Iot In Banking And Financial Services

Published Date: 31 January 2026 | Report Code: iot-in-banking-and-financial-services

Iot In Banking And Financial Services Market Size, Share, Industry Trends and Forecast to 2033

This detailed report covers the IoT integration in Banking and Financial Services, offering insights into market conditions, key trends, and competitive landscapes forecasted from 2024 to 2033. It provides data-driven analysis, segmented market views, regional breakdowns, and forward-looking trends to help stakeholders make informed decisions.

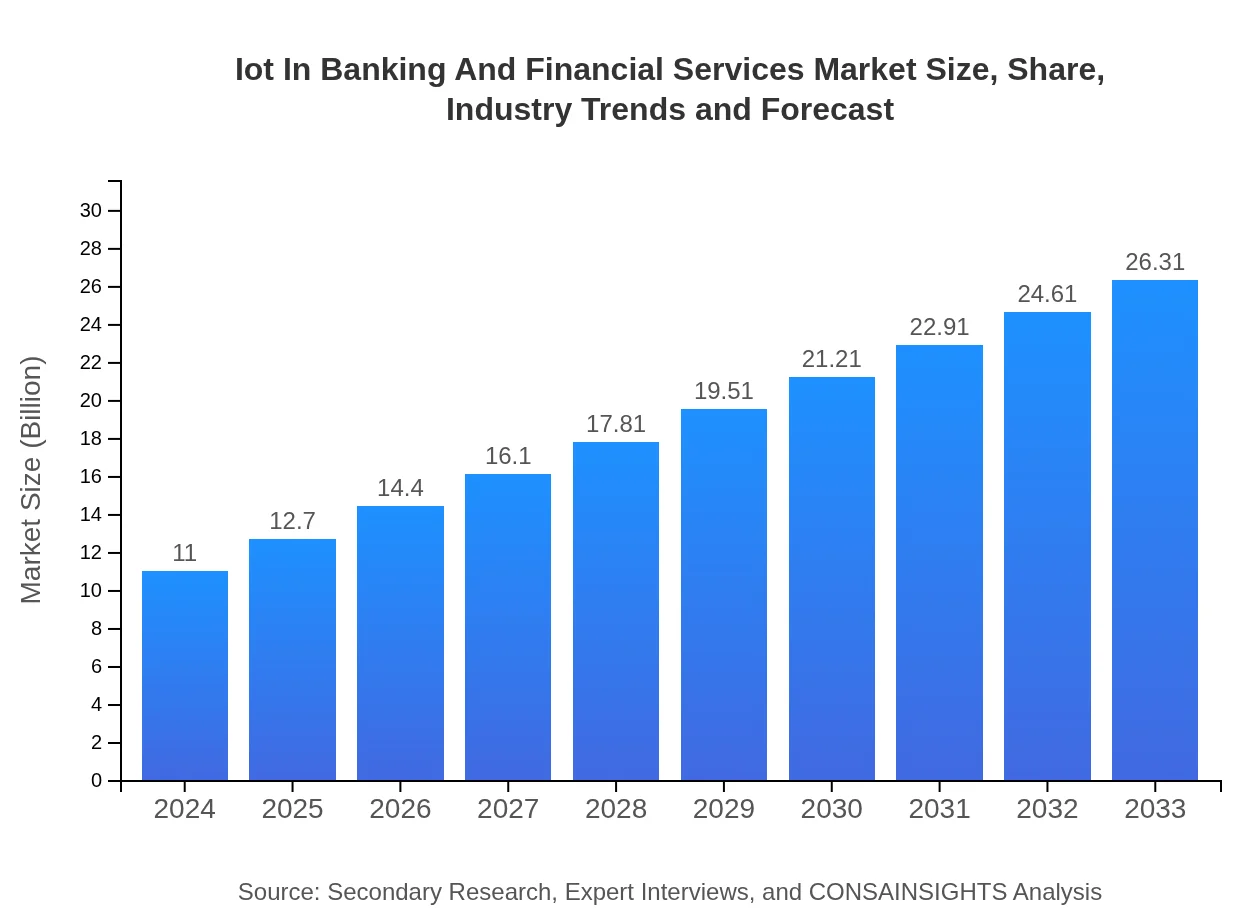

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

| 2024 Market Size | $11.00 Billion |

| CAGR (2024-2033) | 9.8% |

| 2033 Market Size | $26.31 Billion |

| Top Companies | TechBank Solutions, Innovate Fintech Inc. |

| Last Modified Date | 31 January 2026 |

Iot In Banking And Financial Services Market Overview

Customize Iot In Banking And Financial Services market research report

- ✔ Get in-depth analysis of Iot In Banking And Financial Services market size, growth, and forecasts.

