Insolvency Software

Published Date: 31 January 2026 | Report Code: insolvency-software

Insolvency Software Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report on the Insolvency Software market provides an in‐depth analysis of current market conditions and future outlook, including a detailed examination of market drivers, segmentation, regional dynamics, and technology trends. Spanning the forecast period from 2024 to 2033, the report offers actionable insights and robust data to support strategic decision-making.

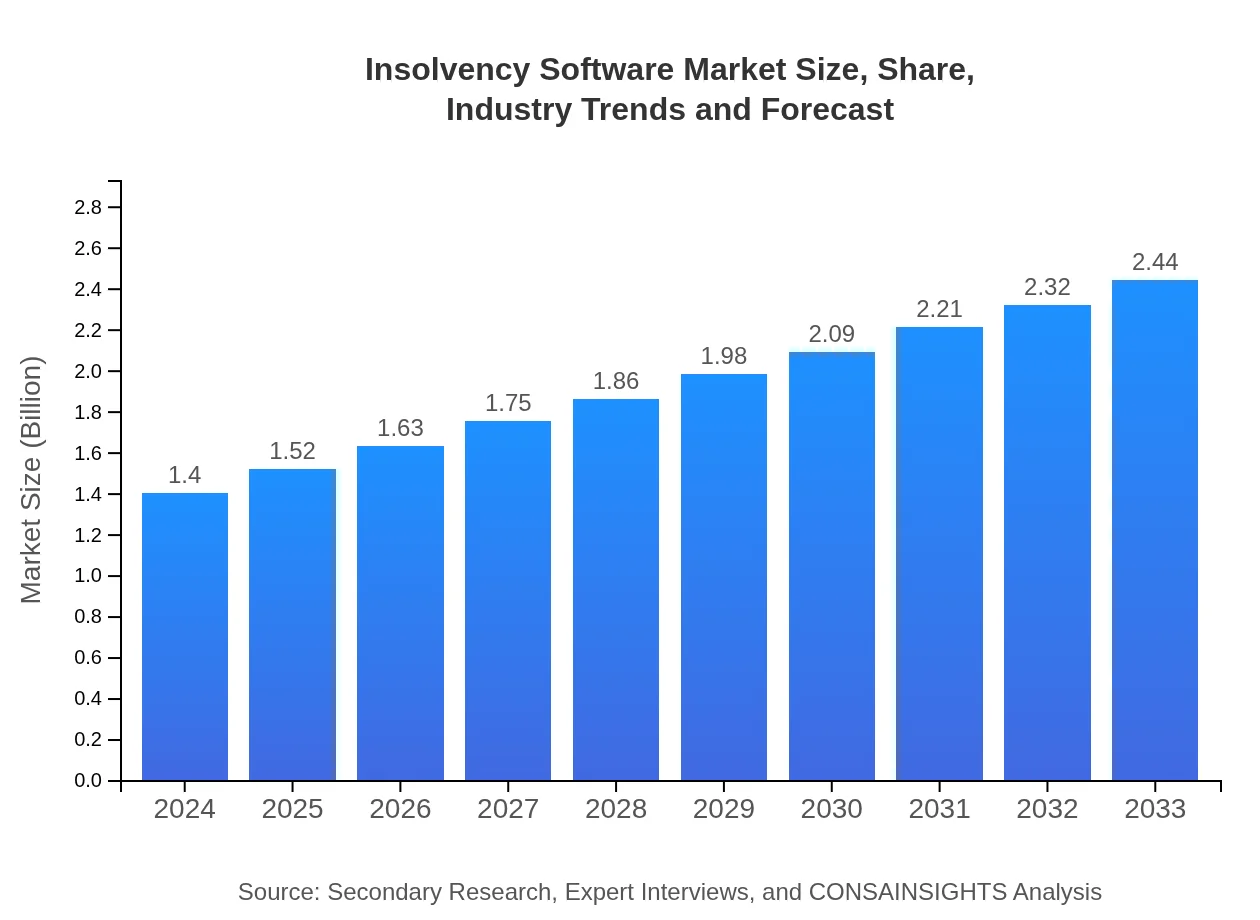

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

| 2024 Market Size | $1.40 Billion |

| CAGR (2024-2033) | 6.2% |

| 2033 Market Size | $2.44 Billion |

| Top Companies | InsolvencyTech Solutions, Restructuring Corp, Digital Insolvency Innovations |

