Commercial Telematics

Published Date: 02 February 2026 | Report Code: commercial-telematics

Commercial Telematics Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in‐depth analysis of the Commercial Telematics market from 2024 to 2033. It covers market trends, technological advancements, regional performance, segmentation details, and forecast insights. Readers will gain actionable insights from current data, strategic trends, and comprehensive analysis of key market drivers and challenges.

| Metric | Value |

|---|---|

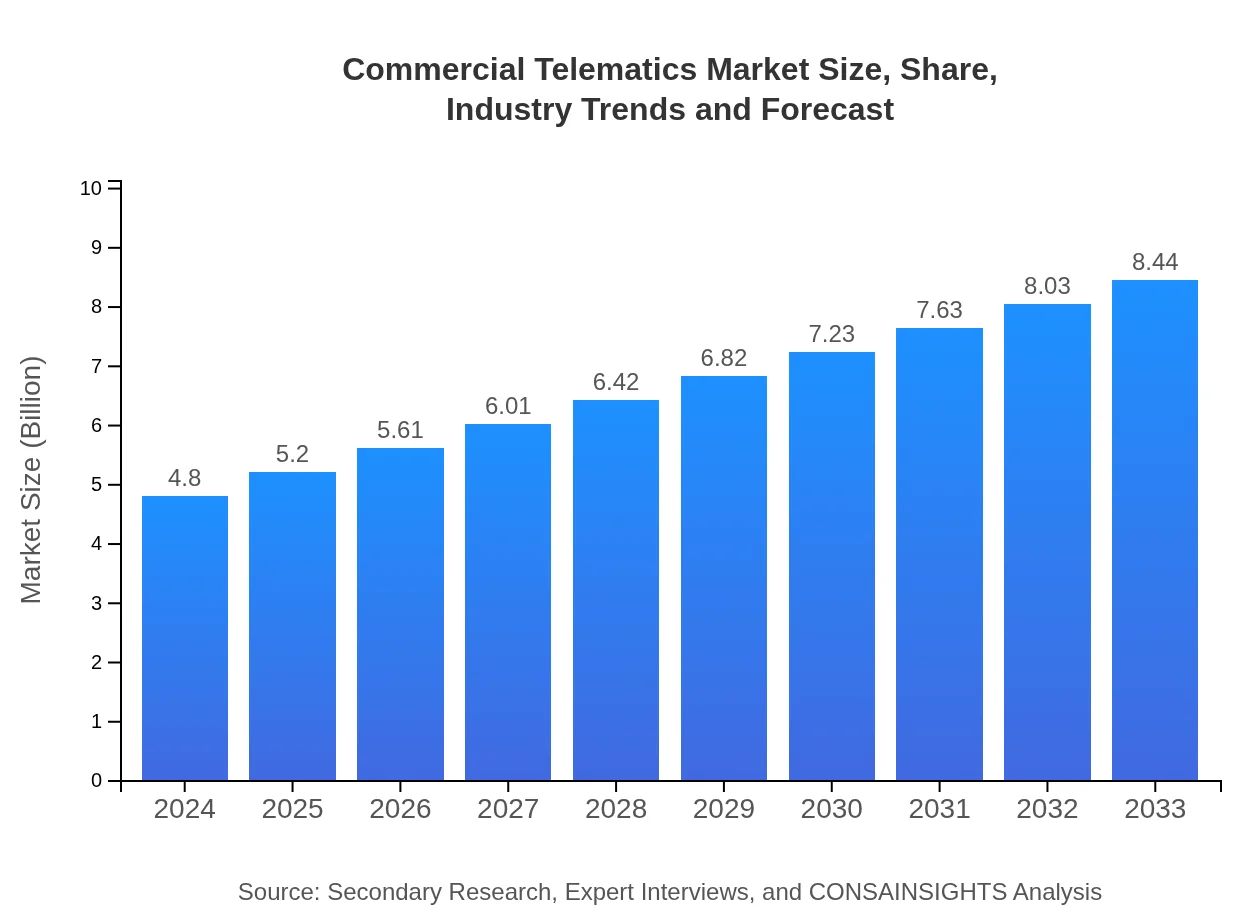

| Study Period | 2024 - 2033 |

| 2024 Market Size | $4.80 Billion |

| CAGR (2024-2033) | 6.3% |

| 2033 Market Size | $8.44 Billion |

| Top Companies | Telematics Innovators Inc., FleetTrack Systems |

| Last Modified Date | 02 February 2026 |

Commercial Telematics Market Overview

Customize Commercial Telematics market research report

- ✔ Get in-depth analysis of Commercial Telematics market size, growth, and forecasts.

