Data Center Physical Security

Published Date: 31 January 2026 | Report Code: data-center-physical-security

Data Center Physical Security Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Data Center Physical Security market, offering insights into market size, growth trends, regional developments, segmentation details, and competitive dynamics. Covering the forecast period 2024 to 2033, the report examines key technological innovations, regulatory influences, and service performance to help stakeholders make informed decisions.

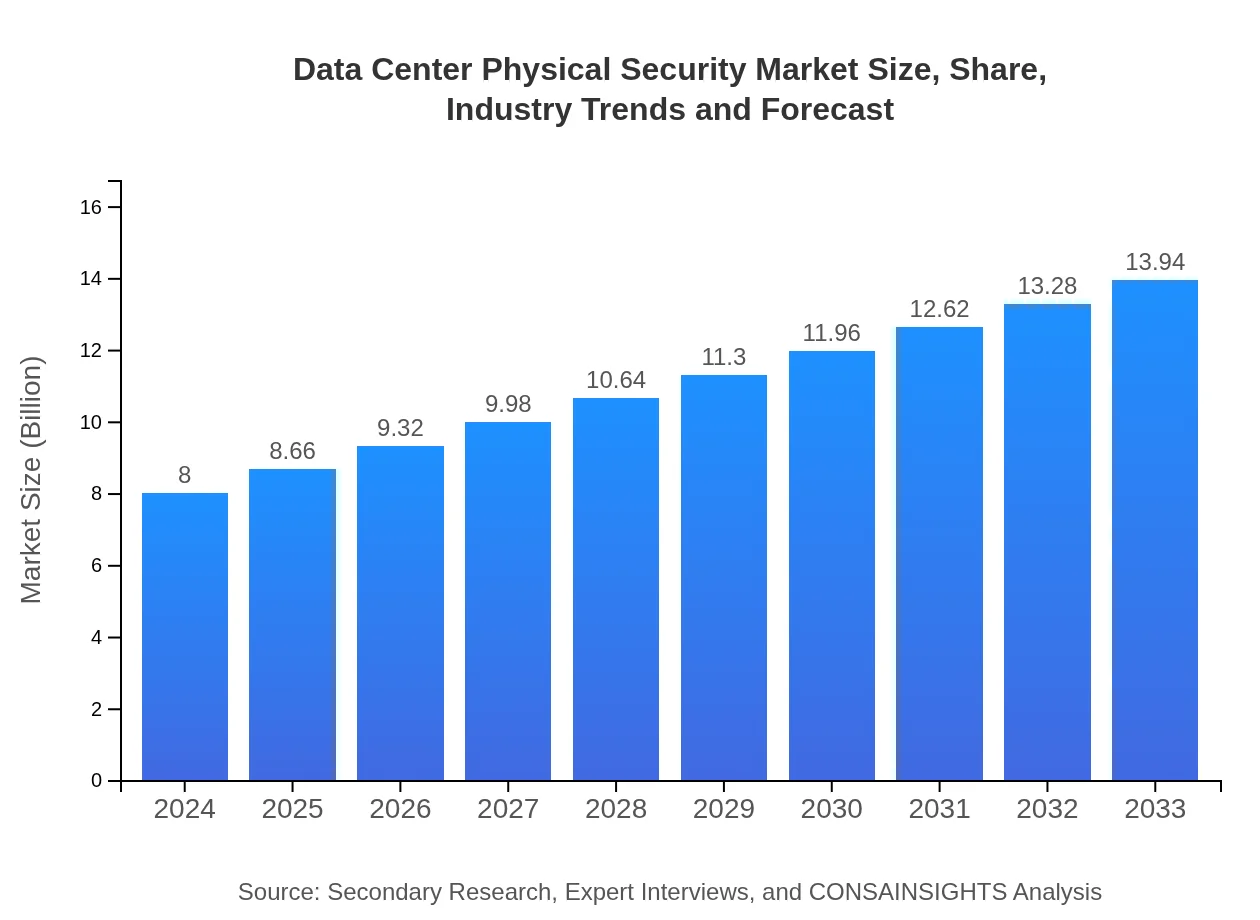

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

| 2024 Market Size | $8.00 Billion |

| CAGR (2024-2033) | 6.2% |

| 2033 Market Size | $13.94 Billion |

| Top Companies | Cisco Systems, IBM Corporation, Hewlett Packard Enterprise, Dell Technologies, Siemens AG |

