Military Computers Market Report

Published Date: 31 January 2026 | Report Code: military-computers

Military Computers Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Military Computers market, covering key insights, trends, and forecasts from 2023 to 2033. It encompasses market size, segmentation, regional analysis, and future growth potentials, offering valuable data for stakeholders looking to navigate this evolving sector.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

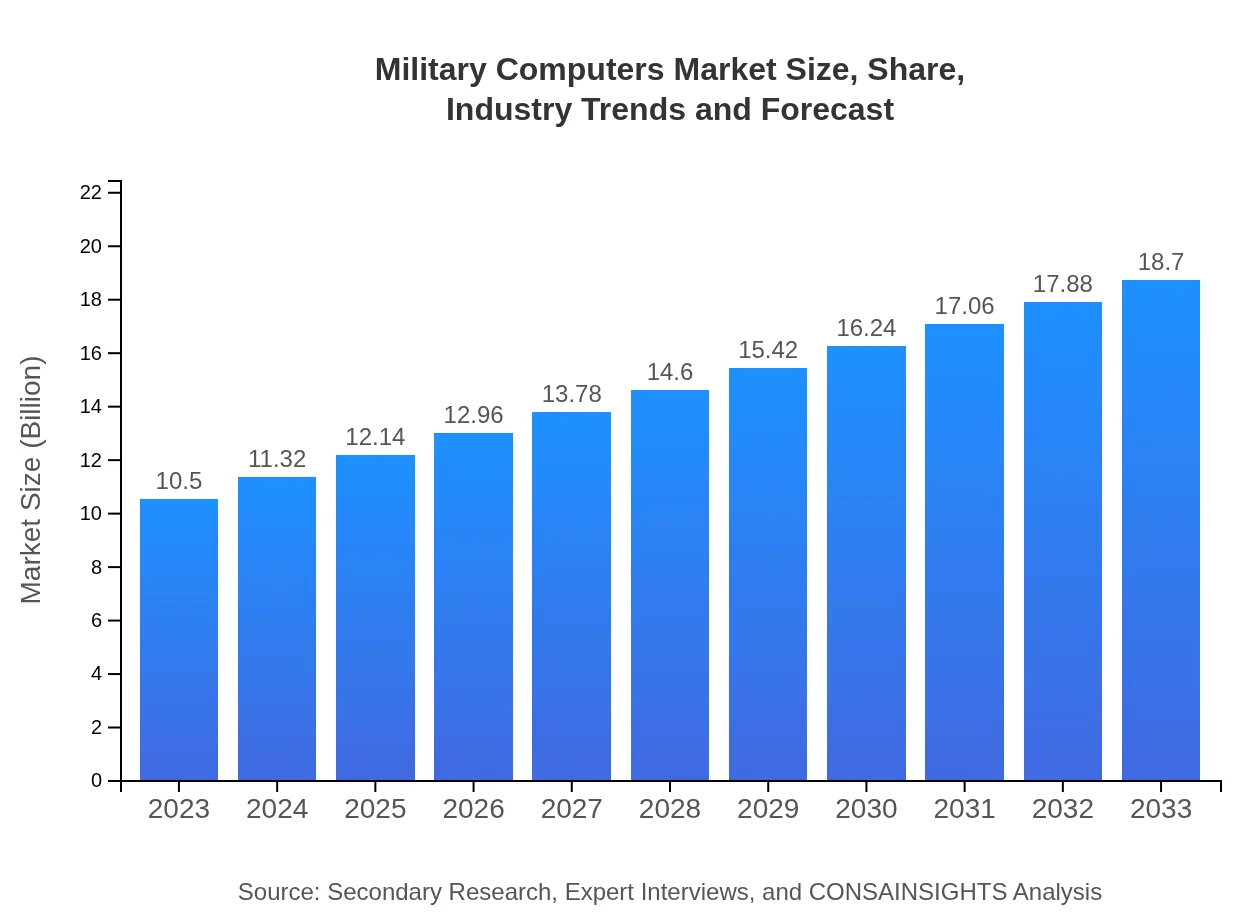

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $18.70 Billion |

| Top Companies | Hewlett Packard Enterprise, Raytheon Technologies, General Dynamics, Dell Technologies |

| Last Modified Date | 31 January 2026 |

Military Computers Market Overview

Customize Military Computers Market Report market research report

- ✔ Get in-depth analysis of Military Computers market size, growth, and forecasts.

