Metrology Services Market Report

Published Date: 02 February 2026 | Report Code: metrology-services

Metrology Services Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Metrology Services market, including market size, growth forecasts from 2023 to 2033, industry dynamics, regional insights, and key market players.

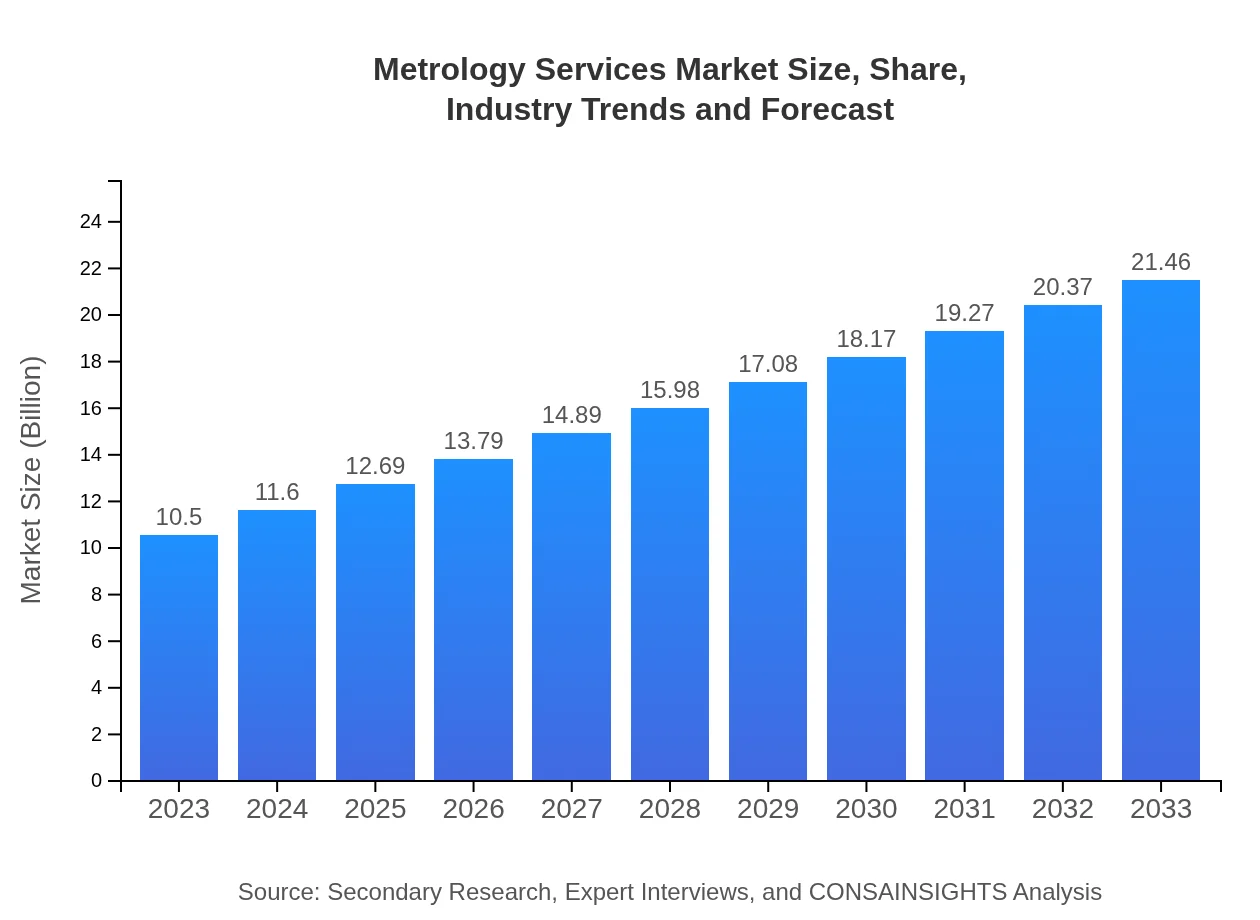

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $21.46 Billion |

| Top Companies | Hexagon AB, Zeiss Group, Fischer Technology, Inc., Mitutoyo Corporation |

| Last Modified Date | 02 February 2026 |

Metrology Services Market Overview

Customize Metrology Services Market Report market research report

- ✔ Get in-depth analysis of Metrology Services market size, growth, and forecasts.

