Wafer Cleaning Equipment Market Report

Published Date: 22 January 2026 | Report Code: wafer-cleaning-equipment

Wafer Cleaning Equipment Market Size, Share, Industry Trends and Forecast to 2033

This report delivers an in-depth analysis of the Wafer Cleaning Equipment market, covering market trends, size, and forecasts from 2023 to 2033. It provides insights into regional performances, segments, technologies, and leading companies in the sector, offering a comprehensive view for stakeholders.

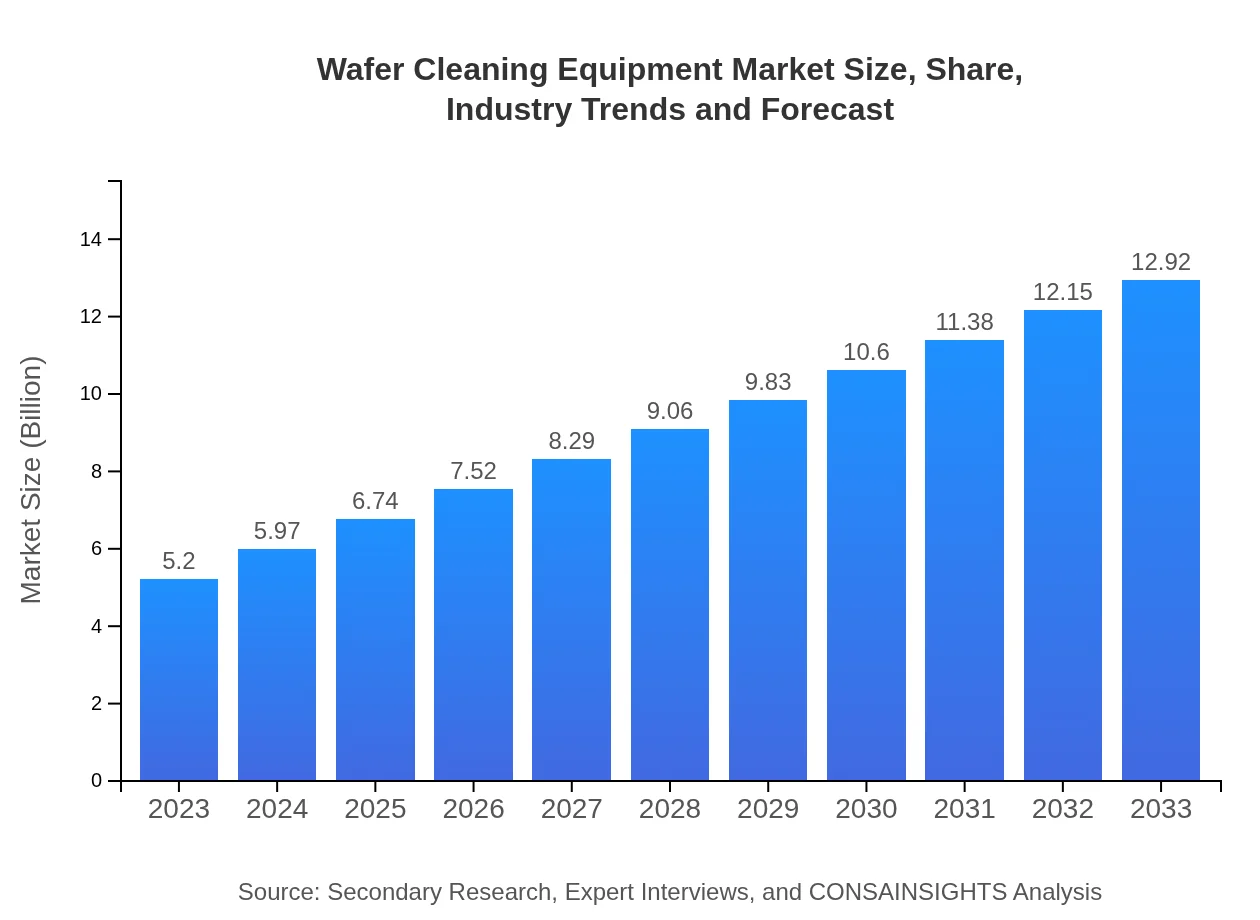

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.20 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $12.92 Billion |

| Top Companies | Applied Materials, Tokyo Electron Limited, ASML , Lam Research, KLA Corporation |

| Last Modified Date | 22 January 2026 |

Wafer Cleaning Equipment Market Overview

Customize Wafer Cleaning Equipment Market Report market research report

- ✔ Get in-depth analysis of Wafer Cleaning Equipment market size, growth, and forecasts.

