Corporate Lending Platform

Published Date: 31 January 2026 | Report Code: corporate-lending-platform

Corporate Lending Platform Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in‐depth analysis of the Corporate Lending Platform market covering forecast insights for 2024 through 2033. It examines market size, growth trends, segmentation, regional performance, and emerging technology and product innovations that are shaping the industry. The insights are supported by detailed data, key trends, and forward‐looking forecasts.

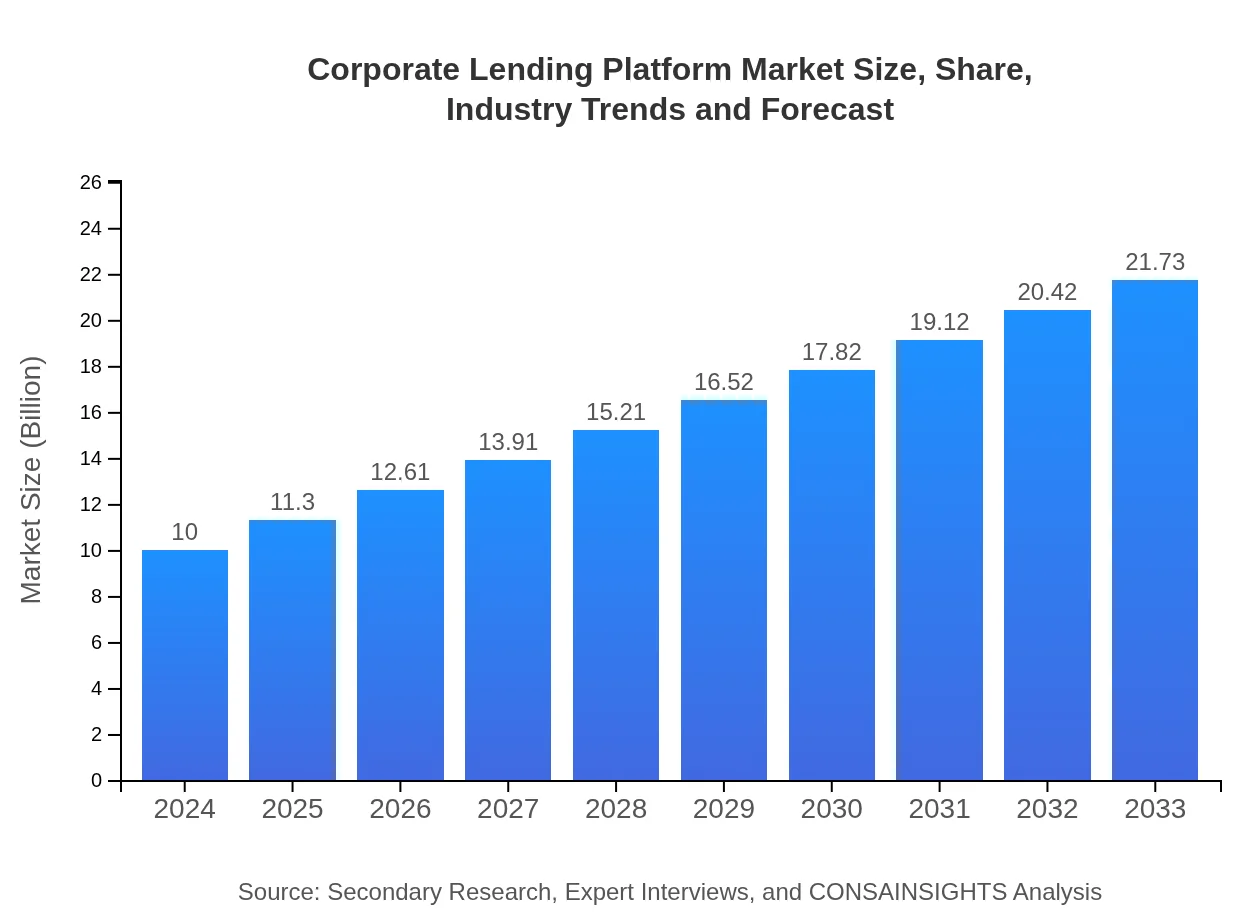

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

| 2024 Market Size | $10.00 Billion |

| CAGR (2024-2033) | 8.7% |

| 2033 Market Size | $21.73 Billion |

| Top Companies | ABC Financial Solutions, XYZ Capital Partners |

| Last Modified Date | 31 January 2026 |

Corporate Lending Platform Market Overview

Customize Corporate Lending Platform market research report

- ✔ Get in-depth analysis of Corporate Lending Platform market size, growth, and forecasts.

- ✔ Understand Corporate Lending Platform's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Corporate Lending Platform

What is the Market Size & CAGR of Corporate Lending Platform market in 2024?

Corporate Lending Platform Industry Analysis

Corporate Lending Platform Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Corporate Lending Platform Market Analysis Report by Region

Europe Corporate Lending Platform:

Europe stands as a key market, witnessing progressive growth from a market size of 2.97 in 2024 to an anticipated 6.45 by 2033. Regulatory harmonization across European nations coupled with advanced technological infrastructure has enhanced consumer trust and accelerated the adoption of digital lending solutions. Strategic investments in technology and cross-border collaborations are defining trends in this mature market.Asia Pacific Corporate Lending Platform:

