Active Pharmaceutical Ingredients Api Market Report

Published Date: 31 January 2026 | Report Code: active-pharmaceutical-ingredients-api

Active Pharmaceutical Ingredients Api Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Active Pharmaceutical Ingredients (API) market from 2023 to 2033, including insights on market size, trends, segmentation, regional analysis, and forecasts.

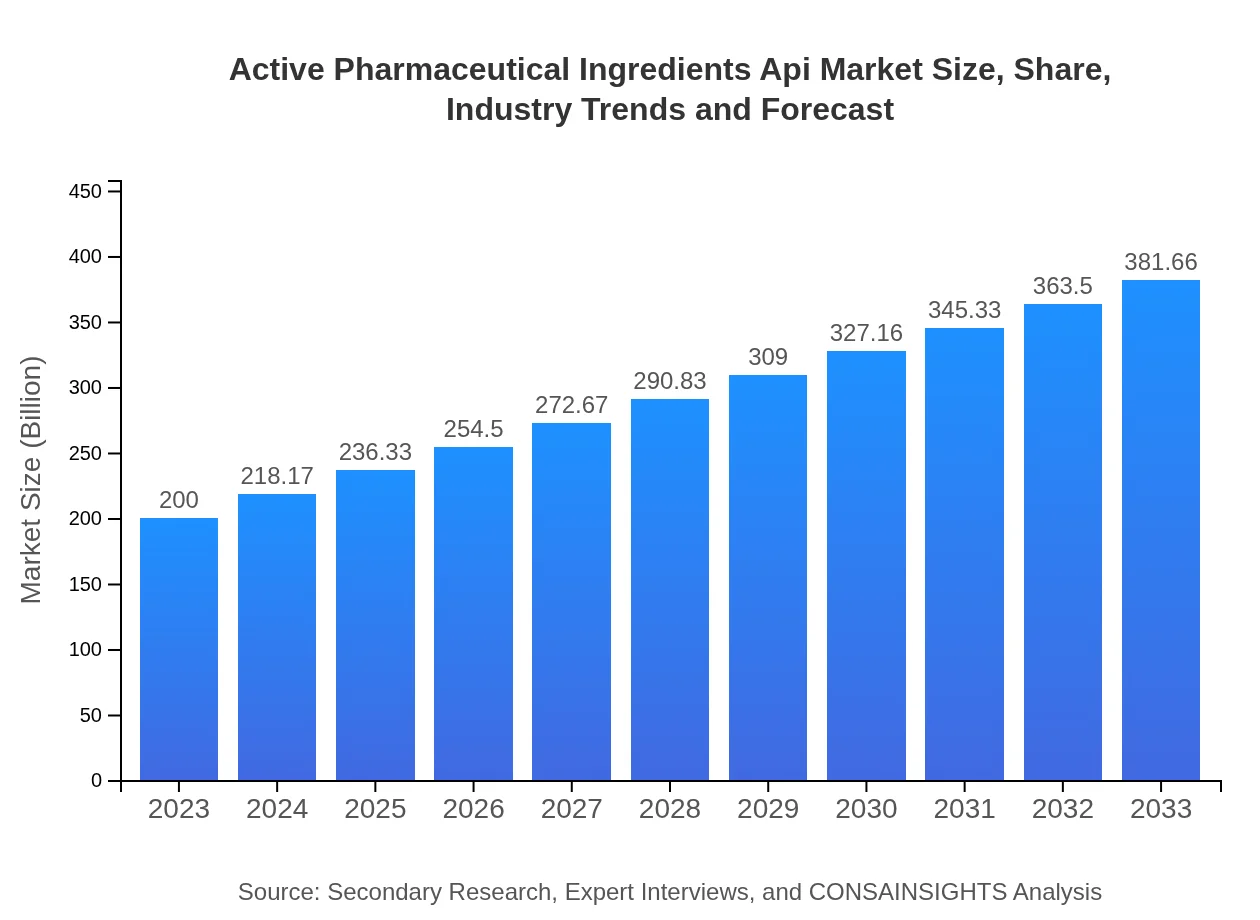

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $200.00 Billion |

| CAGR (2023-2033) | 6.5% |

| 2033 Market Size | $381.66 Billion |

| Top Companies | Pfizer Inc., BASF SE, Teva Pharmaceutical Industries Ltd., Boehringer Ingelheim, Mylan N.V. |

| Last Modified Date | 31 January 2026 |

Active Pharmaceutical Ingredients API Market Overview

Customize Active Pharmaceutical Ingredients Api Market Report market research report

- ✔ Get in-depth analysis of Active Pharmaceutical Ingredients Api market size, growth, and forecasts.

