Fintech As A Service

Published Date: 31 January 2026 | Report Code: fintech-as-a-service

Fintech As A Service Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Fintech As A Service market, covering current trends, growth drivers, and competitive dynamics from 2024 through 2033. It delivers insights on market size, technological innovations, product performance, regional outlooks, and strategic segmentation. The report is designed to inform stakeholders with data-backed forecasts and in‐depth analyses essential for strategic decision-making.

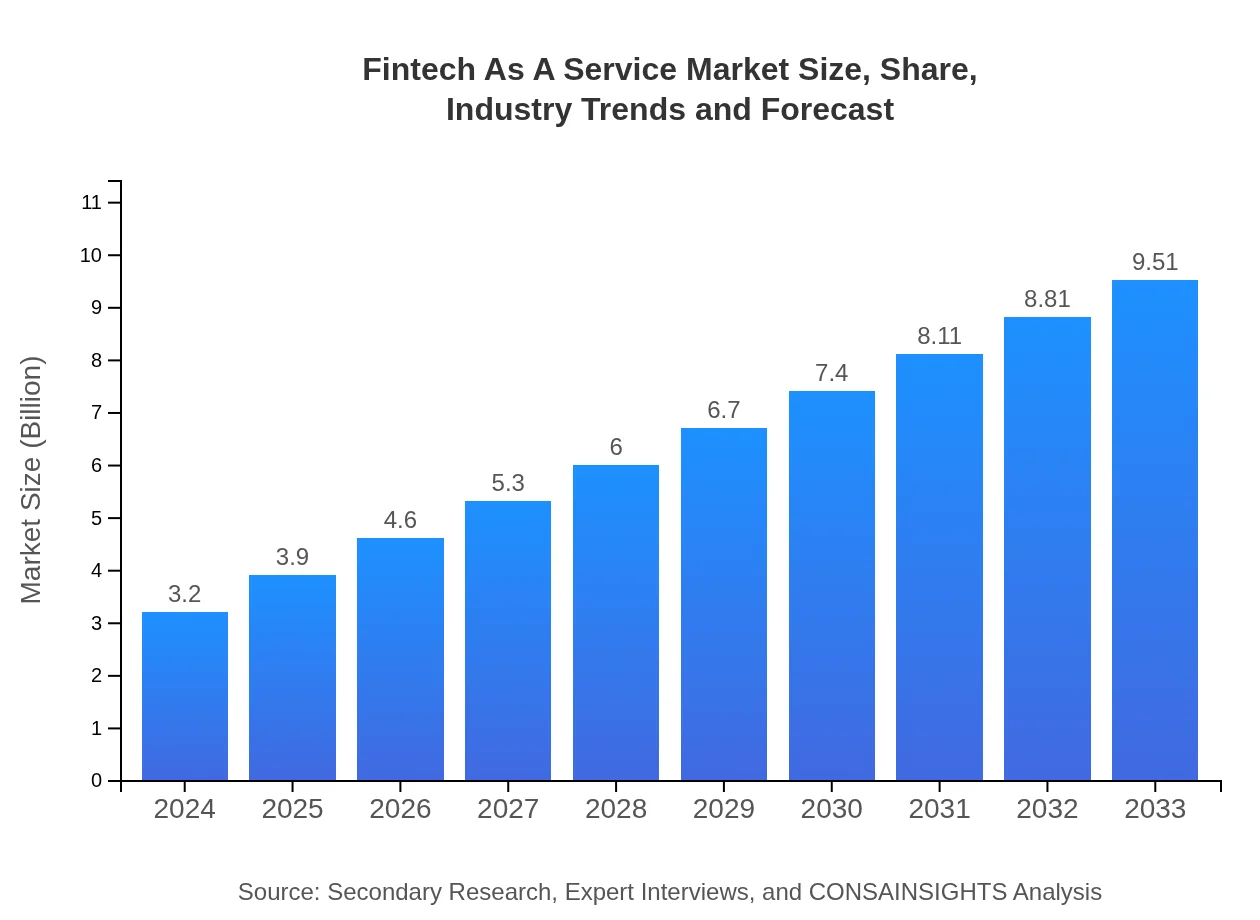

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

| 2024 Market Size | $3.20 Billion |

| CAGR (2024-2033) | 12.3% |

| 2033 Market Size | $9.51 Billion |

| Top Companies | PayTech Global, FinServe Solutions, Digital Bank Innovators |

| Last Modified Date | 31 January 2026 |

Fintech As A Service Market Overview

Customize Fintech As A Service market research report

- ✔ Get in-depth analysis of Fintech As A Service market size, growth, and forecasts.

