Embedded Insurance Platforms

Published Date: 02 February 2026 | Report Code: embedded-insurance-platforms

Embedded Insurance Platforms Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report delves into the current state and future prospects of Embedded Insurance Platforms from 2024 to 2033. The report provides in-depth insights on market size, growth drivers, segmentation, regional analysis, technological trends, and competitive landscape to offer valuable information for stakeholders and decision-makers across the industry. This detailed analysis is essential for future growth.

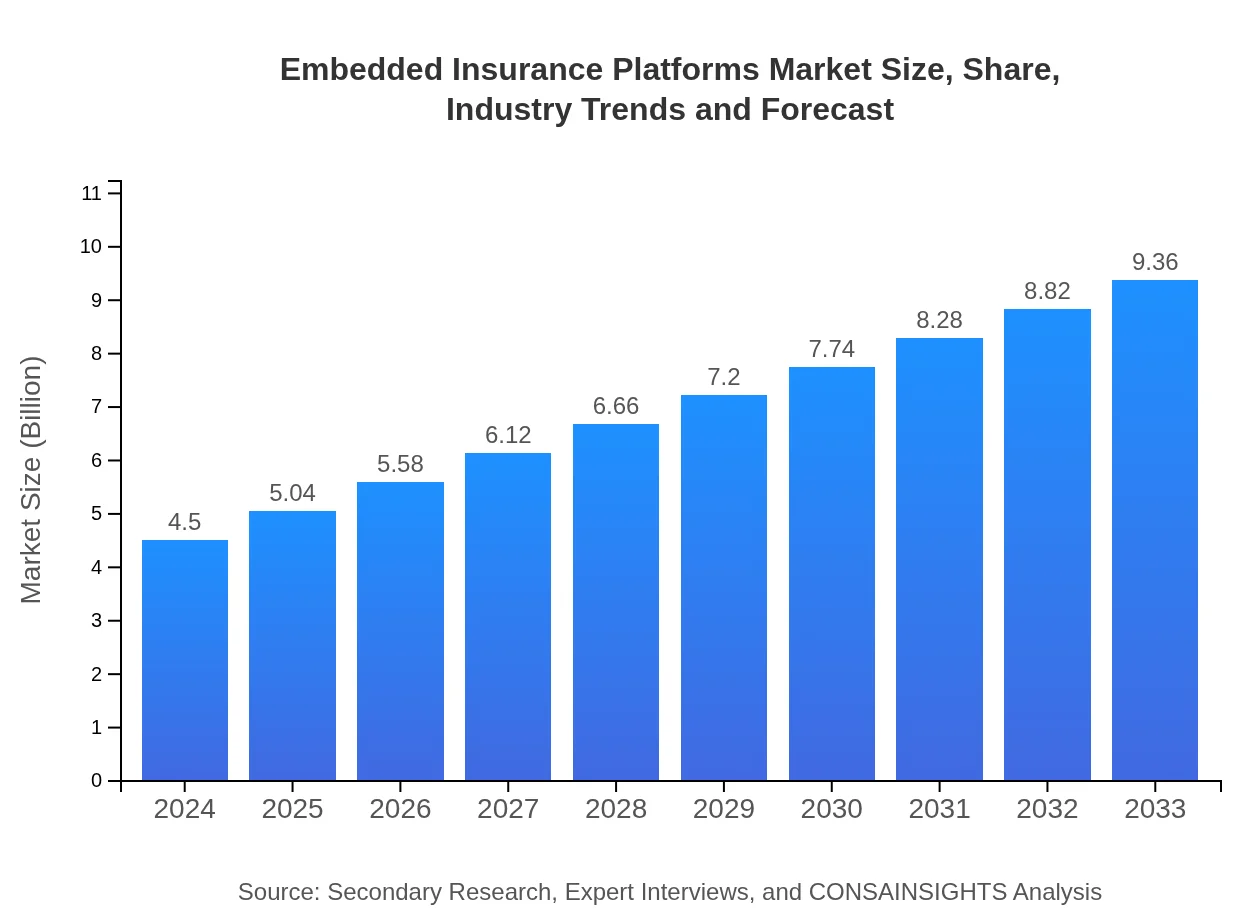

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

| 2024 Market Size | $4.50 Billion |

| CAGR (2024-2033) | 8.2% |

| 2033 Market Size | $9.36 Billion |

| Top Companies | InsureTech Innovations, Embedded Solutions Inc. |

| Last Modified Date | 02 February 2026 |

Embedded Insurance Platforms Market Overview

Customize Embedded Insurance Platforms market research report

- ✔ Get in-depth analysis of Embedded Insurance Platforms market size, growth, and forecasts.

