Orthodontic Services Market Report

Published Date: 31 January 2026 | Report Code: orthodontic-services

Orthodontic Services Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the global orthodontic services market from 2023 to 2033, highlighting market size, growth trends, segmentation, regional insights, and key players within the industry.

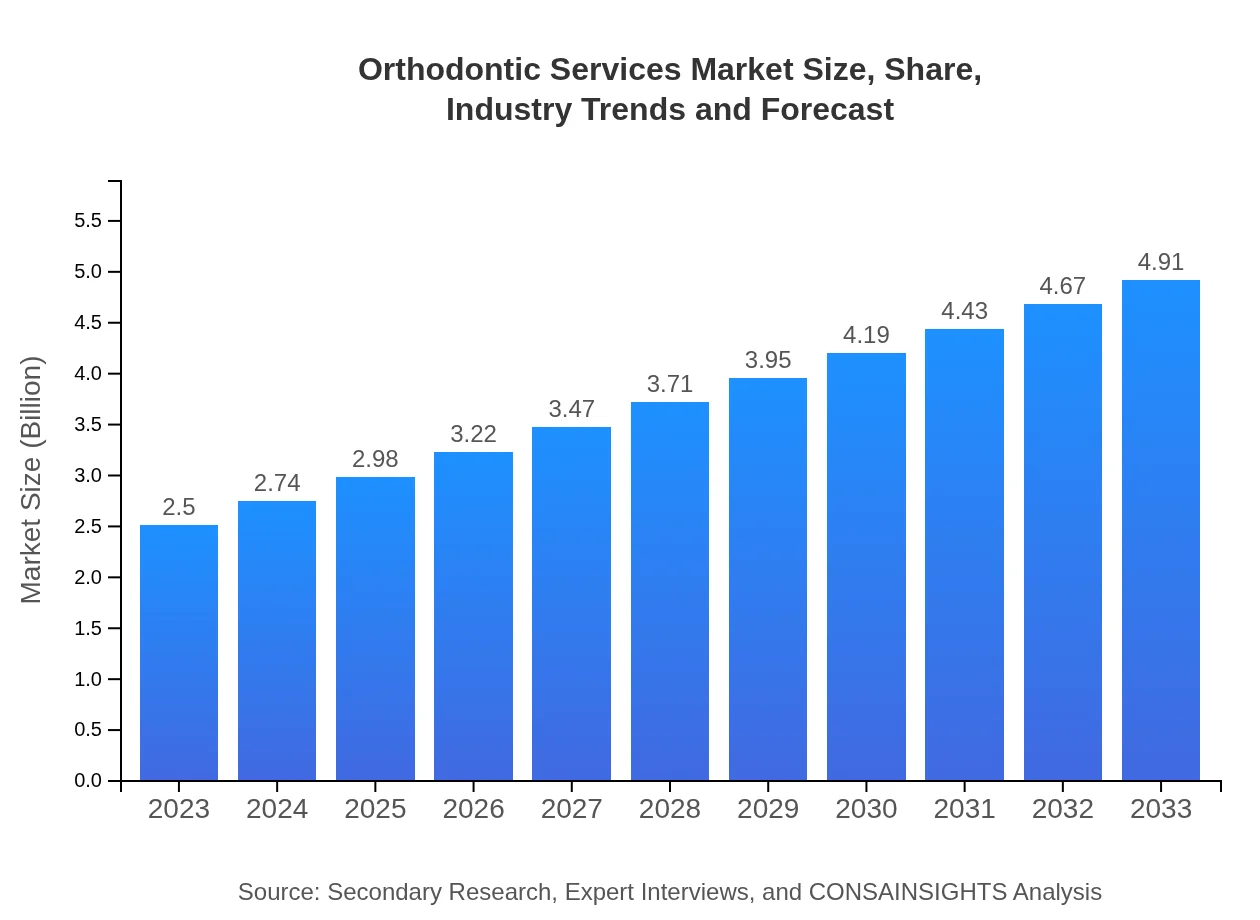

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $4.91 Billion |

| Top Companies | Align Technology, Inc., 3M Company, Ormco Corporation, Henry Schein, Inc., Dentsply Sirona Inc. |

| Last Modified Date | 31 January 2026 |

Orthodontic Services Market Overview

Customize Orthodontic Services Market Report market research report

- ✔ Get in-depth analysis of Orthodontic Services market size, growth, and forecasts.