- ✔ Understand Wafer Cleaning Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Wafer Cleaning Equipment

What is the Market Size & CAGR of Wafer Cleaning Equipment market in 2023?

Wafer Cleaning Equipment Industry Analysis

Wafer Cleaning Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Wafer Cleaning Equipment Market Analysis Report by Region

Europe Wafer Cleaning Equipment Market Report:

Europe's Wafer Cleaning Equipment market is set to grow from $1.60 billion in 2023 to $3.96 billion in 2033. The region is seeing an increase in demand for advanced cleaning systems driven by the growth of electric vehicle manufacturing and renewable energy sectors, necessitating high-quality wafer cleaning solutions.Asia Pacific Wafer Cleaning Equipment Market Report:

In the Asia Pacific region, the Wafer Cleaning Equipment market is expected to grow from $1.04 billion in 2023 to $2.58 billion by 2033. This growth is primarily driven by the presence of key semiconductor manufacturers in countries like China, Taiwan, and South Korea. The increasing production of advanced chips and high-tech devices necessitates efficient cleaning solutions, thus boosting market demand.North America Wafer Cleaning Equipment Market Report:

In North America, the market is expected to experience considerable growth, reaching $4.44 billion by 2033 from $1.79 billion in 2023. The region's strong focus on R&D, coupled with the presence of leading semiconductor companies, reinforces its market position as North America increasingly adopts advanced cleaning technologies.South America Wafer Cleaning Equipment Market Report:

The South American market is projected to grow from $0.46 billion in 2023 to $1.14 billion in 2033. Though currently smaller in comparison to other regions, the rising investments in renewable energy sectors such as solar manufacturing will drive growth for wafer cleaning equipment in Brazil and Argentina.Middle East & Africa Wafer Cleaning Equipment Market Report:

The Middle East and Africa market is expected to expand from $0.32 billion in 2023 to $0.79 billion in 2033. Factors like growing investments in the semiconductor and energy sectors in countries like Israel and the UAE are anticipated to contribute to this market growth.Tell us your focus area and get a customized research report.

