Patch Based Wound Healing Market Report

Published Date: 31 January 2026 | Report Code: patch-based-wound-healing

Patch Based Wound Healing Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Patch Based Wound Healing market, covering insights into market trends, segmentation, regional analysis, and future forecasts from 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

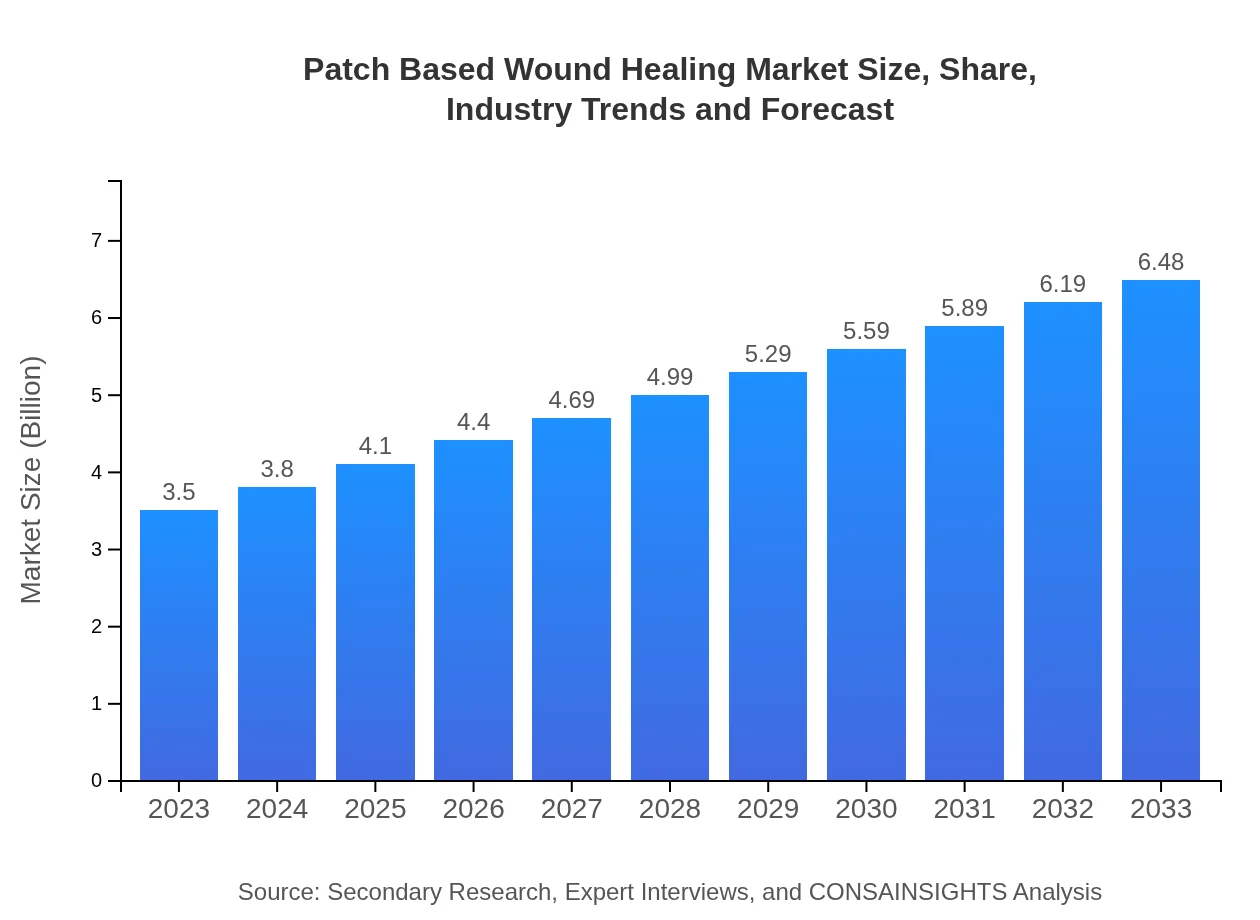

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $6.48 Billion |

| Top Companies | 3M Health Care, Smith & Nephew, Mölnlycke Health Care, Acelity |

| Last Modified Date | 31 January 2026 |

Patch Based Wound Healing Market Overview

Customize Patch Based Wound Healing Market Report market research report

- ✔ Get in-depth analysis of Patch Based Wound Healing market size, growth, and forecasts.

