India Omni Channel And Warehouse Management Systems

Published Date: 31 January 2026 | Report Code: india-omni-channel-and-warehouse-management-systems

India Omni Channel And Warehouse Management Systems Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report provides a detailed analysis of the India Omni Channel And Warehouse Management Systems market. It outlines key market trends, technological advancements, segmentation, and regional insights with forecast data from 2024 through 2033. The report delivers in‐depth insights and data-driven findings, enabling stakeholders to make informed decisions based on future market trajectories.

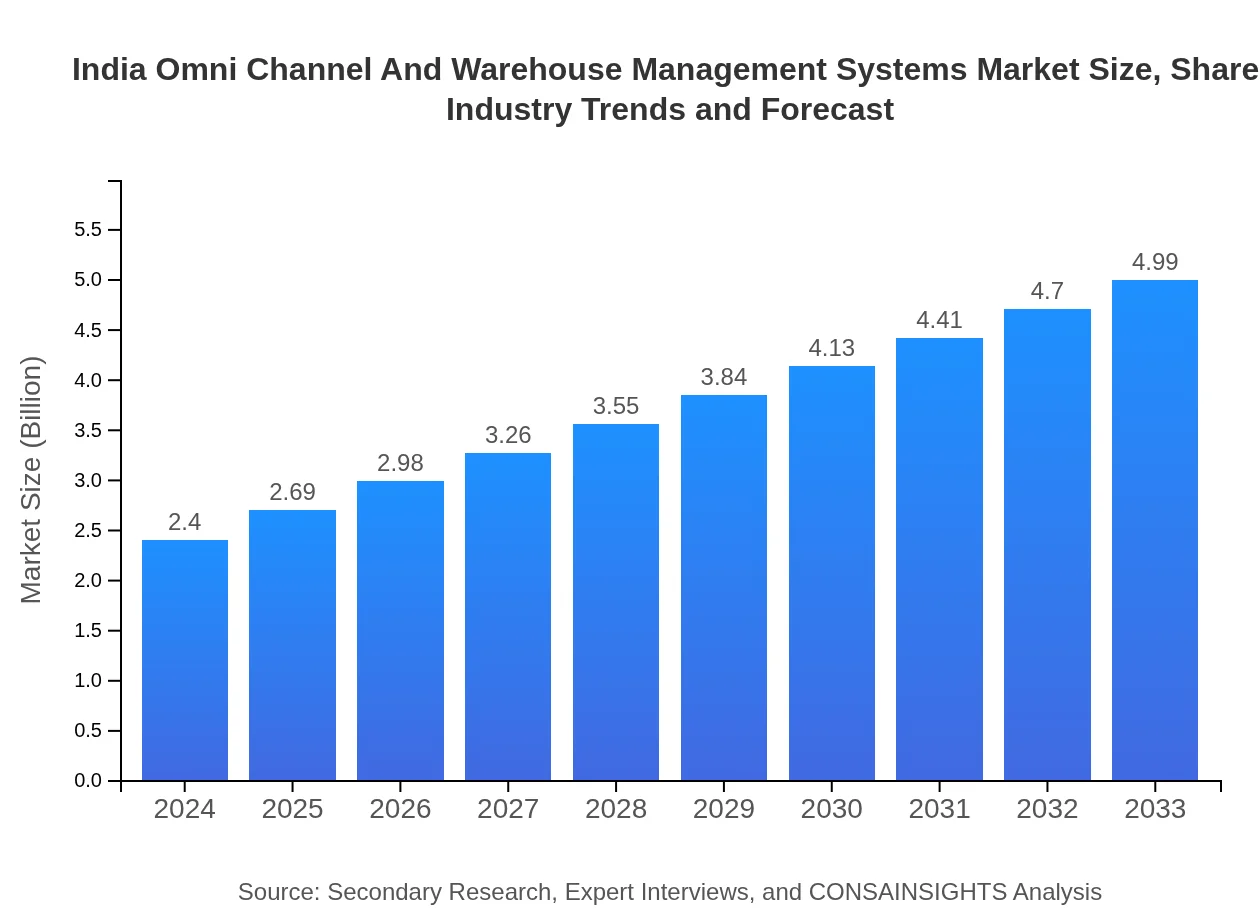

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

| 2024 Market Size | $2.40 Billion |

| CAGR (2024-2033) | 8.2% |

| 2033 Market Size | $4.99 Billion |

| Top Companies | TechInnovate Solutions, NextGen Logistics |

| Last Modified Date | 31 January 2026 |

India Omni Channel And Warehouse Management Systems Market Overview

Customize India Omni Channel And Warehouse Management Systems market research report

- ✔ Get in-depth analysis of India Omni Channel And Warehouse Management Systems market size, growth, and forecasts.

- ✔ Understand India Omni Channel And Warehouse Management Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in India Omni Channel And Warehouse Management Systems

What is the Market Size & CAGR of India Omni Channel And Warehouse Management Systems market in 2024?

India Omni Channel And Warehouse Management Systems Industry Analysis

India Omni Channel And Warehouse Management Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

India Omni Channel And Warehouse Management Systems Market Analysis Report by Region

Europe India Omni Channel And Warehouse Management Systems:

In Europe, the market is characterized by a balance between mature technological adoption and regulatory influences. With a growth from 0.68 in 2024 to 1.41 in 2033, European players are focusing on sustainability and integrated omni-channel solutions. Continuous investments in digital infrastructure further support regional market growth.Asia Pacific India Omni Channel And Warehouse Management Systems:

In the Asia Pacific region, the market is witnessing progressive growth driven by rapid urbanization and increased digital adoption. With market values rising from 0.47 in 2024 to 0.98 by 2033, the region is embracing cloud-based innovations and integrated supply chain solutions. Government initiatives promoting technological upgradation further bolster market expansion.North America India Omni Channel And Warehouse Management Systems:

North America remains a competitive market with advanced infrastructure and high consumer expectations. The market here is projected to grow substantially, moving from a size of 0.86 in 2024 to 1.80 by 2033. Innovations in automation and data analytics are key factors driving market consolidation and expansion in this region.South America India Omni Channel And Warehouse Management Systems:

The South American market, referenced here as Latin America, is in its early stages with a modest market size increase from 0.05 in 2024 to 0.10 in 2033. Despite its smaller scale, gradual digital transformation and targeted investments in omni-channel strategies are paving the way for more significant growth opportunities in the near future.Middle East & Africa India Omni Channel And Warehouse Management Systems:

The Middle East and Africa region is emerging as a promising market with a growth trajectory from 0.34 in 2024 to 0.70 by 2033. Factors such as increasing e-commerce penetration and government initiatives aimed at digitalization contribute to gradual but steady market development, with companies increasingly focusing on efficiency and scalability.Tell us your focus area and get a customized research report.

