Insurance Platform

Published Date: 31 January 2026 | Report Code: insurance-platform

Insurance Platform Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report examines the Insurance Platform market, providing detailed insights into market trends, technological innovations, segmentation, and global performance across regions. Covering the forecast period from 2024 through 2033, the report offers a thorough analysis of market size, CAGR, industry developments, and competitive dynamics, aiming to equip stakeholders with actionable data for strategic decision-making.

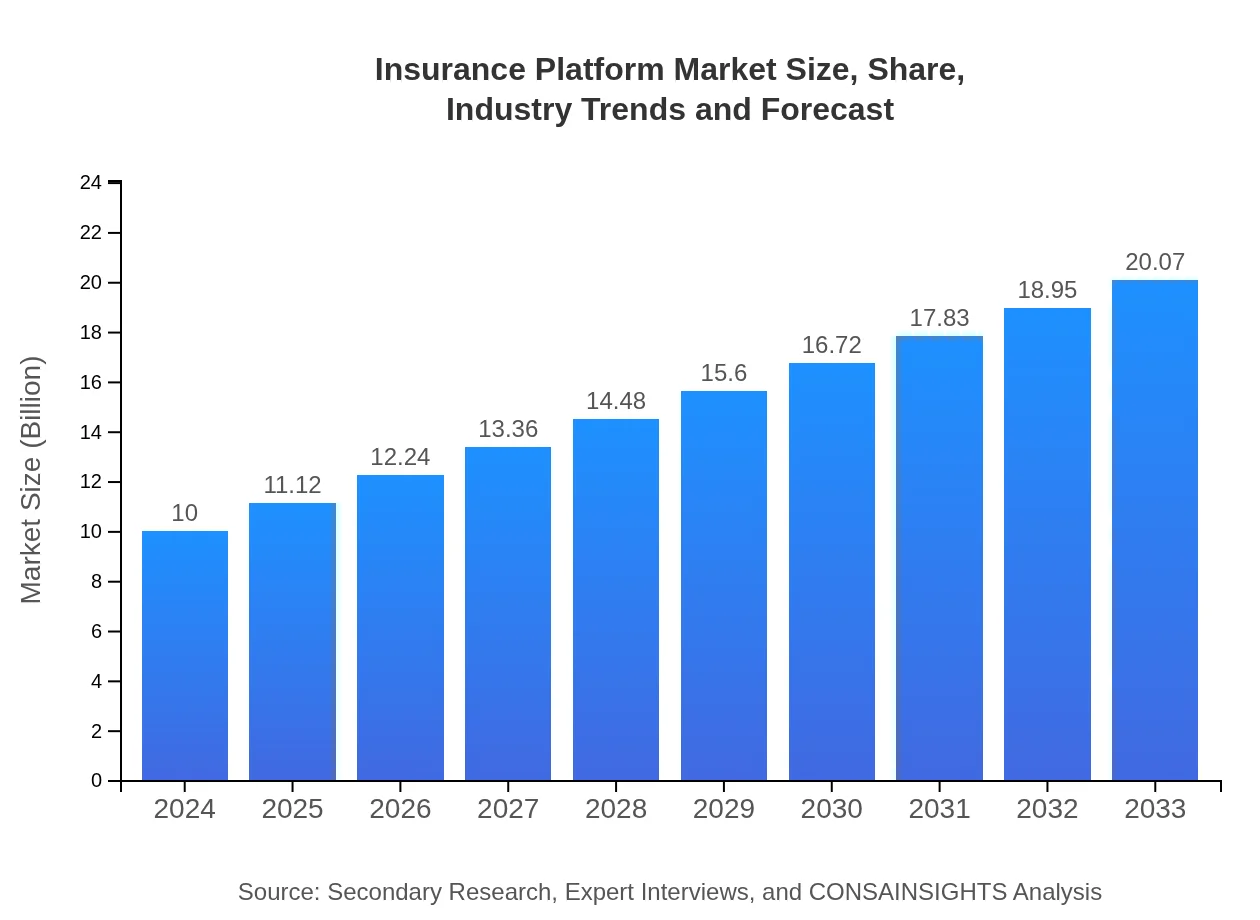

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

| 2024 Market Size | $10.00 Billion |

| CAGR (2024-2033) | 7.8% |

| 2033 Market Size | $20.07 Billion |

| Top Companies | InsureTech Global, Secure Insurance Solutions |

| Last Modified Date | 31 January 2026 |

Insurance Platform Market Overview

Customize Insurance Platform market research report

- ✔ Get in-depth analysis of Insurance Platform market size, growth, and forecasts.

