Cash Flow Management

Published Date: 31 January 2026 | Report Code: cash-flow-management

Cash Flow Management Market Size, Share, Industry Trends and Forecast to 2033

This report delivers an in‐depth analysis of the Cash Flow Management market with comprehensive insights on trends, regional dynamics, technological advancements, and product segmentation. Covering the forecast period from 2024 to 2033, the study provides detailed data on market size, growth rates, competitive landscape, and emerging challenges to help stakeholders make informed decisions.

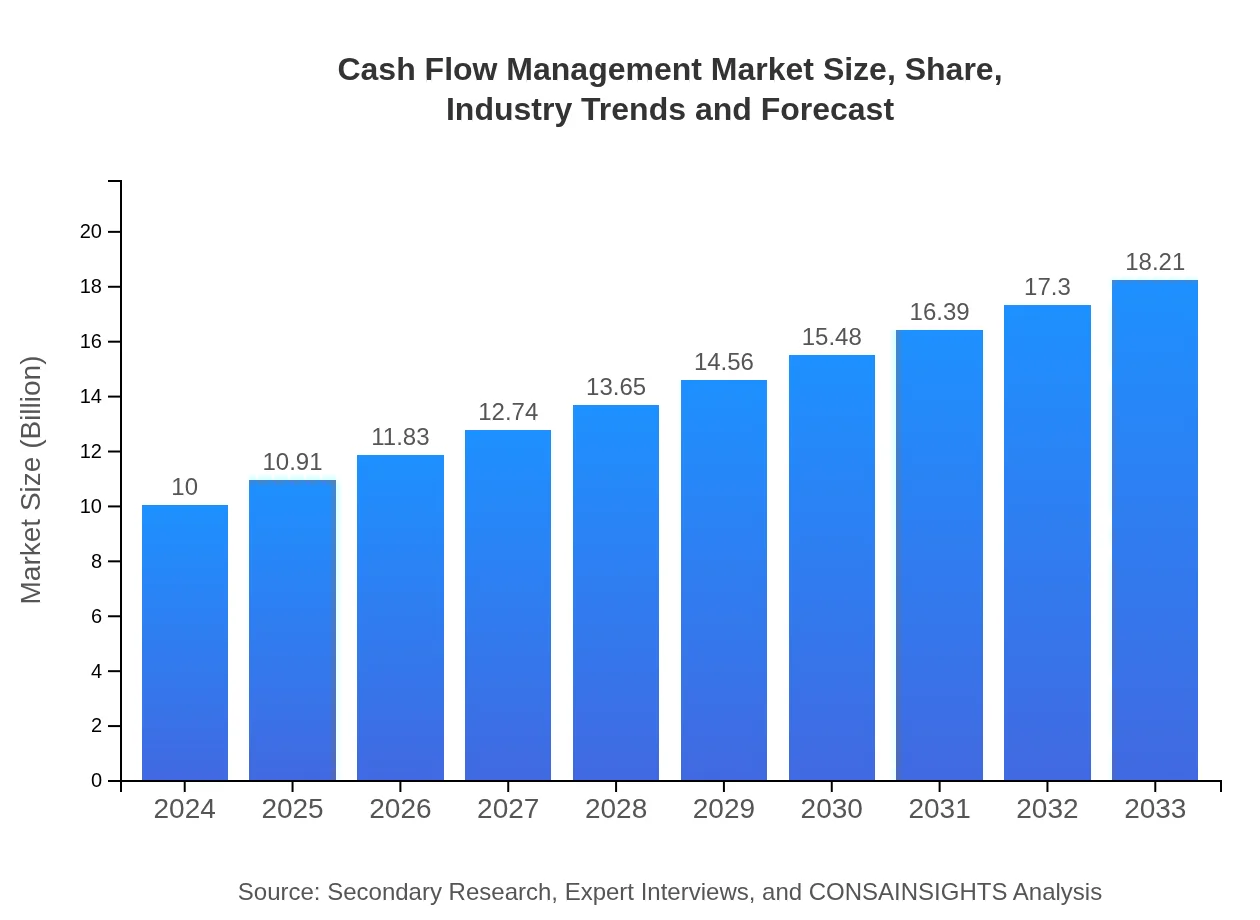

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

| 2024 Market Size | $10.00 Billion |

| CAGR (2024-2033) | 6.7% |

| 2033 Market Size | $18.21 Billion |

| Top Companies | Oracle Financial Services, SAP SE |

| Last Modified Date | 31 January 2026 |

Cash Flow Management Market Overview

Customize Cash Flow Management market research report

- ✔ Get in-depth analysis of Cash Flow Management market size, growth, and forecasts.

