Data Center Rfid

Published Date: 31 January 2026 | Report Code: data-center-rfid

Data Center Rfid Market Size, Share, Industry Trends and Forecast to 2033

Welcome to the comprehensive report on the Data Center RFID market forecast for 2024 to 2033. This report delivers detailed insights into market dynamics, including size, growth, segmentation, regional analysis, technological advancements, and product performance. Our analysis sheds light on current trends, challenges, and future opportunities shaping this critical industry. We provide robust market intelligence.

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

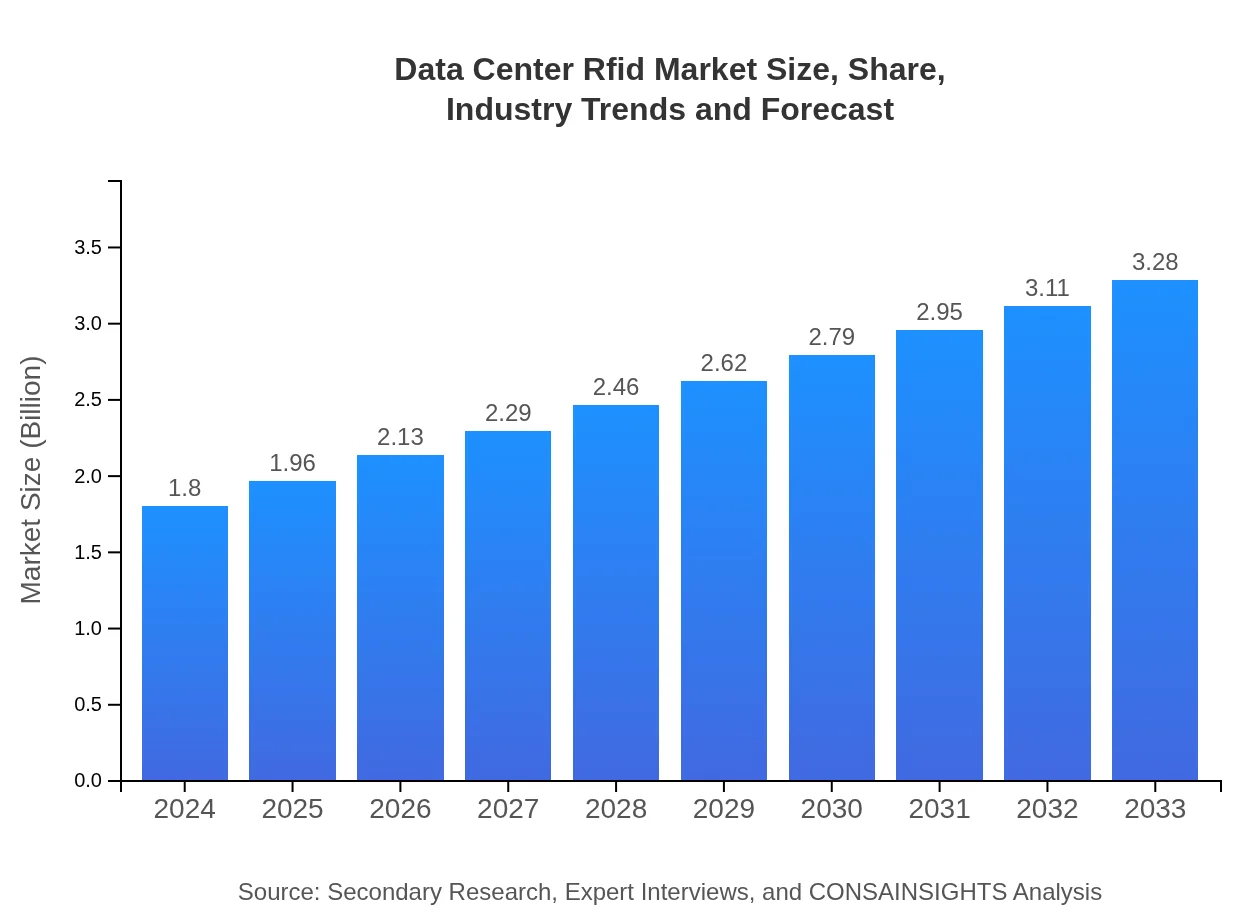

| 2024 Market Size | $1.80 Billion |

| CAGR (2024-2033) | 6.7% |

| 2033 Market Size | $3.28 Billion |

| Top Companies | TechSolutions Inc., Innovative RFID Systems |

| Last Modified Date | 31 January 2026 |

Data Center Rfid Market Overview

Customize Data Center Rfid market research report

- ✔ Get in-depth analysis of Data Center Rfid market size, growth, and forecasts.

