Safety Drives And Motors Market Report

Published Date: 31 January 2026 | Report Code: safety-drives-and-motors

Safety Drives And Motors Market Size, Share, Industry Trends and Forecast to 2033

This report presents a comprehensive analysis of the Safety Drives and Motors market, highlighting key insights, current trends, and future outlook from 2023 to 2033. It covers market dynamics, segmentation, industry analysis, and regional performance to aid stakeholders in making informed decisions.

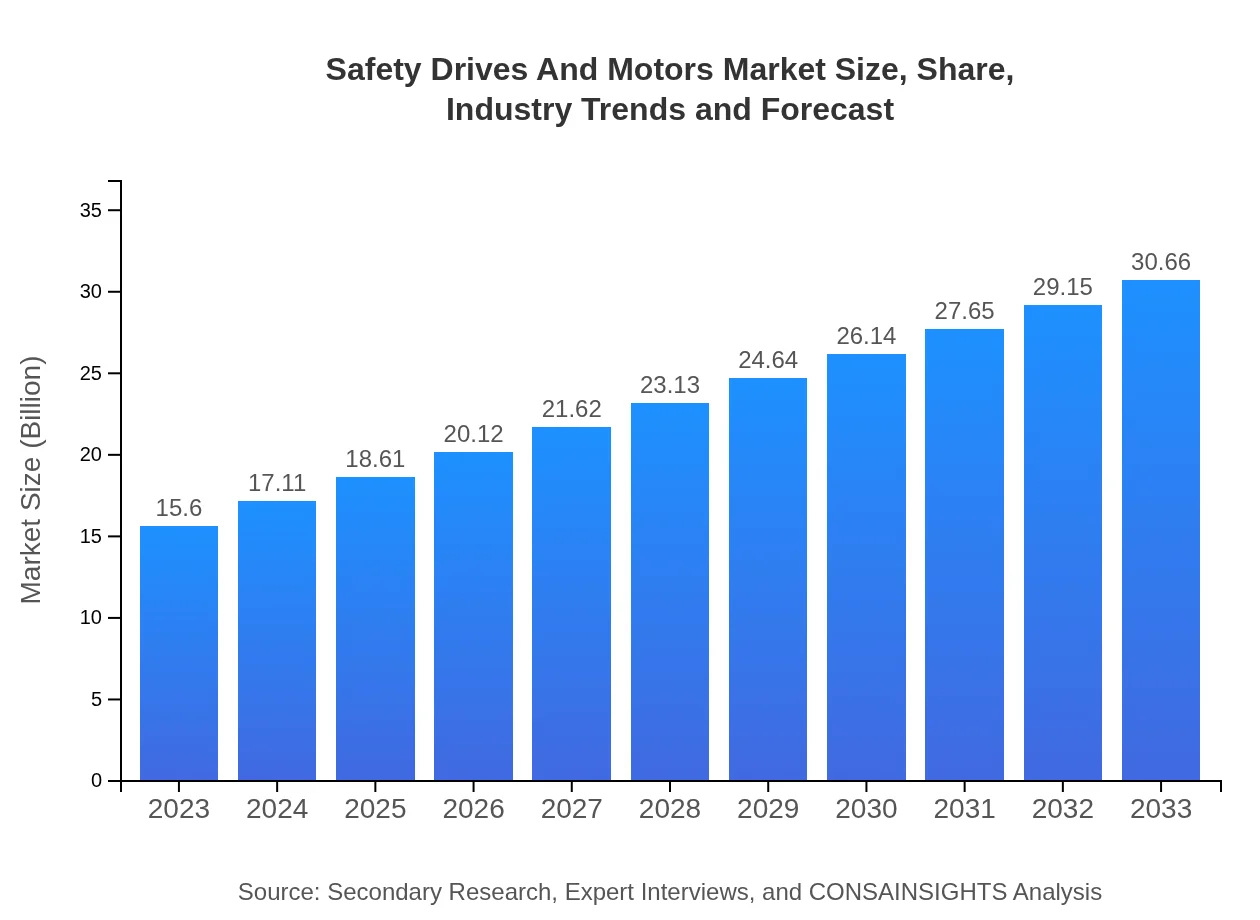

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $30.66 Billion |

| Top Companies | Siemens AG, Rockwell Automation, Inc., Schneider Electric SE, ABB Ltd., Honeywell International Inc. |

| Last Modified Date | 31 January 2026 |

Safety Drives And Motors Market Overview

Customize Safety Drives And Motors Market Report market research report

- ✔ Get in-depth analysis of Safety Drives And Motors market size, growth, and forecasts.