- ✔ Understand Active Pharmaceutical Ingredients Api's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Active Pharmaceutical Ingredients Api

What is the Market Size & CAGR of Active Pharmaceutical Ingredients API market in 2023?

Active Pharmaceutical Ingredients API Industry Analysis

Active Pharmaceutical Ingredients API Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Active Pharmaceutical Ingredients API Market Analysis Report by Region

Europe Active Pharmaceutical Ingredients Api Market Report:

Europe’s API market is characterized by stringent regulatory frameworks and is forecasted to grow from $56.84 billion in 2023 to $108.47 billion by 2033. The region's stability in pharmaceutical advancements and a shift towards biotech are pivotal growth drivers.Asia Pacific Active Pharmaceutical Ingredients Api Market Report:

The Asia Pacific region is witnessing exponential growth, with a market size expected to reach approximately $71.94 billion by 2033 from $37.70 billion in 2023. Factors contributing to this growth include the rise of generic drug manufacturing and a robust pharmaceutical sector fueled by increased healthcare investment and population growth.North America Active Pharmaceutical Ingredients Api Market Report:

North America currently holds a significant share of the API market, with sizes projected to rise from $75.76 billion in 2023 to $144.57 billion by 2033. High healthcare spending, advanced R&D capabilities, and a large number of registered pharmaceutical companies contribute to this robust market presence.South America Active Pharmaceutical Ingredients Api Market Report:

In South America, the API market is relatively smaller, expected to grow from $1.88 billion in 2023 to $3.59 billion in 2033. This growth is driven by an emerging acceptance of quality pharmaceuticals, albeit hampered by economic challenges and regulatory barriers.Middle East & Africa Active Pharmaceutical Ingredients Api Market Report:

In the Middle East and Africa, the API market poised to increase from $27.82 billion in 2023 to $53.09 billion by 2033, reflects rising healthcare initiatives and pharmaceutical partnerships aimed at boosting local production capacities.Tell us your focus area and get a customized research report.