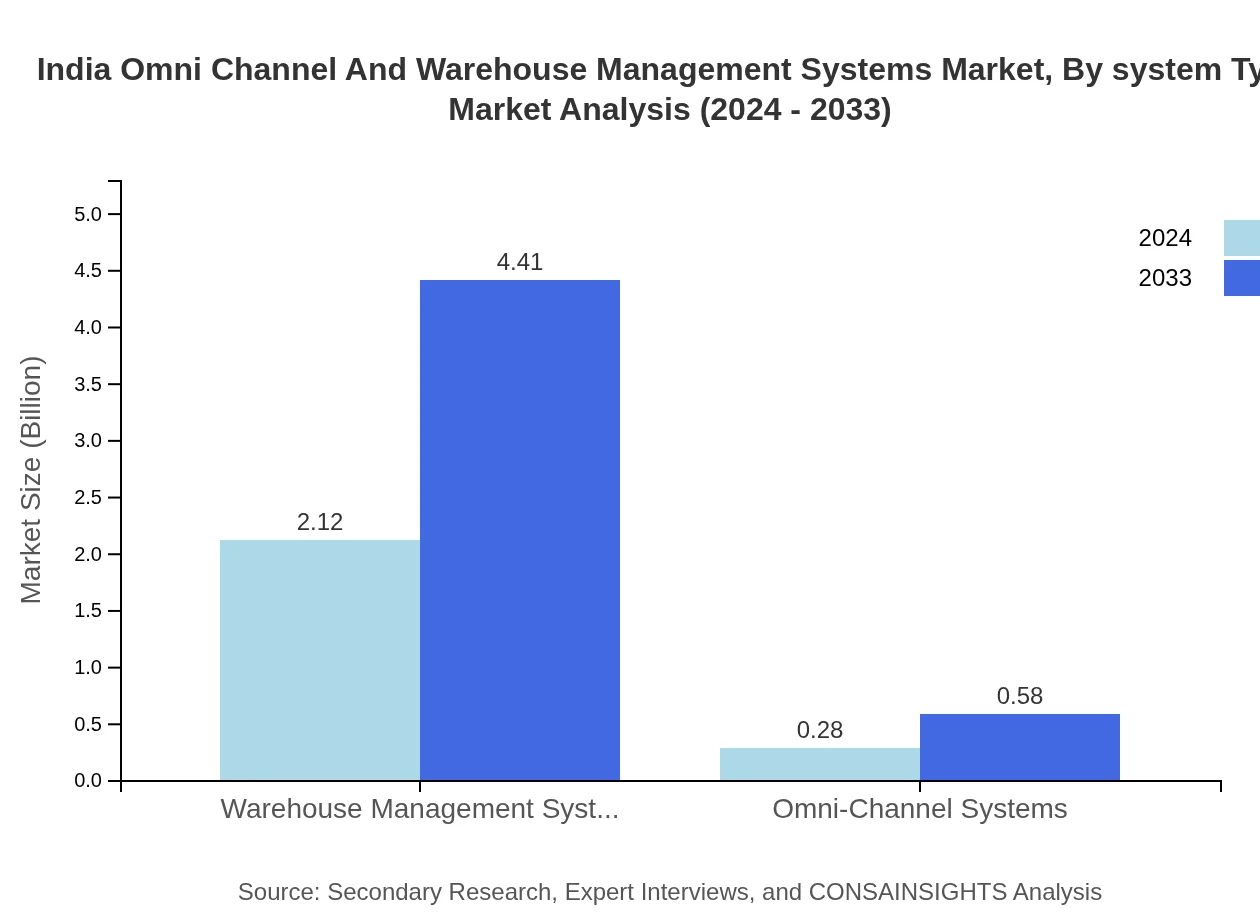

India Omni Channel And Warehouse Management Systems Market Analysis By System Type

The system type segment, which includes both omni-channel solutions and warehouse management systems, presents a dual-faceted growth model in the Indian market. Omni-channel solutions, characterized by their ability to integrate multiple retail channels, improve customer experiences, and streamline operations, are gaining significant traction. Concurrently, warehouse management systems have seen significant investments aimed at improving inventory control and operational transparency. This combined approach is evident in market data reflecting steady upward trends in both sub-segments, where efficiency and technological integration serve as the primary growth drivers. The convergence of these systems is fostering deeper market penetration and enhancing competitive differentiation among suppliers.

