Anti Money Laundering Aml

Published Date: 31 January 2026 | Report Code: anti-money-laundering-aml

Anti Money Laundering Aml Market Size, Share, Industry Trends and Forecast to 2033

This report details a comprehensive analysis of the global Anti Money Laundering (AML) market, exploring key trends, growth drivers, challenges, and regional performance. Covering forecasts from 2024 through 2033, it provides in-depth insights on market size, CAGR, technological advancements, and strategic segmentation, offering valuable data for stakeholders and decision-makers.

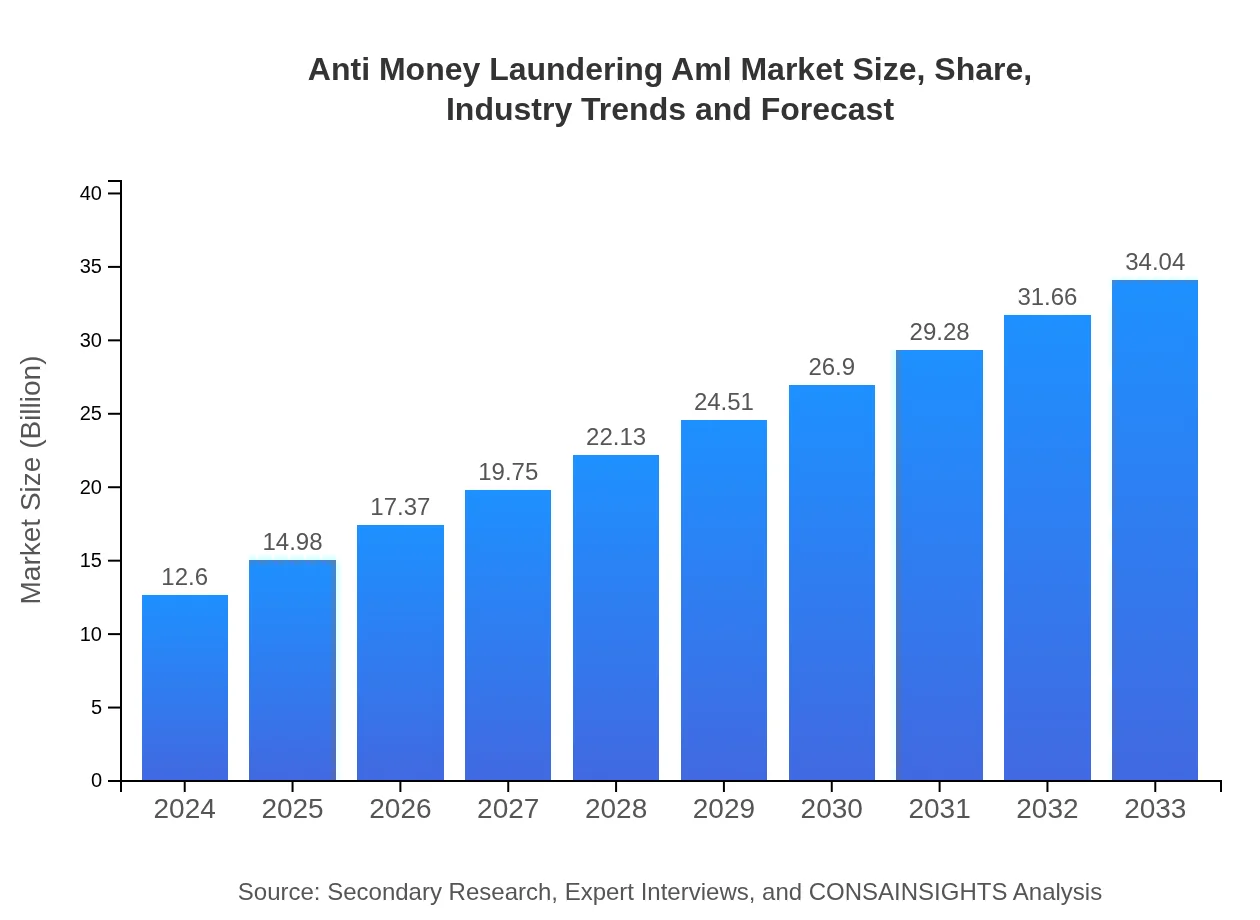

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

| 2024 Market Size | $12.60 Billion |

| CAGR (2024-2033) | 11.2% |

| 2033 Market Size | $34.04 Billion |

| Top Companies | SecureFin Tech, RegulaCorp, AML Innovations |

| Last Modified Date | 31 January 2026 |

Anti Money Laundering Aml Market Overview

Customize Anti Money Laundering Aml market research report

- ✔ Get in-depth analysis of Anti Money Laundering Aml market size, growth, and forecasts.

- ✔ Understand Anti Money Laundering Aml's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Anti Money Laundering Aml

What is the Market Size & CAGR of Anti Money Laundering Aml market in 2024?

Anti Money Laundering Aml Industry Analysis

Anti Money Laundering Aml Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Anti Money Laundering Aml Market Analysis Report by Region

Europe Anti Money Laundering Aml:

Europe stands out with rigorous AML regulations enforced across its financial sectors. The market is projected to expand from $3.32 billion in 2024 to $8.97 billion in 2033, reflecting proactive compliance measures and significant investments in high-tech fraud detection and monitoring systems.Asia Pacific Anti Money Laundering Aml:

In the Asia Pacific region, the AML market is rapidly expanding as nations modernize their financial systems and bolster regulatory frameworks. Market size is projected to grow from $2.62 billion in 2024 to $7.07 billion in 2033, driven by increased digitalization, higher adoption of automated systems, and government initiatives to curb financial crimes.North America Anti Money Laundering Aml:

North America remains a mature and highly competitive market, underpinned by advanced financial infrastructures and stringent regulatory norms. Forecasts show growth from $4.75 billion in 2024 to $12.82 billion in 2033, as organizations invest in state-of-the-art AML technologies and scalable compliance solutions.South America Anti Money Laundering Aml:

South America is gradually embracing more robust AML measures amid evolving regulatory landscapes. With market growth anticipated from $1.14 billion in 2024 to $3.07 billion in 2033, investments are being directed toward enhancing transaction monitoring and compliance operations to address emerging fraud risks.Middle East & Africa Anti Money Laundering Aml:

The Middle East and Africa region, though smaller in scale, is witnessing promising growth with market size increasing from $0.78 billion in 2024 to $2.12 billion in 2033. Strengthened regulatory frameworks and accelerated digital transformation are key factors driving this upward trend.Tell us your focus area and get a customized research report.