- ✔ Understand Embedded Insurance Platforms's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Embedded Insurance Platforms

What is the Market Size & CAGR of Embedded Insurance Platforms market in 2024?

Embedded Insurance Platforms Industry Analysis

Embedded Insurance Platforms Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Embedded Insurance Platforms Market Analysis Report by Region

Europe Embedded Insurance Platforms:

In Europe, the market grows from 1.59 units in 2024 to 3.31 units in 2033. This steady progression is underpinned by stringent regulatory frameworks, a mature insurance market, and increasing digital adoption. Consumers and businesses in Europe are rapidly embracing embedded insurance offerings for their transparency and efficiency.Asia Pacific Embedded Insurance Platforms:

In Asia Pacific, the market is poised for significant expansion, growing from a market size of approximately 0.78 units in 2024 to 1.63 units in 2033. This growth is driven by increased digital transformation, rising disposable income, and a burgeoning middle class that is increasingly receptive to innovative insurance solutions, coupled with supportive government initiatives.North America Embedded Insurance Platforms:

North America's market is projected to expand considerably, moving from 1.47 units in 2024 to 3.05 units in 2033. The region benefits from advanced technological infrastructure, high internet penetration rates, and a strong focus on customer-centric product innovations that drive the seamless integration of insurance solutions across various digital platforms.South America Embedded Insurance Platforms:

South America presents a unique opportunity with the market evolving from 0.22 units in 2024 to 0.46 units in 2033. Although the region faces challenges such as economic volatility and regulatory constraints, the potential for digital adoption and disruptive insurance models signals promising long-term growth.Middle East & Africa Embedded Insurance Platforms:

The Middle East and Africa region, while emerging, shows promising growth, with market size expected to rise from 0.44 units in 2024 to 0.91 units in 2033. Strategic investments in digital infrastructure, coupled with a push towards technological modernization, are likely to spur further growth in these regions.Tell us your focus area and get a customized research report.