- ✔ Understand Orthodontic Services's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Orthodontic Services

What is the Market Size & CAGR of Orthodontic Services market in 2023?

Orthodontic Services Industry Analysis

Orthodontic Services Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Orthodontic Services Market Analysis Report by Region

Europe Orthodontic Services Market Report:

The European orthodontic services market was valued at $0.93 billion in 2023 and is anticipated to grow to $1.83 billion by 2033. The market benefits from strong regulatory support and a well-established network of orthodontic specialists.Asia Pacific Orthodontic Services Market Report:

The Asia Pacific region accounted for a market size of $0.38 billion in 2023, with expectations to reach $0.75 billion by 2033. Increasing urbanization, rising penchants for aesthetic orthodontic solutions, and greater access to dental care are key drivers of growth in this region.North America Orthodontic Services Market Report:

North America holds a significant position in the orthodontic services market with a valuation of $0.81 billion in 2023. By 2033, the market is expected to reach $1.59 billion due to an increasingly aging population and advances in orthodontic technologies that enhance patient experience.South America Orthodontic Services Market Report:

In South America, the orthodontic services market was valued at $0.11 billion in 2023, projected to grow to $0.21 billion by 2033. Growing awareness about oral hygiene and aesthetic preferences among consumers is expected to spur market growth.Middle East & Africa Orthodontic Services Market Report:

The Middle East and Africa orthodontic services market was estimated at $0.26 billion in 2023, with expectations to expand to $0.52 billion by 2033. Increasing investments in healthcare and a growing focus on cosmetic dental procedures contribute to market growth in the region.Tell us your focus area and get a customized research report.