- ✔ Understand Fintech As A Service's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Fintech As A Service

What is the Market Size & CAGR of Fintech As A Service market in 2024?

Fintech As A Service Industry Analysis

Fintech As A Service Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Fintech As A Service Market Analysis Report by Region

Europe Fintech As A Service:

Europe stands out for its mature fintech landscape, with market size forecast to rise from 0.92 in 2024 to 2.72 by 2033. Strategic investments and extensive digital banking initiatives are fostering a robust and competitive environment in the region.Asia Pacific Fintech As A Service:

In Asia Pacific, the market is witnessing vigorous growth with a transition from a 2024 market size of 0.60 to an anticipated 1.79 by 2033. The region benefits from rapid digital adoption, favorable government policies, and a surge in fintech startups, making it a fertile ground for financial service innovations.North America Fintech As A Service:

North America continues to be a leading market with strong infrastructure and technological expertise. The market is projected to expand from 1.22 in 2024 to 3.62 by 2033, driven by high consumer demand and advanced regulatory frameworks.South America Fintech As A Service:

South America exhibits steady market expansion, growing from a modest base of 0.30 in 2024 to an estimated 0.89 by 2033. Increased mobile penetration and evolving customer preferences towards digital financial solutions are key drivers in the region.Middle East & Africa Fintech As A Service:

In the Middle East and Africa, the market is nascent but promising, expected to grow from 0.16 in 2024 to 0.48 by 2033. Expansion is largely driven by increasing digital financial inclusivity and supportive economic reforms.Tell us your focus area and get a customized research report.