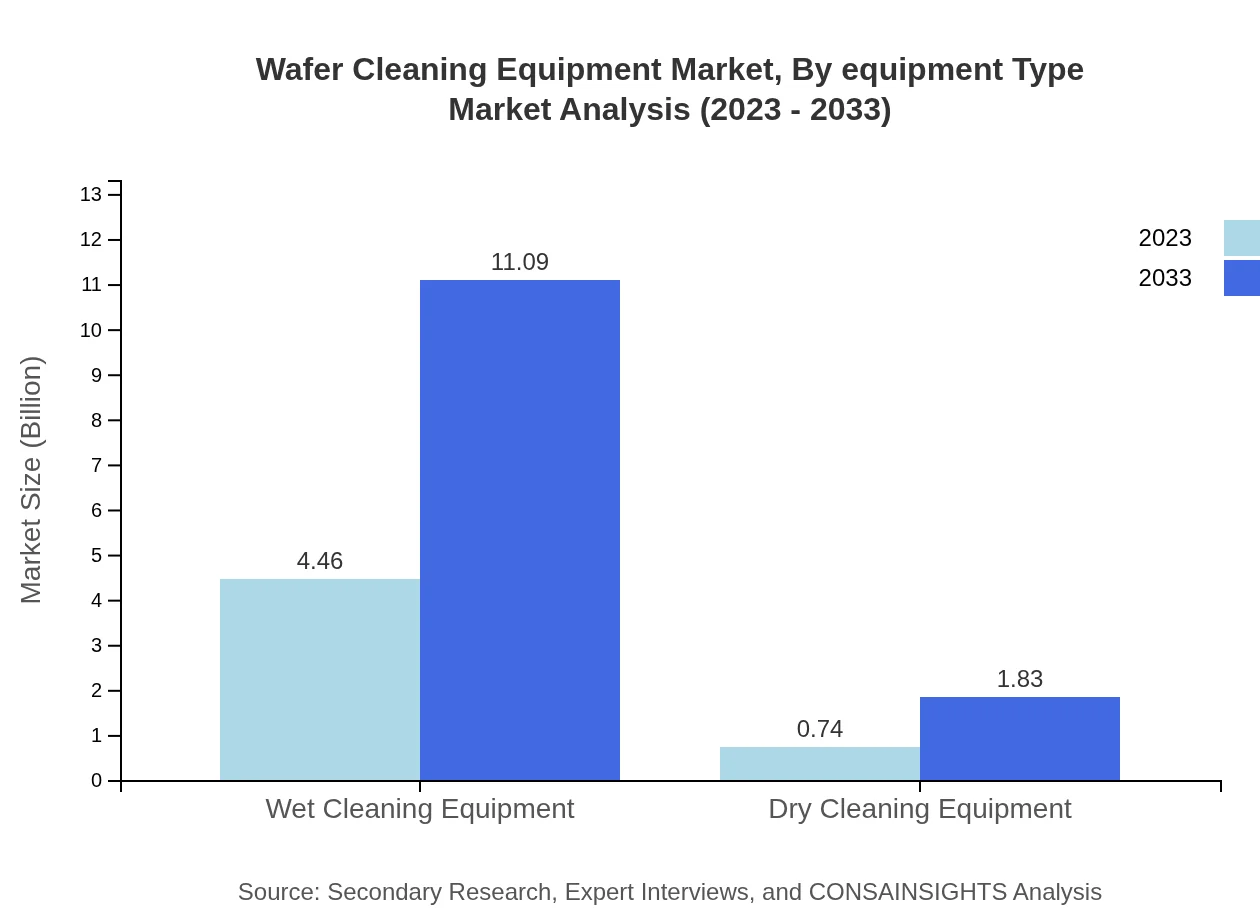

Wafer Cleaning Equipment Market Analysis By Equipment Type

In 2023, the market for Single-Chamber Systems is approximately $4.46 billion, expected to remain dominant at around 85.82% market share through 2033. In contrast, Multi-Chamber Systems hold around $0.74 billion today, projected to maintain 14.18% by 2033. This significant disparity underscores the preference for established cleaning solutions over emerging technologies at present, though Multi-Chamber Systems are growing due to flexibility in cleaning different wafer sizes.