In Asia Pacific, the market exhibits a promising growth path; starting with a market size of 1.90 in 2024 and projecting growth to 4.13 in 2033. Digital transformation and robust economic expansion in countries like China and India are fueling the adoption of advanced lending platforms. Increased smartphone penetration and internet accessibility have also helped streamline operations and facilitate better risk assessment modules.North America Corporate Lending Platform:

North America remains a mature market with significant penetration of digital technologies, where the market size is estimated at 3.64 in 2024 and projected to reach 7.90 by 2033. Innovation in fintech and an integrated financial ecosystem are driving efficiency in lending services. The convergence of traditional banking models with modern technology is further reinforcing market stability and growth.South America Corporate Lending Platform:

South America, though representing a smaller segment with a market size of 0.10 in 2024, is poised for gradual improvement, reaching an expected 0.22 by 2033. Factors such as political reforms, financial modernization initiatives, and improved digital infrastructure are anticipated to contribute to market expansion in this region.Middle East & Africa Corporate Lending Platform:

The Middle East and Africa are emerging regions where the corporate lending platform market is set to grow from a market size of 1.40 in 2024 to 3.04 in 2033. Rapid urbanization, increasing financial inclusion, and digital infrastructure development are key drivers for this segment. Although currently smaller in scale, these regions are witnessing increased participation from both established financial institutions and innovative fintech startups.Tell us your focus area and get a customized research report.