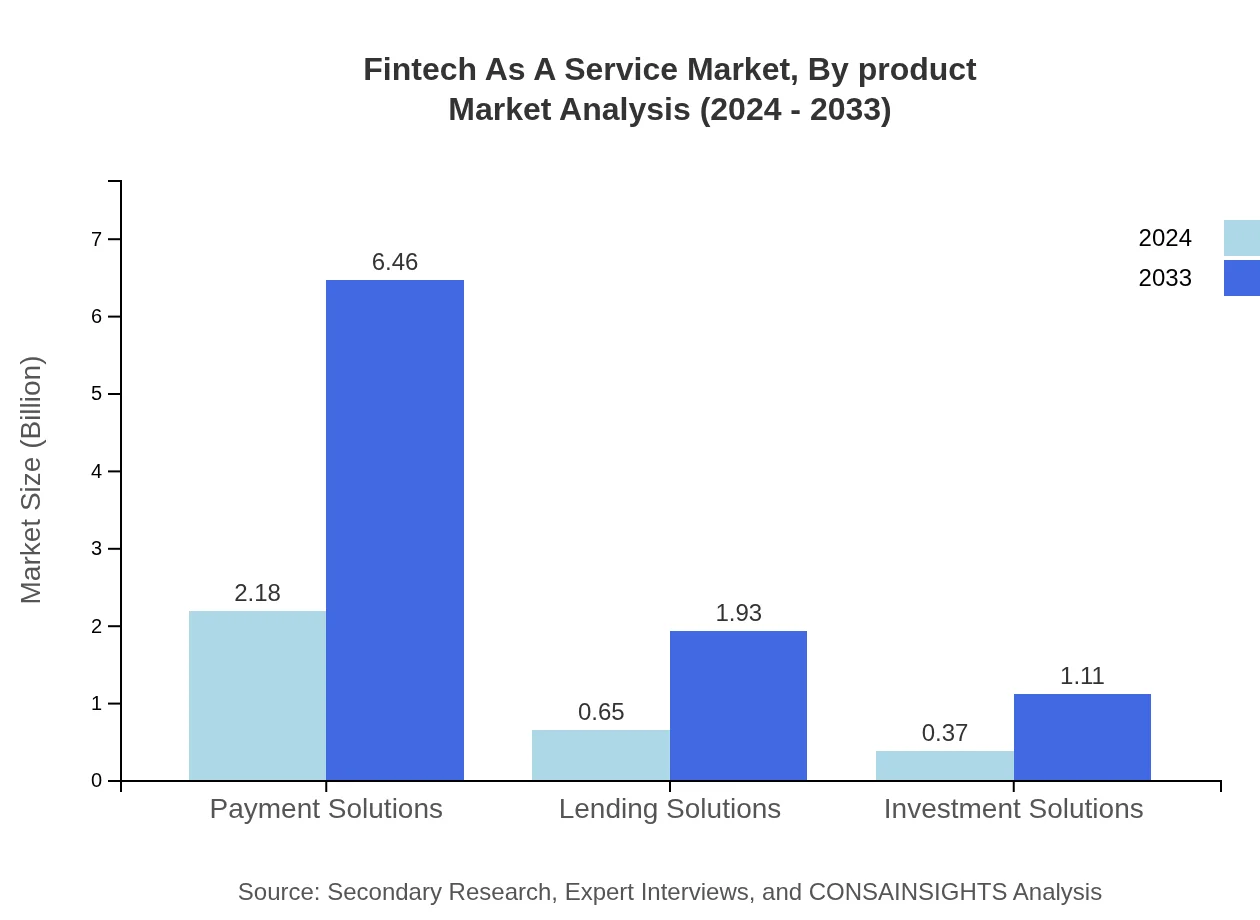

Fintech As A Service Market Analysis By Product

This segment focuses on product-driven innovations where Payment Solutions lead with strong market sizes (growing from 2.18 in 2024 to 6.46 in 2033, consistently holding a 67.98% share), accompanied by Lending Solutions and Investment Solutions. The product segment emphasizes continuous improvements in user interfaces, security, and integration capabilities that allow these products to meet diverse consumer and business needs.

