Carbon Fiber Reinforced Thermoplastic Cfrtp Composite Market Report

Published Date: 02 February 2026 | Report Code: carbon-fiber-reinforced-thermoplastic-cfrtp-composite

Carbon Fiber Reinforced Thermoplastic Cfrtp Composite Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Carbon Fiber Reinforced Thermoplastic (CFRTP) composite market, covering market dynamics, segmentation, regional insights, technology trends, and forecasts from 2023 to 2033.

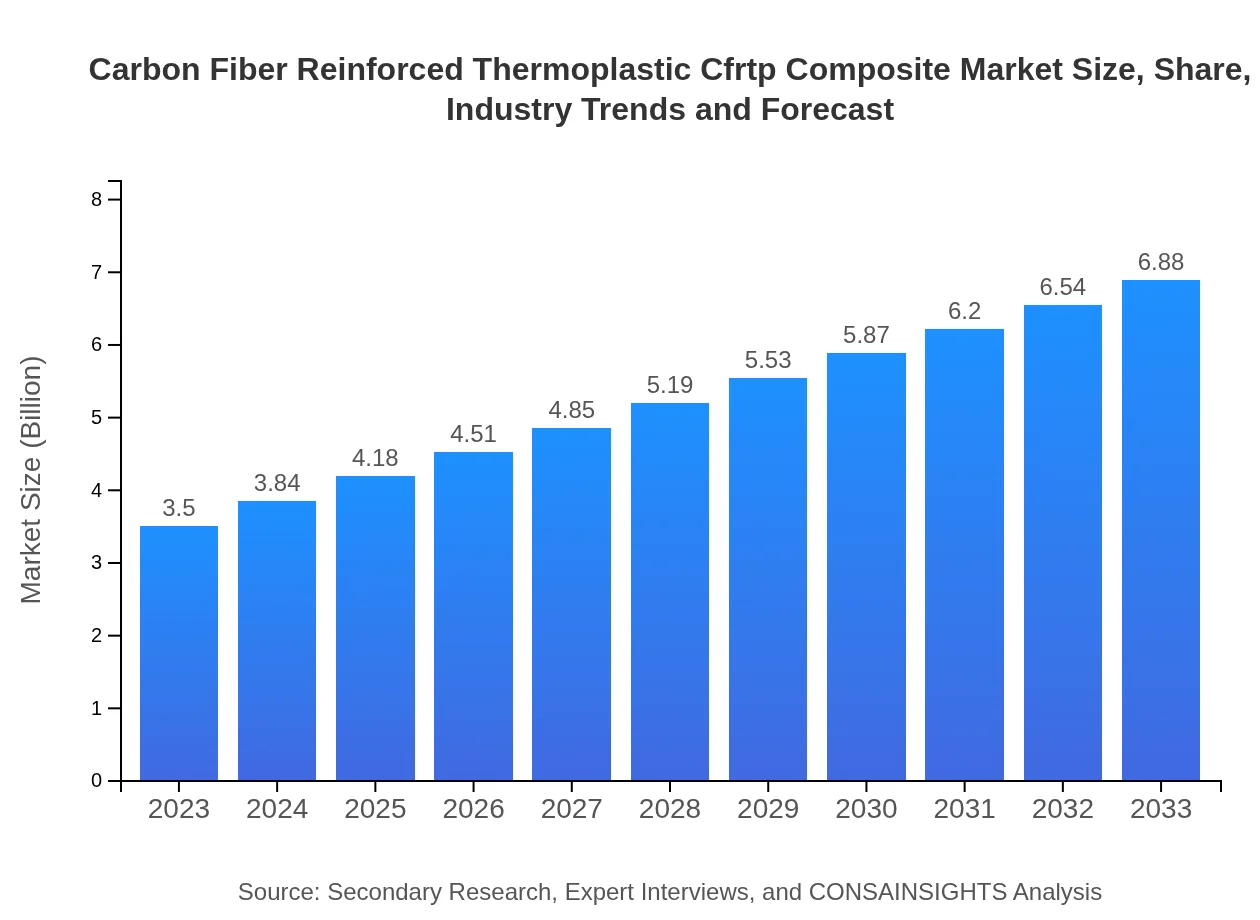

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $6.88 Billion |

| Top Companies | Toray Industries, Inc., SABIC, Teijin Limited, Hexcel Corporation, Mitsubishi Chemical Corp. |

| Last Modified Date | 02 February 2026 |

Carbon Fiber Reinforced Thermoplastic CFRTP Composite Market Overview

Customize Carbon Fiber Reinforced Thermoplastic Cfrtp Composite Market Report market research report

- ✔ Get in-depth analysis of Carbon Fiber Reinforced Thermoplastic Cfrtp Composite market size, growth, and forecasts.