| Last Modified Date | 31 January 2026 |

Insolvency Software Market Overview

Customize Insolvency Software market research report

- ✔ Get in-depth analysis of Insolvency Software market size, growth, and forecasts.

- ✔ Understand Insolvency Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Insolvency Software

What is the Market Size & CAGR of Insolvency Software market in 2024?

Insolvency Software Industry Analysis

Insolvency Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Insolvency Software Market Analysis Report by Region

Europe Insolvency Software:

Europe presents a dynamic and competitive market for insolvency software, driven by stringent regulatory requirements and a robust legal framework. With many countries actively investing in the digital transformation of public and private sector operations, the region has seen a discernible rise in demand for integrated insolvency solutions. Market growth is supported by substantial R&D investments and a strong emphasis on data security and compliance, making European markets highly attractive for technology vendors.Asia Pacific Insolvency Software:

The Asia Pacific region demonstrates robust growth potential in the Insolvency Software market, propelled by rapid digital transformation initiatives and increasing investments in legal technology infrastructure. With emerging economies embracing modern business practices, the rise in insolvency cases has fostered a demand for efficient, technology-driven solutions. The market is expected to benefit from government-led modernization projects and strategic partnerships between local and international firms.North America Insolvency Software:

North America continues to lead the adoption of advanced insolvency software solutions. The region benefits from mature legal frameworks, established technological infrastructure, and significant investments in digital innovation. North American market players are early adopters of cloud-based and AI-powered solutions, which underpin a high demand for customized software solutions that can seamlessly integrate with existing systems. The consistent growth in insolvency cases, paired with a proactive approach in compliance and risk management, further solidifies the region’s dominant market position.South America Insolvency Software:

South America is witnessing gradual market penetration in the realm of insolvency software. Although the current market size remains relatively modest, progressive regulatory reforms and an increasing trend towards business digitization are stimulating growth. The region’s focus on enhancing operational transparency and efficiency in legal proceedings is expected to gradually uplift market demand over the forecast period.Middle East & Africa Insolvency Software:

The Middle East and Africa region is emerging as a promising market segment for insolvence software solutions. Despite a smaller market size compared to other regions, ongoing initiatives to modernize legal and financial sectors are fostering growth. Emphasis on improving regulatory compliance and a gradual shift towards modern IT infrastructures are key drivers. As these regions continue to evolve, they are expected to experience increased market penetration and attract greater investments in digital legal technologies.Tell us your focus area and get a customized research report.