- ✔ Understand Military Computers's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Military Computers

What is the Market Size & CAGR of Military Computers market in 2023?

Military Computers Industry Analysis

Military Computers Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Military Computers Market Analysis Report by Region

Europe Military Computers Market Report:

The European military computers market is expected to grow from $3.43 billion in 2023 to $6.12 billion by 2033. The ongoing geopolitical tensions and increasing defense collaboration among NATO members demand innovative military computing solutions, thereby propelling the market's growth in this region.Asia Pacific Military Computers Market Report:

In the Asia Pacific region, the military computers market is set to grow from $1.94 billion in 2023 to $3.45 billion by 2033, fueled by increasing defense expenditures and modernization initiatives in countries such as India and China. The emphasis on advanced technological solutions in military operations is driving demand, particularly for rugged and secure computing devices.North America Military Computers Market Report:

North America remains a dominant player in the military computers market, with a significant increase projected from $3.64 billion in 2023 to $6.48 billion by 2033. This growth is driven by high defense budgets, technological advancements, and substantial investments in R&D by countries like the United States. The region's focus on enhancing national security through advanced military technologies presents ample growth opportunities.South America Military Computers Market Report:

The South American military computers market is projected to expand from $0.39 billion in 2023 to $0.69 billion by 2033. Growth in this region is largely attributed to increasing collaborative defense efforts and modernization of military forces as countries focus on improving their strategic capabilities in response to regional challenges.Middle East & Africa Military Computers Market Report:

In the Middle East and Africa, the military computers market is forecasted to grow from $1.11 billion in 2023 to $1.97 billion by 2033. Escalating conflicts and rising defense spending in several countries are contributing factors, as military forces seek to enhance their operational capabilities through advanced computing solutions.Tell us your focus area and get a customized research report.