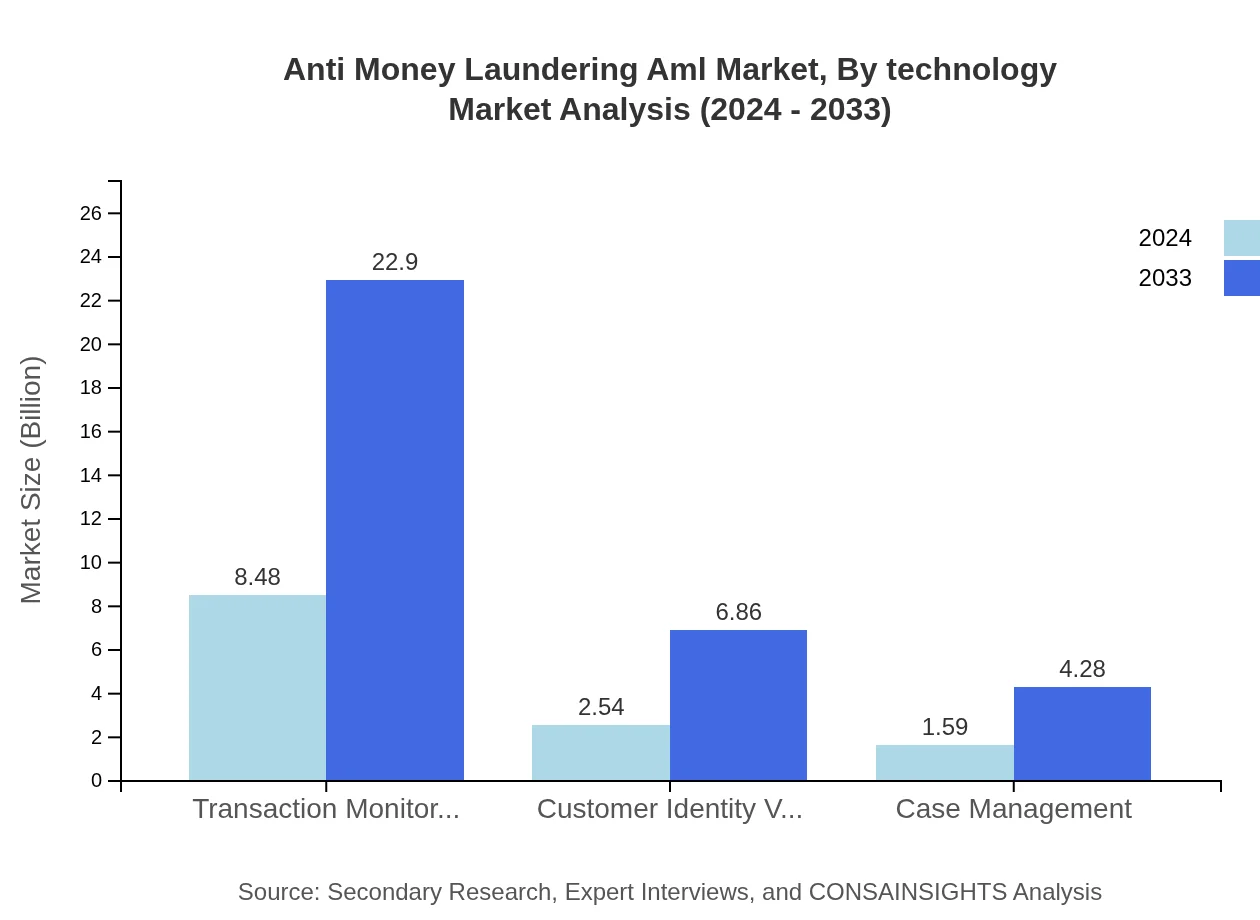

Anti Money Laundering Aml Market Analysis By Technology

The Anti-Money Laundering market by technology segment is witnessing substantial growth driven by the integration of advanced analytics, AI, and machine learning. Companies are investing in these innovations to enhance detection capabilities and streamline operations. The focus is on automating data analysis to quickly identify suspicious transactions and mitigate financial risks. Continuous R&D and technology upgrades are making this segment a pivotal force in contemporary AML strategies.