- ✔ Understand Metrology Services's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Metrology Services

What is the Market Size & CAGR of Metrology Services market in 2023 - 2033?

Metrology Services Industry Analysis

Metrology Services Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Metrology Services Market Analysis Report by Region

Europe Metrology Services Market Report:

In Europe, the Metrology Services market is valued at $3.23 billion in 2023, with estimates of reaching $6.60 billion by 2033. European manufacturers emphasize quality control and precision due to regulatory requirements, fostering significant demand for metrology services across sectors like aerospace, automotive, and pharmaceuticals.Asia Pacific Metrology Services Market Report:

In 2023, the Asia-Pacific region's Metrology Services market is valued at $1.99 billion and projected to reach $4.07 billion by 2033. The region is driven by rapid industrialization, urbanization, and government initiatives to enhance manufacturing capabilities. Countries like China and India are at the forefront, investing in advanced technologies and quality assurance processes, leading to heightened demand for metrology services.North America Metrology Services Market Report:

The North American market for Metrology Services stood at $3.73 billion in 2023 and is anticipated to expand to $7.62 billion by 2033. The region's growth is fueled by a well-established manufacturing base, technological advancements in metrology solutions, and stringent regulations requiring compliance with quality standards in various industries.South America Metrology Services Market Report:

South America's Metrology Services market is estimated at $0.42 billion in 2023, with a growth projection to $0.86 billion by 2033. The primary factors influencing this growth include increasing investments in infrastructure and the need for high-quality standards in industries such as automotive and oil & gas.Middle East & Africa Metrology Services Market Report:

The Middle East and Africa's Metrology Services market is anticipated to grow from $1.13 billion in 2023 to $2.31 billion by 2033, driven by increasing investments in smart manufacturing technologies and quality assurance processes across various industries. The construction and oil sectors are particularly influential in this growth.Tell us your focus area and get a customized research report.