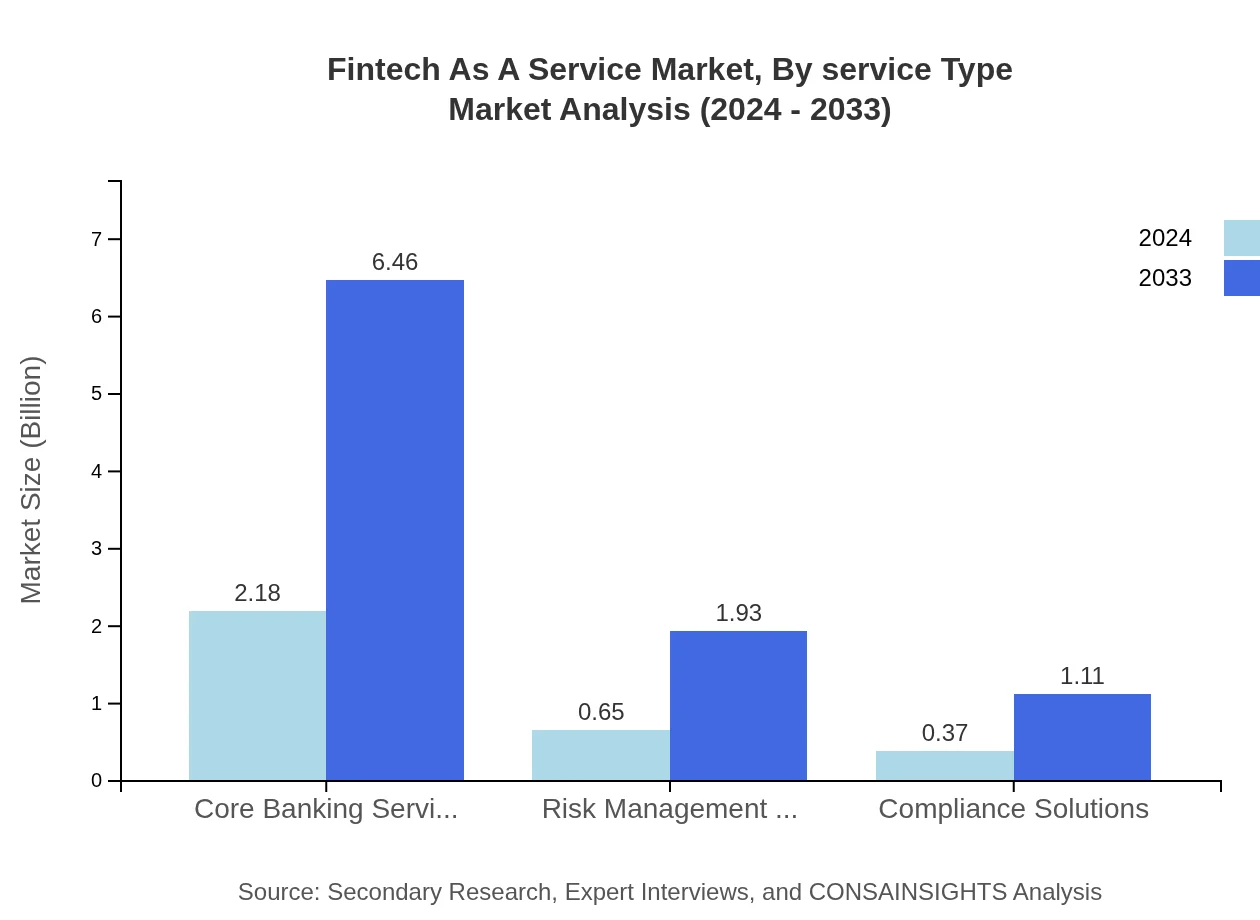

Fintech As A Service Market Analysis By Service Type

In the by-service-type segment, the emphasis is on technology-enabled services. Blockchain Technology, Artificial Intelligence, and Machine Learning are pivotal, offering solutions that are not only secure and transparent but also enhance processing speeds and customer personalization. These technological services maintain high market shares overall, ensuring the seamless performance and scalability of fintech platforms in a dynamic environment.