- ✔ Understand Commercial Telematics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Commercial Telematics

What is the Market Size & CAGR of Commercial Telematics market in 2024?

Commercial Telematics Industry Analysis

Commercial Telematics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Commercial Telematics Market Analysis Report by Region

Europe Commercial Telematics:

Europe displays stable growth with market figures moving from $1.35 billion in 2024 to $2.37 billion by 2033. This region benefits from stringent regulatory norms and a high level of technological advancement, particularly in developed economies. The demand is further bolstered by initiatives focusing on sustainability and enhanced transportation safety protocols.Asia Pacific Commercial Telematics:

The Asia Pacific region is witnessing dynamic market growth owing to rapid urbanization and a surge in infrastructure development. With 2024 market estimates around $0.91 billion, scaling to $1.60 billion by 2033, the region benefits from robust governmental investments in smart transportation and digital infrastructure. Increased industrialization and a burgeoning fleet of commercial vehicles contribute to accelerated market adoption.North America Commercial Telematics:

North America continues to be a leading market, with a significant rise from $1.78 billion in 2024 to an estimated $3.12 billion by 2033 driven by advanced technological adoption and regulatory support. The presence of strong high-tech manufacturing sectors and a large commercial fleet underpin the sustained demand for integrated telematics solutions, coupled with strong R&D and innovation.South America Commercial Telematics:

The South American region, represented by Latin America in the data, is gradually embracing Commercial Telematics solutions. Market sizes increase from approximately $0.25 billion in 2024 to $0.43 billion by 2033 due to rising demand for fleet efficiency and improved logistics services amidst infrastructural challenges. Strategic investments and international collaborations are poised to drive further growth.Middle East & Africa Commercial Telematics:

The Middle East and Africa region is emerging as a promising market with moderate growth indicated by projections rising from $0.52 billion in 2024 to $0.91 billion by 2033. Investment in modern infrastructure, coupled with gradual technological integration within traditional industries, is opening new avenues for telematics adoption, paving the way for increased market presence.Tell us your focus area and get a customized research report.