- ✔ Understand Safety Drives And Motors's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Safety Drives And Motors

What is the Market Size & CAGR of Safety Drives And Motors market in 2023?

Safety Drives And Motors Industry Analysis

Safety Drives And Motors Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Safety Drives And Motors Market Analysis Report by Region

Europe Safety Drives And Motors Market Report:

Europe's market is anticipated to rise from USD 5.04 billion in 2023 to USD 9.91 billion by 2033, influenced by high standards of workplace safety and intensive R&D activities undertaken by leading manufacturing firms.Asia Pacific Safety Drives And Motors Market Report:

In the Asia Pacific region, the Safety Drives and Motors market is projected to grow from USD 2.47 billion in 2023 to USD 4.86 billion by 2033, supported by rapid industrialization and government initiatives to enhance workplace safety standards.North America Safety Drives And Motors Market Report:

North America holds a significant share in the Safety Drives and Motors market, with expected growth from USD 5.85 billion in 2023 to USD 11.50 billion by 2033. This growth is fueled by stringent safety regulations and increasing demand for advanced automation solutions.South America Safety Drives And Motors Market Report:

The South American market is expected to increase from USD 0.96 billion in 2023 to USD 1.89 billion by 2033. The growth is driven by expanding manufacturing activities and increased investment in industrial safety.Middle East & Africa Safety Drives And Motors Market Report:

The Middle East and Africa market is expected to grow from USD 1.27 billion in 2023 to USD 2.49 billion by 2033, driven by industrial development and increasing regulatory focus on safety in manufacturing.Tell us your focus area and get a customized research report.