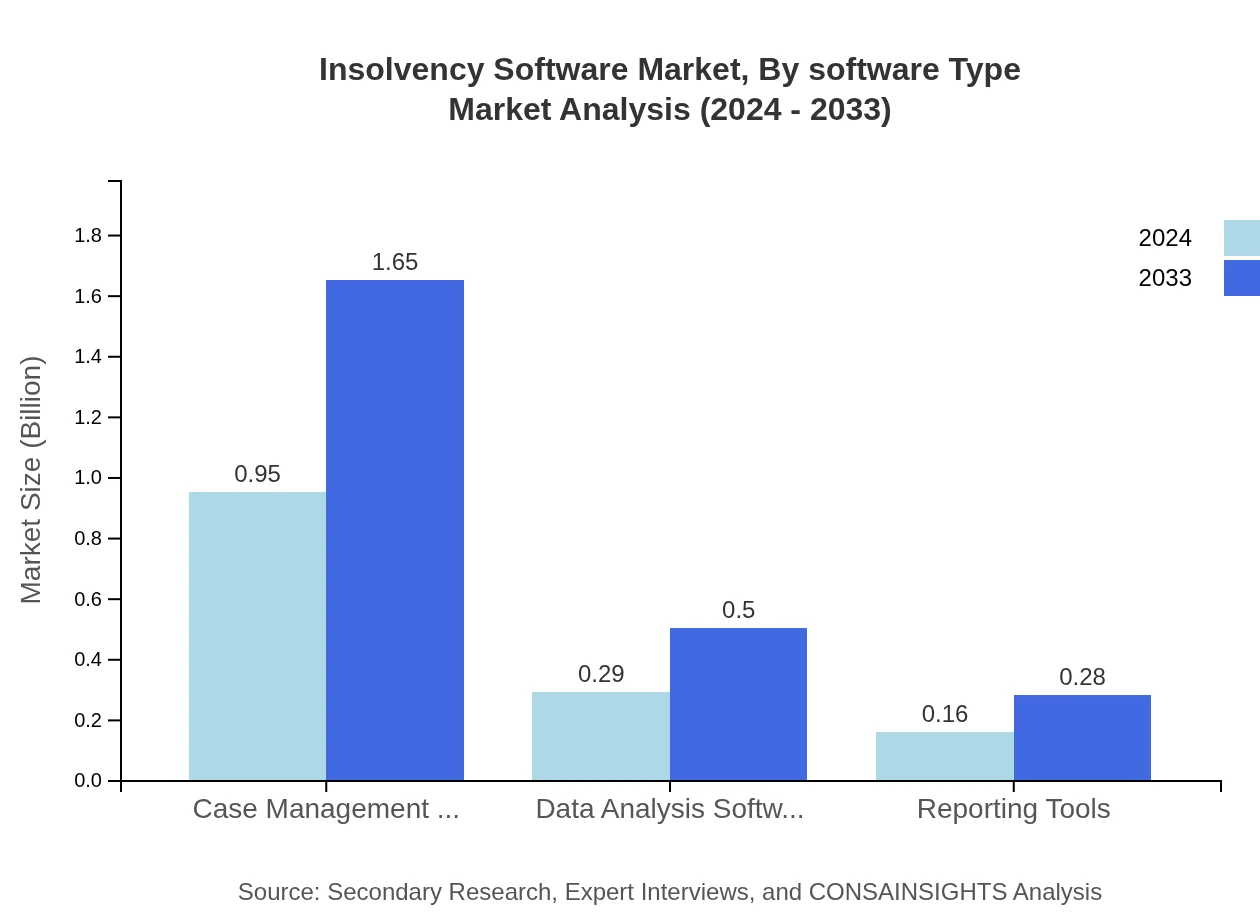

Insolvency Software Market Analysis By Software Type

The software type segment focuses on the diversity of solutions offered within the Insolvency Software market. This includes comprehensive case management systems, integrated reporting tools, and specialized data analysis modules that provide end-to-end functionality. Advancements in technology have led to the development of sophisticated analytics functionalities that enhance predictive capabilities and mitigate risk. Vendors are continuously upgrading core software components, ensuring that systems are not only user-friendly but also highly efficient in managing large volumes of redundant data and complex procedural workflows. The emphasis on customization has played a significant role in meeting the specific needs of various legal practices and financial institutions, thus enhancing overall client satisfaction and driving market growth.

