Legionella Testing Market Report

Published Date: 31 January 2026 | Report Code: legionella-testing

Legionella Testing Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Legionella Testing market from 2023 to 2033, including market size, trends, segmentation, regional insights, and leading players in the industry.

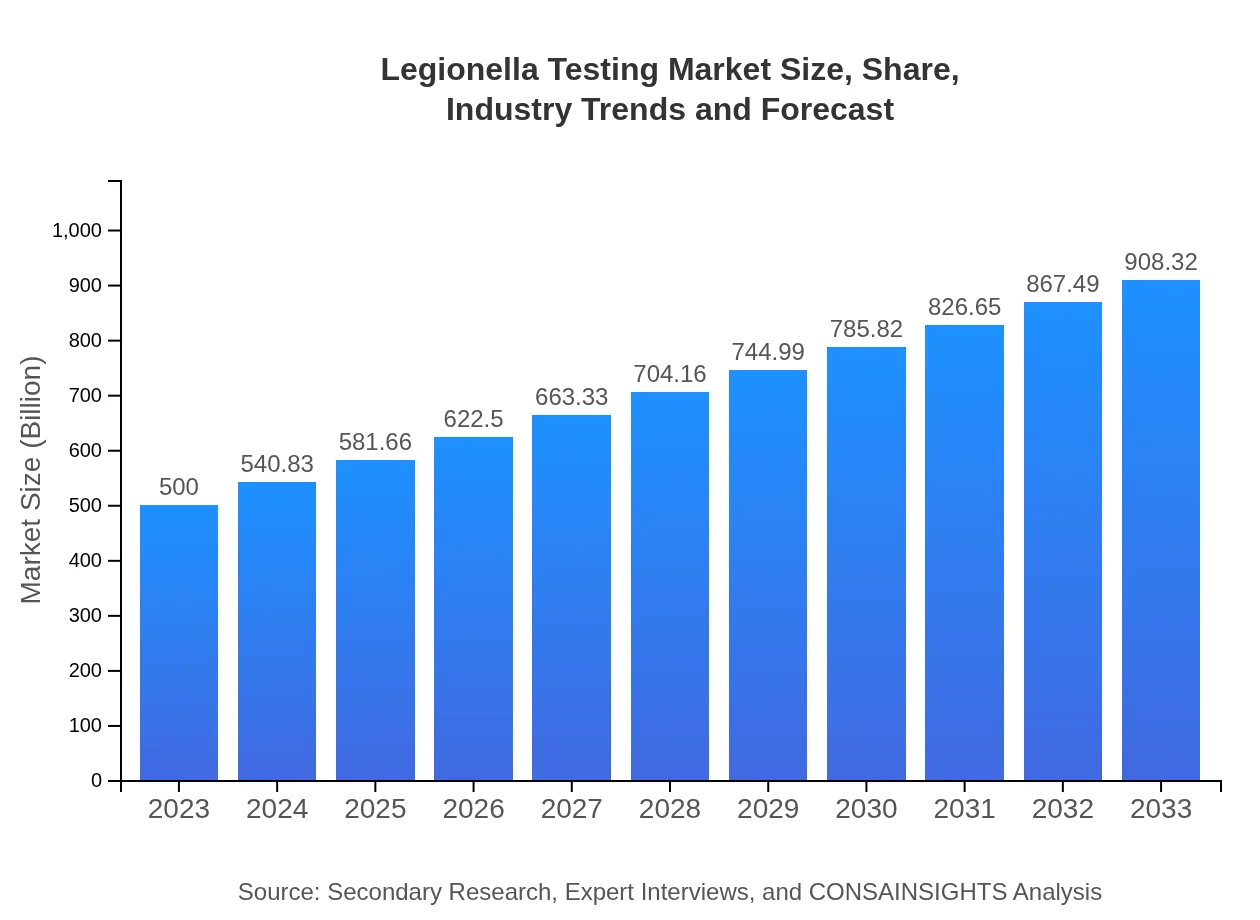

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $500.00 Million |

| CAGR (2023-2033) | 6% |

| 2033 Market Size | $908.32 Million |

| Top Companies | Thermo Fisher Scientific, Abbott Laboratories, Merck Group, Danaher Corporation, Hach Company |

| Last Modified Date | 31 January 2026 |

Legionella Testing Market Overview

Customize Legionella Testing Market Report market research report

- ✔ Get in-depth analysis of Legionella Testing market size, growth, and forecasts.