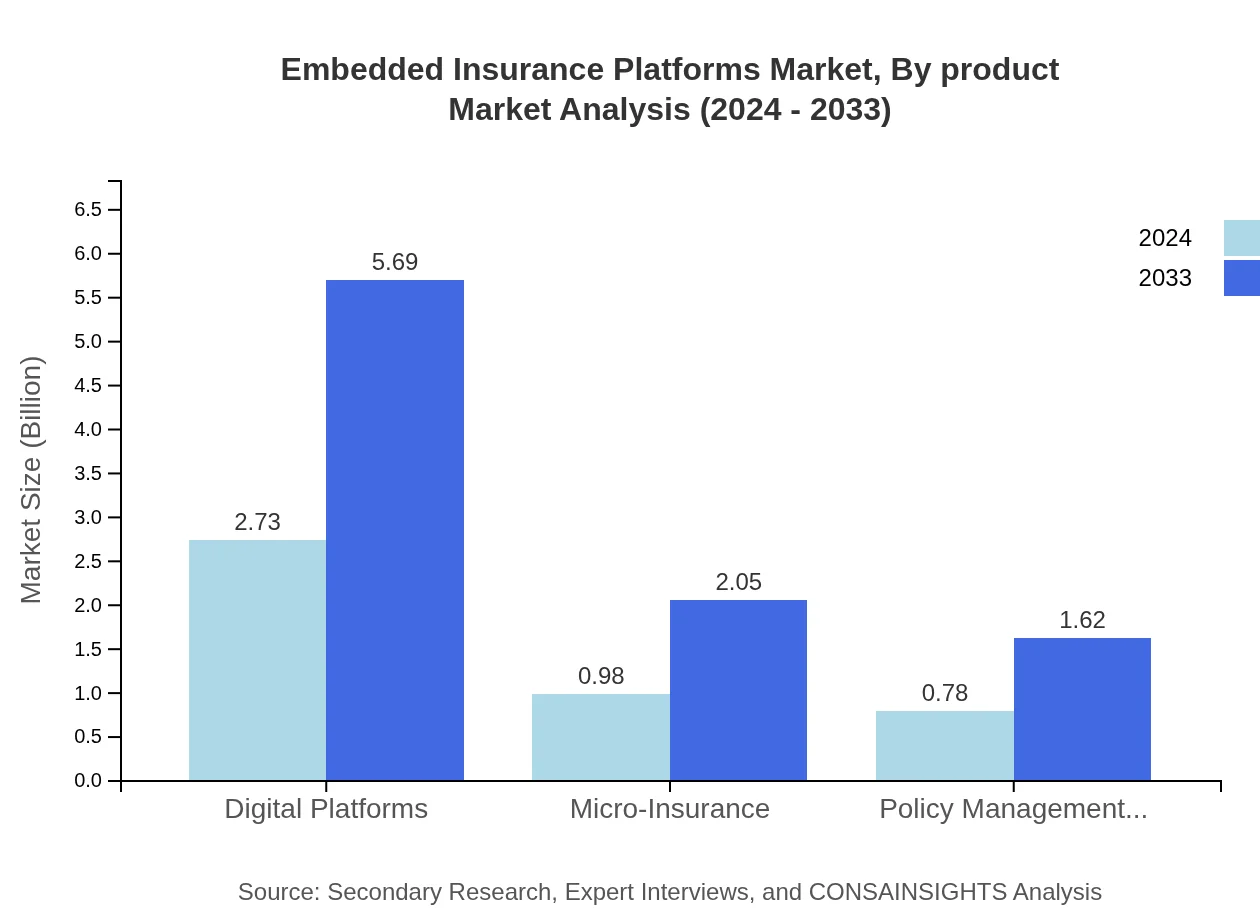

Embedded Insurance Platforms Market Analysis By Product

The product-based segmentation of the Embedded Insurance Platforms market includes key segments such as Digital Platforms, Micro-Insurance, and Policy Management Tools. Digital Platforms are prominent, supported by a market size growth from 2.73 units in 2024 to 5.69 units in 2033 with a steady share of 60.77%, indicating their crucial role in facilitating customer engagement and seamless integration. Micro-Insurance products are witnessing similar growth trajectories, with market sizes increasing from 0.98 to 2.05 units, offering tailored, low-premium policies that cater to underserved segments. Policy Management Tools, which enhance operational efficiency and claims processing, have grown from a market size of 0.78 to 1.62 units. Collectively, these product offerings are instrumental in creating an end-to-end digital insurance ecosystem.