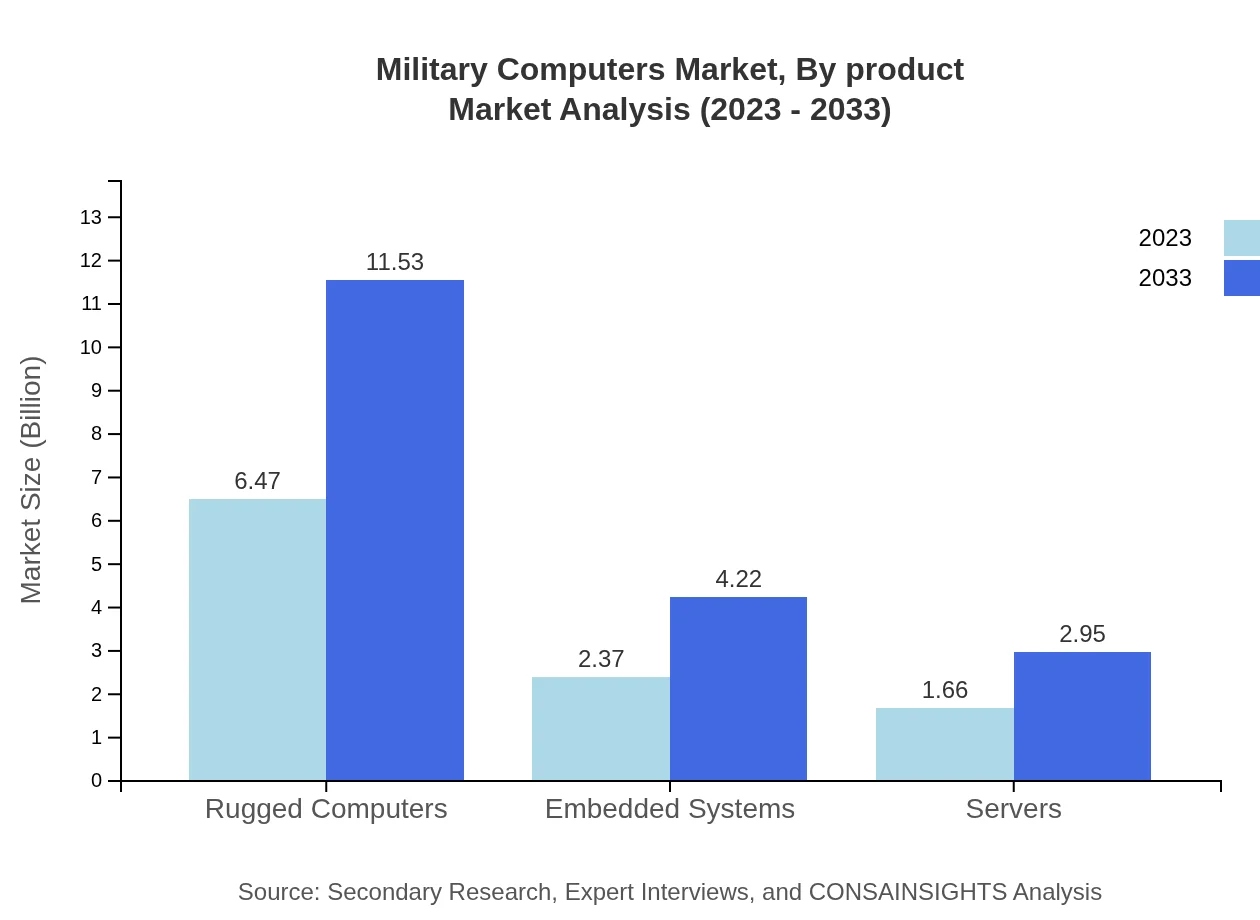

Military Computers Market Analysis By Product

The Military Computers market by product is characterized by segments such as Tactical Use Computers, Rugged Computers, and Embedded Systems. Tactical Use Computers represent the largest segment, with a market size of $9.03 billion in 2023, growing to $16.08 billion by 2033. Rugged Computers follow, increasing from $6.47 billion to $11.53 billion. Embedded Systems, essential for integrated military applications, are expected to grow significantly from $2.37 billion to $4.22 billion during the same period.