- ✔ Understand Data Center Rfid's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Data Center Rfid

What is the Market Size & CAGR of Data Center Rfid market in 2024?

Data Center Rfid Industry Analysis

Data Center Rfid Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Data Center Rfid Market Analysis Report by Region

Europe Data Center Rfid:

Europe is projected to see substantial growth, with market figures increasing from 0.61 in 2024 to 1.11 by 2033. Strong regulatory frameworks, high investments in digital infrastructure, and a focus on operational efficiency are key factors driving the market here.Asia Pacific Data Center Rfid:

In Asia Pacific, the Data Center RFID market is poised for significant growth, with market figures rising from 0.32 in 2024 to an expected 0.59 by 2033. This region benefits from rapid digital transformation and increasing investments in IT infrastructure, coupled with a growing number of data centers.North America Data Center Rfid:

North America remains a strong market, expanding from 0.64 in 2024 to 1.17 by 2033. Early adoption of innovative technologies and a mature IT landscape underpin this robust growth, with companies continuously optimizing their data center operations.South America Data Center Rfid:

South America shows steady progress in the RFID sector, with market figures moving from 0.08 in 2024 to 0.14 by 2033. Although starting from a smaller base, the region is experiencing gradual adoption driven by improvements in telecommunications and data management.Middle East & Africa Data Center Rfid:

In the Middle East and Africa, the market is anticipated to expand from 0.15 in 2024 to 0.27 by 2033. Growing awareness of RFID benefits coupled with increased funding for technological upgrades in emerging markets are contributing to this positive outlook.Tell us your focus area and get a customized research report.