- ✔ Understand Legionella Testing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Legionella Testing

What is the Market Size & CAGR of Legionella Testing market in 2023?

Legionella Testing Industry Analysis

Legionella Testing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Legionella Testing Market Analysis Report by Region

Europe Legionella Testing Market Report:

The European Legionella Testing market is expected to increase from $154.50 million in 2023 to $280.67 million in 2033. Rising awareness of Legionnaires' disease prevalence and compliance with the EU water quality directives are pivotal factors driving this growth.Asia Pacific Legionella Testing Market Report:

In the Asia Pacific region, the Legionella Testing market is anticipated to grow from $99.50 million in 2023 to $180.76 million by 2033. This growth will be driven by increasing industrialization, urbanization, and awareness of public health concerns, particularly in countries like China and India.North America Legionella Testing Market Report:

North America accounted for the largest share in 2023, valued at $162 million, growing to $294.29 million by 2033. The region’s stringent regulations regarding water safety in healthcare settings contribute significantly to the market's growth, alongside advancements in testing technologies.South America Legionella Testing Market Report:

The South American market is set to expand from $34.70 million in 2023 to $63.04 million by 2033. Growing emphasis on water safety and environmental protection initiatives is boosting demand for Legionella testing in the region, particularly in Brazil and Argentina.Middle East & Africa Legionella Testing Market Report:

This region's market is projected to grow from $49.30 million in 2023 to $89.56 million by 2033. Increasing investment in public health initiatives and infrastructure development in countries like UAE and South Africa is promoting the demand for effective Legionella testing.Tell us your focus area and get a customized research report.