- ✔ Understand Patch Based Wound Healing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Patch Based Wound Healing

What is the Market Size & CAGR of Patch Based Wound Healing market in 2023?

Patch Based Wound Healing Industry Analysis

Patch Based Wound Healing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Patch Based Wound Healing Market Analysis Report by Region

Europe Patch Based Wound Healing Market Report:

The European market is expected to grow from USD 0.89 billion in 2023 to USD 1.66 billion by 2033. The growth in this region is driven by increasing surgical procedures and a growing trend of self-care among patients.Asia Pacific Patch Based Wound Healing Market Report:

In the Asia Pacific region, the market is projected to grow from USD 0.71 billion in 2023 to USD 1.32 billion by 2033, showcasing a steady increase fueled by rising healthcare expenditure and improving healthcare infrastructure.North America Patch Based Wound Healing Market Report:

North America leads the Patch Based Wound Healing market, with a market size projected to grow from USD 1.30 billion in 2023 to USD 2.42 billion in 2033. High adoption rates of advanced wound care products and the presence of leading market players contribute significantly to this region's dominance.South America Patch Based Wound Healing Market Report:

The South American market is estimated to expand from USD 0.21 billion in 2023 to USD 0.38 billion by 2033. The growth in this region is primarily attributed to increasing awareness regarding advanced wound care and rising incidences of diabetes and related wounds.Middle East & Africa Patch Based Wound Healing Market Report:

In the Middle East and Africa, the market is anticipated to rise from USD 0.38 billion in 2023 to USD 0.71 billion in 2033. The increasing adoption of advanced medical technologies and the rising incidence of chronic diseases are key growth factors.Tell us your focus area and get a customized research report.

