Ai In Finance Market Size

Published Date: 24 January 2026 | Report Code: ai-in-finance-market-size

Ai In Finance Market Size Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report analyzes the Ai In Finance Market from 2024 through 2033, providing in-depth insights into market size, growth trends, technological innovations, and regional performance. It explores vital aspects such as market segmentation, industry challenges, and forecasted trends. The analysis offers quantitative evidence and qualitative assessments to empower strategic decisions. Accompanying data‐driven insights enhance the overall clarity.

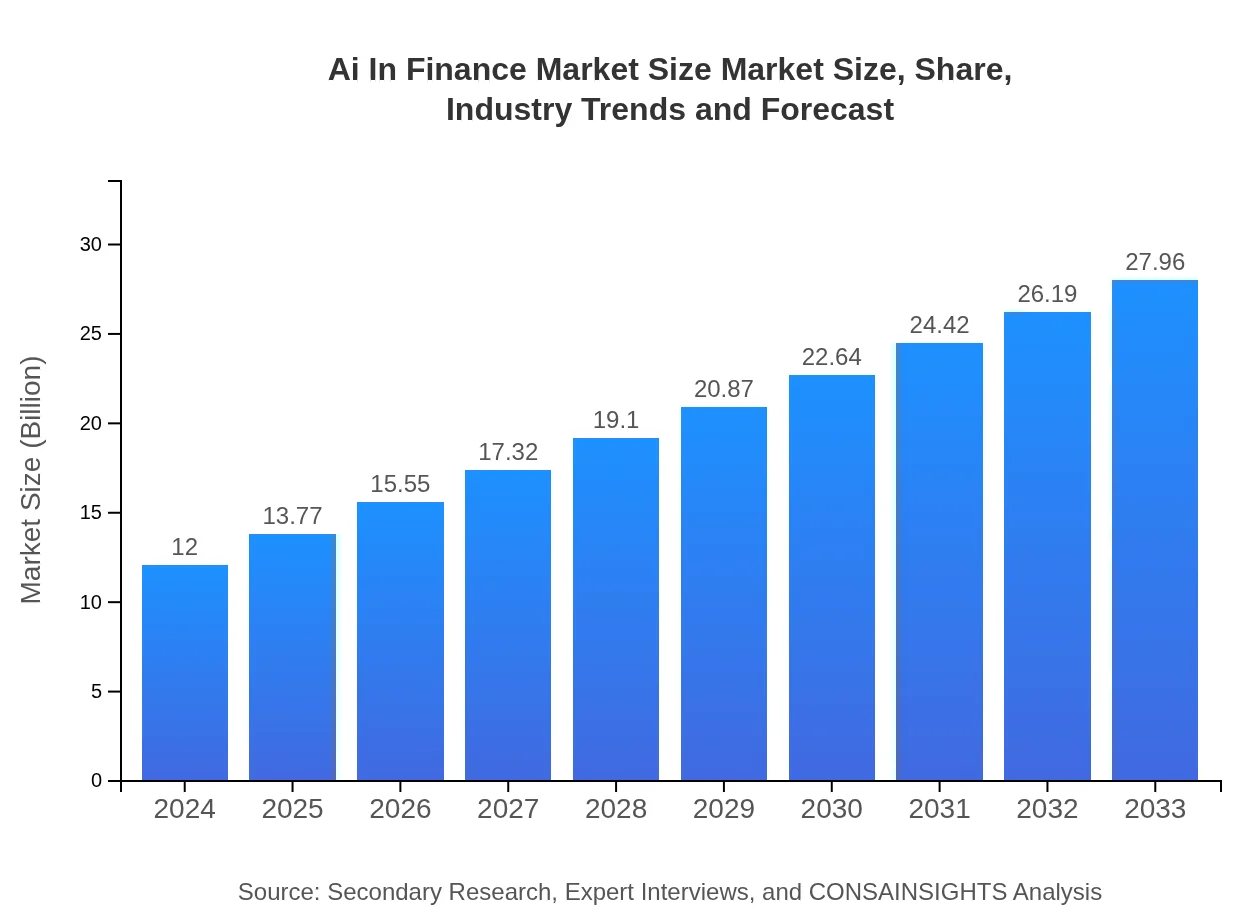

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

| 2024 Market Size | $12.00 Billion |

| CAGR (2024-2033) | 9.5% |

| 2033 Market Size | $27.96 Billion |

| Top Companies | TechFinance Incorporated, AI FinTech Innovations, Global Financial Solutions |

| Last Modified Date | 24 January 2026 |

Ai In Finance Market Size Market Overview

Customize Ai In Finance Market Size market research report

- ✔ Get in-depth analysis of Ai In Finance Market Size market size, growth, and forecasts.

- ✔ Understand Ai In Finance Market Size's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ai In Finance Market Size

What is the Market Size & CAGR of Ai In Finance Market Size market in {Year}?

Ai In Finance Market Size Industry Analysis

Ai In Finance Market Size Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ai In Finance Market Size Market Analysis Report by Region