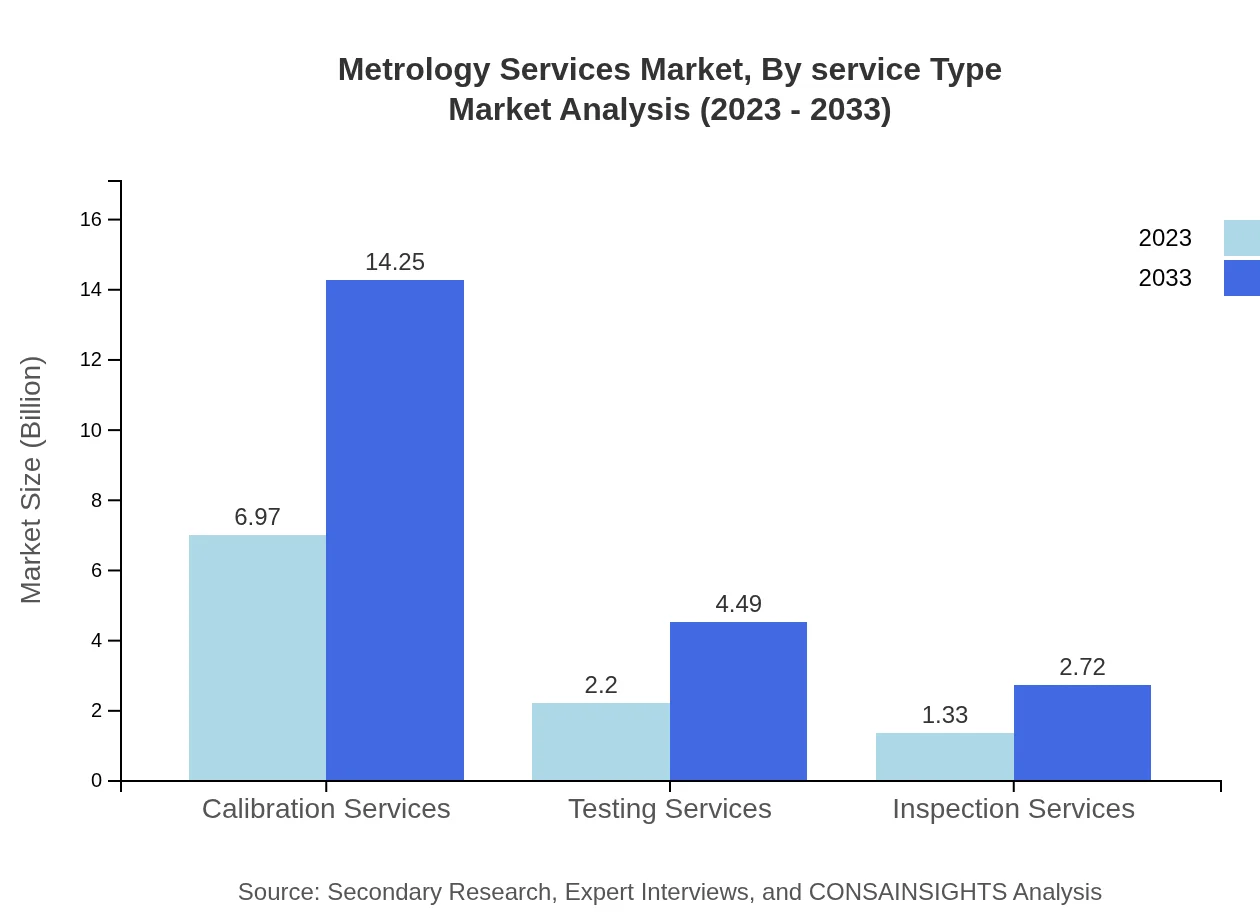

Metrology Services Market Analysis By Service Type

Calibration Services dominate the Metrology Services market, with a valuation of $6.97 billion in 2023 and projected to reach $14.25 billion by 2033. Testing Services and Inspection Services follow suit, focusing on quality assurance in diverse sectors. The market share for Calibration Services stands at 66.39% in 2023, indicating its pivotal role in maintaining equipment accuracy.