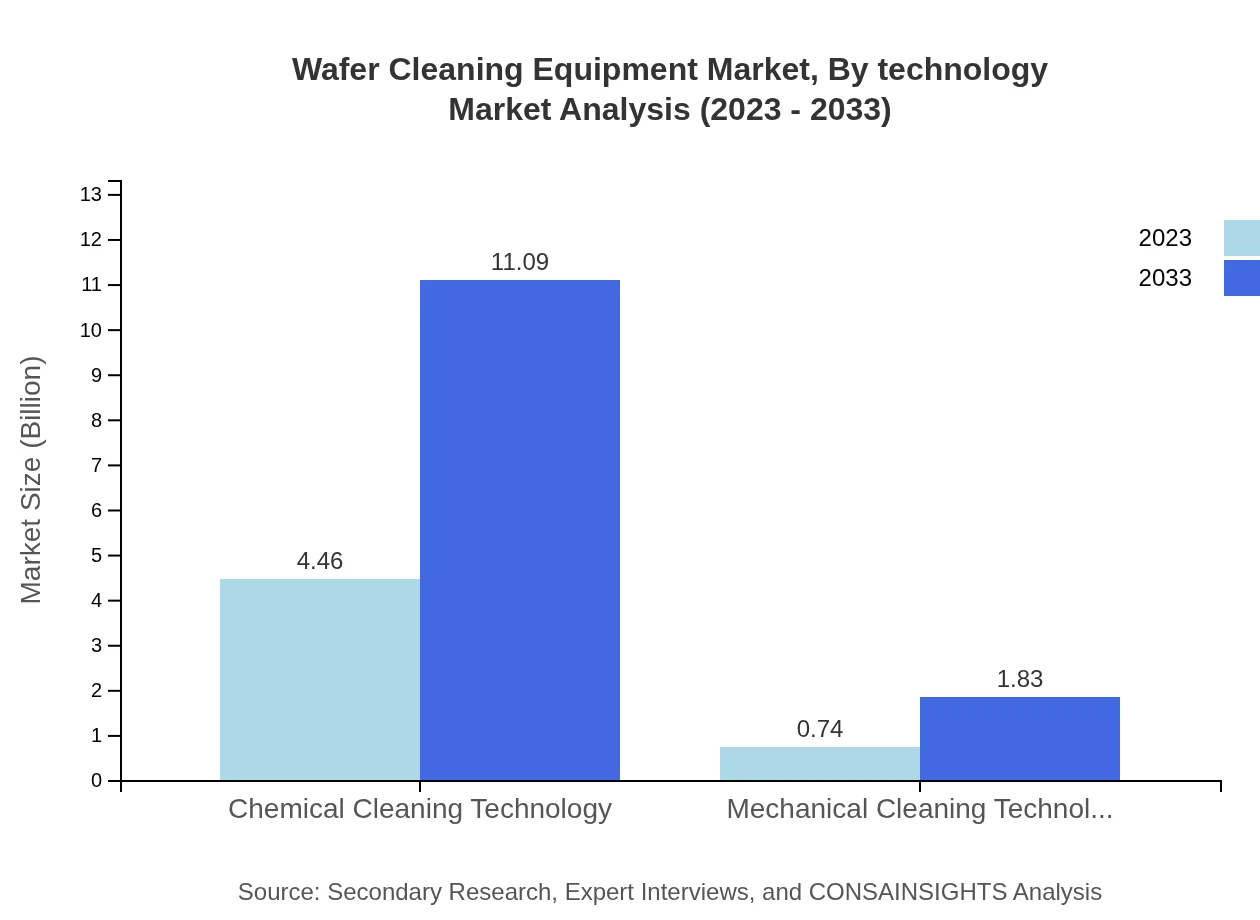

Wafer Cleaning Equipment Market Analysis By Technology

Currently, the market for Chemical Cleaning Technology stands at $4.46 billion, forecasted to hold steady at an 85.82% share in the coming decade. Mechanical Cleaning Technology has a much smaller market size of $0.74 billion today, with an anticipated growth rate reflecting its remaining 14.18% share. Chemical processes remain dominant due to their effectiveness in removing particulates and organic contaminants from wafers.