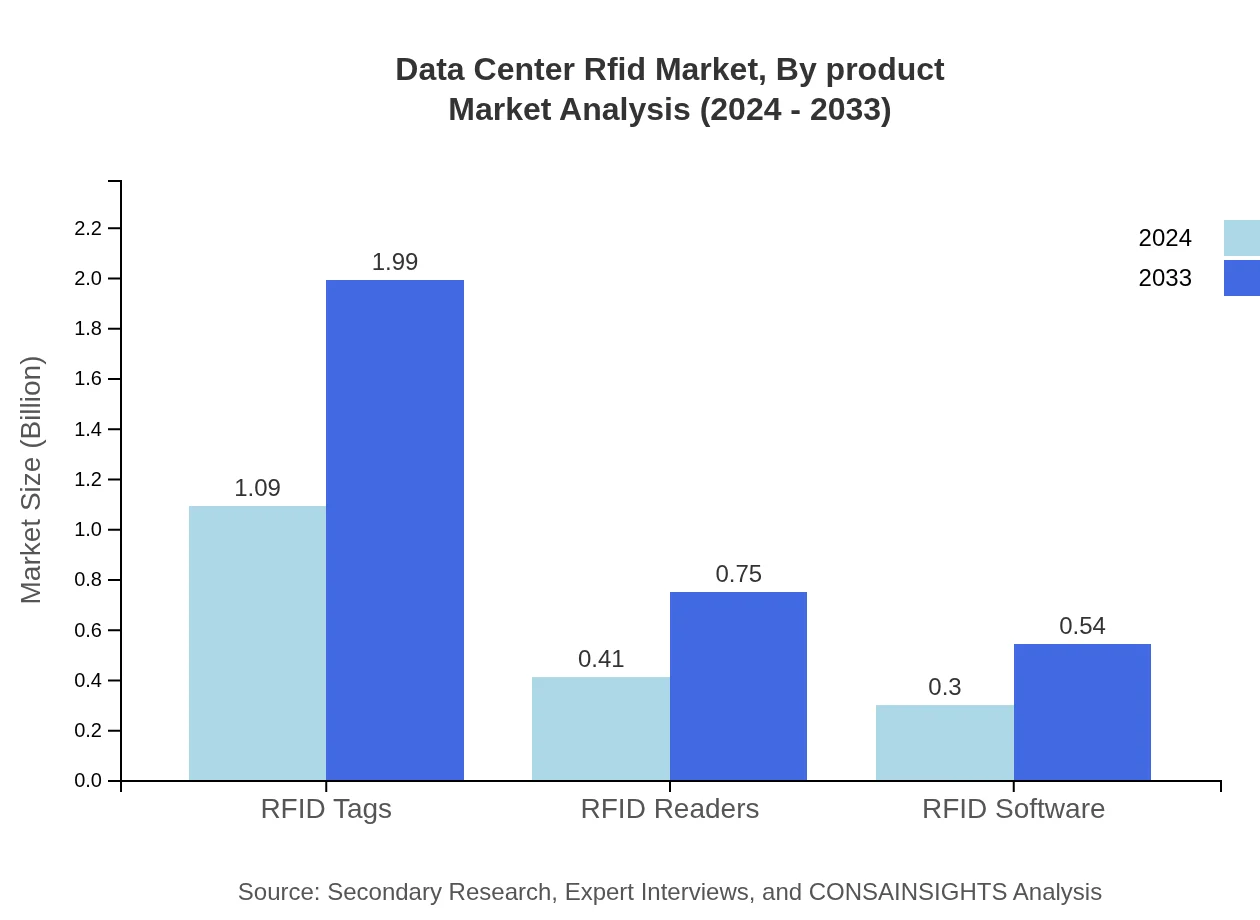

Data Center Rfid Market Analysis By Product

By-product analysis focuses on the RFID component hardware. In 2024, RFID Tags achieved a market size of 1.09 with a 60.68% share, while RFID Readers held a size of 0.41 with a 22.93% share and RFID Software reached 0.30 with a 16.39% share. By 2033, these products are expected to witness strong growth with expanded capabilities and seamless integration. Technological improvements and scalable solutions are driving enhanced performance in data center management and efficient asset tracking, reinforcing the critical role of RFID hardware.