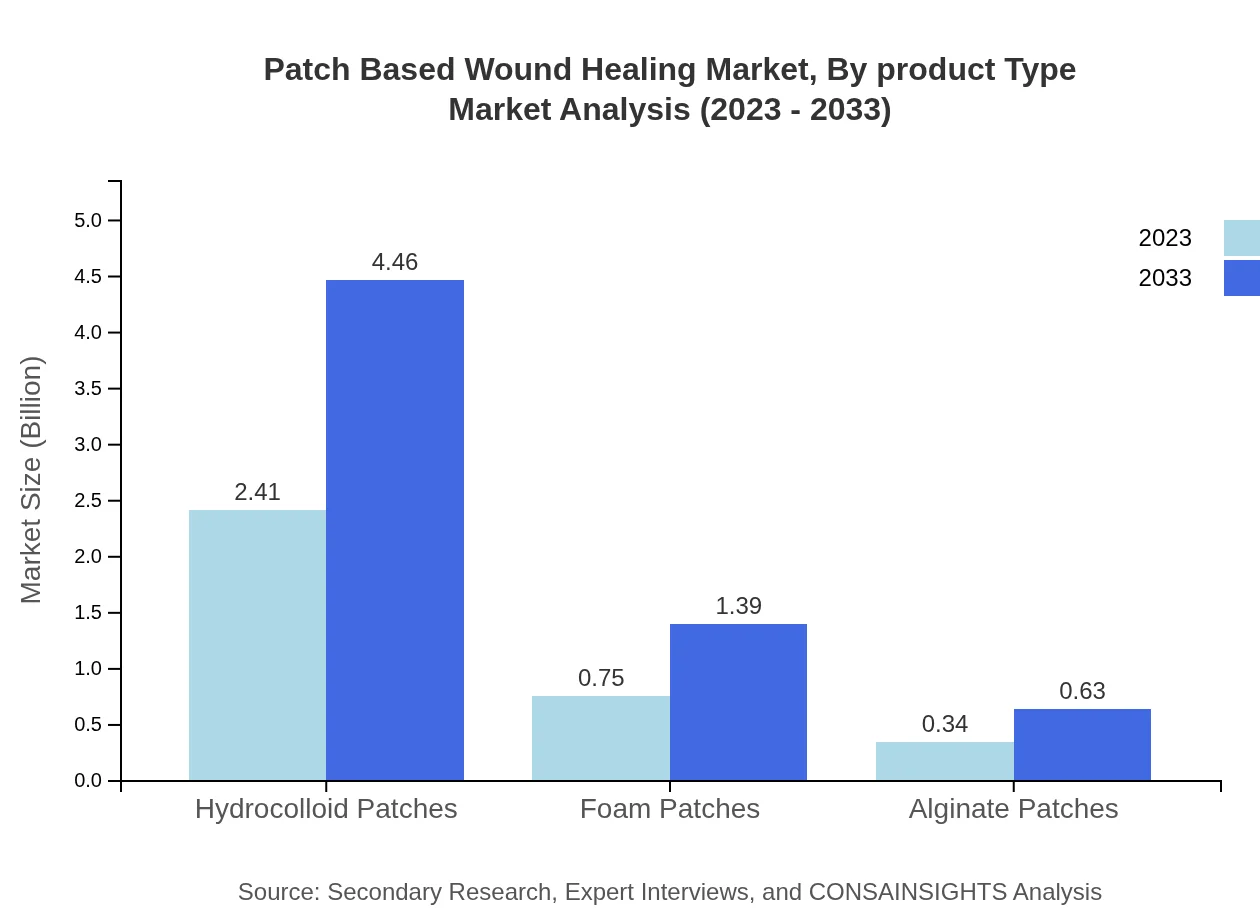

Patch Based Wound Healing Market Analysis By Product Type

The Patch Based Wound Healing market includes products such as hydrocolloid patches (USD 2.41 billion in 2023), foam patches (USD 0.75 billion), and alginate patches (USD 0.34 billion). Hydrocolloid patches dominate the market due to their advanced moisture-retentive properties, while foam patches are recognized for their versatility in treating multiple wound types.