- ✔ Understand Carbon Fiber Reinforced Thermoplastic Cfrtp Composite's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Carbon Fiber Reinforced Thermoplastic Cfrtp Composite

What is the Market Size & CAGR of Carbon Fiber Reinforced Thermoplastic CFRTP Composite market in 2023?

Carbon Fiber Reinforced Thermoplastic CFRTP Composite Industry Analysis

Carbon Fiber Reinforced Thermoplastic CFRTP Composite Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Carbon Fiber Reinforced Thermoplastic CFRTP Composite Market Analysis Report by Region

Europe Carbon Fiber Reinforced Thermoplastic Cfrtp Composite Market Report:

The European CFRTP composite market is expected to increase substantially, from 0.93 billion USD in 2023 to 1.83 billion USD by 2033. A focus on sustainable practices, along with stringent regulations aimed at reducing emissions in transportation, is propelling the market forward.Asia Pacific Carbon Fiber Reinforced Thermoplastic Cfrtp Composite Market Report:

In the Asia Pacific region, the CFRTP composite market is expected to grow from 0.68 billion USD in 2023 to 1.34 billion USD by 2033. The rapid industrialization, coupled with increasing investments in aerospace and automotive sectors in countries like China and India, is bolstering market growth.North America Carbon Fiber Reinforced Thermoplastic Cfrtp Composite Market Report:

North America is anticipated to be a significant market, with values rising from 1.36 billion USD in 2023 to 2.68 billion USD by 2033. Advanced manufacturing capabilities and strong demand from aerospace and automotive sectors will accelerate growth in this region.South America Carbon Fiber Reinforced Thermoplastic Cfrtp Composite Market Report:

The South American CFRTP composite market is projected to grow from 0.18 billion USD in 2023 to 0.35 billion USD by 2033. The expansion is driven by a rise in demand for lightweight materials in the automotive industry and strategic investment in renewable energy applications.Middle East & Africa Carbon Fiber Reinforced Thermoplastic Cfrtp Composite Market Report:

In the Middle East and Africa, the market for CFRTP composites is projected to grow from 0.35 billion USD in 2023 to 0.68 billion USD by 2033. Growing construction activities and investment in aerospace innovations are vital factors driving market growth in this region.Tell us your focus area and get a customized research report.

