Inspection Management Software

Published Date: 31 January 2026 | Report Code: inspection-management-software

Inspection Management Software Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report on Inspection Management Software delves into market dynamics, key growth drivers, and technological advancements shaping the industry between 2024 and 2033. The analysis covers market size, competitive landscape, regional opportunities, segmentation by industry and feature set, and future forecasts, providing critical insights for stakeholders and decision makers.

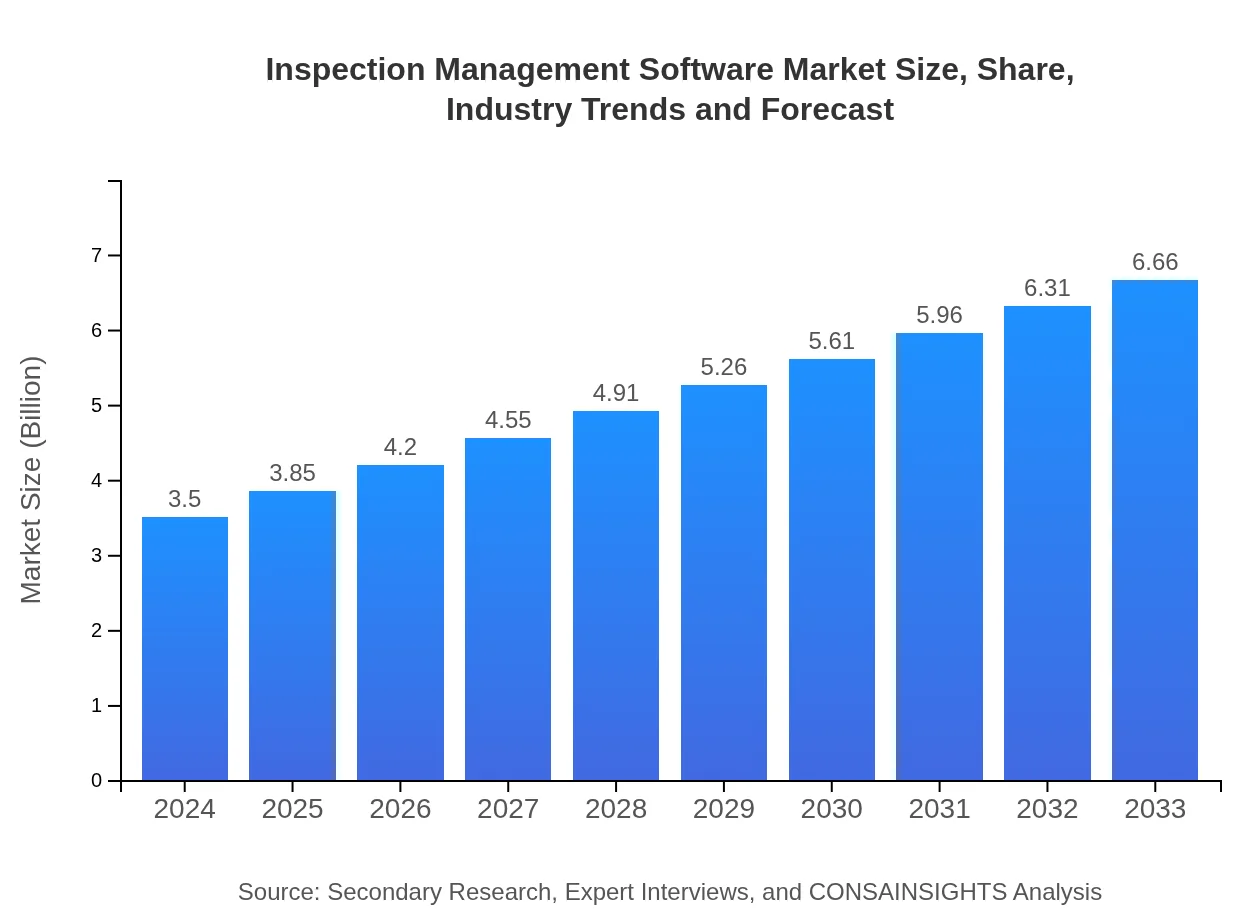

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

| 2024 Market Size | $3.50 Billion |

| CAGR (2024-2033) | 7.2% |

| 2033 Market Size | $6.66 Billion |

| Top Companies | Tech Innovators Inc., InspiroSoft Solutions, InspectionPro Technologies |

| Last Modified Date | 31 January 2026 |

Inspection Management Software Market Overview

Customize Inspection Management Software market research report

- ✔ Get in-depth analysis of Inspection Management Software market size, growth, and forecasts.

