Cybersecurity Certification

Published Date: 31 January 2026 | Report Code: cybersecurity-certification

Cybersecurity Certification Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report thoroughly examines the current state and promising future potential of the global Cybersecurity Certification market. It offers detailed insights into market size, growth trends, extensive segmentation, regional dynamics, and breakthrough technological innovations forecasted between 2024 and 2033. The expert analysis is supported by robust qualitative and quantitative data, thereby providing a comprehensive framework for industry stakeholders worldwide.

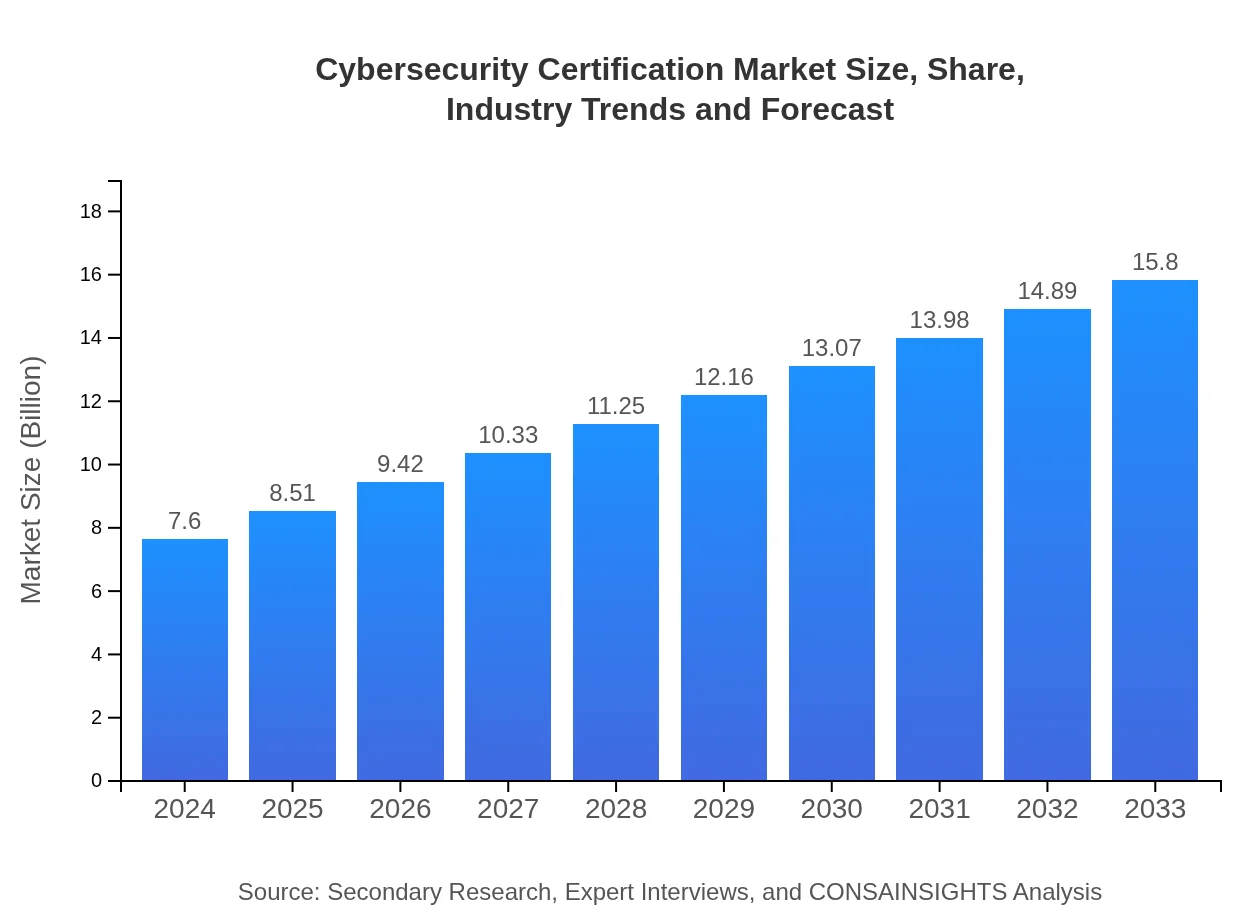

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

| 2024 Market Size | $7.60 Billion |

| CAGR (2024-2033) | 8.2% |

| 2033 Market Size | $15.80 Billion |

| Top Companies | CyberSecure Inc., ShieldTech Solutions |

| Last Modified Date | 31 January 2026 |

Cybersecurity Certification Market Overview

Customize Cybersecurity Certification market research report

- ✔ Get in-depth analysis of Cybersecurity Certification market size, growth, and forecasts.