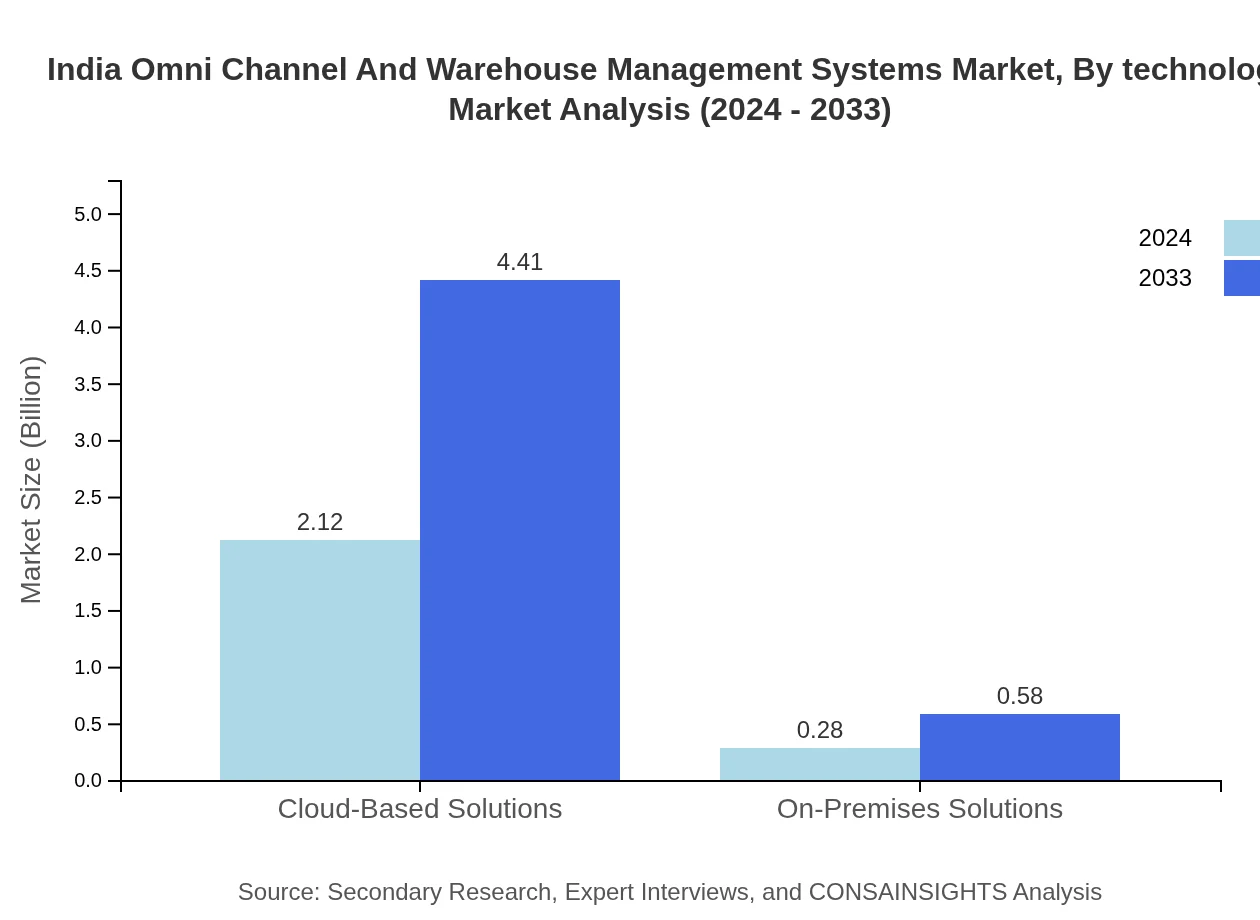

India Omni Channel And Warehouse Management Systems Market Analysis By Technology

Technological innovations form the cornerstone of growth in this market, particularly through the deployment of cloud-based solutions and on-premises systems. Cloud-based solutions are leading with a notable market size escalation from 2.12 in 2024 to 4.41 in 2033, supported by an impressive share of 88.36%. This digital shift facilitates enhanced scalability, real-time analytics, and improved disaster recovery methods. On the other hand, on-premises solutions, though representing a smaller market portion with a size increase from 0.28 to 0.58, continue to serve critical roles in operations requiring heightened security and control. This balance between cloud and on-premises technologies ensures that organizations can select solutions that best fit their operational demands and compliance requirements.