| Last Modified Date | 31 January 2026 |

Data Center Physical Security Market Overview

Customize Data Center Physical Security market research report

- ✔ Get in-depth analysis of Data Center Physical Security market size, growth, and forecasts.

- ✔ Understand Data Center Physical Security's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Data Center Physical Security

What is the Market Size & CAGR of Data Center Physical Security market in {Year}?

Data Center Physical Security Industry Analysis

Data Center Physical Security Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Data Center Physical Security Market Analysis Report by Region

Europe Data Center Physical Security:

Europe is poised for steady growth, with market sizes anticipated to advance from 2.15 in 2024 to 3.75 in 2033. The region benefits from robust regulatory frameworks that emphasize data protection and physical security. Increased government initiatives and industry investments in secure data infrastructures, particularly in Western and Central Europe, are driving this upward trend.Asia Pacific Data Center Physical Security:

In Asia Pacific, the Data Center Physical Security market is experiencing impressive growth, with market size numbers forecast to increase from 1.58 in 2024 to 2.75 in 2033. This region is characterized by rapid digital transformation, expanding data center footprints, and strong government backing for cyber and physical security enhancements. Technological innovation and increased investments in infrastructure, particularly in emerging economies such as India and Southeast Asian countries, are driving market growth.North America Data Center Physical Security:

North America remains a mature market, with market size projected to rise from 2.72 in 2024 to 4.74 in 2033. Here, the demand for state-of-the-art physical security systems is driven by a combination of strict regulatory landscapes, large-scale data center deployments, and the need for secure cloud and hybrid environment solutions. Innovations in artificial intelligence and machine learning are also significantly enhancing the efficiency of security systems in the region.South America Data Center Physical Security:

The South American market, with a reported size of 0.62 in 2024 growing to 1.08 in 2033, is steadily improving its data infrastructure. Although relatively smaller in scale when compared to other regions, rising awareness regarding security vulnerabilities and increased investments in modern data centers are fueling growth. Additionally, regional partnerships and technology transfer initiatives are expected to further boost the market.Middle East & Africa Data Center Physical Security:

In the Middle East and Africa, the market is predicted to grow from 0.93 in 2024 to 1.63 in 2033. Factors such as rising investments in data center capacity, governmental focus on smart city developments, and an evolving regulatory environment contribute to this growth. Despite challenges related to economic disparities and infrastructure gaps, the region is witnessing incremental advancements in physical security technologies.Tell us your focus area and get a customized research report.