- ✔ Understand Cybersecurity Certification's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Cybersecurity Certification

What is the Market Size & CAGR of Cybersecurity Certification market in 2024?

Cybersecurity Certification Industry Analysis

Cybersecurity Certification Market Segmentation and Scope

Tell us your focus area and get a customized research report.

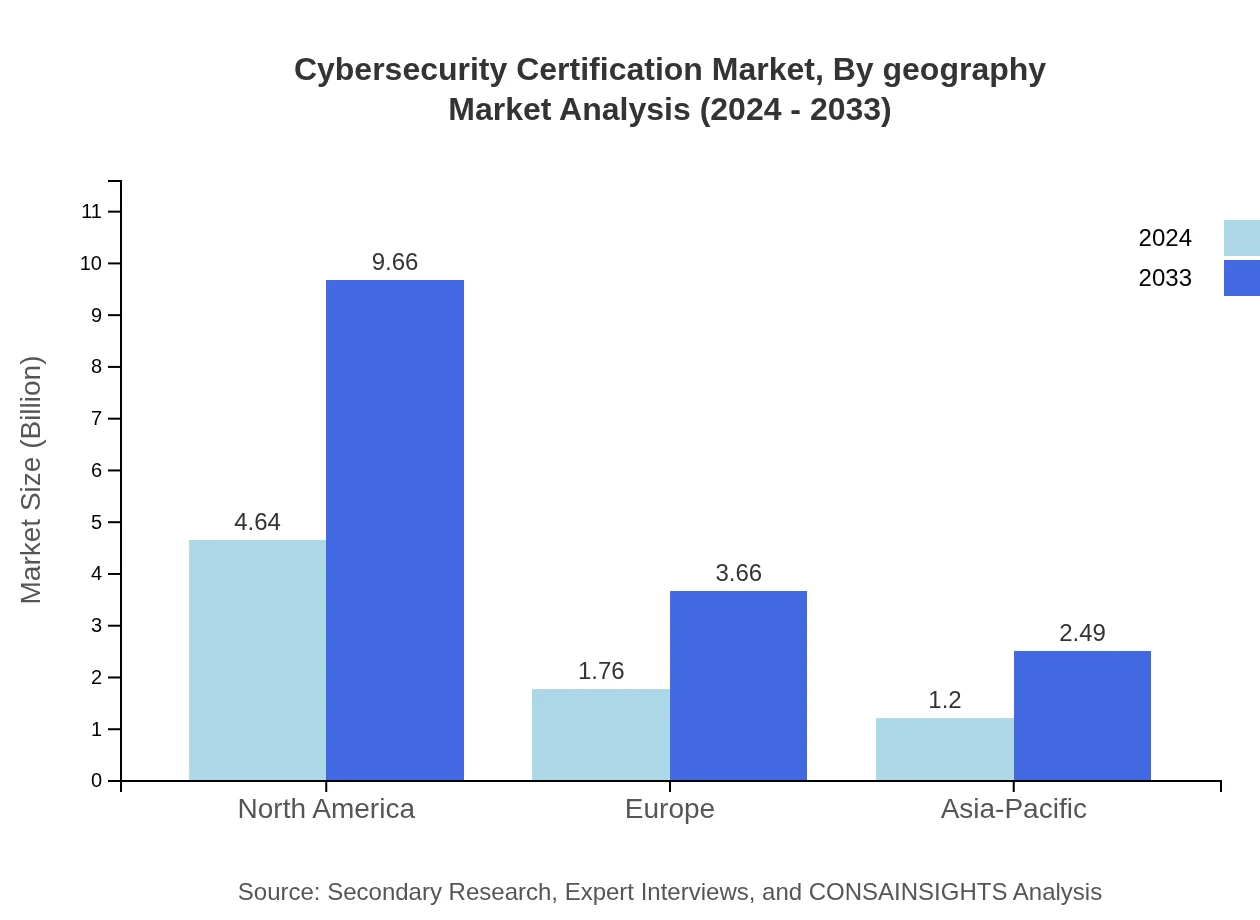

Cybersecurity Certification Market Analysis Report by Region

Europe Cybersecurity Certification:

Europe presents significant growth potential, with a market size estimated at $2.71 billion in 2024 and forecasted to reach $5.64 billion by 2033. Stringent data protection laws and proactive cybersecurity policies are key drivers behind the region's expanding certification initiatives.Asia Pacific Cybersecurity Certification:

In Asia Pacific, the market is experiencing steady growth fueled by rapid digital transformation, increasing internet penetration, and focused government initiatives on cybersecurity. With a market size of $1.33 billion in 2024 expected to reach $2.77 billion by 2033, the region is rapidly adopting advanced certification programs to support its expanding digital ecosystem.North America Cybersecurity Certification:

North America remains a mature and dominant market, with a 2024 market size of $2.49 billion anticipated to grow to $5.17 billion by 2033. This robust performance is underpinned by advanced technology infrastructures, well-established certification providers, and continual innovation in training methods.South America Cybersecurity Certification:

South America, particularly within Latin America, shows emerging growth with market values starting at $0.12 billion in 2024 and projected to rise to $0.25 billion by 2033. Despite its modest beginnings, rising cybersecurity awareness and supportive regulatory moves are gradually expanding market opportunities.Middle East & Africa Cybersecurity Certification:

In the Middle East and Africa, the market is developing at a steady pace, growing from $0.95 billion in 2024 to an expected $1.97 billion by 2033. Enhanced digital infrastructure investments and increasing public-private collaborations are fueling this gradual market maturation.Tell us your focus area and get a customized research report.