- ✔ Understand Iot In Banking And Financial Services's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Iot In Banking And Financial Services

What is the Market Size & CAGR of Iot In Banking And Financial Services market in 2024?

Iot In Banking And Financial Services Industry Analysis

Iot In Banking And Financial Services Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Iot In Banking And Financial Services Market Analysis Report by Region

Europe Iot In Banking And Financial Services:

Europe exhibits robust growth in the IoT space for Banking and Financial Services, progressing from 3.41 in 2024 to 8.17 in 2033, driven by stringent regulatory frameworks and a strong emphasis on data privacy and security. The market here is bolstered by advanced technological infrastructure and a proactive approach to digital transformation, which fosters seamless integration of IoT solutions into traditional banking practices.Asia Pacific Iot In Banking And Financial Services:

In the Asia Pacific region, the IoT in Banking and Financial Services market is expanding steadily, with market values growing from an estimated 1.90 in 2024 to 4.55 in 2033. Rapid urbanization, increased smartphone penetration, and government-led digitization initiatives are major growth drivers. Financial institutions in the region are adopting IoT solutions to refine customer experiences and improve infrastructure resilience, ensuring competitive advantages in a dynamic landscape.North America Iot In Banking And Financial Services:

North America remains a leader in integrating IoT within banking and financial services, with market growth anticipated from 4.25 in 2024 to 10.17 in 2033. The region benefits from a mature technology ecosystem, significant R&D investments, and strategic initiatives in digital banking, which are collectively reinforcing the market’s expansion and innovation-oriented trajectory.South America Iot In Banking And Financial Services:

South America is witnessing gradual but sustained growth in IoT adoption within the banking sector with market estimates advancing from 1.02 in 2024 to 2.43 in 2033. The region faces challenges including infrastructural constraints and regulatory inconsistencies, yet efforts towards digital transformation and improved cybersecurity measures are helping financial institutions embrace IoT technologies to modernize service delivery.Middle East & Africa Iot In Banking And Financial Services:

In the Middle East and Africa region, the market is relatively nascent but promising, with figures expected to increase from 0.42 in 2024 to 0.99 in 2033. Emerging economies are beginning to harness IoT for enhanced financial inclusion and operational efficiency. Despite facing challenges in infrastructure and digital literacy, ongoing investments and regional partnerships are paving the way for gradual market maturation.Tell us your focus area and get a customized research report.