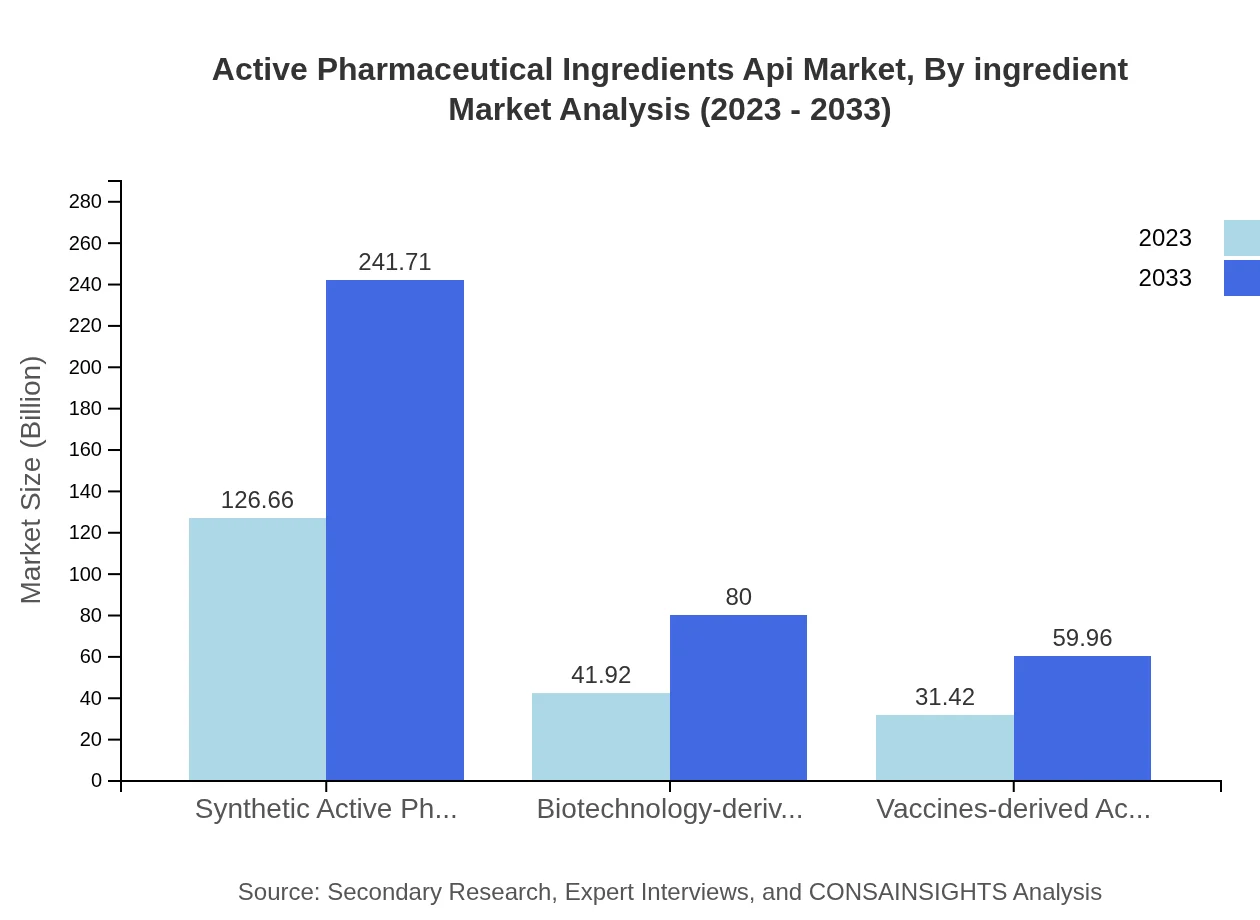

Active Pharmaceutical Ingredients Api Market Analysis By Ingredient

Synthetic Active Pharmaceutical Ingredients dominate the market, projected to grow from $126.66 billion in 2023 to $241.71 billion in 2033, holding a steady market share. Biotechnology-derived APIs will also witness strong growth, with an increase from $41.92 billion to $80 billion within the same timeframe. Vaccines-based APIs remain vital due to their specialized applications, expected to rise from $31.42 to $59.96 billion.