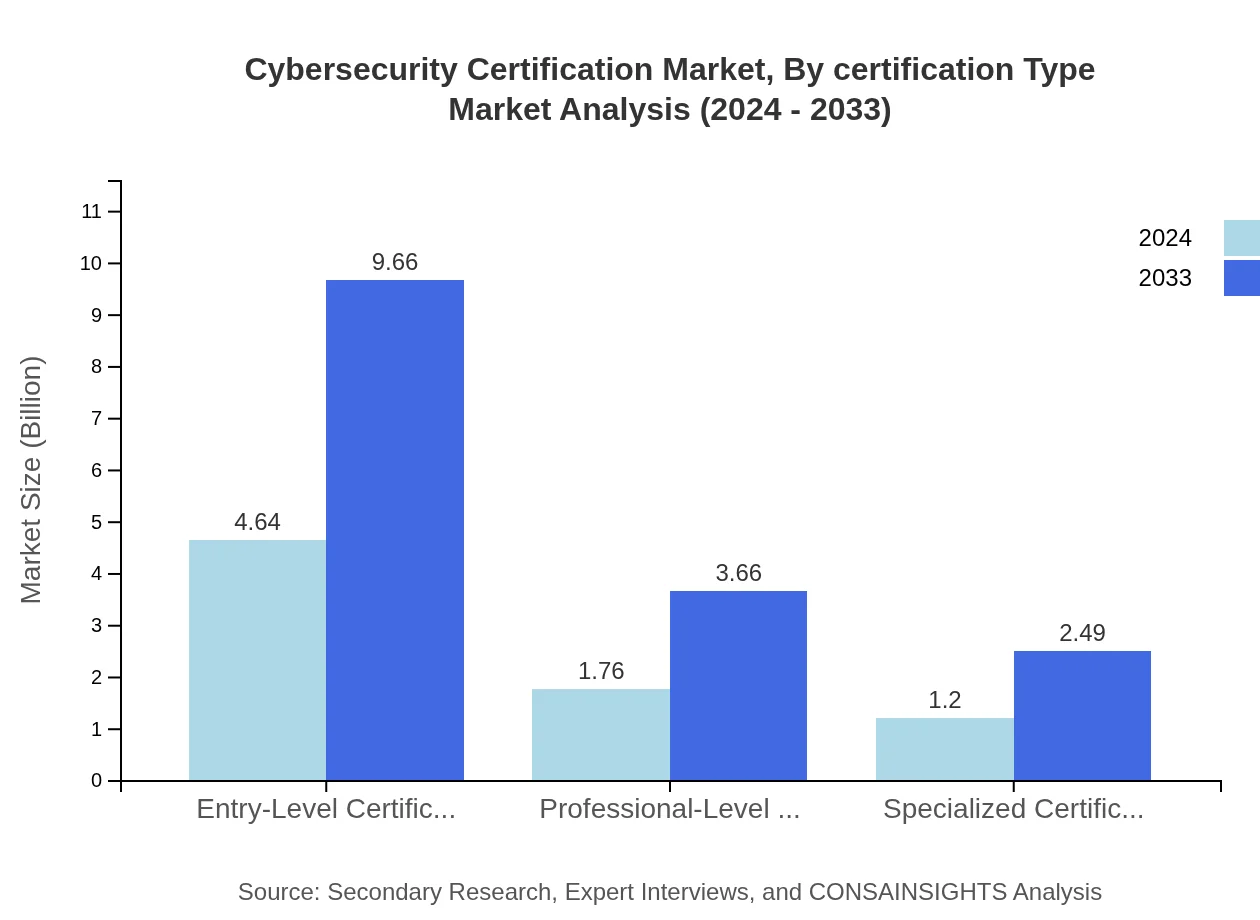

Cybersecurity Certification Market Analysis By Certification Type

The 'by-certification-type' segment dissects the market into entry-level, professional-level, and specialized certifications. Entry-level certifications command a dominant share of 61.11%, serving as the foundational credentials for aspiring professionals. In contrast, professional and specialized tracks cater to experts seeking advanced and niche expertise, ensuring that certification offerings meet the complexities of evolving cybersecurity challenges.