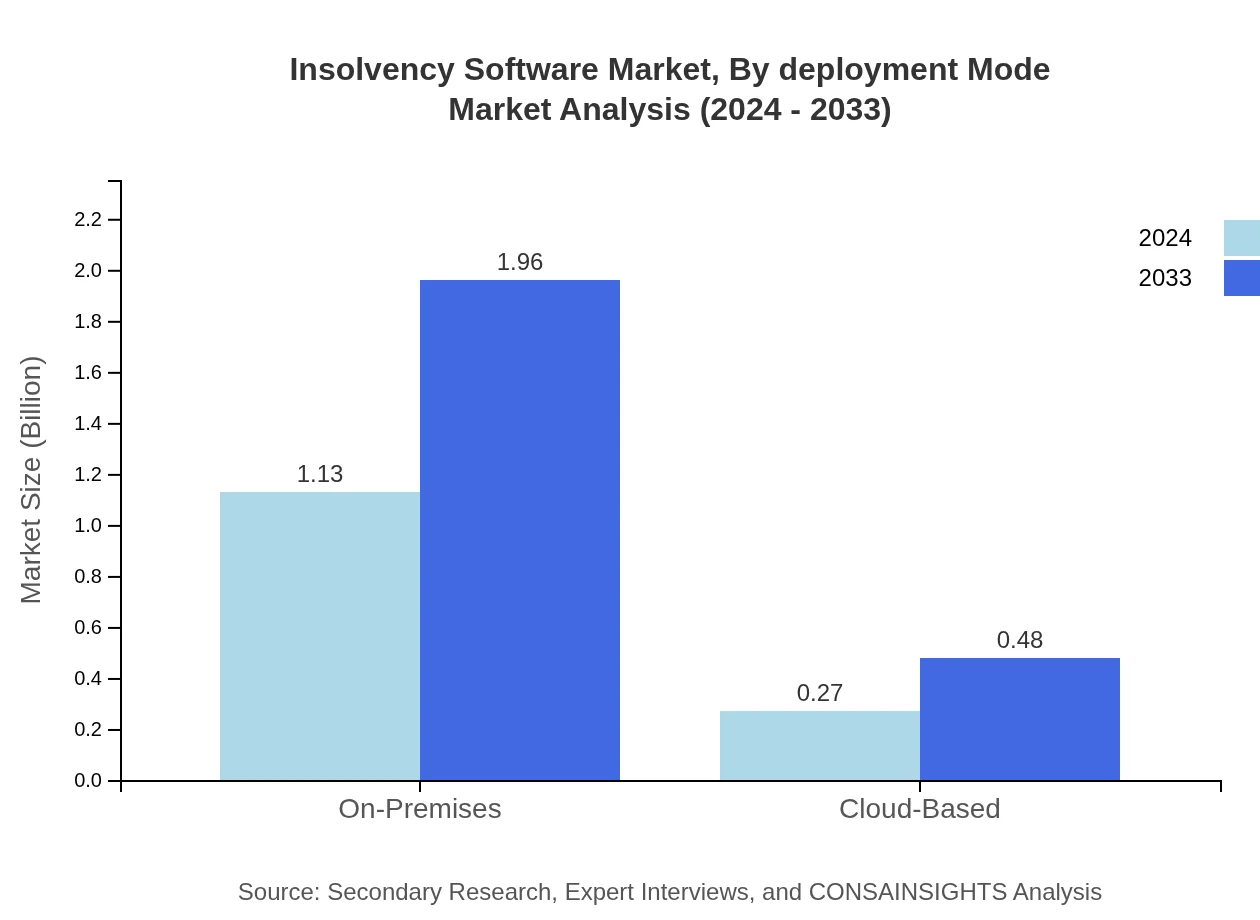

Insolvency Software Market Analysis By Deployment Mode

Deployment mode serves as a critical determinant in the adoption of insolvency software. Two primary deployment models dominate the market: on-premises and cloud-based. On-premises solutions are favored by organizations that require higher levels of control and security over their data, often due to stringent regulatory compliance needs. In contrast, cloud-based models offer scalability, reduced upfront costs, and flexible management, making them especially attractive to mid-sized and small firms with limited IT infrastructure. The ongoing trend is a gradual shift towards hybrid models that leverage the security strengths of on-premises systems combined with the flexibility of cloud solutions. This multifaceted deployment approach ensures that companies can find a tailored solution that precisely meets their operational requirements.