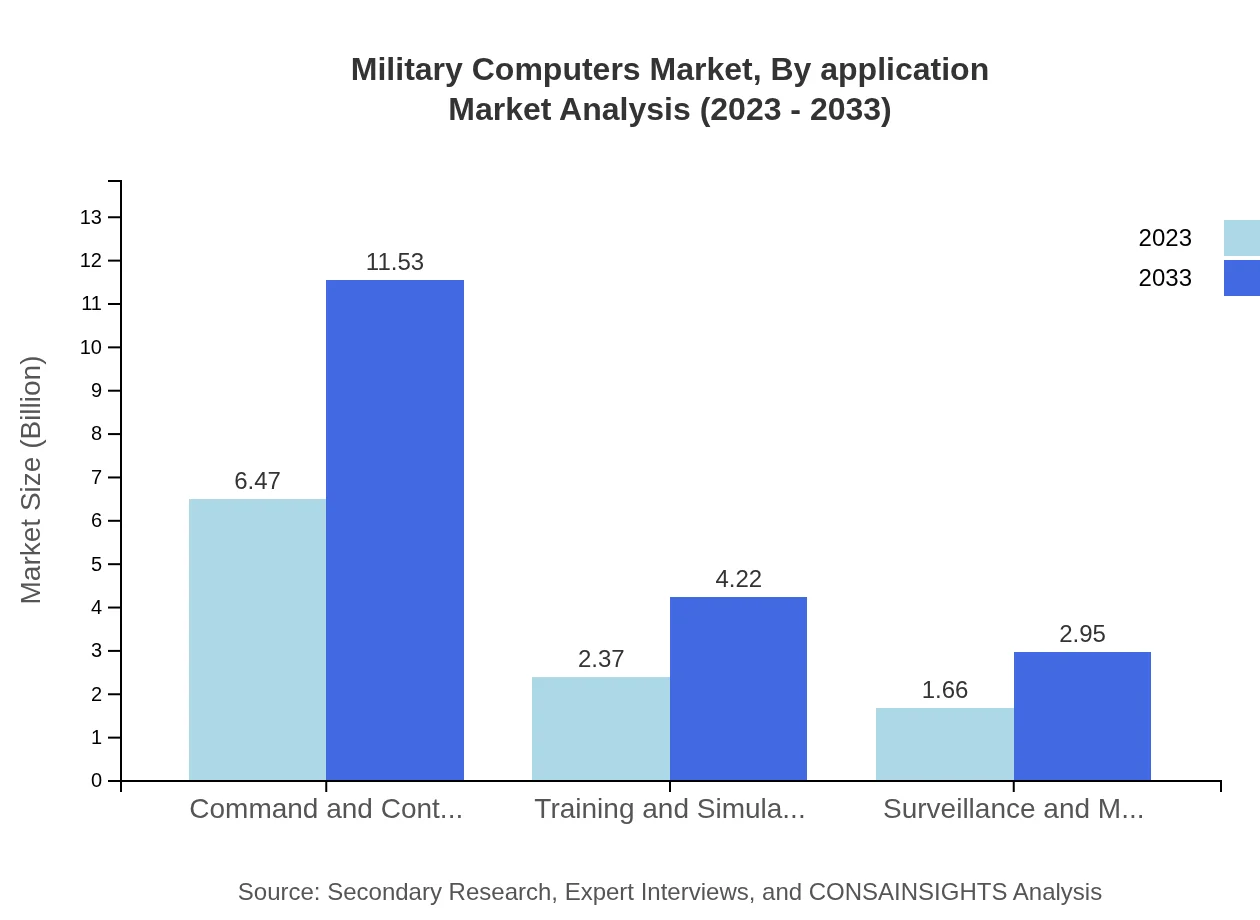

Military Computers Market Analysis By Application

Market segmentation by application illustrates critical areas of focus, including Command and Control, Training and Simulation, and Surveillance and Monitoring. Command and Control systems dominate the market, valued at $6.47 billion in 2023, with expectations to grow to $11.53 billion by 2033. Training and Simulation have a size of $2.37 billion, likely reaching $4.22 billion, driven by rising needs for effective operational preparedness.

