Packaging Resins Market Report

Published Date: 02 February 2026 | Report Code: packaging-resins

Packaging Resins Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Packaging Resins market, focusing on the trends, size, growth factors, and forecasts from 2023 to 2033. It covers insights into various segments and regional markets, providing stakeholders with essential data for strategic planning.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $23.50 Billion |

| CAGR (2023-2033) | 4.2% |

| 2033 Market Size | $35.73 Billion |

| Top Companies | BASF SE, Dow Inc., DuPont, LG Chem |

| Last Modified Date | 02 February 2026 |

Packaging Resins Market Overview

Customize Packaging Resins Market Report market research report

- ✔ Get in-depth analysis of Packaging Resins market size, growth, and forecasts.

- ✔ Understand Packaging Resins's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Packaging Resins

What is the Market Size & CAGR of Packaging Resins market in 2023?

Packaging Resins Industry Analysis

Packaging Resins Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Packaging Resins Market Analysis Report by Region

Europe Packaging Resins Market Report:

The European Packaging Resins market is poised for growth, increasing from $6.82 billion in 2023 to $10.36 billion by 2033. The region is focusing on stringent regulations promoting recycling and the use of biodegradable materials, impacting market dynamics positively.Asia Pacific Packaging Resins Market Report:

The Asia Pacific region is anticipated to witness substantial growth, driven by rapid industrialization, urbanization, and increasing food packaging needs. Market size is projected to grow from $4.46 billion in 2023 to $6.77 billion by 2033, as the demand for flexible packaging continues to rise.North America Packaging Resins Market Report:

North America holds a significant share of the Packaging Resins market and is projected to grow from $8.76 billion in 2023 to $13.32 billion by 2033. The market is characterized by advanced packaging technologies and high demand for sustainable packaging solutions from consumers.South America Packaging Resins Market Report:

In South America, the market for Packaging Resins is expected to grow from $0.72 billion in 2023 to $1.09 billion by 2033. The growth is fueled by the expansion of retail networks and evolving consumer preferences towards convenient packaging solutions.Middle East & Africa Packaging Resins Market Report:

The market in the Middle East and Africa is also expected to expand, with a forecasted growth from $2.75 billion in 2023 to $4.18 billion by 2033. The growth will be propelled by advancements in manufacturing technologies and an increase in disposable income among consumers.Tell us your focus area and get a customized research report.