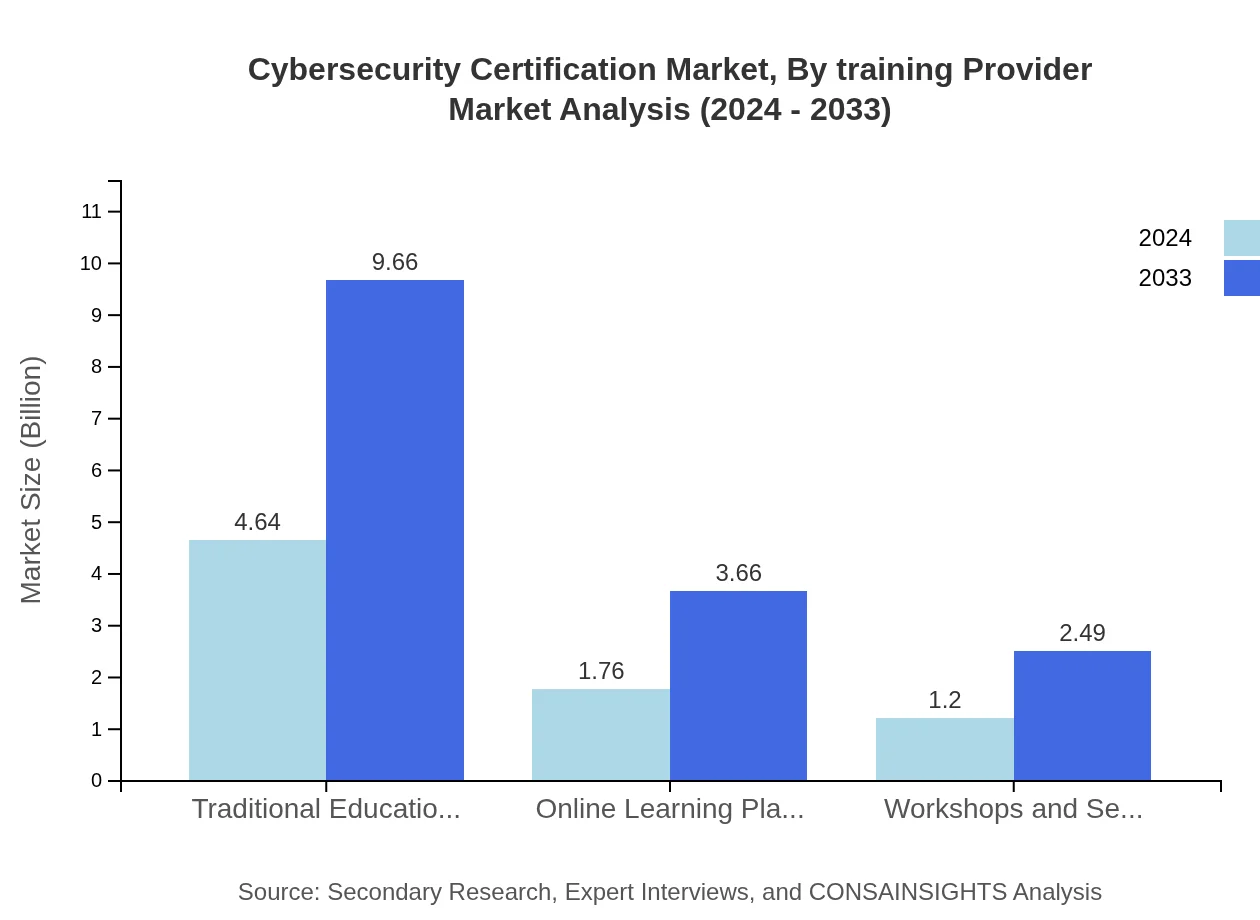

Cybersecurity Certification Market Analysis By Training Provider

The 'by-training-provider' segment categorizes offerings from traditional educational institutions, online learning platforms, and intensive workshops. Traditional institutions offer structured educational environments, while digital platforms provide flexible, accessible learning options. Workshops and seminars deliver focused, intensive training sessions, allowing participants to quickly gain targeted cybersecurity skills and address diverse professional requirements.