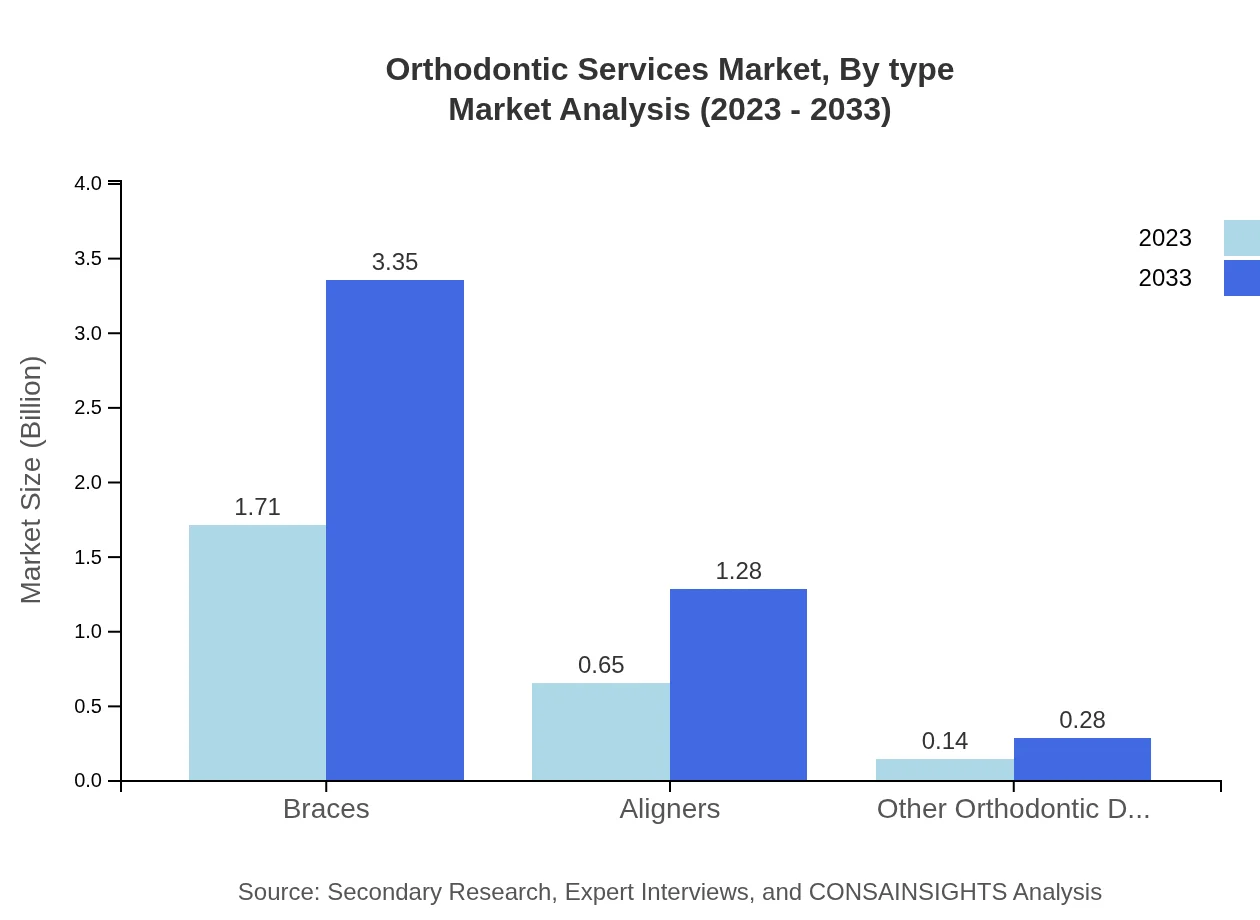

Orthodontic Services Market Analysis By Type

The orthodontic services market is predominantly segmented by type into braces, aligners, and other devices. In 2023, braces accounted for a market size of $1.71 billion and are projected to reach $3.35 billion by 2033. Aligners are also gaining momentum, starting at $0.65 billion and projected to reach $1.28 billion over the same period.