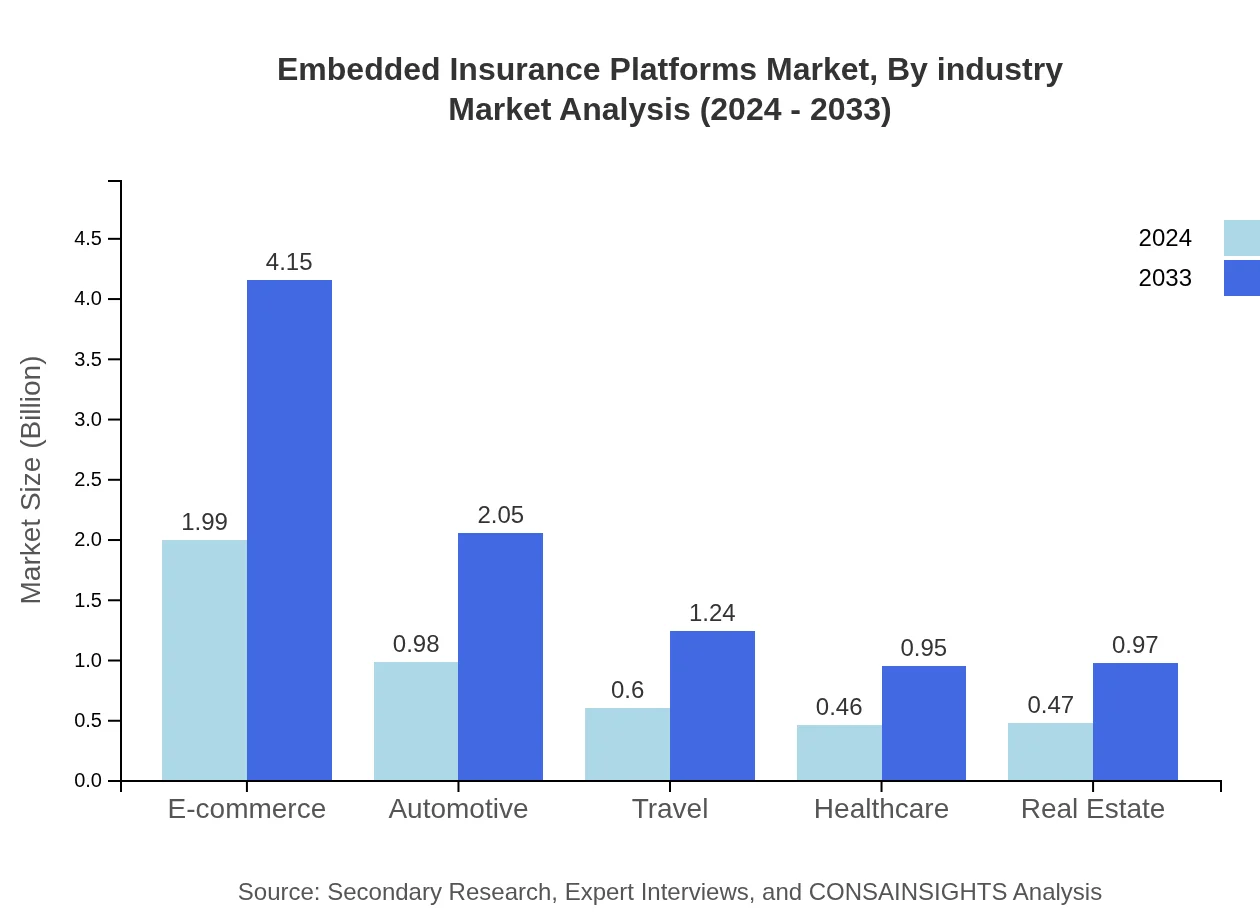

Embedded Insurance Platforms Market Analysis By Industry

Industry segmentation within the market reflects diverse verticals such as E-commerce, Automotive, Travel, Healthcare, and Real Estate. E-commerce has emerged as a robust channel with market size figures rising from 1.99 to 4.15 units and accounting for over 44% of the share, underlining its pivotal role in digital retail. In addition, the Automotive sector, Travel, Healthcare, and Real Estate segments have shown steady growth rates, supported by increasing consumer demand for integrated insurance solutions. The cross-industry approach enhances risk management while amplifying the value proposition for both customers and service providers, ensuring that insurance is embedded in the digital consumer journey.

