Automotive Rubber Molded Components Market Report

Published Date: 02 February 2026 | Report Code: automotive-rubber-molded-components

Automotive Rubber Molded Components Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Automotive Rubber Molded Components market, highlighting current trends, market size forecasts for 2023-2033, and key insights into industry dynamics, regional performance, and technological advancements.

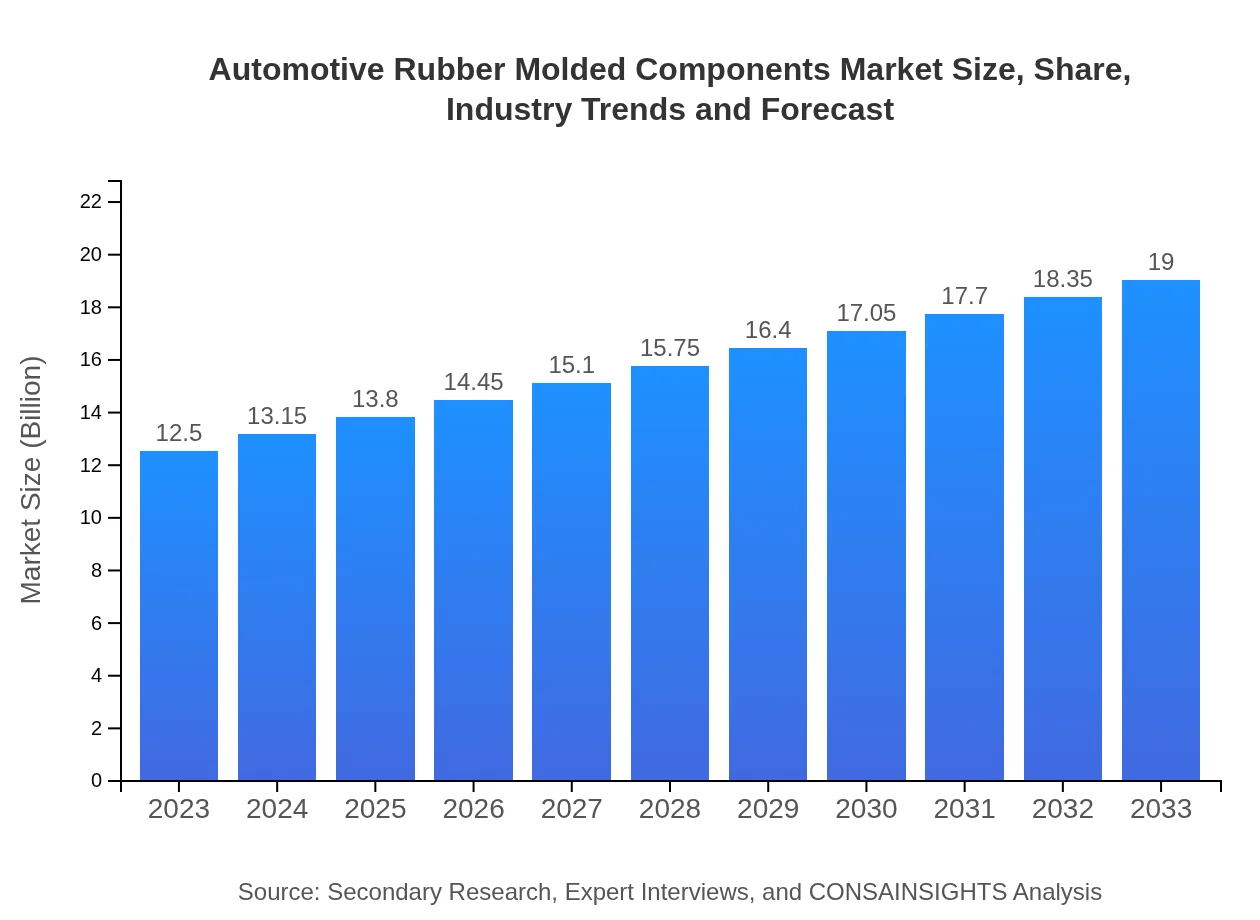

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 4.2% |

| 2033 Market Size | $19.00 Billion |

| Top Companies | Continental AG, Bridgestone Corporation, Goodyear Tire & Rubber Company, Hutchinson SA |

| Last Modified Date | 02 February 2026 |

Automotive Rubber Molded Components Market Overview

Customize Automotive Rubber Molded Components Market Report market research report

- ✔ Get in-depth analysis of Automotive Rubber Molded Components market size, growth, and forecasts.