- ✔ Understand Inspection Management Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Inspection Management Software

What is the Market Size & CAGR of Inspection Management Software market in 2024?

Inspection Management Software Industry Analysis

Inspection Management Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Inspection Management Software Market Analysis Report by Region

Europe Inspection Management Software:

Europe is witnessing significant market growth, with figures moving from 1.11 in 2024 to an anticipated 2.12 by 2033. The region’s emphasis on workplace safety, quality compliance, and environmental regulations spurs the adoption of advanced inspection management software. Collaborative projects and modern infrastructure development are set to amplify market penetration across various industries.Asia Pacific Inspection Management Software:

The Asia Pacific region is showing promising growth with market size projected to rise from 0.65 in 2024 to 1.25 by 2033. Increased industrial activity, rapid adoption of digital technologies, and government initiatives to enhance infrastructure contribute to this positive outlook. Emerging economies in the region are heavily investing in modernization projects, making this a key growth area for inspection management tools.North America Inspection Management Software:

North America continues to be a major hub for innovation and technology adoption in the inspection management sector. With its market size growing from 1.23 in 2024 to 2.35 by 2033, the region benefits from strong regulatory frameworks, high R&D investments, and the presence of leading technology providers that drive the software’s evolution.South America Inspection Management Software:

South America remains a smaller market with an estimated size increase from 0.02 in 2024 to 0.04 in 2033. Factors such as limited industrial automation, economic constraints, and slower digital transformation contribute to modest growth. However, specific countries with robust industrial sectors and export-oriented economies are beginning to deploy advanced inspection management solutions.Middle East & Africa Inspection Management Software:

In the Middle East and Africa, the market is poised for steady expansion with sizes expected to increase from 0.48 in 2024 to 0.92 by 2033. Economic diversification efforts, infrastructure investments, and heightened focus on regulatory compliance are driving the adoption of digital inspection solutions. These regions are gradually overcoming initial adoption challenges, paving the way for future growth.Tell us your focus area and get a customized research report.