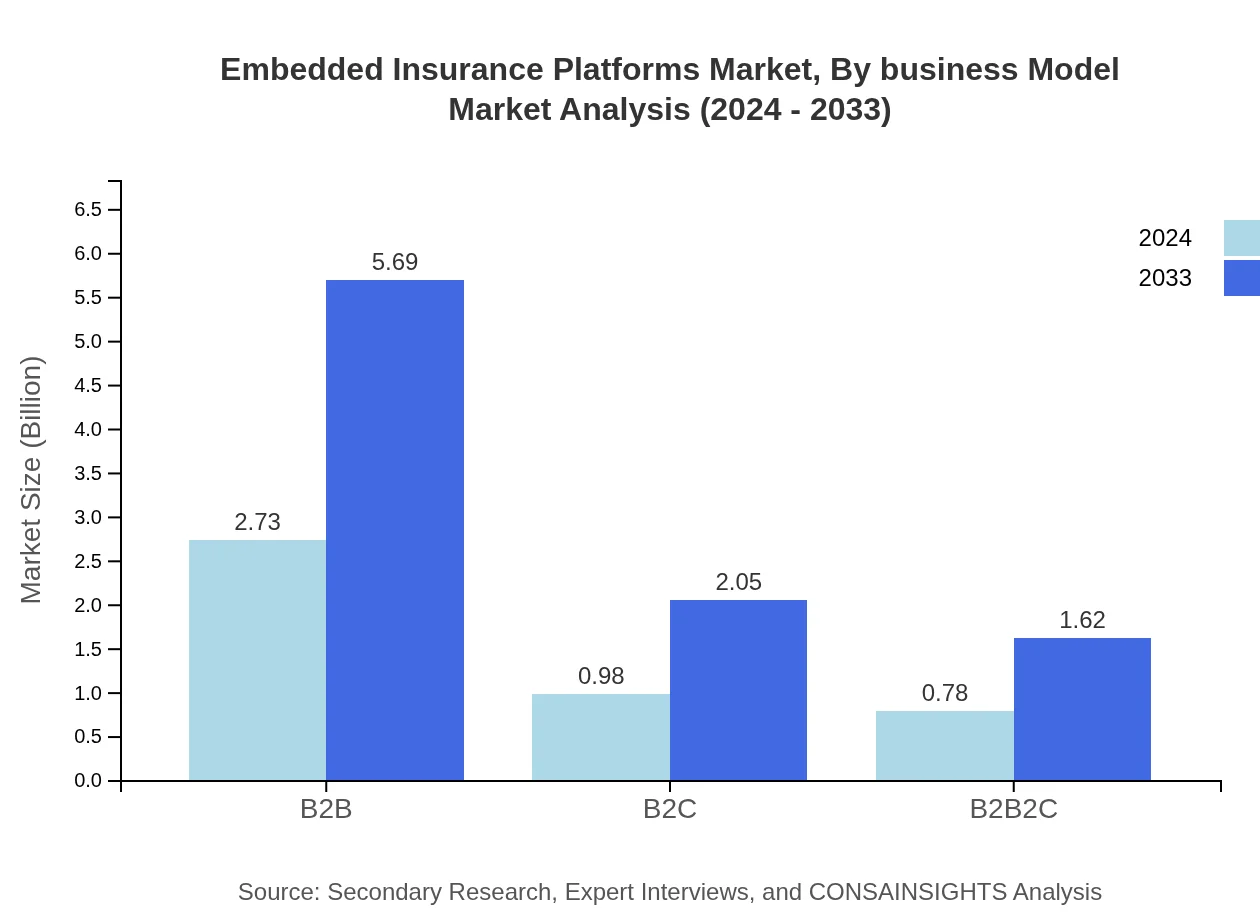

Embedded Insurance Platforms Market Analysis By Business Model

The business model segmentation highlights the distinctions between B2B, B2C, and B2B2C approaches. The B2B channel leads in size with market figures increasing from 2.73 to 5.69 units and a share of 60.77%, underscoring its relevance for large-scale partnerships and integrations with established platforms. The B2C model, while smaller at 0.98 to 2.05 units, plays a critical role in consumer-driven insurance adoption. The B2B2C model represents a hybrid strategy that efficiently combines strengths of both approaches, facilitating widespread adoption and driving market expansion through collaborative efforts between private enterprises, insurers, and digital service providers.