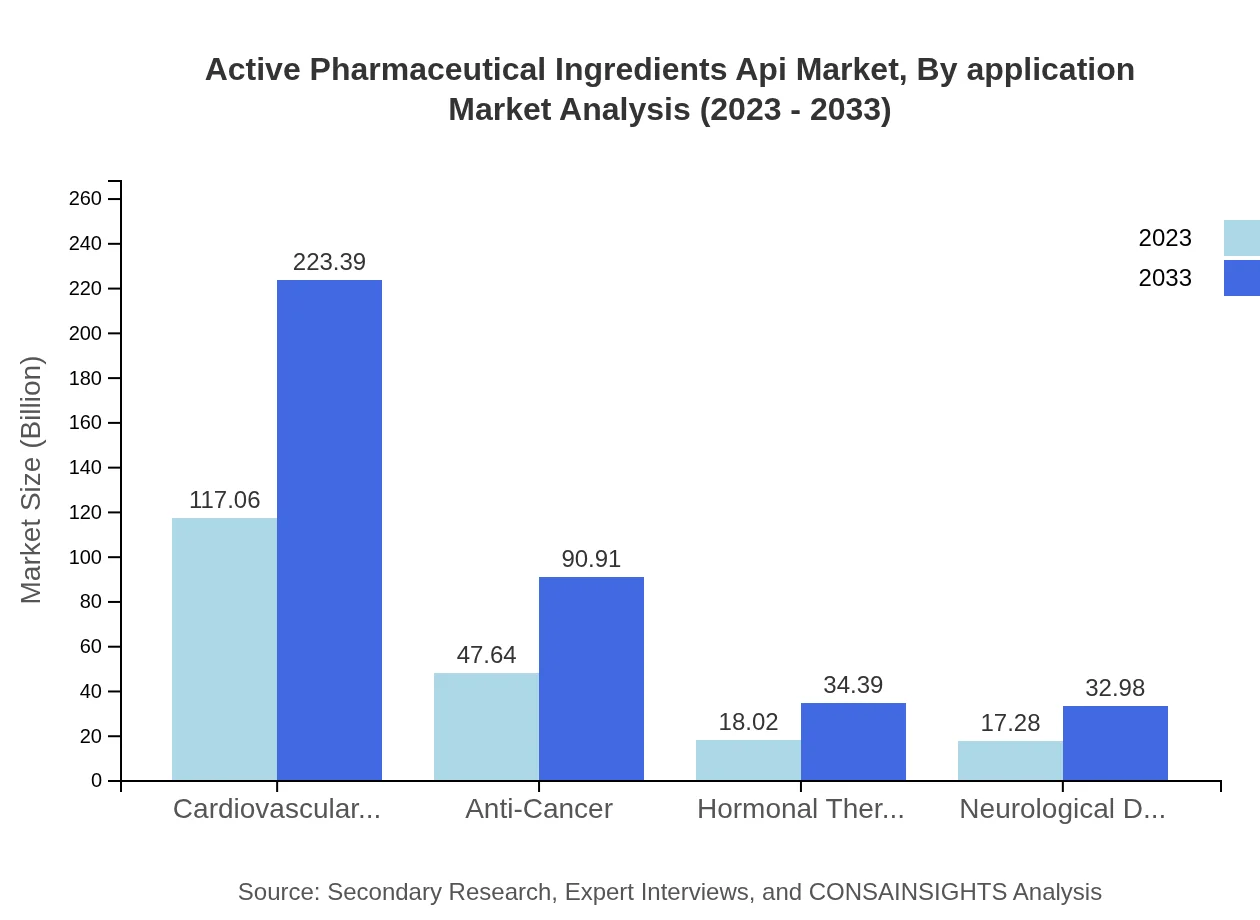

Active Pharmaceutical Ingredients Api Market Analysis By Application

The cardiovascular segment holds the largest market share, transitioning from $117.06 billion in 2023 to $223.39 billion in 2033. Anti-cancer APIs also present substantial growth, from $47.64 billion to $90.91 billion. Hormonal therapies and neurological disorder treatments are expected to maintain their user base, steadily growing due to increasing patient populations.