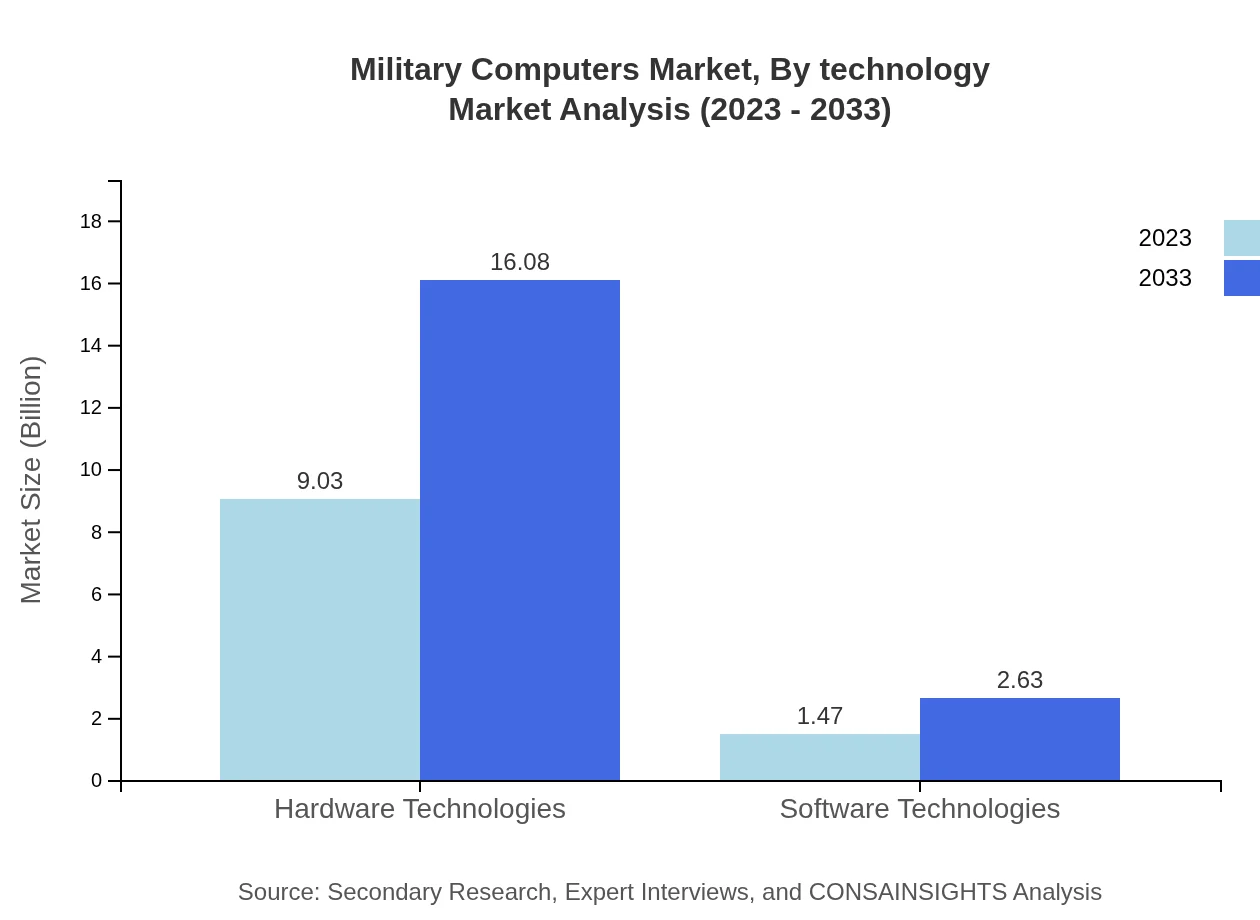

Military Computers Market Analysis By Technology

The military computers market showcases technological advancements impacting product development, notably in Hardware and Software Technologies. Hardware Technologies are forecasted to grow from $9.03 billion in 2023 to $16.08 billion by 2033, dominating the sector while Software Technologies are projected to increase from $1.47 billion to $2.63 billion, emphasizing the importance of robust cybersecurity measures and seamless integration.