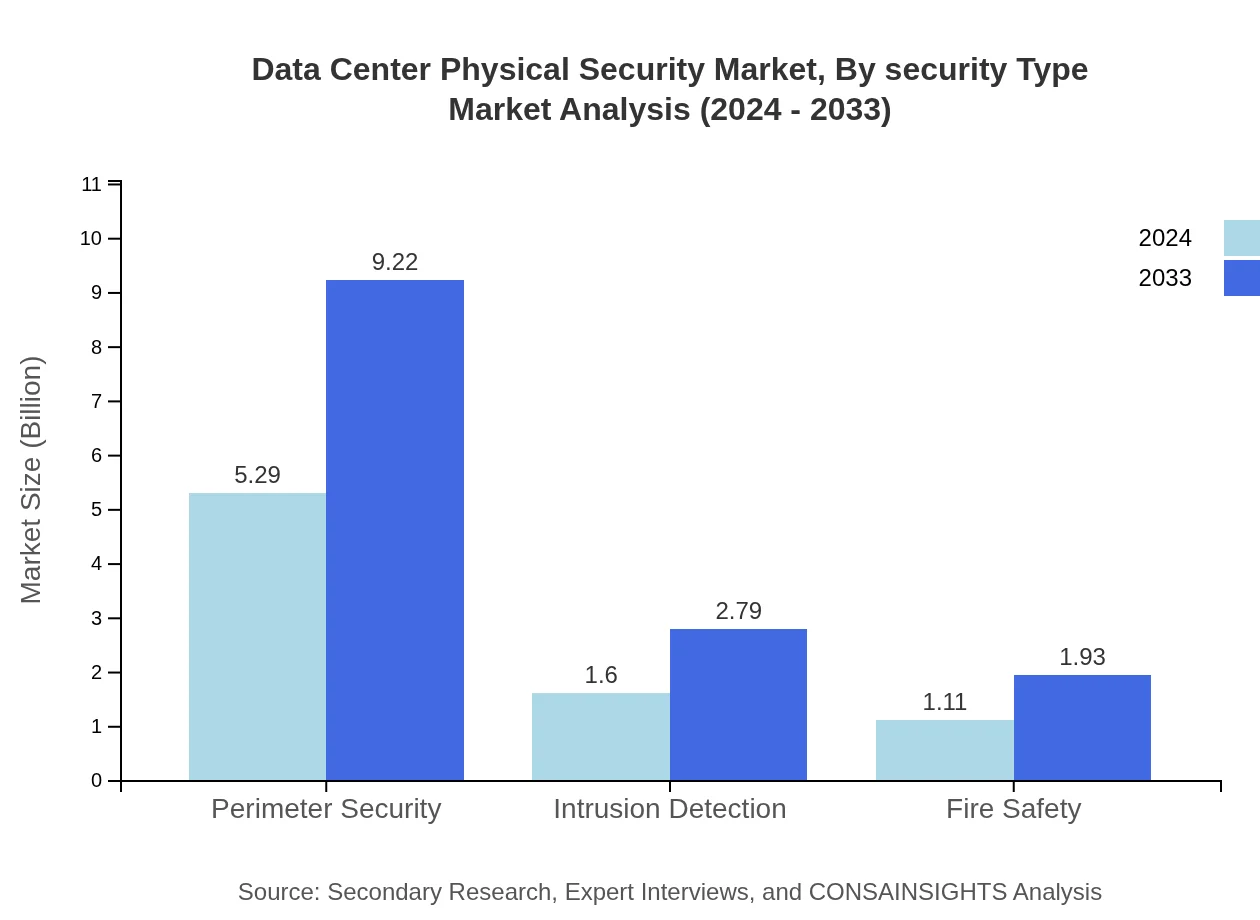

Data Center Physical Security Market Analysis By Security Type

The security type segmentation covers multiple product categories, including video surveillance, access control systems, alarm systems, intrusion detection, perimeter security, and fire safety. Video surveillance remains the dominant segment with both high market size and share proportions. Enhanced by smart analytics and integrated systems, these security tools have shown consistent performance over the years. The emphasis is not only on the hardware components but also on the software integrations that provide real-time alerts and proactive threat management capabilities. This segment’s robust growth is supported by continuous technological upgrades and effective integration with broader cybersecurity measures.