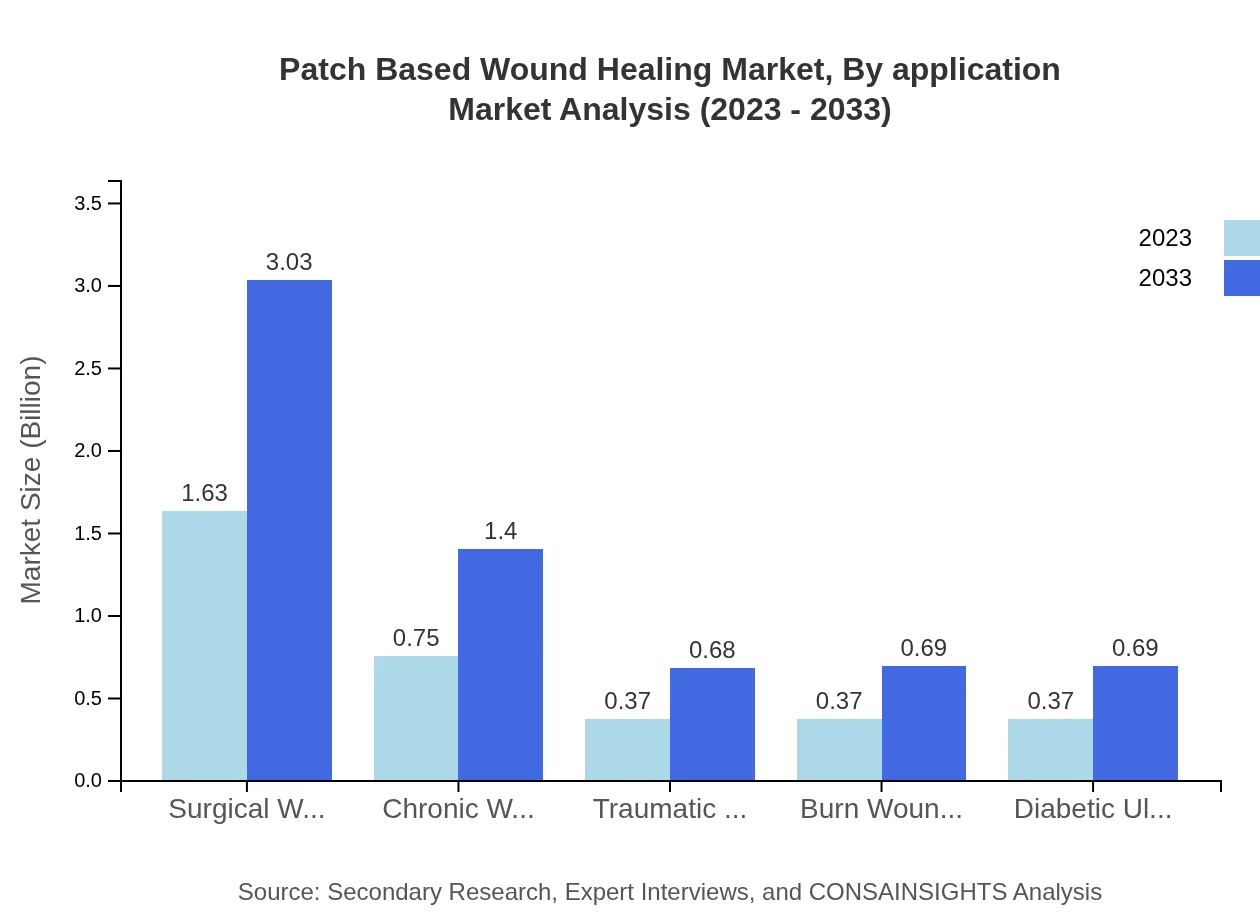

Patch Based Wound Healing Market Analysis By Application

The market segmentation by application demonstrates that surgical wounds hold a market share of 46.7% in 2023, driven by the increasing number of surgeries globally. Chronic wounds account for a significant share as well, with diabetic ulcers and burn wounds being high contributors to market growth.