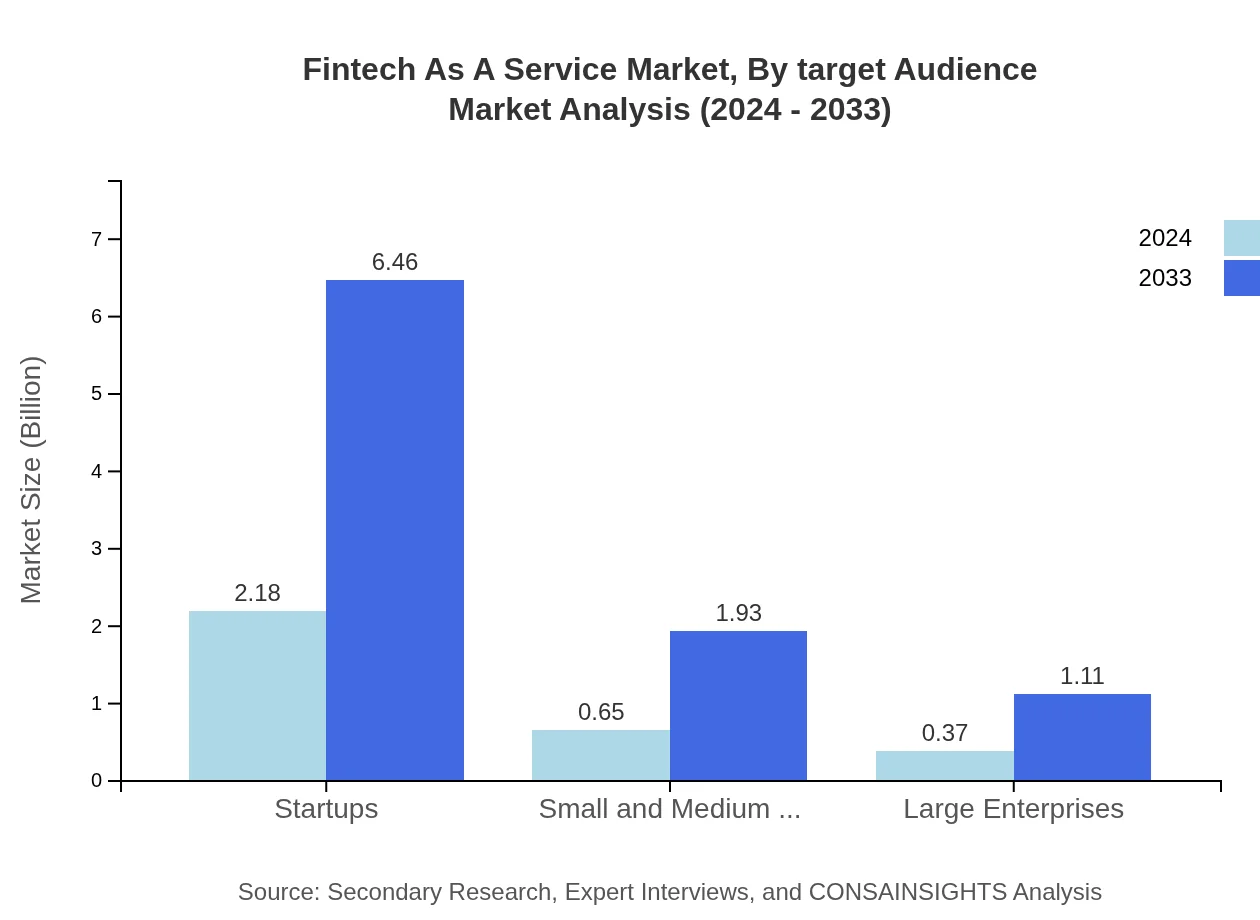

Fintech As A Service Market Analysis By Target Audience

This segment addresses the needs of different user groups. Core Banking Services, Risk Management Services, and Compliance Solutions form the corporate segment, while Startups, Small and Medium Enterprises (SMEs), and Large Enterprises represent varied customer groups. Each sub-segment is tailored to address unique challenges and requirements, ensuring that each audience receives specialized solutions designed to drive operational efficiency and strategic growth.