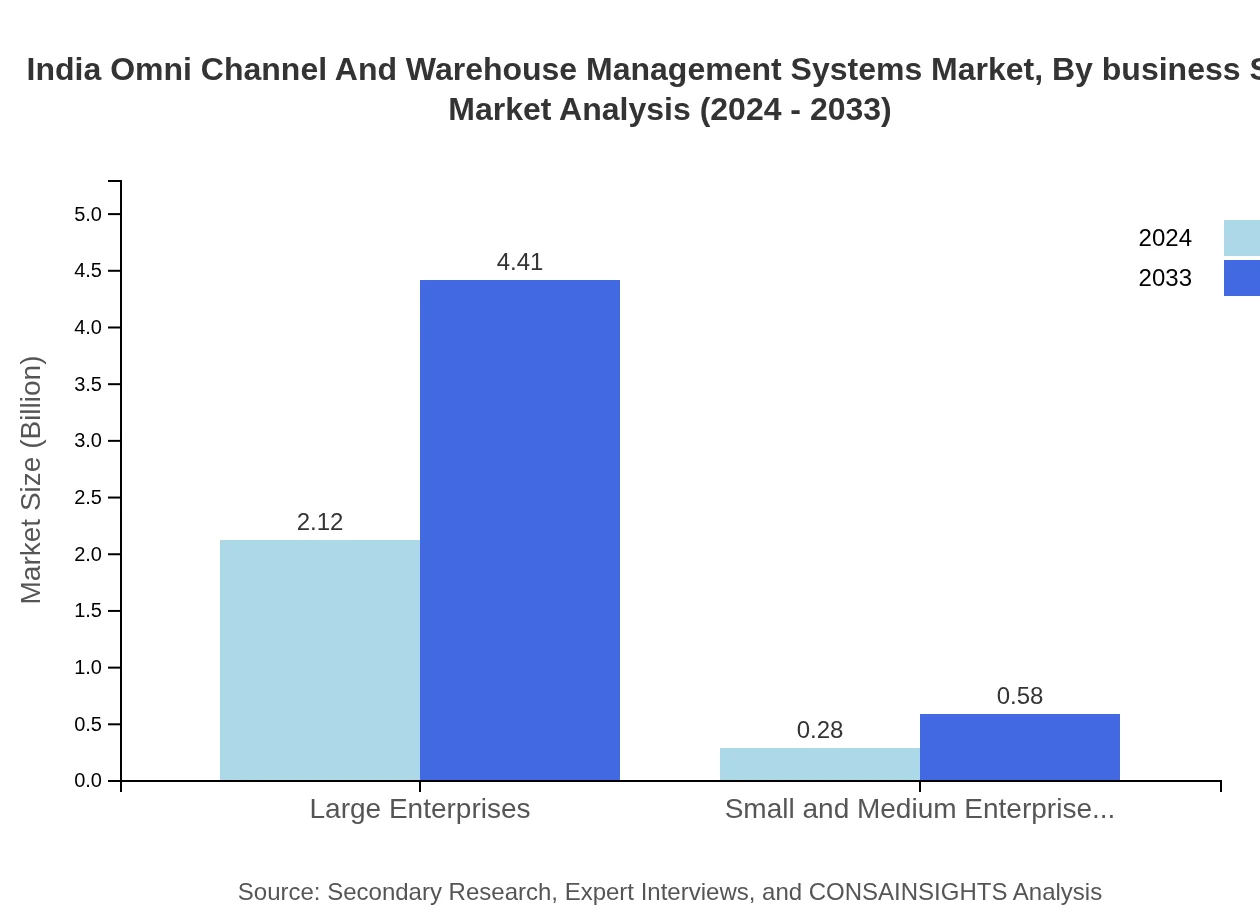

India Omni Channel And Warehouse Management Systems Market Analysis By Business Size

The business size segmentation divides the market landscape into offerings for large enterprises versus small and medium-sized enterprises (SMEs). Large enterprises, enjoying market sizes of approximately 2.12 in 2024 growing to 4.41 by 2033 and dominating with an 88.36% share, benefit from robust, integrated systems that allow them to manage complex operations. In contrast, SMEs, with a market size modestly growing from 0.28 to 0.58 and representing an 11.64% share, are gradually adopting these systems to enhance efficiency and competitiveness. This dichotomy in adoption showcases the tailored solutions that vendors are developing—large-scale implementations for corporations and more agile, cost-effective versions for smaller businesses.