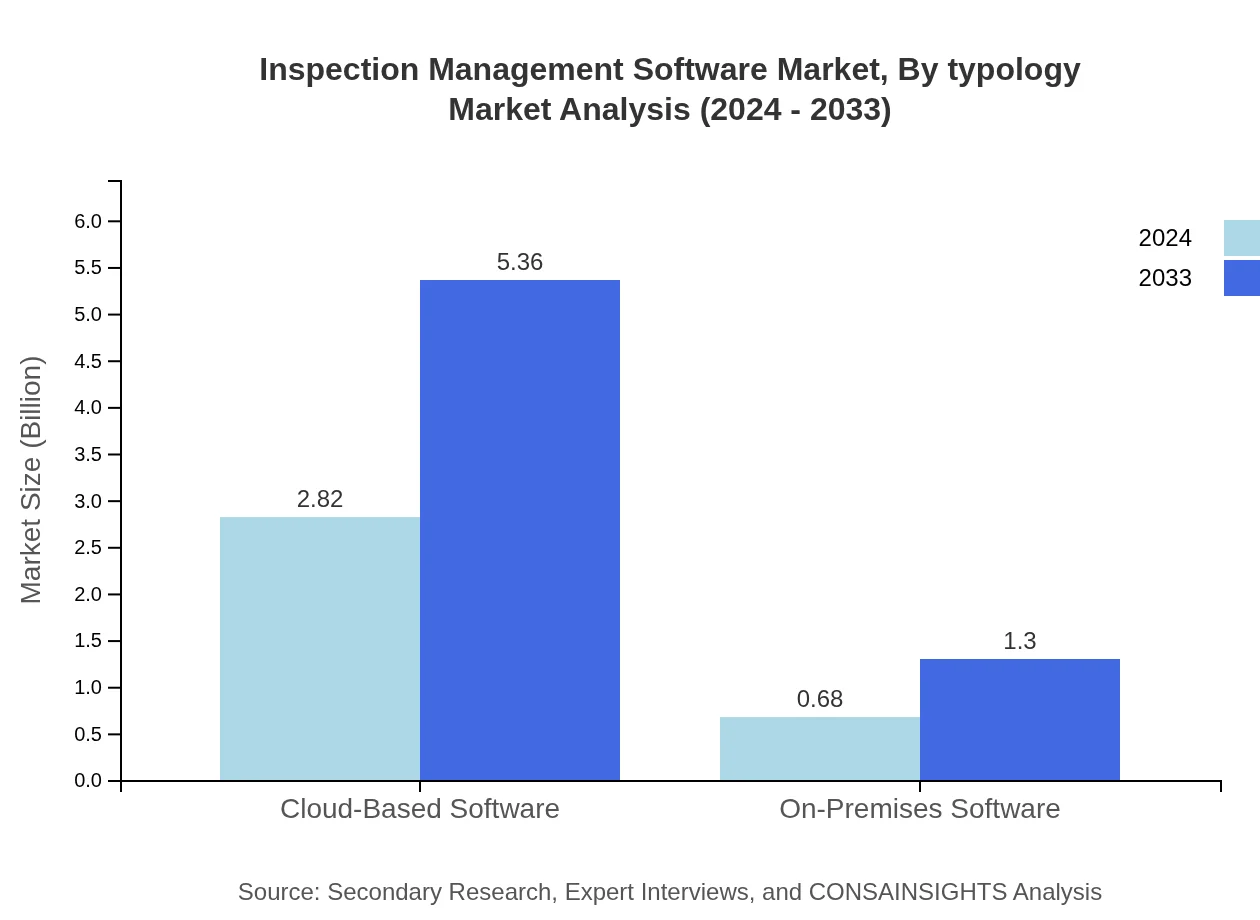

Inspection Management Software Market Analysis By Typology

The typology analysis distinguishes between cloud-based and on-premises solutions. Cloud-based software, with market sizes growing from 2.82 in 2024 to 5.36 by 2033 and maintaining a dominant share of 80.45%, offers scalability, flexibility, and ease of integration with other digital systems. On the other hand, on-premises solutions, which grow from 0.68 to 1.30 and retain a 19.55% share, are preferred by organizations with strict data security requirements and legacy system dependencies. This segmentation underscores the evolving preferences of businesses based on cost, accessibility, and regulatory factors.

