Automotive Sensor Materials Market Report

Published Date: 31 January 2026 | Report Code: automotive-sensor-materials

Automotive Sensor Materials Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Automotive Sensor Materials market, covering market size, trends, segmentation, technology impacts, and future forecasts from 2023 to 2033.

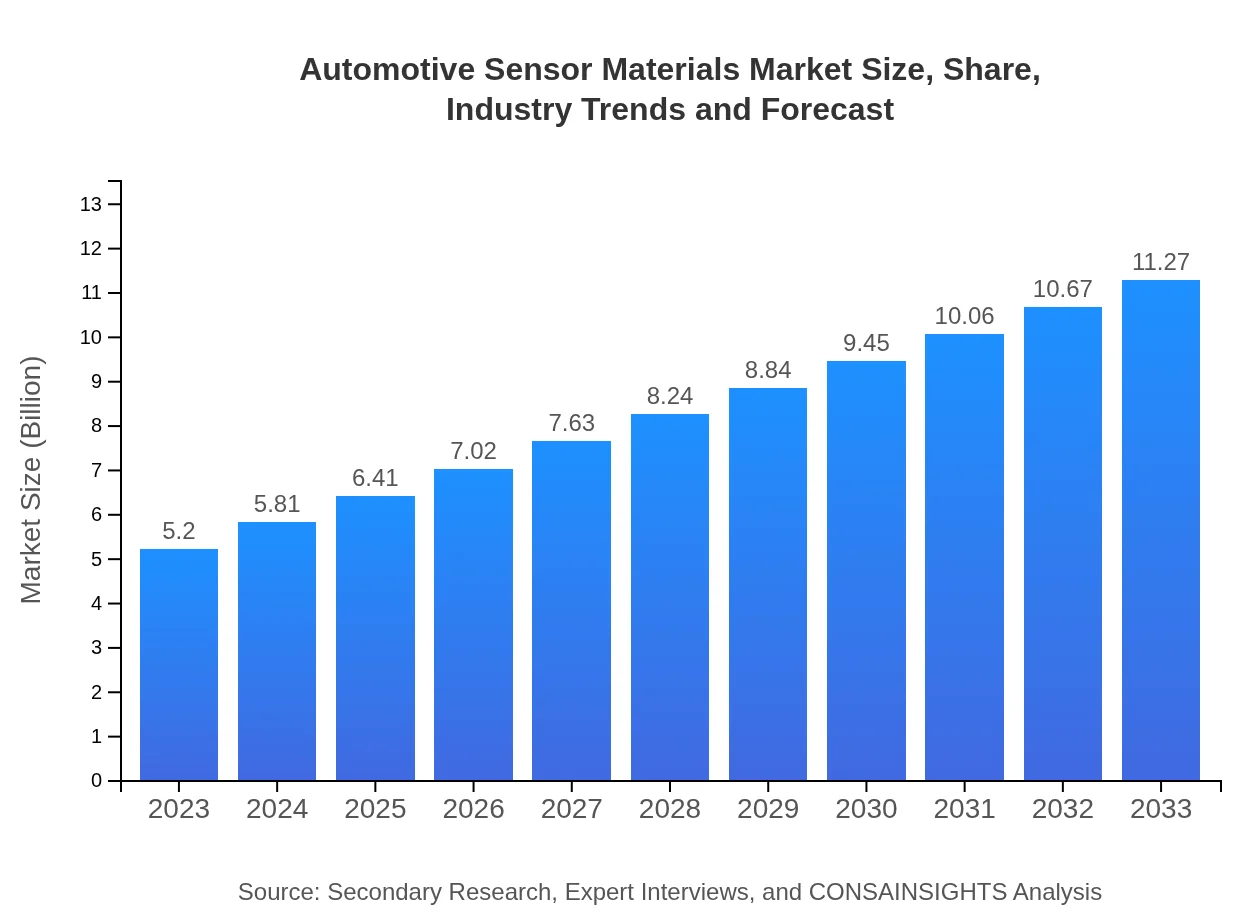

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.20 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $11.27 Billion |

| Top Companies | Bosch, Honeywell , Continental AG, Denso Corporation, TRW Automotive |

| Last Modified Date | 31 January 2026 |

Automotive Sensor Materials Market Overview

Customize Automotive Sensor Materials Market Report market research report

- ✔ Get in-depth analysis of Automotive Sensor Materials market size, growth, and forecasts.