- ✔ Understand Cash Flow Management's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Cash Flow Management

What is the Market Size & CAGR of Cash Flow Management market in 2024?

Cash Flow Management Industry Analysis

Cash Flow Management Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Cash Flow Management Market Analysis Report by Region

Europe Cash Flow Management:

Europe represents a stable and mature market where traditional banking practices blend with modern fintech solutions. In 2024, the market size stood at 2.65 and is forecasted to rise to 4.82 by 2033. European businesses are increasingly adopting digital cash flow management solutions to comply with stringent regulatory requirements and to streamline financial operations. The region also benefits from an integrated economic environment where cross-border financial transactions drive the demand for more sophisticated cash management tools. Continuous innovation in technology and a focus on operational efficiency are expected to propel market growth in this region.Asia Pacific Cash Flow Management:

The Asia Pacific region is exhibiting dynamic growth in the Cash Flow Management market owing to rapid industrialization, a surge in tech adoption, and expanding financial markets. In 2024, the market size was approximately 2.11, which is expected to grow to 3.85 by 2033. Investments in cloud technologies and digital transformation initiatives are driving efficiency in cash flow management practices. Emerging economies in the region are particularly focused on leveraging innovative financial tools to support growth and competitiveness. As businesses mature and regulatory frameworks become more robust, the region is anticipated to continue its upward trend and adopt more sophisticated cash management solutions.North America Cash Flow Management:

North America continues to be a leading market for Cash Flow Management solutions. With a market size of 3.22 in 2024 and an anticipated growth to 5.86 by 2033, the region benefits from mature financial practices, early adoption of technology, and a strong emphasis on data-driven decision-making. Companies are leveraging advanced analytics and integrated ERP systems to optimize cash usage. The well-established financial infrastructure and continuous innovation in software solutions further reinforce North America’s position as a dominant player in the market.South America Cash Flow Management:

South America has begun to witness a growing emphasis on cash flow optimization as local businesses strive to improve financial stability. With a market size of 0.94 in 2024 projected to reach 1.72 by 2033, the region is gradually catching up with global trends. Investment in financial technology is increasing, and companies are focused on reducing operational risks through enhanced liquidity management. Although economic and political uncertainties pose challenges, the overall trajectory suggests steady growth driven by digitalization and improved financial strategies.Middle East & Africa Cash Flow Management:

The Middle East and Africa region is experiencing gradual adoption of advanced cash flow management systems as local businesses strive for operational efficiency amidst economic fluctuations. With a market size of 1.08 in 2024 growing to 1.96 by 2033, the region is marked by a mix of challenges and opportunities. Businesses here are increasingly investing in digital transformation strategies despite infrastructure constraints. There is a growing recognition of the need to integrate technology into financial operations, which, coupled with supportive government policies in certain countries, is likely to result in steady market expansion over the coming years.Tell us your focus area and get a customized research report.