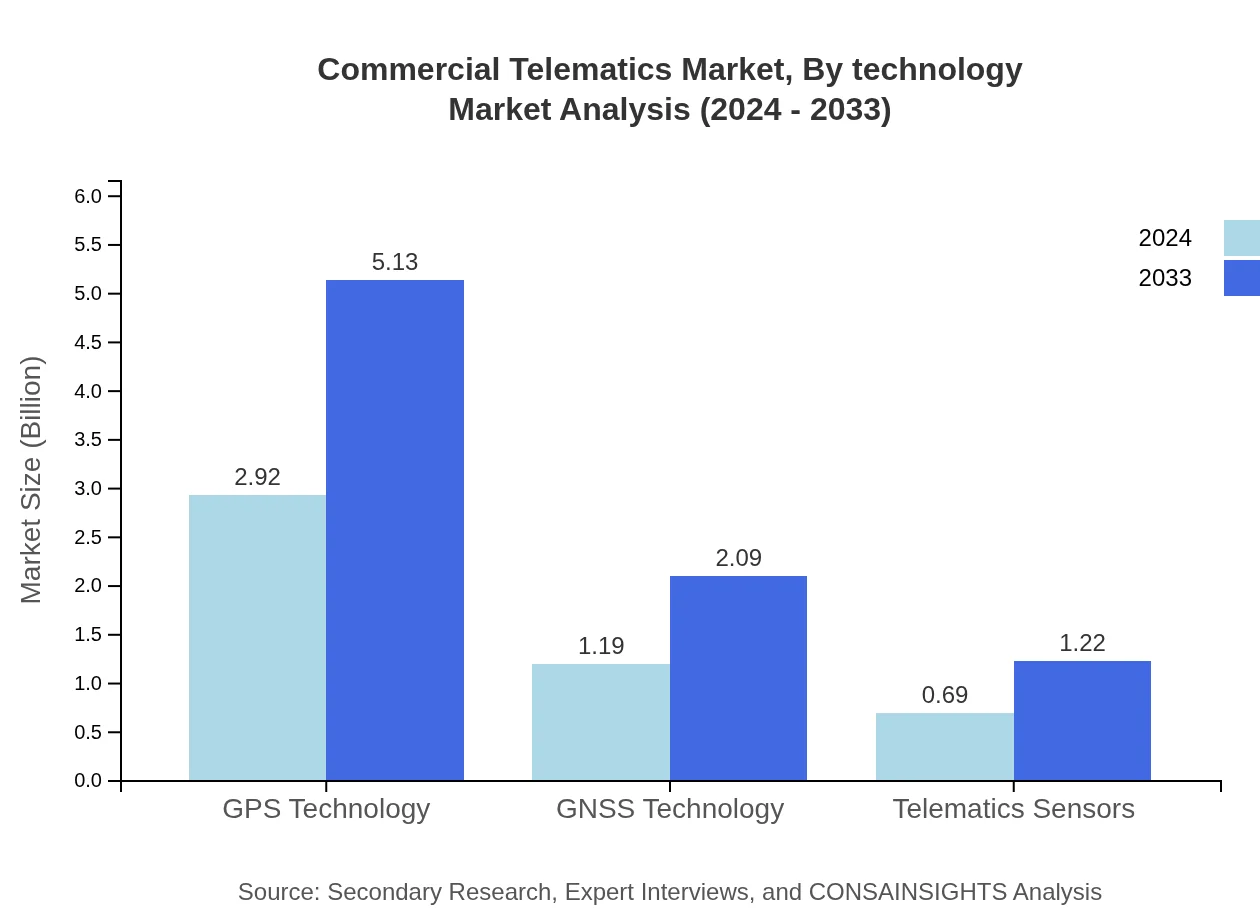

Commercial Telematics Market Analysis By Technology

The by-technology segment focuses on critical technological advancements such as GPS and GNSS systems, telematics sensors, and integrated data analytics platforms. This segment is marked by continuous innovation in tracking accuracy and real-time data processing. With significant investments in research and development, technology providers are expanding capabilities to meet diverse operational requirements and enhance the precision of fleet tracking solutions.