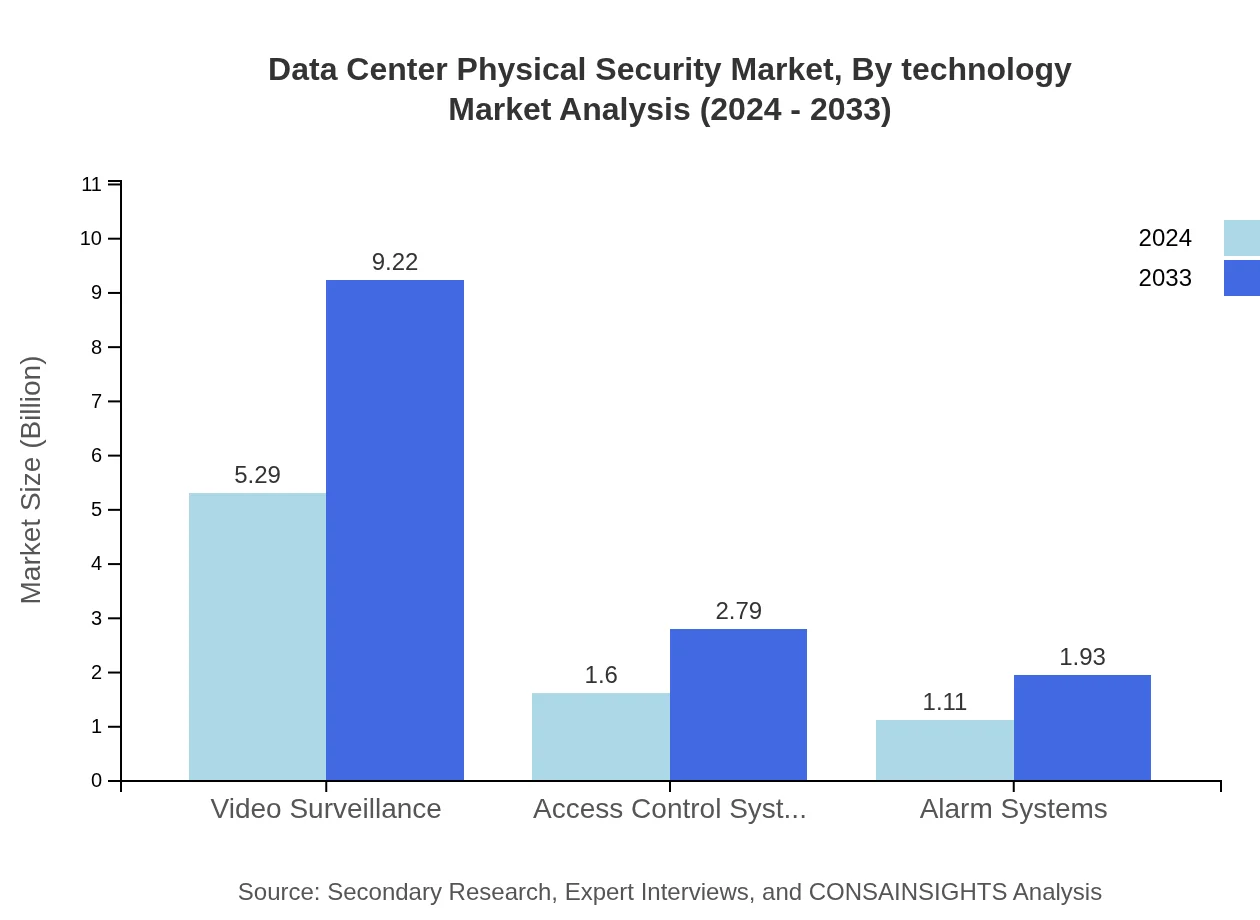

Data Center Physical Security Market Analysis By Technology

Technology innovation in the Data Center Physical Security market encompasses advanced biometric systems, machine learning-driven analytics, cloud-based security management, and IoT-enabled monitoring systems. Innovations in artificial intelligence and sensor technology have significantly improved detection capabilities and response times. The integration of multiple security technologies into a single, cohesive framework allows for real-time data correlation and streamlined security operations. Continuous R&D investments by leading players are also fostering the adoption of flexible and scalable security systems that can be customized to meet diverse operational requirements. Overall, technology remains at the heart of market growth, ensuring enhanced operational efficiency and a higher return on investments.