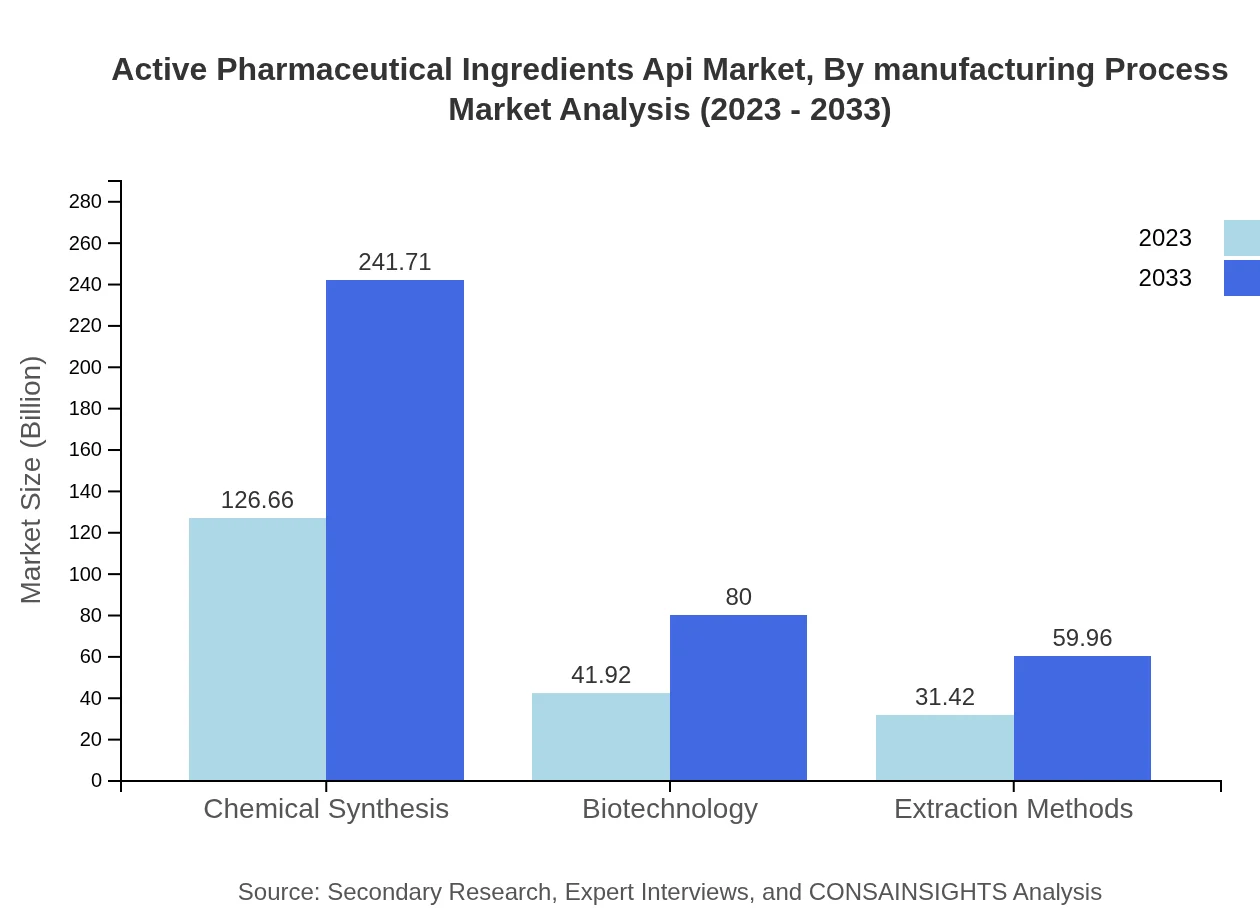

Active Pharmaceutical Ingredients Api Market Analysis By Manufacturing Process

The API market is predominantly driven by Chemical Synthesis, projected to grow from $126.66 billion in 2023 to $241.71 billion by 2033. Biotechnology processes are gaining traction, with significant growth from $41.92 billion to $80 billion. Extraction methods present niche opportunities as biologically diverse therapeutic needs rise.