- ✔ Understand Insurance Platform's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Insurance Platform

What is the Market Size & CAGR of Insurance Platform market in 2024?

Insurance Platform Industry Analysis

Insurance Platform Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Insurance Platform Market Analysis Report by Region

Europe Insurance Platform:

Europe shows robust potential as the market expands from 2.95 in 2024 to 5.92 in 2033. Steady regulatory evolution, high internet penetration, and a competitive insurance landscape are fostering innovation in product offerings and digital service models. The region is steadily transitioning to more agile, technology-driven platforms.Asia Pacific Insurance Platform:

In the Asia Pacific region, the market is projected to grow from a size of 1.88 in 2024 to 3.77 in 2033. Rapid digital adoption, supportive government policies, and increasing consumer awareness are key drivers behind this growth. Regional players are investing in technology to improve efficiency and meet rising expectations for digital service.North America Insurance Platform:

North America remains a mature yet rapidly evolving market, growing from 3.71 in 2024 to 7.44 in 2033. The region benefits from advanced technological infrastructure, a strong regulatory framework, and established consumer trust, which together drive the adoption of integrated insurance platforms and digital risk management solutions.South America Insurance Platform:

South America’s insurance market is also undergoing transformation, with market figures expected to increase from 0.63 in 2024 to 1.27 by 2033. The region is witnessing increased investments in modern IT infrastructure and a digital shift among traditional insurers, fostering a competitive landscape with innovation at its core.Middle East & Africa Insurance Platform:

The Middle East and Africa region is poised for moderate growth, with market size expected to rise from 0.83 in 2024 to 1.67 in 2033. Although smaller in scale, this market is characterized by emerging digital initiatives, increasing smartphone penetration, and evolving consumer behavior which invite new market entrants and advanced insurance solutions.Tell us your focus area and get a customized research report.