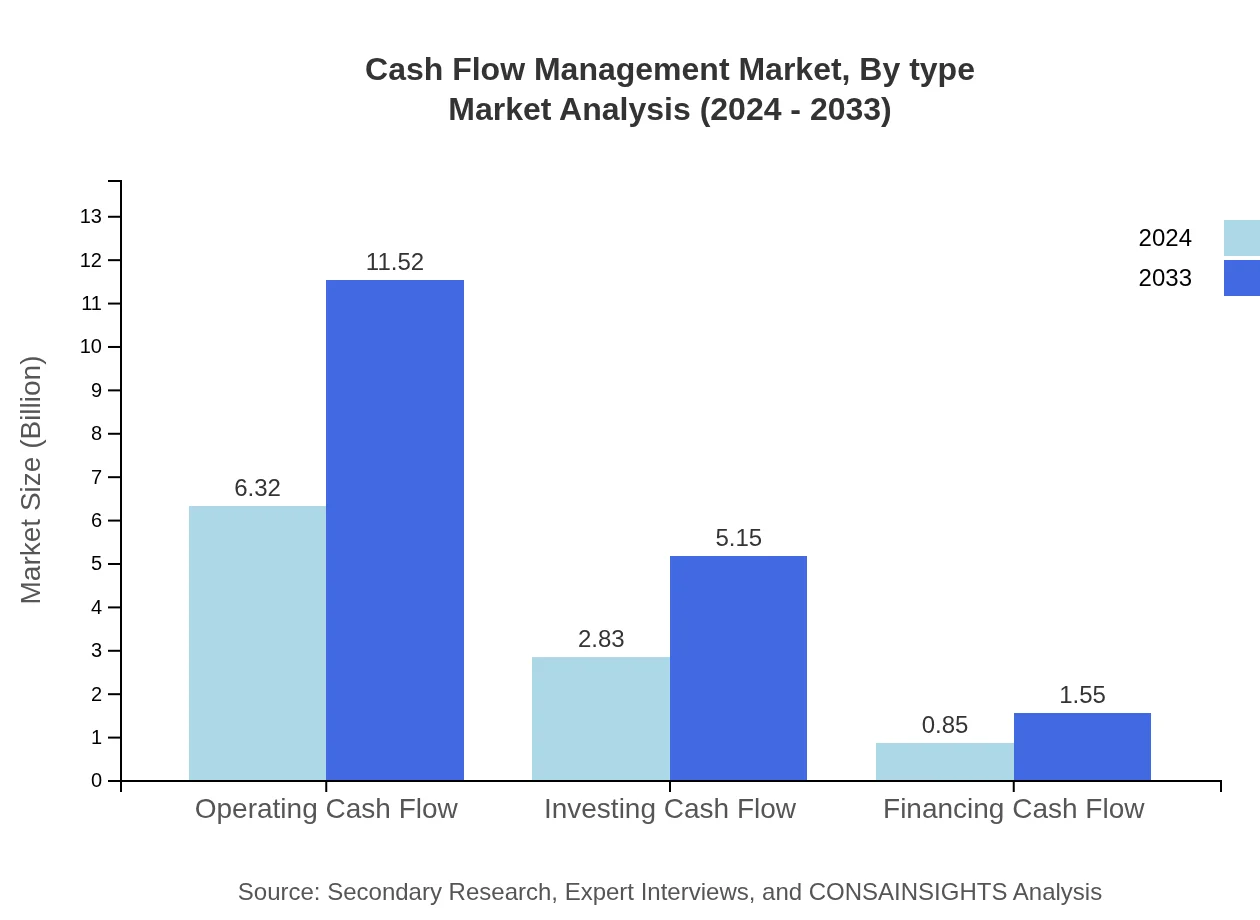

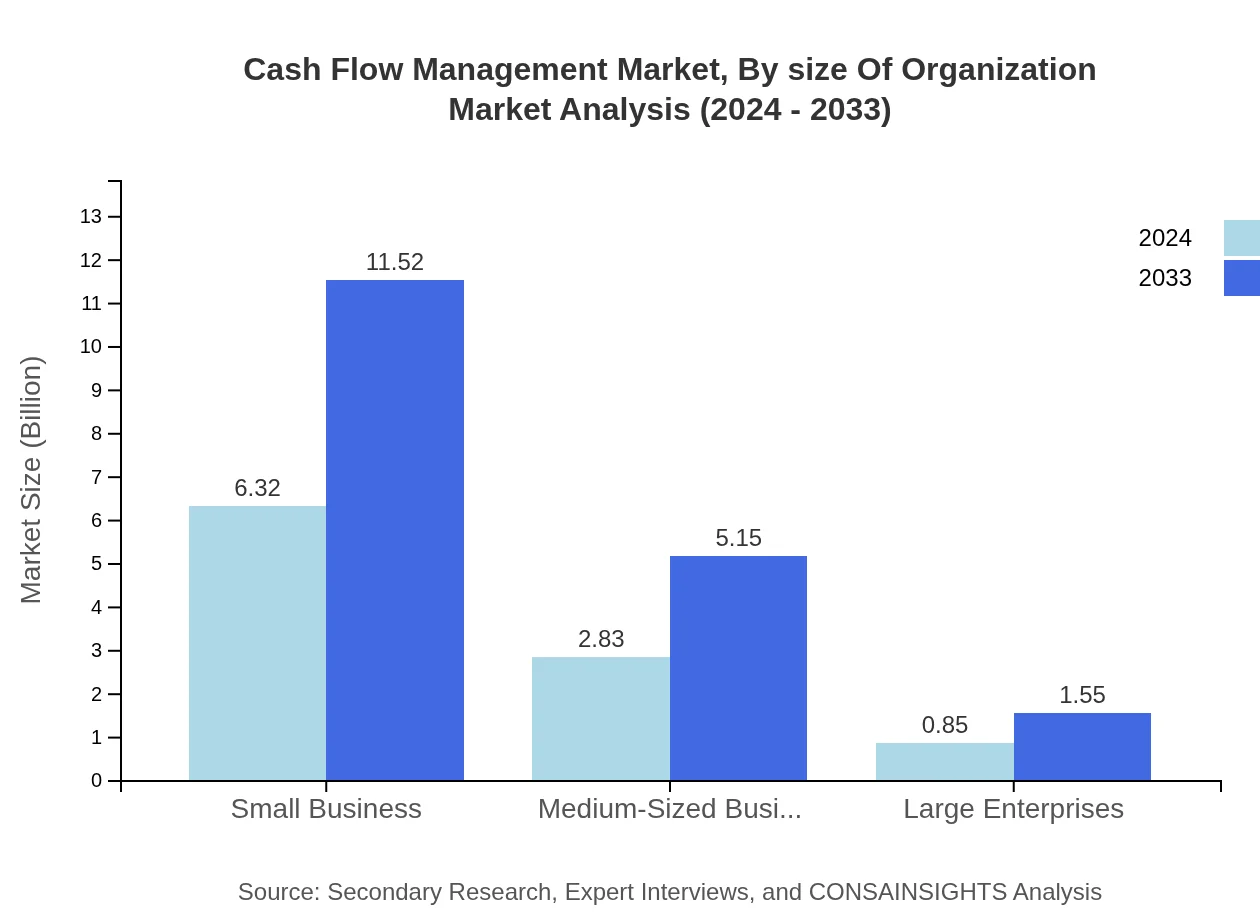

Cash Flow Management Market Analysis By Type

The By Type segment analyzes the three main cash flow types: operating, investing, and financing cash flows. Operating Cash Flow, leading with a market size of 6.32 in 2024 expected to expand to 11.52 by 2033, dominates the segment with a constant share of 63.22%, reflecting its critical importance in day-to-day business operations. Investing Cash Flow, though smaller in size, has maintained a consistent share of 28.29% with size estimates rising from 2.83 in 2024 to 5.15 in 2033. Similarly, Financing Cash Flow, representing financing activities, shows growth from a size of 0.85 to 1.55 and a steady share of 8.49% across the forecast period. These metrics underscore the integral role each cash flow type plays in overall financial management.