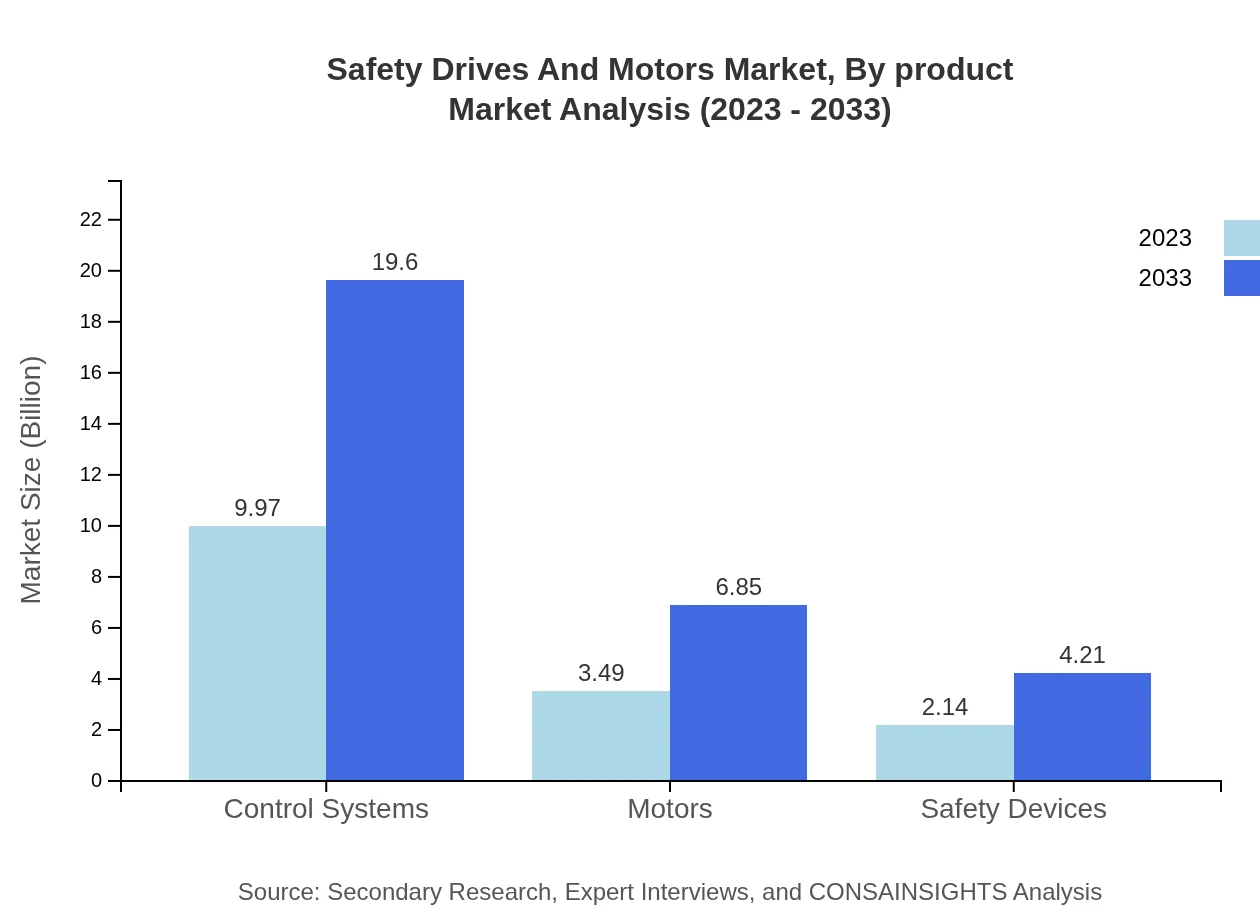

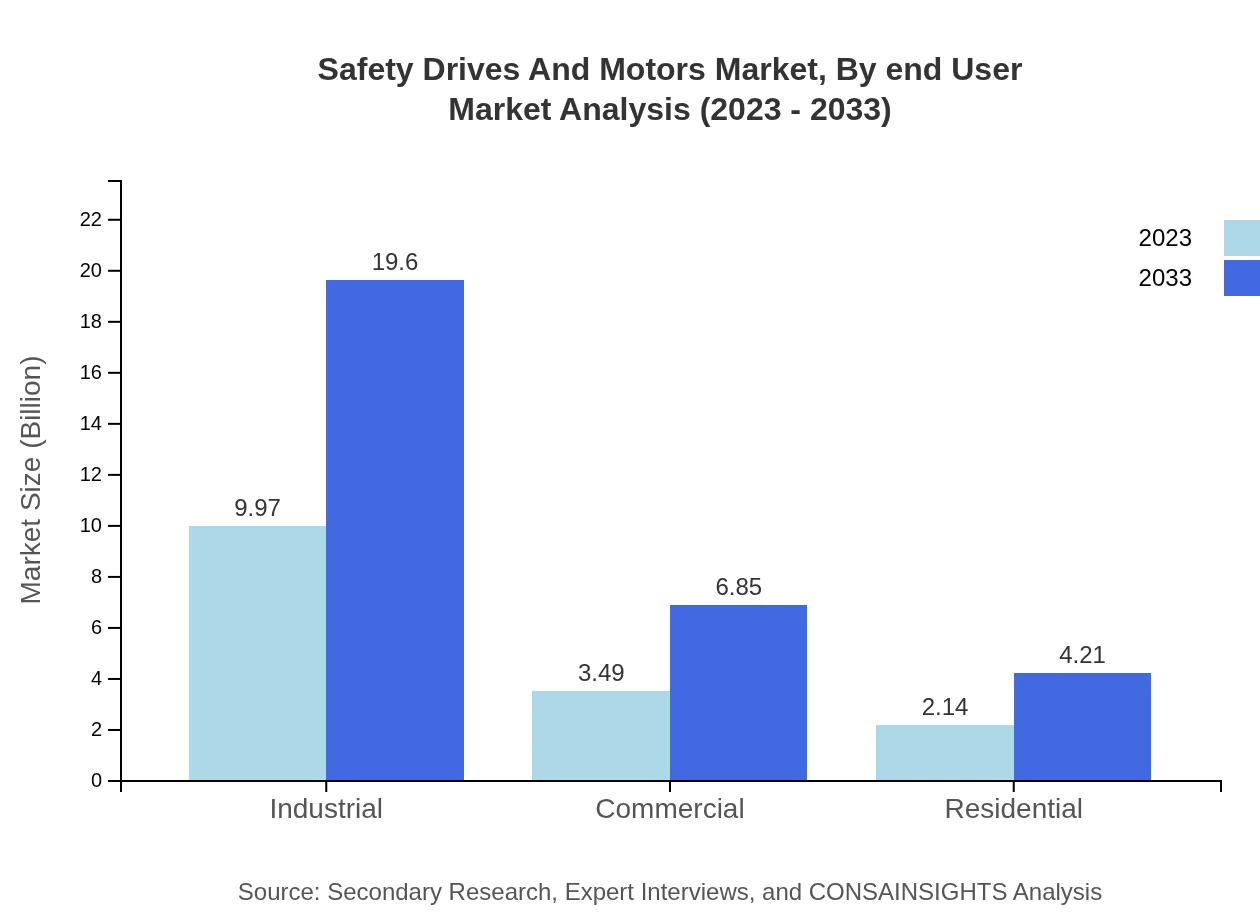

Safety Drives And Motors Market Analysis By Product

The Safety Drives and Motors market, by product, is primarily categorized into Control Systems, Motors, and Safety Devices. The Control Systems segment is anticipated to dominate the market, growing from USD 9.97 billion in 2023 to USD 19.60 billion in 2033. This segment emphasizes advanced automation, enabling real-time monitoring and control. Motors are also growing, projected to reach USD 6.85 billion by 2033 from USD 3.49 billion in 2023. Safety Devices, crucial for compliance and accident prevention, will grow significantly as safety becomes central to industrial operations.