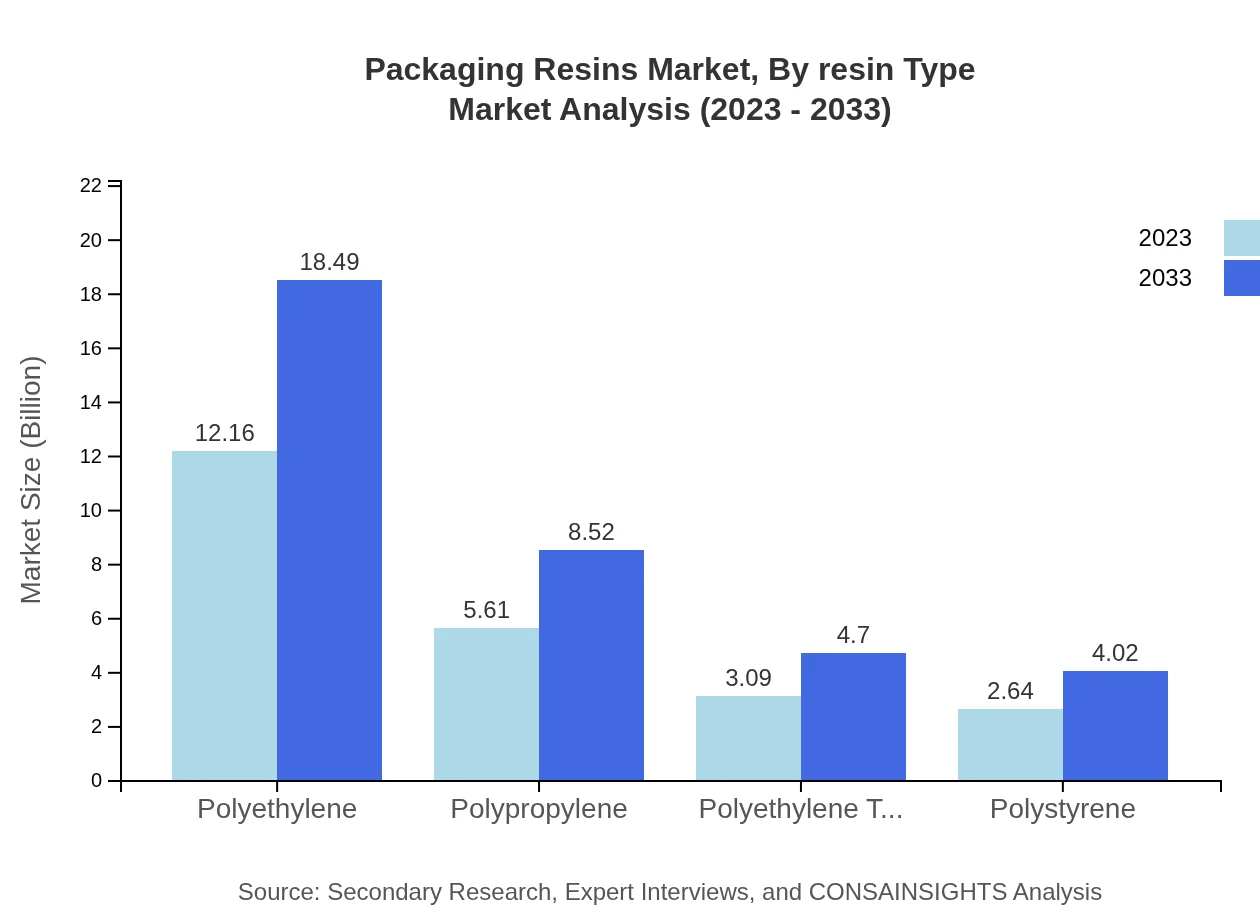

Packaging Resins Market Analysis By Resin Type

The packaging resins market can be divided mainly into four resin types: Polyethylene (PE), which will account for 51.74% of the market, projected size increasing from $12.16 billion in 2023 to $18.49 billion in 2033; Polypropylene (PP) with a market share of 23.86%, growing from $5.61 billion to $8.52 billion; Polyethylene Terephthalate (PET) covering 13.16% of the market, expected to rise from $3.09 billion to $4.70 billion; and Polystyrene (PS) with 11.24% share, increasing from $2.64 billion to $4.02 billion by 2033. The continuous innovation in resin formulations and sustainability trends are critical drivers for these segments.