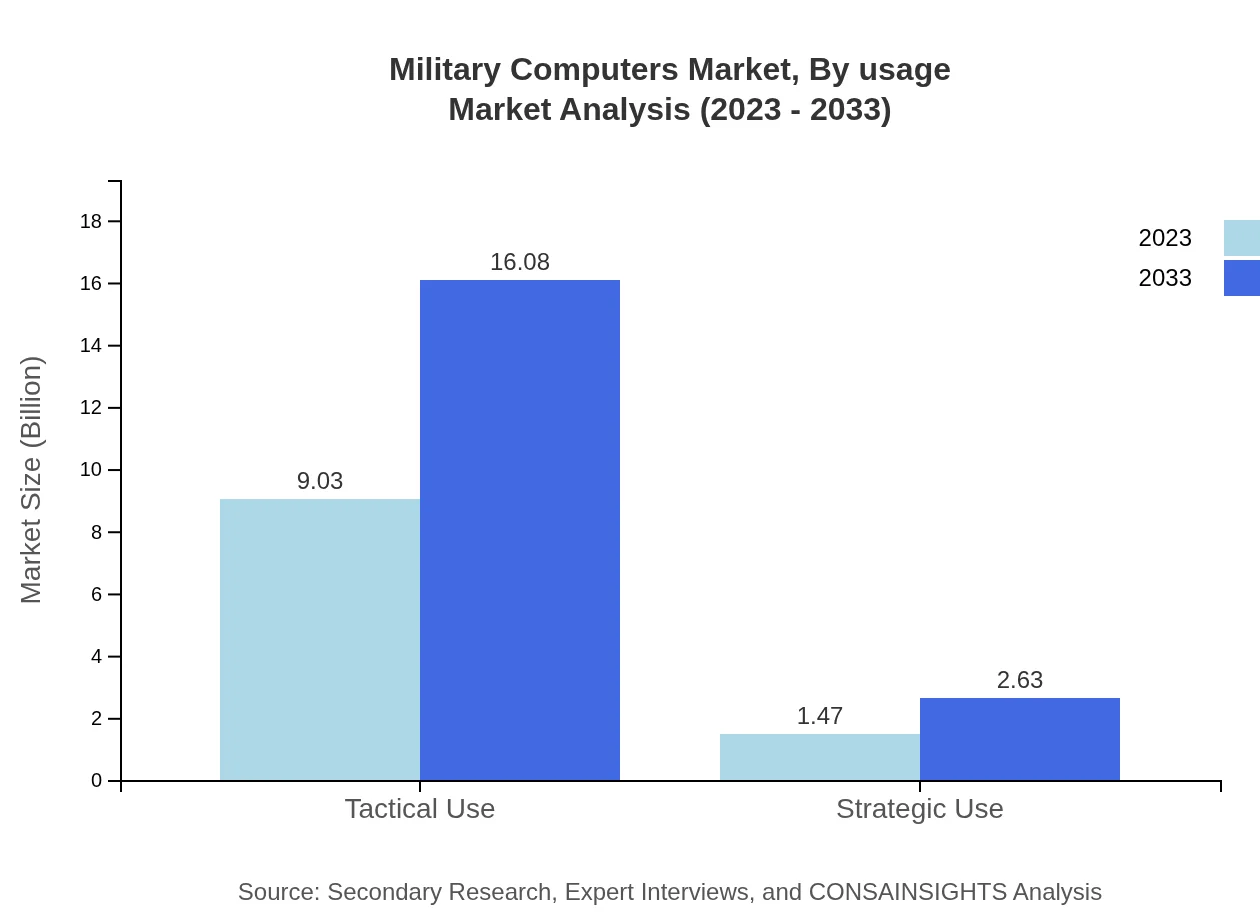

Military Computers Market Analysis By Usage

The usage segmentation includes Tactical and Strategic Use Computers. Tactical computers account for 85.96% of the total market share, with anticipated growth from $9.03 billion to $16.08 billion. In contrast, Strategic Use Computers make up a smaller segment with a growth trajectory from $1.47 billion to $2.63 billion, indicating a concentrated focus on immediate operational needs in most military contexts.