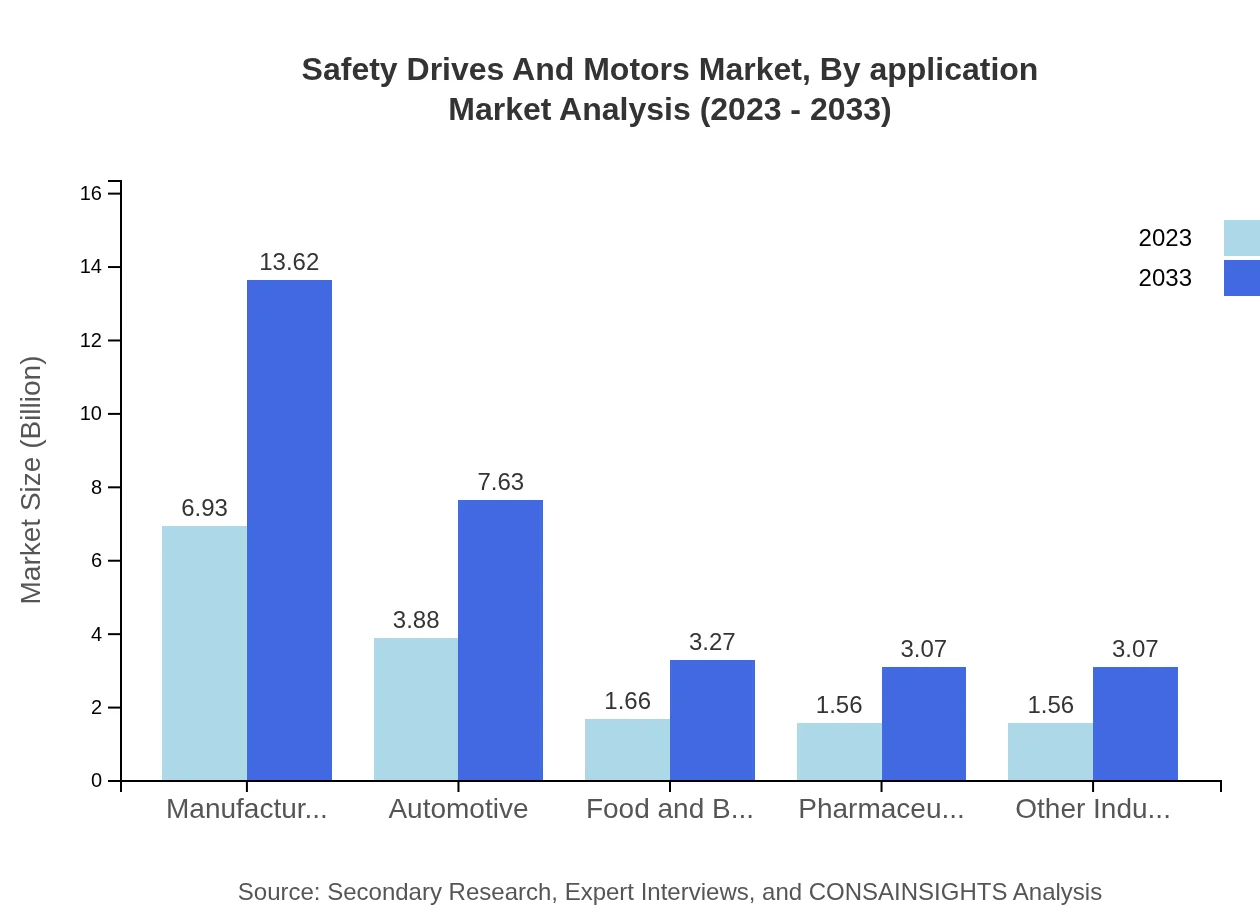

Safety Drives And Motors Market Analysis By Application

Safety Drives and Motors are utilized across various applications, including manufacturing, automotive, food and beverage, and pharmaceuticals. Manufacturing remains the largest application segment, occupying a share of 44.41% in 2023, expected to continue this trend into 2033 with a market size projected at USD 13.62 billion. The automotive sector, valued at USD 3.88 billion in 2023, is set for growth as the demand for automated safety features increases.