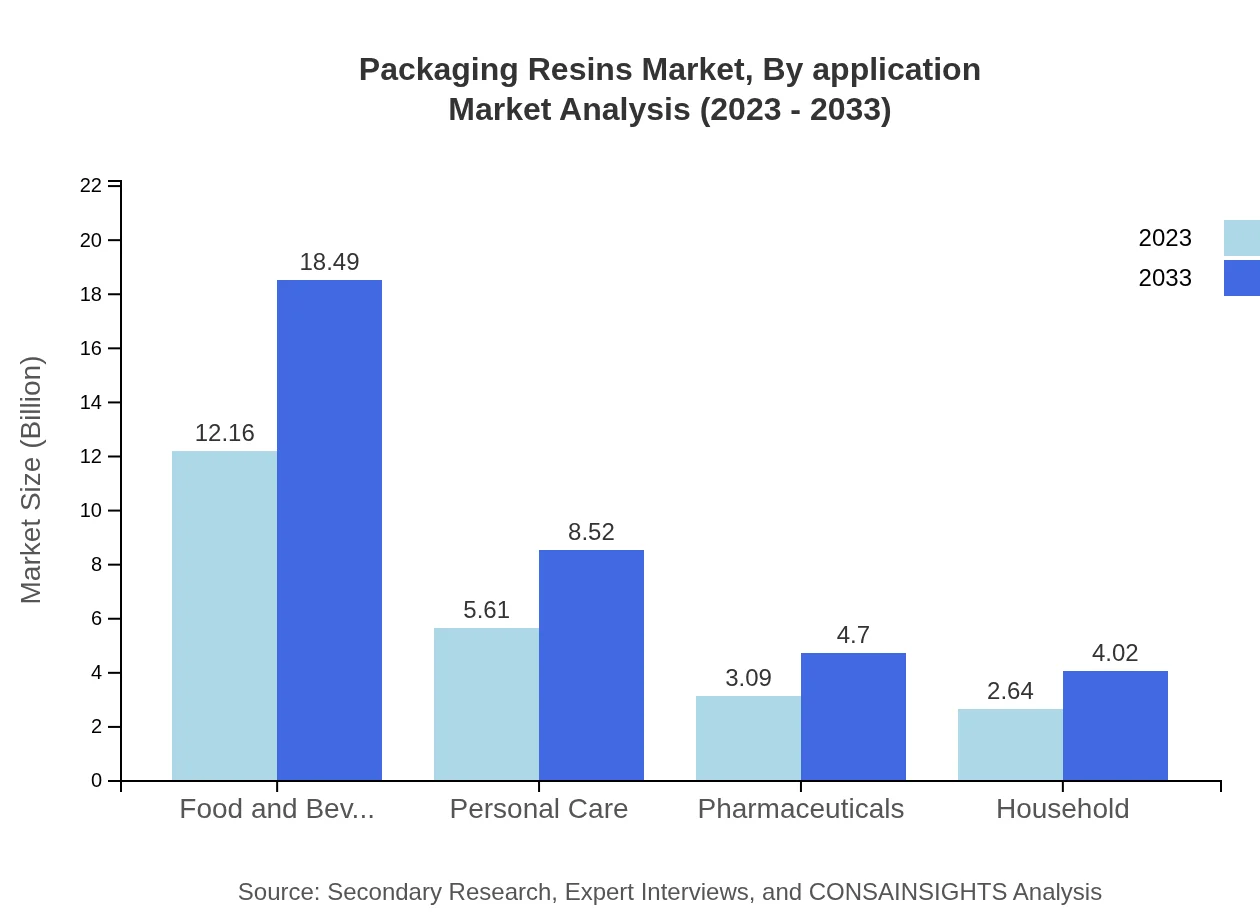

Packaging Resins Market Analysis By Application

Applications of packaging resins are diversely categorized, with the food and beverage sector dominating with 51.74% market share, expanding its size from $12.16 billion to $18.49 billion. The personal care sector follows at 23.86% market share, projected to increase from $5.61 billion to $8.52 billion, alongside pharmaceuticals and household applications showing robust growth. Each segment's growth is bolstered by rising consumer spending and the advent of e-commerce, necessitating effective packaging solutions.