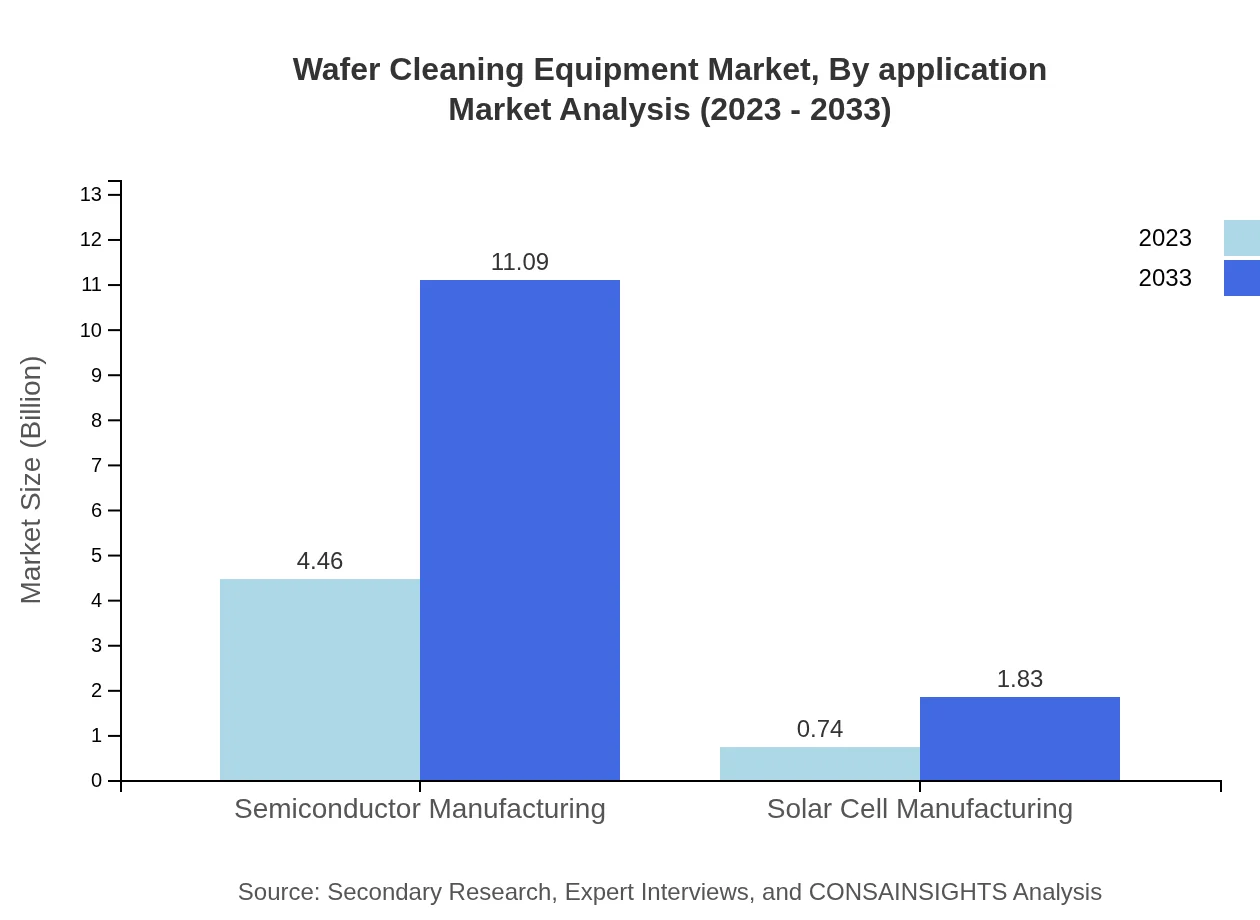

Wafer Cleaning Equipment Market Analysis By Application

In the realm of Semiconductor Manufacturing, which dominates the market at $4.46 billion (85.82% share), this segment is projected for robust growth fueled by the continuous advancements in chip manufacturing technology. The Solar Cell Manufacturing segment, valued at $0.74 billion (14.18% share) in 2023, is also expected to expand as global interest in renewable energy solutions surges.