Embedded Insurance Platforms Market Analysis By Insurance Type

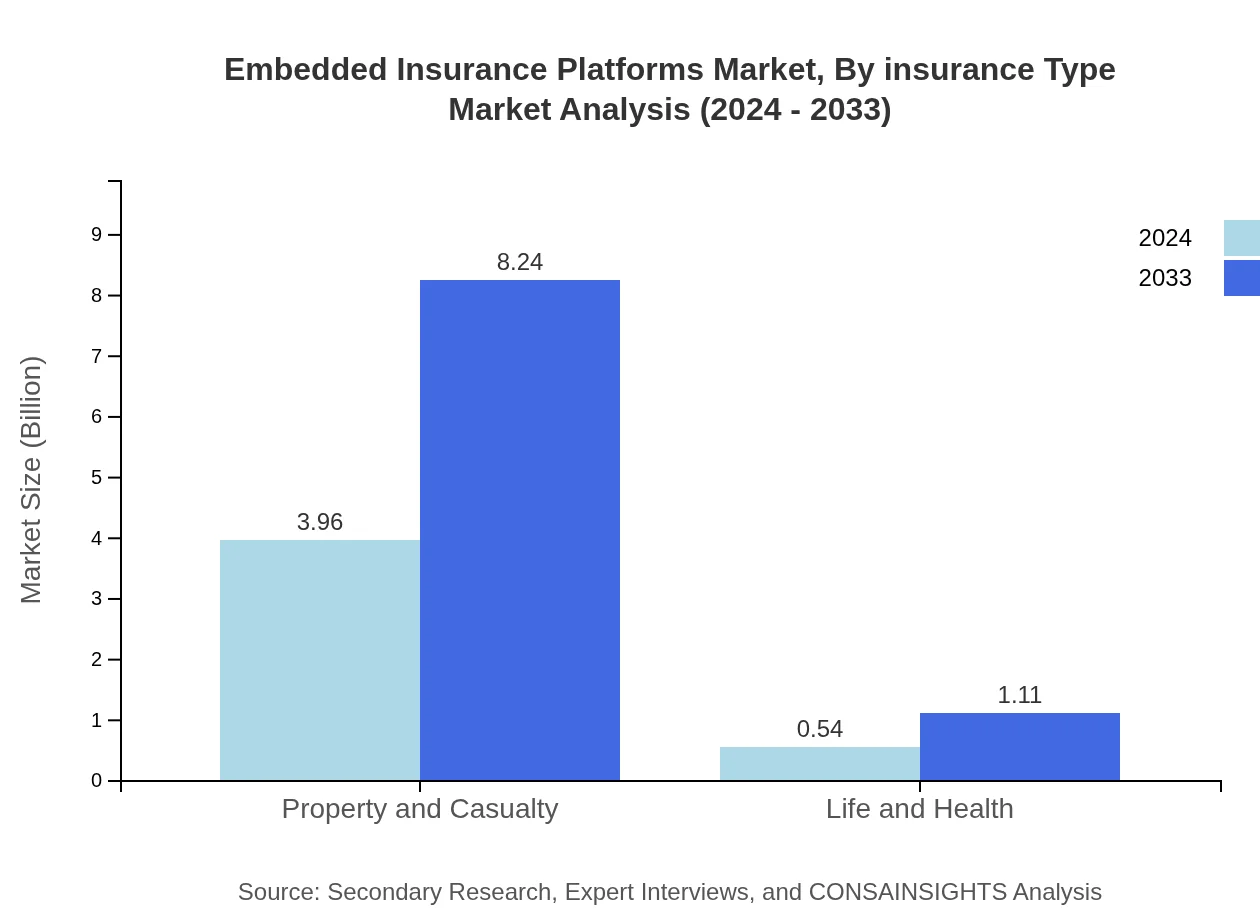

Insurance type segmentation is primarily divided into Property and Casualty and Life and Health. The Property and Casualty segment is dominant with market sizes expanding from 3.96 units in 2024 to 8.24 units in 2033, holding an impressive share of 88.09%. This dominance is due to the extensive range of applications and the high adaptability of property-centric products within digital platforms. Conversely, the Life and Health segment, although smaller, is steadily growing from 0.54 to 1.11 units, securing a share of 11.91%. These segmented approaches enable tailored solutions that address specific risk profiles, consumer needs, and regulatory requirements, ensuring a balanced growth across product lines.