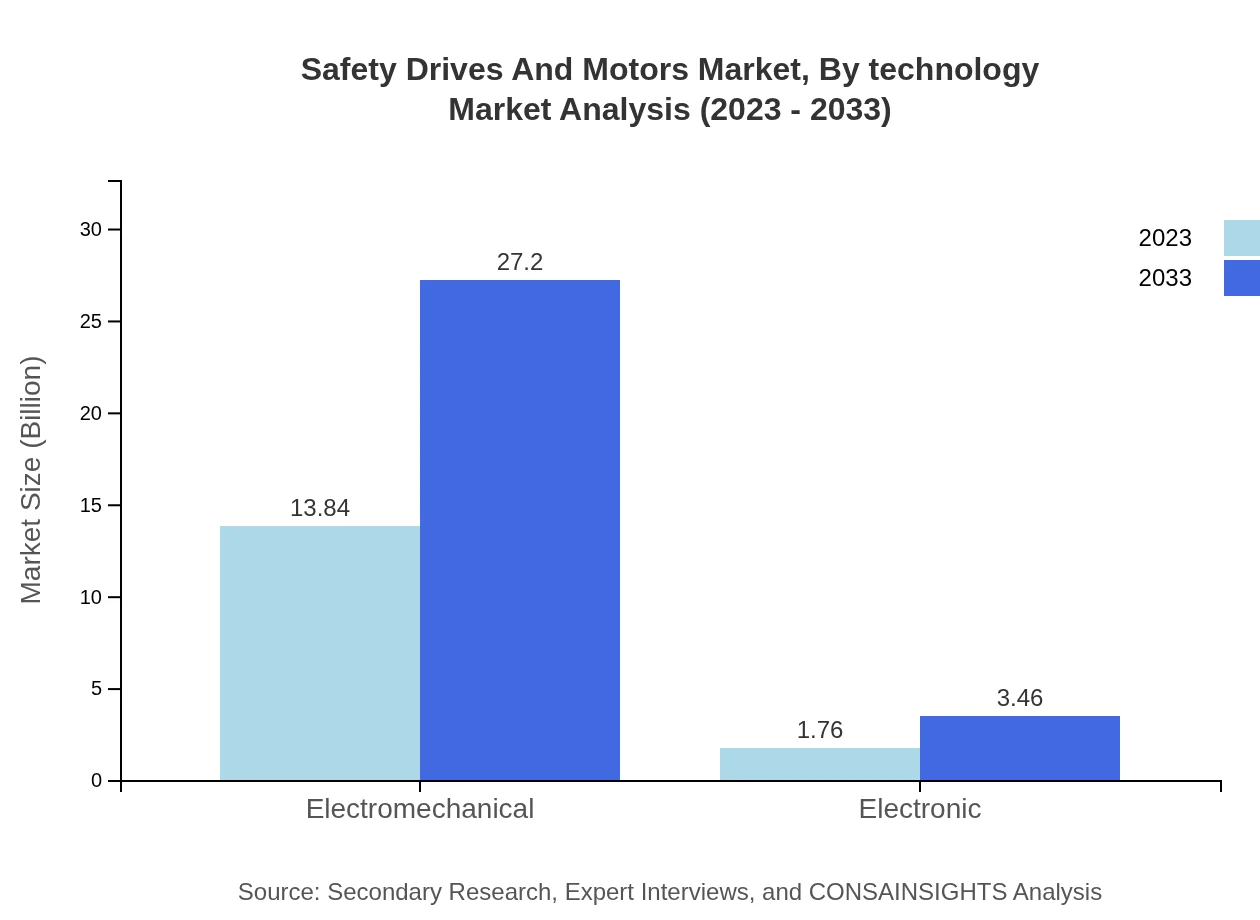

Safety Drives And Motors Market Analysis By Technology

The market can be segmented by technology into Electromechanical and Electronic systems. The Electromechanical segment, holding an 88.7% share in 2023, is predicted to maintain its lead, growing to USD 27.20 billion by 2033. The Electronic segment is also expanding, with applications in precision control systems enhancing operational safety in various industrial processes, projected to reach USD 3.46 billion.

