Composite Resin Market Report

Published Date: 02 February 2026 | Report Code: composite-resin

Composite Resin Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Composite Resin market, offering insights into market size, trends, growth forecasts, and industry dynamics from 2023 to 2033.

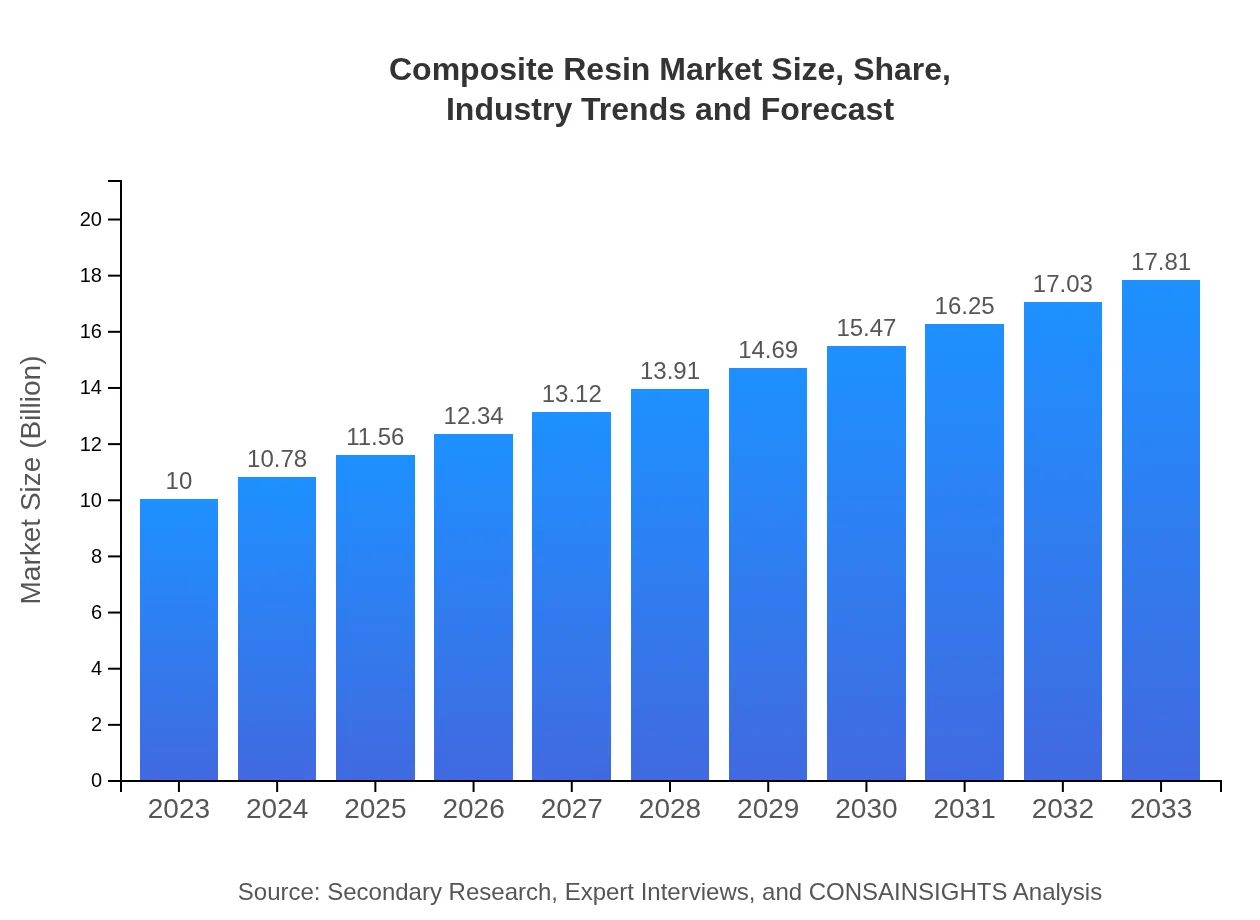

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $17.81 Billion |

| Top Companies | BASF SE, Mitsubishi Chemical Corporation, Hexion Inc., Sika AG |

| Last Modified Date | 02 February 2026 |

Composite Resin Market Overview

Customize Composite Resin Market Report market research report

- ✔ Get in-depth analysis of Composite Resin market size, growth, and forecasts.

