Data Center Support Infrastructure

Published Date: 31 January 2026 | Report Code: data-center-support-infrastructure

Data Center Support Infrastructure Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Data Center Support Infrastructure market from 2024 to 2033. It covers key insights into market size, CAGR, industry dynamics, segmentation, regional performance, technology innovations, product performance, and future trends, offering valuable data-driven perspectives for stakeholders and decision-makers in the industry.

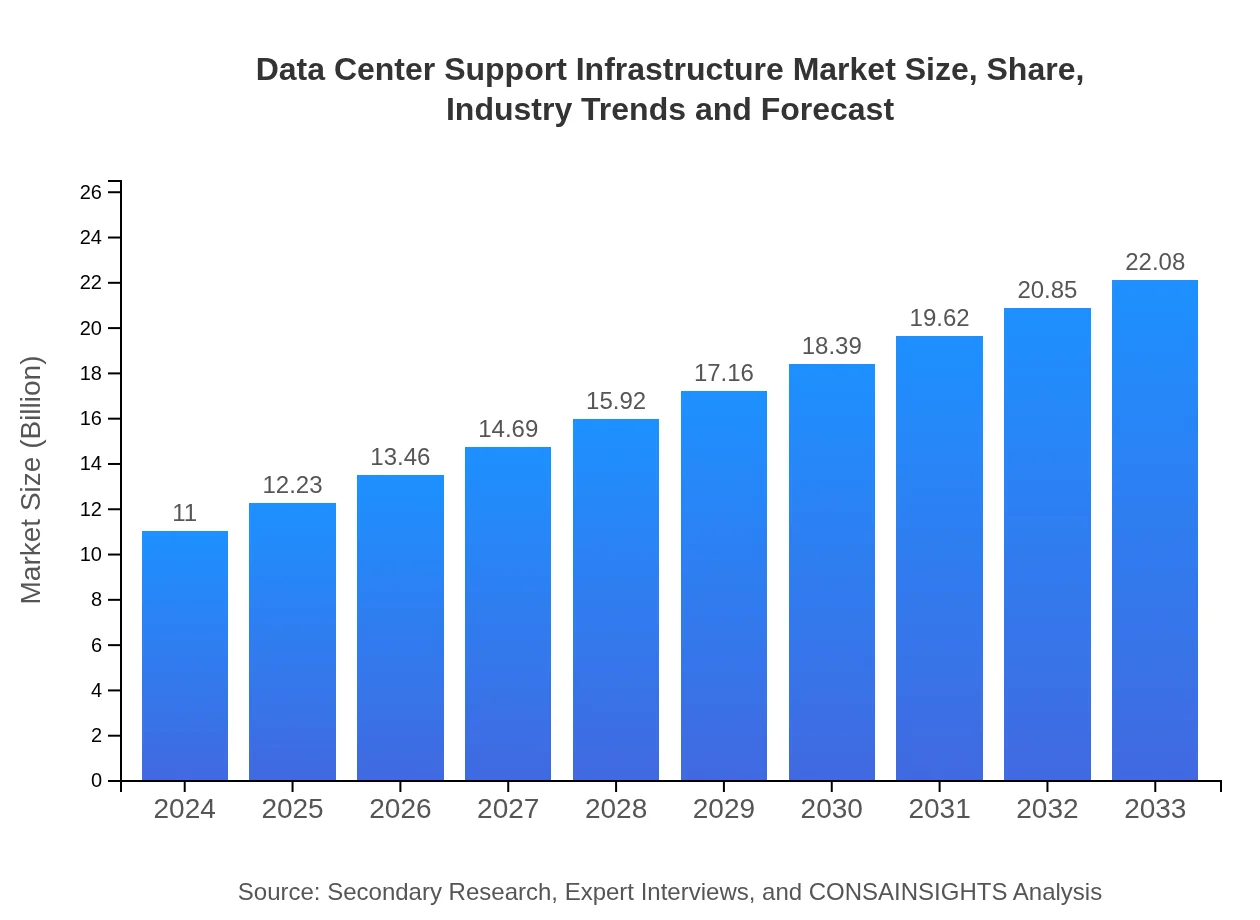

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

| 2024 Market Size | $11.00 Billion |

| CAGR (2024-2033) | 7.8% |

| 2033 Market Size | $22.08 Billion |

| Top Companies | TechCore Solutions, Infratech Global |

| Last Modified Date | 31 January 2026 |

Data Center Support Infrastructure Market Overview

Customize Data Center Support Infrastructure market research report

- ✔ Get in-depth analysis of Data Center Support Infrastructure market size, growth, and forecasts.

- ✔ Understand Data Center Support Infrastructure's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Data Center Support Infrastructure

What is the Market Size & CAGR of Data Center Support Infrastructure market in 2024?

Data Center Support Infrastructure Industry Analysis

Data Center Support Infrastructure Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Data Center Support Infrastructure Market Analysis Report by Region

Europe Data Center Support Infrastructure:

Europe’s market, valued at around 3.29 units in 2024 and anticipated to escalate to 6.61 units by 2033, reflects a mature yet dynamically evolving landscape. European nations are at the forefront of implementing stringent energy conservation policies and adopting green technologies. These proactive regulatory measures, combined with high investments in digital technologies, are fostering steady growth across the continent.Asia Pacific Data Center Support Infrastructure:

In Asia Pacific, the market is witnessing a steady rise, with the 2024 market size at approximately 2.17 units and expected to double to around 4.35 units by 2033. The rapid industrial modernization, increased IT investments, and regulatory encouragement for energy-efficient solutions are primary growth drivers in the region. Countries like China, India, and Japan have become epicenters of digital innovation, catalyzing demand for sophisticated support infrastructure.North America Data Center Support Infrastructure:

North America continues to be a stronghold of innovation and investment in data center infrastructure. With a market size of approximately 3.87 units in 2024 and expected to reach 7.76 units by 2033, the region sees substantial investments in cutting-edge technologies and an increasing focus on sustainable and energy-efficient infrastructure solutions. The established ecosystem of technology providers further supports robust growth in the region.South America Data Center Support Infrastructure:

South America, represented through Latin America, is emerging as a promising region. The market, starting at an estimated 0.38 units in 2024, is forecast to grow to about 0.76 units by 2033. This growth is spurred by increasing digital adoption, expanding data center investments, and regional government incentives aimed at reducing technological gaps. Local improvements in power reliability and cooling technologies are adding to the region’s competitive edge.Middle East & Africa Data Center Support Infrastructure:

The Middle East and Africa region, with a market size of about 1.29 units in 2024, is set to expand to approximately 2.59 units by 2033. Increased governmental support, strategic investments in data center development, and a growing awareness of digital transformation are driving improved infrastructure capabilities. These factors, alongside an increasing focus on advanced cooling and power systems, contribute to the region’s rising prominence in the global market.Tell us your focus area and get a customized research report.