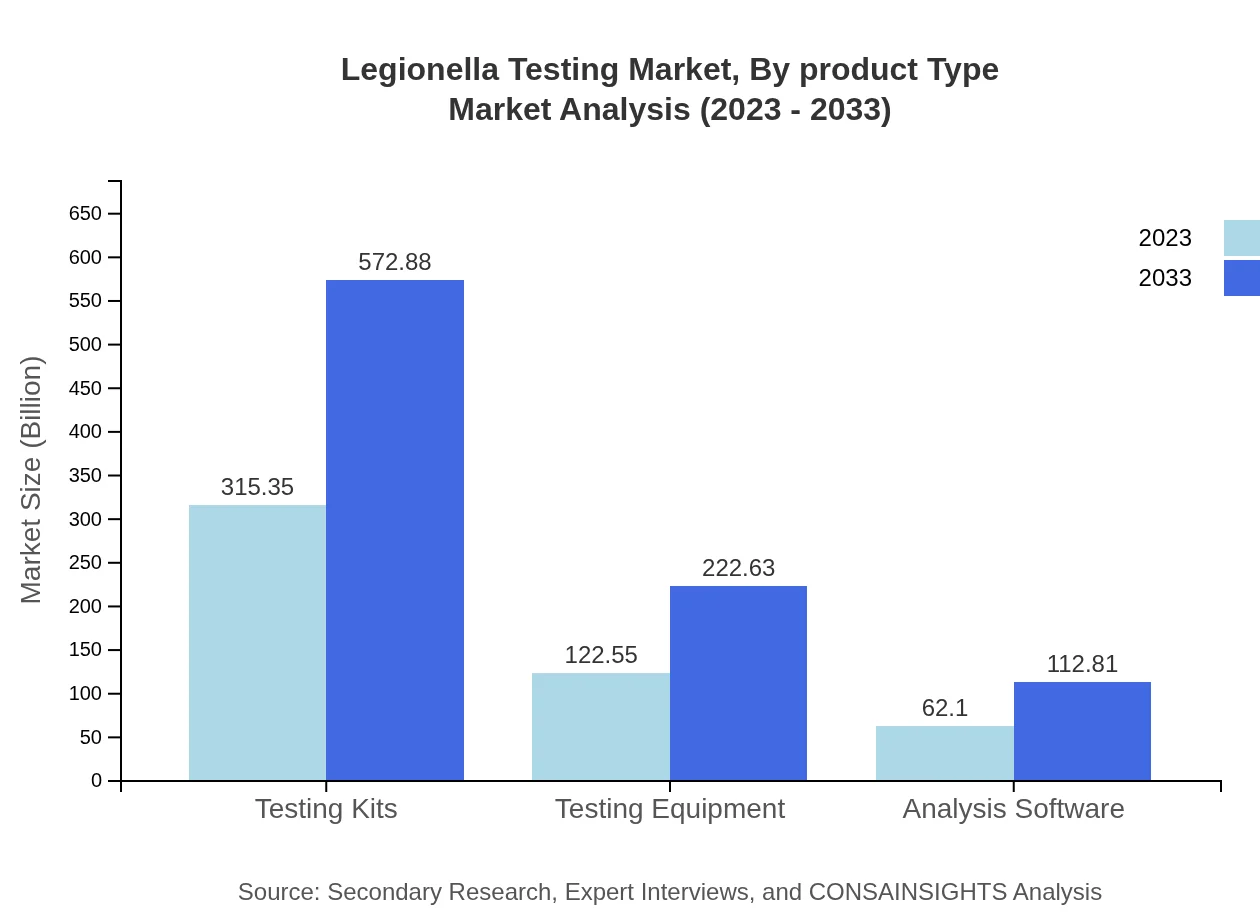

Legionella Testing Market Analysis By Product Type

The Legionella Testing market by product type includes testing kits and equipment, both of which are crucial in various testing environments. In 2023, testing kits dominate with a market size of $315.35 million, projected to reach $572.88 million by 2033. Testing equipment, while leading in importance, shows a smaller size of $122.55 million in 2023, increasing to $222.63 million by 2033.