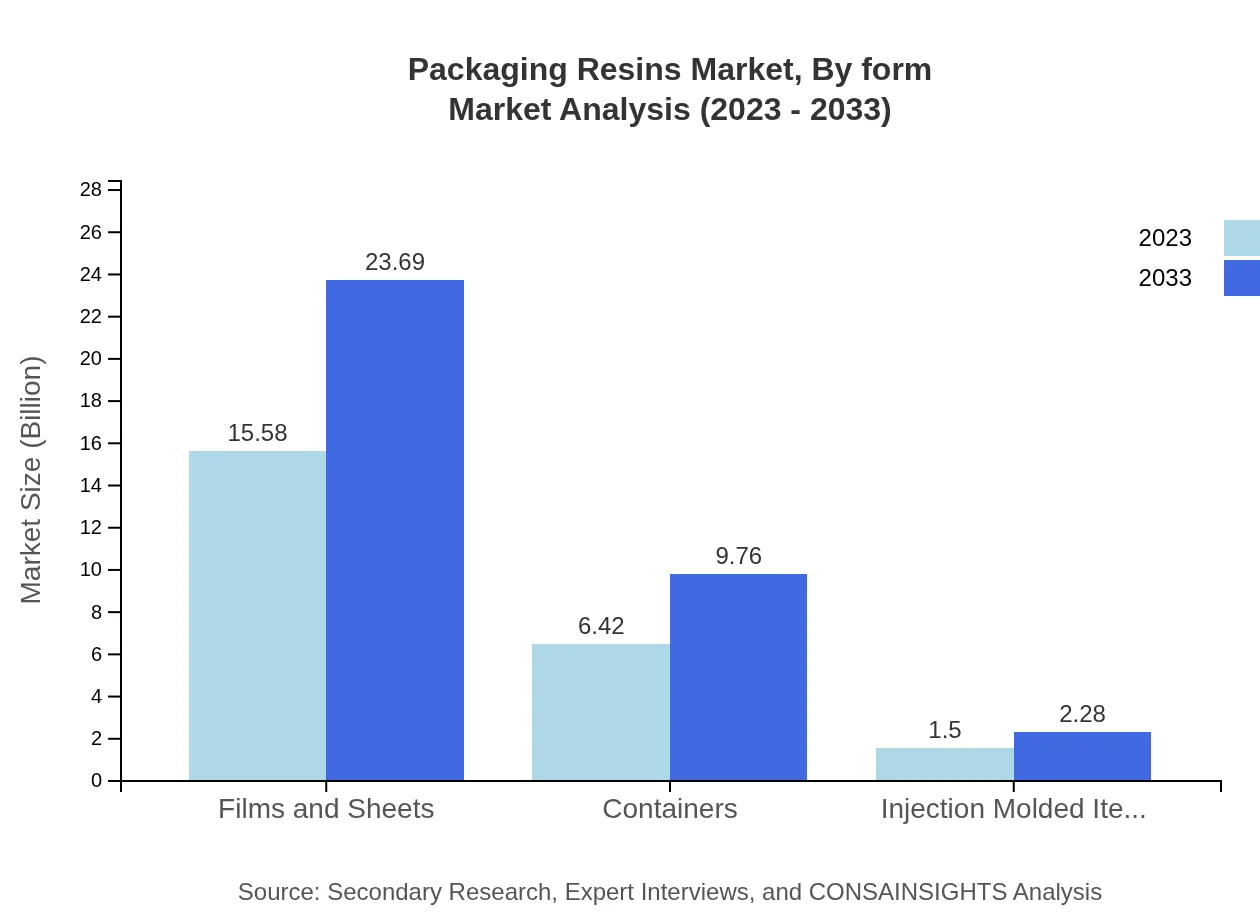

Packaging Resins Market Analysis By Form

The packaging resins market by form is primarily subdivided into flexible and rigid types. Flexible packaging, including films and sheets, accounts for 66.31% of the market and is projected to grow substantially from $15.58 billion in 2023 to $23.69 billion by 2033. Rigid packaging, such as containers and bottles, is also expected to increase in market size from $6.42 billion to $9.76 billion, offering various application benefits across multiple industries.

