Stable Isotope Labeled Compounds Market Report

Published Date: 31 January 2026 | Report Code: stable-isotope-labeled-compounds

Stable Isotope Labeled Compounds Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the stable isotope labeled compounds market, outlining key trends, sizing forecasts from 2023 to 2033, and regional analyses. Insights cover market dynamics, advancements in technology, segmented evaluations, and key players shaping the industry.

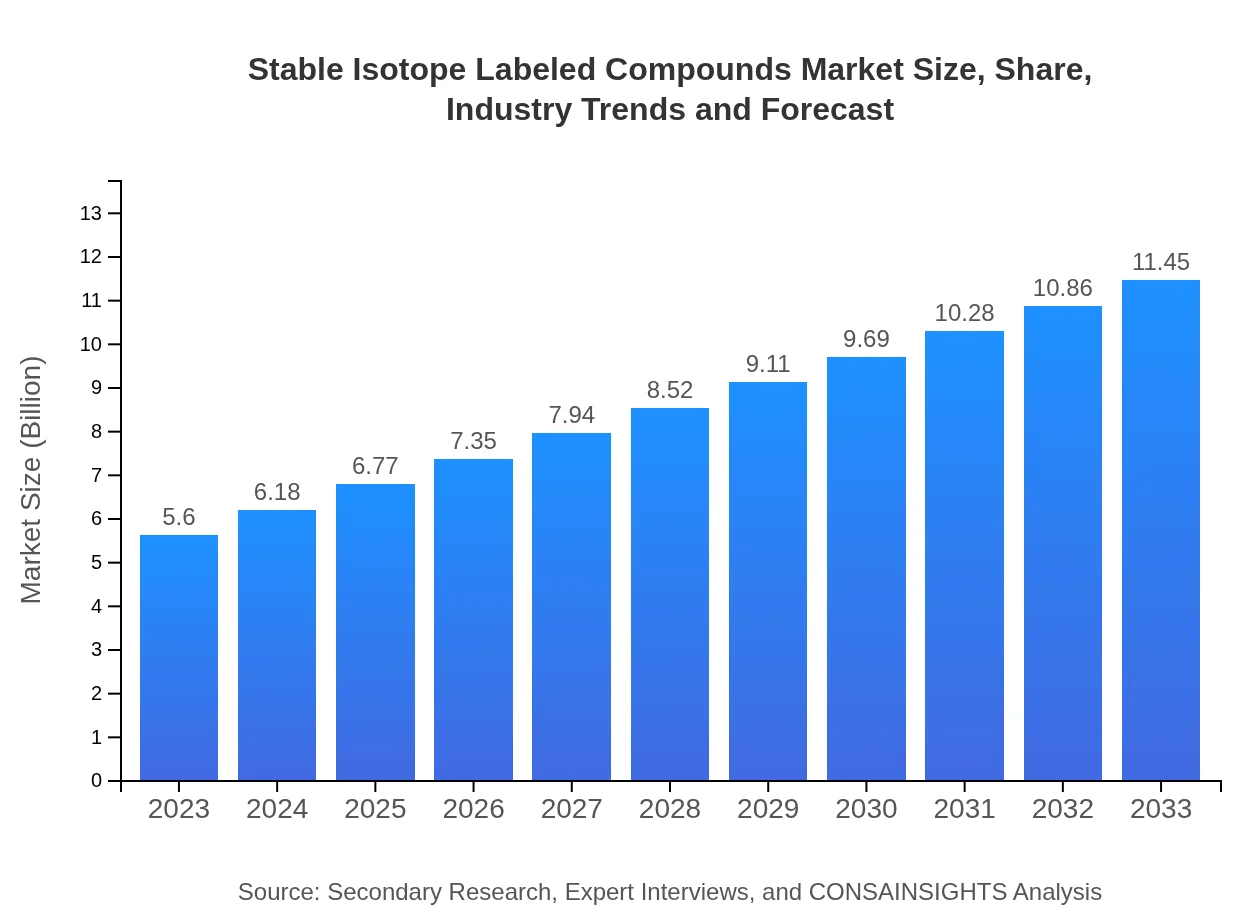

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $11.45 Billion |

| Top Companies | Cambridge Isotope Laboratories, Inc., Isotopes Incorporated, Sigma-Aldrich (MilliporeSigma), Wellington Laboratories |

| Last Modified Date | 31 January 2026 |

Stable Isotope Labeled Compounds Market Overview

Customize Stable Isotope Labeled Compounds Market Report market research report

- ✔ Get in-depth analysis of Stable Isotope Labeled Compounds market size, growth, and forecasts.