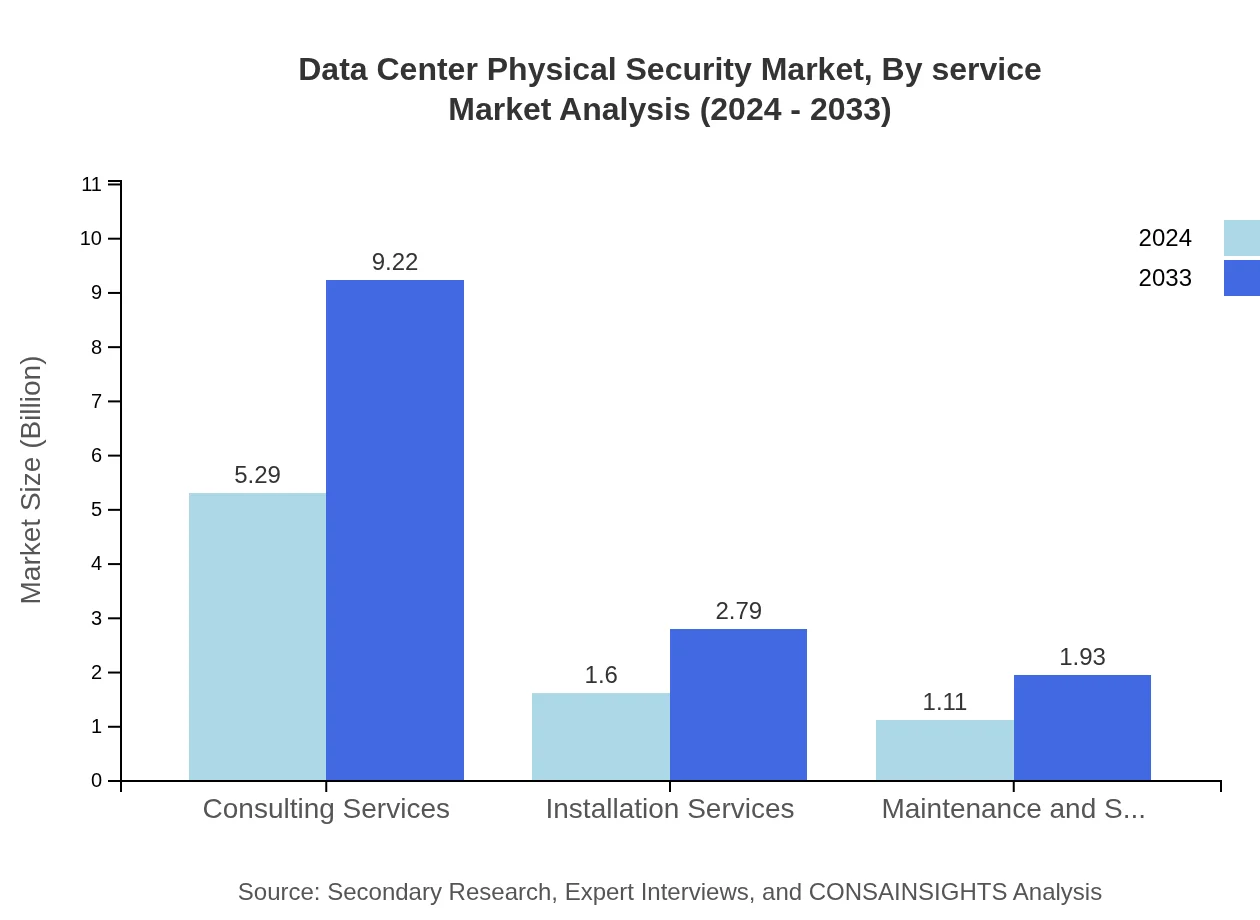

Data Center Physical Security Market Analysis By Service

Service-based segmentation further deepens the market dynamics with key areas including consulting services, installation, and maintenance and support. Consulting services, holding the largest share, are valued for their expertise in designing and implementing security strategies that align with stringent compliance standards. Installation services ensure that robust security systems are deployed following best practices, whereas maintenance and support guarantee continuous system performance and rapid issue resolution. With service contracts often spanning several years, companies can optimize their operational efficiency and ensure minimal downtime. The stable revenue shares across these service segments underscore the importance of comprehensive support alongside technological investments.