Data Center Rfid Market Analysis By Application

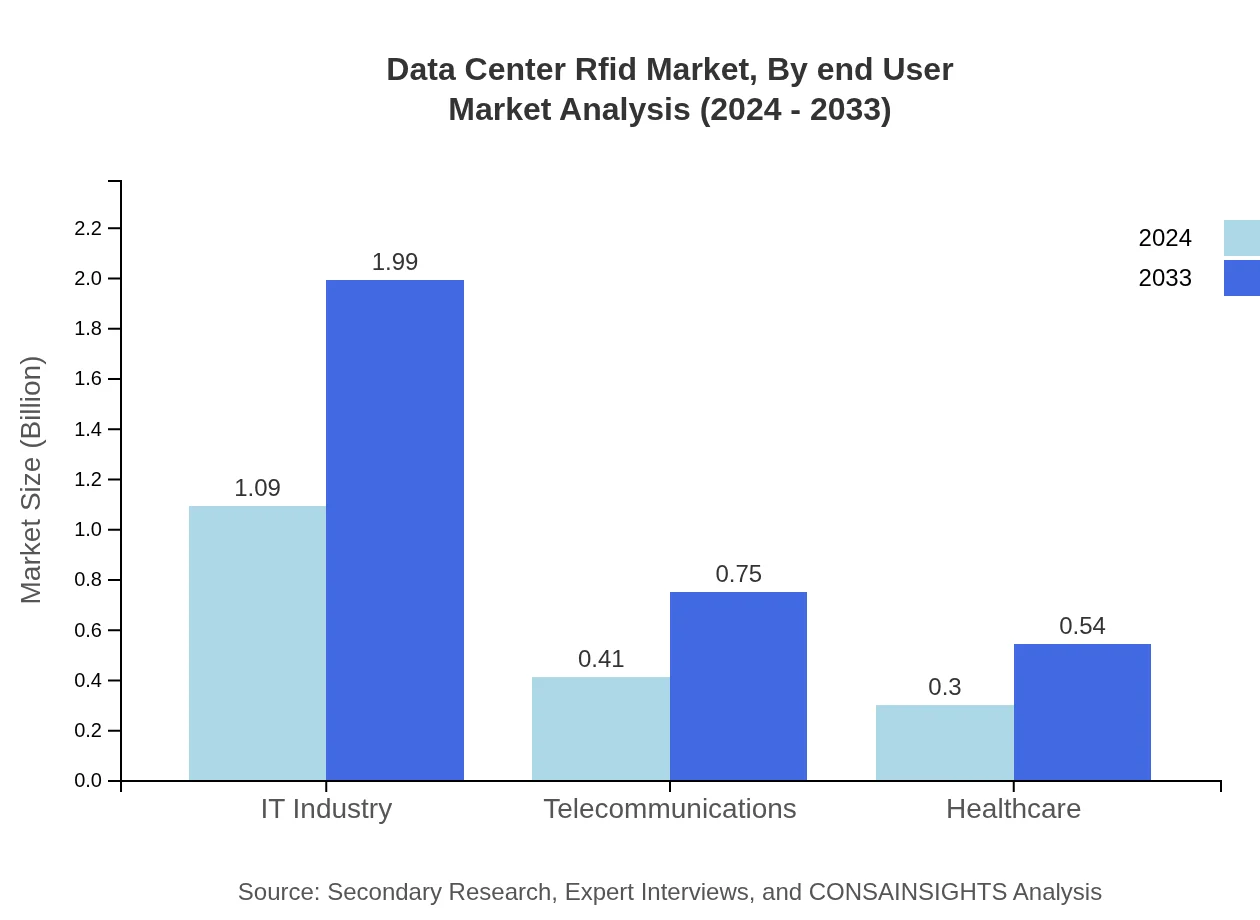

By-application analysis evaluates the use of RFID technology across various industry sectors. In this segment, the IT Industry recorded a market size of 1.09 with a 60.68% share in 2024, while Telecommunications and Healthcare contributed market sizes of 0.41 and 0.30, with shares of 22.93% and 16.39% respectively. Forecasts for 2033 suggest these sectors will expand further as RFID solutions become integral to enhancing operational efficiency, enabling real-time monitoring, and ensuring regulatory compliance across industries.