Embedded Insurance Platforms Market Analysis By Technology

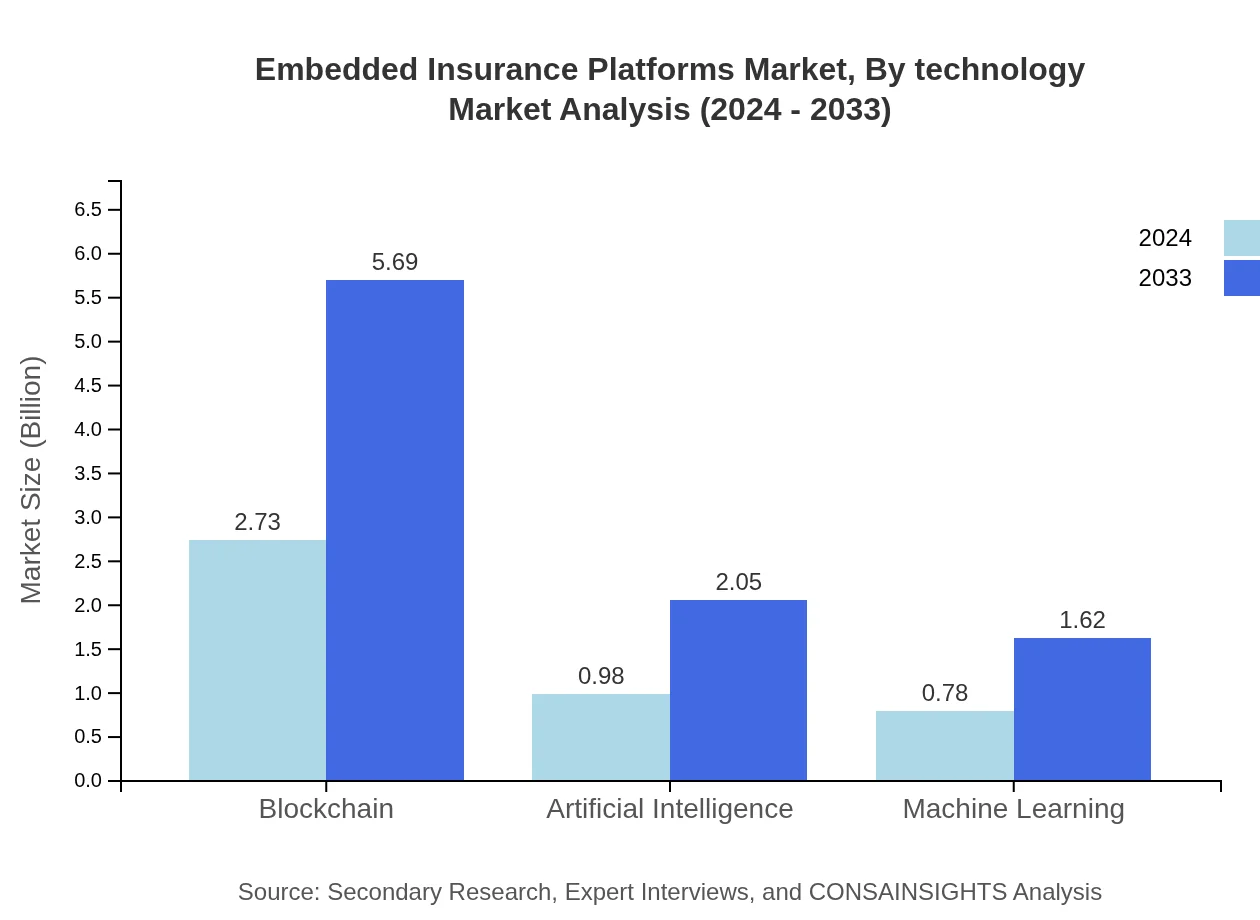

Technological segmentation underscores the impact of innovations such as Blockchain, Artificial Intelligence, and Machine Learning on market performance. Blockchain solutions have shown significant market growth with sizes increasing from 2.73 units to 5.69 units and maintaining a strong share of 60.77%, primarily due to their ability to provide transparency and security. Artificial Intelligence is another key driver, with its market size progressing from 0.98 to 2.05 units, facilitating advanced data analytics and customer insights. Machine Learning, contributing with market sizes from 0.78 to 1.62 units, enhances process automation and risk assessment. These technological innovations are not only ensuring operational efficiency but are also driving competitive differentiation within the Embedded Insurance Platforms market.

Embedded Insurance Platforms Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Embedded Insurance Platforms Industry

InsureTech Innovations:

InsureTech Innovations is a pioneer in integrating insurance solutions with digital platforms, leveraging advanced analytics and cloud technologies to streamline policies and claims. Their user-centric approach and strategic alliances have positioned them as a leader in the embedded insurance space.Embedded Solutions Inc.:

Embedded Solutions Inc. has redefined how insurance is delivered by incorporating state-of-the-art technology into traditional models. Their innovative product suite and robust platform integrations have enabled seamless insurance experiences across various digital channels.We're grateful to work with incredible clients.