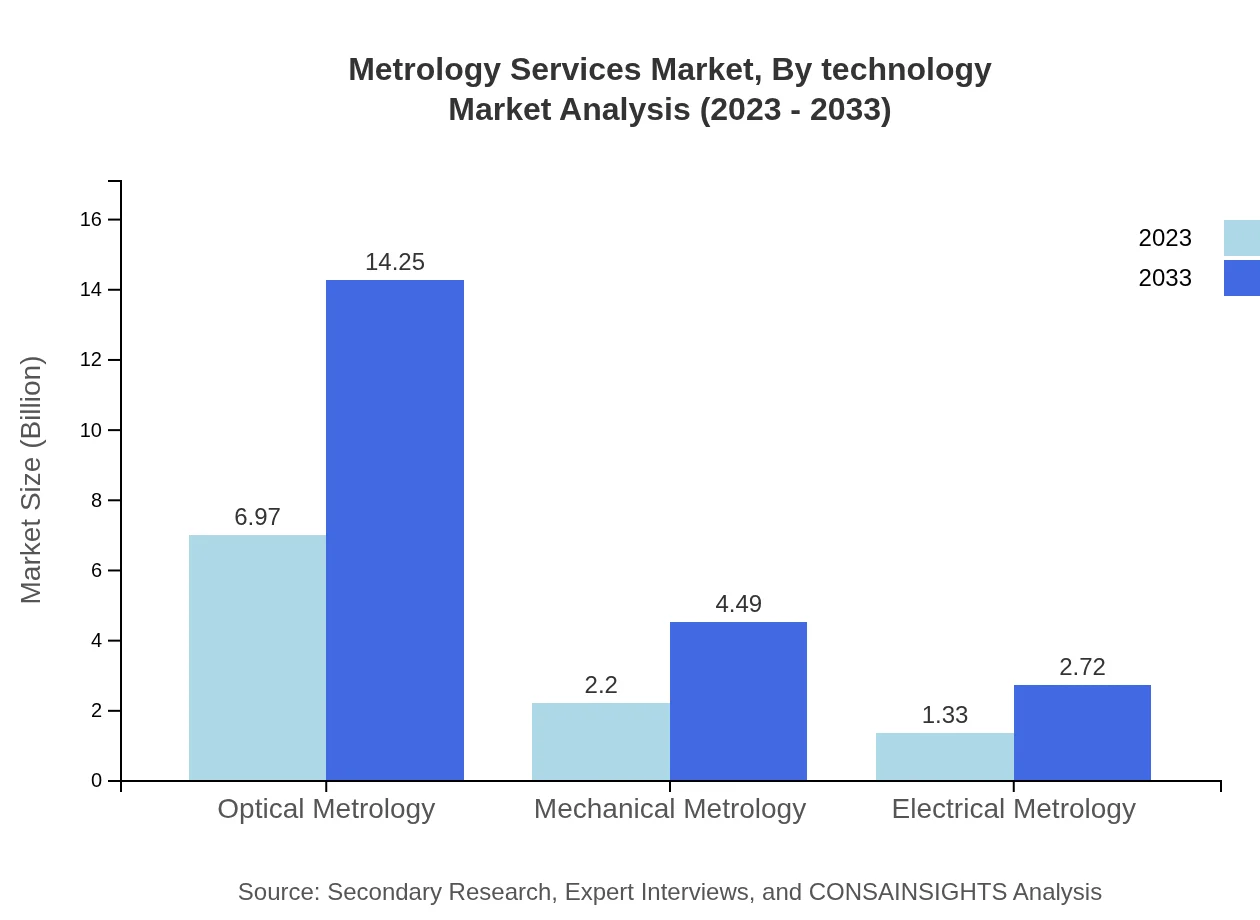

Metrology Services Market Analysis By Technology

Technological advancements such as digital metrology, automation, and software integration are transforming the Metrology Services landscape. These innovations enhance measurement accuracy, reduce errors, and increase efficiency across all service types. The growing adoption of IoT in metrology is particularly noteworthy, as it enables real-time data monitoring.