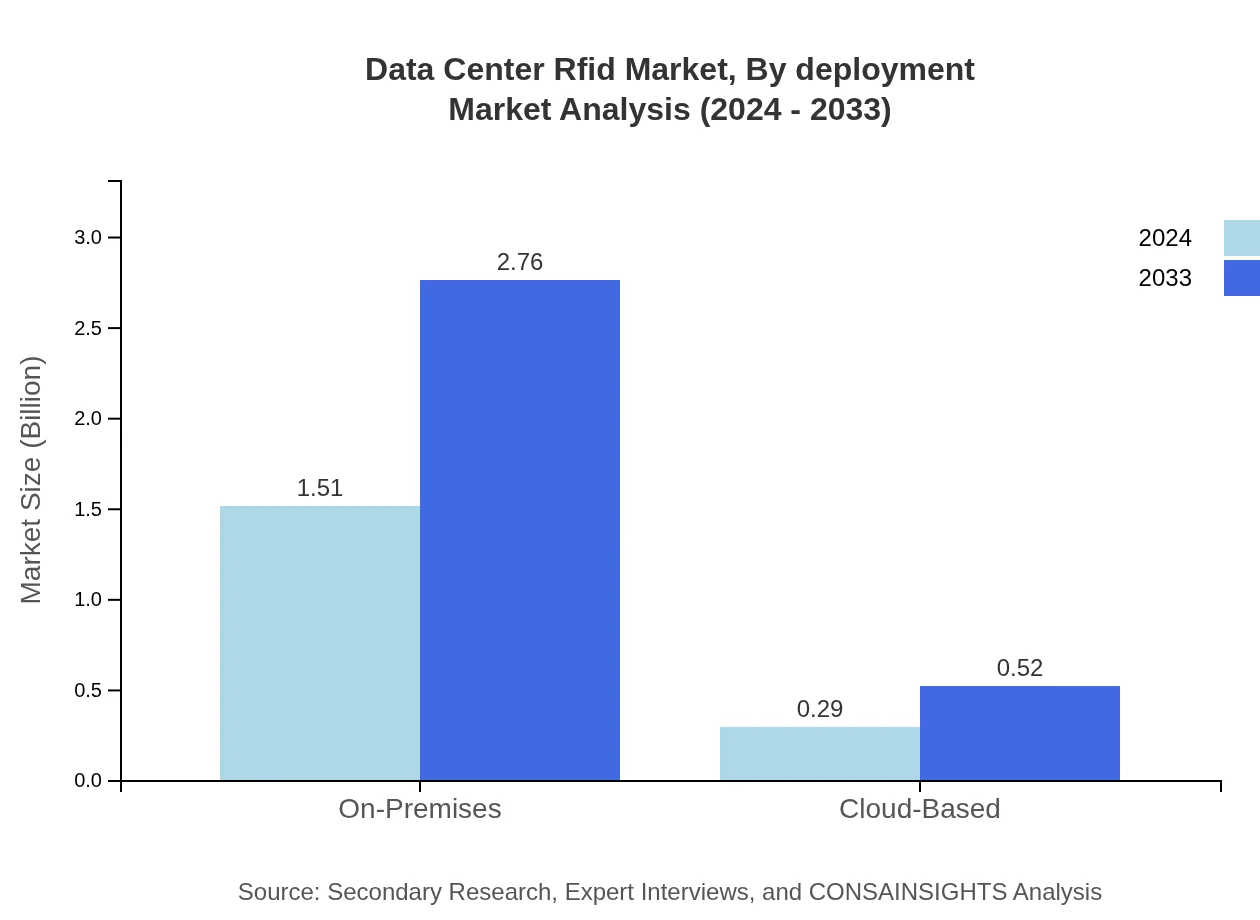

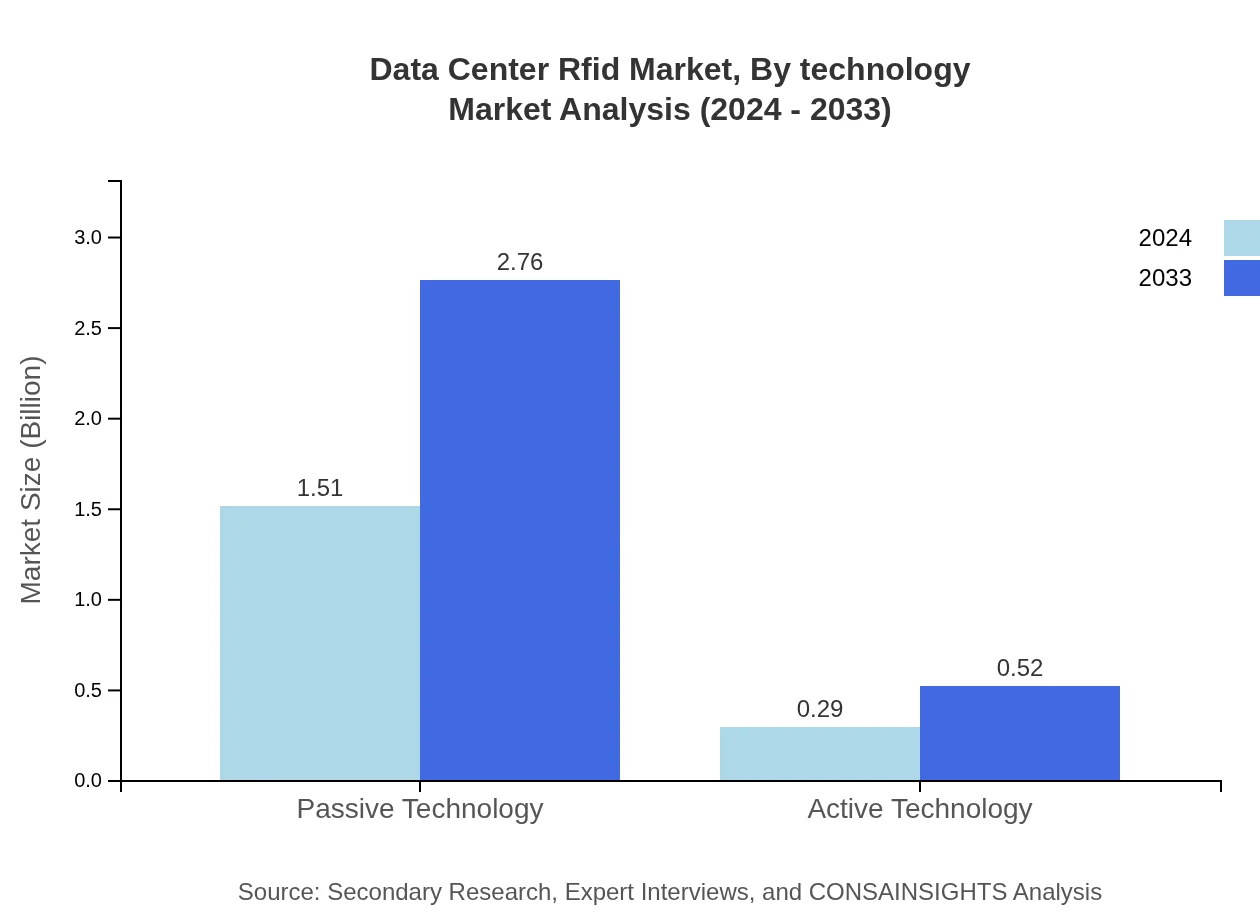

Data Center Rfid Market Analysis By Deployment

By-deployment mode analysis differentiates between on-premises and cloud-based configurations. On-Premises deployment captured a market size of 1.51 with an 84.05% share in 2024, underscoring its reliability for sectors demanding robust security and data control. In contrast, Cloud-Based solutions held a smaller share with a size of 0.29 and 15.95% share, catering to organizations seeking flexibility. Projections for 2033 indicate growth for both segments as companies adopt more cost-effective and scalable data management solutions.