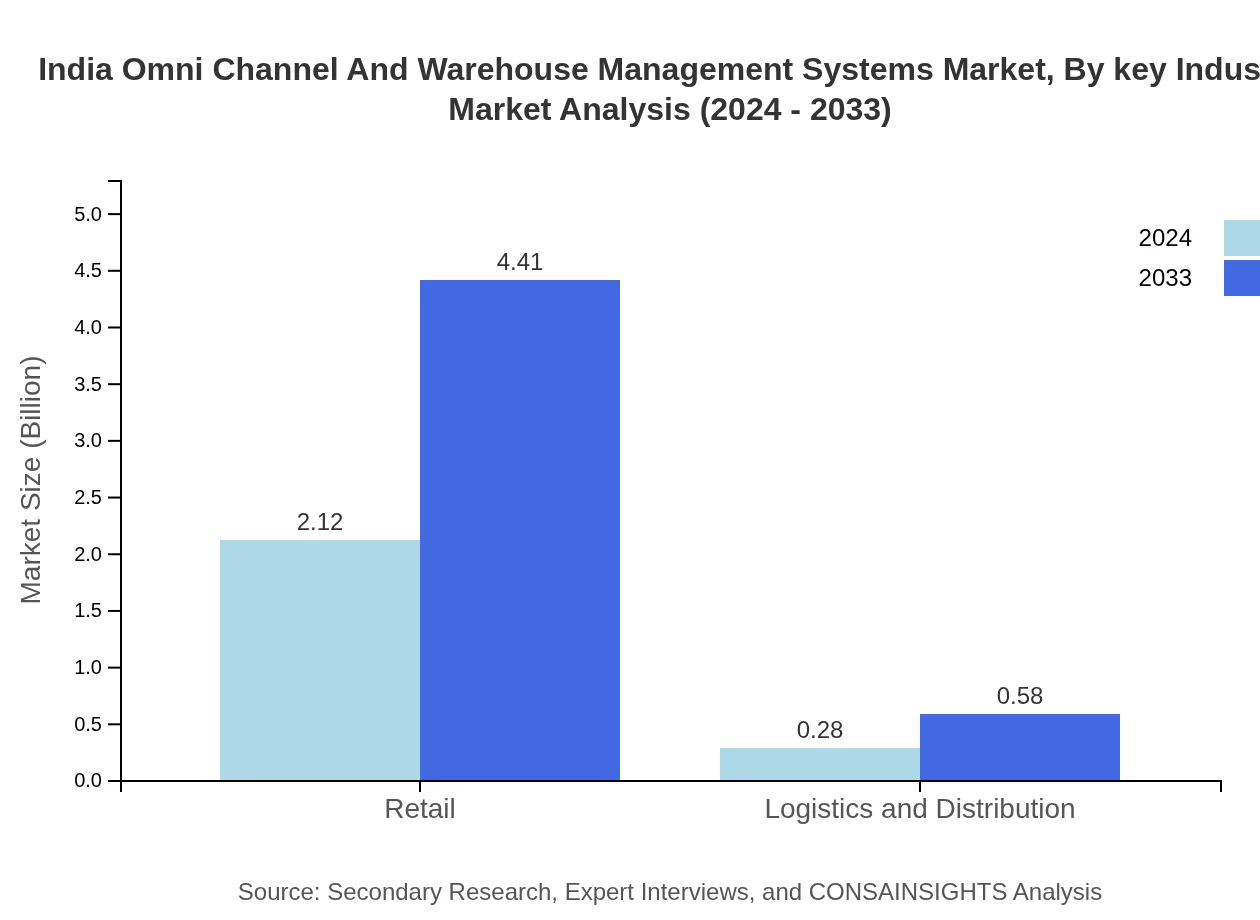

India Omni Channel And Warehouse Management Systems Market Analysis By Key Industry

