors.

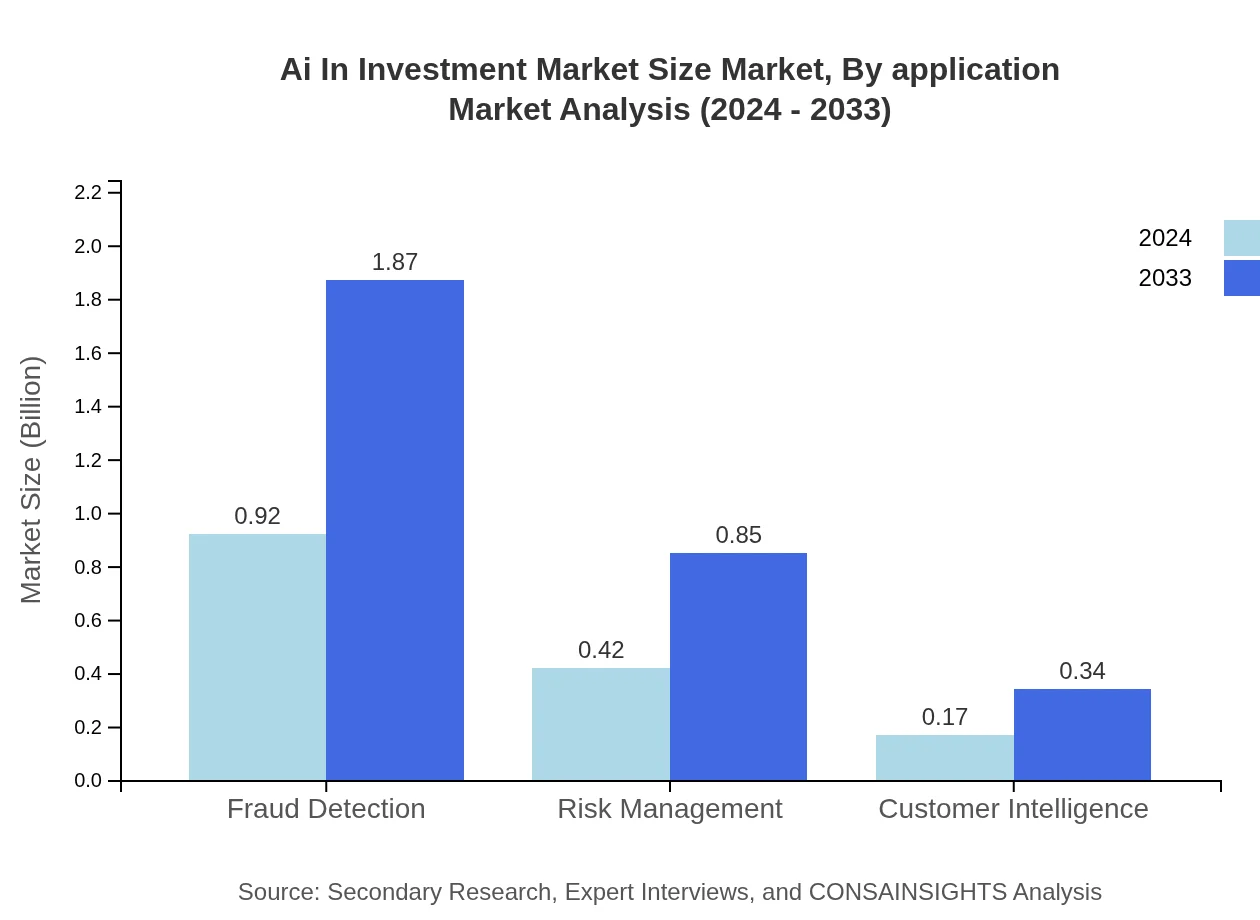

Ai In Investment Market Size Market Analysis By Application

The by-application analysis emphasizes applications like fraud detection, risk management, and customer intelligence. These applications are critical in ensuring that investment strategies are secure, compliant, and tailored to individual investor profiles. The integration of AI in these applications enables real-time monitoring and swift response to market anomalies. Additionally, the enhancement of customer intelligence capabilities has transformed client engagement by providing personalized investment solutions. The robustness of these applications positions them as key growth drivers in the overall AI investment space.