- ✔ Understand Stable Isotope Labeled Compounds's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Stable Isotope Labeled Compounds

What is the Market Size & CAGR of Stable Isotope Labeled Compounds market in 2023?

Stable Isotope Labeled Compounds Industry Analysis

Stable Isotope Labeled Compounds Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Stable Isotope Labeled Compounds Market Analysis Report by Region

Europe Stable Isotope Labeled Compounds Market Report:

The European market is anticipated to grow from USD 1.79 billion in 2023 to USD 3.66 billion by 2033, bolstered by strict regulatory frameworks that promote innovative drug developments and investments in metabolic studies.Asia Pacific Stable Isotope Labeled Compounds Market Report:

In the Asia Pacific region, the stable isotope labeled compounds market is expected to grow from USD 0.97 billion in 2023 to USD 1.99 billion by 2033. This growth is driven by increasing R&D expenditures in biotechnology and pharmaceutical sectors, alongside rising government initiatives supporting healthcare innovations.North America Stable Isotope Labeled Compounds Market Report:

North America remains the largest market, expected to grow from USD 2.09 billion in 2023 to USD 4.26 billion by 2033. The region benefits from a robust pharmaceutical industry and significant investments in research and clinical trials, especially in the USA.South America Stable Isotope Labeled Compounds Market Report:

The South American market is projected to increase from USD 0.12 billion in 2023 to USD 0.25 billion by 2033. This modest growth is primarily due to expanding research initiatives and partnerships with global firms focusing on local pharmaceutical development.Middle East & Africa Stable Isotope Labeled Compounds Market Report:

The Middle East and Africa market is projected to rise from USD 0.63 billion in 2023 to USD 1.28 billion by 2033, with increasing healthcare objectives aimed at enhancing the pharmaceutical and diagnostic sectors.Tell us your focus area and get a customized research report.