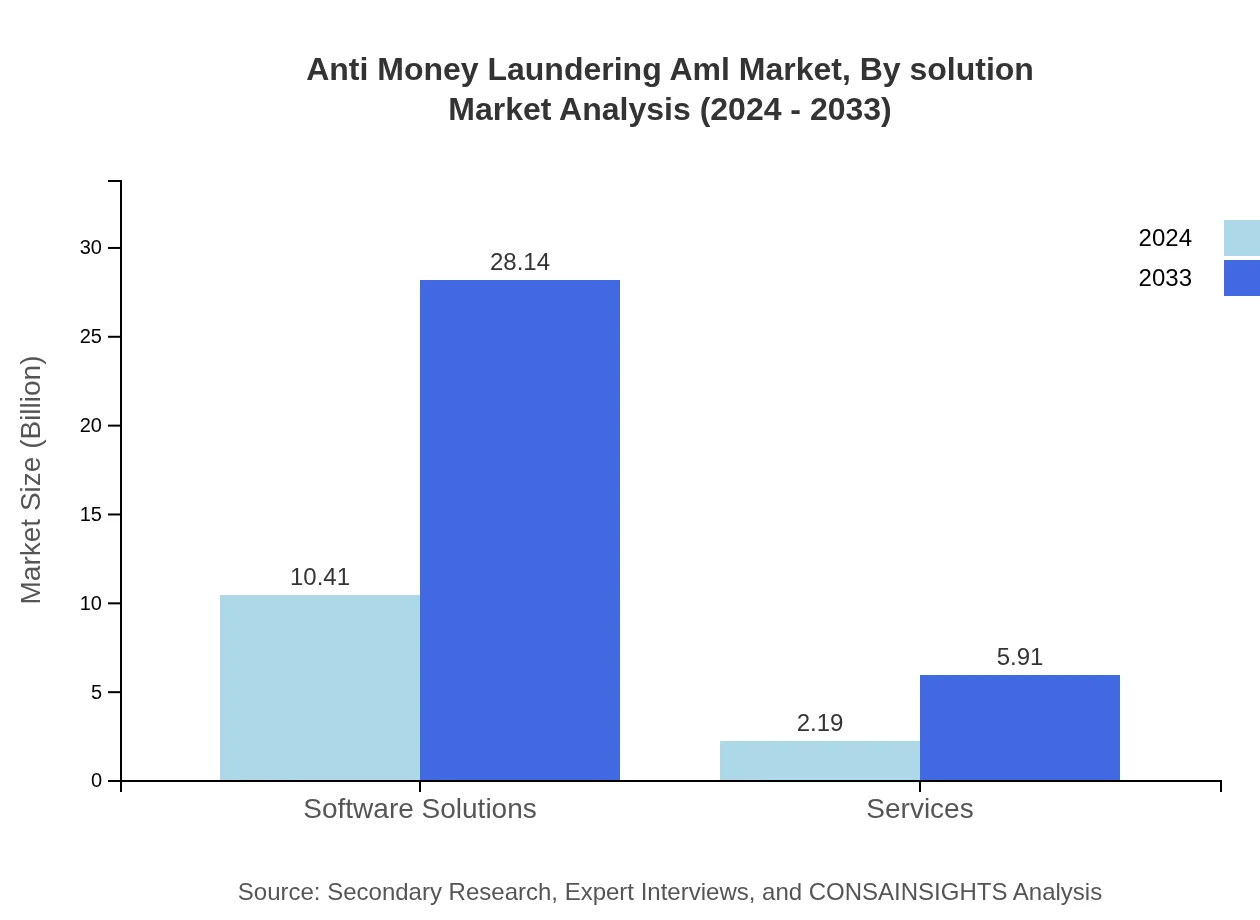

Anti Money Laundering Aml Market Analysis By Solution

The AML market by solution emphasizes a comprehensive suite of offerings including software solutions and service integrations. Organizations deploy these systems to manage core functionalities such as transaction monitoring, customer identity verification, and case management. With an increasing demand for modular and scalable solutions, this segment is rapidly evolving in response to dynamic regulatory requirements and the complexities of modern financial transactions.