- ✔ Understand Automotive Sensor Materials's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automotive Sensor Materials

What is the Market Size & CAGR of Automotive Sensor Materials market in 2023?

Automotive Sensor Materials Industry Analysis

Automotive Sensor Materials Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automotive Sensor Materials Market Analysis Report by Region

Europe Automotive Sensor Materials Market Report:

Europe is expected to grow from $1.44 billion in 2023 to $3.13 billion by 2033 due to stringent regulatory frameworks promoting vehicle safety and emissions reduction, encouraging the adoption of advanced sensors.Asia Pacific Automotive Sensor Materials Market Report:

In 2023, the Asia Pacific region holds a market size of $1.07 billion, projected to reach $2.31 billion by 2033. The growth is propelled by high vehicle production rates and increasing electronics integration in automobiles.North America Automotive Sensor Materials Market Report:

North America leads with a market size of $1.91 billion in 2023, forecasted to reach $4.13 billion by 2033, spurred by robust demand for advanced automotive technologies and electric vehicles.South America Automotive Sensor Materials Market Report:

The South American market for Automotive Sensor Materials is relatively smaller, starting at $0.43 billion in 2023 and expected to grow to $0.93 billion by 2033, driven mainly by rising automotive sales and investments in manufacturing.Middle East & Africa Automotive Sensor Materials Market Report:

The market in the Middle East and Africa is smaller, with an initial size of $0.35 billion in 2023, projected to grow to $0.76 billion by 2033, influenced by ongoing urbanization and development in automotive infrastructure.Tell us your focus area and get a customized research report.