- ✔ Understand Composite Resin's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Composite Resin

What is the Market Size & CAGR of Composite Resin market in 2023 and 2033?

Composite Resin Industry Analysis

Composite Resin Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Composite Resin Market Analysis Report by Region

Europe Composite Resin Market Report:

Europe is expected to see growth from $3.22 billion in 2023 to $5.73 billion by 2033, with emphasis on developing sustainable composite materials. Regulations promoting eco-friendly solutions are expected to boost demand.Asia Pacific Composite Resin Market Report:

In the Asia-Pacific region, the Composite Resin market is expected to grow from $1.67 billion in 2023 to $2.97 billion by 2033, driven by increasing investments in construction and aerospace sectors. Countries like China and India are focusing on infrastructure development, which propels demand for composite materials.North America Composite Resin Market Report:

North America holds a significant share of the Composite Resin market, with revenues projected to increase from $3.72 billion in 2023 to $6.62 billion by 2033. Key drivers include technological advancements in manufacturing processes and the presence of leading aerospace and automotive industries.South America Composite Resin Market Report:

The South American market for Composite Resins is projected to expand from $0.10 billion in 2023 to $0.18 billion by 2033, albeit at a slower rate. Growth is supported by emerging applications in construction, though economic fluctuations in the region pose risks.Middle East & Africa Composite Resin Market Report:

In the Middle East and Africa, the market is anticipated to grow from $1.30 billion in 2023 to $2.31 billion by 2033, supported by infrastructural development and a rising trend towards durable construction materials.Tell us your focus area and get a customized research report.