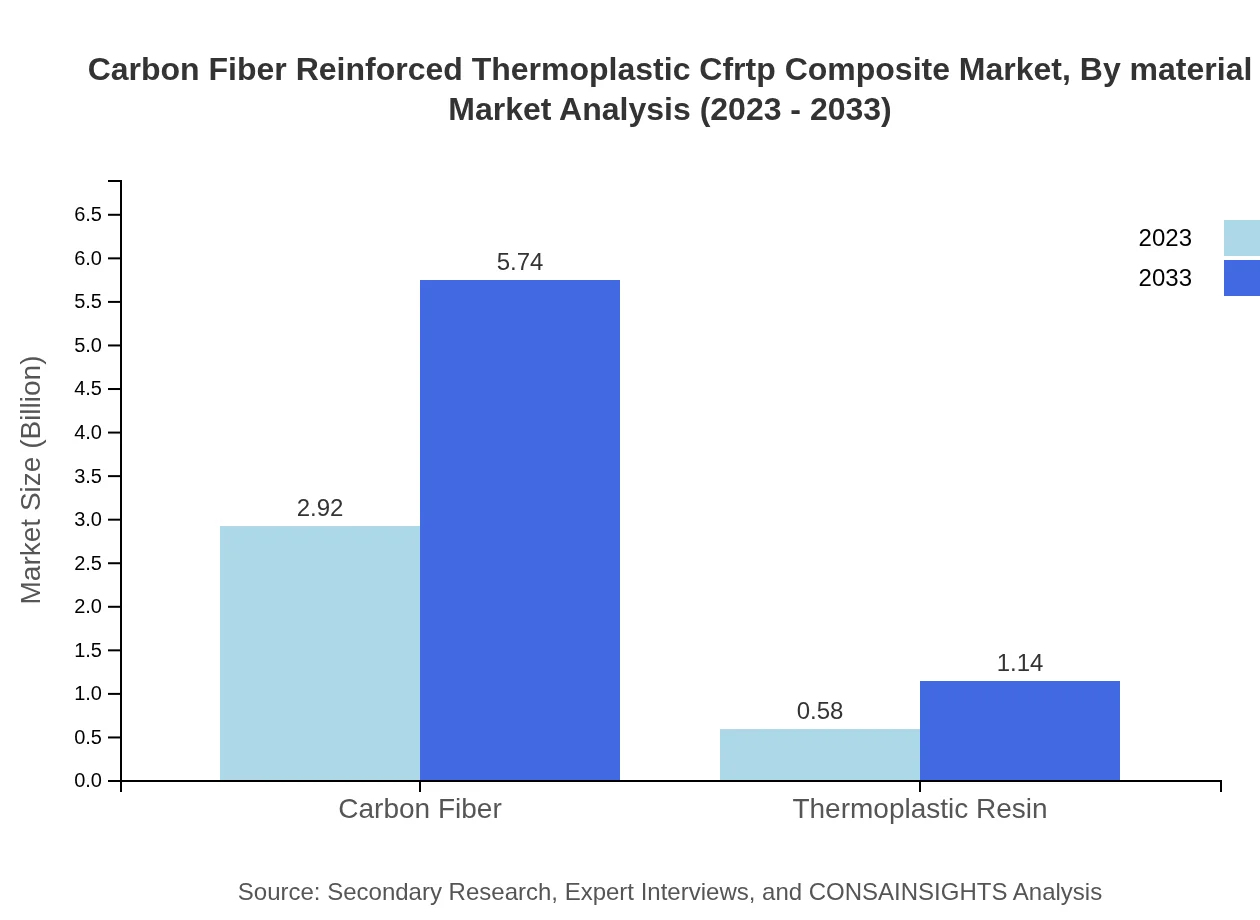

Carbon Fiber Reinforced Thermoplastic Cfrtp Composite Market Analysis By Material

The CFRTP composite market is predominantly segmented into carbon fiber and thermoplastic resins, with carbon fiber representing a substantial market share. Carbon fiber-based composites are projected to grow from 2.92 billion USD in 2023 to 5.74 billion USD by 2033, while thermoplastic resins will see growth from 0.58 billion USD to 1.14 billion USD in the same period.