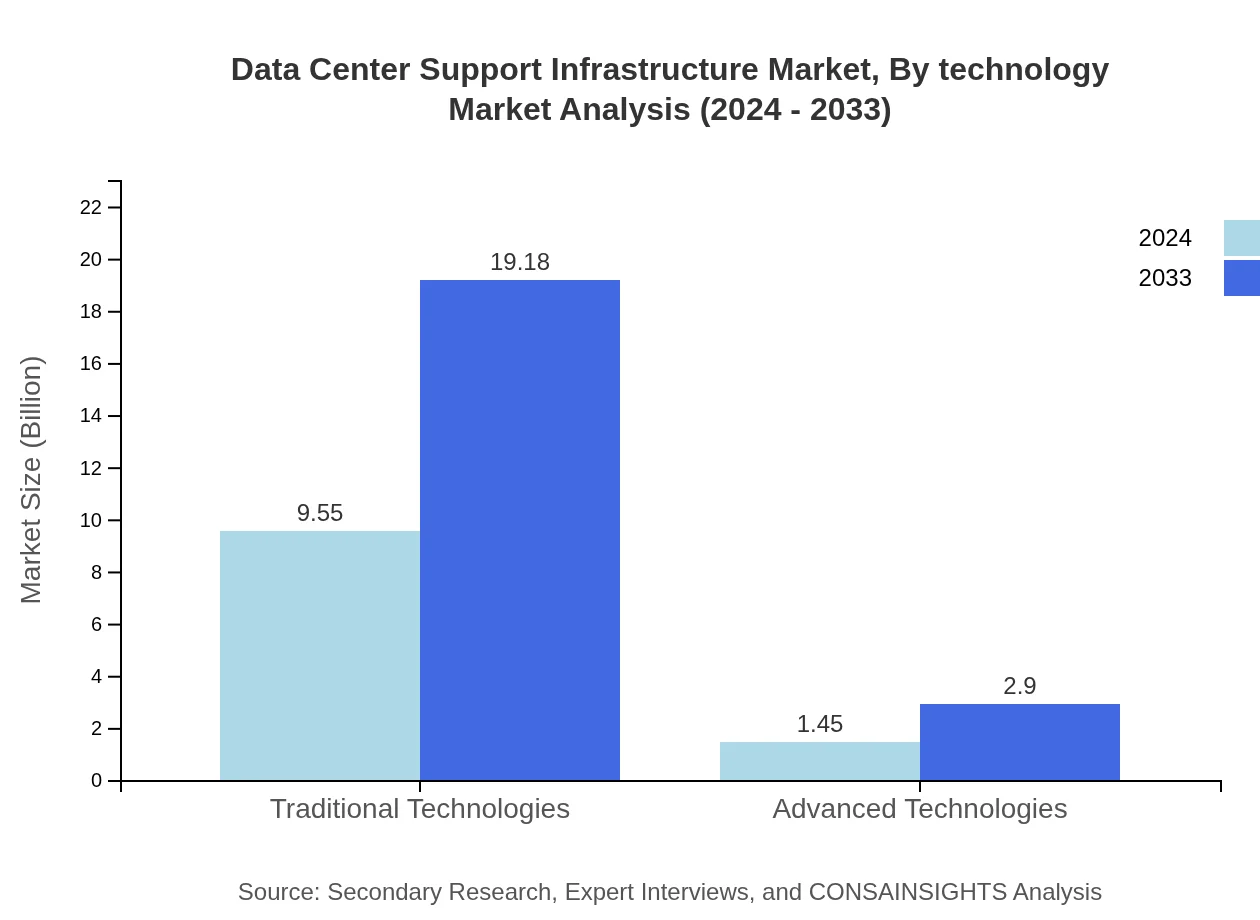

Data Center Support Infrastructure Market Analysis By Infrastructure Type

Within the infrastructure type segmentation, the market is primarily divided between Traditional Technologies and Advanced Technologies. Traditional Technologies, valued at 9.55 units in 2024, continue to dominate with an 86.86% share and are projected to grow to around 19.18 units by 2033 while maintaining their percentage share. In contrast, Advanced Technologies, starting at 1.45 units in 2024, hold a 13.14% market share and are expected to double by 2033. These categories reflect the balance between legacy systems and emerging solutions enhancing operational efficiencies.