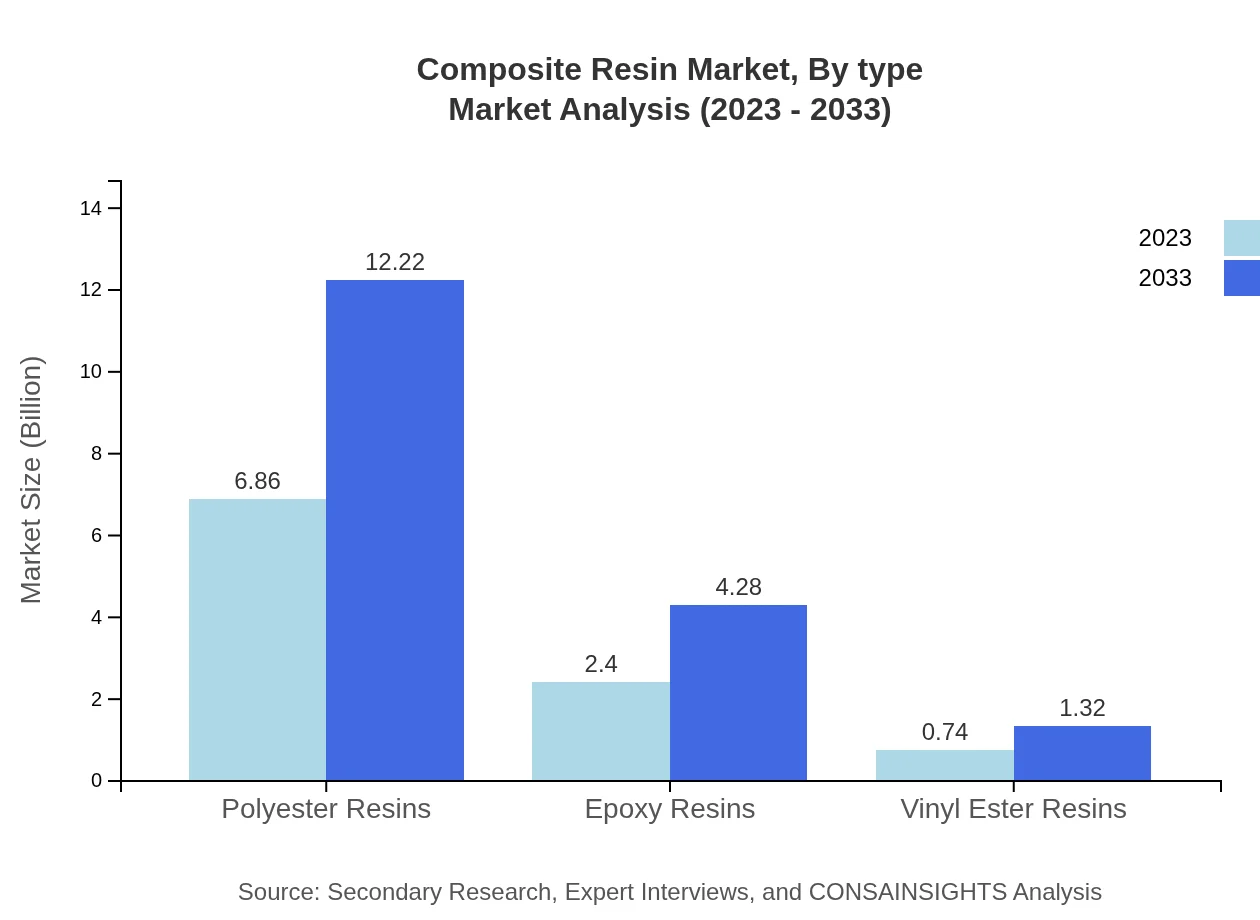

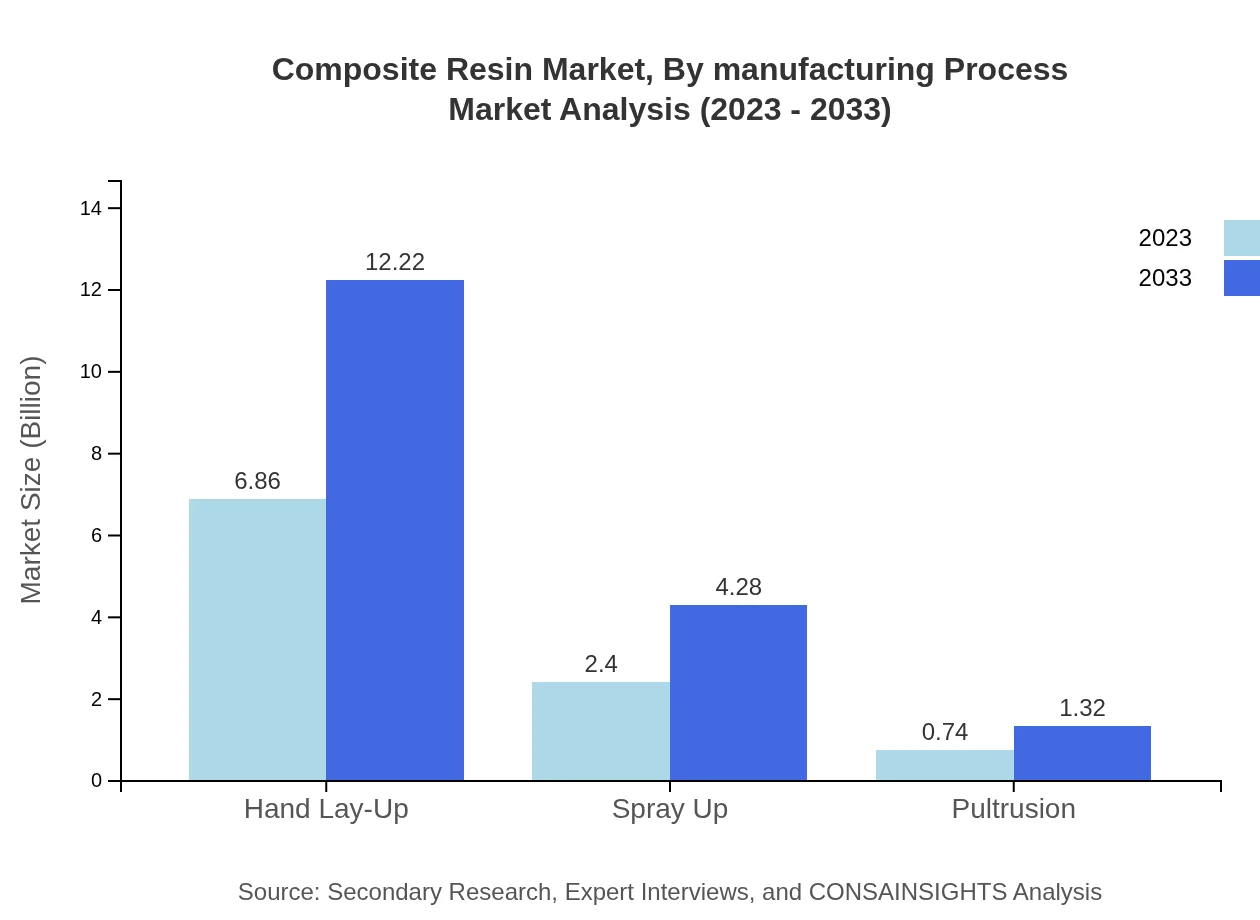

Composite Resin Market Analysis By Type

The Composite Resin market, by type, significantly includes Polyester Resins, Epoxy Resins, and Vinyl Ester Resins. Polyester Resins dominate the market with a size of $6.86 billion in 2023, projected to grow to $12.22 billion by 2033. Epoxy Resins follow with $2.40 billion and forecasted growth to $4.28 billion, while Vinyl Ester Resins account for $0.74 billion, expected to rise to $1.32 billion by 2033.