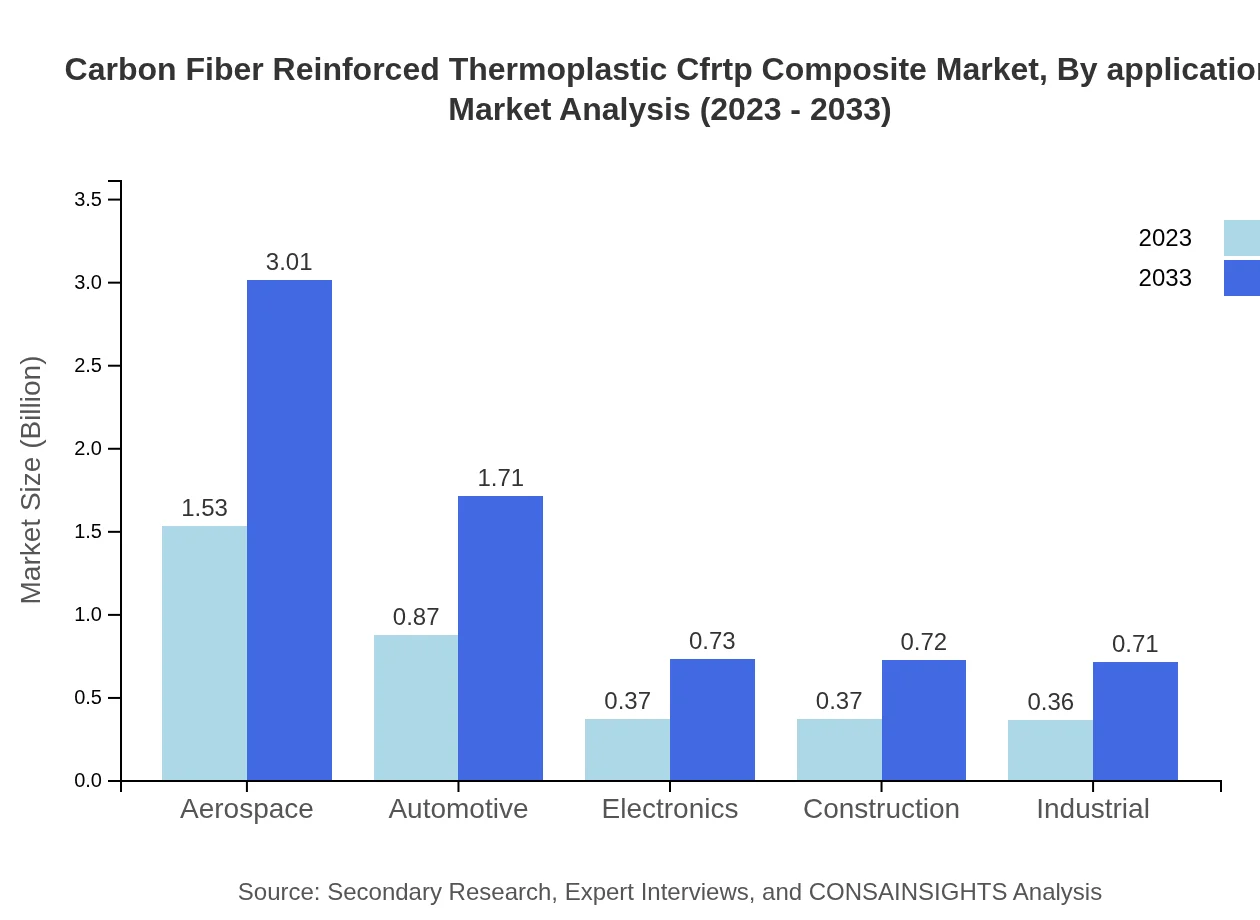

Carbon Fiber Reinforced Thermoplastic Cfrtp Composite Market Analysis By Application