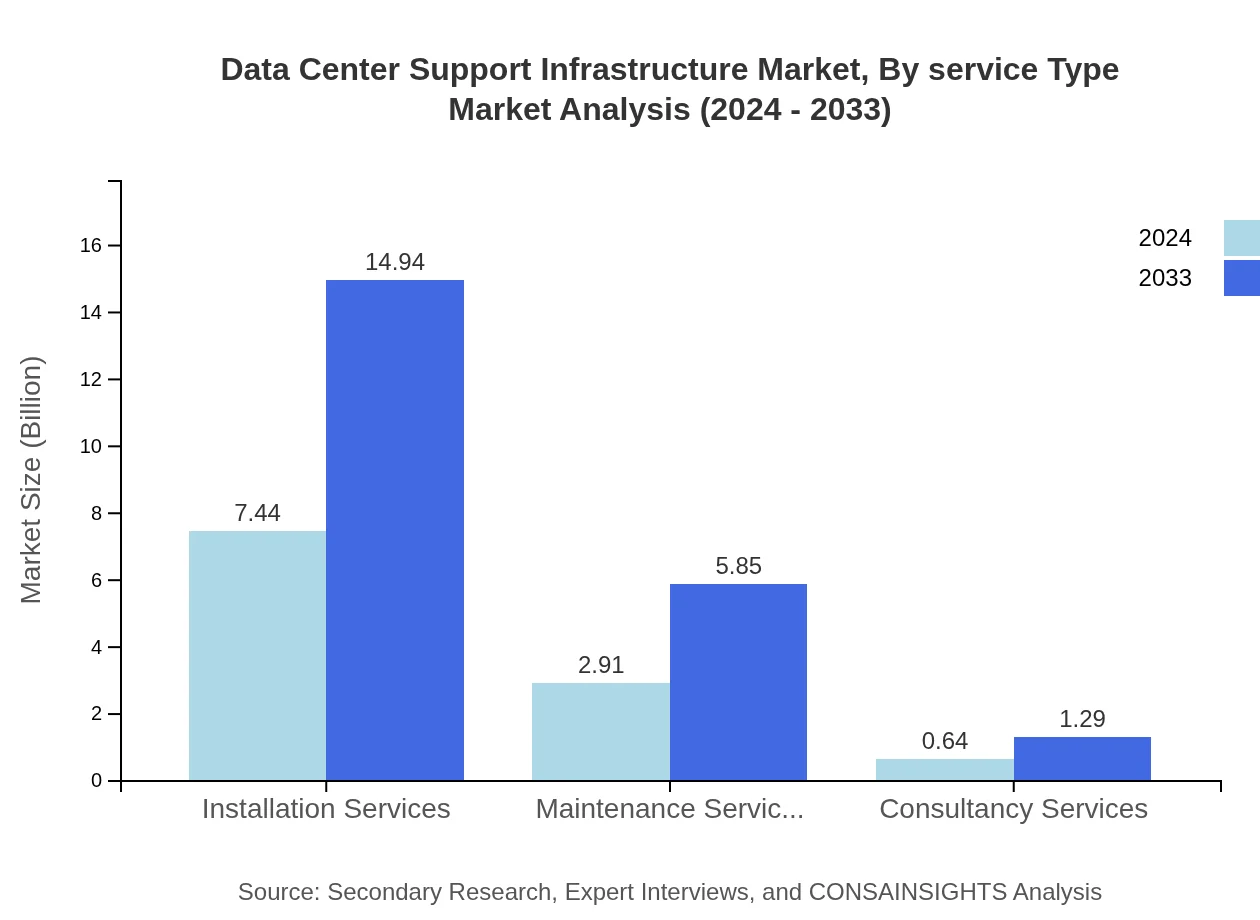

Data Center Support Infrastructure Market Analysis By Service Type

Service type segmentation includes Installation Services, Maintenance Services, and Consultancy Services. Installation Services, which account for a substantial market share of 67.67%, are expected to grow from 7.44 units in 2024 to 14.94 units by 2033. Maintenance Services, with a share of 26.48%, will increase from 2.91 to 5.85 units. Meanwhile, Consultancy Services, though smaller, remain pivotal by providing strategic guidance, growing from 0.64 units in 2024 to 1.29 units by 2033. This segmentation highlights the diverse services required to support robust data center operations.