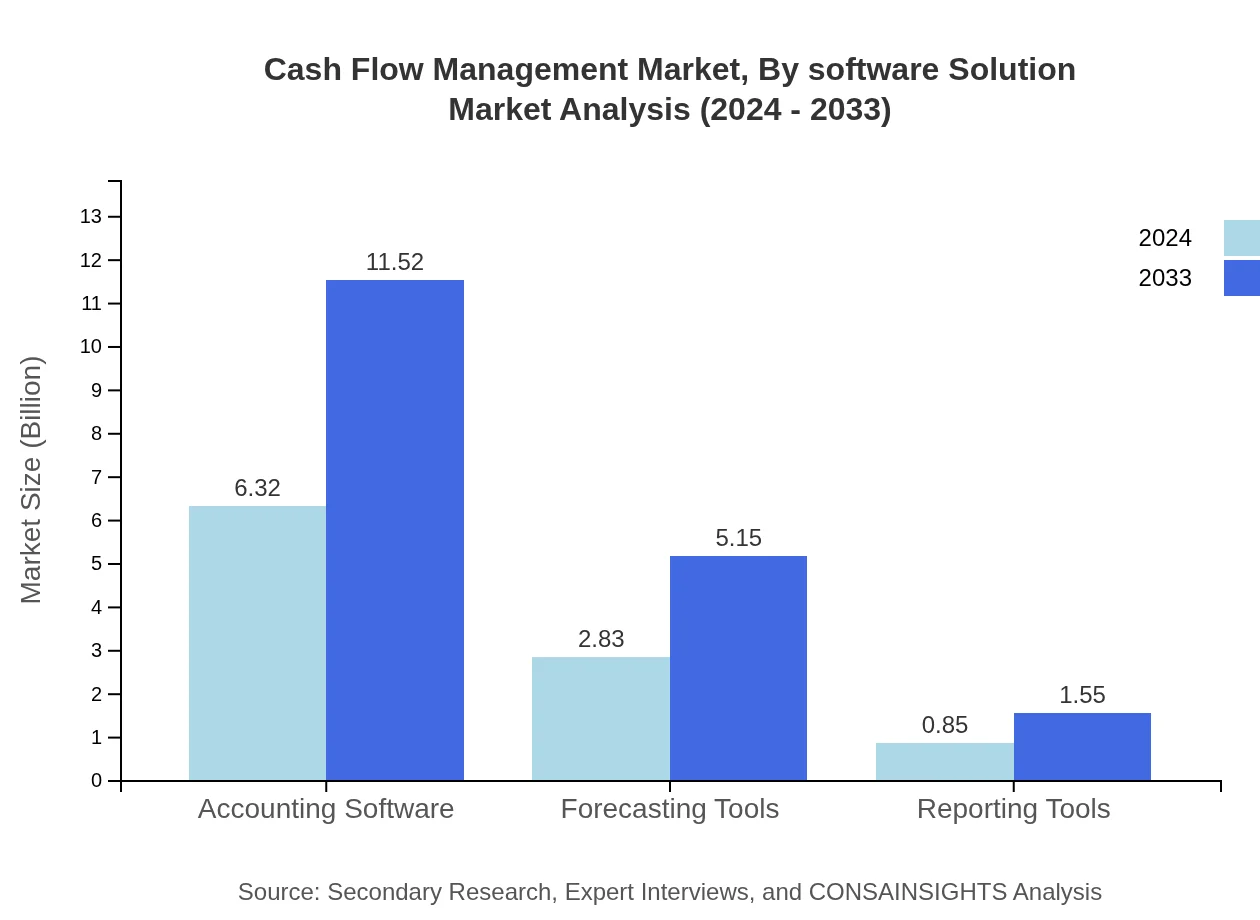

Cash Flow Management Market Analysis By Software Solution

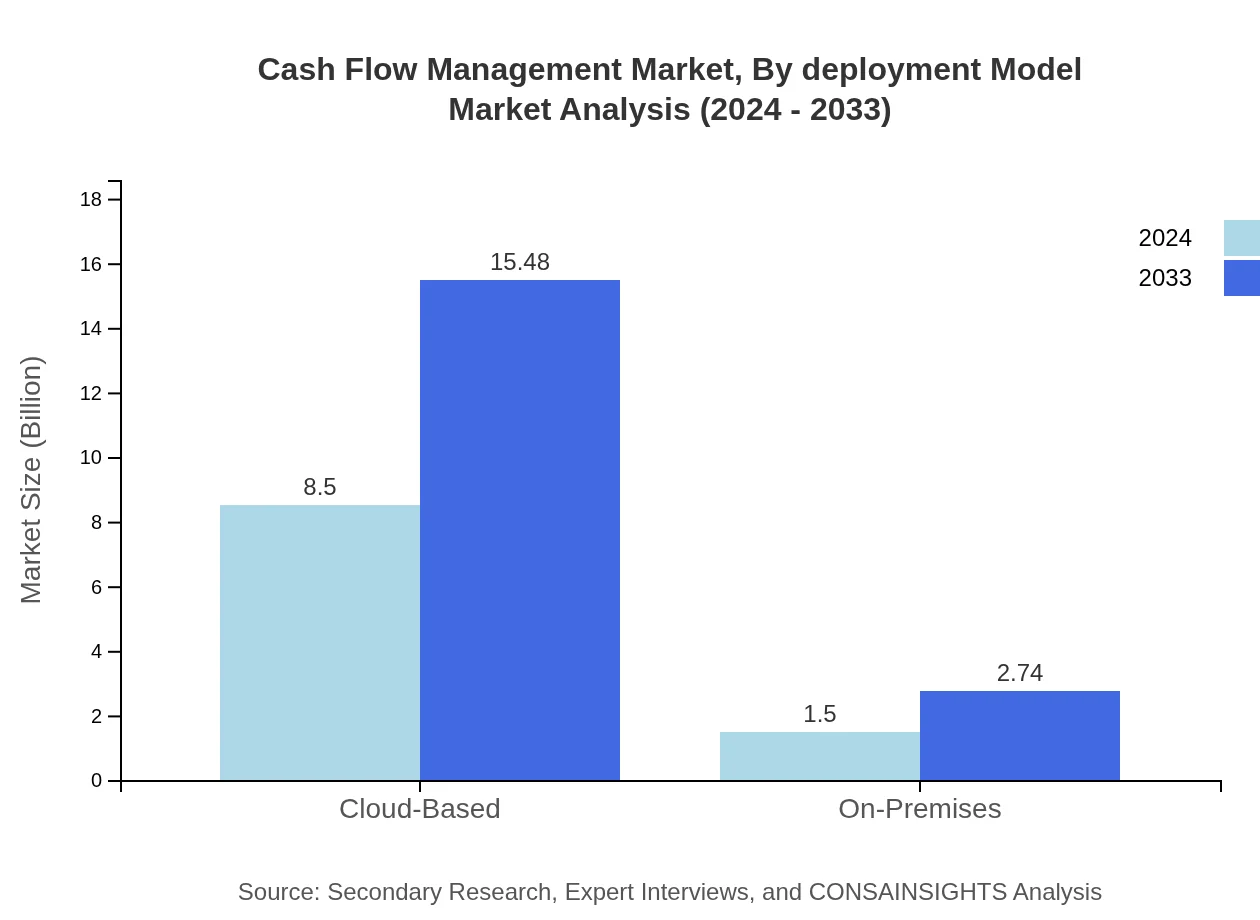

Within the software solutions category, the analysis distinguishes between cloud-based and on-premises solutions. Cloud-Based solutions are highly dominant, with a market size projected to increase from 8.50 in 2024 to 15.48 in 2033, capturing an impressive 84.98% share in both periods. This trend is indicative of the growing preference for cost-effective, scalable, and easily updatable financial solutions. On-Premises solutions, while still relevant, hold a smaller market segment – growing from 1.50 to 2.74 in size while maintaining a 15.02% share. The robust performance of cloud-based offerings highlights the industry’s shift towards digital and agile financial management systems that meet the evolving needs of modern enterprises.