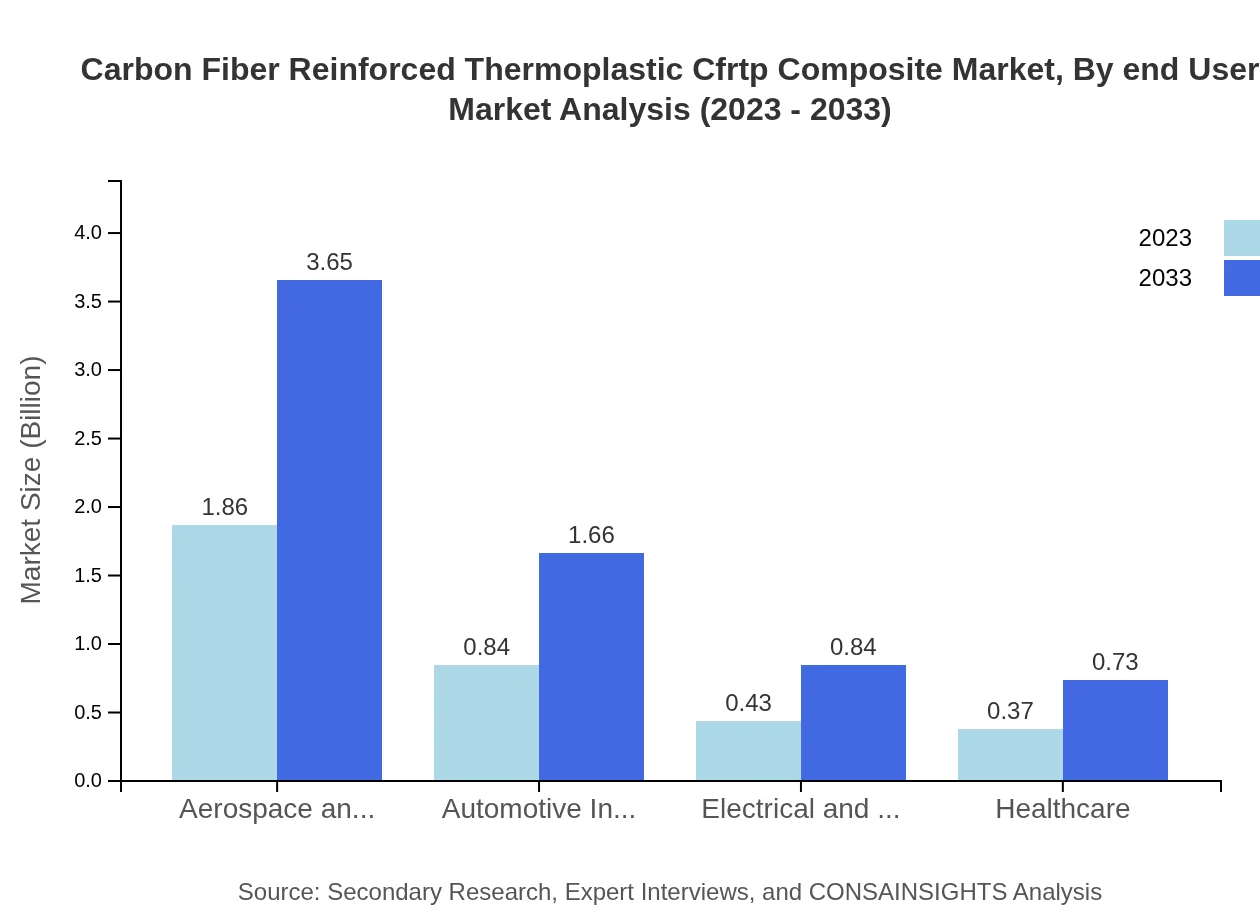

Inspections reveal that the aerospace and defense sector holds the significant share of the CFRTP market, with a value growing from 1.86 billion USD in 2023 to 3.65 billion USD by 2033. The automotive sector follows closely with an increase from 0.84 billion USD to 1.66 billion USD, driven by the need for lightweight structures.