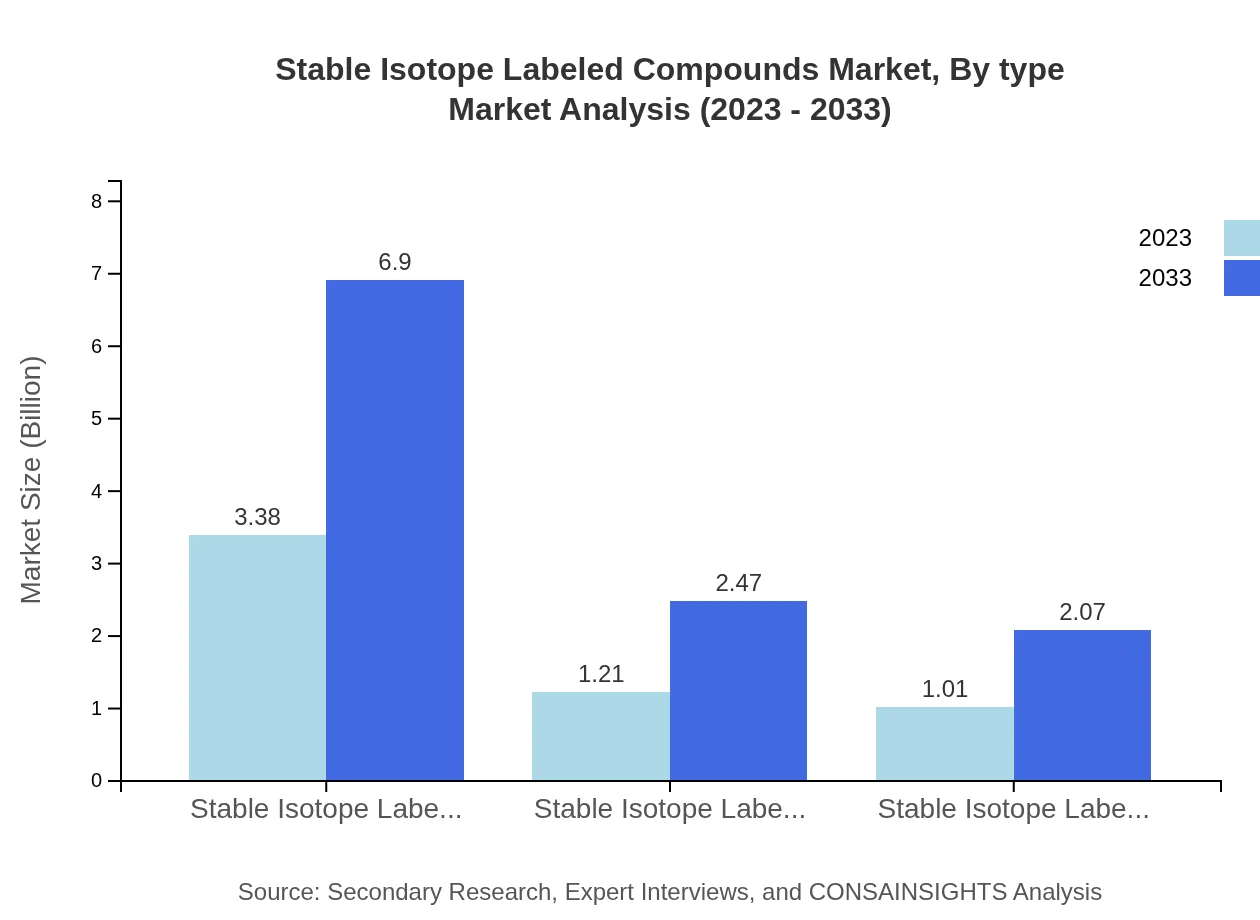

Stable Isotope Labeled Compounds Market Analysis By Type

In 2023, the Stable Isotope Labeled Amino Acids segment leads with a market size of USD 3.38 billion and a share of 60.29%. It is expected to reach USD 6.90 billion by 2033. Other significant segments include Labeled Nucleotides (USD 1.21 billion in 2023) expected to grow to USD 2.47 billion, and Metabolites (USD 1.01 billion in 2023) anticipated to increase to USD 2.07 billion.