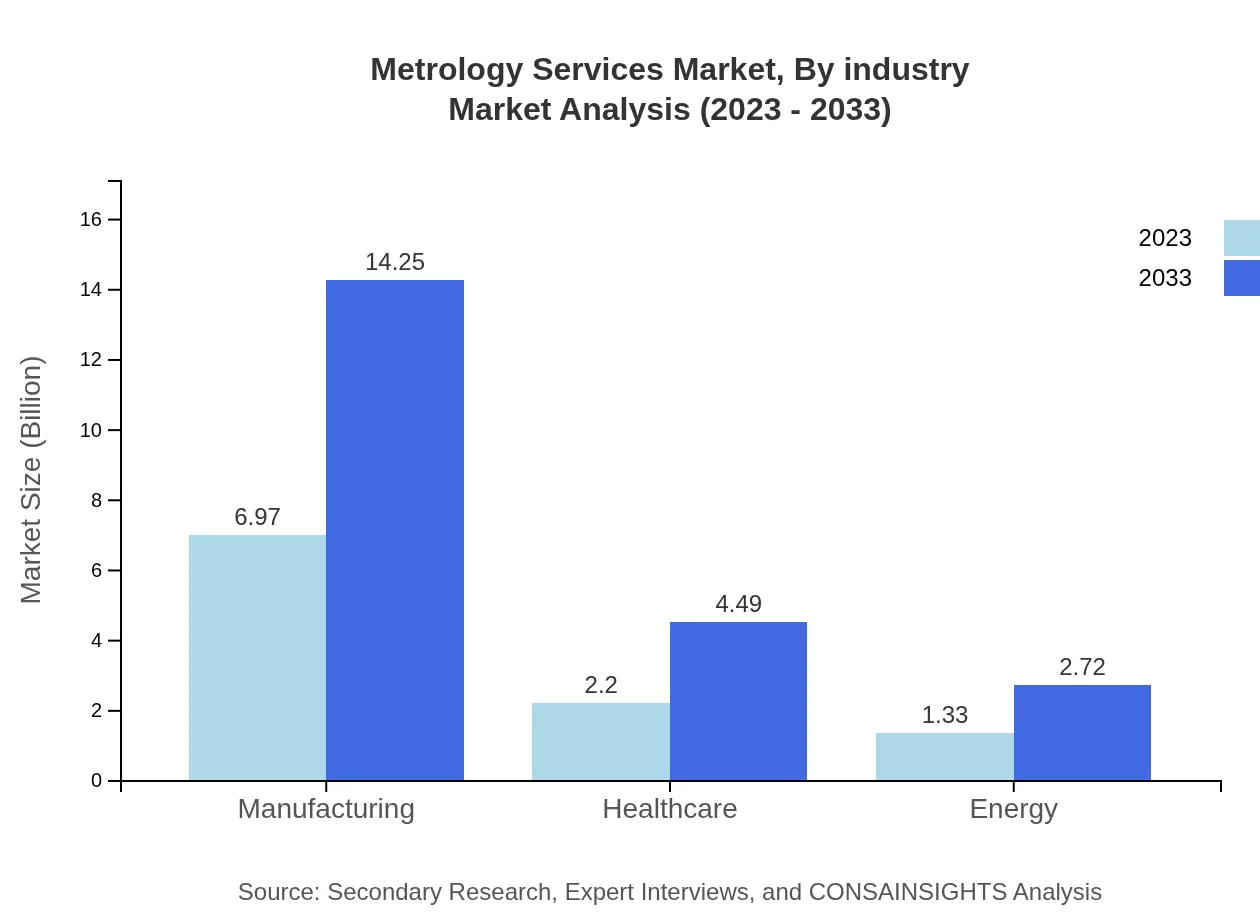

Metrology Services Market Analysis By Industry

The Manufacturing sector commands the largest share, representing approximately $6.97 billion in 2023 and increasing to an expected $14.25 billion by 2033. Healthcare and Energy are also significant sectors, with specific growth driven by the need for precise measurements and robust quality assurance practices.