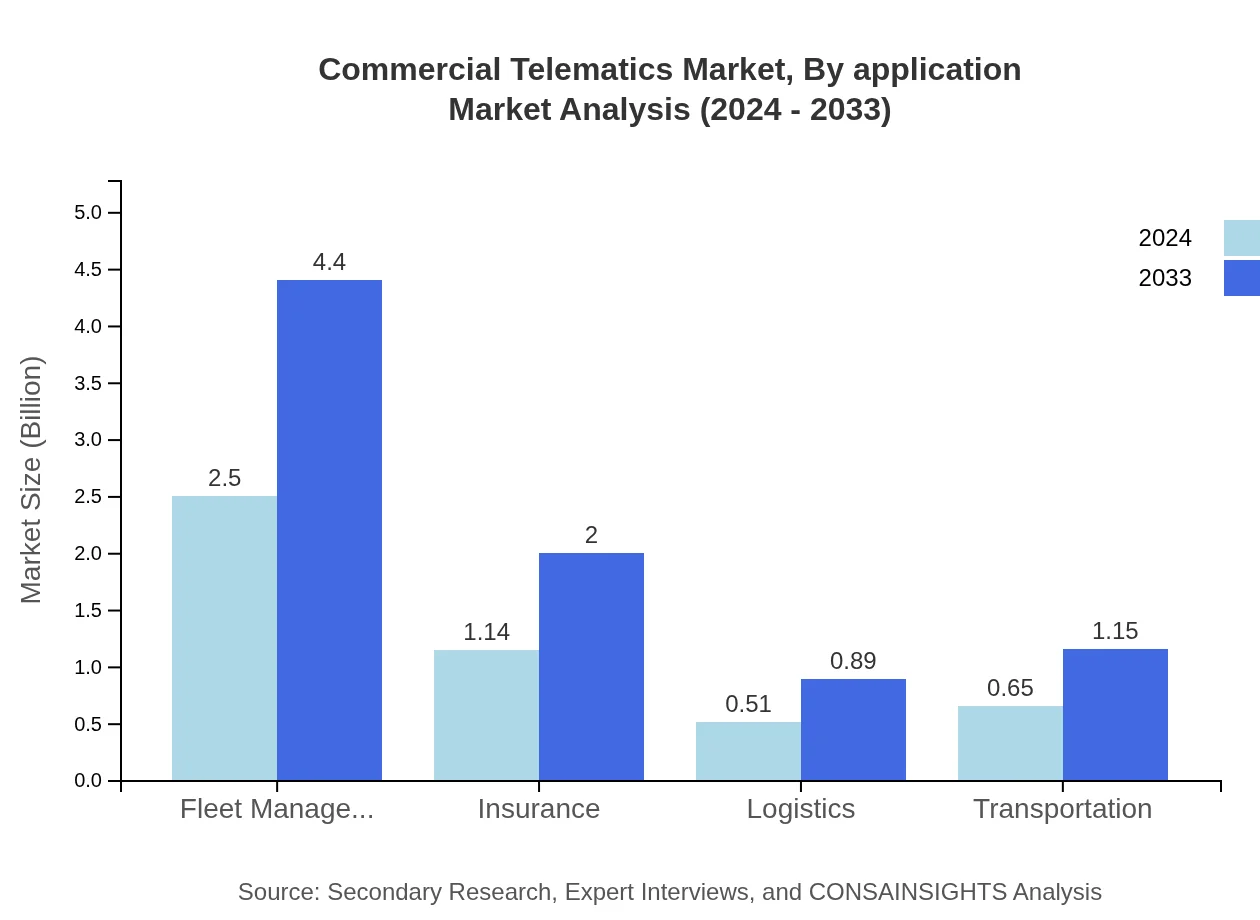

Commercial Telematics Market Analysis By Application

Within the by-application segment, Commercial Telematics is tailored to address industry-specific challenges. This includes applications in transport and logistics, construction, retail operations, oil and gas sectors, and government operations. Each application leverages telematics for improved asset management, enhanced safety measures, and optimized operational efficiencies. The ability to customize solutions for individual industry needs is driving broader market acceptance, ensuring sustained demand across varied sectors.