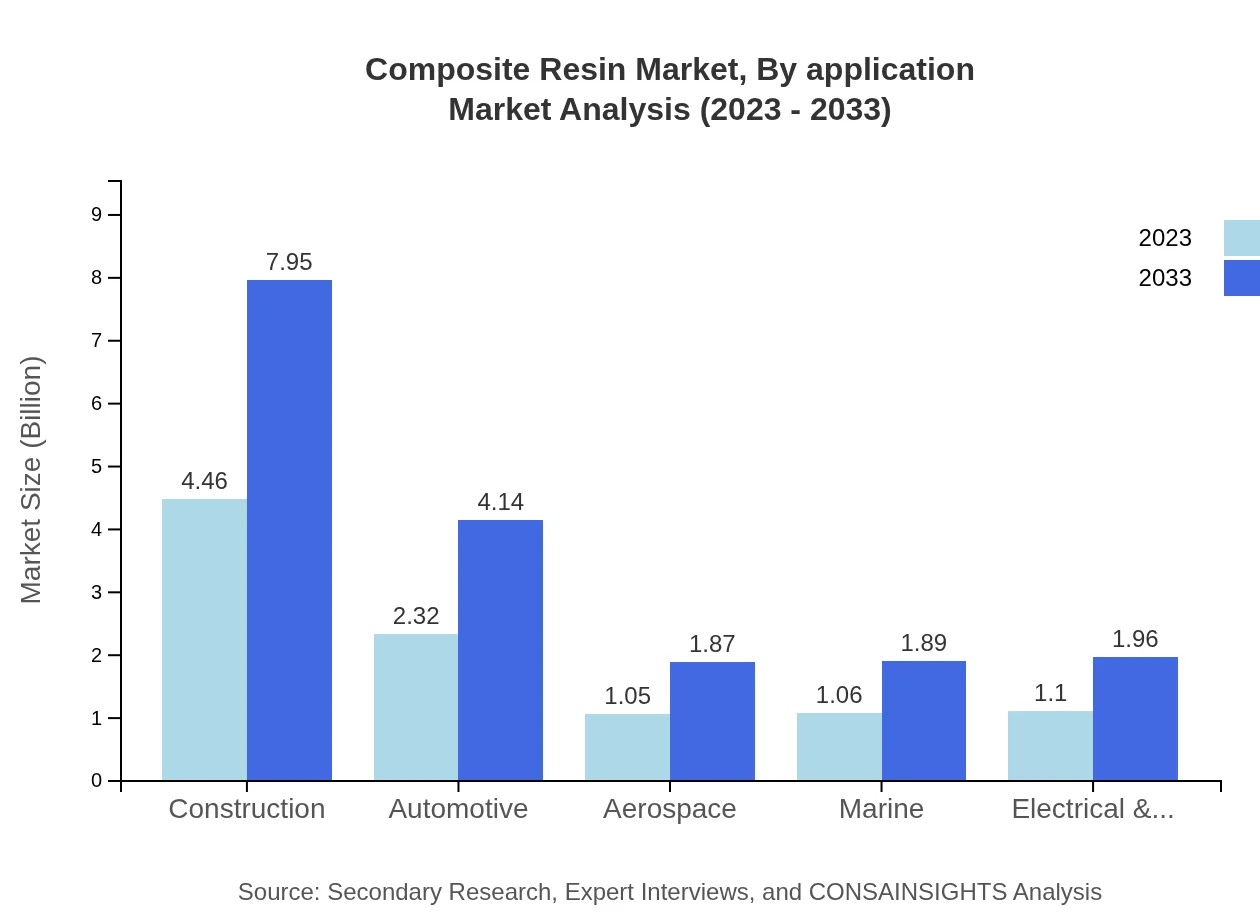

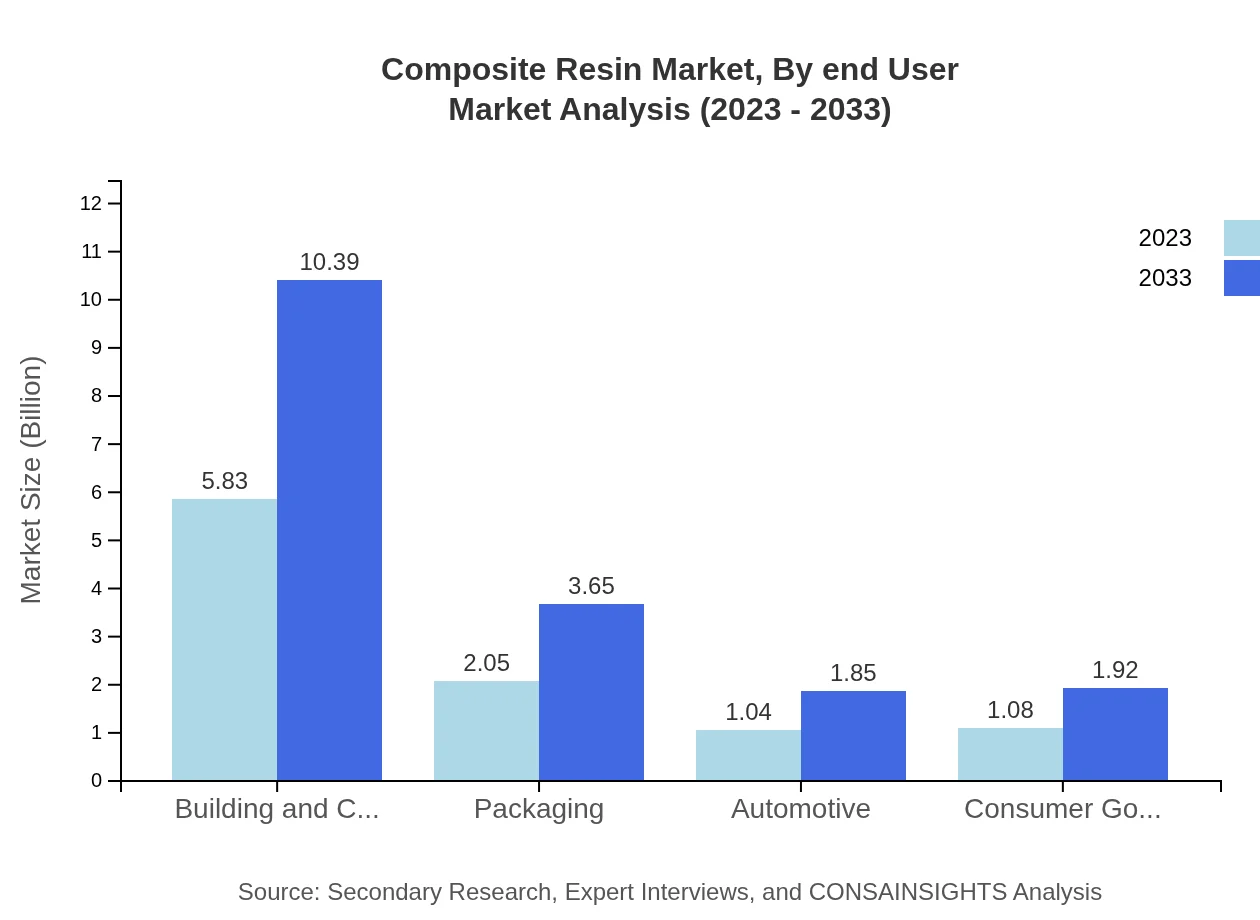

Composite Resin Market Analysis By Application

Applications of Composite Resins include Building and Construction, Packaging, Automotive, and Aerospace among others. Building and Construction is the largest application segment, valued at $5.83 billion in 2023 and anticipated to reach $10.39 billion. Packaging and Automotive applications also signify considerable markets, reflecting trends in durable and lightweight materials.