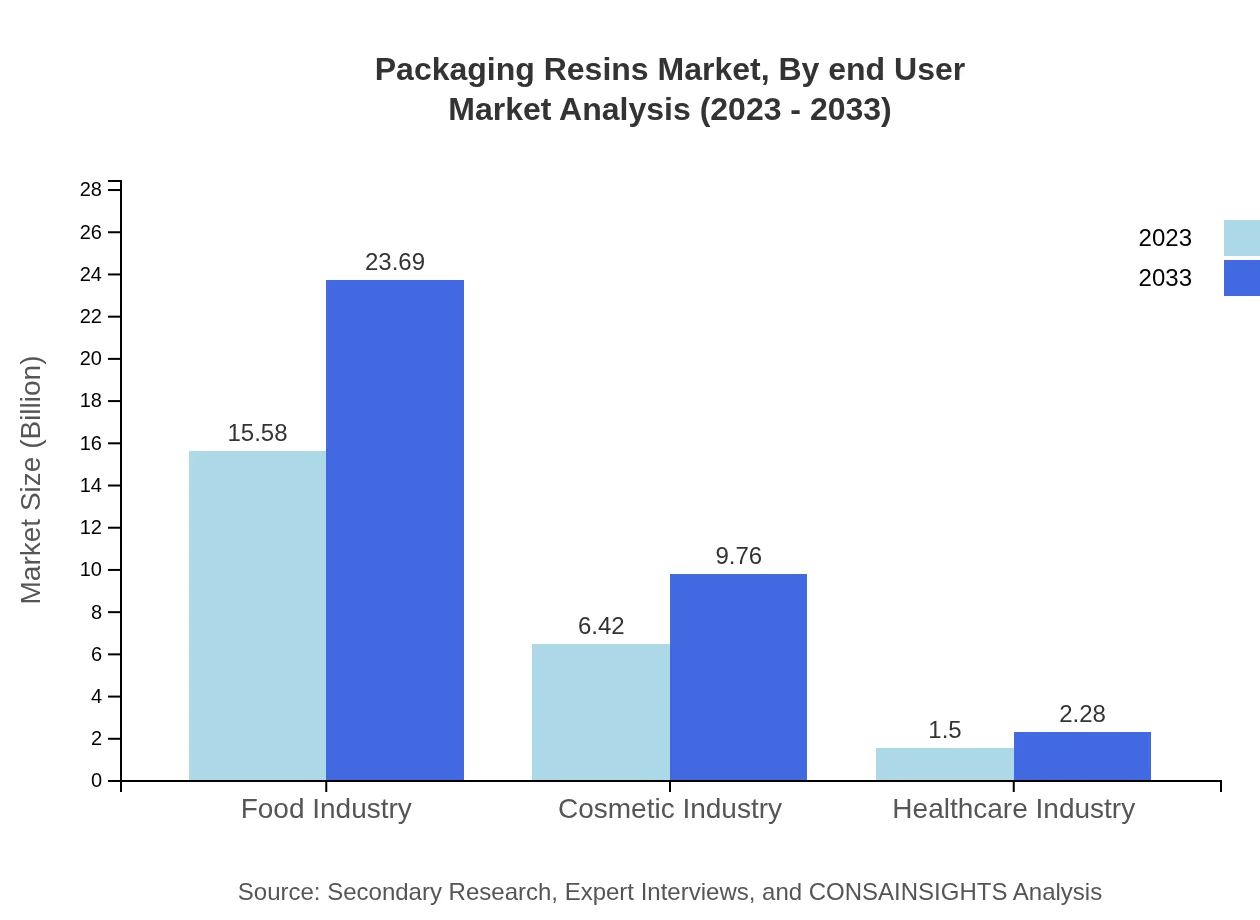

Packaging Resins Market Analysis By End User

The packaging resins market by end-user industry showcases diverse growth potential, notably in food and beverage with a significant market share of 51.74%, expected to grow from $12.16 billion to $18.49 billion. The personal care and healthcare sectors also display promising growth trajectories, owing to the essential nature of effective packaging in safeguarding product integrity and enhancing user experience.