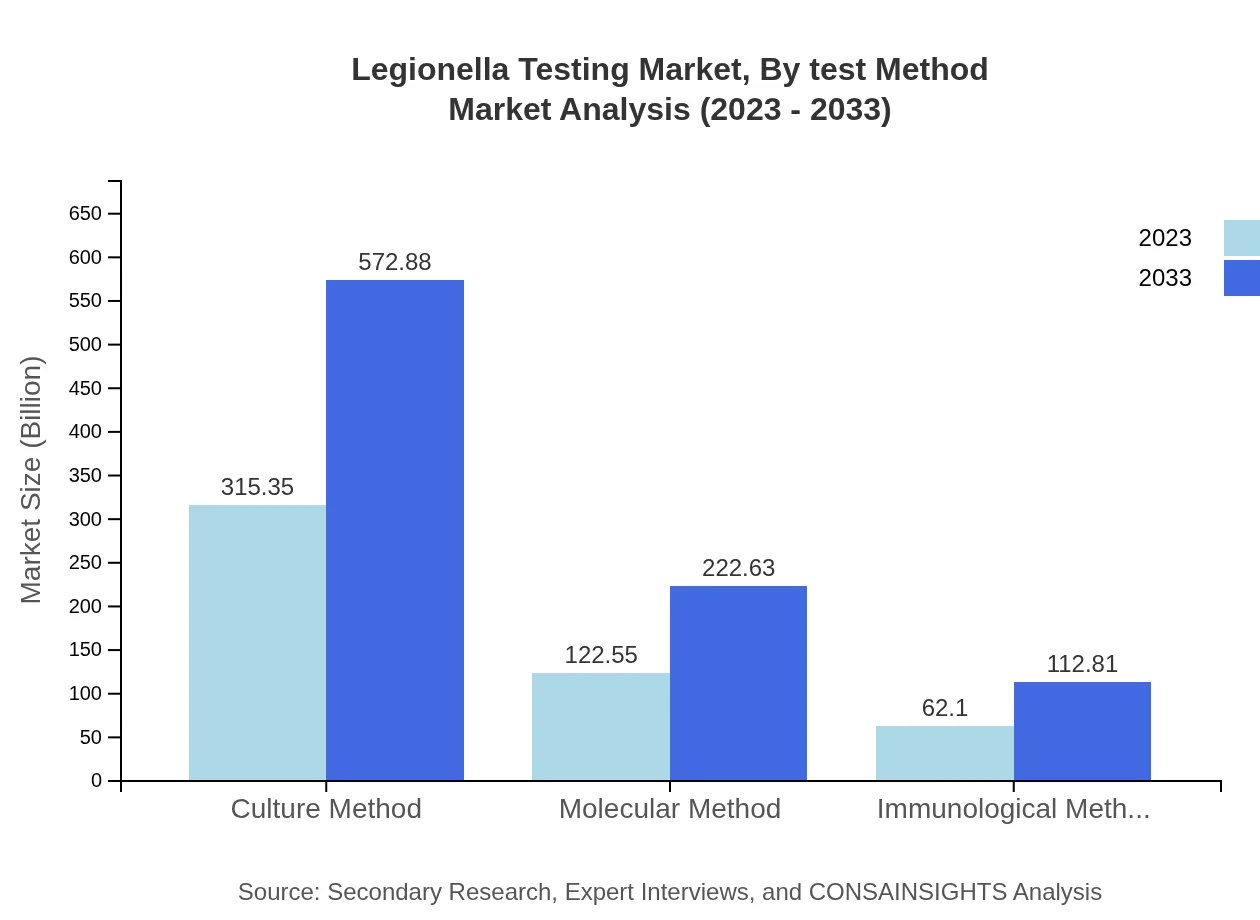

Legionella Testing Market Analysis By Test Method

Market analysis by test methods reveals that the culture method remains prominent, holding a size of $315.35 million in 2023 and projected to grow to $572.88 million by 2033. Molecular methods also show significant growth potential, starting at $122.55 million in 2023 and reaching $222.63 million by 2033.