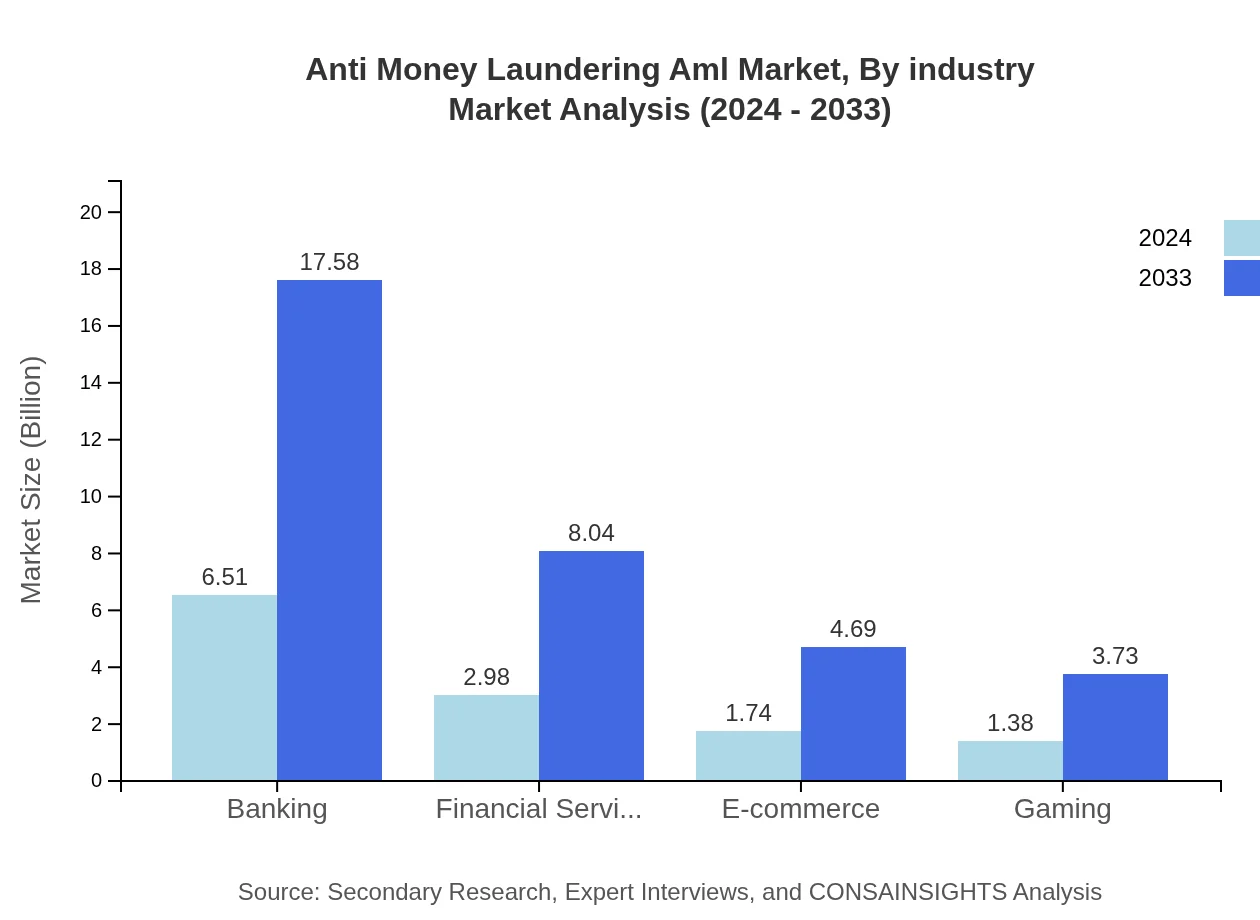

Anti Money Laundering Aml Market Analysis By Industry

Segmenting the AML market by industry reveals tailored approaches across various sectors such as Banking, Financial Services, E-commerce, and Gaming. Each industry leverages specialized AML frameworks to address unique risks and compliance challenges. Banking remains predominant with significant investments in fraud detection technologies, while other sectors are progressively growing their AML capabilities to keep pace with increasing digital transactions and evolving threat landscapes.