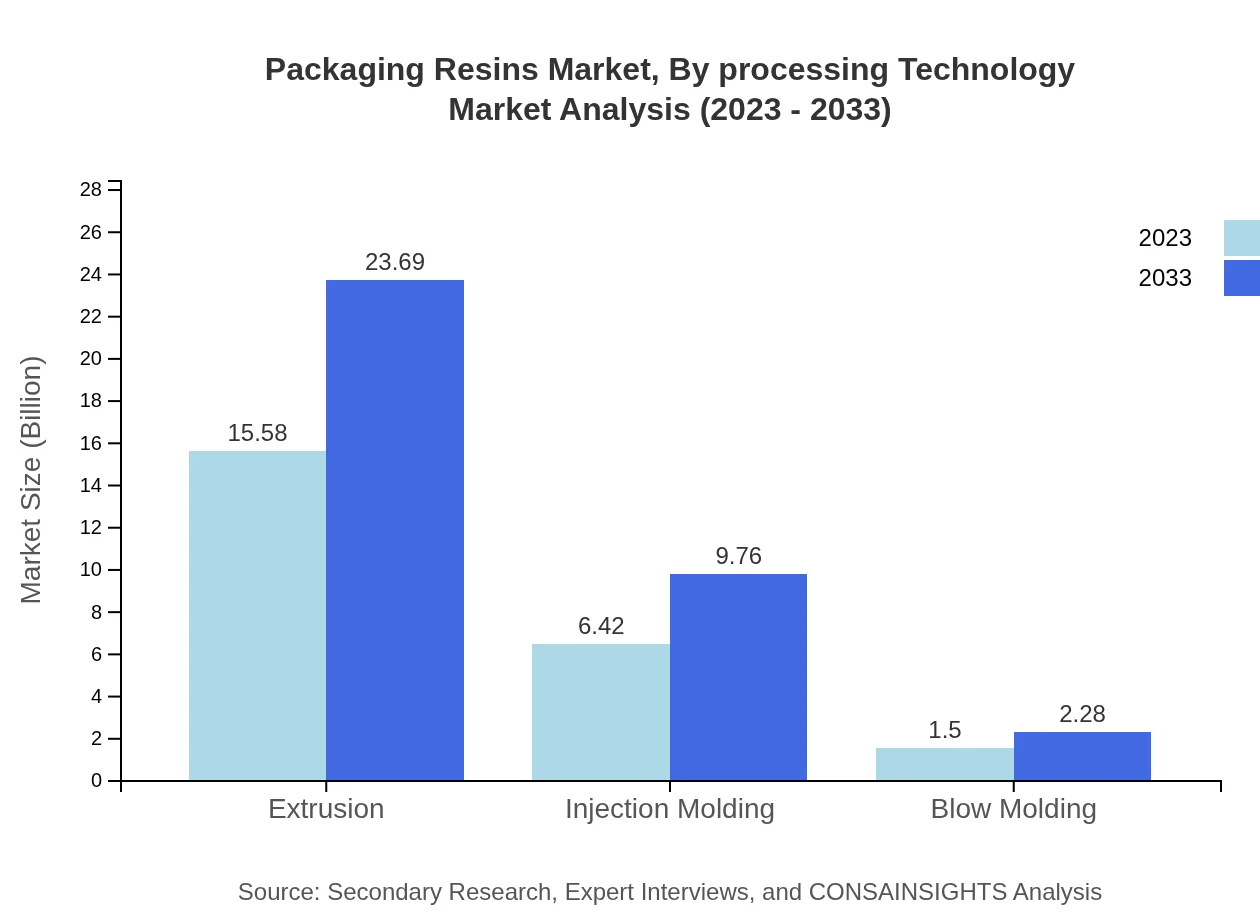

Packaging Resins Market Analysis By Processing Technology

Key processing technologies such as extrusion, injection molding, and blow molding significantly influence the packaging resins market. The extrusion segment leads with a 66.31% market share, expanding from $15.58 billion to $23.69 billion by 2033. Injection molding and blow molding technologies are also expected to see growth, reflecting advancements in efficiency and product design tailored to consumer preferences.

Packaging Resins Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Packaging Resins Industry

BASF SE:

A leading chemical manufacturer producing high-quality packaging resins, BASF SE focuses on sustainability and innovative technologies that cater to the evolving packaging demands.Dow Inc.:

Dow Inc. specializes in advanced materials and packaging solutions, heavily investing in R&D for sustainable resin technologies, emphasizing reducing environmental impacts.DuPont:

DuPont is a significant player in the packaging resins market, offering a diverse portfolio of materials used in food and consumer packaging applications, prioritizing safety and performance.LG Chem:

A global leader known for its production of high-performance resins, LG Chem emphasizes innovation in processing techniques and materials to meet market demands.We're grateful to work with incredible clients.

FAQs

What is the market size of packaging Resins?

The global packaging resins market size was valued at approximately $23.5 billion in 2023, with a projected CAGR of 4.2% from 2023 to 2033, indicating robust growth trends in this sector over the next decade.

What are the key market players or companies in this packaging Resins industry?

The packaging resins market includes prominent players such as Dow, BASF, and SABIC, which dominate the industry through innovative product development and expanding their manufacturing capabilities globally.

What are the primary factors driving the growth in the packaging Resins industry?

Key drivers for growth include increasing demand for sustainable packaging solutions, technological advancements that enhance resin properties, and the growing food and beverage sectors adopting these materials for better preservation and safety.

Which region is the fastest Growing in the packaging Resins?

Asia Pacific is the fastest-growing region in the packaging resins market, with growth expected from $4.46 billion in 2023 to $6.77 billion by 2033, reflecting a high demand for innovative packaging solutions in emerging markets.

Does ConsaInsights provide customized market report data for the packaging Resins industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs in the packaging resins industry, allowing clients to obtain precise data relevant to their strategic goals and market conditions.

What deliverables can I expect from this packaging Resins market research project?

Deliverables include comprehensive market analysis, regional breakdowns, segmentation data, competitive landscape insights, and forecasts, providing a thorough understanding of market trends and opportunities.

What are the market trends of packaging Resins?

Current trends in the packaging resins market include the increasing adoption of biodegradable materials, innovation in product formulations for improved performance, and expanding applications in sectors such as food and personal care.