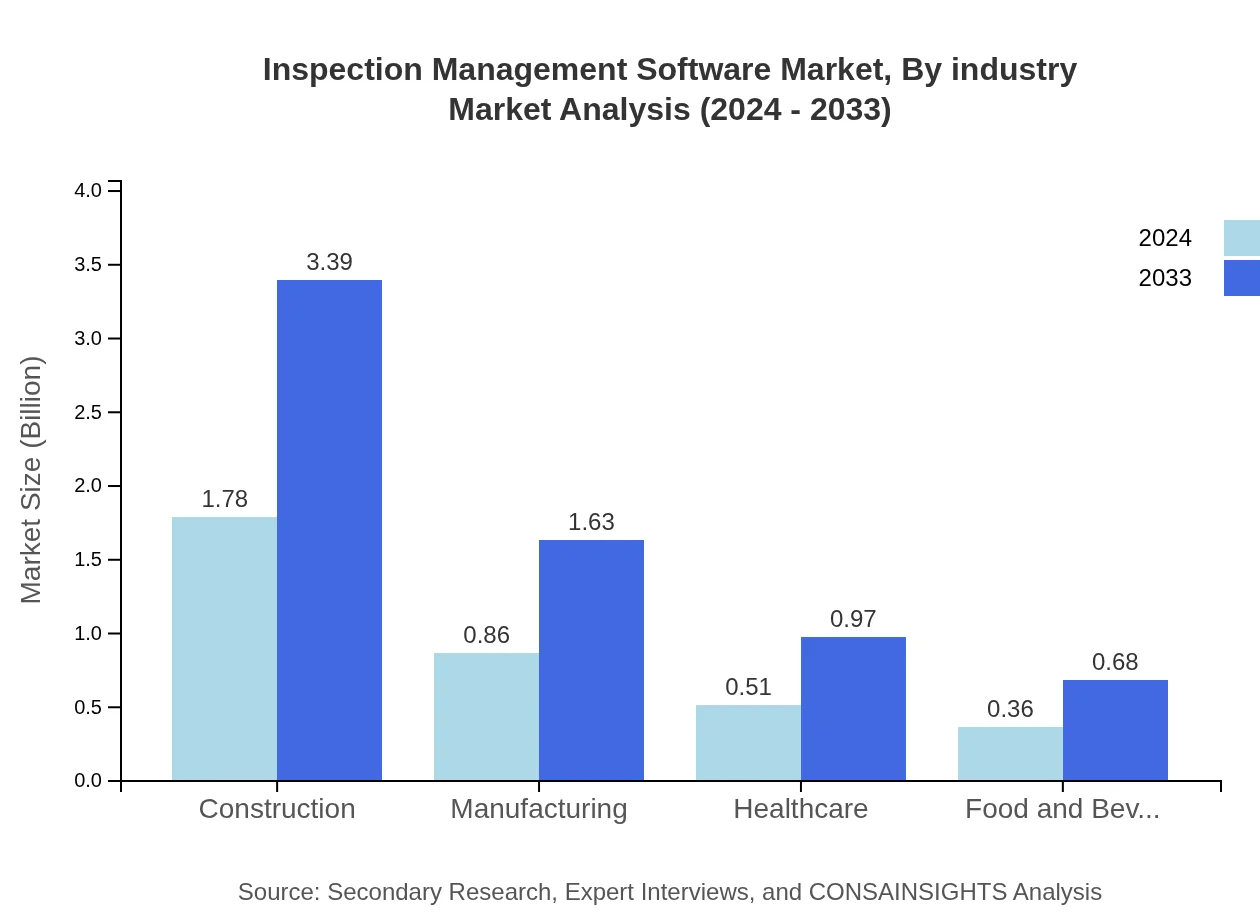

Inspection Management Software Market Analysis By Industry

Industry segmentation examines sectors such as construction, manufacturing, healthcare, and food & beverage. The construction sector is the largest, with market size rising from 1.78 in 2024 to 3.39 by 2033, representing a dominant share of 50.84%. Manufacturing follows with figures increasing from 0.86 to 1.63 and a consistent share of 24.47%. Healthcare and food & beverage sectors, though smaller, are experiencing steady growth, underscoring the diversified application of inspection management technologies across various high-stakes environments.