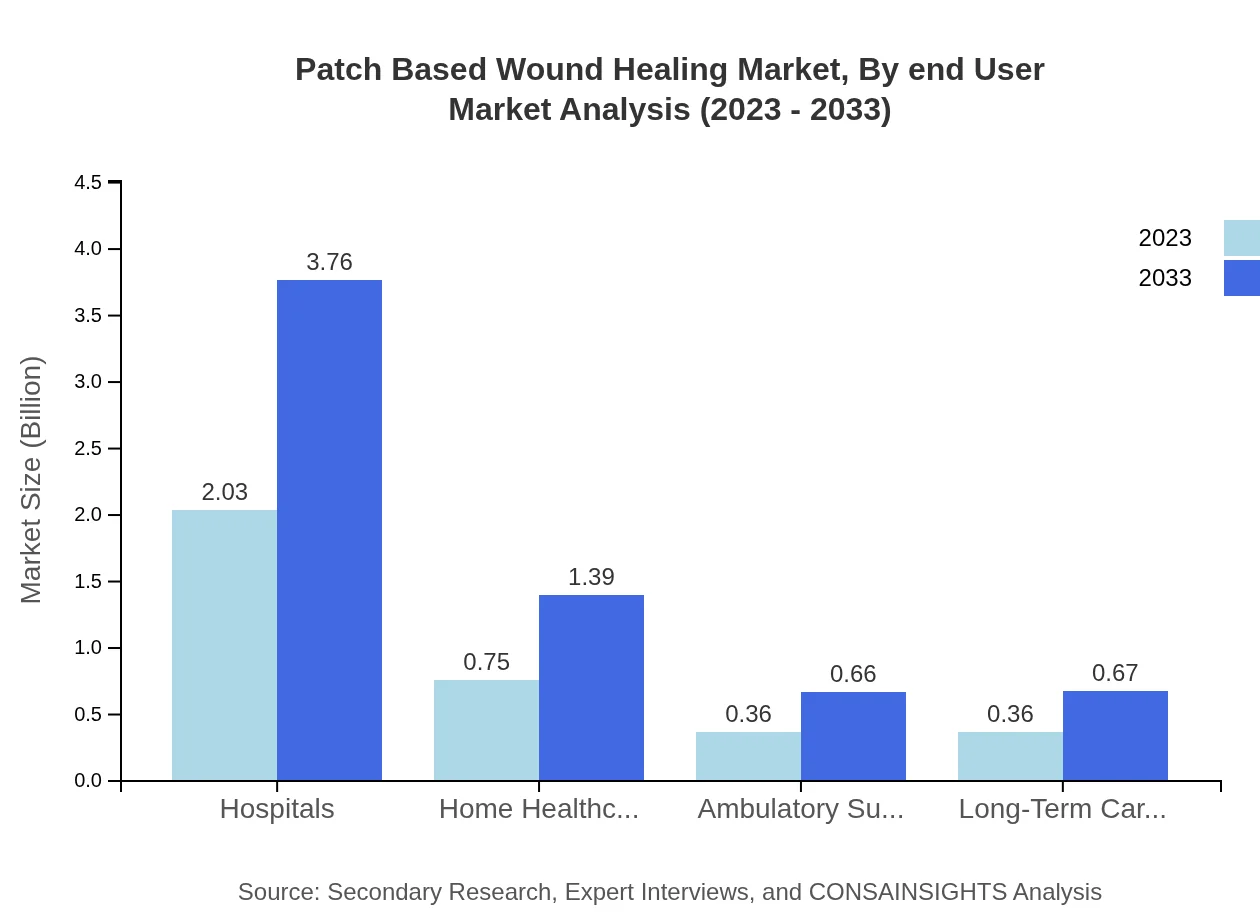

Patch Based Wound Healing Market Analysis By End User

Hospitals emerge as the largest end-user segment, accounting for 57.99% of the market in 2023. Home healthcare is increasingly gaining traction, estimated to reach USD 1.39 billion by 2033, highlighting the trend toward outpatient care solutions.

