Nato Ammunition Market Report

Published Date: 03 February 2026 | Report Code: nato-ammunition

Nato Ammunition Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the NATO ammunition market from 2023 to 2033, covering market size, industry dynamics, regional insights, technological advancements, and competitive landscape to deliver actionable insights for stakeholders.

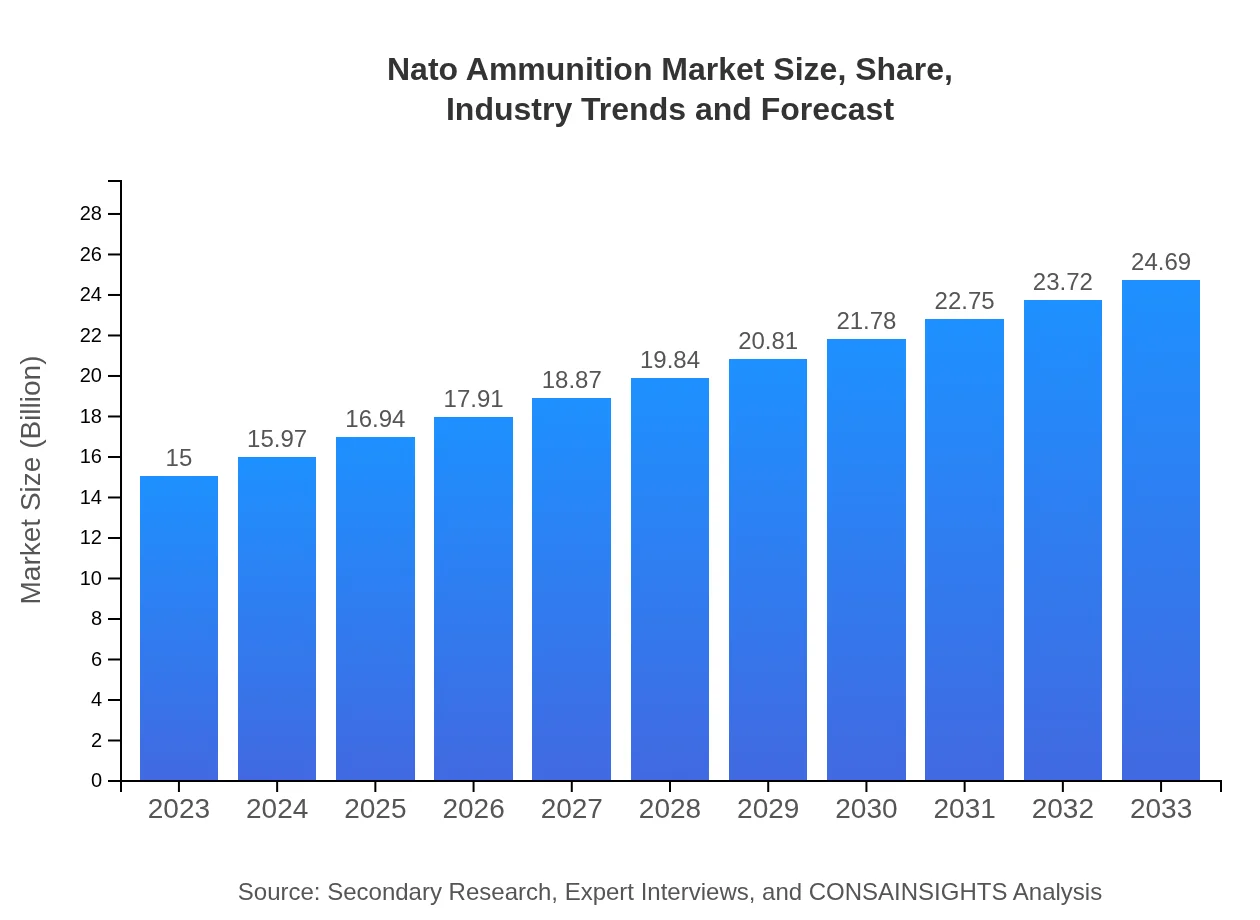

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $24.69 Billion |

| Top Companies | General Dynamics Ordnance and Tactical Systems, Northrop Grumman, BAE Systems, Thales Group, Rheinmetall AG |

| Last Modified Date | 03 February 2026 |

NATO Ammunition Market Overview

Customize Nato Ammunition Market Report market research report

- ✔ Get in-depth analysis of Nato Ammunition market size, growth, and forecasts.