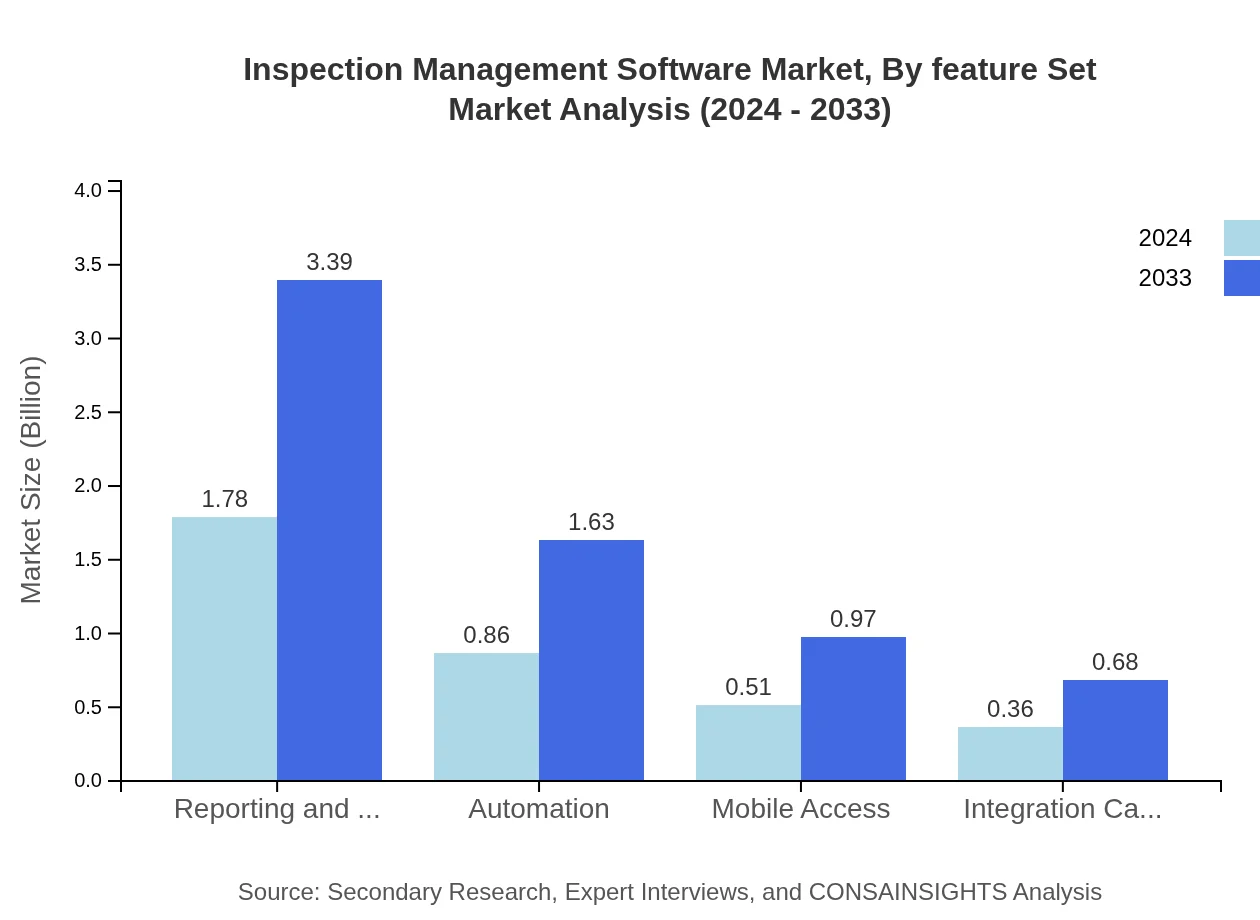

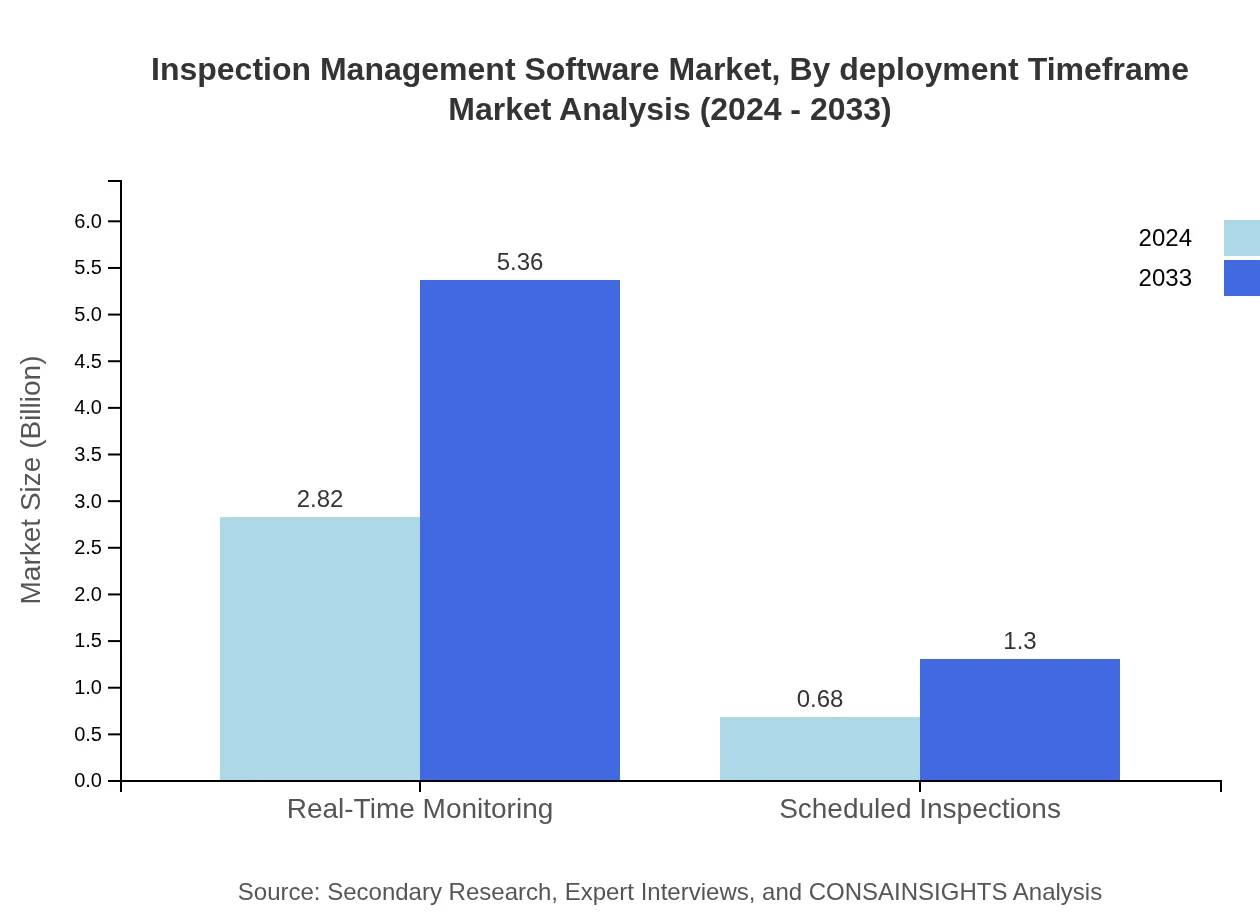

Inspection Management Software Market Analysis By Feature Set

Feature set analysis focuses on key functionalities offered by inspection management software. Reporting and analytics are critical, with market sizes moving from 1.78 in 2024 to 3.39 by 2033 and a share of 50.84%, enabling insightful decision-making. Automation features, essential for reducing manual intervention, grow from 0.86 to 1.63 with a share of 24.47%. Mobile access and integration capabilities, along with real-time monitoring and scheduled inspections, further enhance operational efficiency by providing users with on-demand access to data and seamless system interoperability.