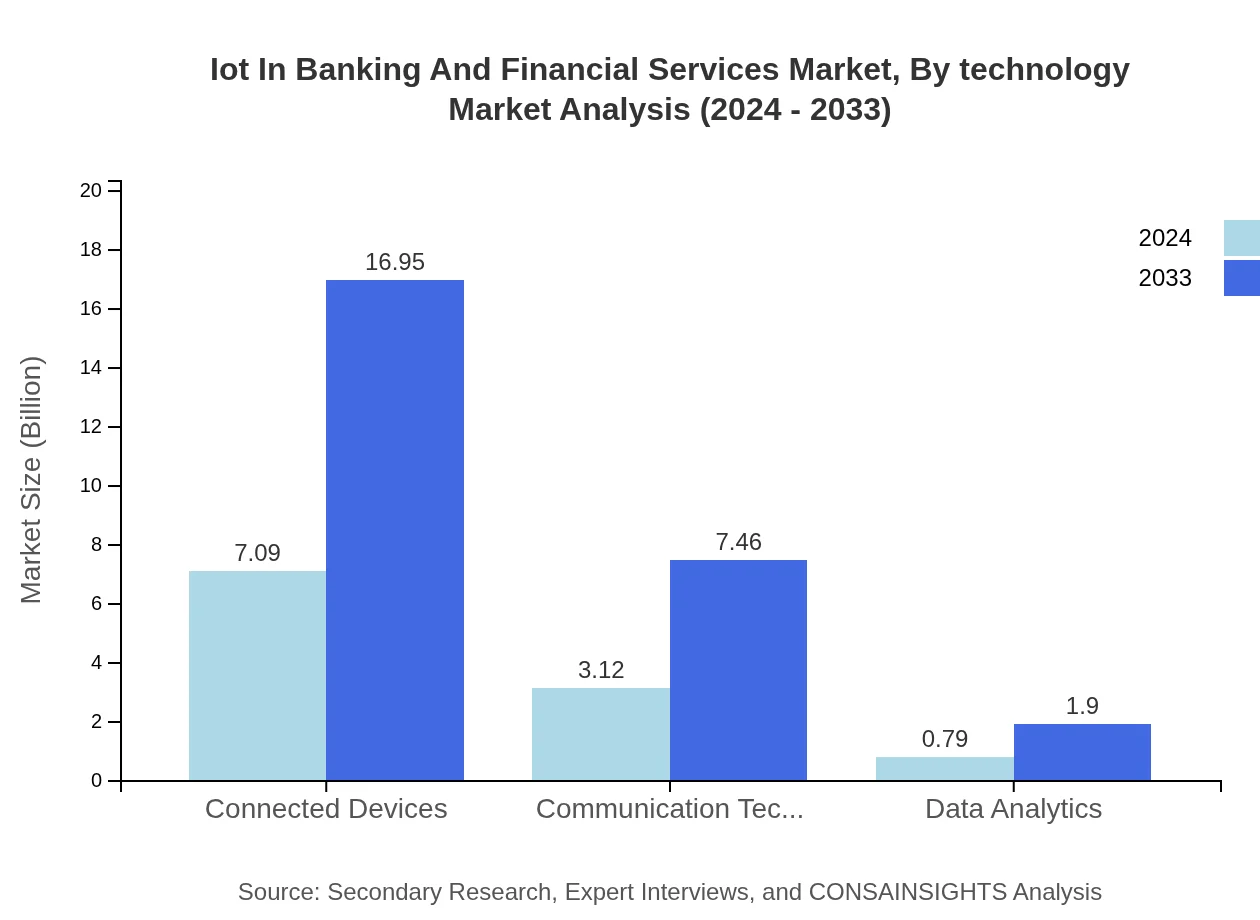

Iot In Banking And Financial Services Market Analysis By Technology

The technology segment has been a major catalyst for the IoT revolution in financial services. Innovations in security protocols, connected devices, communication networks, and data analytics are enabling streamlined operations and safeguarding critical information. As banks invest in advanced sensor technology and network infrastructure, the digitization of transactions and real-time monitoring capabilities are substantially increasing efficiency. This segment is expected to drive significant value by enhancing fraud detection and reducing operational risks.