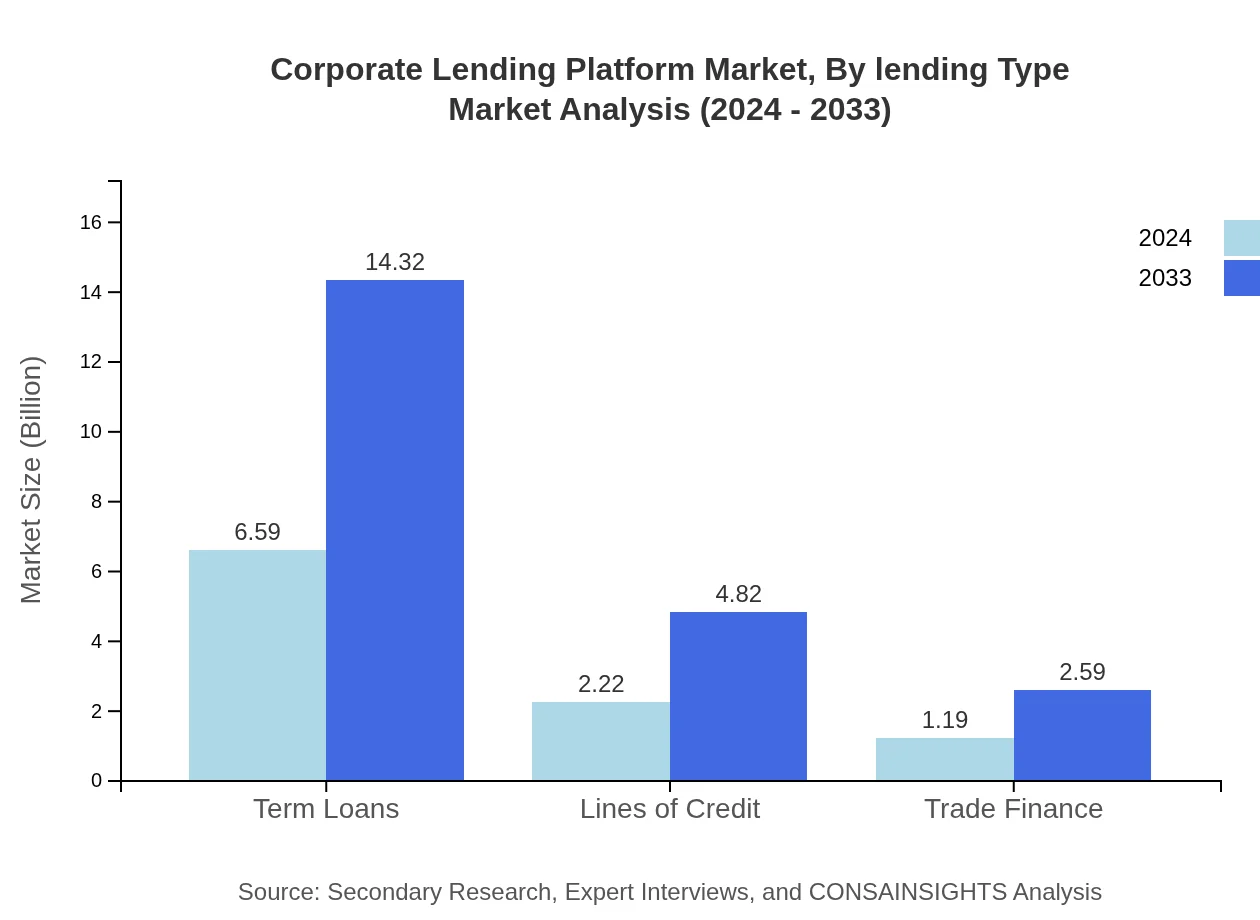

Corporate Lending Platform Market Analysis By Lending Type

The market segmentation by lending type incorporates key products such as Term Loans, Lines of Credit, and Trade Finance. In 2024, Term Loans held a significant market size of 6.59 and dominated with a share of 65.91%. Similarly, Lines of Credit represented a market size of 2.22 with a share of 22.19%, while Trade Finance recorded a market size of 1.19 with an 11.90% share. Forecasts indicate that by 2033, Term Loans are expected to grow to a market size of 14.32, Lines of Credit to 4.82, and Trade Finance to 2.59, maintaining their relative market shares. This segmentation not only underlines the present contribution of each product type but also highlights the scalability and future potential associated with innovative lending solutions that organizations are likely to adopt.