Military Computers Market Analysis By Customer

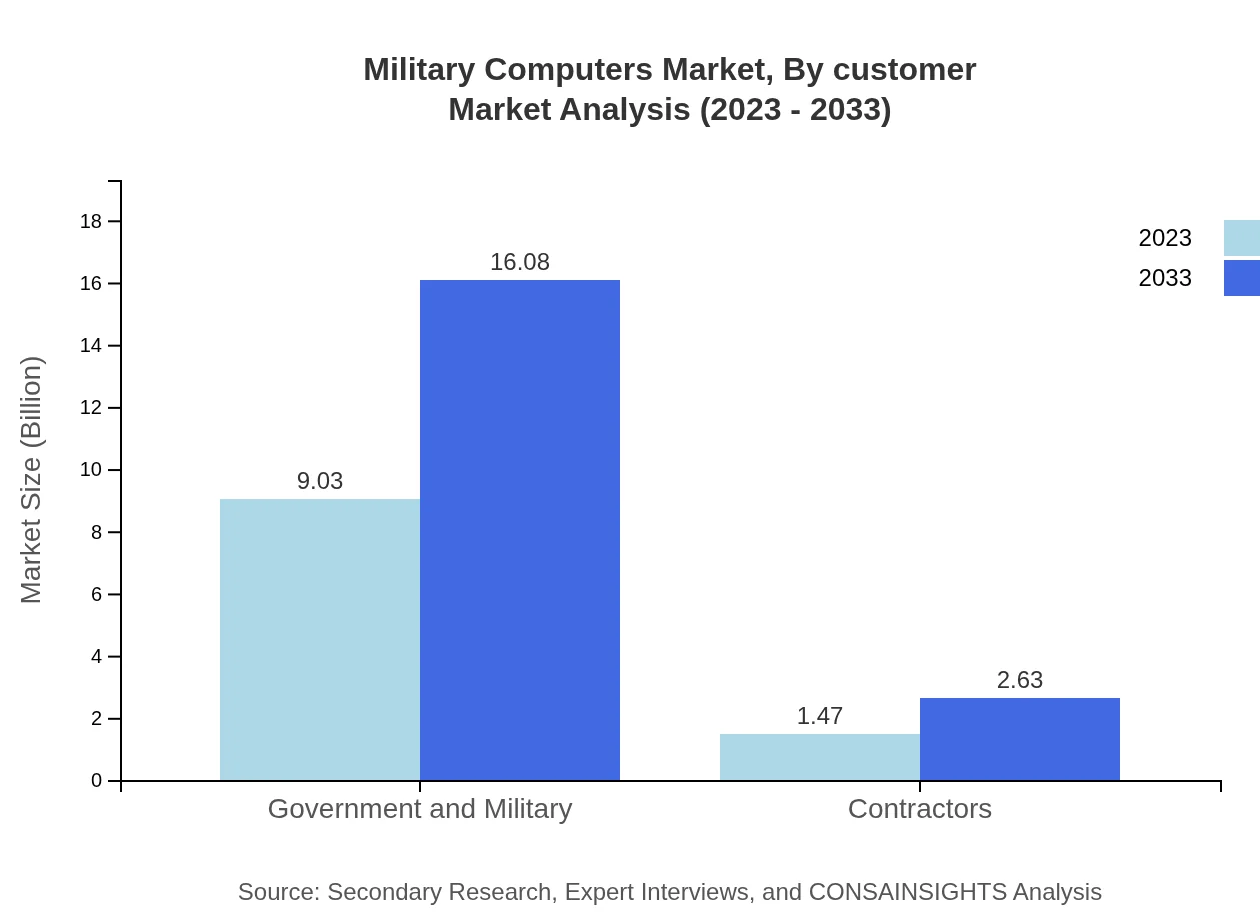

Customer segmentation primarily includes Government and Military entities, along with Contractors. Government and Military customers dominate the market, reaching $9.03 billion in 2023 and expanding to $16.08 billion by 2033. Contractors, catering to military needs, exhibit growth paralleling this trend, increasing from $1.47 billion to $2.63 billion, thus playing a crucial role in supply chain dynamics.

Military Computers Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Military Computers Industry

Hewlett Packard Enterprise:

A prominent leader in the defense computing sector, offering high-performance computers and secure communication solutions tailored for military applications.Raytheon Technologies:

Known for their advanced defense technologies, including military-grade computing solutions that enhance situational awareness and operational efficiency.General Dynamics:

A key player in the military computers market, providing a range of rugged computing technologies designed for harsh operational environments.Dell Technologies:

Offers a broad portfolio of rugged and mobile workstations equipped with high-end computational capabilities for defense applications.We're grateful to work with incredible clients.

FAQs

What is the market size of military Computers?

The global military computers market is valued at approximately $10.5 billion in 2023 and is projected to grow at a CAGR of 5.8%, reaching around $17 billion by 2033.

What are the key market players or companies in the military Computers industry?

Key players in the military computers market include prominent firms specialized in defense technology, systems integration, and rugged computing solutions, although specific company names are not detailed in the report.

What are the primary factors driving the growth in the military Computers industry?

The growth in the military-computers industry is primarily driven by the increasing demand for advanced defense technologies, the need for reliable rugged systems, and investments in military modernization programs across various nations.

Which region is the fastest Growing in the military Computers?

The Asia-Pacific region is identified as the fastest-growing in the military computers market, with market growth from $1.94 billion in 2023 to an estimated $3.45 billion by 2033.

Does ConsaInsights provide customized market report data for the military Computers industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the military-computers industry, allowing clients to gain targeted insights based on unique requirements.

What deliverables can I expect from this military Computers market research project?

Deliverables include comprehensive market analysis reports, segment details, regional insights, and strategic recommendations based on current trends and future forecasts for military computers.

What are the market trends of military Computers?

Current trends in the military computers market include the adoption of AI technologies, growth in tactical computing solutions, and the increasing focus on cybersecurity measures to protect military data systems.