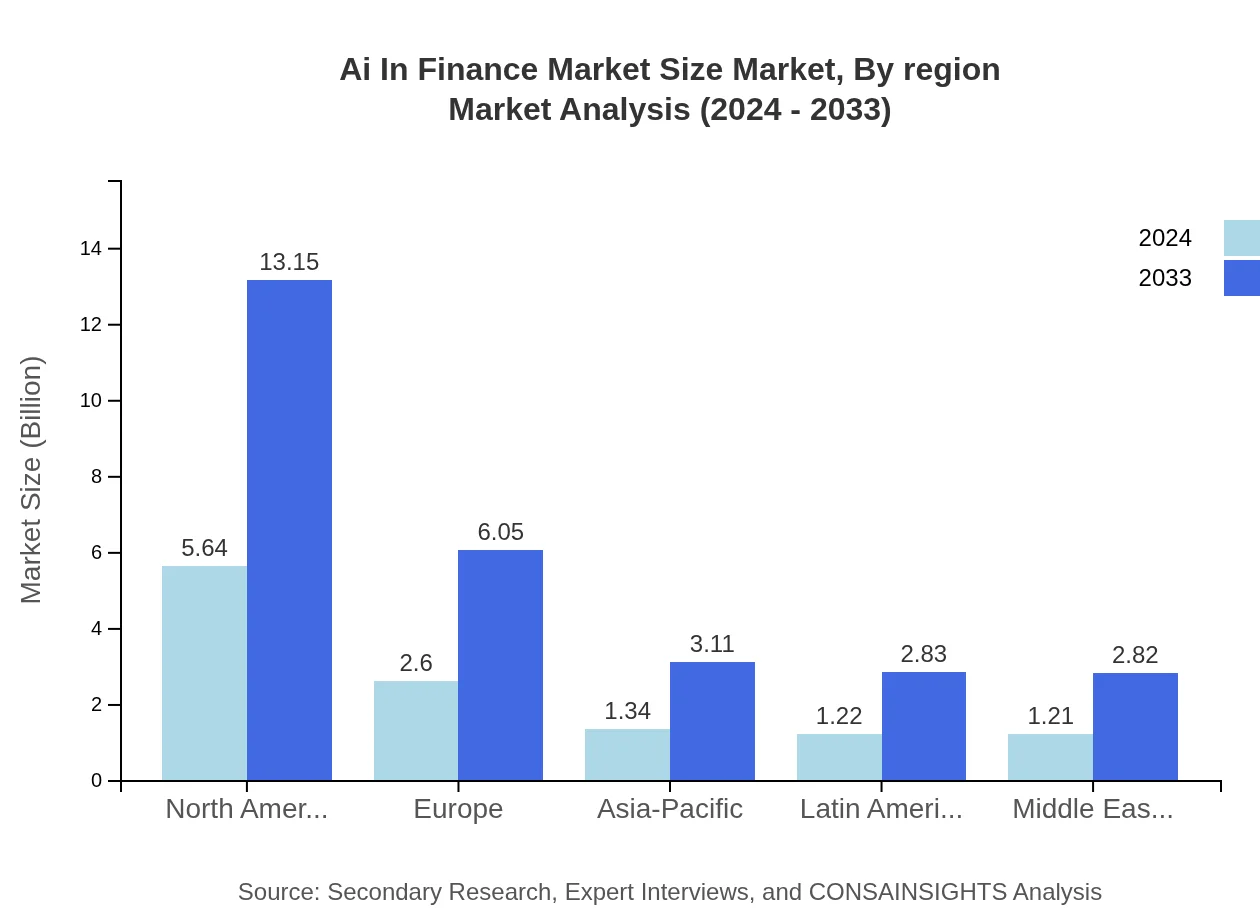

Europe Ai In Finance Market Size:

In Europe, stringent regulatory standards combined with innovative financial practices have propelled growth, with market forecasts indicating an increase from $4.38 billion in 2024 to $10.20 billion by 2033.Asia Pacific Ai In Finance Market Size:

In the Asia Pacific region, the market is gradually expanding, driven by increasing technology adoption and supportive governmental policies, with market values projected to rise from $1.93 billion in 2024 to $4.50 billion by 2033.North America Ai In Finance Market Size:

North America remains a dominant player with a robust market presence, where cutting-edge technologies drive the sector, growing from $3.98 billion in 2024 to an anticipated $9.28 billion by 2033.South America Ai In Finance Market Size:

Reflecting trends in Latin America, the South America region exhibits steady growth fueled by digital transformation in finance and the deployment of AI for improved risk management and customer engagement.Middle East & Africa Ai In Finance Market Size:

The Middle East and Africa, although starting at a smaller base, are emerging markets showing potential for accelerated growth, expected to expand from $0.75 billion in 2024 to $1.75 billion by 2033.Tell us your focus area and get a customized research report.