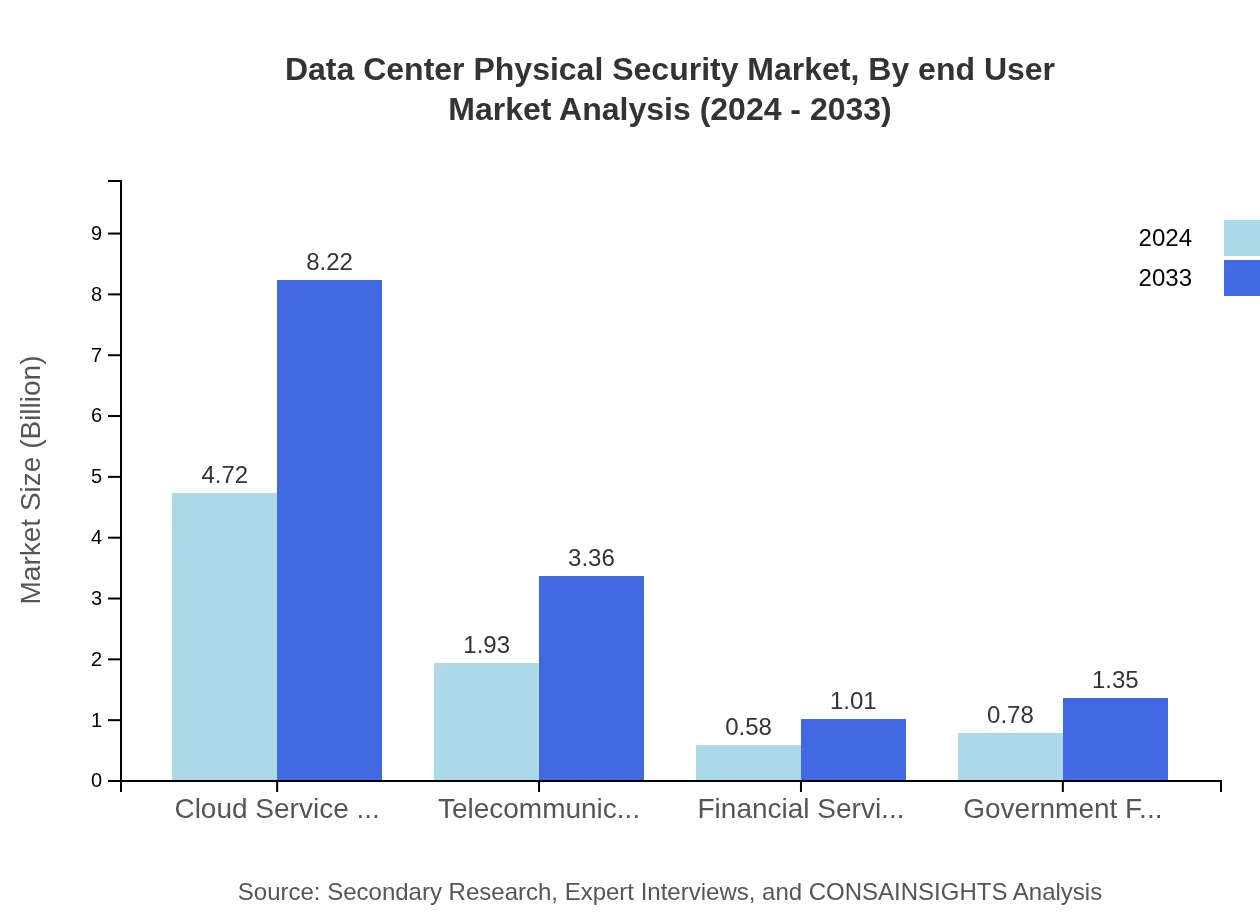

Data Center Physical Security Market Analysis By End User

End-user segmentation reveals that diverse sectors such as financial services, government facilities, healthcare, and commercial enterprises are critical to the market’s demand. Financial institutions and government facilities, in particular, require stringent security measures due to the sensitive nature of the data handled. While each segment faces specific regulatory and operational needs, the common denominator is an increasing awareness of the potential risks and the need for robust physical security measures. Customizing solutions to meet the nuanced demands of each end-user drives innovation and strategic partnerships in the market. Enhanced safety protocols, compliance with evolving standards, and real-time threat management are among the key factors propelling this segment forward.