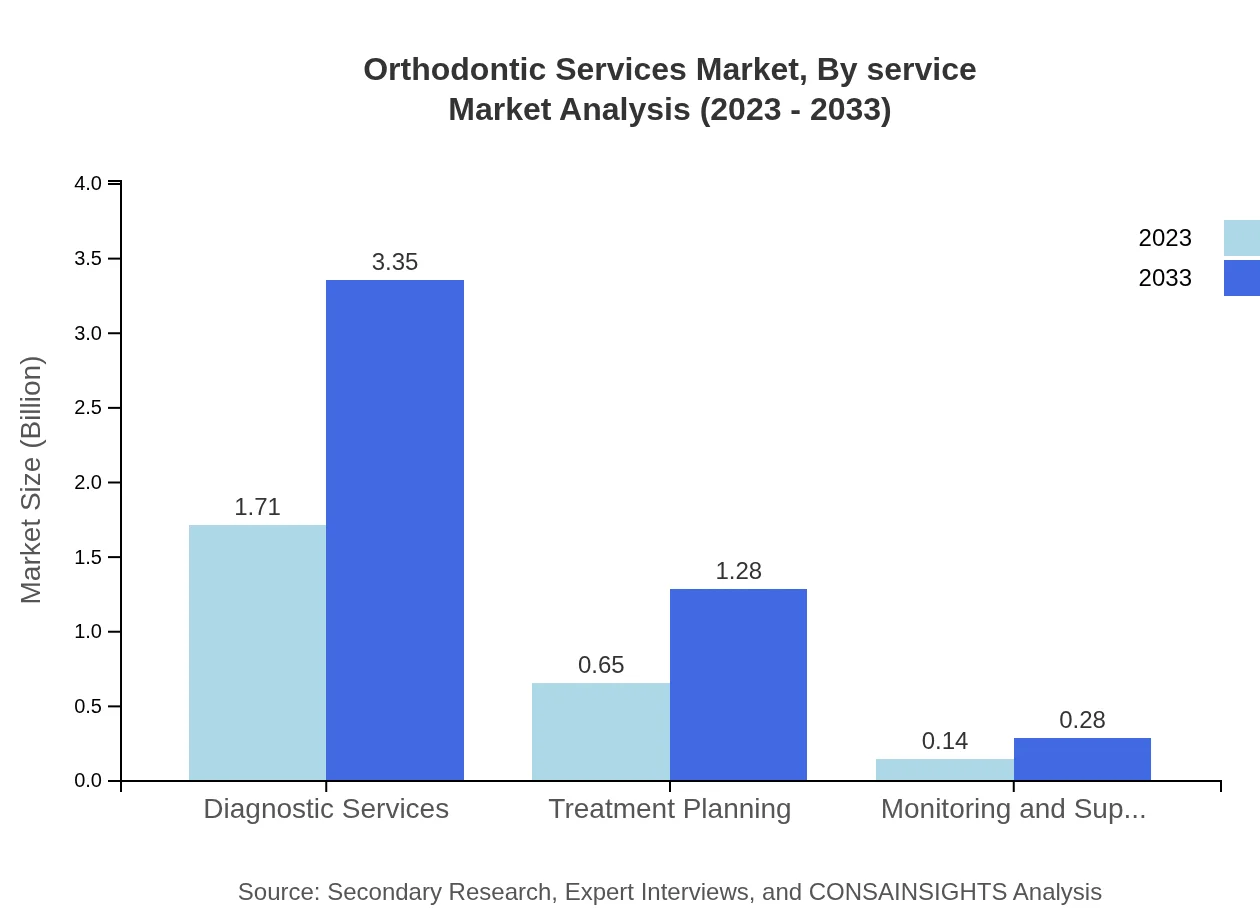

Orthodontic Services Market Analysis By Service

The service segment is categorized into diagnostic services, treatment planning, and support services. Diagnostic services dominate with a value of $1.71 billion in 2023, expected to rise to $3.35 billion by 2033. Treatment planning is also significant, starting at $0.65 billion and reaching $1.28 billion in the same year.