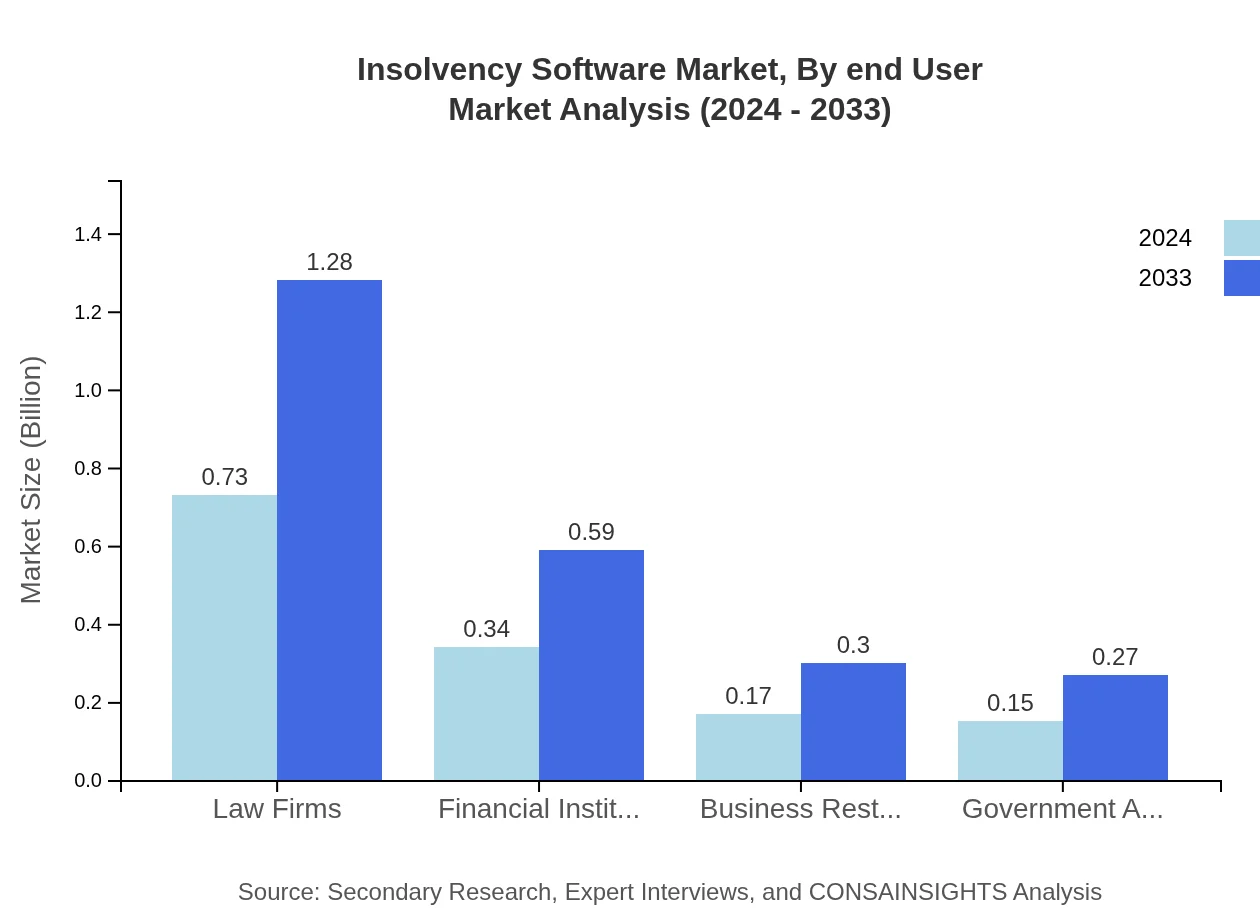

Insolvency Software Market Analysis By End User

The end-user segmentation of the insolvency software market is comprehensive and includes law firms, financial institutions, business restructuring firms, and government agencies. Each category has distinct requirements driven by the scale and complexity of operations. Law firms and restructuring specialists often require highly specialized tools that support case management, document automation, and compliance tracking. Financial institutions typically prioritize software that seamlessly integrates with existing systems to manage risk and ensure regulatory adherence. Meanwhile, government agencies require robust, secure, and user-friendly systems to administer large-scale insolvency proceedings accurately. The tailored solutions provided across these end-user segments are integral to the market’s overall growth, as vendors continually seek to innovate in order to offer more focused and efficient service solutions.