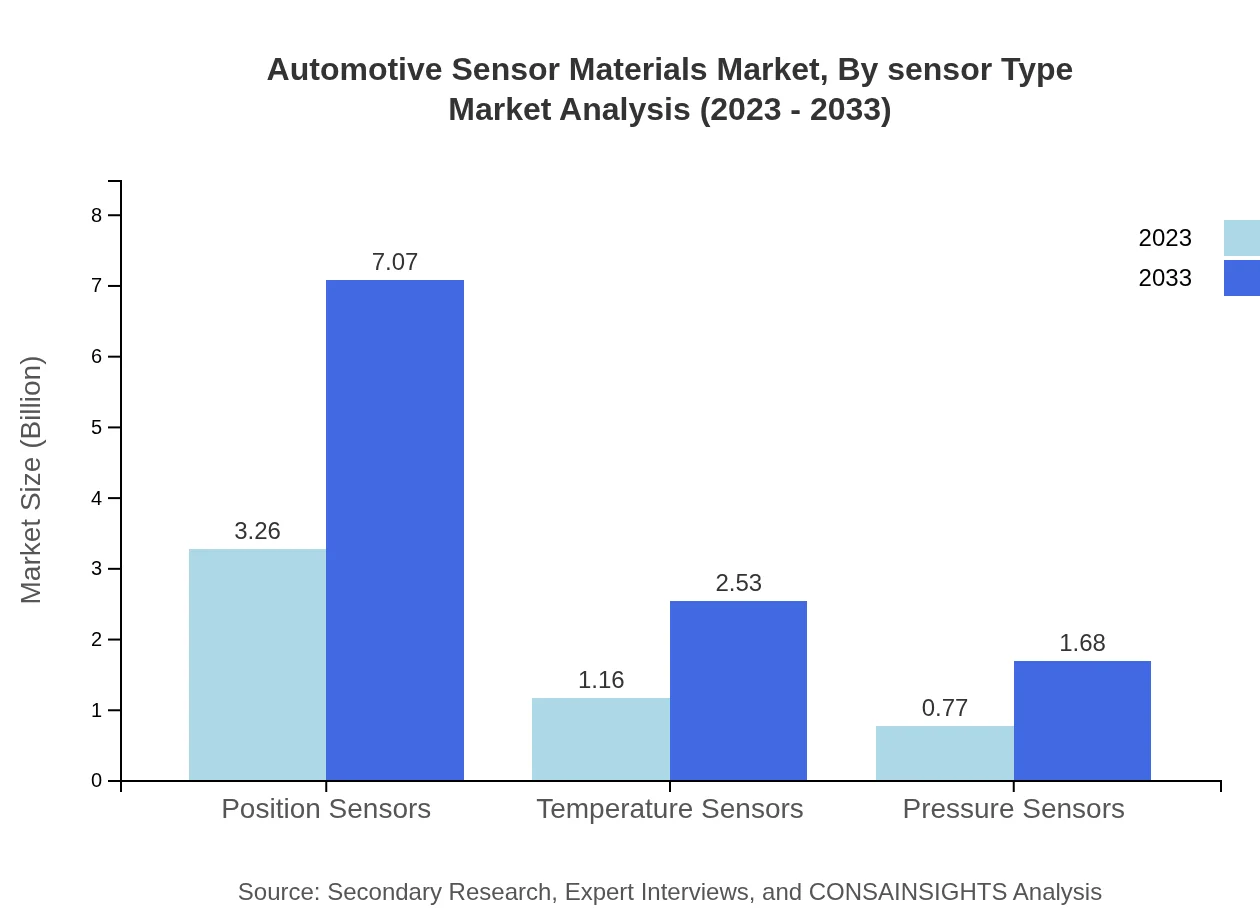

Automotive Sensor Materials Market Analysis By Sensor Type

Sensor types include Position Sensors, Temperature Sensors, Pressure Sensors, with market sizes of $3.26 billion, $1.16 billion, and $0.77 billion in 2023 respectively. Position Sensors dominate with a share of 62.7%, expanding to $7.07 billion by 2033. Each type's adoption will be driven by innovations in automotive safety and intelligence.