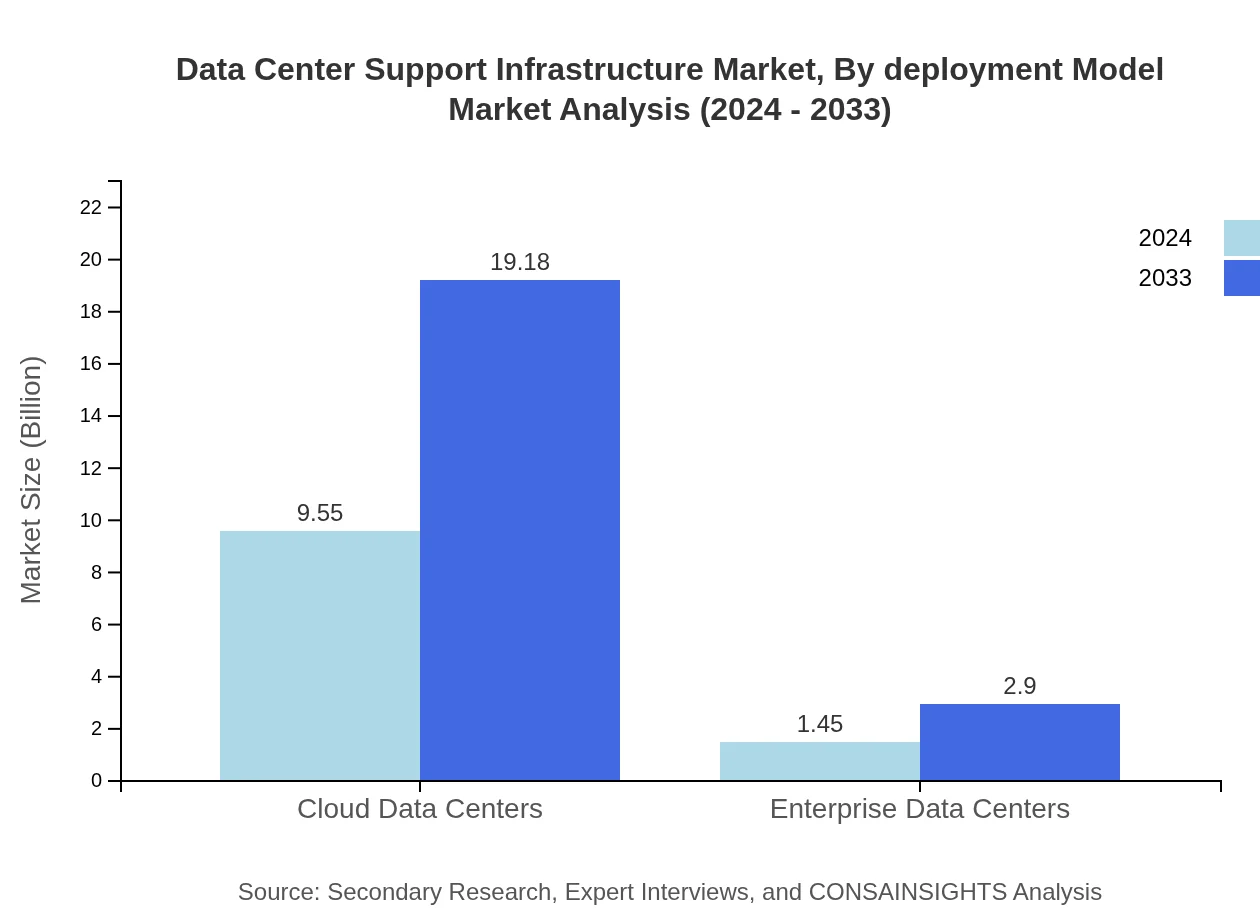

Data Center Support Infrastructure Market Analysis By Technology

Technology segmentation is characterized by the division between Cloud Data Centers and Enterprise Data Centers. Cloud Data Centers, commanding an 86.86% share, are forecast to grow from 9.55 units in 2024 to 19.18 units by 2033, reinforcing the trend toward scalable, outsourced infrastructure solutions. In contrast, Enterprise Data Centers represent a 13.14% share, growing from 1.45 units in 2024 to 2.90 units by 2033. This technological split underscores the industry’s emphasis on flexible, cloud-enabled platforms while still catering to the needs of enterprise-level data management.