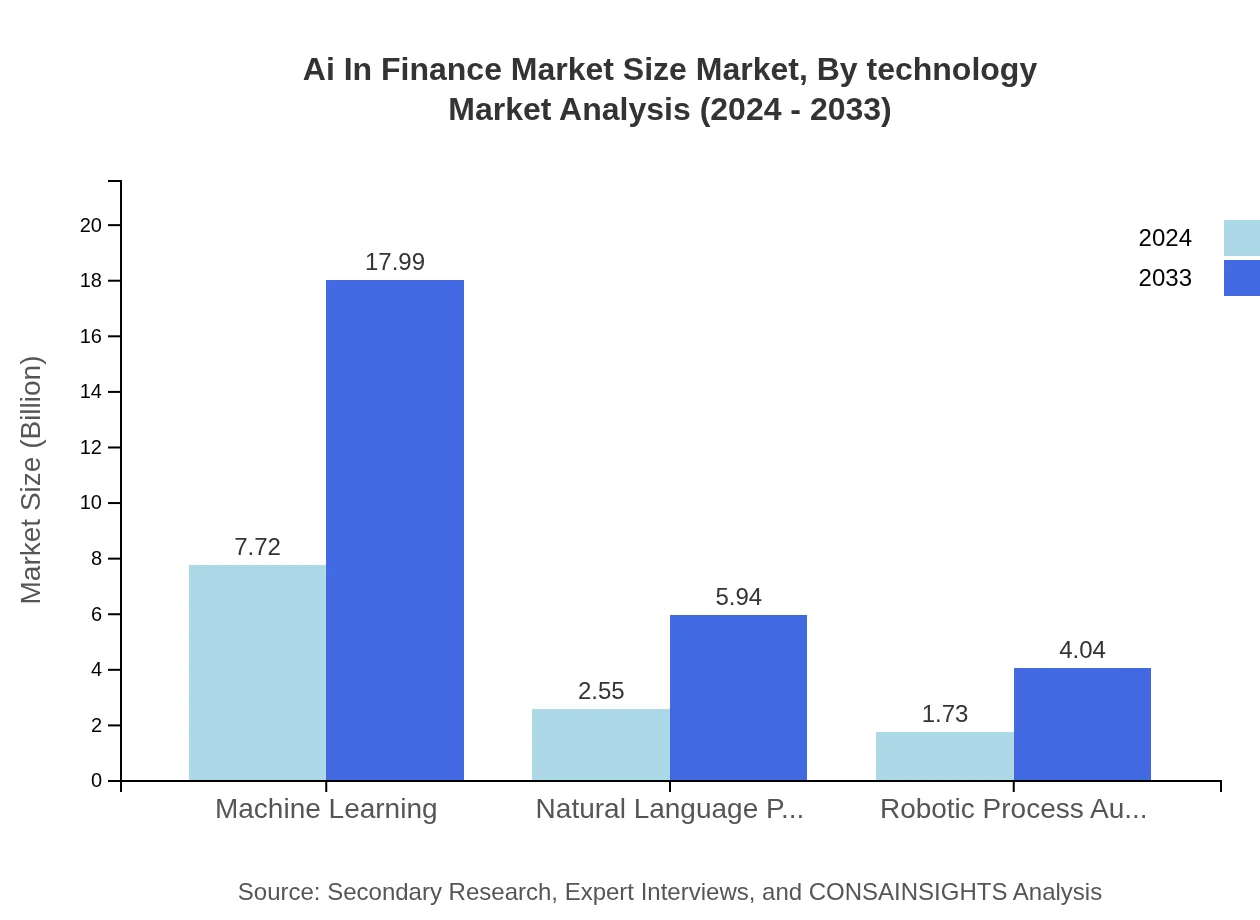

Ai In Finance Market Size Market Analysis By Technology

Under the technology segment, advancements in machine learning, natural language processing, and robotic process automation are reshaping financial operations. Detailed market analytics show that machine learning, with its high market share, drives predictive modeling and risk assessment. Continuous innovation in AI algorithms further fuels technological growth, providing firms with powerful tools to process and analyze vast datasets in real-time.