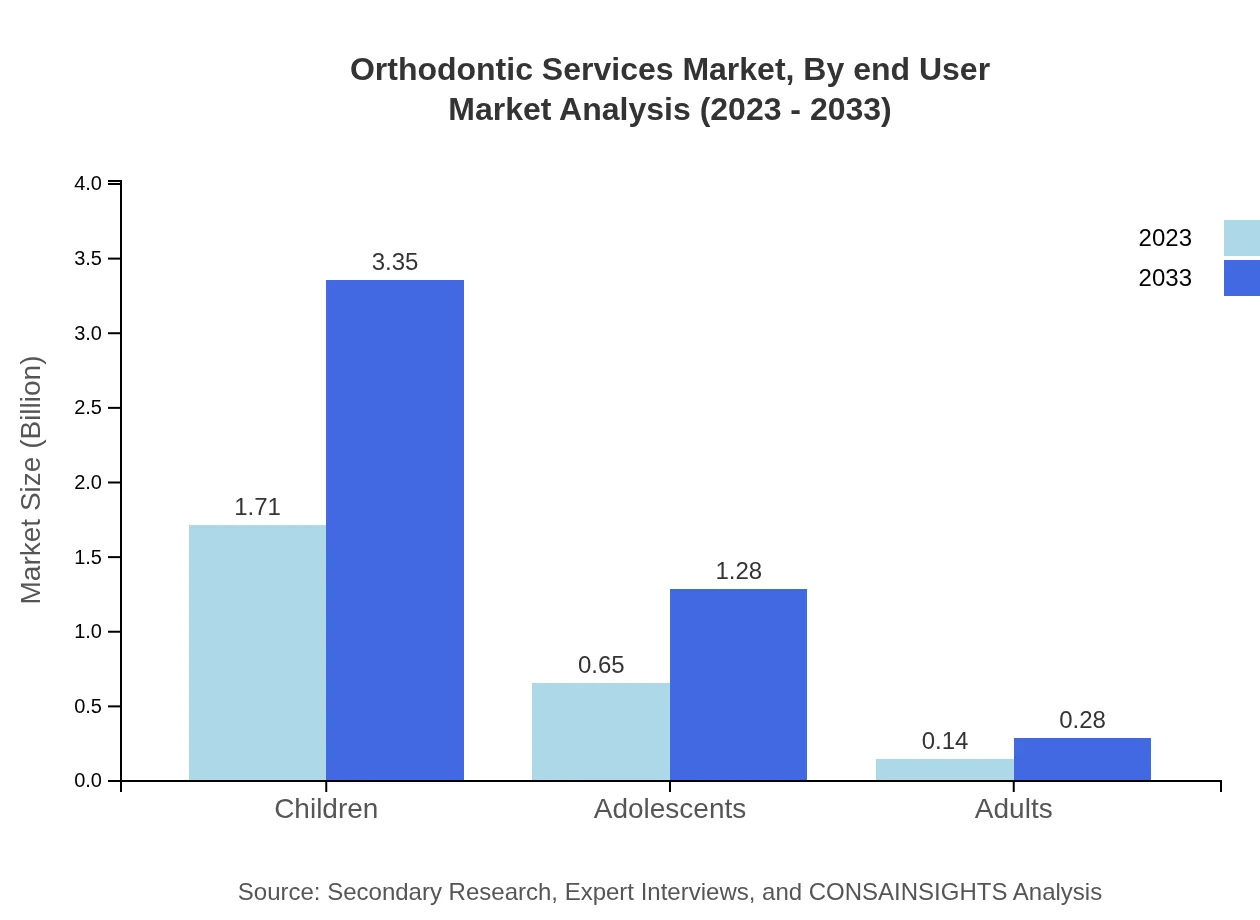

Orthodontic Services Market Analysis By End User

The market is further segmented by end-user demographics including children, adolescents, and adults. The children's segment leads with a market size of $1.71 billion in 2023, projected to increase to $3.35 billion by 2033, capturing a significant share due to high treatment discussions among parents.