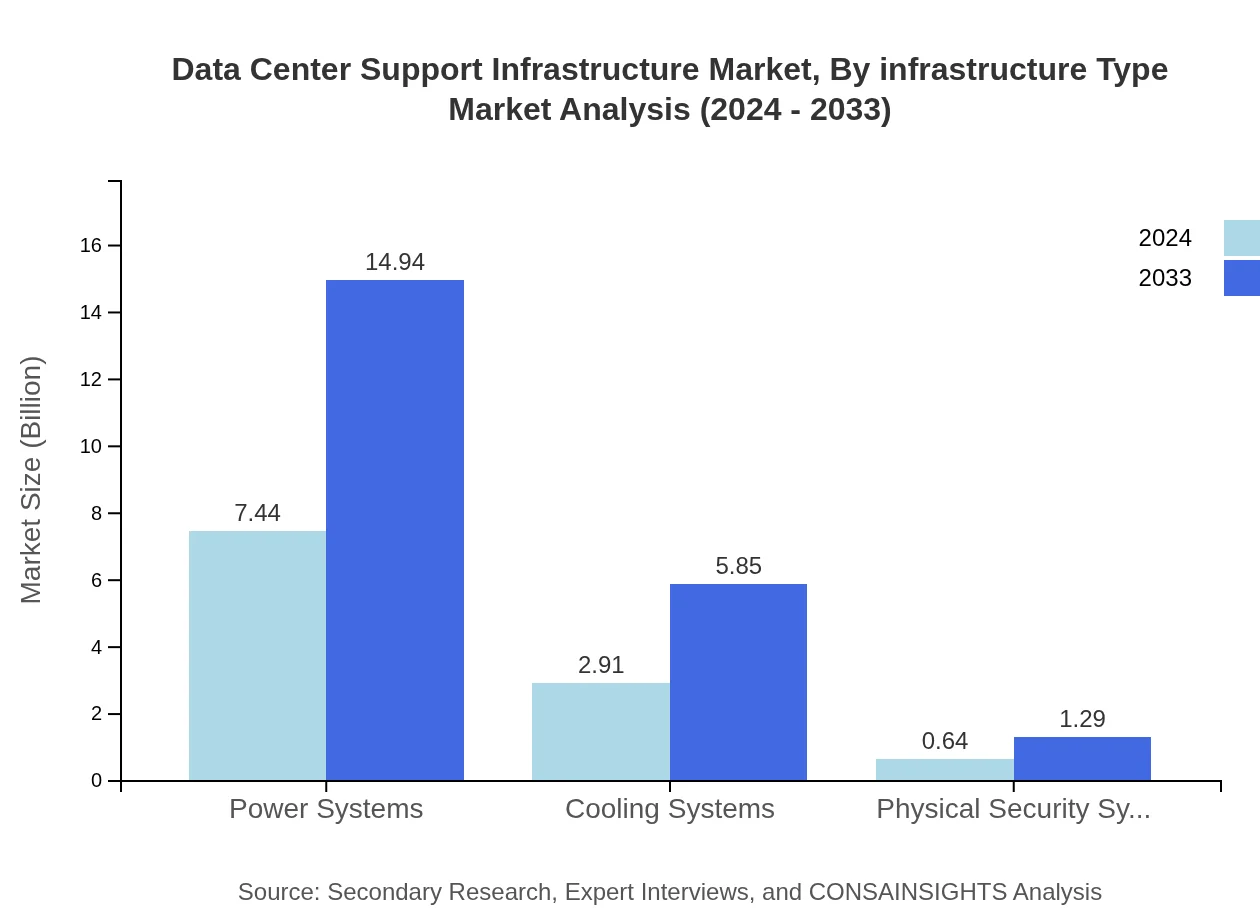

Data Center Support Infrastructure Market Analysis By Deployment Model

In the deployment model segment, product performance analysis focuses on key elements such as Power Systems, Cooling Systems, and Physical Security Systems. Power Systems, which hold a dominant share of 67.67%, are expected to grow from 7.44 units in 2024 to 14.94 units by 2033. Similarly, Cooling Systems, with a 26.48% share, will expand from 2.91 to 5.85 units, and Physical Security Systems, accounting for a smaller yet significant 5.85% share, are projected to grow from 0.64 to 1.29 units. These components are integral to ensuring uninterrupted performance and robust data center operations.