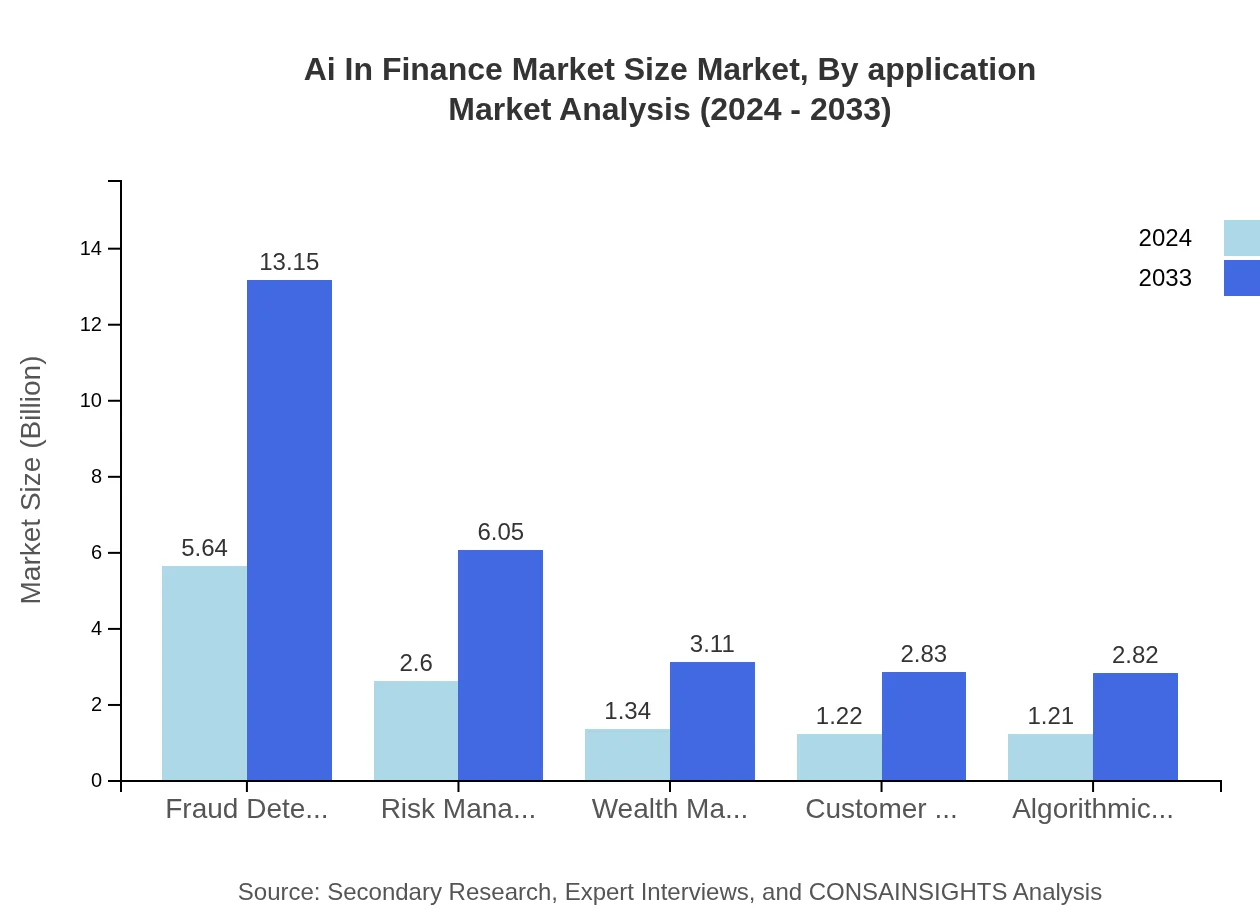

Ai In Finance Market Size Market Analysis By Application

This segment focuses on crucial applications such as fraud detection, risk management, wealth management, customer service, and algorithmic trading. AI applications have revolutionized these areas by enhancing process automation, improving accuracy in decision-making, and reducing operational costs. Financial institutions recognize the strategic importance of AI in streamlining operations and achieving competitive advantage across multiple application areas.