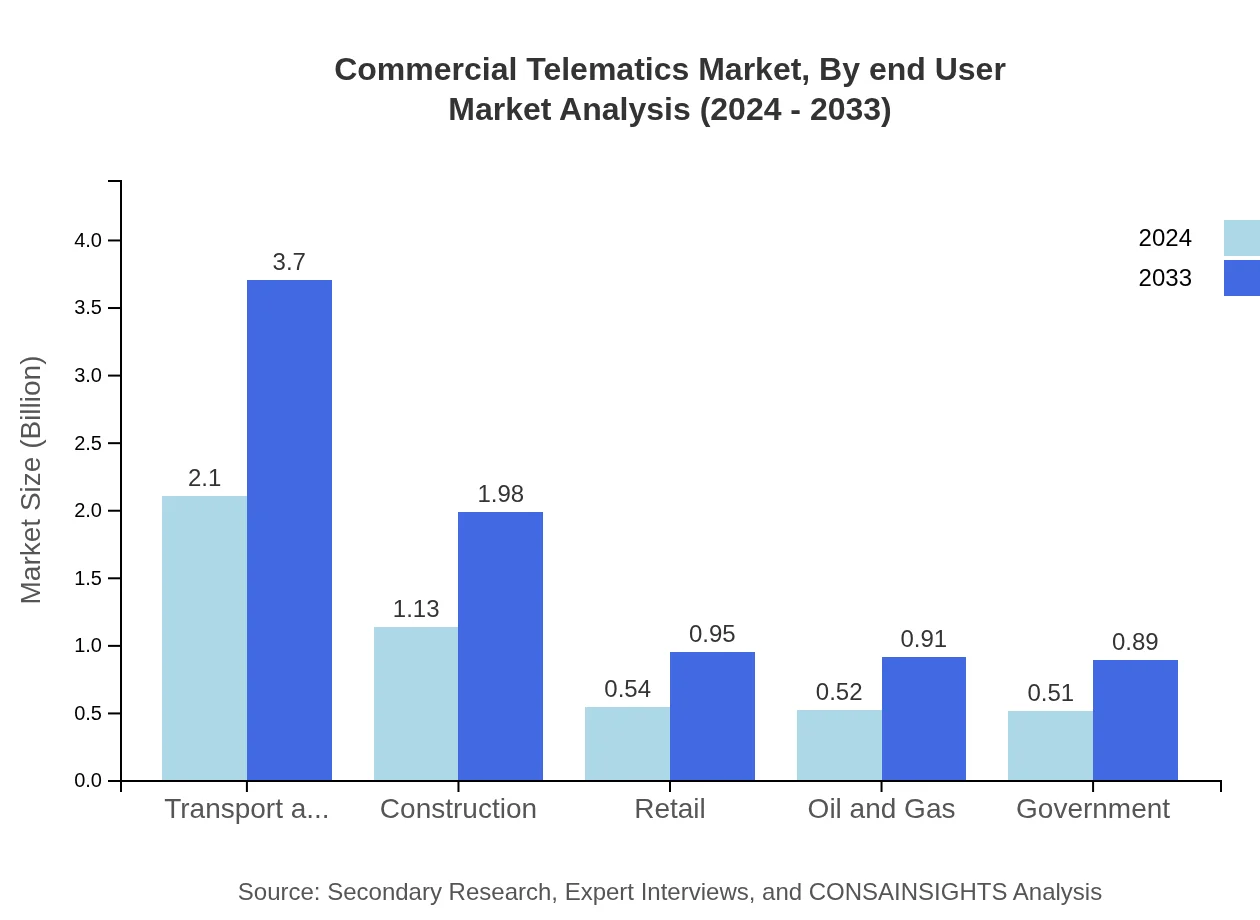

Commercial Telematics Market Analysis By End User

The by-end-user segment examines how diverse industries implement telematics solutions. End users range from large commercial fleets to small businesses, including transport companies, logistics firms, construction companies, and public sector organizations. This sector-specific analysis highlights how user-specific requirements such as real-time tracking, predictive maintenance, and data analytics integration enhance operational efficiency. The growth in this segment is fueled by the need for resource optimization and improved compliance with regulatory mandates.