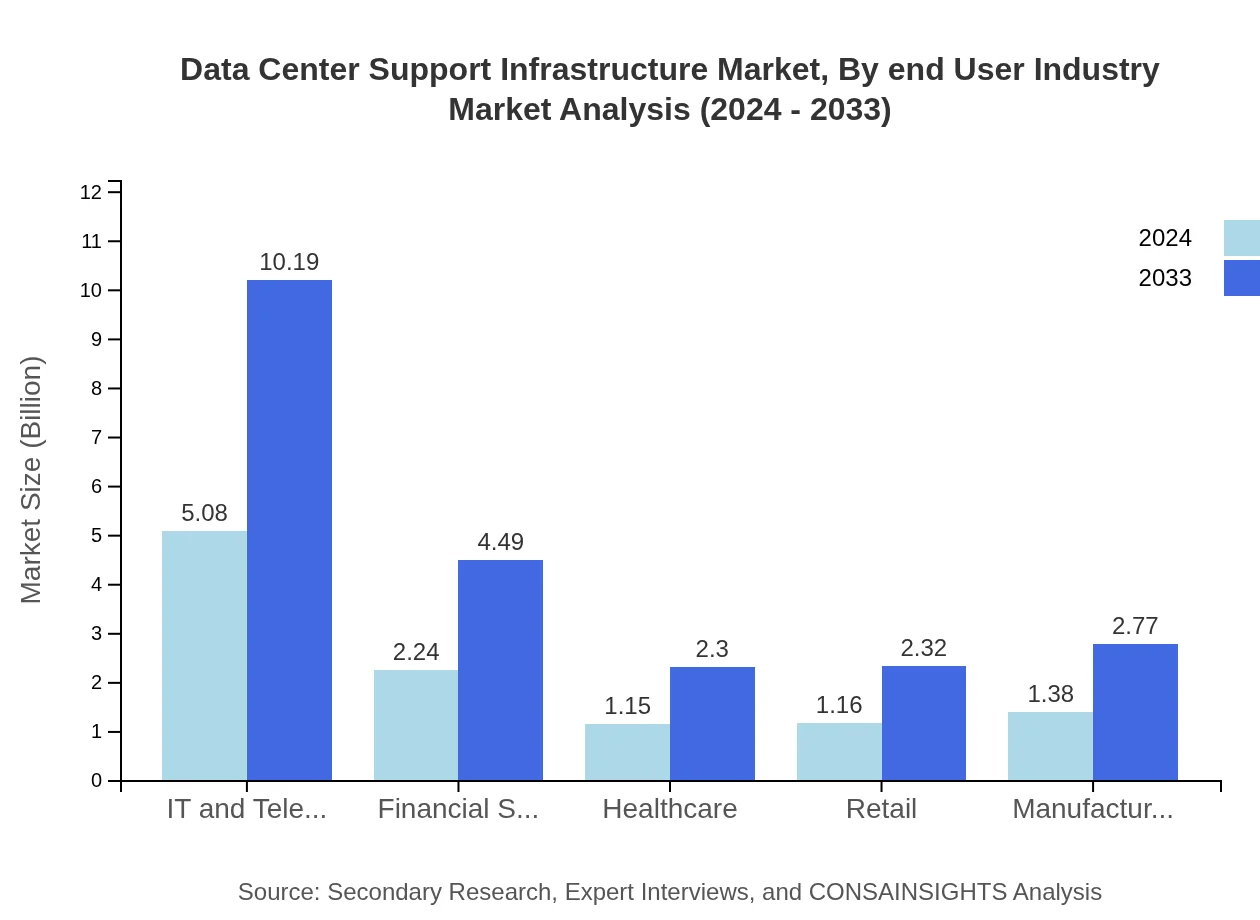

Data Center Support Infrastructure Market Analysis By End User Industry

End-user industry segmentation captures the diversity of sectors utilizing data center support infrastructure. IT and Telecom leads with a 46.17% share, growing from 5.08 units in 2024 to 10.19 units by 2033, supported by rapid digitalization. Financial Services, Healthcare, Retail, and Manufacturing are also critical, with respective market sizes growing from 2.24 to 4.49 units, 1.15 to 2.30 units, 1.16 to 2.32 units, and 1.38 to 2.77 units. This segmentation underscores the essential role of tailored support solutions tailored to the unique demands of various industries.

Data Center Support Infrastructure Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Data Center Support Infrastructure Industry

TechCore Solutions:

TechCore Solutions is a front-runner in providing advanced data center support infrastructure. The company specializes in integrating traditional and modern technologies to deliver reliable installation, maintenance, and security solutions. Their innovative approach and commitment to energy efficiency have earned them a prominent position in the global market.Infratech Global:

Infratech Global is renowned for its comprehensive range of services that span infrastructure deployment, system modernization, and consultancy. With a solid reputation for excellence, Infratech Global leverages deep industry expertise and forward-thinking strategies to drive market growth and set benchmarks in data center support operations.We're grateful to work with incredible clients.

FAQs

How can the data Center Support Infrastructure report help align our marketing strategy with customer adoption trends?

The data center support infrastructure report highlights adoption trends, informing marketing strategies to align with customer needs. It reveals market segments and technologies in demand, ultimately guiding targeted campaigns to enhance product offerings and customer engagement, ensuring relevance as the market grows at a CAGR of 7.8%.

What product features are in highest demand according to data Center Support Infrastructure trends?

According to the trends, advanced technologies and maintenance services are in high demand. The focus on efficiency, reliability, and security features in data cabinets and power systems is pivotal as the market grows, with traditional technologies holding significant market shares.