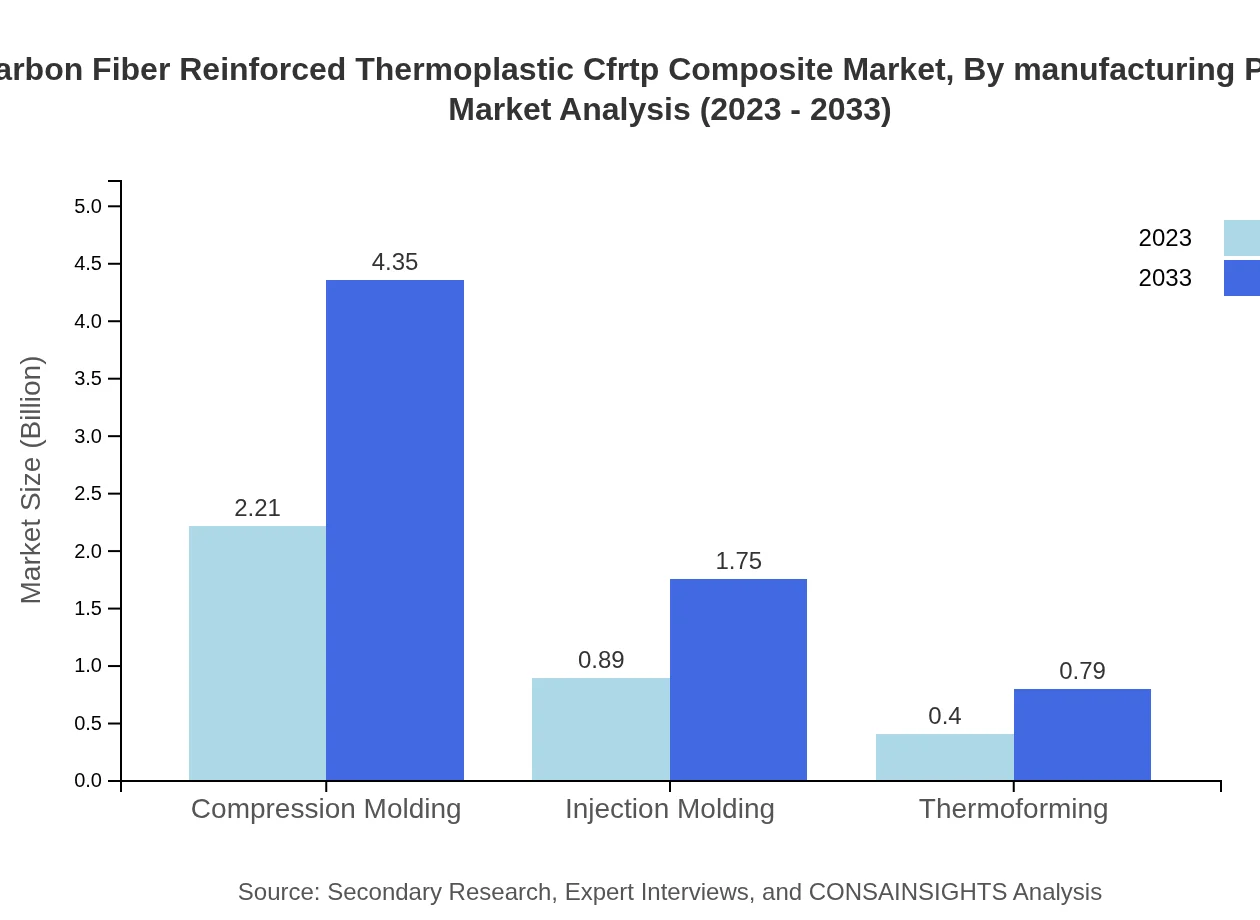

Carbon Fiber Reinforced Thermoplastic Cfrtp Composite Market Analysis By Manufacturing Process