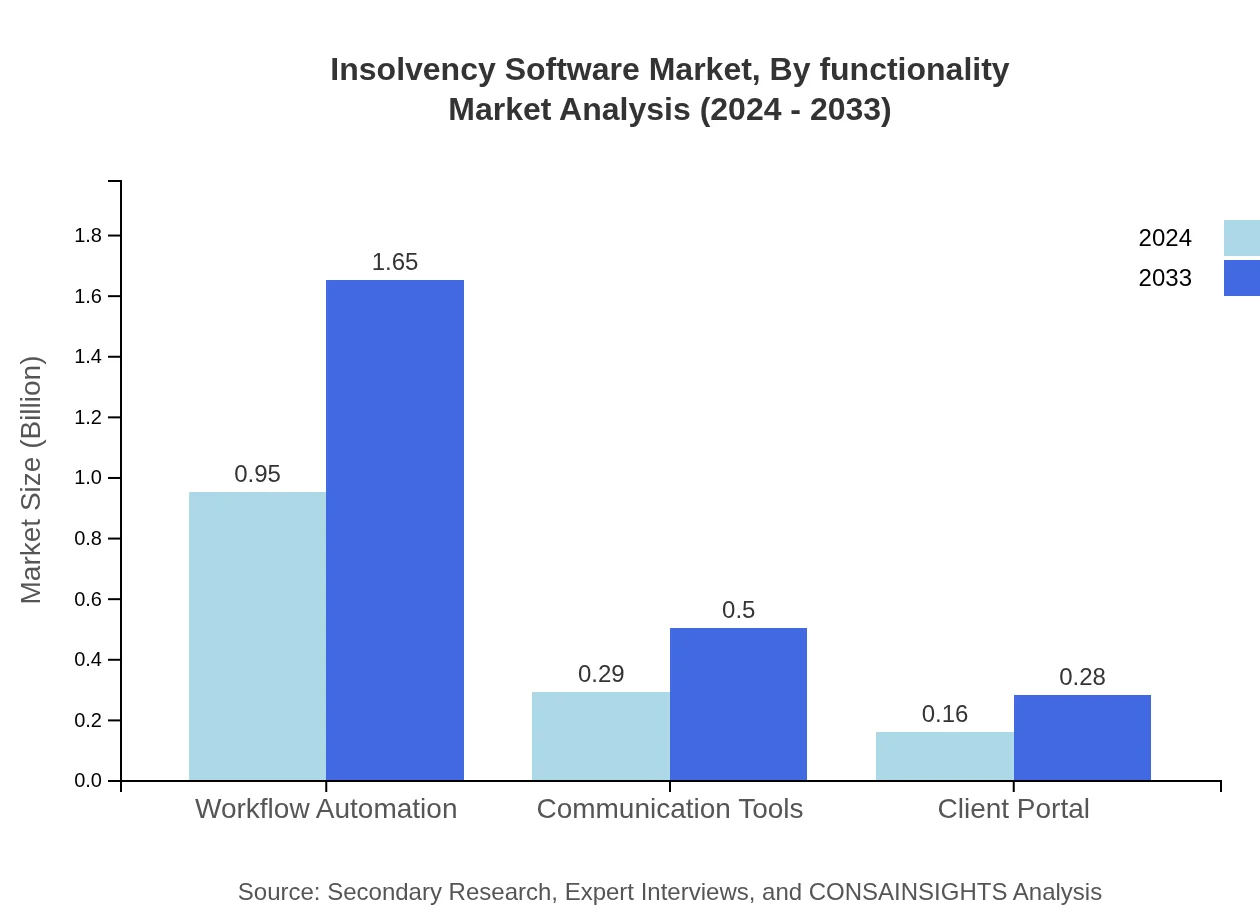

Insolvency Software Market Analysis By Functionality

Functionality within insolvency software encompasses a broad range of essential features that drive operational excellence. Key functional modules include workflow automation, communication tools, client portals, case management systems, data analysis software, and reporting tools. Workflow automation is central to streamlining complex procedures, reducing errors, and increasing efficiency. Communication tools and client portals enhance connectivity between stakeholders, ensuring timely updates and improved collaboration. Advanced case management systems support the intricate nature of insolvency processes, while data analysis and reporting tools enable precise tracking of outcomes and performance metrics. Together, these functionalities not only improve the productivity and reliability of insolvency processes but also contribute significantly to reducing overall operational costs and risk.