Which regions offer the best market entry and expansion opportunities in the data Center Support Infrastructure industry?

North America leads with a market projection of $7.76 billion by 2033. Europe follows closely, expected to reach $6.61 billion, with Asia Pacific also showing promise. Expanding into these regions offers lucrative opportunities amidst a growing global market estimated at $11 billion.

What emerging technologies and innovations are shaping the data Center Support Infrastructure market?

Emerging technologies like cloud computing and energy-efficient systems are crucial in shaping the data center landscape. Innovations in cooling systems and power management are vital as market demands evolve, enhancing operational efficiency in an industry projected to grow at 7.8% CAGR.

Does the data Center Support Infrastructure report include competitive landscape and market share analysis?

Yes, the report provides comprehensive competitive landscape analysis along with market share breakdowns among key players across various segments. This data aids in strategic planning and benchmarking against competitors in a rapidly evolving data center market.

How can executives use the data Center Support Infrastructure report to evaluate investment risks and ROI?

Executives can leverage the report's insights into market size and growth projections to assess the viability of investments. By analyzing segment performance and regional dynamics, they can make informed decisions, mitigating risks while optimizing potential ROI in a $11 billion market.

What is the market size of data Center Support Infrastructure?

The data center support infrastructure market is valued at $11 billion in 2024, with a projected compound annual growth rate of 7.8% until 2033, indicating substantial growth and opportunities for stakeholders.

What are the key market segments within the data Center Support Infrastructure?

Key market segments include traditional technologies, leading with a projected size of $19.18 billion by 2033, and advanced technologies, expected to reach $2.90 billion. Moreover, installation services command significant shares demonstrating the importance of operational support.

What are the projected market sizes for data Center Support Infrastructure across different regions by 2033?

In 2033, North America aims for $7.76 billion, Europe $6.61 billion, Asia Pacific $4.35 billion, the Middle East and Africa $2.59 billion, and Latin America $0.76 billion, highlighting diverse growth opportunities significant for regional strategies.