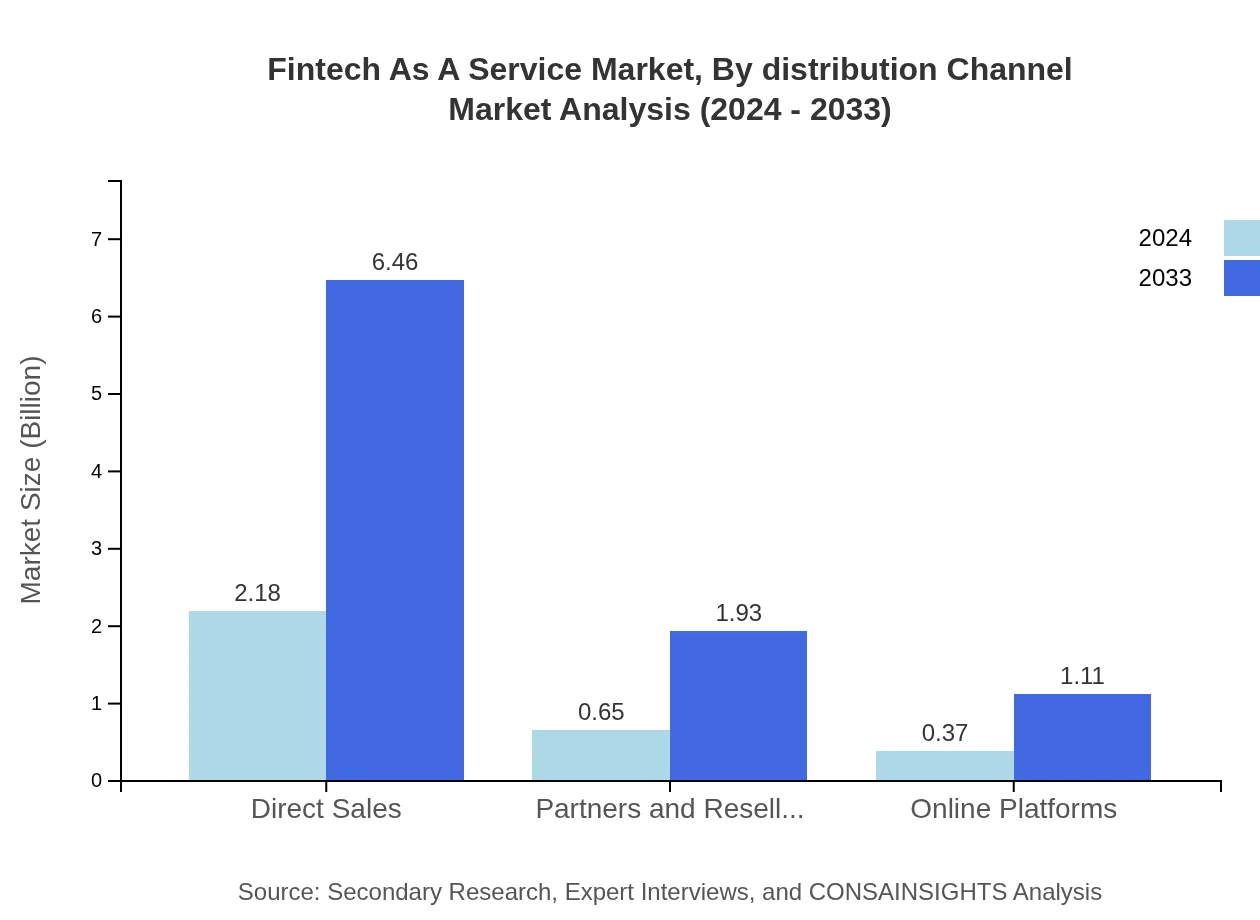

Fintech As A Service Market Analysis By Distribution Channel

The distribution channel segment analyzes how products and services reach end users. Direct Sales, Partners and Resellers, and Online Platforms are the primary channels. These channels enable fintech companies to optimize market reach and customer engagement, ensuring that services are delivered efficiently to a broad user base while fostering deeper customer relationships through tailored channel strategies.