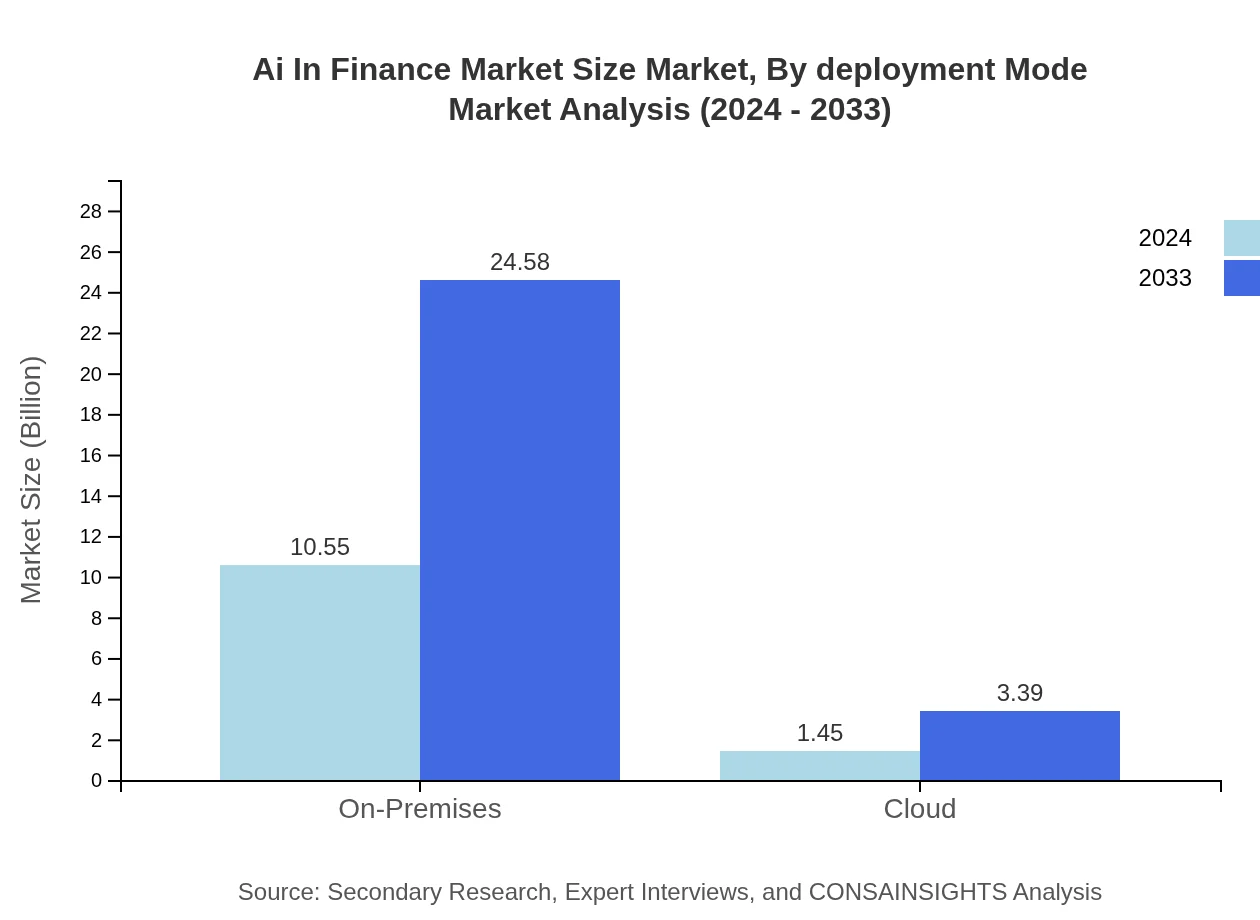

Ai In Finance Market Size Market Analysis By Deployment Mode

Deployment mode analysis distinguishes between on-premises and cloud-based solutions. On-premises implementations offer advantages in security and control, making them preferred by many large institutions. Conversely, cloud solutions are rapidly gaining traction due to their scalability, flexibility, and cost-efficiency. The dual-mode strategy enables companies to align IT infrastructure with evolving regulatory requirements and operational needs.