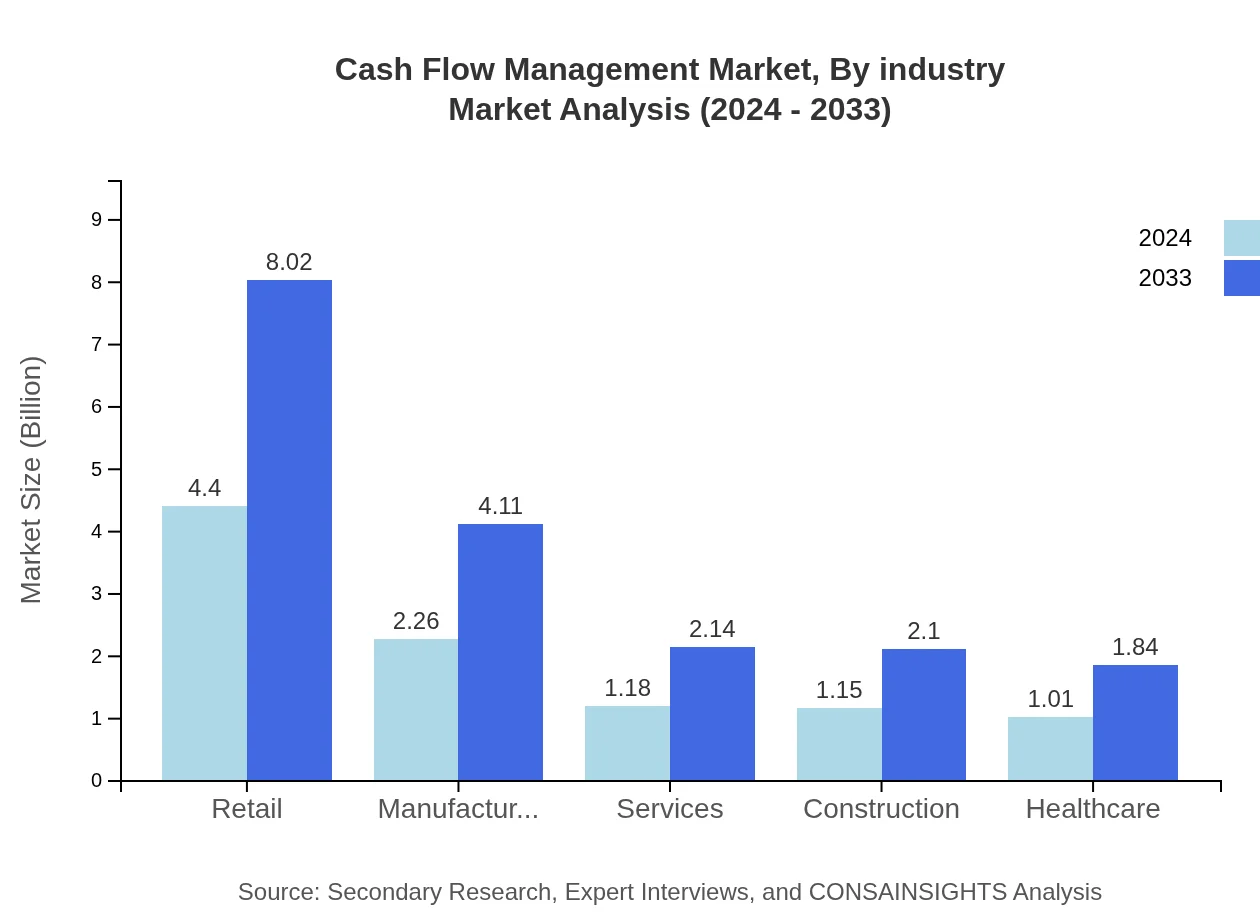

Cash Flow Management Market Analysis By Industry

The industry segmentation details how different sectors utilize cash flow management systems for enhanced operational effectiveness. The retail sector is a key contributor, with a market size increase from 4.40 in 2024 to 8.02 in 2033 and holding a 44.03% share. Manufacturing is another critical segment, showcasing growth from 2.26 to 4.11 and maintaining a 22.57% share. Additionally, services, construction, and healthcare sectors are also significant, with each sector reflecting consistent share values of 11.77%, 11.52%, and 10.11% respectively over the forecast period. These insights reinforce the fact that regardless of industry, efficient cash management is vital for controlling costs and optimizing growth opportunities.