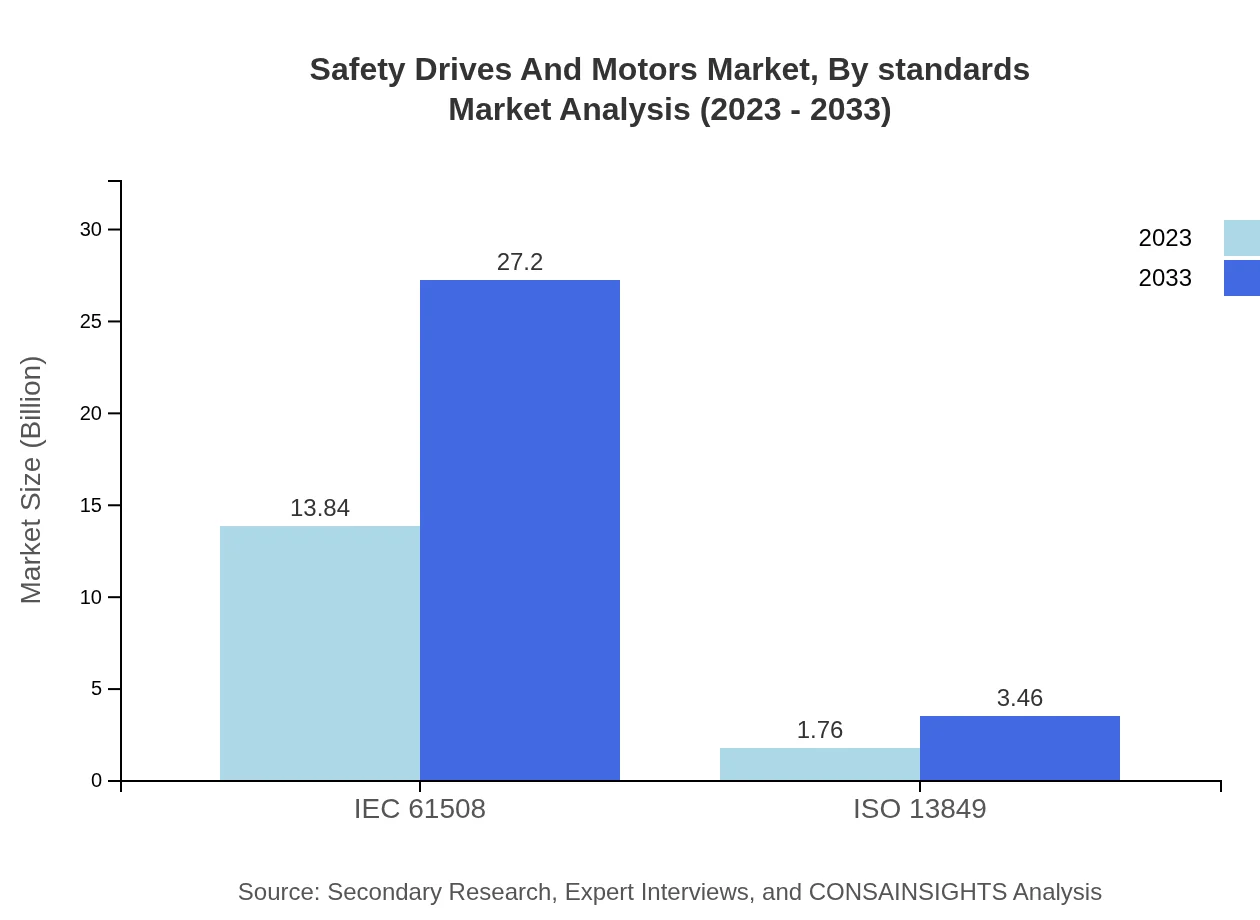

Safety Drives And Motors Market Analysis By Standards

Compliance with safety standards such as IEC 61508 and ISO 13849 is critical in the Safety Drives and Motors market. IEC 61508 segment, which comprised an 88.7% market share in 2023, is projected to grow significantly, paralleling an overall increase in safety regulation adherence. ISO 13849, also essential for designing safety-critical machinery, is predicted to expand as manufacturers prioritize safety.

Safety Drives And Motors Market Analysis By End User

Key end-user industries for Safety Drives and Motors include manufacturing, automotive, pharmaceuticals, food and beverage, and others. The manufacturing industry leads, drawing significant investment for safety compliance and automation, while the automotive sector showcases rapid growth in integrating safety technologies in vehicles. The food and beverage industry, with its compliance-driven needs for cleanliness and safety, will also contribute to market growth.

Safety Drives And Motors Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Safety Drives And Motors Industry

Siemens AG:

Siemens AG is a global leader in automation technology, offering a wide range of safety drives and motors, driving advancements in industrial safety and efficiency.Rockwell Automation, Inc.:

Rockwell Automation specializes in industrial automation solutions, particularly in safety and control systems, enhancing operational safety across diverse applications.Schneider Electric SE:

Schneider Electric focuses on digital transformation of energy management and automation, providing comprehensive safety solutions in motors and drives.ABB Ltd.:

ABB is a pioneer in power and automation technologies, delivering an expansive range of safety drives and motors designed for sustainable and secure operations.Honeywell International Inc.:

Honeywell emphasizes safety and productivity in its offerings, providing advanced safety drives and motors catering to various industrial needs.We're grateful to work with incredible clients.

FAQs

What is the market size of safety Drives And Motors?

The global safety drives and motors market is valued at approximately $15.6 billion in 2023. It is projected to grow at a CAGR of 6.8%, reaching significant growth by 2033.

What are the key market players or companies in this safety Drives And Motors industry?

Leading players in the safety drives and motors industry include Siemens, Schneider Electric, Rockwell Automation, ABB, and Mitsubishi Electric. These companies dominate due to their innovative technologies and extensive market reach.

What are the primary factors driving the growth in the safety Drives And Motors industry?

Key growth drivers include increasing safety regulations, the demand for automation in various industries, technological advancements, and the rising need for energy-efficient systems. These factors collectively enhance market opportunities.

Which region is the fastest Growing in the safety Drives And Motors?

North America is the fastest-growing region in the safety drives and motors market, projected to grow from $5.85 billion in 2023 to $11.50 billion by 2033, indicating robust demand and a growing industrial base.

Does ConsaInsights provide customized market report data for the safety Drives And Motors industry?

Yes, ConsaInsights offers customized market report data tailored to client needs in the safety drives and motors industry, ensuring detailed insights aligned with specific business objectives.

What deliverables can I expect from this safety Drives And Motors market research project?

Expected deliverables include an in-depth market analysis, growth forecasts, competitor positioning, and regional insights, all presented in a comprehensible format tailored to strategic decision-making.

What are the market trends of safety Drives And Motors?

Current trends include increasing integration of IoT in safety systems, a shift towards digitalization, rising adoption of AI technologies, and growing investments in automation across various sectors.