Electrolaser Market Report

Published Date: 31 January 2026 | Report Code: electrolaser

Electrolaser Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Electrolaser market, focusing on market trends, size, segmentation, and regional insights for the forecast period of 2023 to 2033. It aims to deliver strategic insights for industry stakeholders and game changers.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

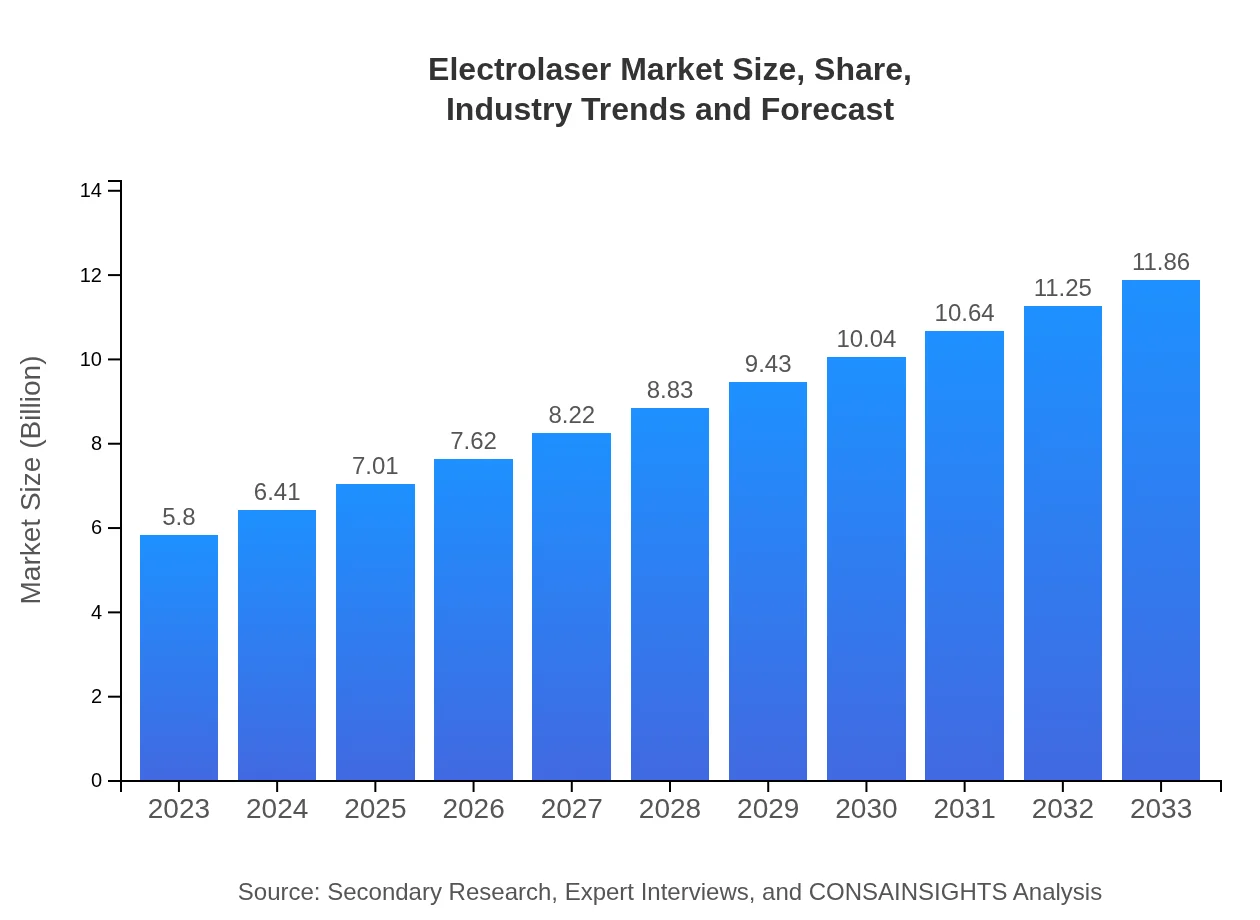

| 2023 Market Size | $5.80 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $11.86 Billion |

| Top Companies | Thales Group, Lockheed Martin, Northrop Grumman, Raytheon Technologies |

| Last Modified Date | 31 January 2026 |

Electrolaser Market Overview

Customize Electrolaser Market Report market research report

- ✔ Get in-depth analysis of Electrolaser market size, growth, and forecasts.