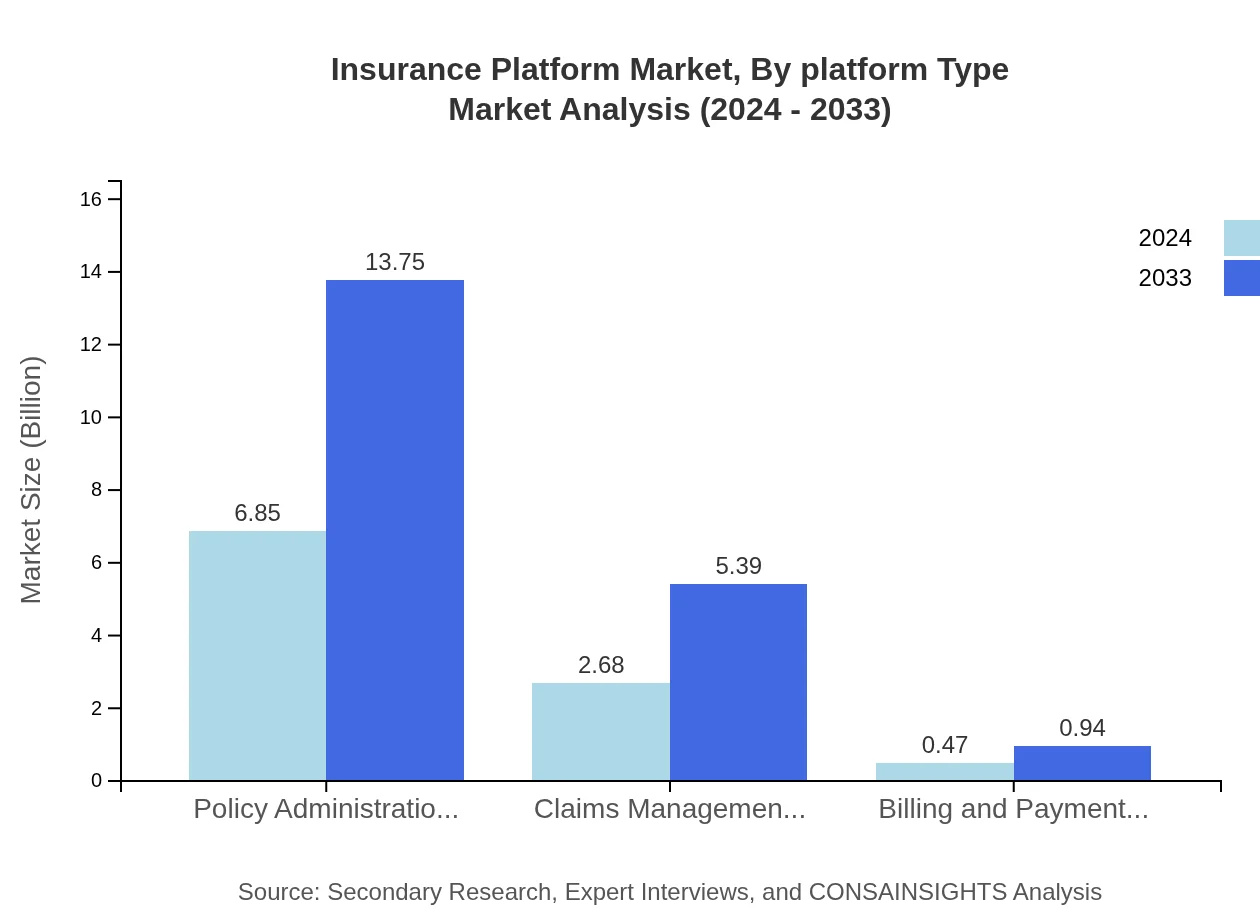

Insurance Platform Market Analysis By Platform Type

Analyzing the market by platform type reveals a complex ecosystem where traditional insurance carriers coexist with innovative brokerage firms and third-party administrators. Each segment demonstrates distinct performance metrics with insurance carriers dominating due to their extensive network and operational scale. The market analysis highlights that despite differing sizes, each segment maintains steady market shares. Technological integrations play a pivotal role, as platforms increasingly incorporate artificial intelligence and blockchain solutions to enhance their service options. This analysis provides critical insights into how platform-specific strategies are evolving to meet digital demands.