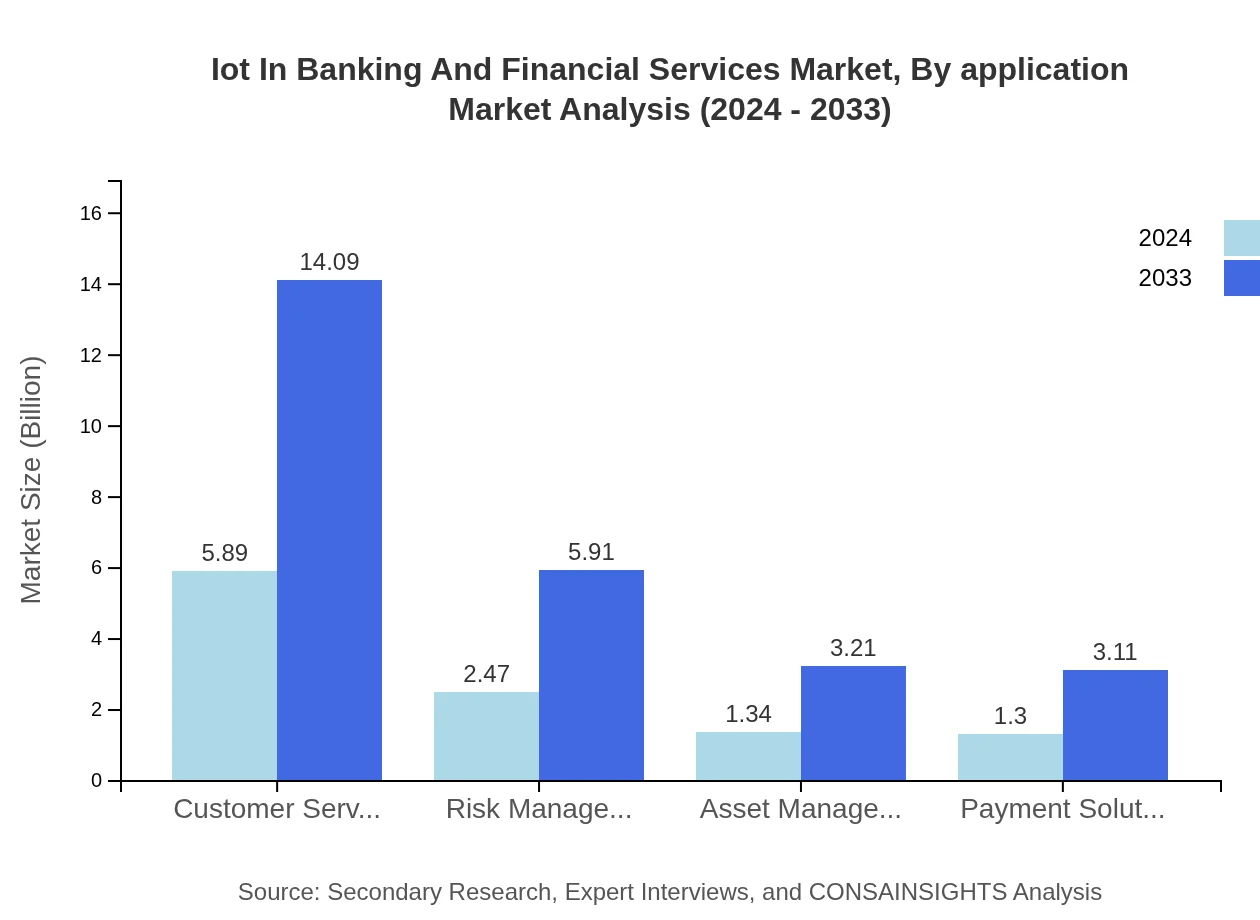

Iot In Banking And Financial Services Market Analysis By Application

Applications of IoT in the financial sector are diverse, ranging from retail and investment banking to insurance and fintech services. Retail banking benefits through enhanced branch automation, customer service improvement, and secure digital environments, while investment banking leverages IoT for real-time data flow and market analytics. Insurance and fintech are also evolving with tailored solutions for risk assessment and personalized product offerings, demonstrating that application-specific innovation is critical to overall market growth.