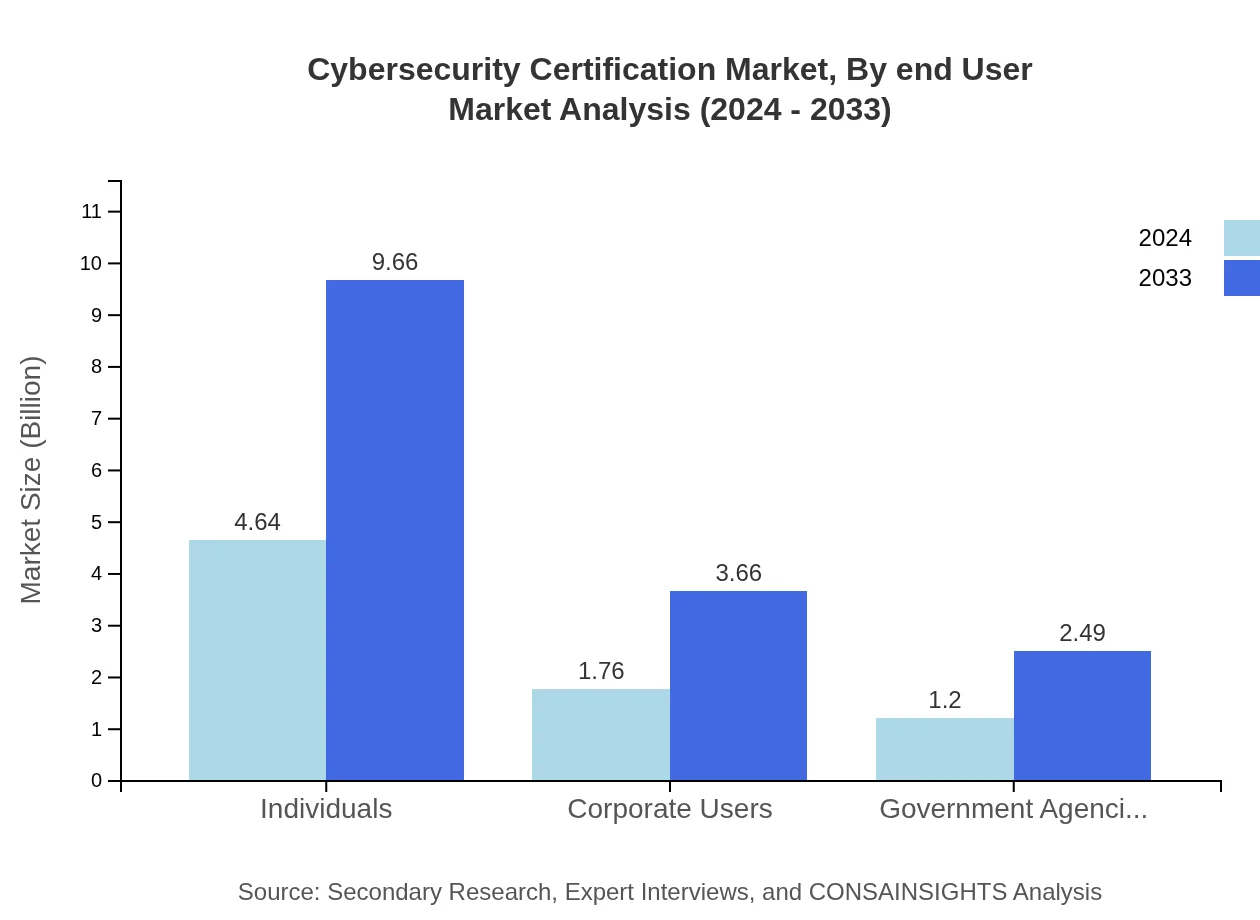

Cybersecurity Certification Market Analysis By End User

The 'by-end-user' segment distinguishes between individual learners, corporate users, and government agencies. Individuals utilize certifications for career progression and skill validation, while corporations invest in training programs to reduce risk and enhance employee competence. Government agencies adopt certification standards to enforce consistent cybersecurity protocols, ensuring both national and organizational resilience.

Cybersecurity Certification Market Analysis By Geography

The 'by-geography' segment examines regional disparities, highlighting differences in market dynamics across North America, Europe, and Asia-Pacific. North America leads in market share due to established infrastructure and mature ecosystems, while Europe and Asia-Pacific offer robust growth prospects driven by evolving regulatory frameworks and technological innovation. This segmentation guides stakeholders in forming effective, localized market strategies.

Cybersecurity Certification Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Cybersecurity Certification Industry

CyberSecure Inc.:

CyberSecure Inc. is a pioneer in the cybersecurity training domain, renowned for its innovative certification programs and strategic industry collaborations. The company's commitment to continuous curriculum improvement and adherence to high standards has made its credentials highly sought-after globally.ShieldTech Solutions:

ShieldTech Solutions specializes in developing tailored training modules that bridge the gap between traditional education and cutting-edge technology trends. By integrating advanced tools like AI and cloud security into their certification frameworks, ShieldTech Solutions has established itself as a trusted leader in the evolving cybersecurity landscape.We're grateful to work with incredible clients.

FAQs

How can the cybersecurity certification report help align our marketing strategy with customer adoption trends?

By analyzing market trends, the cybersecurity certification report provides insights into customer needs and preferences. This information enables marketers to identify what customers are seeking, thus tailoring their offerings to meet market demands effectively.

What product features are in highest demand according to the cybersecurity certification trends?

Key features in demand include online accessibility, diverse certification levels (entry, professional, specialized), and integration with existing IT systems, reflecting a shift towards more comprehensive and flexible learning solutions in the cybersecurity certification market.

Which regions offer the best market entry and expansion opportunities in the cybersecurity certification industry?

North America, with a market size of $2.49 billion in 2024, and Europe, expected to grow from $2.71 billion in 2024 to $5.64 billion by 2033, present substantial growth opportunities in the cybersecurity certification space.

What emerging technologies and innovations are shaping the cybersecurity certification market?

Emerging technologies influencing the market include AI for adaptive learning, blockchain for credential verification, and cloud-based platforms for training delivery, all pivotal in enhancing user experience and certification reliability.

Does the cybersecurity certification report include competitive landscape and market share analysis?

Yes, the cybersecurity certification report includes a detailed competitive landscape analysis, highlighting major players, their market share, and strategic positioning, essential for understanding market dynamics and competitive strategies.

How can executives use the cybersecurity certification report to evaluate investment risks and ROI?

The report provides comprehensive market data, including size ($7.6 billion, CAGR: 8.2%) and regional insights, enabling executives to assess potential risks and forecast returns effectively before making investment decisions.

What is the current market size of the cybersecurity certification industry?

The global cybersecurity certification market is valued at approximately $7.6 billion in 2024, with an expected compound annual growth rate (CAGR) of 8.2%, underscoring robust growth driven by increasing cybersecurity threats.

What are the segment insights of the cybersecurity certification market?

In 2024, individuals are projected to dominate the market with $4.64 billion, while corporate users and government agencies follow at $1.76 billion and $1.20 billion respectively, highlighting the significance of personal certifications in the industry.