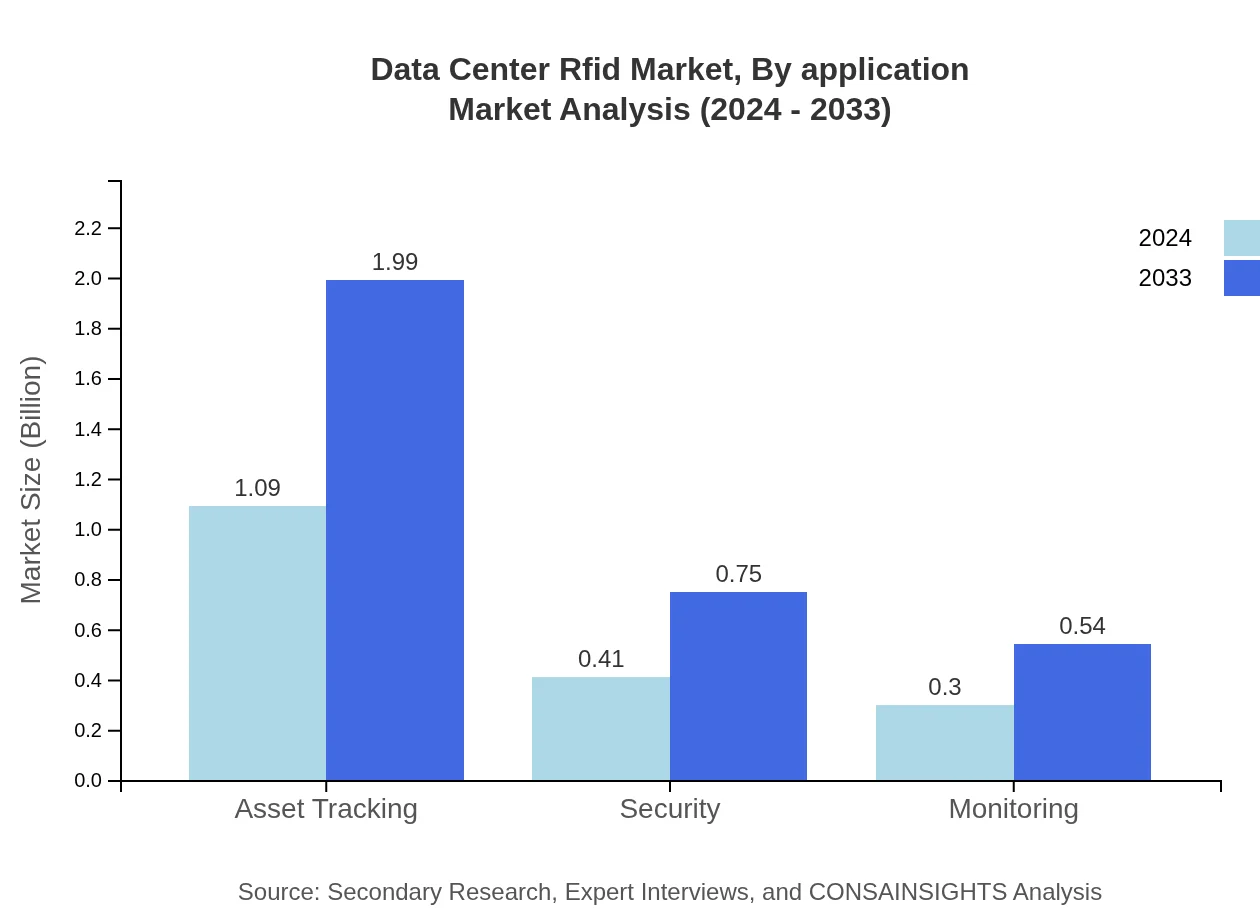

Data Center Rfid Market Analysis By End User

By-end-user analysis examines the performance of RFID technology across key operational fields such as asset tracking, security, and monitoring. In 2024, the Asset Tracking segment registered a market size of 1.09 with a 60.68% share, while Security and Monitoring segments recorded sizes of 0.41 and 0.30, with shares of 22.93% and 16.39% respectively. These segments are set for steady expansion by 2033, driven by the growing need for precise tracking, enhanced security measures, and reliability in data center operations.

Data Center Rfid Market Analysis By Technology

By-technology analysis focuses on the differentiation between Passive and Active RFID technologies. In 2024, Passive Technology dominated the market with a size of 1.51 and an 84.05% share, while Active Technology captured a size of 0.29 with a 15.95% share. As we approach 2033, both technologies are anticipated to benefit from continued innovation, with Passive solutions maintaining dominance due to their cost efficiency, longer read ranges, and ease of implementation in large-scale data center operations.

Data Center Rfid Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Data Center Rfid Industry

TechSolutions Inc.:

TechSolutions Inc. is renowned for its cutting-edge RFID hardware and comprehensive system solutions that streamline data center operations. Their focus on innovation and integration has set industry benchmarks, driving efficiency and security in various applications.Innovative RFID Systems:

Innovative RFID Systems specializes in sophisticated RFID software integrations and robust deployment strategies. The company continually invests in R&D, enabling breakthrough solutions that enhance real-time tracking and operational management across global data centers.We're grateful to work with incredible clients.

FAQs

How can the Data Center RFID Market Report help align our marketing strategy with customer adoption trends?

The Data Center RFID market, currently at $1.8 billion with a CAGR of 6.7%, reveals consumer preferences and behaviors, aiding marketers in targeting strategies. Insights from the report can identify adoption trends, enabling companies to align their marketing efforts with effective messaging that resonates with customer needs.

What product features are in highest demand according to the Data Center RFID Market trends?

Top features in demand include RFID tags, with a projected size growth from $1.09 billion in 2024 to $1.99 billion by 2033, and RFID readers, expected to expand from $0.41 billion to $0.75 billion. These features reflect the need for efficient tracking and management solutions in data centers.

Which regions offer the best market entry and expansion opportunities in the Data Center RFID industry?

North America leads the Data Center RFID market, with a size projected to grow from $0.64 billion in 2024 to $1.17 billion by 2033. Europe and Asia Pacific also show potential, with sizes expected to reach $1.11 billion and $0.59 billion respectively, indicating robust growth across these regions.

What emerging technologies and innovations are shaping the Data Center RFID market?

Innovations in passive and active RFID technologies dominate the market, with passive RFID expected to hold an 84.05% share in 2024, while emerging cloud-based solutions are projected to reach $0.52 billion by 2033. These advancements enhance asset tracking efficiency and overall operational workflows.

Does the Data Center RFID Market Report include competitive landscape and market share analysis?

Yes, the report includes a comprehensive analysis of the competitive landscape, detailing market shares and positioning. This information is crucial for understanding competitive dynamics and for strategizing effectively in a marketplace projected to grow steadily.

How can executives use the Data Center RFID Market Report to evaluate investment risks and ROI?

Executives can leverage the Data Center RFID Market Report to assess market trends, projected growth rates of 6.7%, and regional insights. Evaluating the opportunities in high-growth areas assists in making informed investment decisions and estimating potential ROI.

What is the market size of Data Center RFID?

The Data Center RFID market is valued at $1.8 billion in 2024, with a CAGR of 6.7%. This growth signal indicates upward trends in adoption and implementation of RFID technologies across data centers and related industries.

What are the key segments in the Data Center RFID market?

Key segments include RFID tags, with a market size of $1.09 billion in 2024, RFID readers at $0.41 billion, and RFID software at $0.30 billion. Each segment shows potential for significant growth, emphasizing operational benefits across various applications.