Key industry analysis delves into crucial sectors such as retail and logistics and distribution. The retail segment, experiencing a consistent market size growth from 2.12 in 2024 to 4.41 in 2033 with an 88.36% share, underscores the vital role integrated management systems play in modern consumer engagement and inventory management. Similarly, the logistics and distribution sector, although smaller in scale with a market size expansion from 0.28 to 0.58 and an 11.64% share, is essential for ensuring timely and efficient supply chain operations. These industry-specific segments illustrate distinct challenges and opportunities, emphasizing the necessity for specialized solutions that cater to individual operational environments.

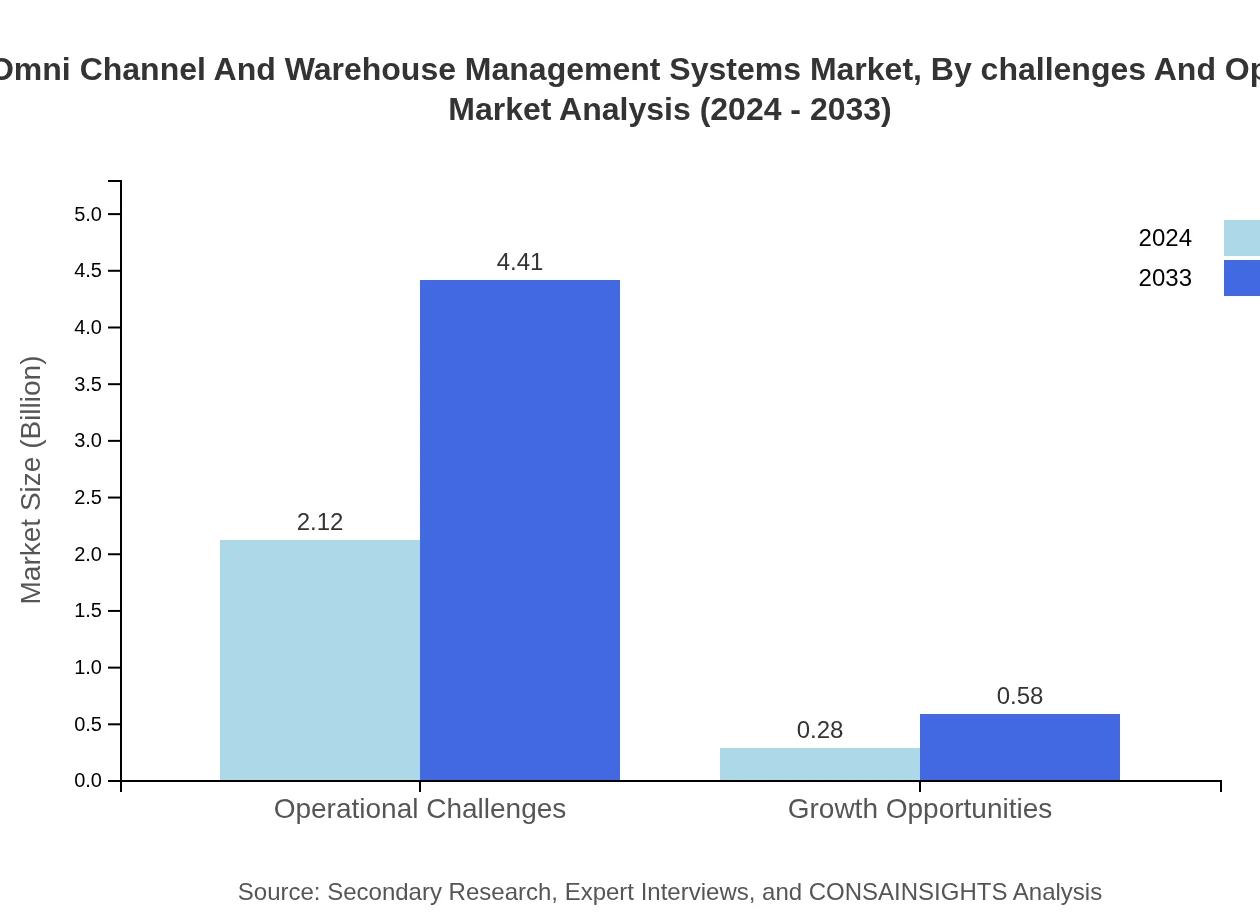

India Omni Channel And Warehouse Management Systems Market Analysis By Challenges And Opportunities