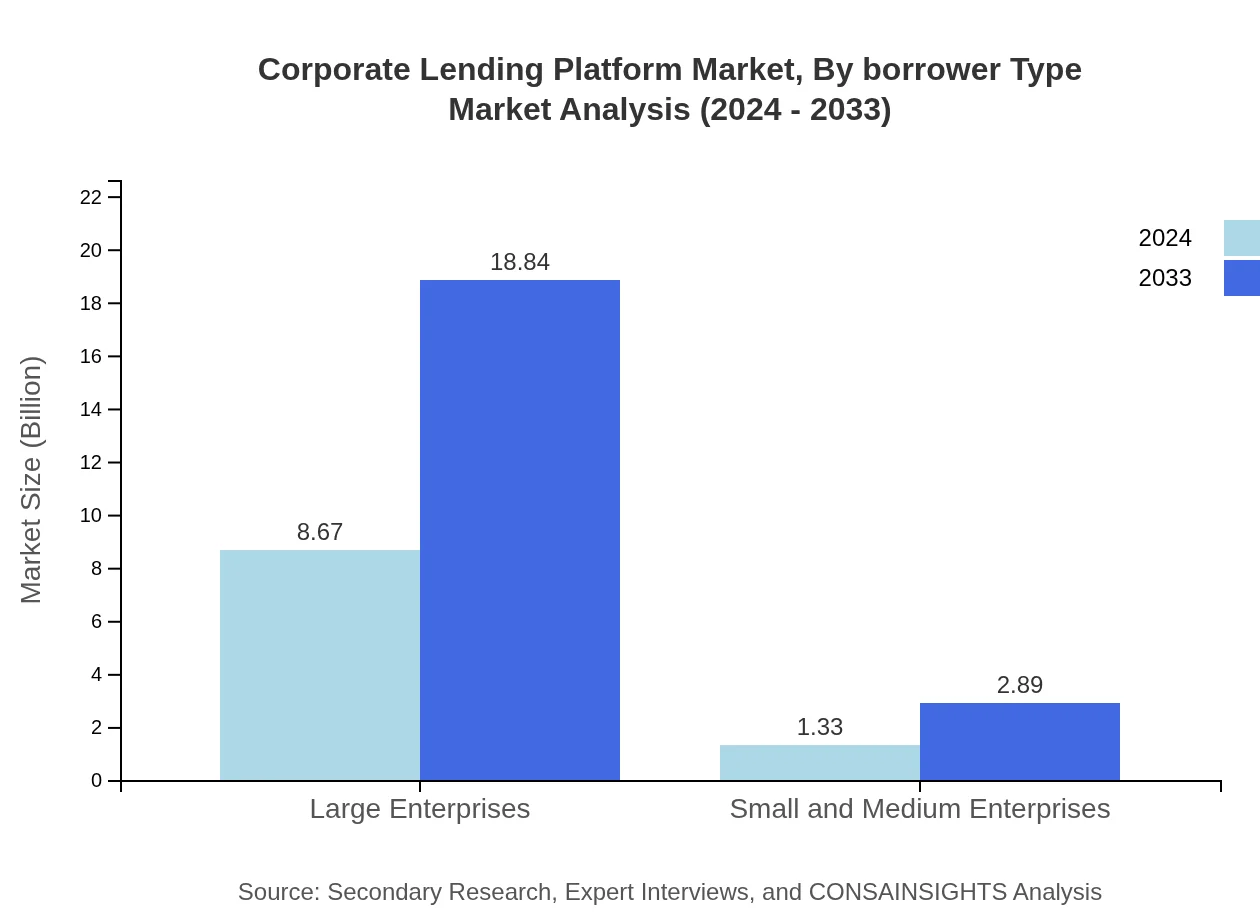

Corporate Lending Platform Market Analysis By Borrower Type

Segmenting the market by borrower type showcases the distinct needs of large enterprises versus small and medium enterprises (SMEs). Large Enterprises presently command a market size of 8.67 with a dominant share of 86.71%, indicating their robust engagement with corporate lending platforms due to higher credit requirements and established financial track records. Conversely, SMEs, although having a smaller market size of 1.33 and a 13.29% share, represent a segment with considerable growth potential as digital lending platforms simplify credit access. By 2033, the sizing for large enterprises is expected to increase to 18.84, while SMEs could potentially increase to 2.89, underscoring the evolving financial needs and opportunities in a diversified corporate lending environment.