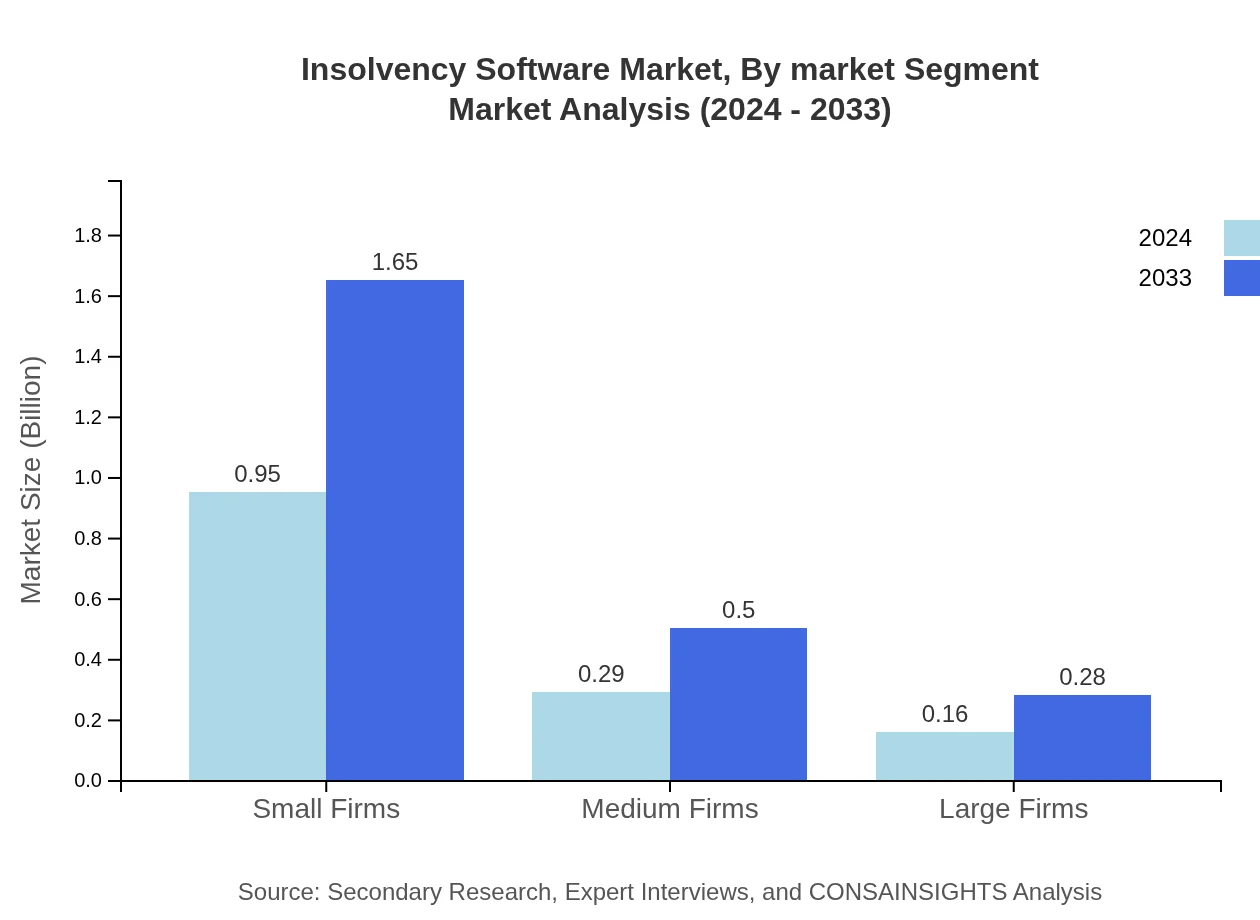

Insolvency Software Market Analysis By Market Segment

The market segmentation by organizational size reflects how different entities adapt insolvency software to meet their specific needs. Generally, the market is categorized into small, medium, and large firms. Small firms, which constitute the largest share, appreciate the user-friendly design and cost-effectiveness of modern insolvency software, enabling them to manage cases without incurring significant IT investments. Medium-sized enterprises seek robust solutions that balance affordability with enhanced functionalities, while large firms require comprehensive systems that offer advanced customization, heightened security, and scalable architecture to handle complex and voluminous legal proceedings. Each segment’s requirements drive product innovations and tailored service offerings, ensuring that vendors continue to meet the evolving needs of diverse market players.

Insolvency Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Insolvency Software Industry

InsolvencyTech Solutions:

InsolvencyTech Solutions is a leader in providing cutting-edge technological solutions tailored for insolvency and bankruptcy proceedings. Their comprehensive suite of products integrates advanced analytics, workflow automation, and secure cloud capabilities.Restructuring Corp:

Restructuring Corp has earned a reputation for delivering robust software solutions designed to manage complex insolvency cases. The company emphasizes regulatory compliance, seamless integration, and continuous innovation in its software offerings.Digital Insolvency Innovations:

Digital Insolvency Innovations focuses on empowering legal and financial institutions with state-of-the-art software that drives efficiency and transparency. Their commitment to research and development has positioned them as pioneers in integrating artificial intelligence with insolvency management systems.We're grateful to work with incredible clients.

FAQs

How can the report help align our marketing strategy with customer adoption trends?

The report provides insights into customer adoption trends, which can inform targeted marketing strategies. With the insolvency software market projected to reach $1.4 billion by 2033, optimizing strategies to align with these trends enhances customer acquisition and retention efforts.