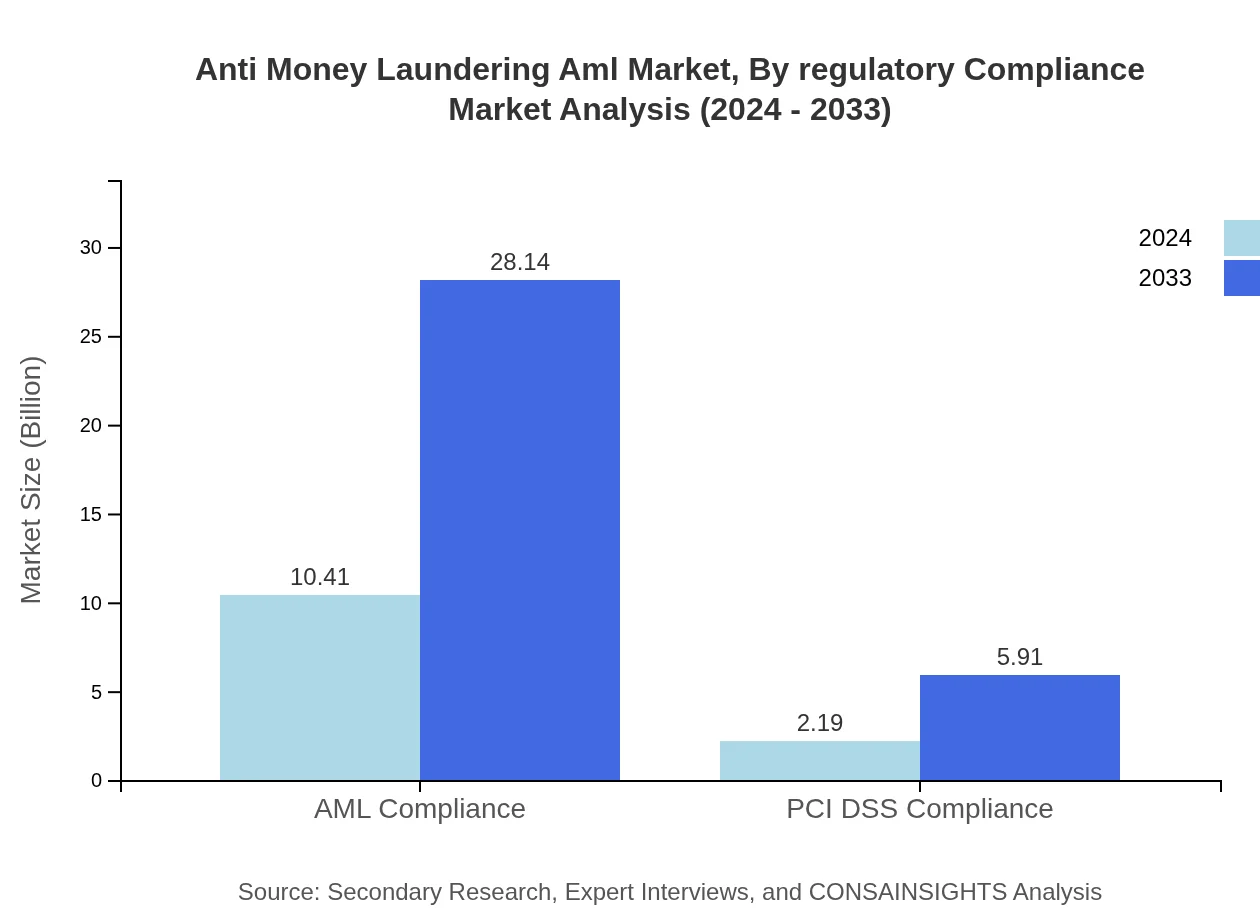

Anti Money Laundering Aml Market Analysis By Regulatory Compliance

Focusing on regulatory compliance, this segment underscores adherence to international standards, including AML and PCI DSS compliance. Companies in this area invest in robust monitoring systems to mitigate risks associated with non-compliance. Emphasis is placed on automated reporting, stringent process integration, and enhanced transparency, ensuring that organizations can meet complex regulatory demands while maintaining financial integrity.

Anti Money Laundering Aml Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Anti Money Laundering Aml Industry

SecureFin Tech:

SecureFin Tech is a leading innovator, renowned for its AI-driven platforms that offer real-time transaction monitoring and comprehensive fraud detection capabilities. The company has consistently set benchmarks in technological integration to enhance regulatory compliance and operational resilience.RegulaCorp:

RegulaCorp delivers robust compliance solutions across diverse markets. With a proven track record in implementing advanced AML systems, the company supports financial institutions worldwide in managing risk and ensuring adherence to stringent regulatory standards.AML Innovations:

AML Innovations focuses on next-generation analytics and seamless system integration. It drives market trends through continuous R&D, offering scalable and adaptable solutions that meet the evolving needs of the global AML landscape.We're grateful to work with incredible clients.