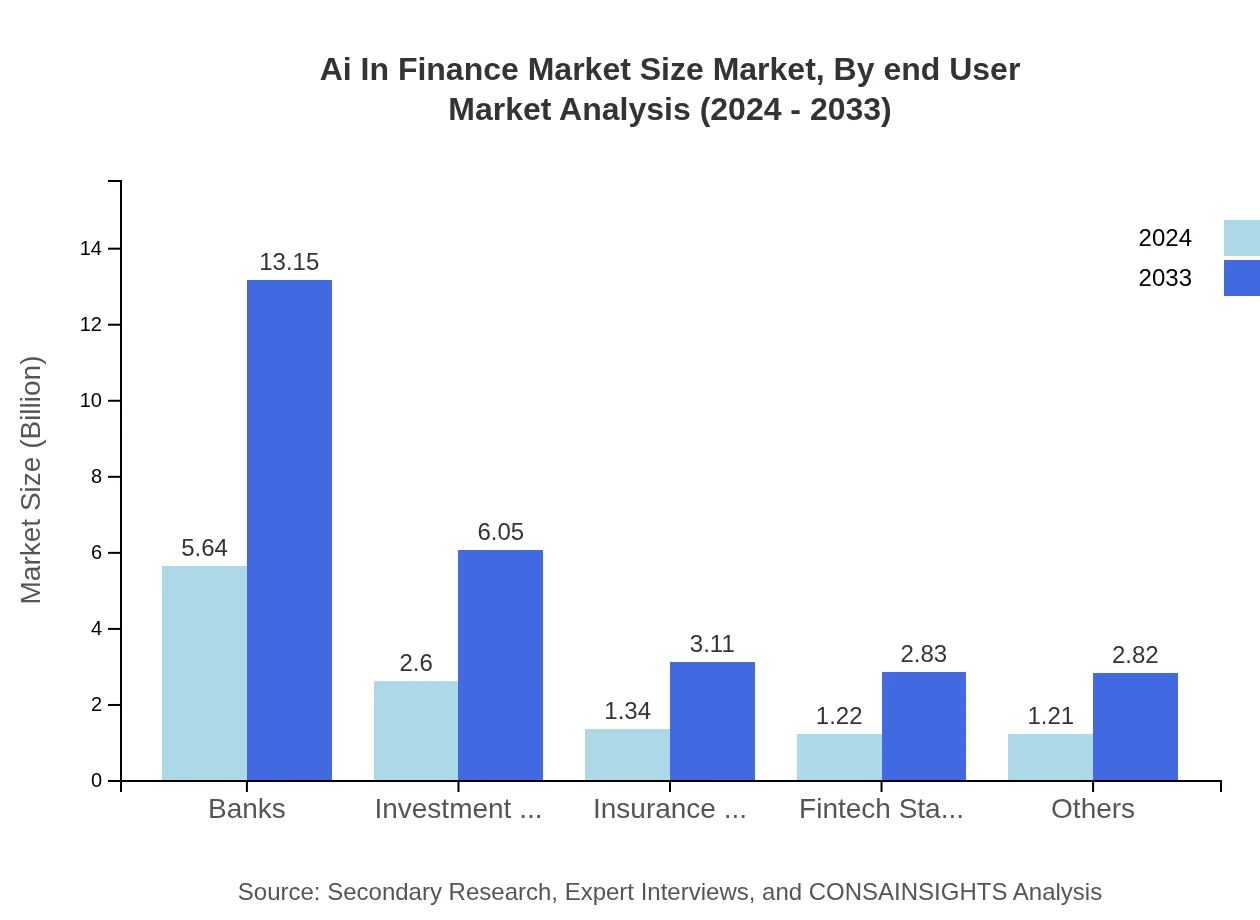

Ai In Finance Market Size Market Analysis By End User

End-user segmentation reveals a diverse clientele including banks, investment firms, insurance companies, fintech startups, and others. Banks continue to lead with significant investments in AI technology to enhance operations, while investment and insurance sectors leverage AI for risk assessment and personalized services. This segment reflects the trend towards incorporating advanced analytics and automation in various financial services.

Ai In Finance Market Size Market Analysis By Region

Regional segmentation within this market provides unique insights into local growth drivers and challenges. Comprehensive analysis across North America, Europe, Asia Pacific, South America, and the Middle East and Africa indicates that while mature markets continue to innovate, emerging regions offer substantial opportunities for expansion. This segment highlights the importance of localized strategies and tailored deployment of AI solutions to maximize market penetration and performance.

Ai In Finance Market Size Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ai In Finance Market Size Industry

TechFinance Incorporated:

A leader in integrating advanced AI solutions into traditional banking frameworks and setting benchmarks in operational efficiency.AI FinTech Innovations:

Known for developing cutting-edge algorithms that enhance risk management and customer engagement across the financial sector.Global Financial Solutions:

Delivers robust AI platforms that have transformed financial services and continues to drive market advancements globally.We're grateful to work with incredible clients.