- ✔ Understand Automotive Rubber Molded Components's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automotive Rubber Molded Components

What is the Market Size & CAGR of Automotive Rubber Molded Components market in 2023?

Automotive Rubber Molded Components Industry Analysis

Automotive Rubber Molded Components Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automotive Rubber Molded Components Market Analysis Report by Region

Europe Automotive Rubber Molded Components Market Report:

Europe, valued at approximately $3.57 billion in 2023, is projected to reach $5.42 billion by 2033. The region is characterized by strict regulatory standards and a strong emphasis on automotive innovation, particularly in sustainable materials and production processes.Asia Pacific Automotive Rubber Molded Components Market Report:

The Asia Pacific region holds a significant share of the automotive rubber molded components market. In 2023, the market size is approximately $2.47 billion and is forecasted to reach around $3.75 billion by 2033. This growth is propelled by the booming automotive manufacturing industry, particularly in countries like China, India, and Japan, where vehicle production rates are soaring.North America Automotive Rubber Molded Components Market Report:

North America is expected to see robust growth in the automotive rubber molded components market, with a market size of around $4.45 billion in 2023, increasing to about $6.76 billion by 2033. The U.S. automotive sector's shift toward more efficient and environmentally friendly vehicle production contributes significantly to this growth.South America Automotive Rubber Molded Components Market Report:

In South America, the market for automotive rubber molded components was valued at approximately $0.87 billion in 2023. The growth rate in this region is modest, with projections indicating a market size of $1.33 billion by 2033. Increased investments in automotive manufacturing and a growing automotive market in Brazil and Argentina are key drivers.Middle East & Africa Automotive Rubber Molded Components Market Report:

In the Middle East and Africa, the market was estimated at around $1.14 billion in 2023, with an anticipated growth to $1.74 billion by 2033. The region's expansion is driven by increasing vehicle ownership, infrastructural developments, and rising disposable income.Tell us your focus area and get a customized research report.