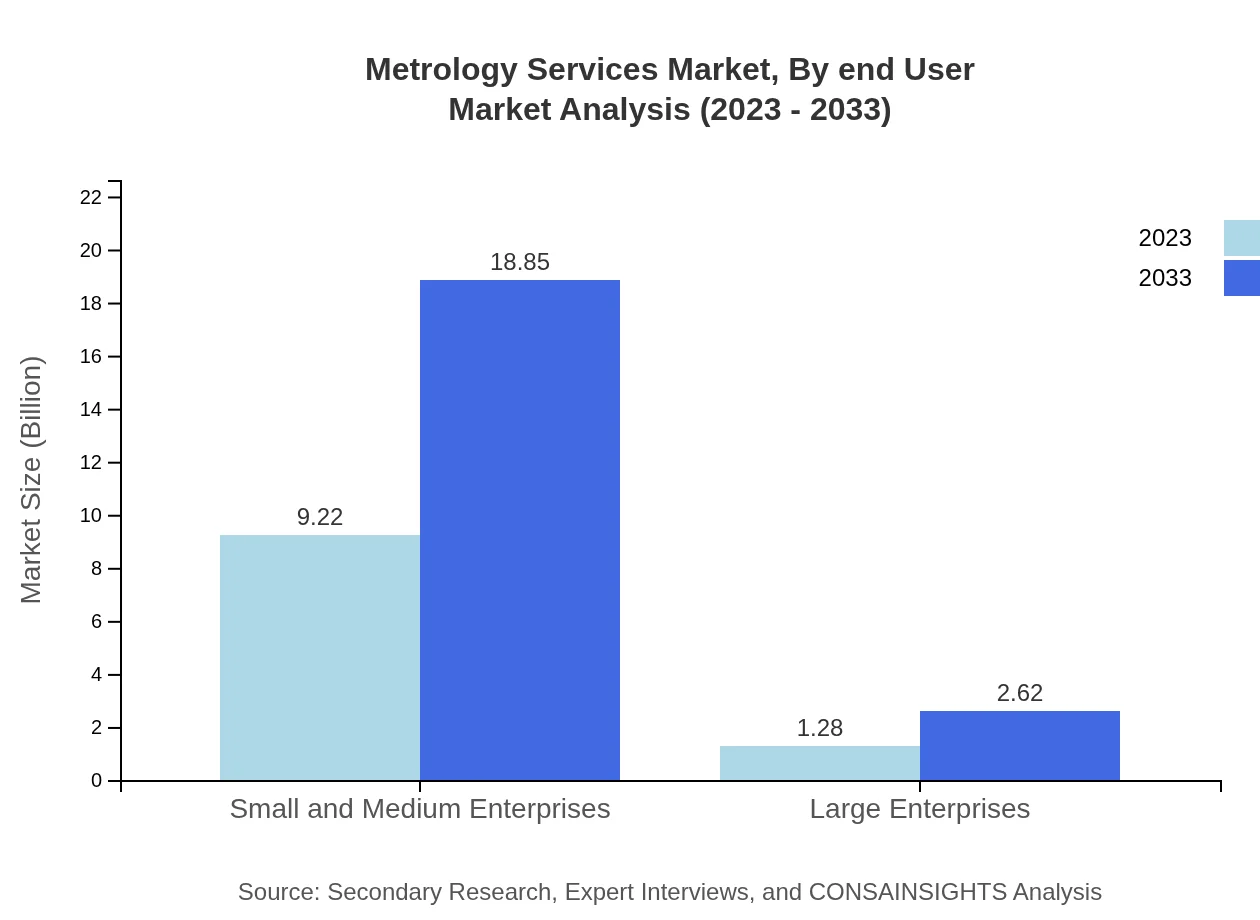

Metrology Services Market Analysis By End User

End-users include small and medium enterprises, which account for 87.81% of the market in 2023, valued at $9.22 billion. Large enterprises represent a smaller segment but show increasing demand for specialized metrology services to comply with strict industry standards and enhance operational efficiency.