- ✔ Understand Electrolaser's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Electrolaser

What is the Market Size & CAGR of Electrolaser market in 2023?

Electrolaser Industry Analysis

Electrolaser Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Electrolaser Market Analysis Report by Region

Europe Electrolaser Market Report:

Europe's market for Electrolaser technologies is forecasted to grow from USD 1.86 billion in 2023 to USD 3.79 billion by 2033. Leading market players are heavily investing in innovation and sustainability practices. The increasing focus on renewable energy and automation technologies is also expected to bolster the market in this region over the coming years.Asia Pacific Electrolaser Market Report:

In the Asia Pacific region, the Electrolaser market is expected to grow from USD 0.93 billion in 2023 to USD 1.89 billion by 2033. Countries like China and India are investing heavily in defense and industrial sectors, driving the demand for Electrolaser technologies. The availability of a skilled workforce and favorable government initiatives further support this growth trajectory.North America Electrolaser Market Report:

The North American Electrolaser market is projected to grow significantly from USD 2.19 billion in 2023 to USD 4.48 billion by 2033. The United States, being a leader in defense and aerospace technology, is a major contributor to the growth of the market. Continued investments in military projects and R&D initiatives are expected to propel market growth in this region.South America Electrolaser Market Report:

In South America, the market size is estimated to increase from USD 0.38 billion in 2023 to USD 0.77 billion by 2033. The growing automotive and aerospace industries in countries such as Brazil and Argentina are anticipated to increase the demand for Electrolaser products. Additionally, advancements in industrial automation will contribute positively to the market.Middle East & Africa Electrolaser Market Report:

In the Middle East and Africa, the Electrolaser market is anticipated to grow from USD 0.45 billion in 2023 to USD 0.92 billion by 2033. The demand is driven by military investments and the need for advanced manufacturing technologies. The region's growing industrial base and stabilization of economies are expected to enhance the adoption of Electrolaser technologies.Tell us your focus area and get a customized research report.