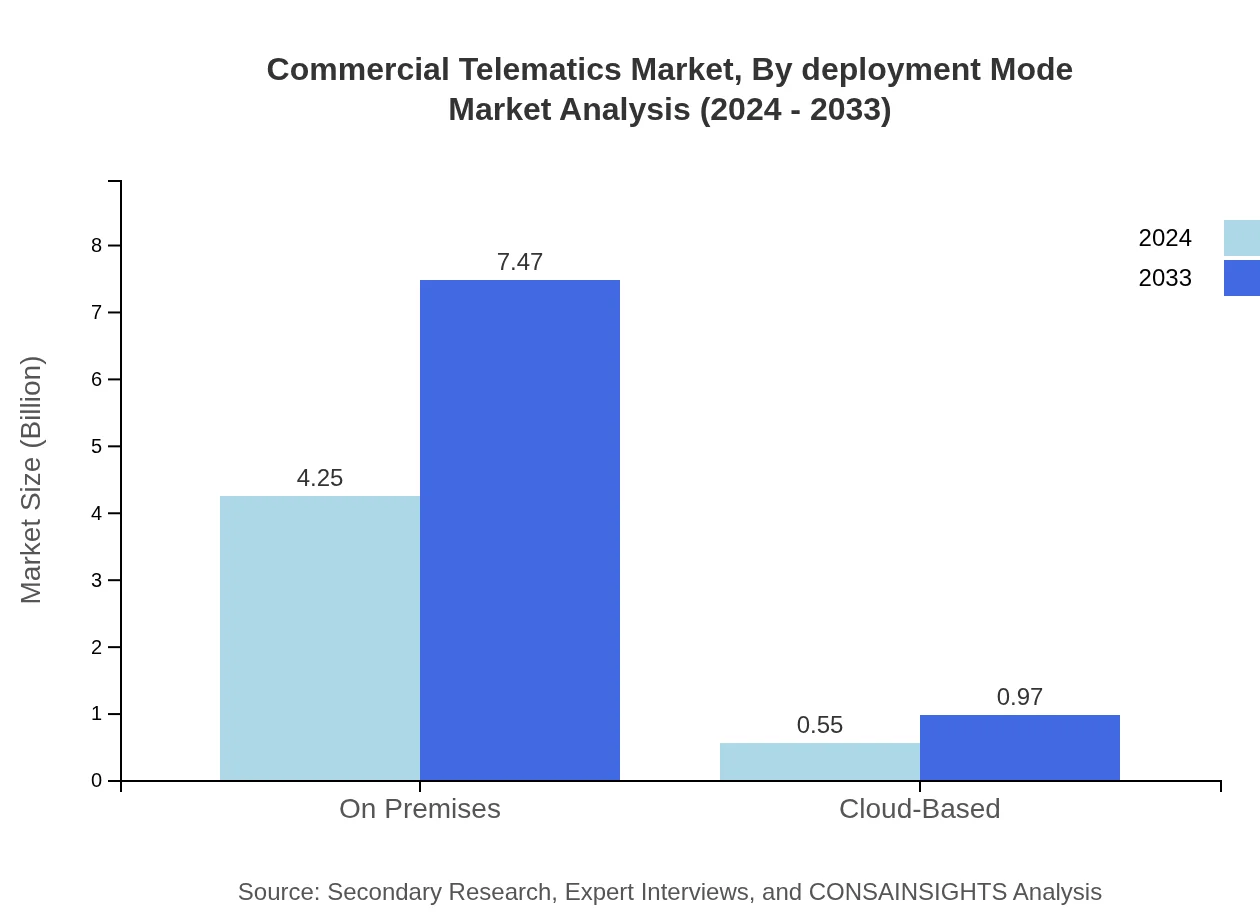

Commercial Telematics Market Analysis By Deployment Mode

In the by-deployment-mode segment, the market is commonly divided between On-Premises and Cloud-Based deployment options. On-Premises solutions are favored by enterprises with rigorous data security protocols and substantial IT infrastructures, commanding a significant share. Conversely, Cloud-Based deployments offer scalability and cost efficiency, making them attractive to small and medium-sized enterprises. The dual structure of deployment modes is enabling businesses of all sizes to leverage telematics technologies effectively.