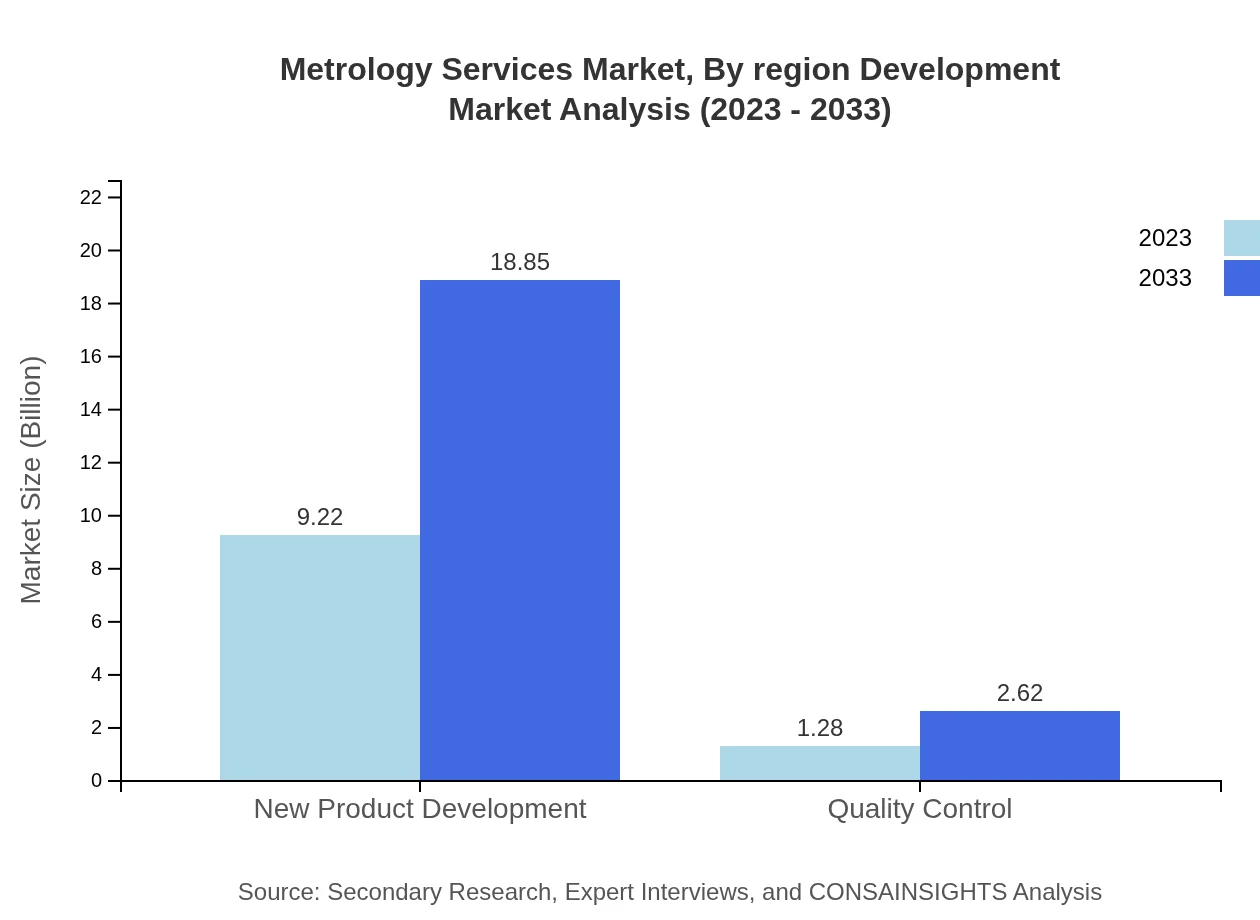

Metrology Services Market Analysis By Region Development

The market is advancing with significant developments in technology, especially in regions like North America and Europe. Emerging markets in Asia Pacific are also progressing rapidly, driven by increasing investments in industrial sectors and quality control.

Metrology Services Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Metrology Services Industry

Hexagon AB:

A leader in digital solutions across the Metrology Services industry, Hexagon AB offers a comprehensive range of measurement technologies, ensuring high-precision measurements for various sectors, including aerospace and automotive.Zeiss Group:

The Zeiss Group is renowned for its optical metrology solutions, providing advanced systems and services that enhance measurement accuracy and quality control.Fischer Technology, Inc.:

Specialized in measuring systems, Fischer offers solutions that cater to various sectors, focusing on non-destructive testing and surface analysis technology.Mitutoyo Corporation:

With a rich history in measurement, Mitutoyo provides high-quality tools and systems essential for calibration, inspection, and testing services.We're grateful to work with incredible clients.

FAQs

What is the market size of metrology Services?

The global Metrology Services market is valued at approximately $10.5 billion in 2023, with a projected CAGR of 7.2%. By 2033, the market is expected to see significant growth driven by advancements in measurement technology.

What are the key market players or companies in this metrology Services industry?

Key players in the Metrology Services industry include leading companies offering innovative measurement solutions. They play vital roles in technological advancements and maintaining high standards in measurement accuracy across various sectors.

What are the primary factors driving the growth in the metrology Services industry?

Growth in the metrology services industry is mainly driven by the increasing demand for precision in manufacturing, advancements in metrology technologies, and the growing emphasis on quality assurance in various sectors such as automotive and healthcare.

Which region is the fastest Growing in the metrology Services?

Asia Pacific is the fastest-growing region in the Metrology Services market, with market size projected to grow from $1.99 billion in 2023 to $4.07 billion by 2033, showing significant demand for precision measurement in expanding industries.

Does Consainsights provide customized market report data for the metrology Services industry?

Yes, Consainsights offers customized market report data tailored to specific needs in the Metrology Services industry, enabling businesses to gain insights relevant to their areas of interest and strategic goals.

What deliverables can I expect from this metrology Services market research project?

From the Metrology Services market research project, you can expect comprehensive deliverables including detailed market size analysis, growth projections, competitive landscape assessments, and insights into trends and innovations shaping the industry.

What are the market trends of metrology Services?

Market trends in the metrology services industry include increased adoption of automation, integration of AI in measurement systems, a growing focus on sustainability, and the rising importance of digital transformation in quality assurance processes.