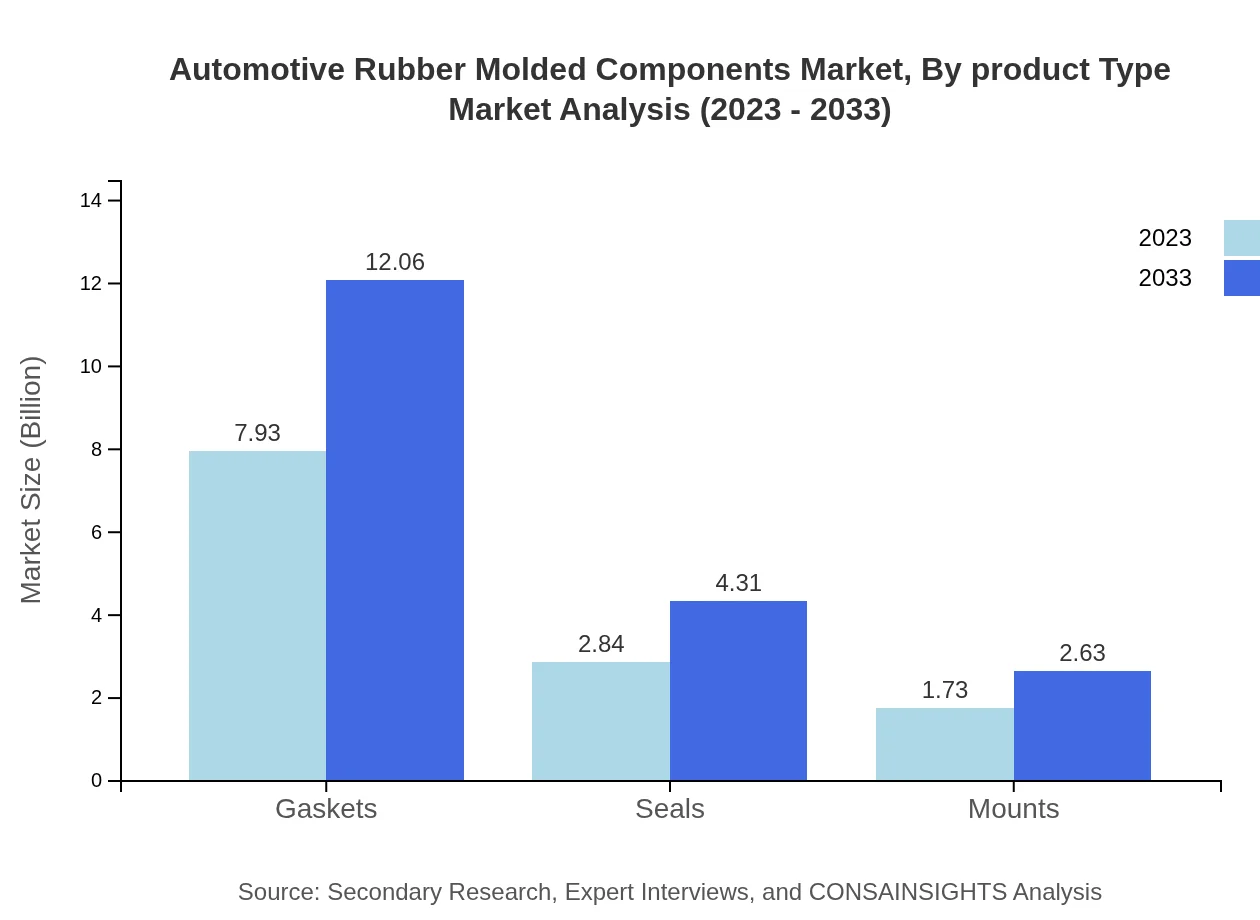

Automotive Rubber Molded Components Market Analysis By Product Type

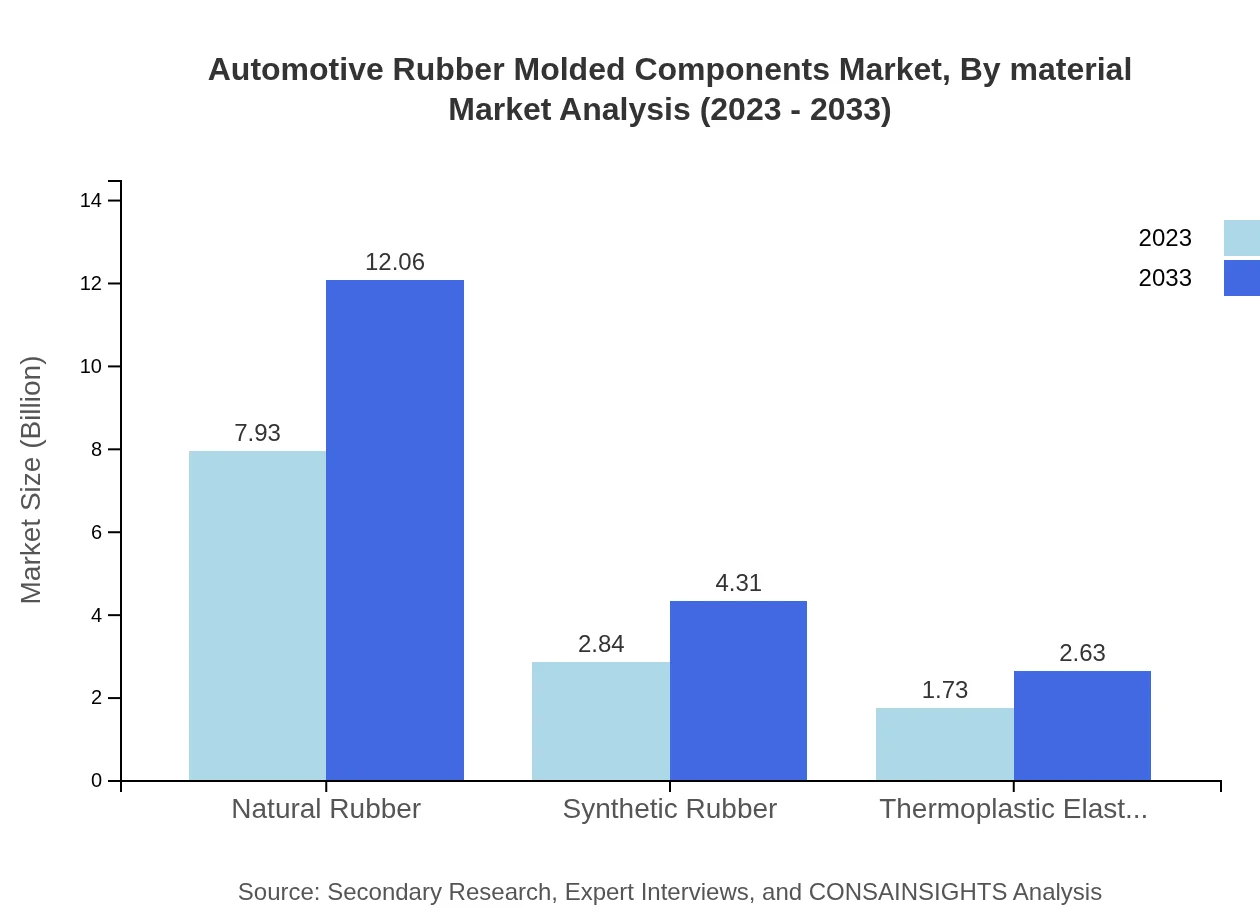

The market is dominated by natural rubber, accounting for approximately $7.93 billion in 2023, expected to rise to $12.06 billion by 2033, holding a 63.45% market share. Synthetic rubber follows, valued at $2.84 billion in 2023, increasing to $4.31 billion in 2033, representing a 22.70% market share. Thermoplastic elastomers currently generate $1.73 billion, forecasted to reach $2.63 billion by 2033, providing a 13.85% share.