- ✔ Understand Nato Ammunition's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Nato Ammunition

What is the Market Size & CAGR of NATO Ammunition market in 2023?

NATO Ammunition Industry Analysis

NATO Ammunition Market Segmentation and Scope

Tell us your focus area and get a customized research report.

NATO Ammunition Market Analysis Report by Region

Europe Nato Ammunition Market Report:

Europe's NATO ammunition market is significant, valued at $3.62 billion in 2023 and expected to reach $5.96 billion by 2033. The need for enhanced defense capabilities in response to geopolitical tensions in Eastern Europe drives member states to upgrade their ammunition reserves and collaborate on joint procurement initiatives.Asia Pacific Nato Ammunition Market Report:

In 2023, the Asia Pacific NATO ammunition market is valued at $3.04 billion, with projections for 2033 reaching $5.00 billion. Countries such as India, Japan, and South Korea are ramping up their military capabilities, leading to increased demand for NATO-style ammunition. Additionally, collaborations with NATO forces foster interoperability and enhance defense strategies in the region.North America Nato Ammunition Market Report:

North America, particularly the United States, dominates the NATO ammunition market, starting at $5.52 billion in 2023 and projected to expand to $9.09 billion by 2033. The robust defense budget, ongoing military modernization programs, and global operations are key factors contributing to this significant growth.South America Nato Ammunition Market Report:

The South American NATO ammunition market is estimated at $1.43 billion in 2023 and is expected to grow to $2.35 billion by 2033. Increasing internal security challenges and investments in modernization are driving countries like Brazil and Colombia to enhance their ammunition procurement strategies, focusing on partnerships with NATO.Middle East & Africa Nato Ammunition Market Report:

In 2023, the Middle East and Africa NATO ammunition market stands at $1.39 billion, anticipated to grow to $2.29 billion by 2033. Countries in this region are increasingly focusing on military readiness, particularly amid regional conflicts, fostering demand for NATO-compliant ammunition and military supplies.Tell us your focus area and get a customized research report.