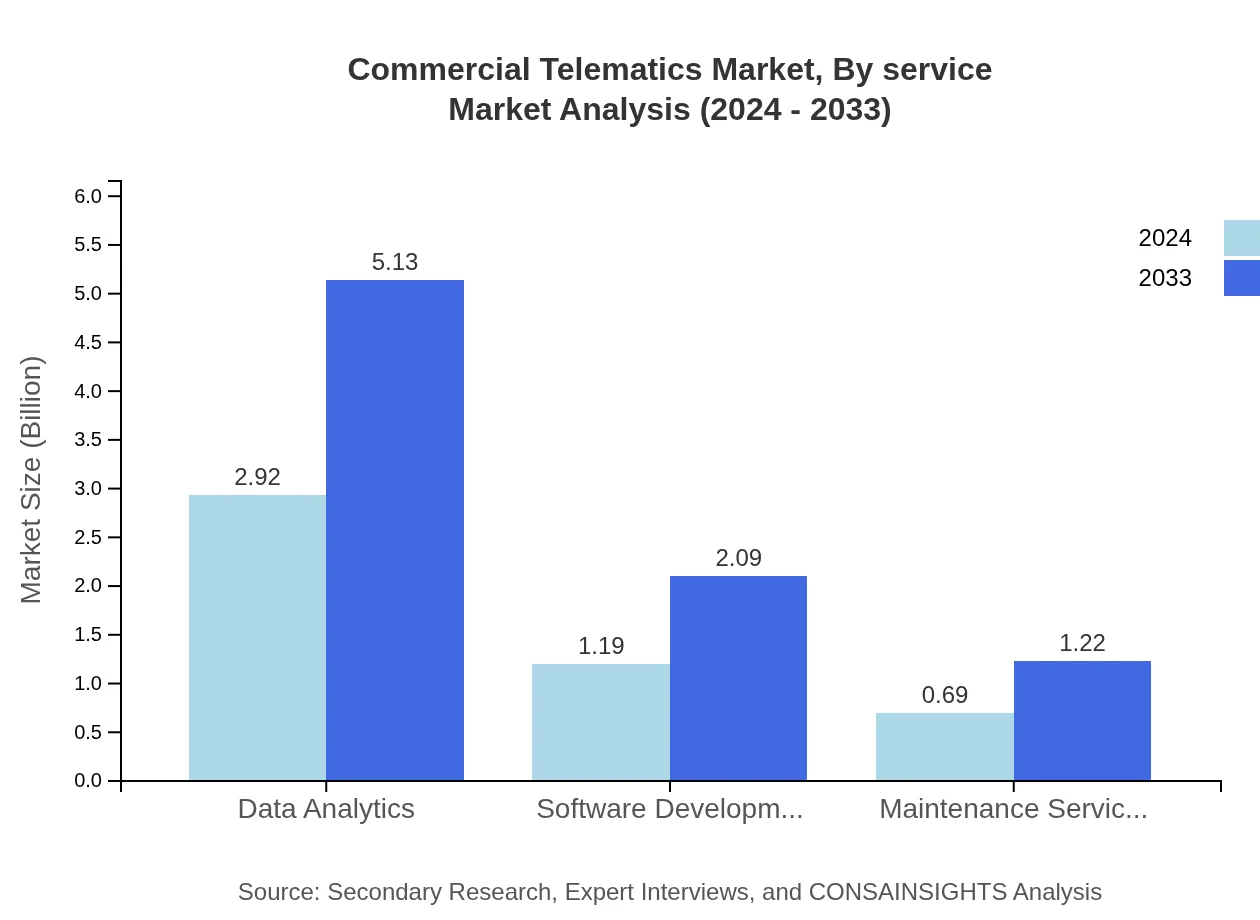

Commercial Telematics Market Analysis By Service

The by-service segment focuses on the support and maintenance services that complement technological offerings in the telematics space. Services such as software updates, system integration, real-time monitoring, and analytical reporting are crucial in ensuring seamless operations. The emphasis on high-quality service delivery—including maintenance and troubleshooting—is critical for maximizing the uptime and reliability of telematics systems, thereby driving sustained customer engagement and recurring revenue models.

Commercial Telematics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Commercial Telematics Industry

Telematics Innovators Inc.:

Telematics Innovators Inc. is a pioneer in advanced tracking, data analytics, and integrated fleet management solutions. Their innovative technologies and strategic partnerships have enabled them to set industry benchmarks in enhancing operational efficiency and safety.FleetTrack Systems:

FleetTrack Systems specializes in cloud-based telematics services and end-to-end fleet management systems. With a strong focus on real-time data monitoring and predictive maintenance, the company consistently delivers robust and scalable telematics solutions to a global clientele.We're grateful to work with incredible clients.

FAQs

What is the market size of commercial telematics?

The global commercial telematics market is valued at $4.8 billion in 2024 and is projected to grow at a CAGR of 6.3% from 2024 to 2033, reaching significant market heights.

What are the key market players or companies in this commercial telematics industry?

Key players in the commercial telematics industry include advanced tech companies and logistics specialists, focusing on software, data analytics, and fleet management solutions that cater to various market segments.

What are the primary factors driving the growth in the commercial telematics industry?

Growth in the commercial telematics industry is driven by technological advancements in GPS and GNSS technology, increasing demand for fleet management, and the ever-growing need for efficient logistics and transportation solutions.

Which region is the fastest Growing in the commercial telematics?

North America is the fastest-growing region in the commercial telematics market, projected to grow from $1.78 billion in 2024 to $3.12 billion in 2033, reflecting strong demand for telematics solutions.

Does ConsaInsights provide customized market report data for the commercial telematics industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs in the commercial telematics industry, helping clients gain insights into market trends and opportunities.

What deliverables can I expect from this commercial telematics market research project?

Deliverables from this market research project include comprehensive reports, data analytics, and detailed market segmentation insights across various verticals including transportation, logistics, and fleet management.

What are the market trends of commercial telematics?

Current trends in commercial telematics include increased integration of IoT solutions, a shift towards cloud-based systems, and a growing emphasis on data analytics and fleet optimization strategies.