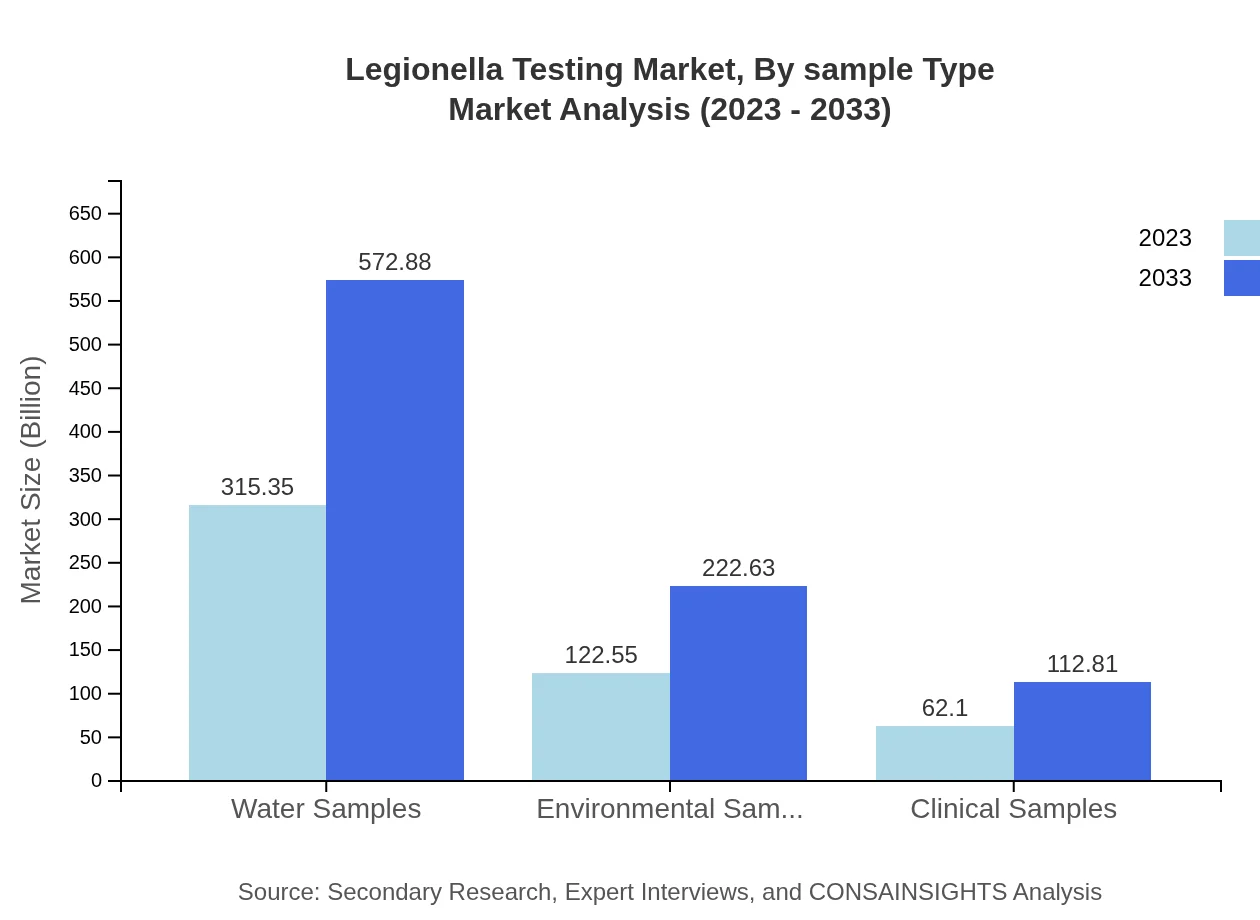

Legionella Testing Market Analysis By Sample Type

When analyzing by sample type, water samples dominate the market with a size of $315.35 million in 2023, projected to advance to $572.88 million by 2033. Environmental samples follow with $122.55 million, expected to grow to $222.63 million, reflecting a steady increase in industry demand for comprehensive testing solutions.