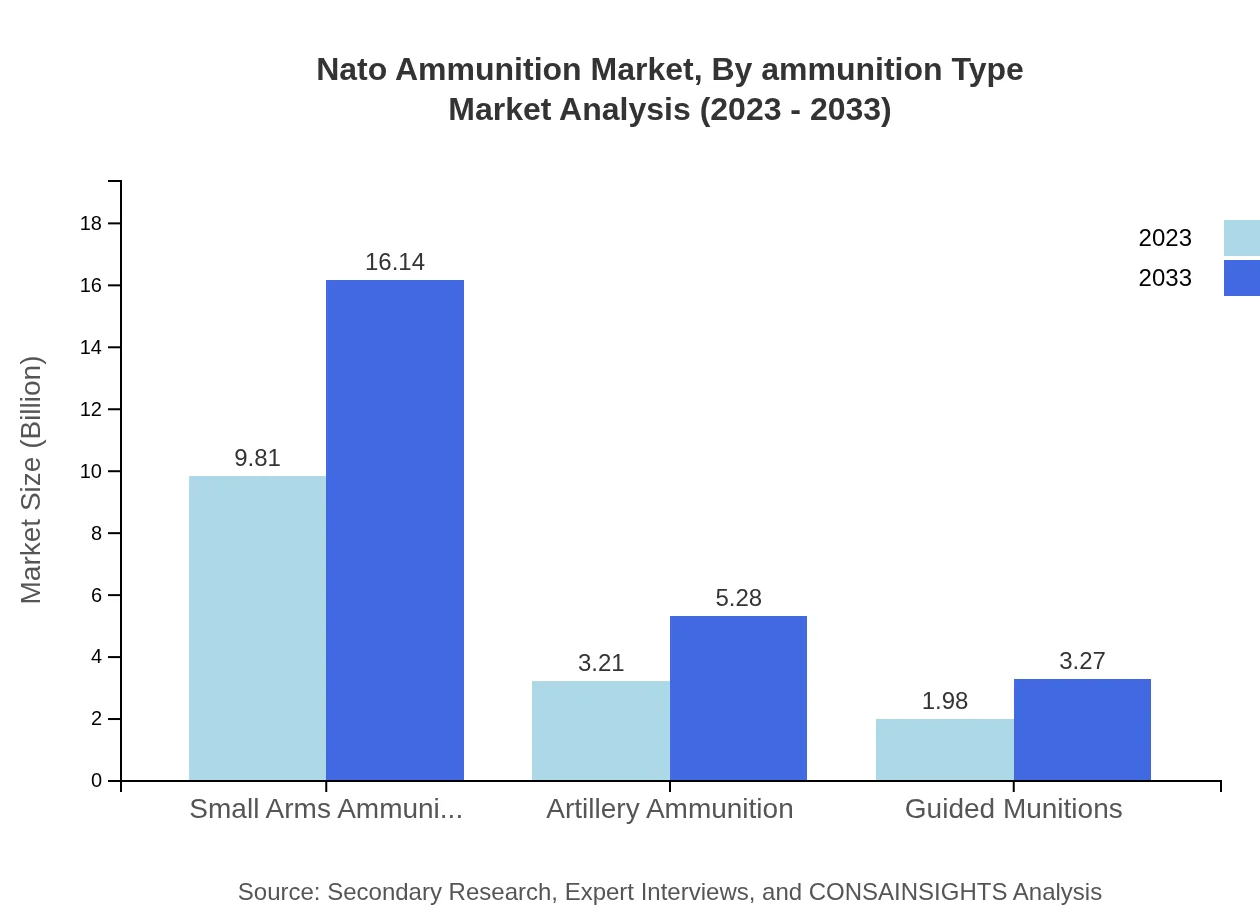

Nato Ammunition Market Analysis By Ammunition Type

The NATO ammunition market segmented by ammunition type includes categories such as Small Arms Ammunition, Artillery Ammunition, and Guided Munitions. In 2023, Small Arms Ammunition accounts for the largest segment at $9.81 billion, accounting for 65.4% market share, while Guided Munitions and Artillery Ammunition are projected to grow significantly due to evolving military strategies.