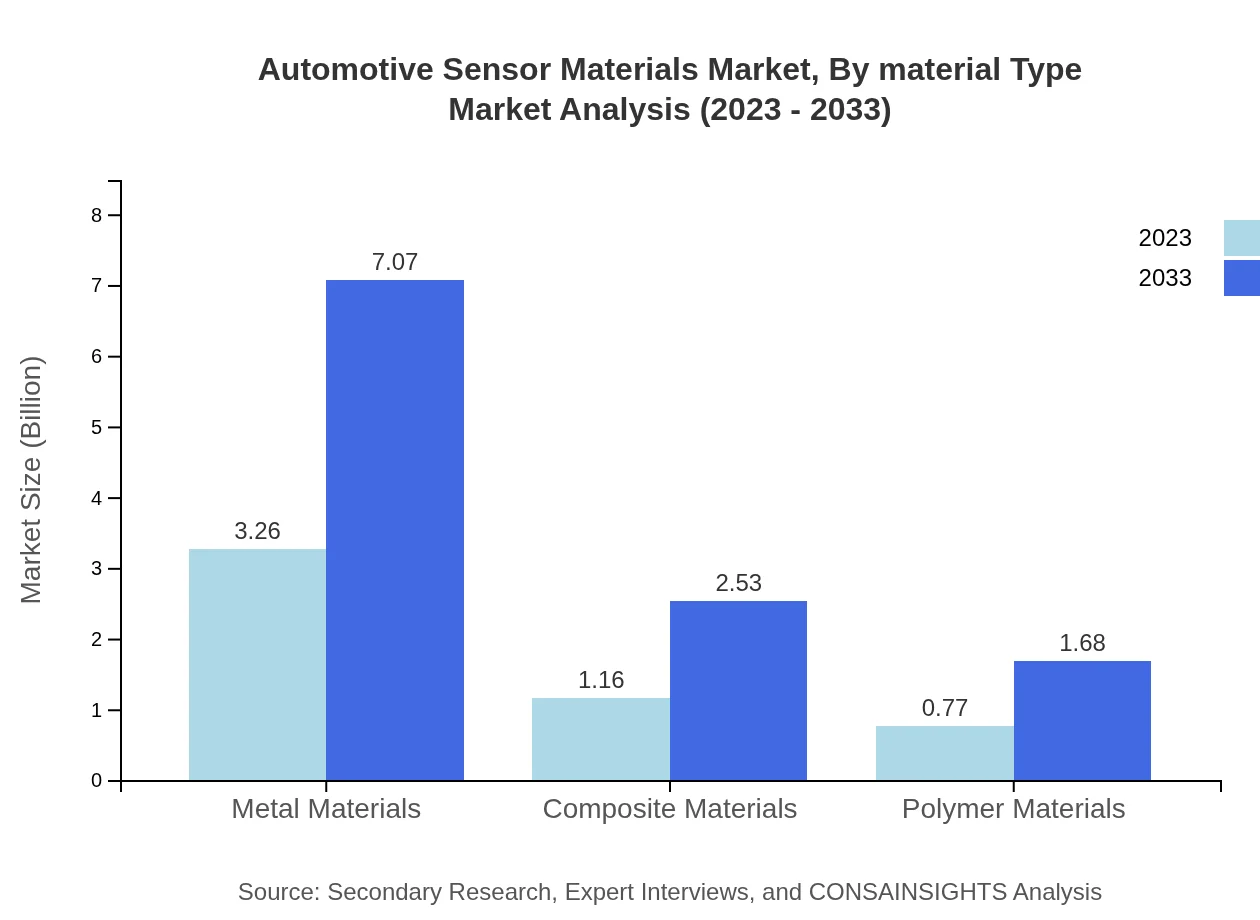

Automotive Sensor Materials Market Analysis By Material Type

The market comprises Metal Materials ($3.26 billion), Composite Materials ($1.16 billion), and Polymer Materials ($0.77 billion) in 2023. Metal Materials hold a significant 62.7% market share, crucial for durability in sensors.