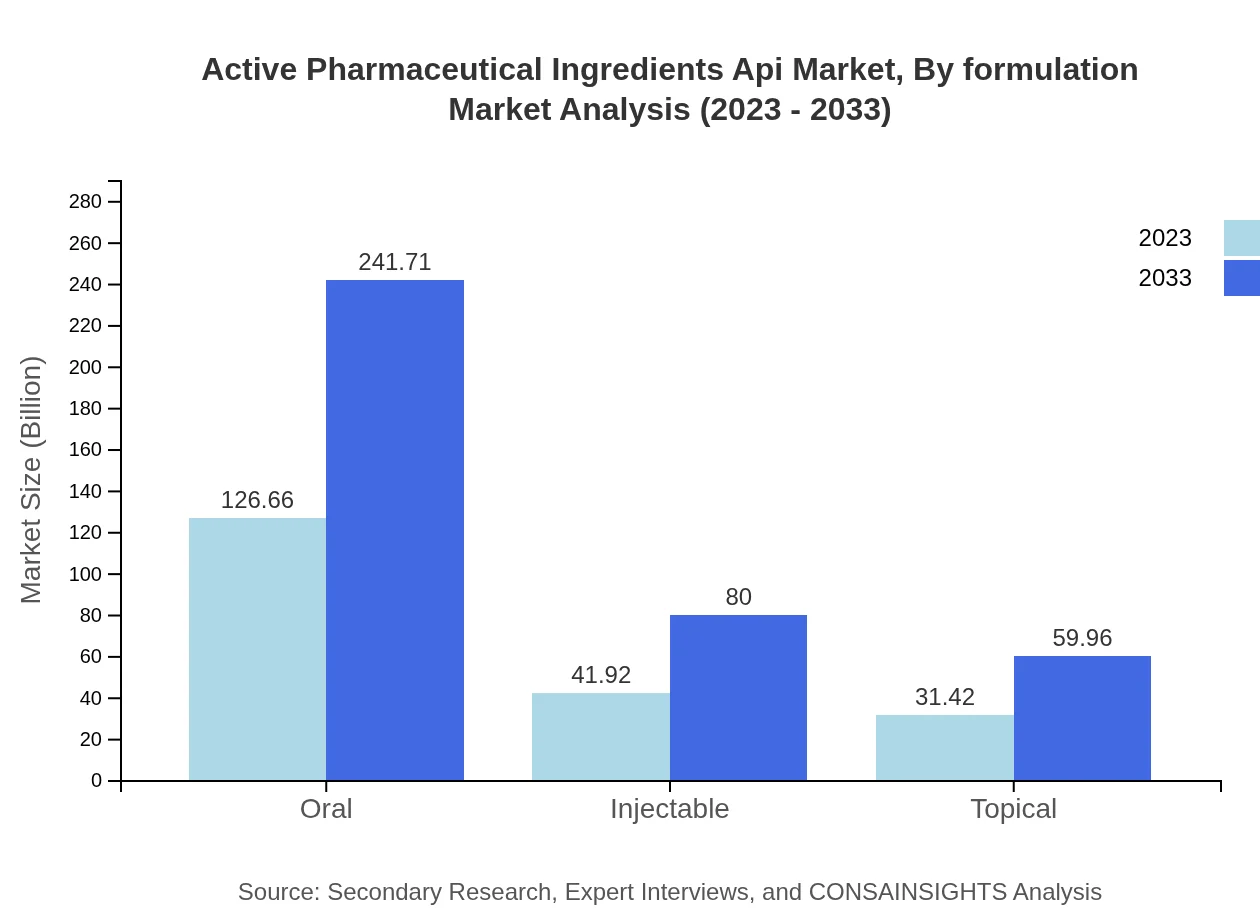

Active Pharmaceutical Ingredients Api Market Analysis By Formulation

Oral formulations dominate the market with significant size from $126.66 billion to $241.71 billion. Injectable formulations are also on the rise from $41.92 billion to $80 billion as they gain traction for specific therapies. Topical formulations grow steadily from $31.42 billion to $59.96 billion due to lifestyle and skincare trends.

Active Pharmaceutical Ingredients API Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Active Pharmaceutical Ingredients API Industry

Pfizer Inc.:

A leader in the biopharmaceutical sector, Pfizer produces a wide range of APIs and engages in extensive R&D for new drugs.BASF SE:

As a global chemical company, BASF is pivotal in the API market, producing organic and inorganic substances for pharmaceuticals.Teva Pharmaceutical Industries Ltd.:

A prominent player specializing in generic APIs, Teva contributes to drug accessibility globally, focusing on sustainable production methods.Boehringer Ingelheim:

Engaged in the development of complex APIs, Boehringer Ingelheim leads in biopharmaceutical services and manufacturing.Mylan N.V.:

Mylan specializes in generic medicines and aims to provide high-quality APIs in various therapeutic areas, contributing to a large pool of drugs.We're grateful to work with incredible clients.

FAQs

What is the market size of Active Pharmaceutical Ingredients API?

The Active Pharmaceutical Ingredients API market is expected to grow from approximately $200 billion in 2023 to a projected size driven by a CAGR of 6.5%, indicating a robust expansion opportunity over the next decade.

What are the key market players or companies in the Active Pharmaceutical Ingredients API industry?

Key players in the Active Pharmaceutical Ingredients API market include established pharmaceutical companies and specialty manufacturers that specialize in the production and supply of APIs for the pharmaceutical industry. Their competitiveness drives innovation and efficiency.

What are the primary factors driving the growth in the Active Pharmaceutical Ingredients API industry?

The growth in the Active Pharmaceutical Ingredients API market is driven by factors like increasing demand for generic drugs, advancements in biotechnology, and rising health concerns leading to higher spending on pharmaceuticals, creating a positive outlook for the industry.

Which region is the fastest Growing in the Active Pharmaceutical Ingredients API?

The fastest-growing region in the Active Pharmaceutical Ingredients API market is predicted to be Asia Pacific, with market sizes growing from $37.70 billion in 2023 to $71.94 billion by 2033, reflecting robust development prospects.

Does ConsaInsights provide customized market report data for the Active Pharmaceutical Ingredients API industry?

Yes, ConsaInsights offers customized market report data tailored to the needs of clients in the Active Pharmaceutical Ingredients API industry, allowing for a deeper understanding of specific market dynamics.

What deliverables can I expect from this Active Pharmaceutical Ingredients API market research project?

Deliverables from the Active Pharmaceutical Ingredients API market research project typically include comprehensive reports detailing market size, segmentation analysis, regional insights, competitive landscape evaluations, and future growth projections.

What are the market trends of Active Pharmaceutical Ingredients API?

Current market trends in the Active Pharmaceutical Ingredients API sector highlight a shift towards biologics, increasing regulatory oversight, and a focus on sustainable production methods, all contributing to an evolving industry landscape.