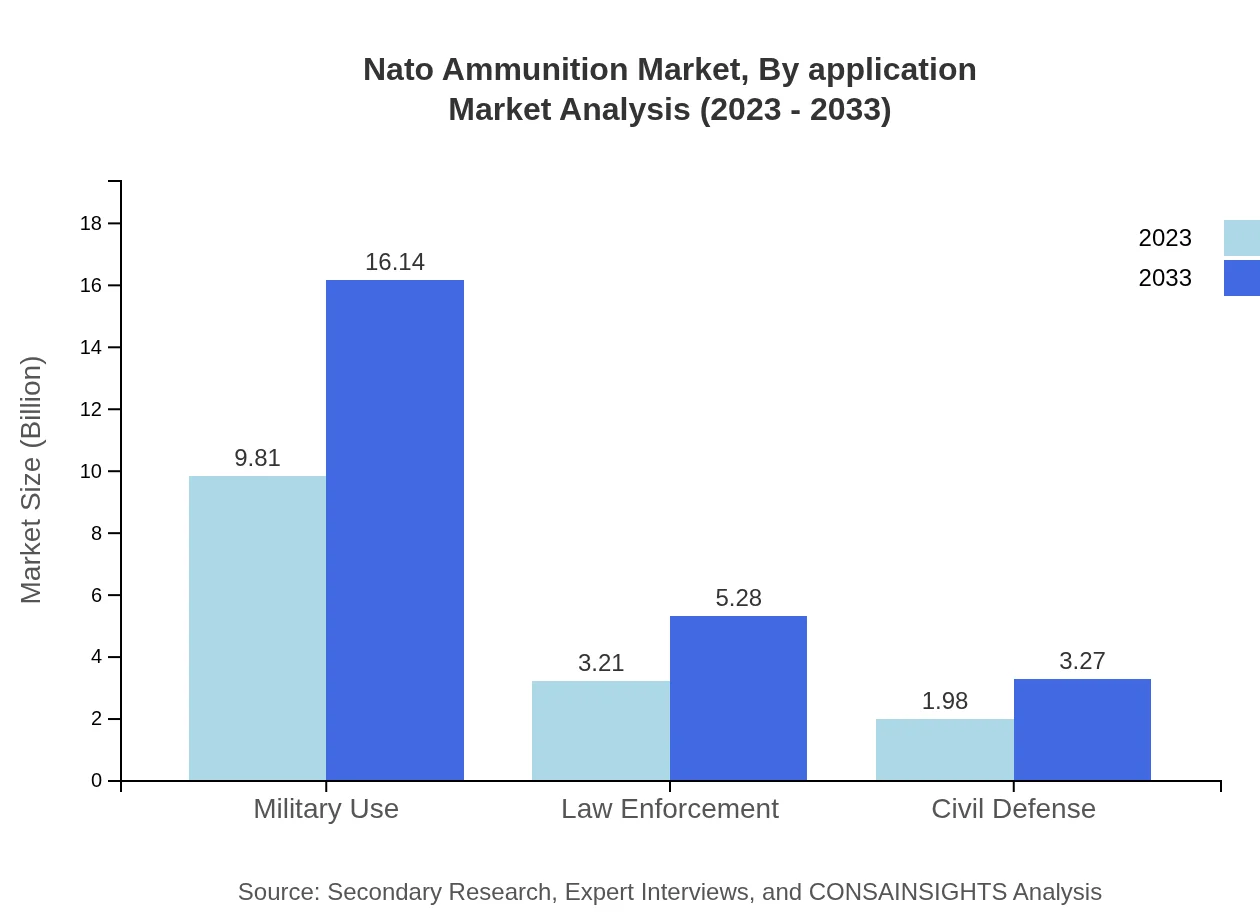

Nato Ammunition Market Analysis By Application

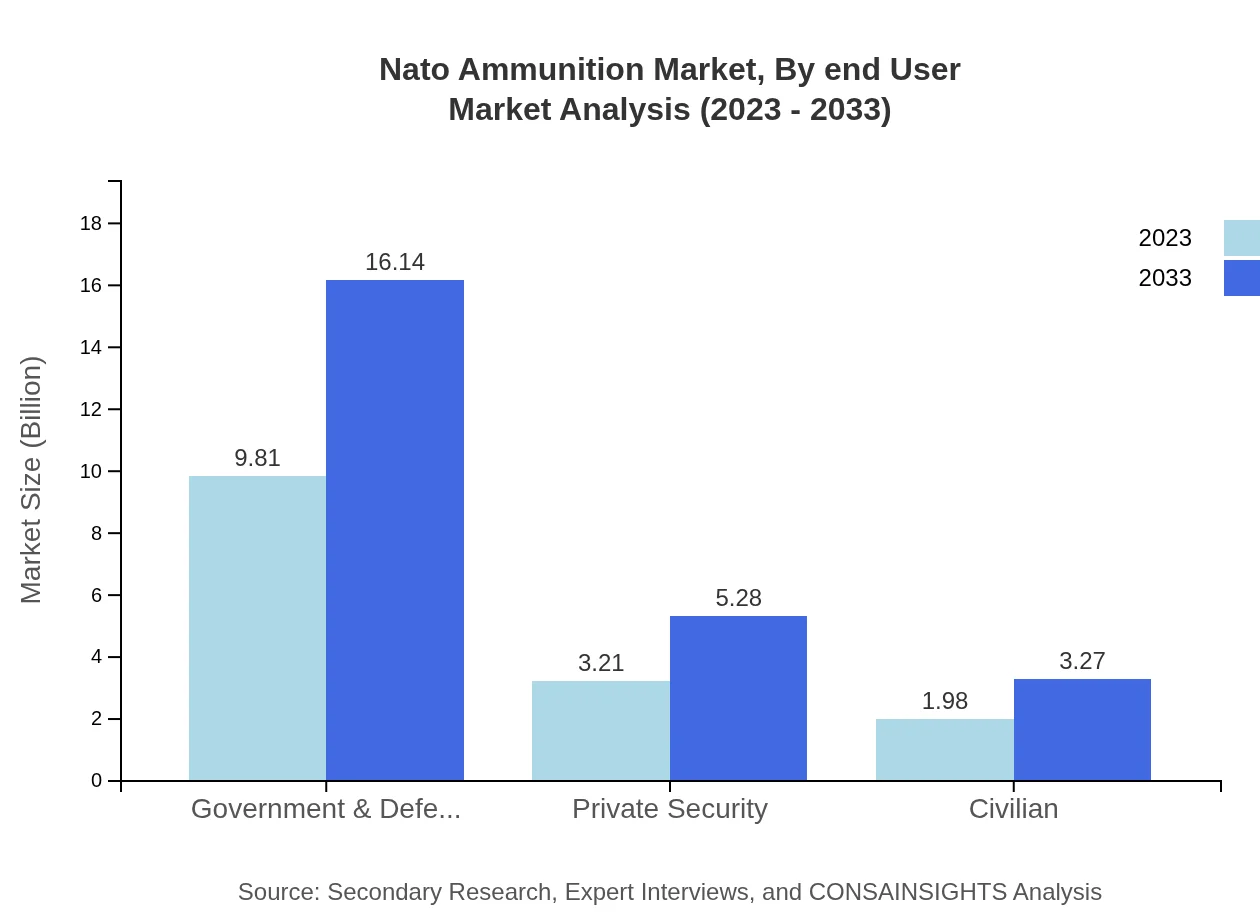

The market is segmented into Government & Defense, Private Security, and Civilian uses. Government & Defense holds a major share, valued at $9.81 billion in 2023 and maintaining a 65.4% market share. The Private Security sector is also growing, with an expected market size of $3.21 billion in 2023, up to $5.28 billion by 2033.