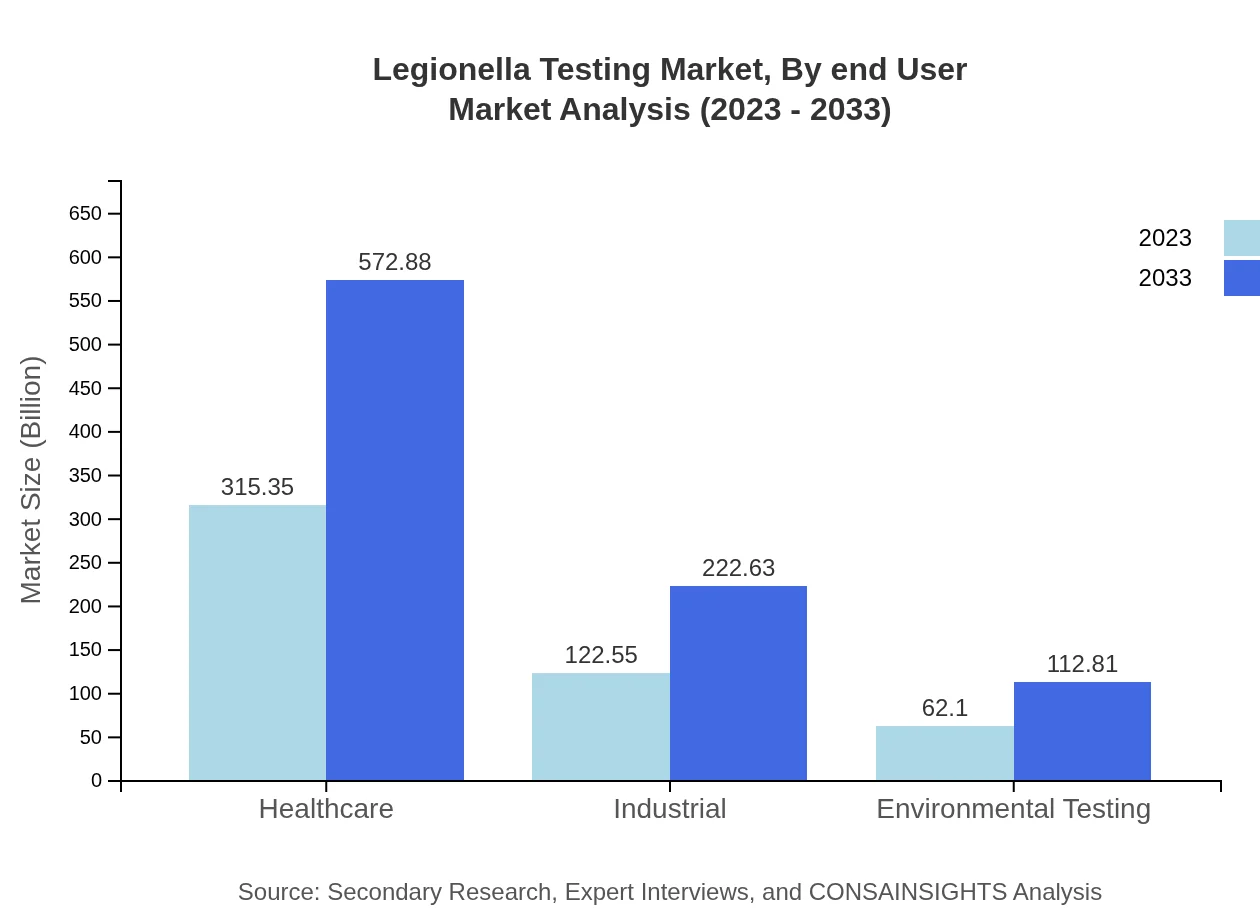

Legionella Testing Market Analysis By End User

For end-users, the healthcare sector leads with a market size of $315.35 million in 2023 and a projected growth to $572.88 million by 2033, highlighting the urgent need for effective testing in hospitals. Industrial applications will gradually expand from $122.55 million in 2023 to $222.63 million by 2033 as industry standards evolve.

Legionella Testing Market Analysis By Region

Global Legionella Testing Market, By Region Market Analysis (2023 - 2033)

The regional breakdown illustrates that North America currently accounts for the largest market share and will continue to grow significantly. Europe holds a strong position, driven by regulatory compliance. Asia Pacific shows rapid growth due to increasing public health measures, while Latin America and MEA are emerging markets with considerable growth potential.

Legionella Testing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Legionella Testing Industry

Thermo Fisher Scientific:

A leader in laboratory diagnostics, providing advanced solutions for detecting Legionella bacteria in water samples.Abbott Laboratories:

Renowned for its innovation in diagnostic tools, Abbott offers advanced testing kits and methodologies for exceptional accuracy in Legionella detection.Merck Group:

A global player committed to sustainable solutions, Merck develops testing technologies essential for monitoring Legionella in industrial and healthcare settings.Danaher Corporation:

Danaher specializes in innovative diagnostic tools, providing accuracy and efficiency pertaining to Legionella testing across various sectors.Hach Company:

Hach is instrumental in water quality analysis, offering comprehensive solutions for Legionella testing and environmental monitoring.We're grateful to work with incredible clients.

FAQs

What is the market size of legionella testing?

The legionella testing market is currently valued at $500 million, with an anticipated growth rate of 6% CAGR. By 2033, the market size is expected to significantly increase as awareness and regulations around water quality and safety expand.

What are the key market players or companies in the legionella testing industry?

The legionella testing industry features prominent companies including IDEXX Laboratories, Thermo Fisher Scientific, and Hach Company. These players are recognized for their innovation in testing technologies and commitment to providing reliable testing methods for legionella detection.

What are the primary factors driving the growth in the legionella testing industry?

Key growth factors for the legionella testing industry include increasing regulatory requirements for water safety, rising awareness of health risks associated with legionella bacteria, and technological advancements in testing that enhance accuracy and efficiency in detection.

Which region is the fastest Growing in the legionella testing?

North America is currently the fastest-growing region in the legionella testing market, with a projected rise from $162 million in 2023 to $294.29 million by 2033. Europe and Asia Pacific also show robust growth, fueled by strict regulations and growing healthcare awareness.

Does ConsaInsights provide customized market report data for the legionella testing industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the legionella testing industry. This includes in-depth analysis of market trends, key players, and forecast data to support informed decision-making.

What deliverables can I expect from this legionella testing market research project?

The deliverables from the legionella testing market research project include detailed market analysis reports, growth forecasts, competitive landscape assessments, and insights into market trends and consumer behavior, all designed to inform strategic business decisions.

What are the market trends in legionella testing?

Current market trends in legionella testing include a growing focus on proactive water safety management, increased demand for rapid testing methods, and the integration of technology in testing solutions. Companies are leveraging innovations to meet regulatory requirements effectively.