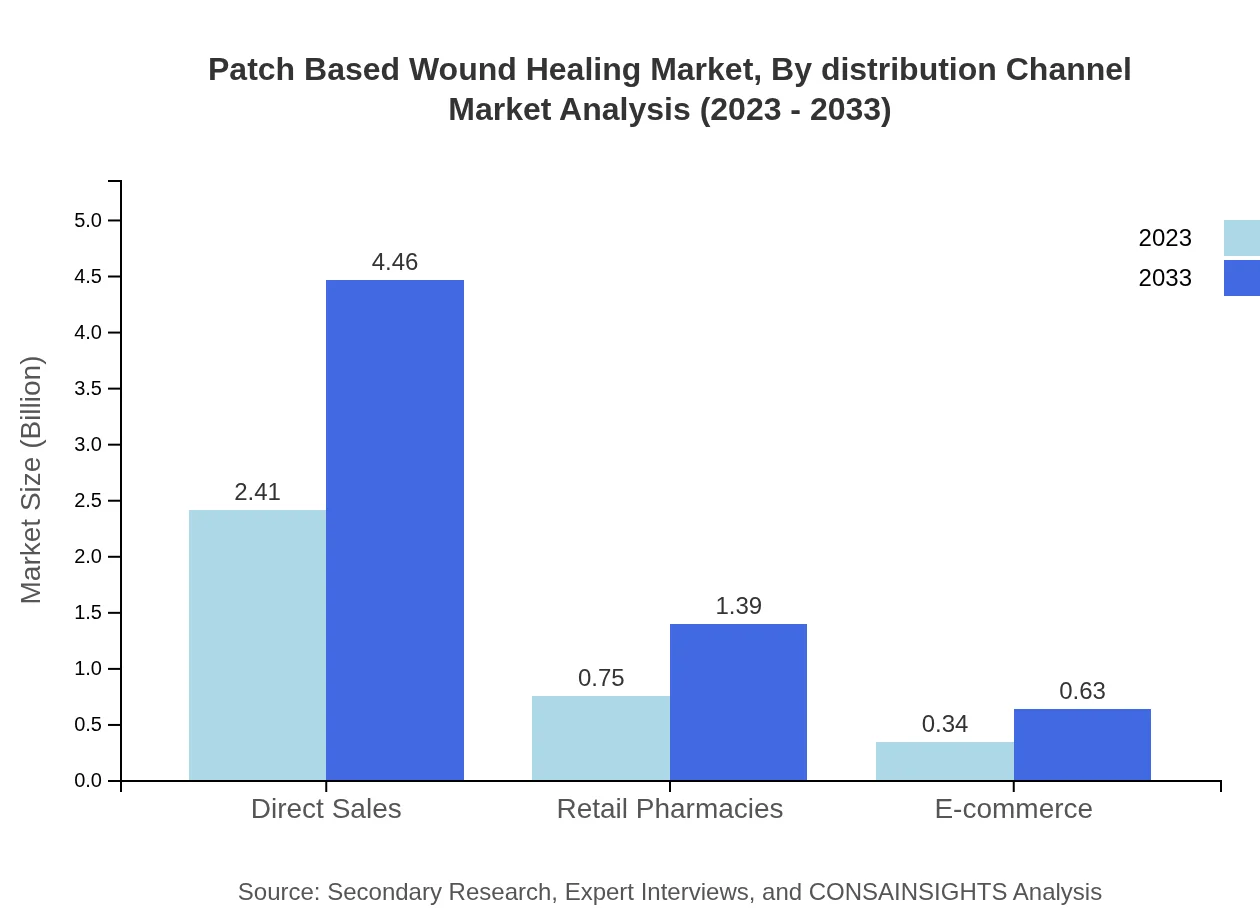

Patch Based Wound Healing Market Analysis By Distribution Channel

The distribution channel further divides the market into direct sales, retail pharmacies, and e-commerce. Direct sales dominated the market with a share of 68.79% in 2023. E-commerce is increasingly pivotal due to the rise of online sales and consumer preference for accessible purchasing options.