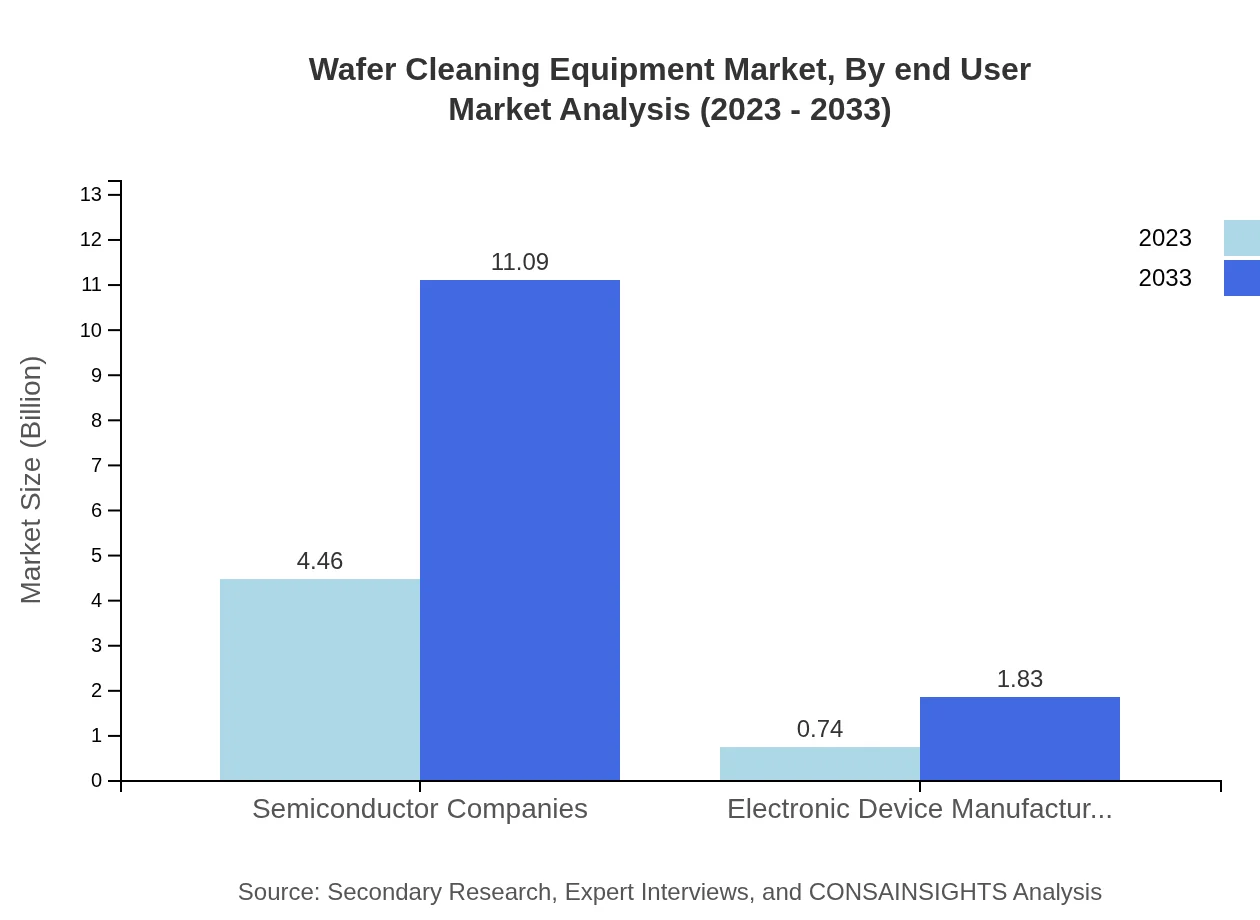

Wafer Cleaning Equipment Market Analysis By End User

End-users primarily include semiconductor companies and electronic device manufacturers. Semiconductor firms account for a significant market share of 85.82% with an expected growth of $4.46 billion, while electronic device manufacturers hold a proportionally smaller yet growing share of 14.18%. The increasing reliance on cleaner processes within these industries will bolster the demand for cleaning equipment.