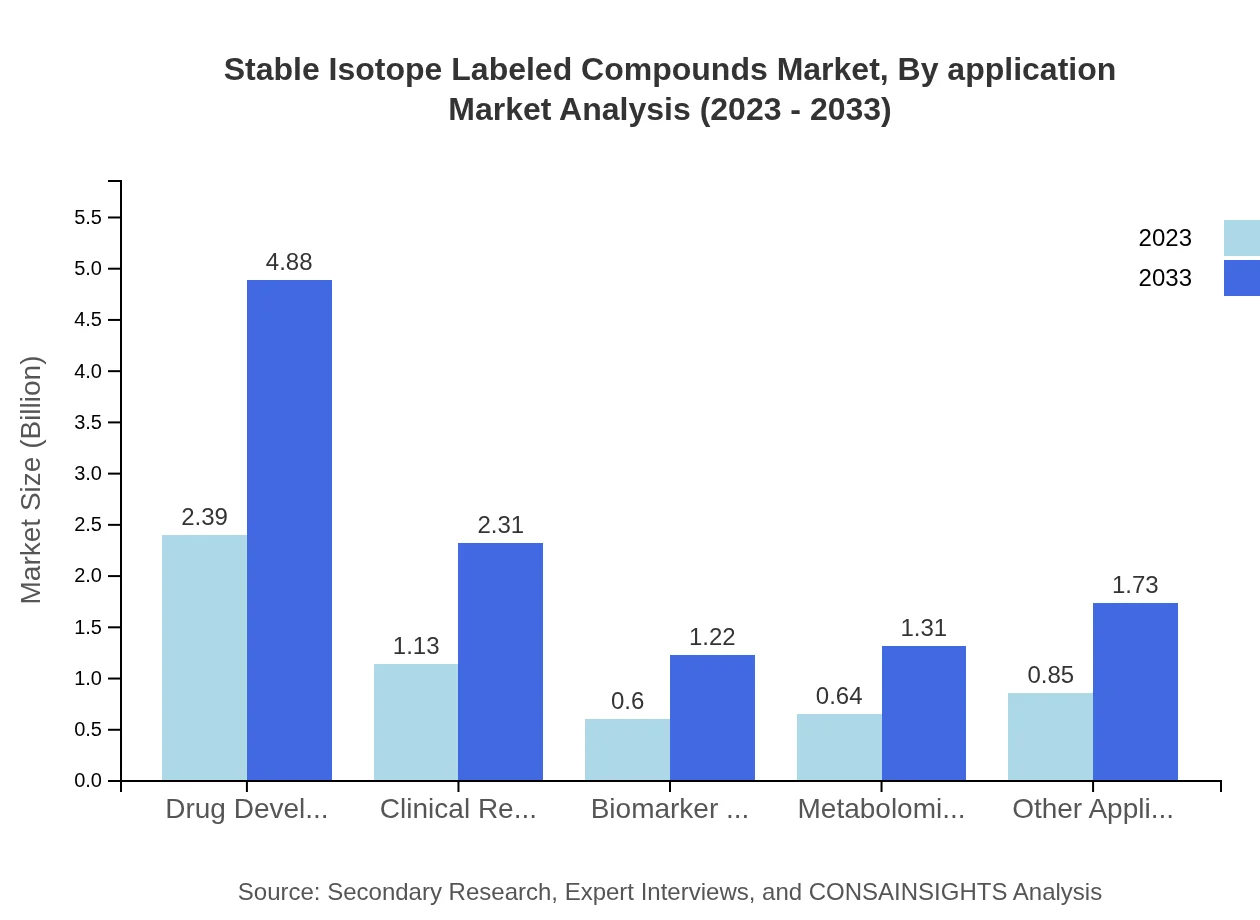

Stable Isotope Labeled Compounds Market Analysis By Application

The application in Drug Development represents 42.59% of the market with a size of USD 2.39 billion in 2023, projected to grow to USD 4.88 billion by 2033. Clinical Research holds a crucial share of 20.22% with growth from USD 1.13 billion to USD 2.31 billion. Biomarker Discovery accounts for 10.65%, increasing from USD 0.60 billion to USD 1.22 billion.