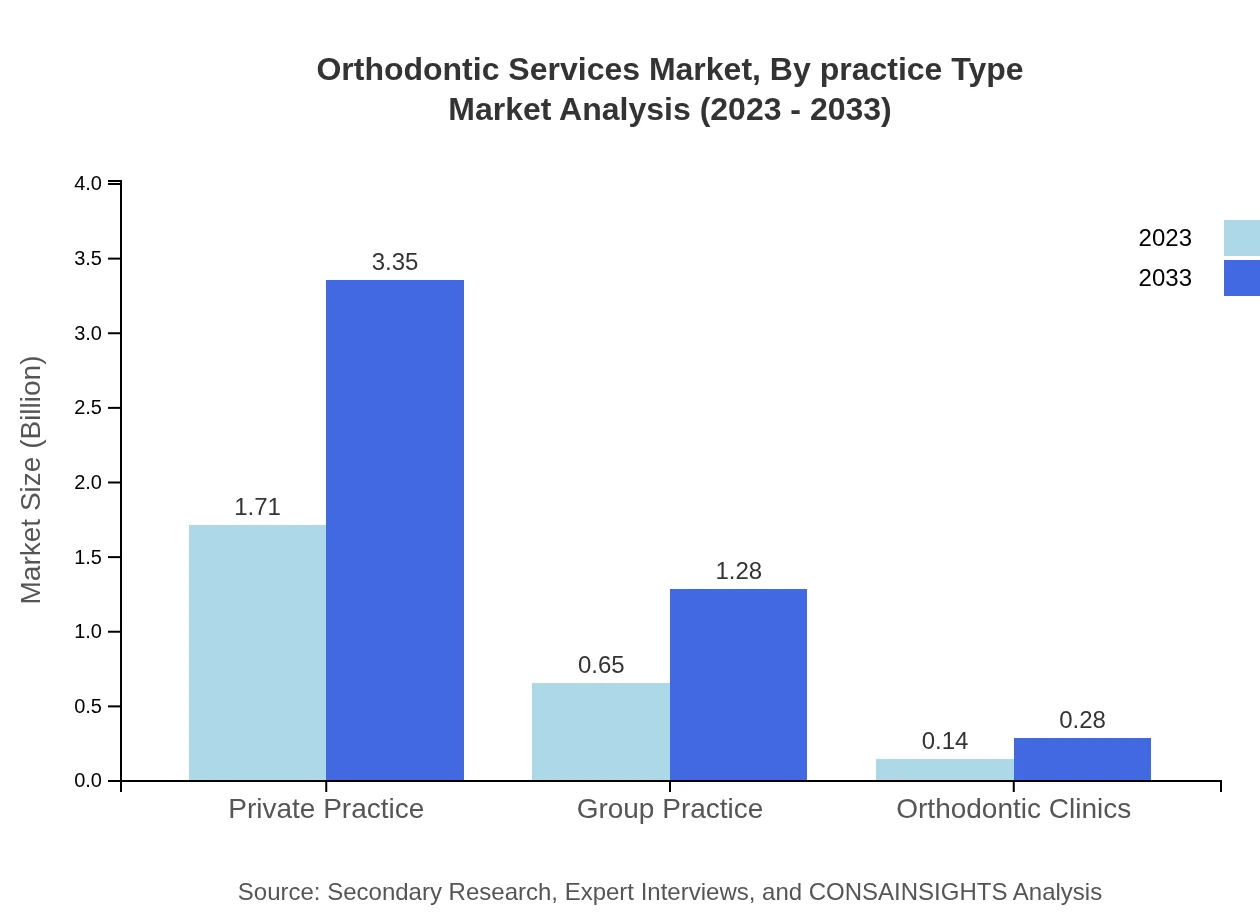

Orthodontic Services Market Analysis By Practice Type

Segments of practice types include private practices, group practices, and orthodontic clinics. Private practices, with a size of $1.71 billion in 2023, are projected to reach $3.35 billion by 2033, maintaining a dominant market share as they are the primary providers of orthodontic services.

Orthodontic Services Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Orthodontic Services Industry

Align Technology, Inc.:

Align Technology, Inc. is a leading manufacturer of clear aligners and the maker of the Invisalign system, which has transformed orthodontic treatments.3M Company:

3M Company is a diversified technology company that provides a comprehensive range of orthodontic products, including brackets and bonding systems.Ormco Corporation:

Ormco Corporation specializes in innovative orthodontic appliances, including brackets, wires, and clinical solutions, contributing significantly to the orthodontics market.Henry Schein, Inc.:

Henry Schein, Inc. is a healthcare provider of dental supplies and solutions, supporting dental professionals worldwide in orthodontic services.Dentsply Sirona Inc.:

Dentsply Sirona Inc. is known for dental and orthodontic products, including imaging systems and restorative materials, enhancing orthodontic care.We're grateful to work with incredible clients.

FAQs

What is the market size of orthodontic services?

The orthodontic services market is valued at $2.5 billion in 2023 and is expected to grow at a CAGR of 6.8% over the next decade. By 2033, the market is projected to expand significantly, reflecting increasing demand and advancements in dental technologies.

What are the key market players or companies in the orthodontic services industry?

The orthodontic services industry comprises several key players, including major dental practitioners and orthodontic manufacturers. These companies focus on innovative braces, aligners, and supporting devices to capture a larger market share and meet consumer needs.

What are the primary factors driving the growth in the orthodontic services industry?

Key drivers include increasing awareness of dental aesthetics, advancements in orthodontic technology, and a rising prevalence of dental issues among all age groups. The trend towards personalized dental care solutions further fuels market growth.

Which region is the fastest Growing in the orthodontic services market?

North America is the fastest-growing region, with a market size of $0.81 billion in 2023, projected to reach $1.59 billion by 2033. Europe follows closely, growing from $0.93 billion to $1.83 billion within the same period.

Does ConsaInsights provide customized market report data for the orthodontic services industry?

Yes, ConsaInsights offers customized market reports tailored to specific requirements within the orthodontic services industry. Clients can receive detailed analyses and forecasts based on their unique business needs.

What deliverables can I expect from this orthodontic services market research project?

Deliverables typically include a comprehensive market analysis, trend insights, competitive landscape assessments, regional breakdowns, segment data, and future projections to guide strategic decision-making.

What are the market trends of orthodontic services?

Current trends in the orthodontic services industry include a shift towards clear aligners, increased use of digital treatment planning, and a growing preference for home-based orthodontic solutions. These trends shape the industry's evolution and customer engagement strategies.