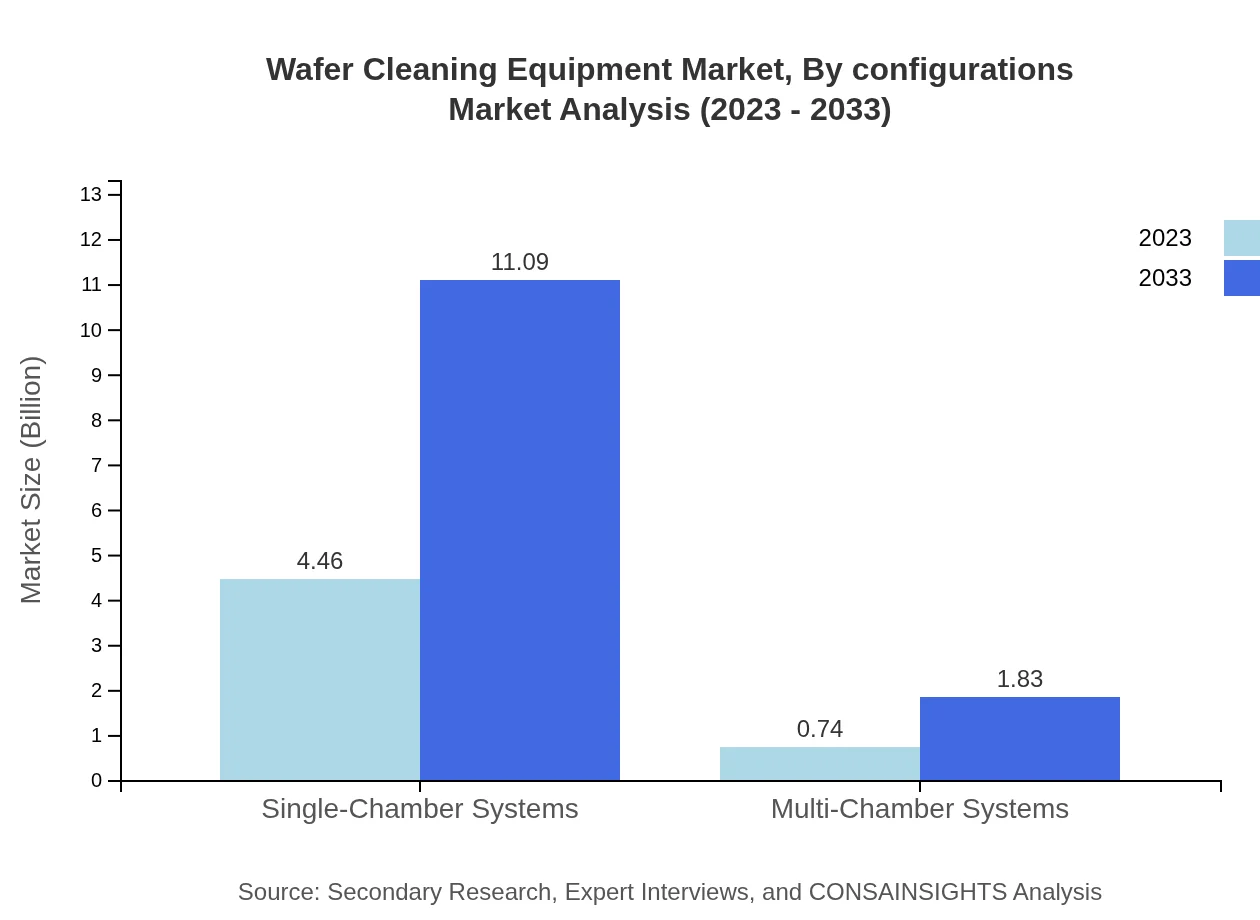

Wafer Cleaning Equipment Market Analysis By Configurations

The analysis reveals a bifurcation in configurations, with wet cleaning processes accounting for $4.46 billion and maintaining a dominant share due in part to their effectiveness at cleaning contaminants from wafers, at 85.82%. In contrast, the dry cleaning market reflects a smaller size of $0.74 billion with a 14.18% share, driven by specific applications where water or chemical usage is not feasible.

Wafer Cleaning Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Wafer Cleaning Equipment Industry

Applied Materials:

A leading provider of equipment, services, and software for the semiconductor industry, Applied Materials is renowned for their innovative cleaning and etching solutions, catering to advanced chip manufacturing.Tokyo Electron Limited:

Tokyo Electron is a global supplier of semiconductor production equipment, providing cutting-edge cleaning technologies vital for manufacturing high-performance chips.ASML :

Specializing in photolithography systems, ASML enhances wafer cleaning methods through advanced technology that improves the overall manufacturing yield and operational efficiency.Lam Research:

Lam Research offers comprehensive solutions in wafer fabrication, including wet and dry cleaning systems, significantly contributing to the efficiency of semiconductor processing.KLA Corporation:

KLA Corporation is valued in wafer manufacturing for their robust inspection and metrology tools, which complement cleaning processes to ensure semiconductor quality and performance.We're grateful to work with incredible clients.

FAQs

What is the market size of wafer Cleaning Equipment?

The global wafer-cleaning equipment market is valued at approximately $5.2 billion in 2023, with a projected CAGR of 9.2% through 2033.

What are the key market players or companies in this wafer Cleaning Equipment industry?

Major players in the wafer-cleaning equipment market include companies specializing in semiconductor fabrication equipment, cleaning technologies, and surface treatment solutions designed for advanced manufacturing processes.

What are the primary factors driving the growth in the wafer Cleaning Equipment industry?

Growth in the wafer-cleaning equipment market is driven by increasing demand for semiconductors, advancements in fabrication technologies, and stringent cleanliness standards required for chip manufacturing processes.

Which region is the fastest Growing in the wafer Cleaning Equipment?

The fastest-growing region for wafer-cleaning equipment is North America, projected to grow from $1.79 billion in 2023 to $4.44 billion by 2033, indicating substantial investment in semiconductor manufacturing.

Does ConsaInsights provide customized market report data for the wafer Cleaning Equipment industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the wafer-cleaning equipment industry, ensuring accurate and relevant insights for decision-making.

What deliverables can I expect from this wafer Cleaning Equipment market research project?

From the wafer-cleaning equipment market research, expect comprehensive reports including market size analysis, growth projections, competitive landscape, and segmented data for various applications and technologies.

What are the market trends of wafer Cleaning Equipment?

Trends in the wafer-cleaning equipment market include technological advancements, increasing automation in cleaning processes, and rising demand for environmentally friendly cleaning solutions across the semiconductor industry.