Cash Flow Management Market Analysis By Deployment Model

Deployment models within the Cash Flow Management market are primarily divided into on-premises and cloud-based solutions. In alignment with evolving IT strategies, cloud-based deployment is proving to be the preferred model due to its flexibility, reduced upfront costs, and ease of integration with existing platforms. The on-premises model, while reliable for organizations with stringent data security requirements, shows a slower growth trend in comparison. The analysis indicates that market players investing in cloud solutions are better positioned to leverage real-time data analytics, scalability, and continuous software upgrades, thereby enhancing their competitive edge in a fast-paced financial environment.

Cash Flow Management Market Analysis By Size Of Organization

The market outlook further segments based on the size of the organization. Small businesses, which account for a significant 63.22% share, see their market size moving in tandem with standardized, cost-effective solutions, growing from 6.32 in 2024 to 11.52 by 2033. Medium-sized businesses, with a more moderate share of 28.29%, and large enterprises, with an 8.49% share, also contribute to the overall market opportunity. This segmentation is vital as it highlights that regardless of organizational scale, the need for precise and predictive cash flow management remains a constant driver of market evolution.

Cash Flow Management Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Cash Flow Management Industry

Oracle Financial Services:

Oracle Financial Services offers advanced cash management solutions that integrate seamlessly with enterprise systems, ensuring comprehensive financial oversight and operational efficiency. Its innovative technology and robust analytical capabilities have positioned it as a market leader in the cash flow management sector.SAP SE:

SAP SE leverages its expertise in enterprise resource planning to deliver integrated cash management platforms that streamline financial operations. The company’s continuous innovations in digital transformation and analytics have made it a prominent player driving efficiency across global markets.We're grateful to work with incredible clients.

FAQs

How can the cash Flow Management report help align our marketing strategy with customer adoption trends?

The cash-flow-management report can align marketing strategies by identifying customer needs, preferences, and adoption patterns. With a global market size of $10 billion and a CAGR of 6.7%, insights can refine targeting and enhance customer engagement in tune with market dynamics.

What product features are in highest demand according to the cash Flow Management trends?

Demand for cloud-based solutions is high, accounting for 84.98% of market share by 2033. The report highlights essential features such as real-time analytics, user-friendly interfaces, and integration capabilities, crucial for enhancing customer satisfaction and retention.

Which regions offer the best market entry and expansion opportunities in the cash Flow Management industry?

North America presents significant opportunities, projected to grow from $3.22 billion in 2024 to $5.86 billion by 2033. Meanwhile, Europe and Asia Pacific also show substantial growth potential, catering to diverse market needs.

What emerging technologies and innovations are shaping the cash Flow Management market?

Key innovations include AI-driven forecasting tools and advanced reporting capabilities. These technologies streamline operations, improve cash flow insight, and contribute to the market's growth, with cloud-based solutions leading the sector and projected to dominate the landscape.

Does the cash Flow Management report include competitive landscape and market share analysis?

Yes, the report provides a comprehensive analysis of the competitive landscape, detailing market share across segments such as operating and investing cash flow. By understanding competitors’ strategies, companies can position themselves effectively in the market.

How can executives use the cash Flow Management report to evaluate investment risks and ROI?

Executives can leverage the report's detailed analysis of market trends, growth forecasts, and regional insights to assess investment risks. Understanding segment data and competitive positioning aids in making informed, strategic investment decisions.

What is the market size of cash Flow Management?

The cash-flow-management market is valued at $10 billion, with a projected CAGR of 6.7% through 2033. This growth underscores the increasing importance of effective cash-flow strategies in today’s financial landscape.

How is the cash Flow Management market segmented regionally?

Regionally, North America leads with a forecast of $5.86 billion by 2033, followed by Europe at $4.82 billion, Asia Pacific at $3.85 billion, Latin America at $1.72 billion, and the Middle East and Africa at $1.96 billion by the same year.

What segments are most relevant in the cash Flow Management landscape?

Key segments include Operating Cash Flow, dominating the market with a share of 63.22%, alongside Cloud-Based solutions projected at 84.98%. Other significant areas are Investing and Financing Cash Flow, contributing to wide-ranging application across industries.