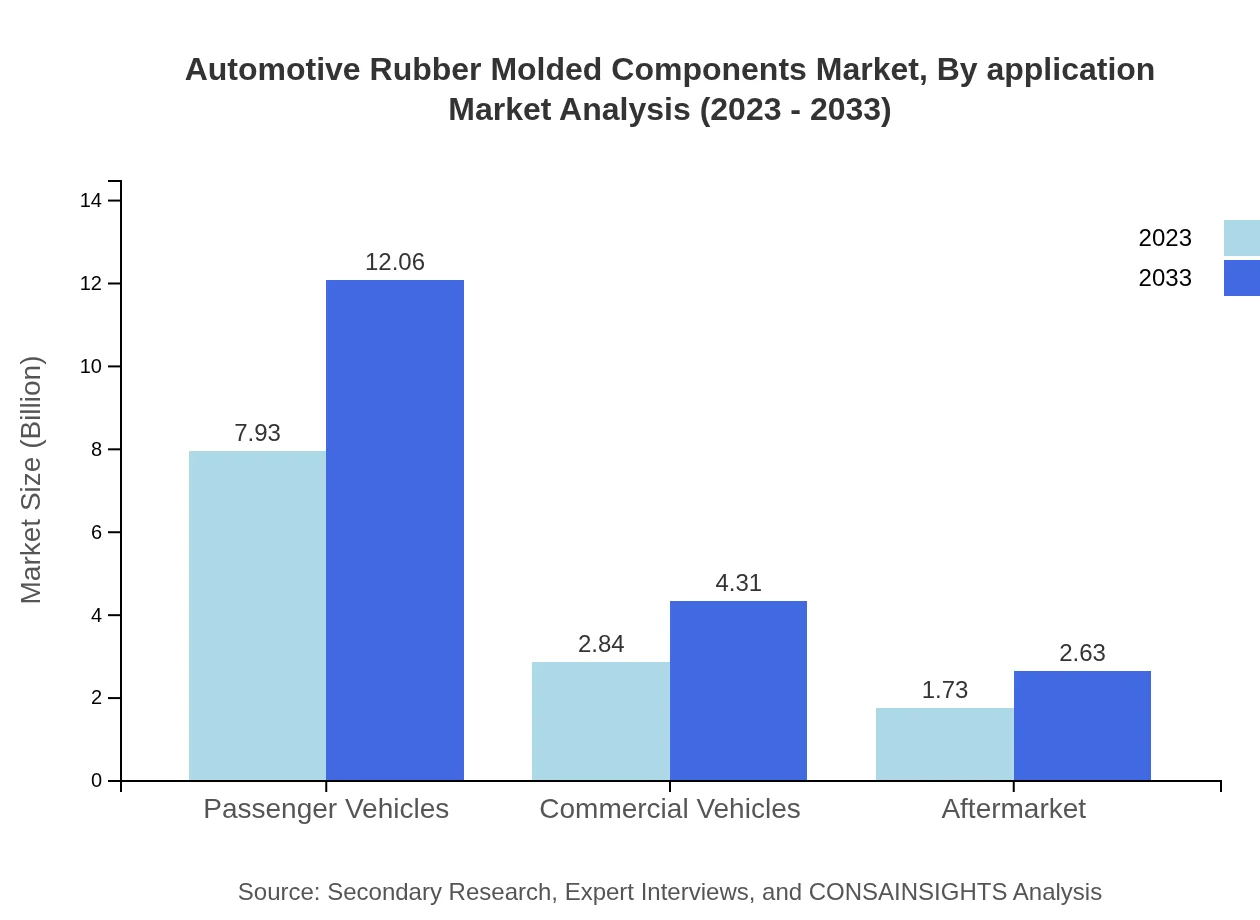

Automotive Rubber Molded Components Market Analysis By Application

Passenger vehicles dominate the market with a size of $7.93 billion in 2023, echoing that same $12.06 billion in 2033. This segment contributes a share of 63.45%. Conversely, commercial vehicles are expected to grow from $2.84 billion to $4.31 billion, accounting for 22.70% of the market share. The aftermarket, particularly for replacement components, is expected to grow from $1.73 billion to $2.63 billion, maintaining a 13.85% share.