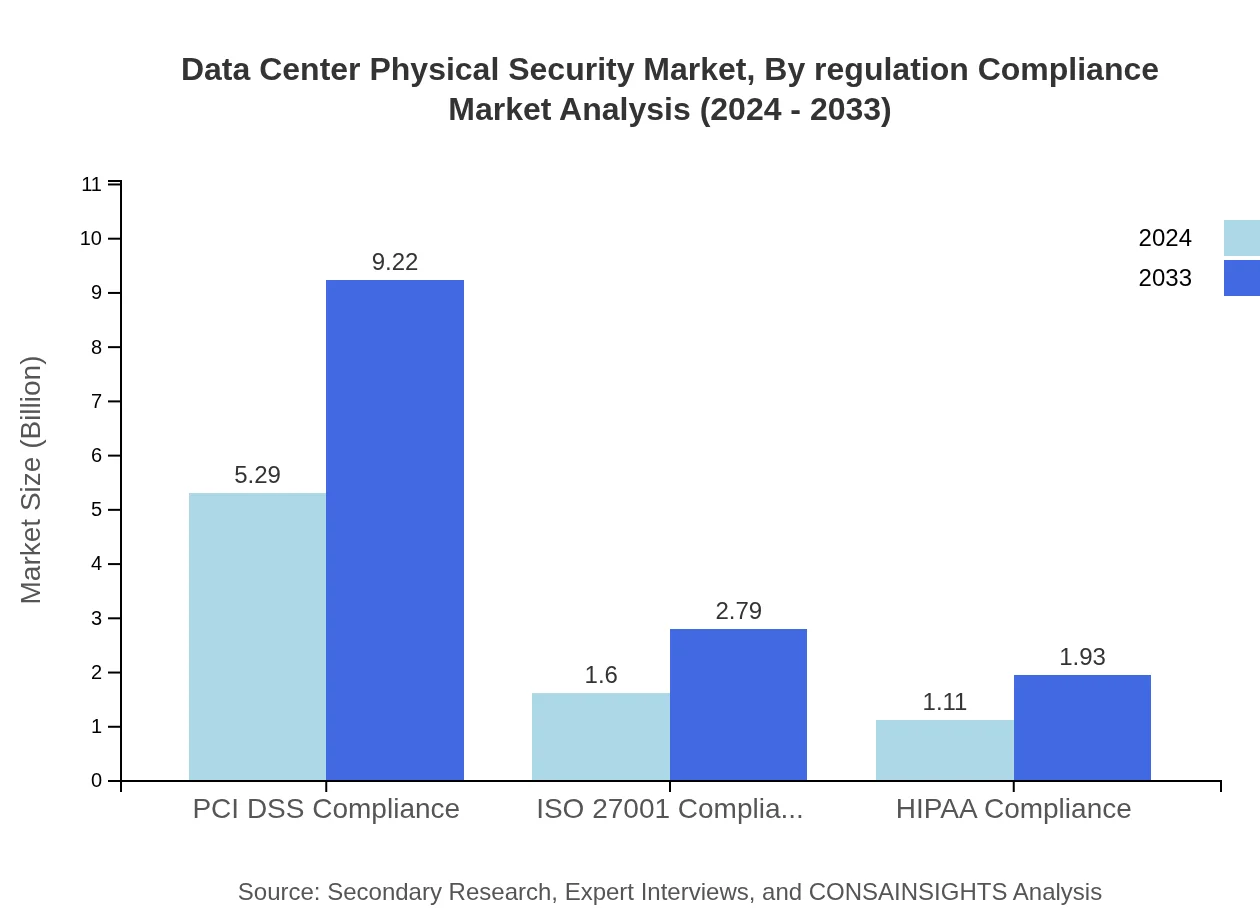

Data Center Physical Security Market Analysis By Regulation Compliance

Regulation and compliance have emerged as major factors influencing market strategies in the Data Center Physical Security sector. With international standards such as PCI DSS, ISO 27001, and HIPAA setting stringent benchmarks for data security, companies are investing heavily in systems that not only provide physical protection but also help achieve compliance. Regulatory mandates drive innovation across the board and ensure that even small-scale data centers maintain high standards of security. In parallel, adherence to international compliance standards enhances customer trust and underpins long-term revenue growth. The sustained market share witnessed by the compliance segment reflects the critical importance placed on meeting both legal obligations and operational efficiency through rigorous physical security measures.

Data Center Physical Security Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Data Center Physical Security Industry

Cisco Systems:

Cisco Systems has long been a leader in networking solutions and has extended its expertise to robust physical security systems, integrating cutting-edge video analytics and access control solutions to protect data center environments.IBM Corporation:

IBM leverages its extensive technological expertise and global presence to offer integrated data security solutions that ensure both physical and cyber protection, ensuring high system reliability and regulatory compliance.Hewlett Packard Enterprise:

HPE combines technological innovation with comprehensive service offerings to provide high-end security solutions. Their scalable systems are designed to adapt to evolving threats in today’s dynamic data center environments.Dell Technologies:

Dell Technologies focuses on integrated security solutions that blend hardware with advanced software analytics. Their offerings cover everything from surveillance to intrusion detection, ensuring robust protection against evolving threats.Siemens AG:

Siemens AG leverages its industrial automation background to deliver high-performance security systems. Their solutions integrate seamlessly into existing infrastructures, offering reliable physical protection and compliance support.We're grateful to work with incredible clients.