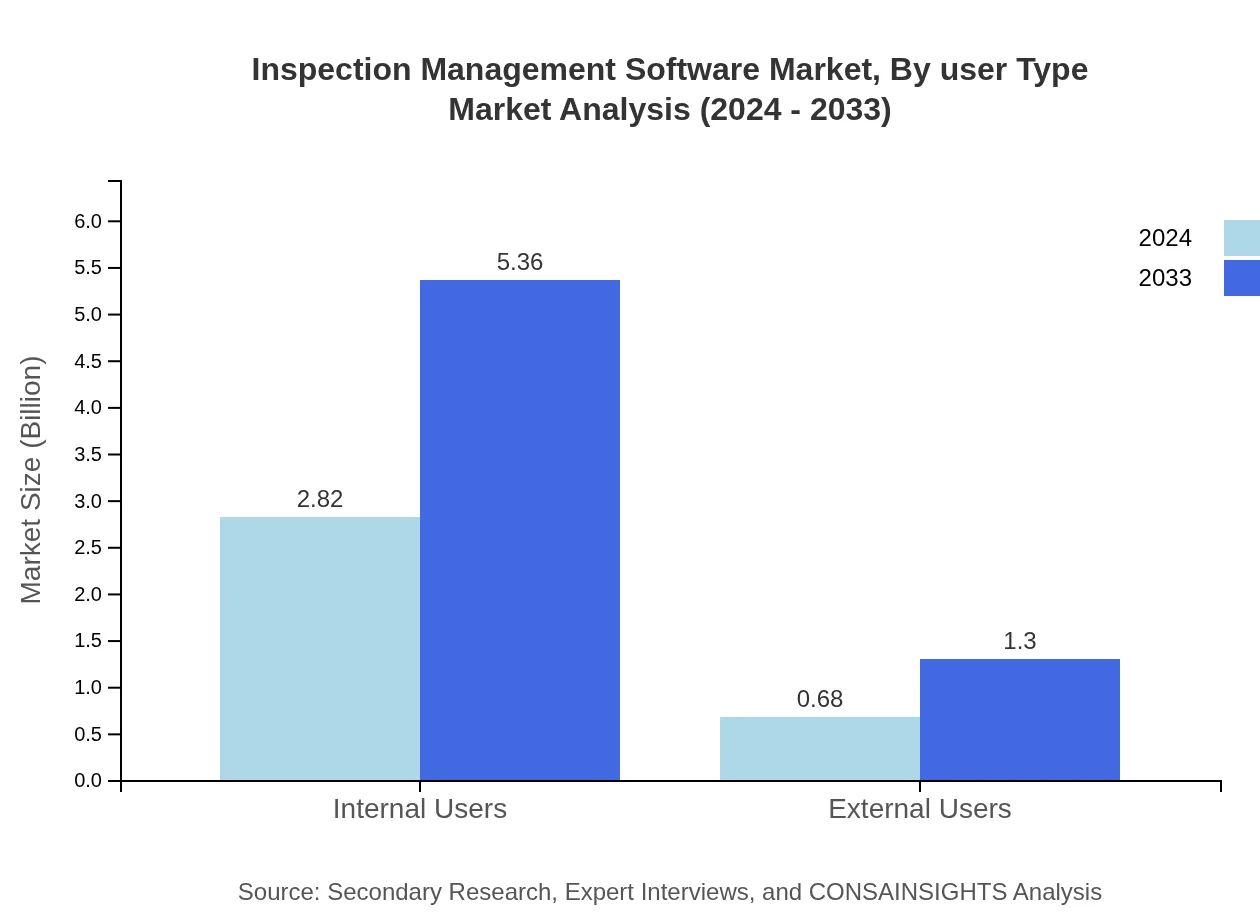

Inspection Management Software Market Analysis By User Type

The user type segmentation categorizes solutions based on internal and external usage. Internal users benefit significantly from comprehensive data analytics and streamlined workflows, with their segment growing from 2.82 in 2024 to 5.36 by 2033, capturing an 80.45% market share. External users, while still crucial, represent a smaller portion of the user base with market sizes increasing from 0.68 to 1.30 and holding a 19.55% share. The segmentation reflects a balanced focus on internal operational efficiencies alongside client-facing services and external compliance.

Inspection Management Software Market Analysis By Deployment Timeframe

Deployment timeframe segmentation focuses on the speed and strategy of software implementation. Organizations are increasingly preferring rapid deployment methods that offer minimal downtime and quick integration with existing operations. This segment highlights the transition from long-term, large-scale installations to agile, iterative deployments that align with evolving business needs. The emphasis on shorter deployment cycles is particularly relevant for high-demand sectors requiring immediate updates and real-time optimization, ensuring that inspection management solutions remain both current and scalable.

Inspection Management Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Inspection Management Software Industry

Tech Innovators Inc.:

Tech Innovators Inc. is renowned for its cutting-edge inspection management platforms that integrate AI-driven analytics and real-time monitoring, setting industry benchmarks for efficiency and reliability.InspiroSoft Solutions:

InspiroSoft Solutions provides a comprehensive suite of cloud-based inspection tools, enabling businesses to streamline compliance, improve safety standards, and enhance operational performance across multiple sectors.InspectionPro Technologies:

InspectionPro Technologies offers innovative on-premises and hybrid solutions designed to cater to industries with strict security protocols, delivering robust data management and seamless system integration.We're grateful to work with incredible clients.

FAQs

How can the inspection Management Software help align our marketing strategy with customer adoption trends?

The inspection management software market is projected to reach $3.5 billion with a CAGR of 7.2%. By identifying customer preferences for features and tracking adoption trends, marketers can tailor their strategies to enhance engagement and retention.

What product features are in highest demand according to the inspection Management Software trends?

Key features driving demand include real-time monitoring and reporting & analytics, accounting for 80.45% and 50.84% of market segments respectively by 2033. Automation and mobile access are also crucial as user expectations evolve.

Which regions offer the best market entry and expansion opportunities in the inspection Management Software industry?

North America leads with a market size projected at $2.35 billion by 2033, closely followed by Europe at $2.12 billion. Asia Pacific is expected to grow significantly, reaching $1.25 billion, presenting promising opportunities.

What emerging technologies and innovations are shaping the inspection Management Software market?

Innovations include cloud-based solutions and advanced analytics. Integration capabilities and mobile access are gaining traction, enabling enhanced functionalities and real-time updates, significantly transforming operational efficiencies across various sectors.

Does the inspection Management Software report include competitive landscape and market share analysis?

Yes, the report encompasses detailed insights into competitive positioning and market shares across segments including construction, manufacturing, and healthcare, providing vital data for strategic decision-making.

How can executives use the inspection Management Software report to evaluate investment risks and ROI?

Executives can leverage market size projections, CAGR, and competitive landscape data to assess potential risks and align investment strategies, ensuring higher chances of achieving desired ROI by targeting promising sectors and regions.

What is the market size of inspection Management Software?

The inspection management software market is valued at $3.5 billion in 2024, with a projected CAGR of 7.2%, indicating robust growth opportunities for stakeholders over the upcoming years.