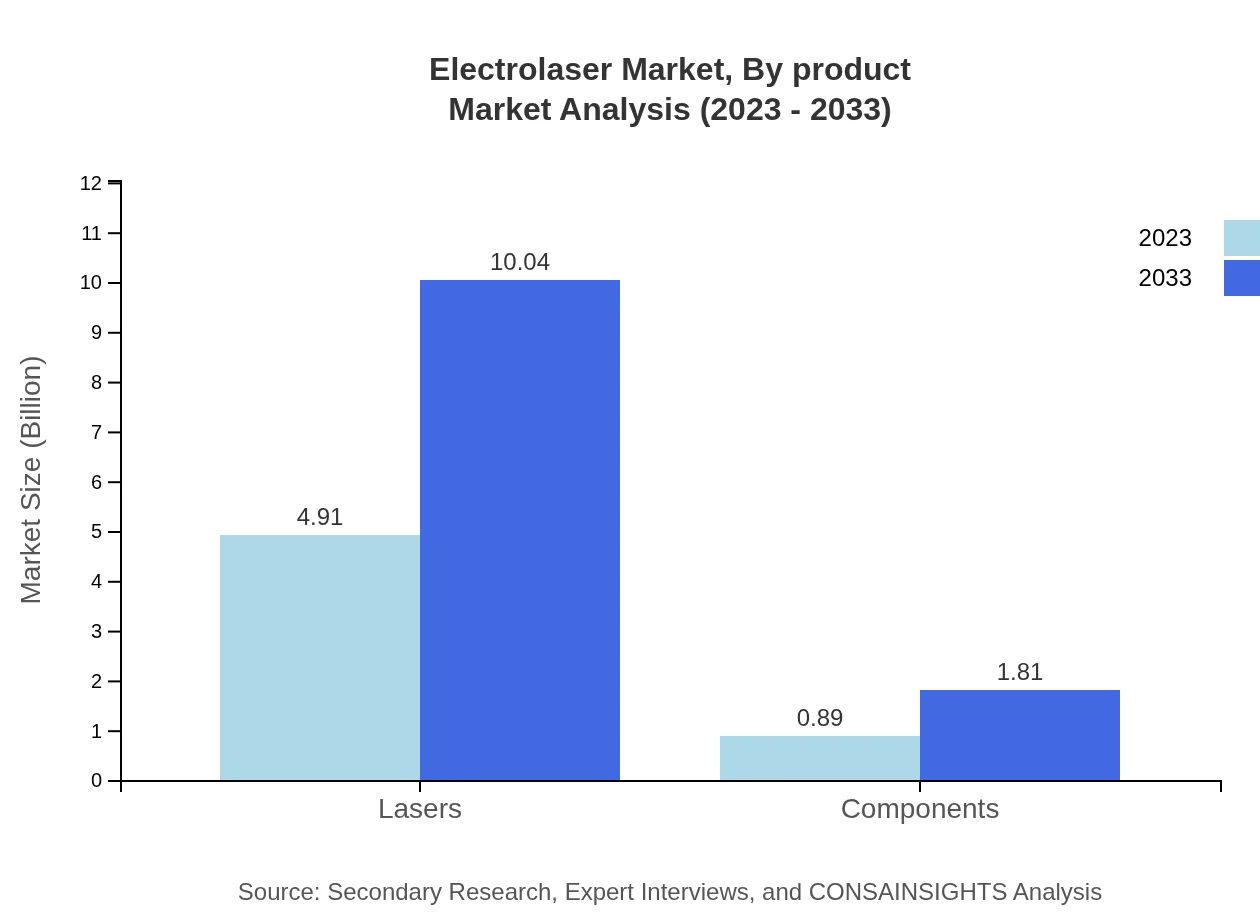

Electrolaser Market Analysis By Product

The analysis of the Electrolaser market by product shows robust growth in the laser segment, which is estimated to increase from USD 4.91 billion in 2023 to USD 10.04 billion by 2033, maintaining a consistent market share of 84.71%. In contrast, the components segment also shows promising growth, rising from USD 0.89 billion to USD 1.81 billion, accounting for 15.29% of the market share.