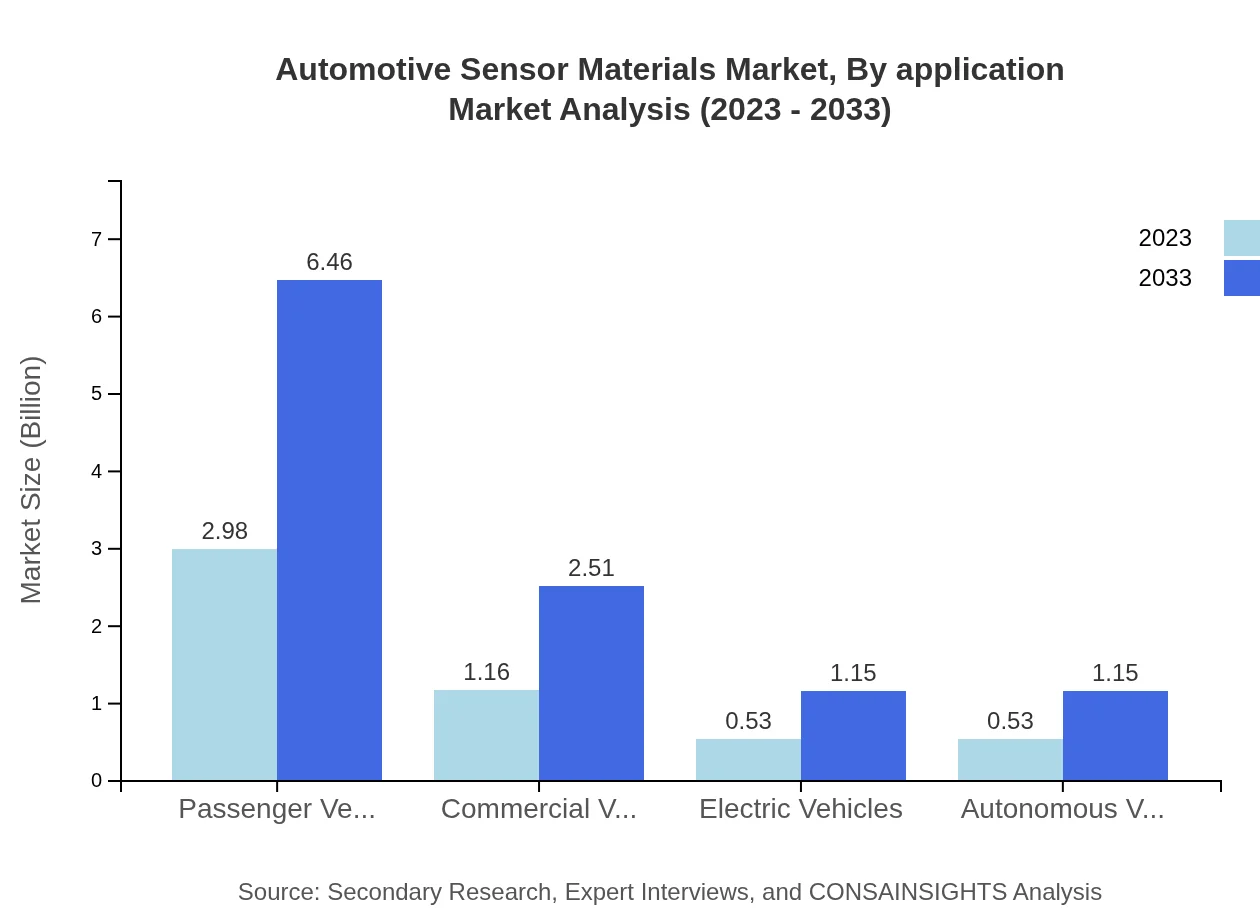

Automotive Sensor Materials Market Analysis By Application

Applications such as Passenger Vehicles ($2.98 billion), Commercial Vehicles ($1.16 billion), and Electric Vehicles ($0.53 billion) dominate the landscape, with passenger vehicles accounting for 57.3% share in 2023 and expected to rise to $6.46 billion by 2033.