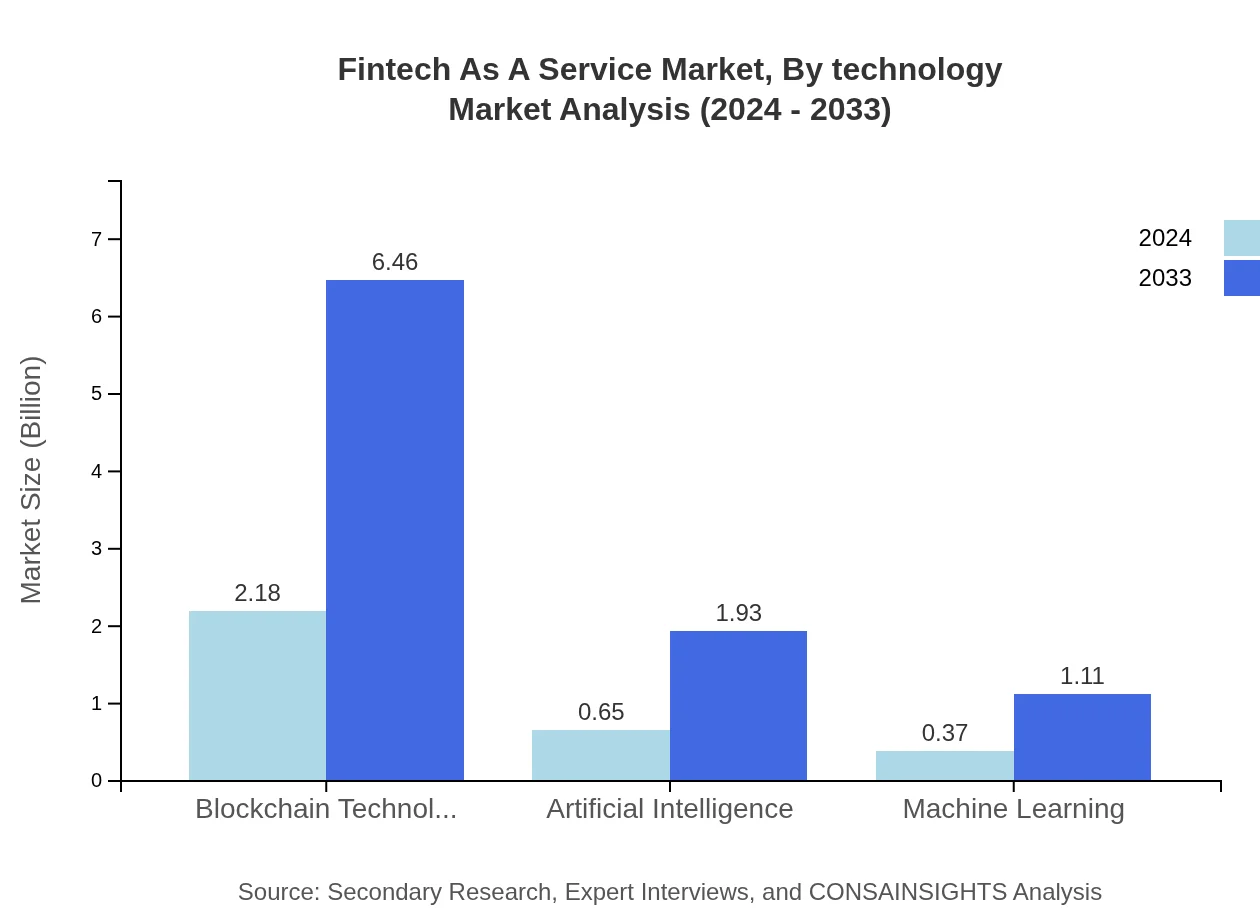

Fintech As A Service Market Analysis By Technology

Focusing on the technological backbone of fintech services, this segment highlights the integration of innovative technologies that drive operational excellence. Emerging trends in blockchain, artificial intelligence, and machine learning are revolutionizing service models, enhancing security and customer experience. This analysis underscores the importance of continued investment in technology to maintain competitive advantage and respond swiftly to market shifts.

Fintech As A Service Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Fintech As A Service Industry

PayTech Global:

PayTech Global is at the forefront of payment innovations, providing secure digital payment solutions and cloud-based services that streamline banking operations across multiple regions.FinServe Solutions:

FinServe Solutions specializes in offering integrated fintech platforms that enhance lending, investment, and risk management services, thereby driving efficiency and performance in the financial sector.Digital Bank Innovators:

Known for its cutting-edge technology integrations, Digital Bank Innovators delivers a suite of fintech solutions including AI-driven insights and blockchain-based security, setting benchmarks for industry standards.We're grateful to work with incredible clients.

FAQs

How can the fintech As A Service report help align our marketing strategy with customer adoption trends?

The report highlights customer adoption trends, detailing projected market growth from $3.2 billion with a CAGR of 12.3%. Understanding these trends enables tailored marketing strategies that resonate with evolving consumer needs and facilitates effective positioning in the competitive fintech landscape.

What product features are in highest demand according to the fintech As A Service trends?

According to current trends, demand is notably high for payment solutions projected to grow to $6.46 billion by 2033. Features enabling seamless transactions and enhanced security are essential drivers in customer preferences, particularly in a fast-evolving fintech ecosystem.

Which regions offer the best market entry and expansion opportunities in the fintech As A Service industry?

North America leads with a projected market of $3.62 billion by 2033, followed by Europe at $2.72 billion. Asia Pacific and Latin America also show promising growth, reaching $1.79 billion and $0.89 billion respectively, presenting diverse opportunities for market entry.

What emerging technologies and innovations are shaping the fintech As A Service market?

Key technologies transforming the market include artificial intelligence and blockchain, projected to grow to $1.93 billion and $6.46 billion by 2033 respectively. These innovations enhance operational efficiency, improve security, and drive competitive advantages in service delivery.

Does the fintech As A Service report include competitive landscape and market share analysis?

Yes, the report extensively covers competitive landscapes and market share analysis. This includes detailed insights into key players and their strategies, allowing businesses to understand competitive positioning and identify potential partnerships or acquisition targets.

How can executives use the fintech As A Service report to evaluate investment risks and ROI?

Executives can leverage the report's data on market size, CAGR, and segment performance to assess investment viability. By analyzing projected trends and regional growth, they can make informed decisions that strategically align with potential ROI and risk profiles.

What is the market size of fintech As A Service?

The fintech-as-a-service market is currently valued at $3.2 billion with a projected CAGR of 12.3%, indicating substantial growth potential. This market will expand, facilitated by increasing adoption of digital financial services across various segments.