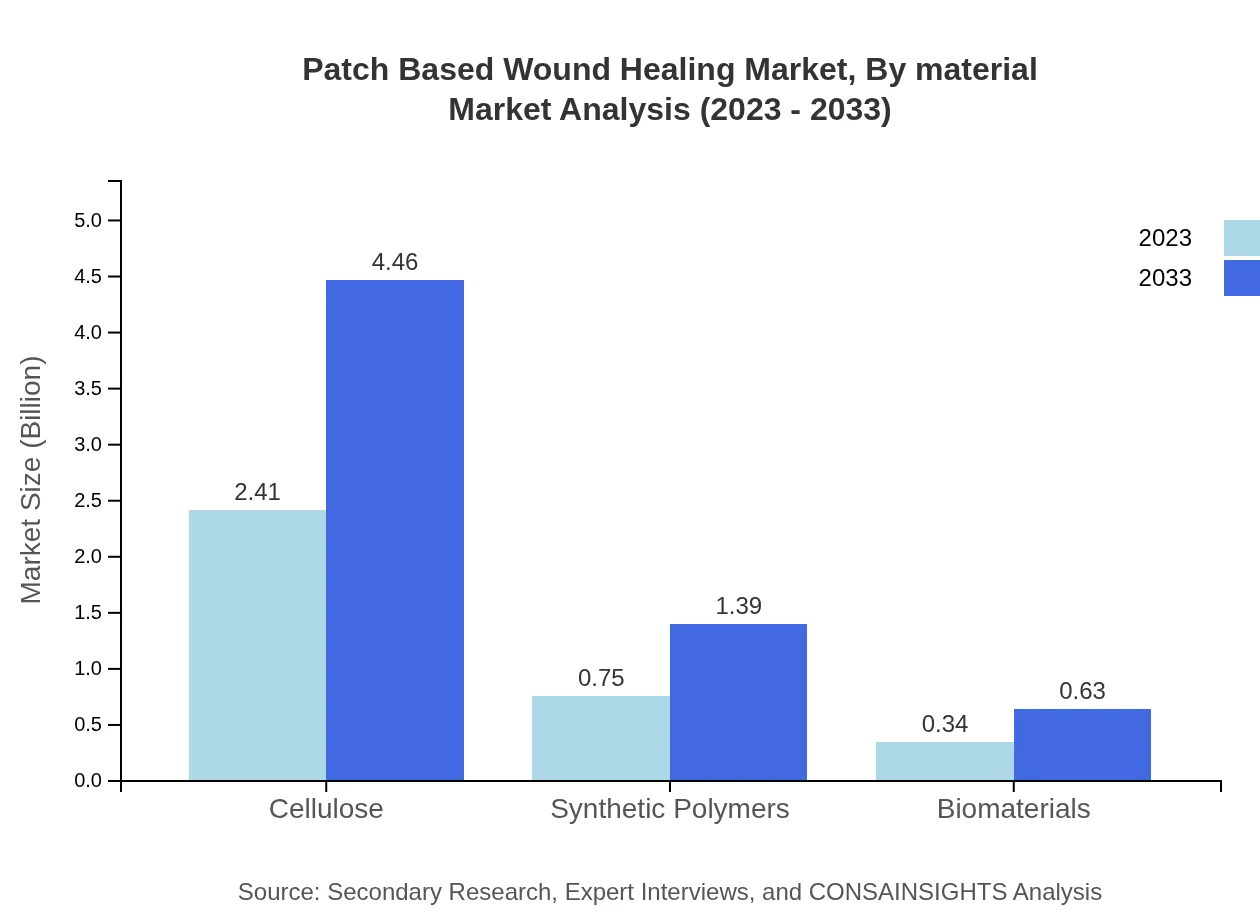

Patch Based Wound Healing Market Analysis By Material

The key materials used in patches include cellulose, synthetic polymers, and biomaterials. Cellulose leads the market with a share of 68.79% in 2023, owing to its biocompatibility and effectiveness. Synthetic polymers and biomaterials are gaining attention due to their advanced properties.

Patch Based Wound Healing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Patch Based Wound Healing Industry

3M Health Care:

A leading provider of advanced wound care solutions known for its innovative products like Tegaderm and Coban.Smith & Nephew:

A global medical technology company specializing in advanced wound management and regenerative medicine.Mölnlycke Health Care:

Renowned for its Safetac technology and comprehensive portfolio of wound management products.Acelity:

A healthcare company focusing on wound healing and regenerative medicine, with a range of market-leading products.We're grateful to work with incredible clients.

FAQs

What is the market size of patch Based wound healing?

The patch-based wound healing market is projected to grow from $3.5 billion in 2023 to significant heights by 2033, with a remarkable CAGR of 6.2%. This growth is attributed to the increasing demand for advanced wound care solutions.

What are the key market players or companies in this industry?

The patch-based wound healing industry boasts several key players such as Johnson & Johnson, Smith & Nephew, 3M, Medtronic, and Coloplast. These companies are significant contributors to technological advancements and market expansion.

What are the primary factors driving the growth in the patch Based wound healing industry?

Key growth factors include increasing incidences of chronic wounds, a rising geriatric population, advancements in wound care technologies, and heightened awareness regarding wound management. These factors contribute to a booming market demand.

Which region is the fastest Growing in the patch Based wound healing market?

North America is the fastest-growing region for patch-based wound healing, expanding from $1.30 billion in 2023 to $2.42 billion in 2033. Other notable regions are Europe and Asia Pacific, both showing substantial growth rates.

Does ConsaInsights provide customized market report data for the patch Based wound healing industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the patch-based wound healing industry, allowing businesses to gain insights that are pertinent to their strategies and market positioning.

What deliverables can I expect from this patch Based wound healing market research project?

Deliverables include comprehensive market analyses, segmentation data, competitive landscapes, growth forecasts, and strategic recommendations. Customized insights will equip stakeholders to make informed decisions.

What are the market trends of patch Based wound healing?

Trends include a shift toward advanced wound dressings, increased utilization of telemedicine for wound management, and growth in e-commerce channels. The focus on innovative material development, such as hydrocolloid and foam patches, continues to shape the market.