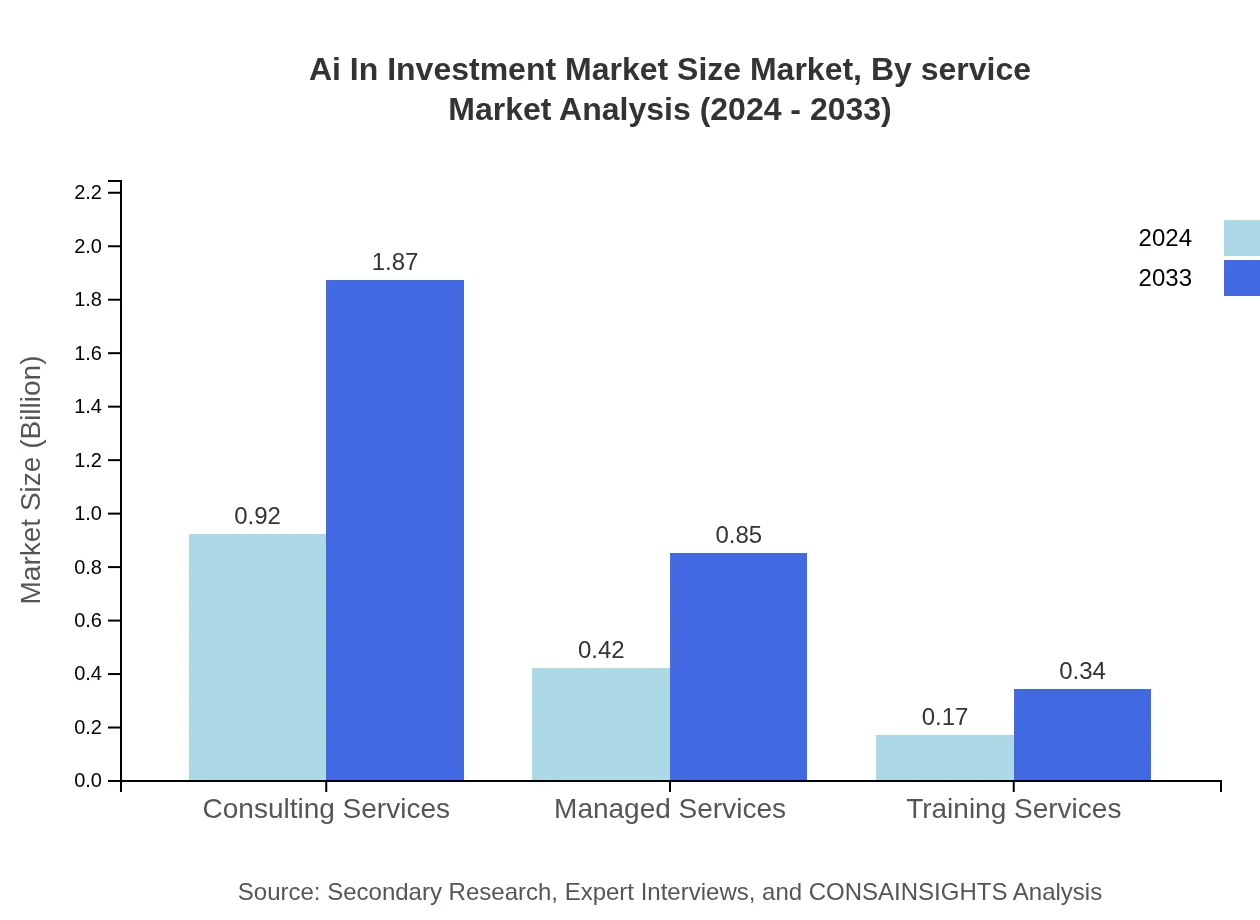

Ai In Investment Market Size Market Analysis By Service

The by-service segment includes consulting, managed, and training services. Consulting services, holding a dominant share, offer strategic advisory that directly influences investment decisions. Managed services provide ongoing support and operational efficiency, while training services ensure stakeholders remain proficient in deploying and managing AI-enabled tools. Each service segment is pivotal in bridging technological capabilities with practical market applications, thereby driving the market’s competitive differentiation and accelerating its adoption across various financial domains.

Ai In Investment Market Size Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ai In Investment Market Size Industry

Alpha Analytics:

Alpha Analytics is a pioneering company at the forefront of integrating AI into investment strategies. The firm excels in delivering state-of-the-art algorithmic trading solutions and advanced financial analytics, serving a global clientele with innovative, data-driven insights.Beta Investments:

Beta Investments has established itself as a leader in the AI investment landscape. With a robust portfolio of robo-advisory and risk management solutions, the company offers comprehensive services that empower investors to achieve optimized and secure portfolio performance.Gamma Fintech:

Gamma Fintech leverages cutting-edge AI technologies to offer innovative managed and consulting services. Their expertise in quantitative investing and financial data analytics positions them as a critical player in shaping the future of the investment market.We're grateful to work with incredible clients.