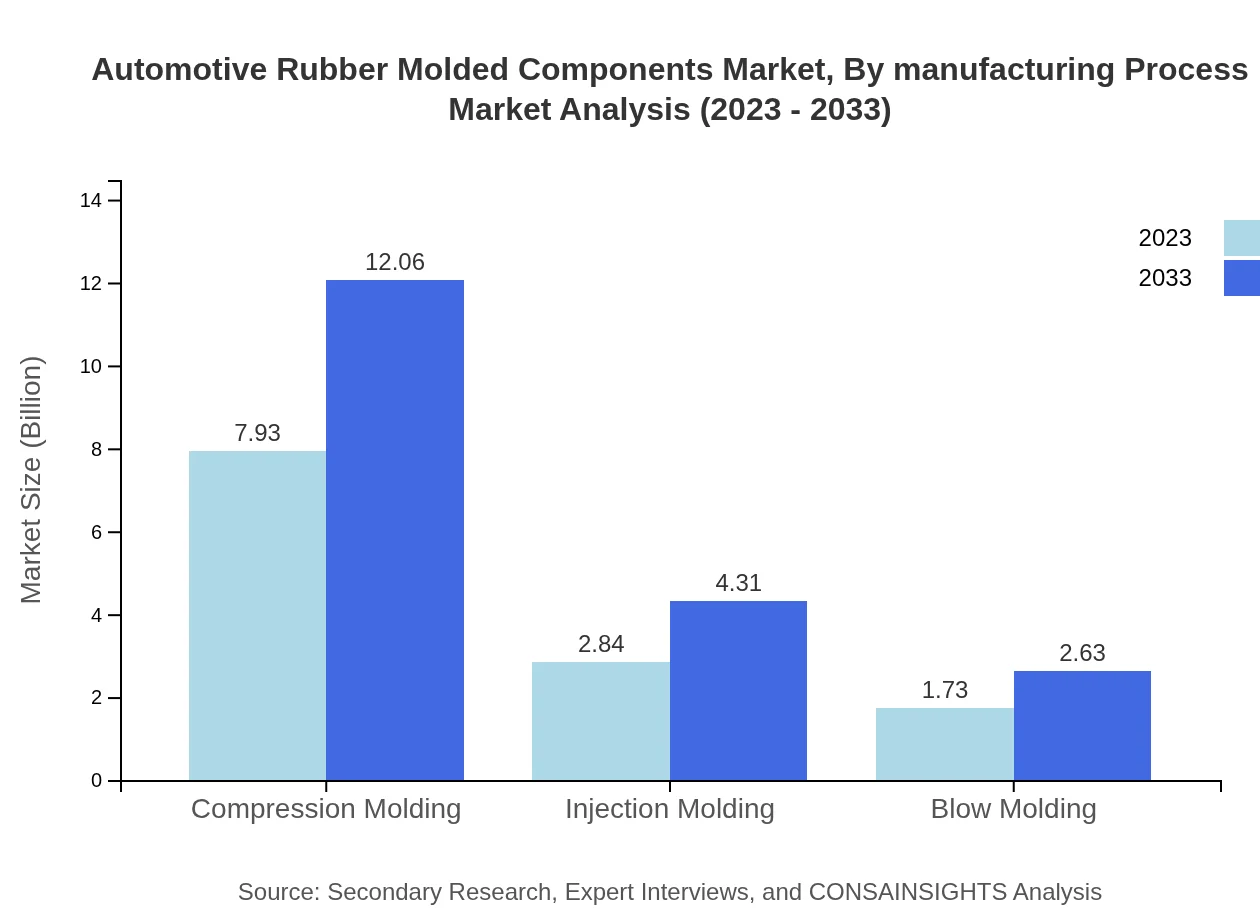

Automotive Rubber Molded Components Market Analysis By Manufacturing Process

Compression molding is the leading method, accounting for $7.93 billion in 2023, projected to reach $12.06 billion by 2033, leading with a 63.45% market share. Injection molding follows with $2.84 billion in 2023, set to grow to $4.31 billion by 2033, representing 22.70% share. Blow molding captures the remaining market, estimated at $1.73 billion in 2023, anticipated to grow to $2.63 billion by 2033, providing a 13.85% share.

Automotive Rubber Molded Components Market Analysis By Material

Natural rubber remains the primary material type, comprising a market of $7.93 billion in 2023, that will grow to $12.06 billion, maintaining a 63.45% market share. In contrast, synthetic rubber, at $2.84 billion, is expected to broaden to $4.31 billion by 2033 with a 22.70% share. Thermoplastic elastomers, while smaller, still represent a significant growth area, moving from $1.73 billion to $2.63 billion (13.85% share).

Automotive Rubber Molded Components Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automotive Rubber Molded Components Industry

Continental AG:

Continental AG is a global leader in automotive components, focusing on advanced rubber technologies for safe and sustainable mobility.Bridgestone Corporation:

Bridgestone is known for high-quality rubber products, including automotive components, with a strong commitment to innovation and sustainability.Goodyear Tire & Rubber Company:

Goodyear is a prominent tire manufacturer that also specializes in rubber molded components, emphasizing advanced manufacturing techniques.Hutchinson SA:

Hutchinson specializes in rubber and polymer solutions and is known for its contribution to automotive rubber molded components, particularly vibration control products.We're grateful to work with incredible clients.

FAQs

What is the market size of automotive rubber molded components?

The automotive rubber molded components market is expected to reach a size of approximately $12.5 billion by 2033, with a compound annual growth rate (CAGR) of 4.2% from 2023 to 2033.

What are the key market players or companies in the automotive rubber molded components industry?

Key market players include major manufacturers and suppliers of rubber components that serve the automotive sector, focusing on innovation and compliance with industry standards to maintain competitive advantage and market share.

What are the primary factors driving the growth in the automotive rubber molded components industry?

Growth is driven by increasing automotive production and demand for electric vehicles, the need for lightweight materials, and advancements in rubber processing technologies enhancing product performance and durability.

Which region is the fastest Growing in automotive rubber molded components?

The fastest-growing region is North America, projected to grow from $4.45 billion in 2023 to $6.76 billion by 2033, driven by robust automotive manufacturing and a shift towards electrification.

Does ConsaInsights provide customized market report data for the automotive rubber molded components industry?

Yes, ConsaInsights offers customized market report data tailored to meet specific client needs, providing detailed analysis, forecasts, and insights relevant to the automotive rubber molded components sector.

What deliverables can I expect from this automotive rubber molded components market research project?

Deliverables include comprehensive market analysis reports, trend assessments, competitive landscape evaluations, and detailed regional and segment data to inform strategic decision-making.

What are the market trends of automotive rubber molded components?

Key trends include the growing adoption of natural rubber, increasing demand for seals and gaskets in passenger vehicles, and advancements in molding technologies like injection and compression molding.