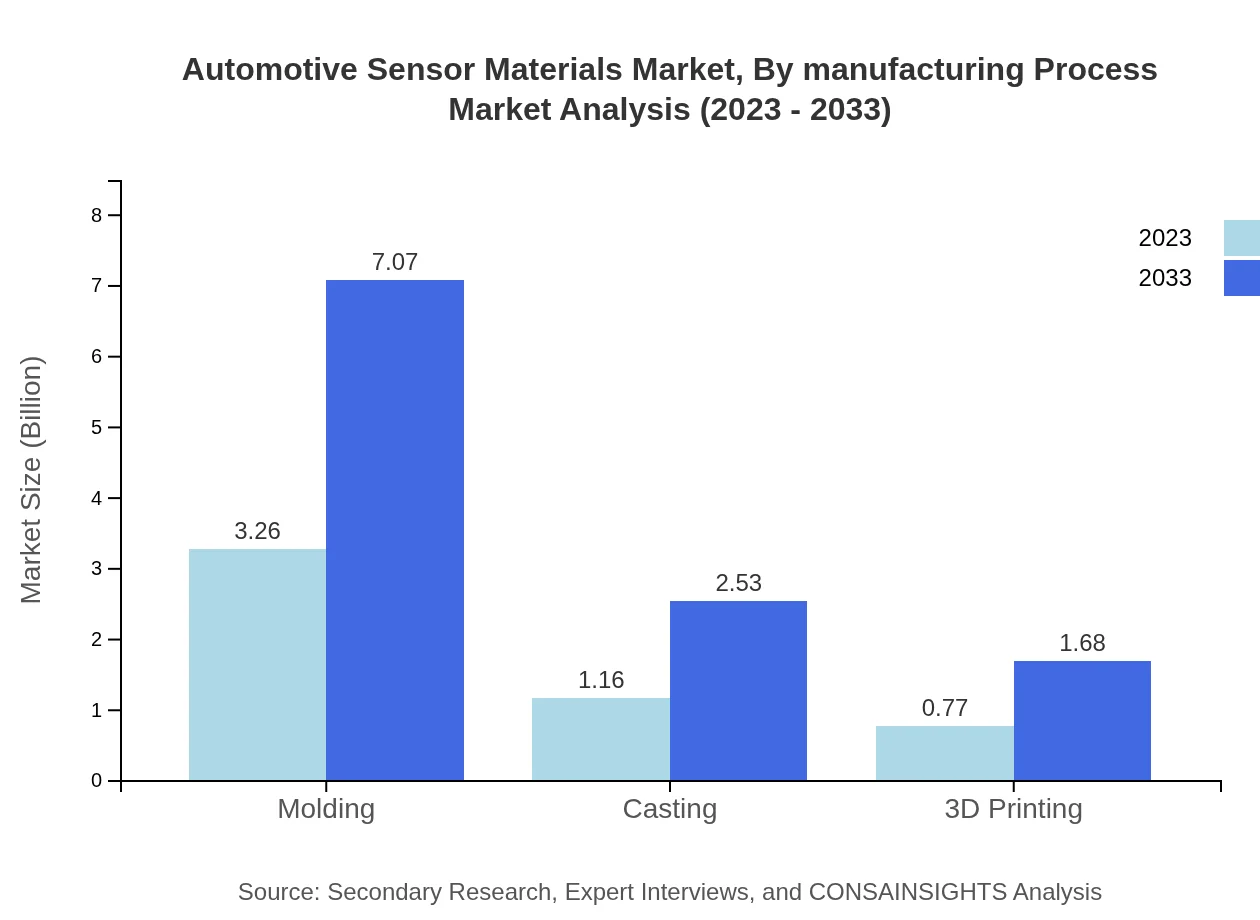

Automotive Sensor Materials Market Analysis By Manufacturing Process

Manufacturing processes like Molding ($3.26 billion), Casting ($1.16 billion), and 3D Printing ($0.77 billion) are predominant. Molding leads with 62.7% share, expected to grow to $7.07 billion by 2033.

Automotive Sensor Materials Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automotive Sensor Materials Industry

Bosch:

A pioneer in automotive technologies, Bosch manufactures various sensor types crucial for vehicle safety and automation.Honeywell :

Focusing on innovative sensor technologies, Honeywell supplies precision sensors for automotive applications driving efficiency and safety.Continental AG:

Continental AG is a leader in automotive supplies, offering advanced sensor systems supporting autonomous vehicle development.Denso Corporation:

Denso Corporation specializes in advanced automotive systems and sensor technologies, contributing significantly to emission reduction and automotive safety.TRW Automotive:

Known for safety and steering systems, TRW provides various sensors that enhance vehicle control and integration with modern technologies.We're grateful to work with incredible clients.

FAQs

What is the market size of automotive Sensor Materials?

The automotive sensor materials market is valued at $5.2 billion in 2023, with a projected CAGR of 7.8% over the next decade, indicating significant growth potential through 2033.

What are the key market players or companies in the automotive Sensor Materials industry?

Key players in the automotive sensor materials industry include major automotive manufacturers, semiconductor companies, and material suppliers focusing on sensor innovation and material performance enhancements.

What are the primary factors driving the growth in the automotive sensor materials industry?

Key growth drivers include increased vehicle electrification, rising safety standards, advancements in sensor technology, and the growing demand for autonomous vehicles and smart automotive applications.

Which region is the fastest Growing in the automotive sensor materials market?

North America is currently the fastest-growing region, projected to increase from $1.91 billion in 2023 to $4.13 billion by 2033, driven by tech advancements and an expanding automotive sector.

Does ConsaInsights provide customized market report data for the automotive sensor materials industry?

Yes, ConsaInsights offers tailored market report data for the automotive sensor materials industry, allowing clients to obtain detailed insights specific to their needs and objectives.

What deliverables can I expect from this automotive sensor materials market research project?

Deliverables include in-depth market analysis reports, regional data insights, competitive landscape evaluations, trend assessments, and forecasts covering market size projections and growth opportunities.

What are the market trends of automotive sensor materials?

Key trends include integration of advanced materials like composites in sensor design, increasing adoption of IoT and AI for vehicle monitoring, and a rise in electric and autonomous vehicle technologies.