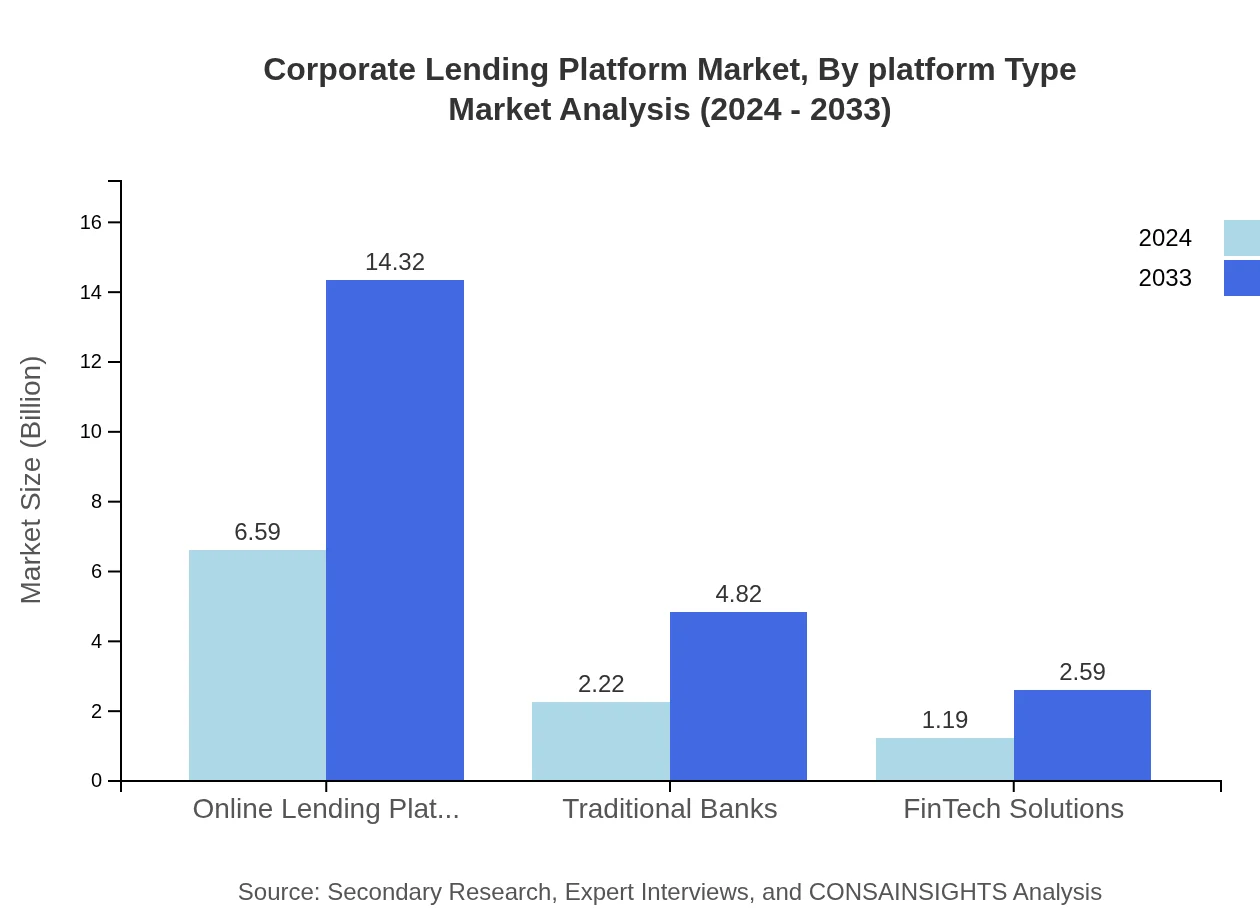

Corporate Lending Platform Market Analysis By Platform Type

The market analysis by platform type emphasizes the competition among online lending platforms, traditional banks, and fintech solutions. Online Lending Platforms continue to capture a significant portion of the market with a size of 6.59 and a share of 65.91% in 2024, thanks to their agile, customer-centric approaches. In contrast, Traditional Banks recorded a market size of 2.22 with a 22.19% share, while FinTech Solutions accounted for 1.19 in size and an 11.90% share. By 2033, these segments are forecasted to increase to 14.32, 4.82, and 2.59 respectively, demonstrating a persistent shift towards digital interfaces and technologically advanced finance solutions that enhance transaction efficiency and customer satisfaction.