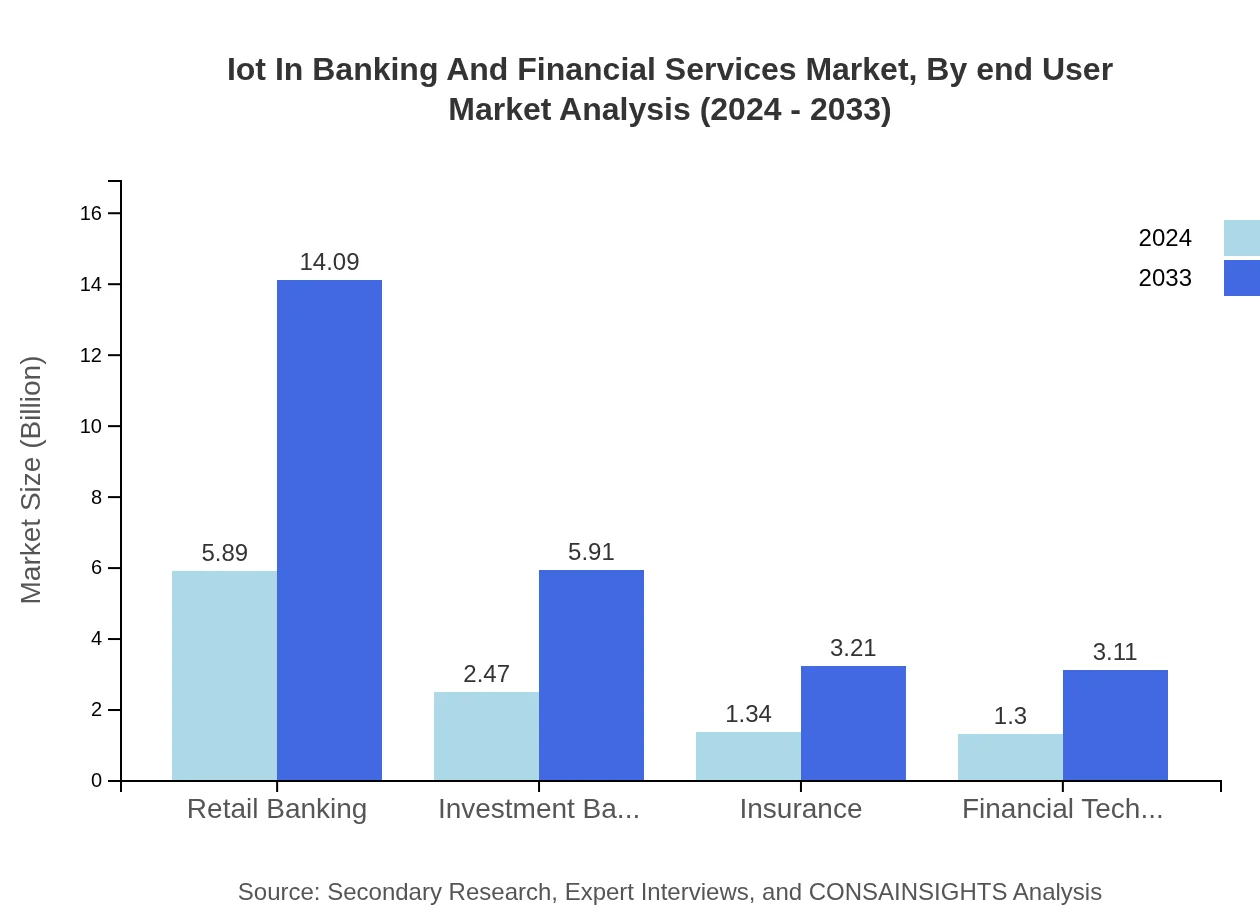

Iot In Banking And Financial Services Market Analysis By End User

End-user segments in this market include both consumers and enterprises that benefit from IoT integrations. Customers experience faster, more secure transactions and personalized services. Financial institutions, on the other hand, gain improved efficiency in areas such as customer service, asset management, payment solutions, and risk management. These enhanced capabilities not only streamline operational workflows but also improve customer satisfaction and drive loyalty in a competitive financial landscape.