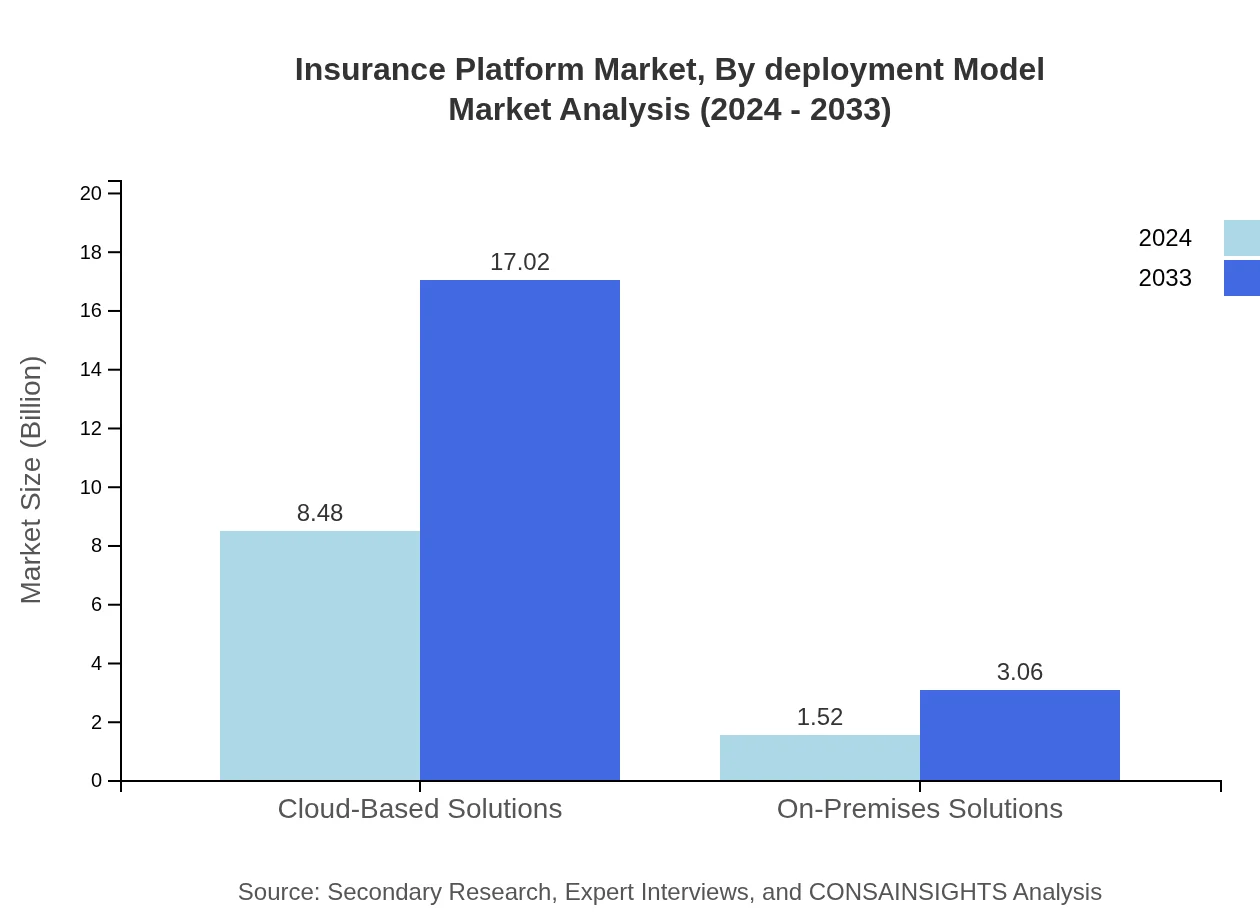

Insurance Platform Market Analysis By Deployment Model

Deployment models in the Insurance Platform sector include cloud-based and on-premises solutions, each offering unique benefits. Cloud-based solutions are rapidly gaining traction due to their scalability, cost-efficiency, and ease of integration with emerging digital tools. On-premises solutions, on the other hand, continue to serve organizations with stringent data control requirements. The comparative analysis underlines that while cloud solutions command a higher share, both models play crucial roles in serving varied client needs. Progressive improvements in cybersecurity and data management are further bridging any gaps between the two deployment strategies.