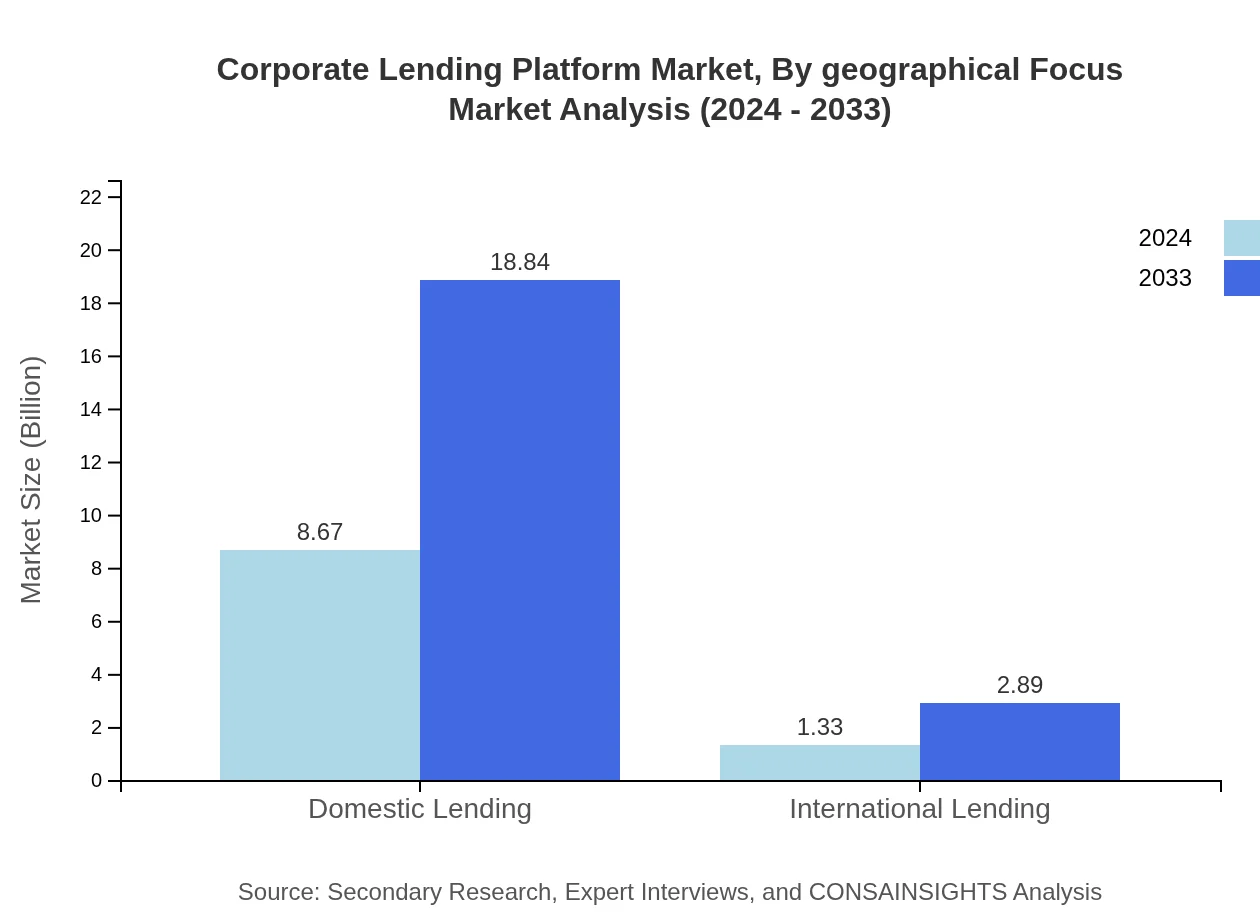

Corporate Lending Platform Market Analysis By Geographical Focus

When segmented by geographical focus, the market distinguishes between Domestic and International Lending. In 2024, Domestic Lending held a market size of 8.67 with an 86.71% share, predominantly driven by large-scale corporate borrowers operating within established financial systems. International Lending, while smaller with a size of 1.33 and a 13.29% share, is witnessing steady adoption as global business operations expand and cross-border transactions increase. By 2033, both domestic and international segments are predicted to experience proportional growth, underscoring the importance of localized strategies in tandem with global outreach efforts to harness expanding opportunities within the corporate lending continuum.

Corporate Lending Platform Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Corporate Lending Platform Industry

ABC Financial Solutions:

ABC Financial Solutions has been at the forefront of innovation in the corporate lending space. Their integrated digital platforms and robust risk management systems have set industry benchmarks, driving efficiency and increased transparency in lending operations across global markets.XYZ Capital Partners:

XYZ Capital Partners is renowned for its strategic emphasis on technology-driven lending solutions. With a focus on digital transformation, they have effectively bridged the gap between traditional banking and fintech, delivering tailored solutions that cater to diverse corporate needs and fostering market growth.We're grateful to work with incredible clients.

FAQs

How can the report help align our marketing strategy with customer adoption trends?

The report indicates a Corporate Lending Platform market size of $10 Billion, growing at a CAGR of 8.7%. Insights into customer adoption trends allow marketers to target high-demand features, ensuring alignment with evolving customer preferences, thereby optimizing marketing efforts.

What product features are in highest demand according to the report trends?