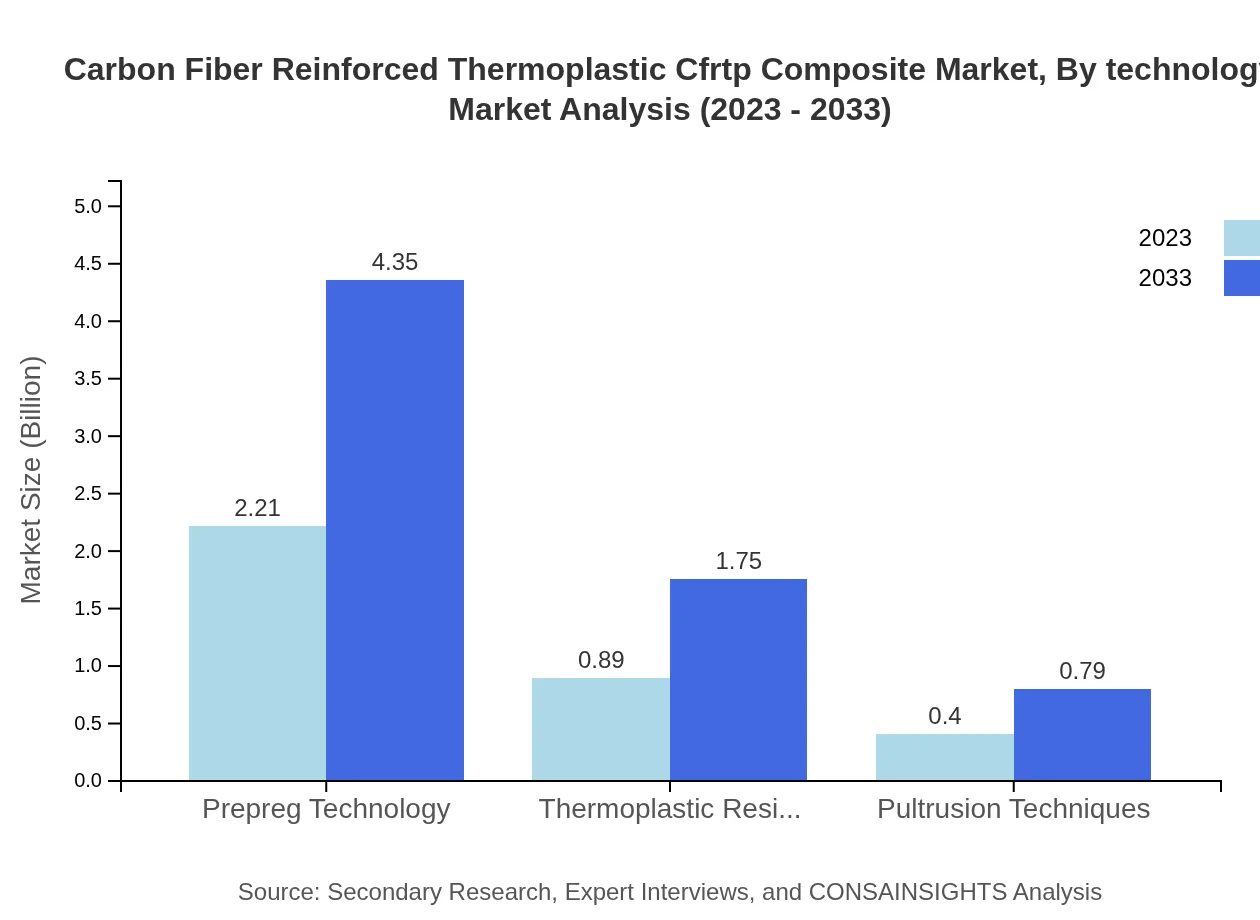

Key manufacturing processes include compression molding, injection molding, and thermoforming. Compression molding remains dominant, with market values projected to grow from 2.21 billion USD in 2023 to 4.35 billion USD by 2033. Injection molding will also play a crucial role, with growing demand propelling it from 0.89 billion USD to 1.75 billion USD.

Carbon Fiber Reinforced Thermoplastic Cfrtp Composite Market Analysis By End User

End-user sectors such as aerospace, automotive, electronics, construction, and healthcare are critical to the CFRTP composite market landscape. The aerospace sector is particularly noteworthy, projected to expand from 1.53 billion USD to 3.01 billion USD from 2023 to 2033, driven largely by innovations in aircraft design.

Carbon Fiber Reinforced Thermoplastic Cfrtp Composite Market Analysis By Technology

Technological advances such as prepreg technology and thermoplastic resin transfer molding are instrumental in shaping the market. Prepreg technology is expected to grow from 2.21 billion USD in 2023 to 4.35 billion USD, while thermoplastic resin transfer molding will rise from 0.89 billion USD to 1.75 billion USD over the same timeline.

Carbon Fiber Reinforced Thermoplastic CFRTP Composite Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Carbon Fiber Reinforced Thermoplastic CFRTP Composite Industry

Toray Industries, Inc.:

A leading manufacturer of carbon fiber and composite materials, Toray provides advanced CFRTP solutions tailored for aerospace and automotive applications.SABIC:

SABIC is a global leader in chemicals and polymers, providing innovative CFRTP solutions that enhance performance across multiple industries.Teijin Limited:

Teijin specializes in high-performance materials and advanced composites, focusing on eco-friendly CFRTP products for various sectors.Hexcel Corporation:

Hexcel is known for its composite technologies, offering a broad range of CFRTP products suitable for aerospace and industrial applications.Mitsubishi Chemical Corp.:

Mitsubishi Chemical is involved in the production of advanced composite materials, providing innovative CFRTP solutions for lightweight manufacturing.We're grateful to work with incredible clients.

FAQs

What is the market size of carbon Fiber Reinforced Thermoplastic Cfrtp Composite?

The carbon fiber reinforced thermoplastic (CFRTP) composite market is currently valued at $3.5 billion in 2023 and is expected to grow at a CAGR of 6.8% through 2033.

What are the key market players or companies in this carbon Fiber Reinforced Thermoplastic Cfrtp Composite industry?

Key players in the CFRTP composite market include leading manufacturers from aerospace, automotive, and electronics sectors, specializing in high-performance composite materials, enhancing product durability and performance.

What are the primary factors driving the growth in the carbon Fiber Reinforced Thermoplastic Cfrtp Composite industry?

Growth drivers include increasing demand for lightweight materials in aerospace and automotive industries, advancements in manufacturing technologies, and rising environmental regulations promoting sustainable materials.

Which region is the fastest Growing in the carbon Fiber Reinforced Thermoplastic Cfrtp Composite?

The Asia Pacific region is the fastest-growing market for CFRTP composites, projected to reach $1.34 billion by 2033, driven by industrial growth and increasing adoption in various sectors.

Does ConsaInsights provide customized market report data for the carbon Fiber Reinforced Thermoplastic Cfrtp Composite industry?

Yes, ConsaInsights offers customized market report data tailored to specific research needs within the carbon fiber reinforced thermoplastic composite industry, ensuring relevant insights.

What deliverables can I expect from this carbon Fiber Reinforced Thermoplastic Cfrtp Composite market research project?

You can expect comprehensive market analysis reports including market size, growth forecasts, regional analyses, competitive landscape assessments, and key market trends tailored for CFRTP composites.

What are the market trends of carbon Fiber Reinforced Thermoplastic Cfrtp Composite?

Current trends include increased utilization in aerospace and automotive applications, development of advanced manufacturing techniques, and a shift towards eco-friendly composites within the CFRTP industry.