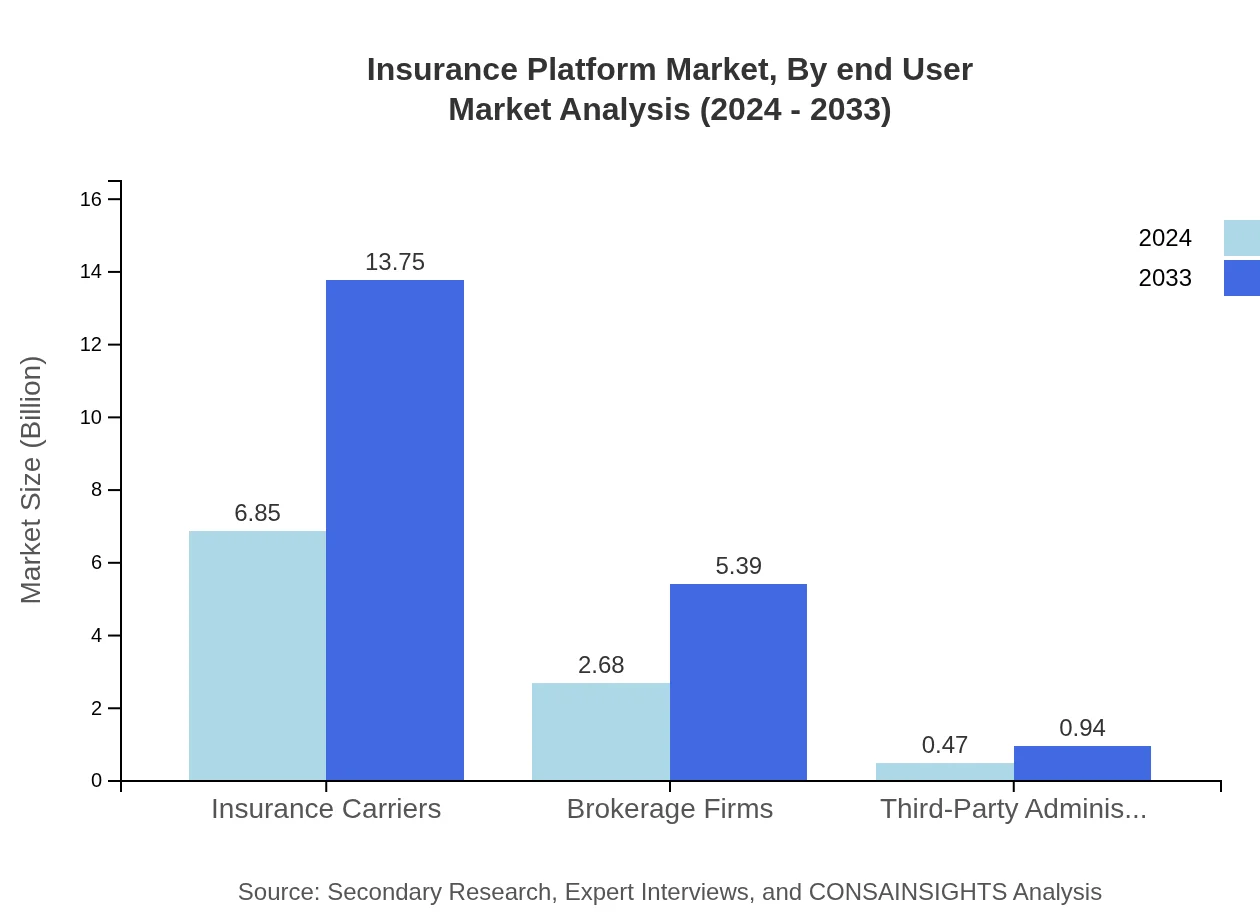

Insurance Platform Market Analysis By End User

End-user analysis of the Insurance Platform market segments the industry into corporate, individual, and specialized industry players. Corporations rely on robust platforms for comprehensive risk management and policy administration, whereas individuals expect streamlined, user-friendly digital experiences. Specialized users, including small and medium enterprises, demand tailored solutions to address niche insurance requirements. This segmentation underscores the need for adaptive, scalable platforms that can cater to diverse user preferences. Customer-centric innovations, improved support systems, and targeted marketing strategies are vital for capturing and retaining market share across these varied end-user groups.