FAQs

How can the Data Center Physical Security Market Report help align our marketing strategy with customer adoption trends?

The Data Center Physical Security Market, projected at $8 billion with a CAGR of 6.2%, provides insights on customer preferences, allowing marketers to tailor strategies that resonate with adoption trends and prioritize features relevant to the target audience.

What product features are in highest demand according to the Data Center Physical Security Market trends?

The report reveals high demand for video surveillance, perimeter security, and access control systems, which are crucial for maintaining security in data centers, influencing product development priorities for vendors in this sector.

Which regions offer the best market entry and expansion opportunities in the Data Center Physical Security industry?

Regions with significant growth potentials include North America ($4.74 billion by 2033), Europe ($3.75 billion by 2033), and Asia Pacific ($2.75 billion by 2033), each showing promising market entry and expansion opportunities.

What emerging technologies and innovations are shaping the Data Center Physical Security market?

Key innovations include advancements in AI-driven video surveillance, biometric access controls, and IoT integration, which enhance real-time monitoring and response capabilities, reflecting ongoing technological evolution in the data center physical security market.

Does the Data Center Physical Security Market Report include competitive landscape and market share analysis?

Yes, the report encompasses a competitive landscape analysis, detailing market shares among leading vendors across various segments, enabling businesses to benchmark performance and understand competitive dynamics.

How can executives use the Data Center Physical Security Market Report to evaluate investment risks and ROI?

Executives can analyze market forecasts, segment performance, and regional growth rates to assess potential investment risks and determine ROI projections, informing strategic decision-making in the data center physical security space.

What is the market size of data Center Physical Security?

The data center physical security market is valued at $8 billion with a CAGR of 6.2%, indicating robust growth potential and signaling increasing investment in security solutions within this sector.