What product features are in highest demand according to the report trends?

Emerging trends highlight features like Workflow Automation and Case Management Software in high demand, projected to comprise 67.78% of the market. This signals businesses to prioritize these innovations in their product development for effective alignment with customer needs.

Which regions offer the best market entry and expansion opportunities in the insolvency software industry?

The North American market is at $0.47 billion in 2024, growing to $0.81 billion by 2033. Europe follows with a forecast from $0.40 billion to $0.70 billion, indicating prime opportunities for market entry and expansion across these regions.

What emerging technologies and innovations are shaping the insolvency software market?

Innovations like cloud-based solutions and advanced data analysis tools are on the rise, facilitating operational efficiencies. The shift towards these technologies is projected to grow the market significantly, indicating a trend towards modernization in insolvency processes.

Does the report include competitive landscape and market share analysis?

Yes, the report outlines a comprehensive competitive landscape and analyzes market shares among key segments such as Law Firms (52.3%) and Financial Institutions (24.33%). This information aids companies in strategizing against competitors effectively.

How can executives use the report to evaluate investment risks and ROI?

Executives can leverage reported market growth, such as a CAGR of 6.2%, to assess potential ROI on investments. Understanding market dynamics helps in identifying risks and aligning investments with high-growth segments of the insolvency software industry.

What is the market size of insolvency Software?

The insolvency software market is valued at $1.4 billion as of 2024, with a forecasted CAGR of 6.2%. This growth trend reflects increasing demand for software solutions to streamline insolvency processes across various sectors.

What segment data is available for the insolvency Software market?

Segment data reveals that Law Firms are expected to dominate at $0.73 billion in 2024, while Financial Institutions will reach $0.34 billion. This indicates key focus areas for software development and marketing strategies in the coming years.