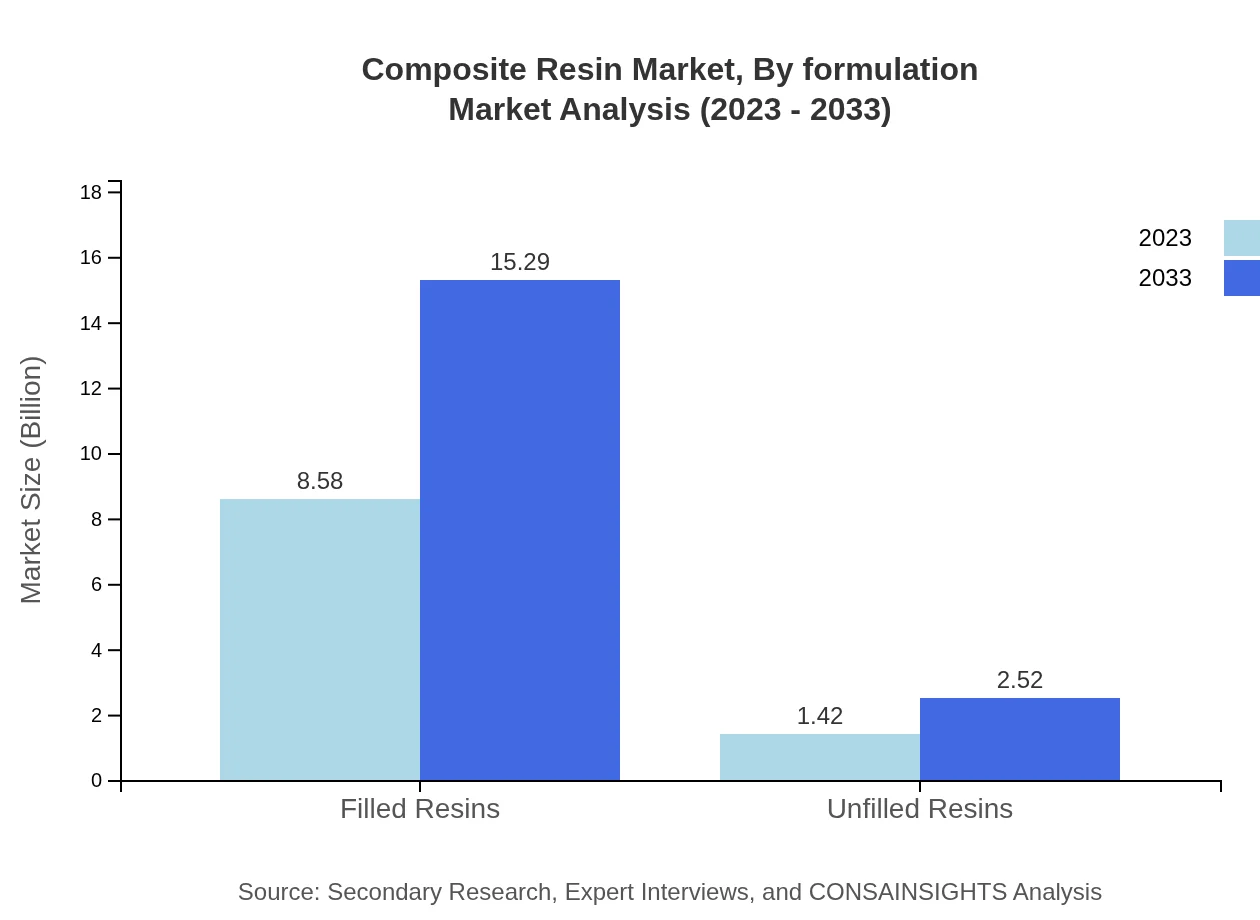

Composite Resin Market Analysis By Formulation

The formulation segment includes Filled Resins and Unfilled Resins, with Filled Resins holding a substantial share of 85.85%, valued at $8.58 billion in 2023 and expected to grow to $15.29 billion by 2033. Unfilled Resins constitute a smaller share of 14.15%, starting at $1.42 billion with a future growth to $2.52 billion.

Composite Resin Market Analysis By End User

End-user industries of Composite Resins include Automotive, Aerospace, Marine, and Electrical & Electronics. The automotive industry is particularly noteworthy, growing from $2.32 billion to $4.14 billion, revealing opportunities driven by innovations in vehicle design.

Composite Resin Market Analysis By Manufacturing Process

The manufacturing processes impacting the Composite Resins market include Hand Lay-Up, Spray Up, and Pultrusion. Hand Lay-Up remains the preferred method, noted for its scalability and cost-effectiveness, while Pultrusion shows potential due to automation trends.

Composite Resin Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Composite Resin Industry

BASF SE:

A leading chemical company, BASF offers a wide range of composite materials, focusing on innovation and sustainability in its products.Mitsubishi Chemical Corporation:

This company specializes in composite resins for diverse applications, particularly emphasizing automotive and aerospace solutions.Hexion Inc.:

Hexion is known for developing epoxy resins with high-performance characteristics, catering to the industrial and consumer markets.Sika AG:

A global leader in construction chemicals, Sika provides advanced composite resin solutions that enhance structural integrity in building applications.We're grateful to work with incredible clients.

FAQs

What is the market size of composite Resin?

The global composite resin market size is approximately $10 billion in 2023 and is projected to achieve a CAGR of 5.8%, reaching around $17.54 billion by 2033. This growth reflects increased demand across various applications, particularly in construction and automotive industries.

What are the key market players or companies in this composite Resin industry?

Leading companies in the composite resin industry include BASF SE, Dow Chemical Company, DuPont, 3M, and Huntsman Corporation. These firms are known for their innovative products and technology advancements, contributing to the overall market expansion.

What are the primary factors driving the growth in the composite Resin industry?

Key drivers include the rising demand for lightweight materials in automotive and aerospace sectors, increased infrastructural spending, and technological advancements in resin formulations. Additionally, growing environmental concerns boost the shift towards sustainable and recyclable composite materials.

Which region is the fastest Growing in the composite Resin?

The fastest-growing region for composite resins is North America, with a market size of $3.72 billion in 2023, projected to reach $6.62 billion by 2033. Europe also shows significant growth from $3.22 billion to $5.73 billion in the same timeframe.

Does CosaInsights provide customized market report data for the composite Resin industry?

Yes, CosaInsights offers customized market report data tailored to specific needs, including detailed insights on market segments, regional analyses, and competitive landscape. This flexibility ensures clients receive relevant information for their strategic decisions.

What deliverables can I expect from this composite Resin market research project?

Expect comprehensive deliverables such as market size data, growth forecasts, segment analysis, competitive profiling, and regional trend assessments. Reports will be formatted for easy interpretation, aiding in strategic planning and decision-making.

What are the market trends of composite Resin?

Current trends in the composite resin market include increased adoption of bio-based resins, growth in the electric vehicle sector, and rising use of composites in various industries such as aerospace, automotive, and construction. Demand for customized solutions is also on the rise.