According to the report data, Term Loans dominate with a 65.91% share in 2024. Lines of Credit and Trade Finance also show significant presence, indicating that these product features should be prioritized in product development and marketing strategies.

Which regions offer the best market entry and expansion opportunities in the report industry?

Based on regional data, North America leads with a market size of $3.64 Billion in 2024, expanding to $7.90 Billion by 2033. Europe ($2.97 Billion) and Asia Pacific ($1.90 Billion) offer substantial growth as well, making them ideal for expansion.

What emerging technologies and innovations are shaping the report market?

Emerging technologies such as AI and blockchain are enhancing risk assessment and streamline lending processes. Innovations in online lending platforms will play a crucial role in increasing efficiency and customer satisfaction in the Corporate Lending Platform market.

Does the report include competitive landscape and market share analysis?

Yes, the report includes a comprehensive competitive landscape and market share analysis. It details shares of various segments, including Large Enterprises at 86.71% and highlights key players, which is essential for strategic positioning.

How can executives use the report to evaluate investment risks and ROI?

Executives can evaluate risks by analyzing market size, which is projected at $10 Billion, with an 8.7% CAGR. The report offers insights into competitive dynamics and customer trends, crucial for assessing ROI prospects in Corporate Lending Platform investments.

What is the market size of corporate Lending Platform?

The Corporate Lending Platform market size is estimated at $10 Billion in 2024, with a projected CAGR of 8.7%. This robust growth reflects the increasing demand for efficient lending solutions in various segments.

What segment data is presented in the report?

Segment data reveals Term Loans at $6.59 Billion (2024), making up 65.91% market share. Other segments include Lines of Credit ($2.22 Billion) and Trade Finance ($1.19 Billion), indicating diverse opportunities across various lending types.