In this segment, the focus is on the dual aspects of operational challenges and growth opportunities. Operational challenges, with market sizes moving from 2.12 in 2024 to 4.41 in 2033 and capturing an 88.36% share, include issues like system integration complexities, cyber security risks, and the need for continuous technological updates. Conversely, the growth opportunities segment, though representing a smaller portion with a market size of 0.28 in 2024 growing to 0.58 by 2033 and an 11.64% share, highlights areas where market innovations, strategic investments, and regulatory reforms have the potential to drive substantial benefits. Both segments underline the importance of a balanced approach, where addressing challenges effectively can unlock pathways to capitalize on emerging opportunities.

India Omni Channel And Warehouse Management Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in India Omni Channel And Warehouse Management Systems Industry

TechInnovate Solutions:

TechInnovate Solutions is a pioneering leader in digital transformation, offering state-of-the-art omni-channel and warehouse management systems. Their innovative suite of products integrates cloud-based technology with robust analytics, ensuring operational excellence across diverse market segments.NextGen Logistics:

NextGen Logistics has established itself as a market behemoth through its comprehensive systems designed for supply chain optimization. Known for its agile solutions and responsive customer service, the company continues to drive industry advancements in warehouse management and omni-channel integration.We're grateful to work with incredible clients.

FAQs

How can the India Omni-Channel and Warehouse Management Systems Report help align our marketing strategy with customer adoption trends?

The India Omni-Channel and Warehouse Management Systems market is projected at $2.4 billion with a CAGR of 8.2% until 2033. Understanding customer adoption trends from this report helps in tailoring marketing strategies to meet evolving consumer preferences and market demands.

What product features are in highest demand according to the India Omni-Channel and Warehouse Management Systems trends?

Cloud-based solutions dominate this market, comprising 88.36% share in 2024. Emerging trends indicate an increasing demand for advanced analytics features, integration capabilities, and user-friendly interfaces that enhance operational efficiencies across supply chains.

Which regions offer the best market entry and expansion opportunities in the India Omni-Channel and Warehouse Management Systems industry?

In 2024, North America and Europe present significant opportunities, expected to grow to $1.8 billion and $1.41 billion by 2033 respectively. The Asia Pacific region also shows robust growth potential, with market sizes projected to reach $0.98 billion.

What emerging technologies and innovations are shaping the India Omni-Channel and Warehouse Management Systems market?

Innovations such as AI-driven predictive analytics, IoT integration, and real-time inventory management are pivotal. These technologies enhance operational efficiencies and customer experiences, driving adoption within enterprises to meet evolving marketplace demands.

Does the Report include competitive landscape and market share analysis?

Yes, the report provides an in-depth competitive landscape analysis, highlighting leading market players, their market share, and strategic initiatives. This insights enable companies to identify competitive trends and position themselves effectively in the marketplace.

How can executives use the Report to evaluate investment risks and ROI?

Executives can utilize the report's market size and growth forecast data, including a CAGR of 8.2%, to gauge potential investment risks. By analyzing market trends and competitive landscapes, firms can forecast ROI based on strategic placement in high-growth areas.

What are the main market segments identified in the India Omni-Channel and Warehouse Management Systems market?

Key segments include Cloud-Based Solutions, accounting for 88.36% of market share and projected growth from $2.12 billion in 2024 to $4.41 billion by 2033. Both Large Enterprises and SMEs are vital, with similar growth trajectories expected in operational challenges.