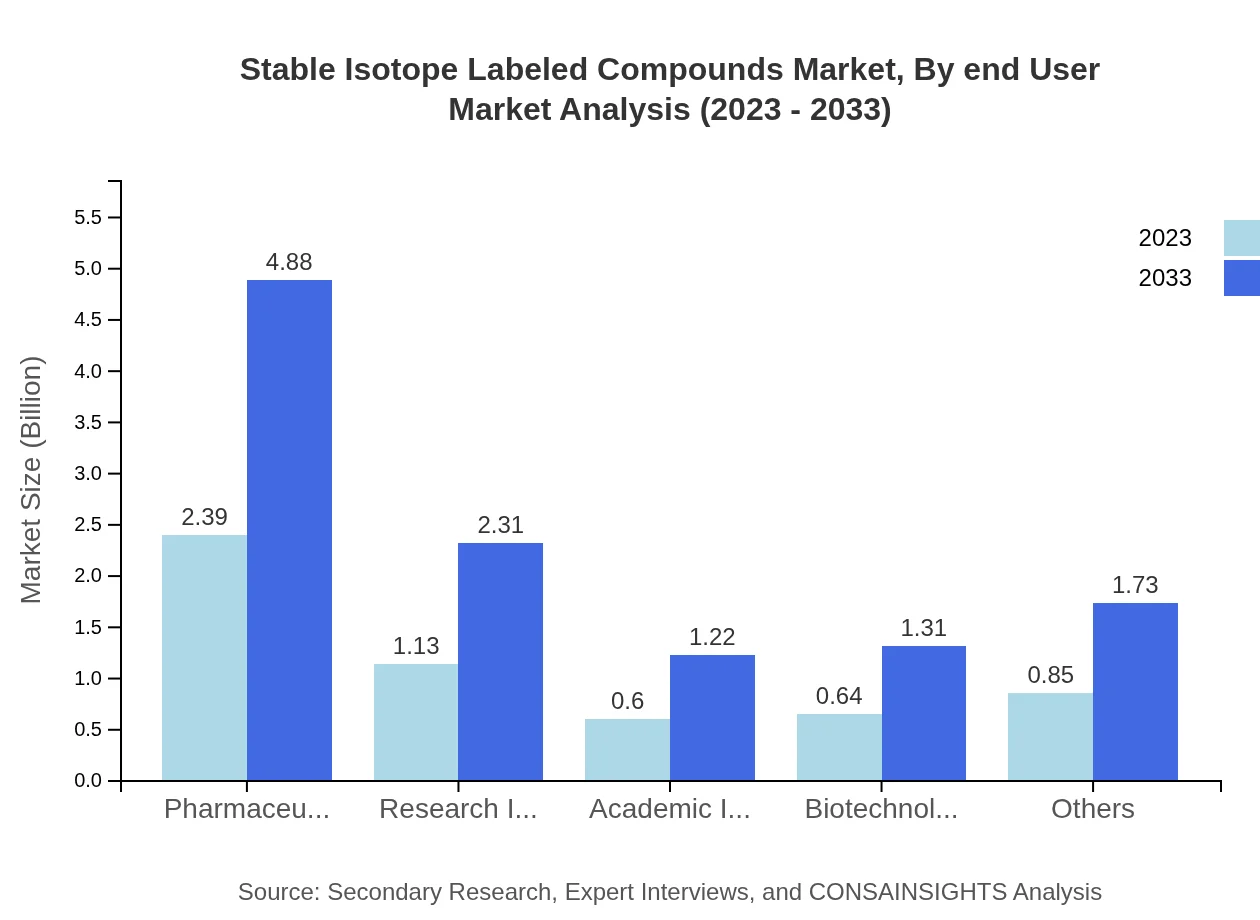

Stable Isotope Labeled Compounds Market Analysis By End User

Pharmaceutical Companies dominate with USD 2.39 billion in 2023, projected to rise to USD 4.88 billion. Research Institutes follow with USD 1.13 billion, accounting for a 20.22% share, expected to reach USD 2.31 billion by 2033. The Academic Institutions segment is anticipated to grow from USD 0.60 billion to USD 1.22 billion, holding a 10.65% market share.

Stable Isotope Labeled Compounds Market Analysis By Region

Global Stable Isotope Labeled Compounds Market, By Region Market Analysis (2023 - 2033)

The regional analysis reveals substantial growth across all regions, with North America and Europe leading the market. These markets benefit from advanced technology adoption and significant research activities, while Asia Pacific shows rapid development backed by increasing healthcare investments. South America, while slower growing, offers emerging opportunities. The Middle East and Africa are progressively expanding, focusing on enhancing local capabilities.

Stable Isotope Labeled Compounds Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Stable Isotope Labeled Compounds Industry

Cambridge Isotope Laboratories, Inc.:

A leader in the production and distribution of stable isotope-labeled compounds, known for innovations in isotopic labeling techniques across various applications.Isotopes Incorporated:

Specializes in providing a broad range of stable isotopes and has established a strong foothold in pharmaceuticals and clinical research.Sigma-Aldrich (MilliporeSigma):

A major supplier of chemicals and lab products, contributing significantly to the stable isotope market with a focus on high purity and quality compounds.Wellington Laboratories:

Known for its specialized isotope-labeled compounds, serving environmental, pharmaceutical, and health sectors.We're grateful to work with incredible clients.

FAQs

What is the market size of stable Isotope Labeled Compounds?

The global stable-isotope-labeled compounds market is projected to grow from $5.6 billion in 2023 to a significant size by 2033, with a CAGR of 7.2%. This growth highlights the increasing demand in various sectors including pharmaceuticals and research.

What are the key market players or companies in this stable Isotope Labeled Compounds industry?

Key players in the stable-isotope-labeled compounds market include leading pharmaceutical companies, research institutions, and biotechnology firms. These organizations drive innovation and supply chain efficiencies that are crucial for market growth.

What are the primary factors driving the growth in the stable Isotope Labeled Compounds industry?

The growth of the stable-isotope-labeled compounds market is propelled by advancements in drug development technologies, increased funding for research projects, and rising demand for precision medicine, driving the need for high-quality labeled compounds.

Which region is the fastest Growing in the stable Isotope Labeled Compounds?

North America is the fastest-growing region in the stable-isotope-labeled compounds market, expected to grow from $2.09 billion in 2023 to $4.26 billion by 2033, reflecting strong investments in healthcare and biotechnology sectors.

Does ConsaInsights provide customized market report data for the stable Isotope Labeled Compounds industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs within the stable-isotope-labeled compounds industry, helping businesses identify opportunities and make informed decisions based on detailed analyses.

What deliverables can I expect from this stable Isotope Labeled Compounds market research project?

Deliverables from the market research project on stable-isotope-labeled compounds typically include comprehensive market analysis, regional data, segment insights, and trends, along with strategic recommendations to optimize market positioning.

What are the market trends of stable Isotope Labeled Compounds?

Current market trends in the stable-isotope-labeled compounds sector include an uptick in metabolomic studies, heightened focus on drug development precision, and an increasing preference for sustainable and ethically sourced isotopes among users.