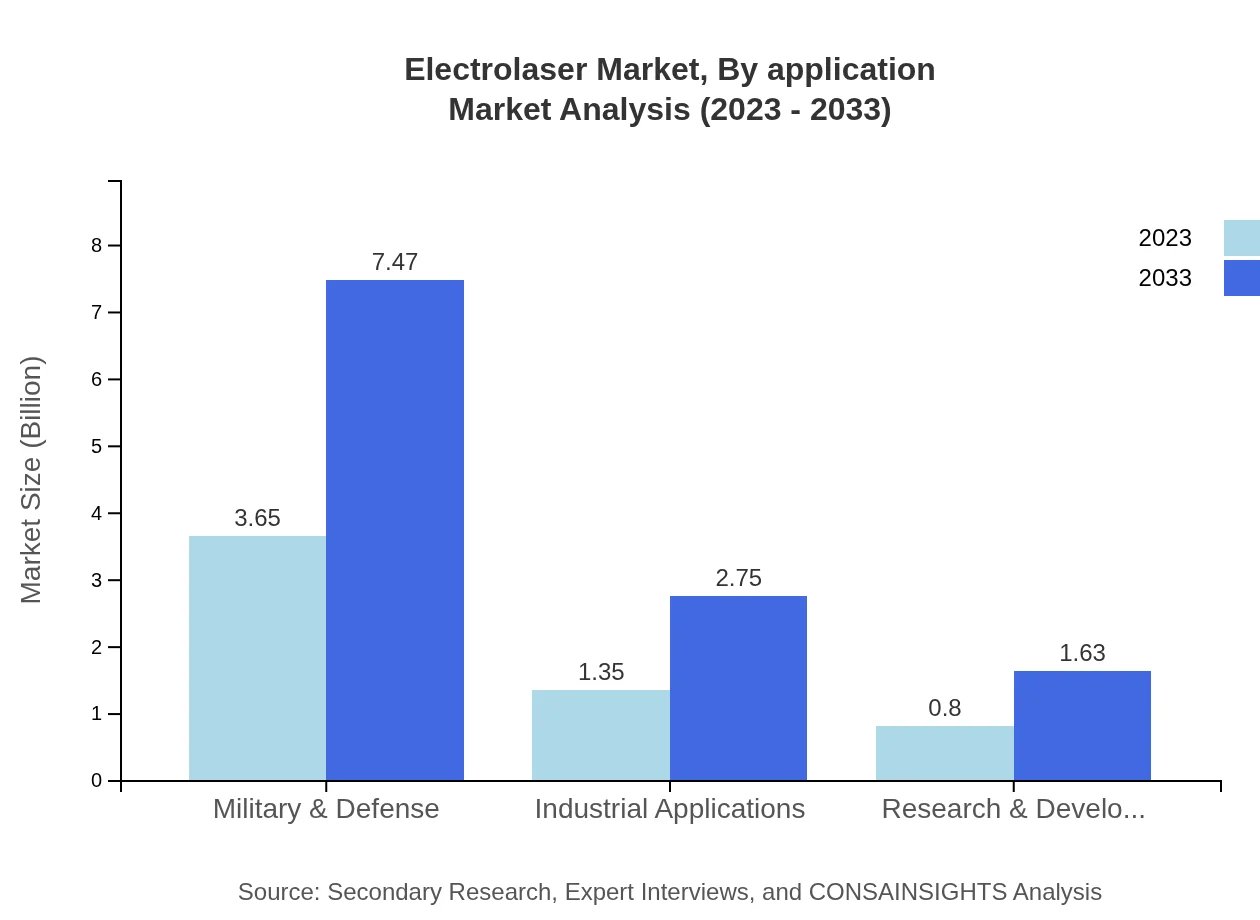

Electrolaser Market Analysis By Application

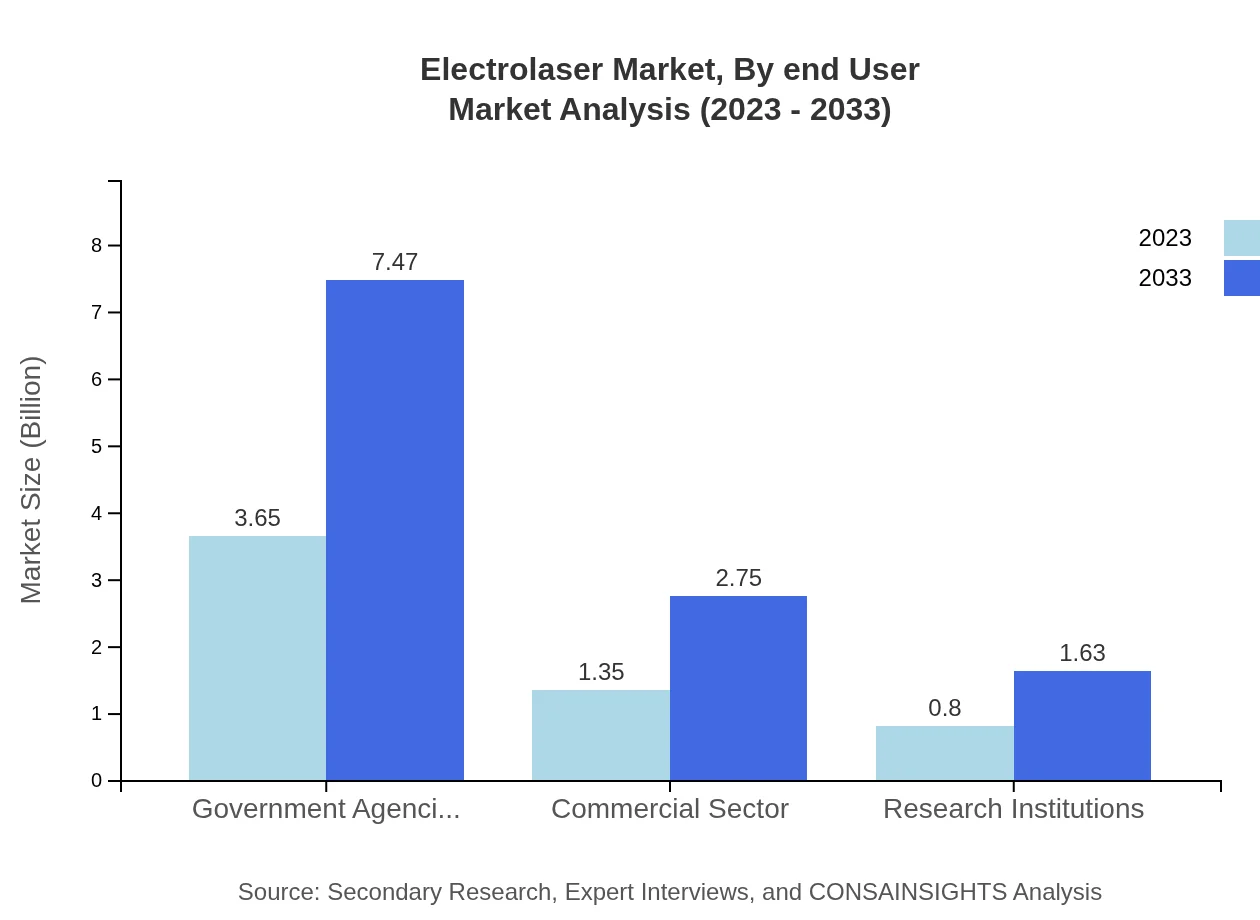

In the application segment, the Government Agencies hold a major share, projected to grow from USD 3.65 billion in 2023 to USD 7.47 billion by 2033, maintaining a 63.01% share. The military and defense application is crucial, followed by commercial sectors that rise from USD 1.35 billion to USD 2.75 billion, holding a share of 23.21%. Research institutions will witness growth from USD 0.80 billion to USD 1.63 billion, representing 13.78% of the market.