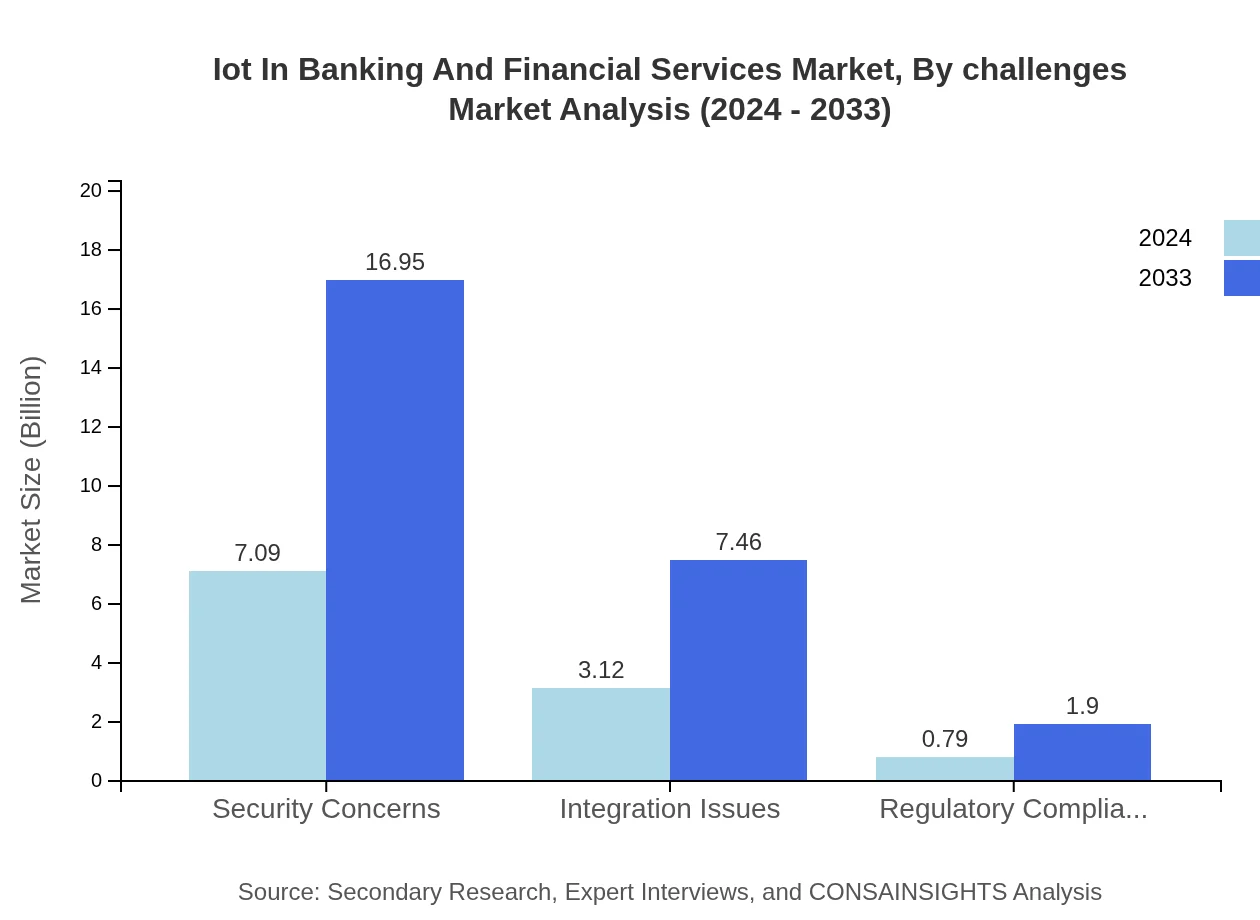

Iot In Banking And Financial Services Market Analysis By Challenges

The challenges in implementing IoT across banking services are centered on integration complexities, regulatory compliance, and security concerns. Many institutions struggle with legacy system compatibility, which complicates the deployment of new IoT solutions. Additionally, the evolving regulatory environment demands continuous upgrades and realignment of security protocols. Despite these hurdles, ongoing innovation and strategic collaboration between technology providers and financial institutions are gradually mitigating these issues, paving the way for a more resilient and responsive IoT ecosystem.

Iot In Banking And Financial Services Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Iot In Banking And Financial Services Industry

TechBank Solutions:

TechBank Solutions is renowned for its innovative IoT platforms that optimize client operations through advanced data analytics and secure connectivity, fostering enhanced customer engagement and operational efficiency.Innovate Fintech Inc.:

Innovate Fintech Inc. leads in integrating IoT with financial management systems, providing cutting-edge solutions that streamline banking processes and deliver robust security measures, ensuring digital transformations are smooth and scalable.We're grateful to work with incredible clients.

FAQs

How can the IoT in Banking and Financial Services report help align our marketing strategy with customer adoption trends?

Understanding customer adoption trends through the IoT in Banking and Financial Services report allows your marketing strategy to be data-driven, targeting areas of higher demand and growth. The projected market can reach $11 billion by 2033, growing at a CAGR of 9.8%.

What product features are in highest demand according to the IoT in Banking and Financial Services trends?

The highest demand features in this sector include security features, data analytics, and customer service enhancements. With security concerns projected to be valued at $16.95 billion by 2033, integrating these features enhances product appeal.

Which regions offer the best market entry and expansion opportunities in the IoT in Banking and Financial Services industry?

North America shows significant promise, with a market size expected to grow from $4.25 billion in 2024 to $10.17 billion by 2033. Europe and Asia Pacific also display growth potential, reaching $8.17 billion and $4.55 billion respectively by 2033.

What emerging technologies and innovations are shaping the IoT in Banking and Financial Services market?

Technologies such as AI-driven analytics, blockchain for secure transactions, and enhanced mobile banking solutions are reshaping the market. These innovations are anticipated to drive market growth significantly, improving customer engagement and operational efficiency.

Does the IoT in Banking and Financial Services report include competitive landscape and market share analysis?

Yes, the report features a comprehensive competitive landscape, detailing market shares across key segments. It highlights that connected devices and security solutions are leading segments, which comprise significant portions of the market share.

How can executives use the IoT in Banking and Financial Services report to evaluate investment risks and ROI?

Executives can leverage the report's insights on market size, growth rates, and key risks like regulatory compliance to make informed investment decisions. Understanding the expected CAGR of 9.8% helps in assessing potential ROI on new projects.

What is the market size of IoT in Banking and Financial Services?

The IoT in Banking and Financial Services market is set to achieve a size of $11 billion by 2033, representing a robust growth trajectory with a CAGR of 9.8%, indicating increasing adoption and utilization of IoT technologies.

What segments are projected to lead the IoT in Banking and Financial Services market?

Retail banking leads the market with expected sizes of $5.89 billion in 2024 and $14.09 billion by 2033. Other key segments include Investment Banking and Insurance, emphasizing the diverse applications of IoT in financial services.