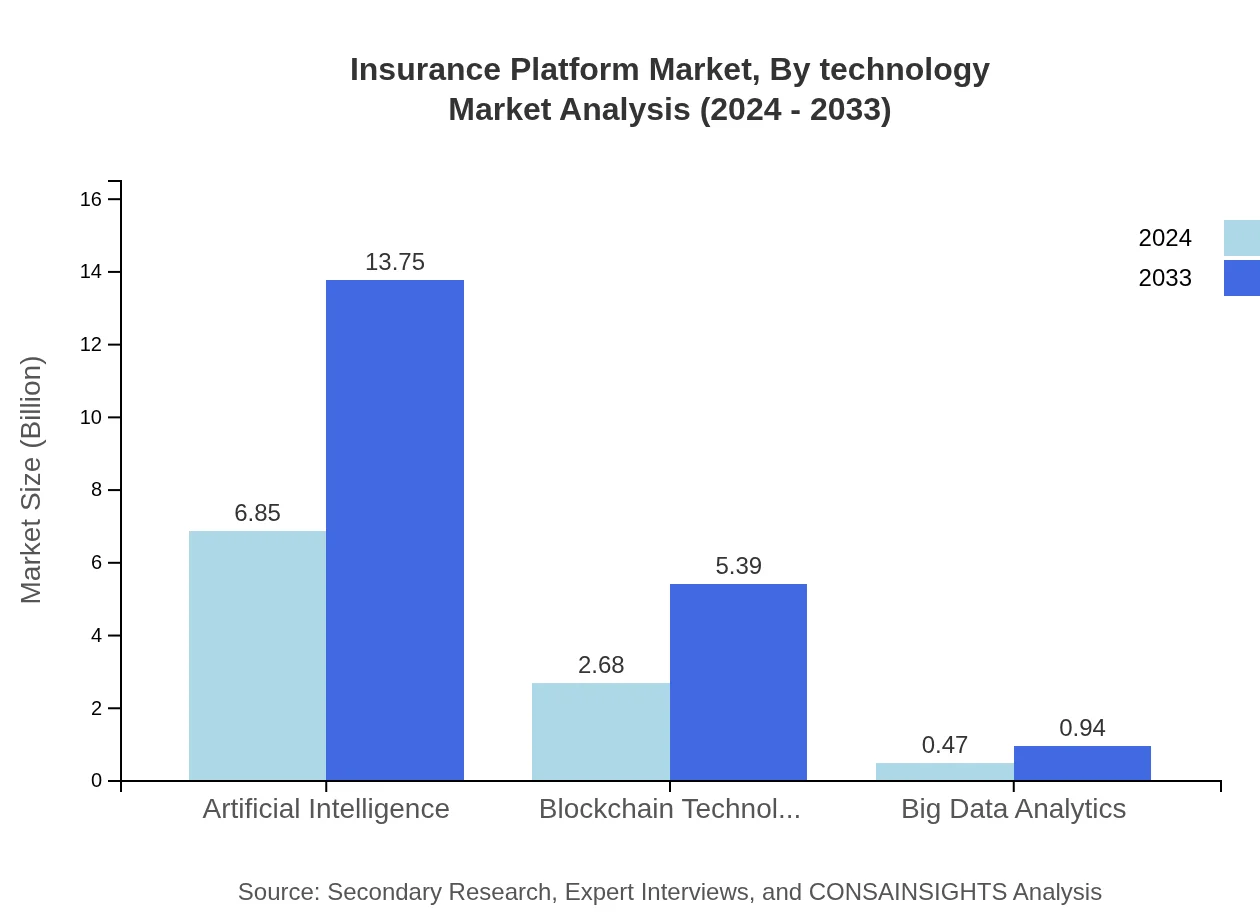

Insurance Platform Market Analysis By Technology

A detailed review of technology integration within the Insurance Platform market reveals significant contributions from artificial intelligence, blockchain, and big data analytics. These technologies are revolutionizing risk assessment, claims processing, and customer engagement by enabling real-time data processing and predictive analytics. Additionally, policy administration systems and claims management modules are benefitting from continuous technological enhancements. The adoption of these advanced technologies not only streamlines operations but also provides a competitive edge in an increasingly digital marketplace. This segment analysis emphasizes that future growth will be closely linked to technological innovation and the effective implementation of these digital tools.

Insurance Platform Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Insurance Platform Industry

InsureTech Global:

InsureTech Global stands at the forefront of digital insurance innovation, delivering cutting-edge solutions that streamline policy administration and claims management. The company consistently invests in R&D to integrate advanced technologies, driving efficiency and customer satisfaction across global markets.Secure Insurance Solutions:

Secure Insurance Solutions has established itself as a key leader by offering robust, scalable platforms that address modern insurance challenges. Their focus on leveraging cloud technology and intelligent analytics has enhanced risk management and improved overall industry standards.We're grateful to work with incredible clients.

FAQs

How can the Insurance Platform market report help align our marketing strategy with customer adoption trends?

The Insurance Platform market report, valued at $10 billion and growing at a CAGR of 7.8%, provides insights into customer preferences, helping marketers tailor strategic initiatives that resonate with consumers and drive adoption.

What product features are in highest demand according to the Insurance Platform market trends?

High-demand features include Cloud-Based Solutions, projected to grow from $8.48 billion in 2024 to $17.02 billion by 2033, reflecting a strong preference for flexibility and scalability among users.

Which regions offer the best market entry and expansion opportunities in the Insurance Platform industry?

North America, with a market size increase from $3.71 billion in 2024 to $7.44 billion by 2033, presents significant expansion opportunities due to its technological adoption and regulatory environment.

What emerging technologies and innovations are shaping the Insurance Platform market?

Key technologies include Artificial Intelligence and Blockchain. AI is expected to grow from $6.85 billion in 2024 to $13.75 billion by 2033, driving efficiency and enhancing customer experiences.

Does the Insurance Platform market report include competitive landscape and market share analysis?

Yes, the report includes a comprehensive competitive landscape analysis, detailing market shares with Insurance Carriers holding 68.49% in 2024, providing vital strategic insights for stakeholders.

How can executives use the Insurance Platform market report to evaluate investment risks and ROI?

Executives can leverage the market projections and competitive insights, including the 7.8% CAGR, to assess investment risks and potential ROI, ensuring informed decision-making for sustainable growth.

What is the market size of the Insurance Platform?

The Insurance Platform market is currently valued at $10 billion, with a projected CAGR of 7.8%, indicating robust growth opportunities for stakeholders over the coming years.

What are the segment data in the Insurance Platform market?

Insurance Carriers dominate with a share of 68.49% in 2024, while Cloud-Based Solutions lead size growth, demonstrating evolving trends in product necessity and market dynamics.