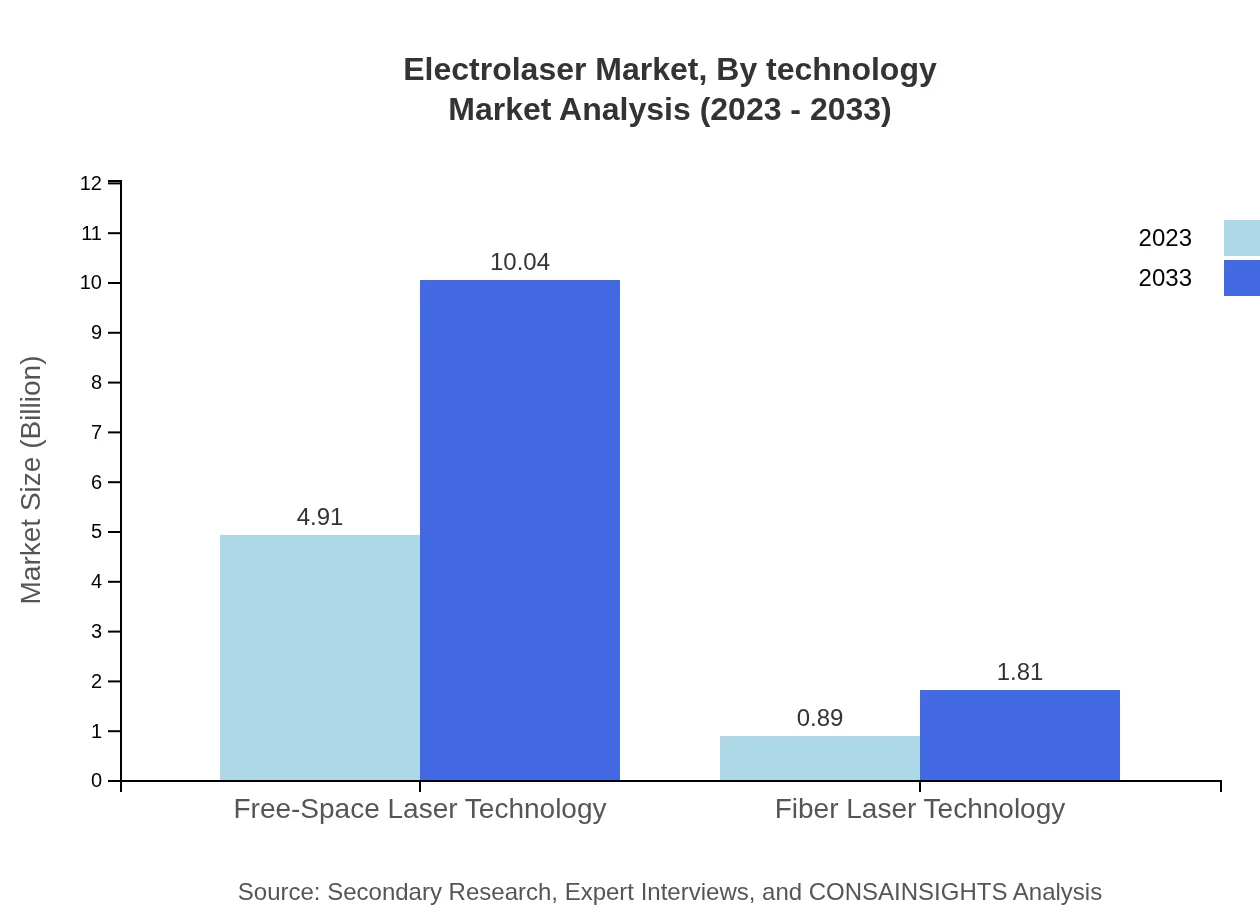

Electrolaser Market Analysis By Technology

The Free-Space Laser Technology dominates the Electrolaser market with a value of USD 4.91 billion in 2023, projected to reach USD 10.04 billion by 2033, showcasing a strong growth trajectory. Fiber Laser Technology, while smaller, is also growing from USD 0.89 billion to USD 1.81 billion, with a steady share of 15.29%.

Electrolaser Market Analysis By End User

The Military & Defense end-user segment leads the market, with an increase from USD 3.65 billion in 2023 to USD 7.47 billion by 2033, holding a consistent share of 63.01%. The industrial applications segment is also significant, reflecting growth from USD 1.35 billion to USD 2.75 billion, maintaining 23.21% share, while Research & Development contributes USD 0.80 billion, expected to reach USD 1.63 billion by 2033 with a share of 13.78%.

Electrolaser Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Electrolaser Industry

Thales Group:

Thales Group is a global leader in aerospace, transport, defense, and security markets providing innovative laser solutions for precision applications.Lockheed Martin:

Lockheed Martin is a security and aerospace company specializing in high-technology systems and devices, including advanced Electrolaser systems for military applications.Northrop Grumman:

Northrop Grumman is a prominent player in the aerospace and defense sector, offering advanced lasers and associated technologies for a wide range of applications.Raytheon Technologies:

Raytheon Technologies is known for its cutting-edge aerospace and defense technologies, enhancing Electrolaser capabilities for military and civilian use.We're grateful to work with incredible clients.

FAQs

What is the market size of electrolaser?

The global Electrolaser market was valued at approximately $5.8 billion in 2023 and is projected to grow at a CAGR of 7.2% over the next decade. By 2033, the market is expected to reach significant heights, reflecting increasing demand.

What are the key market players or companies in this electrolaser industry?

The Electrolaser industry features several key players including major manufacturers, technology providers, and research institutions. These leaders drive innovation and competition within the sector, contributing to its growth and market expansion.

What are the primary factors driving the growth in the electrolaser industry?

Key factors driving growth include advancements in laser technologies, increasing applications in military and industrial sectors, and rising demand for precision instruments. The growing emphasis on defense capabilities also enhances market potential.

Which region is the fastest Growing in the electrolaser market?

North America is the fastest-growing region, projected to expand from $2.19 billion in 2023 to $4.48 billion by 2033. Europe and Asia Pacific follow closely, with robust growth in demand and technological adoption.

Does ConsaInsights provide customized market report data for the electrolaser industry?

Yes, ConsaInsights offers customized market report data tailored to specific client requirements in the electrolaser industry. This includes bespoke analysis, segment reports, and insights vital for strategic planning.

What deliverables can I expect from this electrolaser market research project?

Deliverables from the electrolaser market research project typically include comprehensive market size reports, segment analysis, competitor assessments, growth forecasts, and actionable insights to inform business strategies.

What are the market trends of electrolaser?

Current trends in the electrolaser market include increased investment in defense technologies, advancements in laser applications in various sectors, and a growing focus on research and development to enhance capabilities and efficiency.