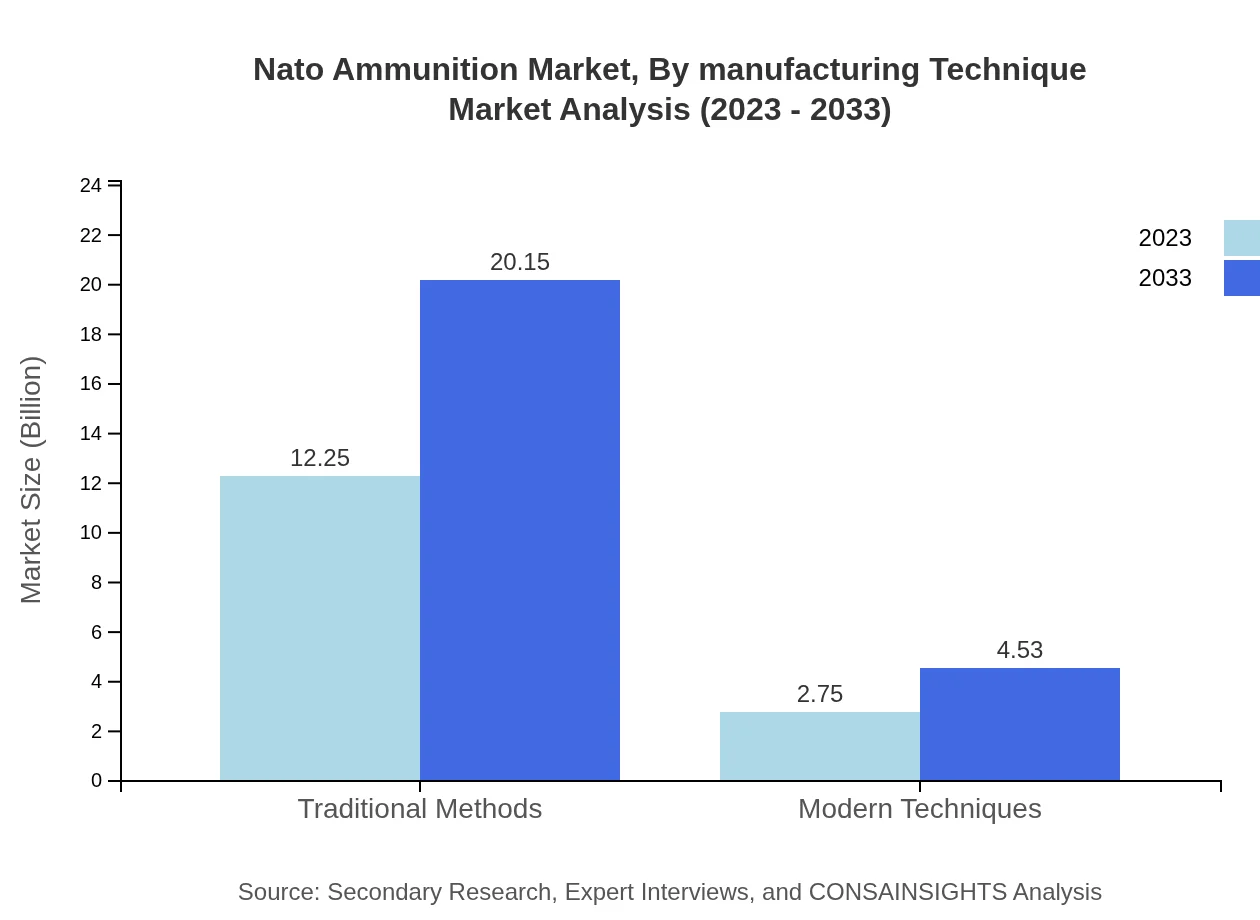

Nato Ammunition Market Analysis By Manufacturing Technique

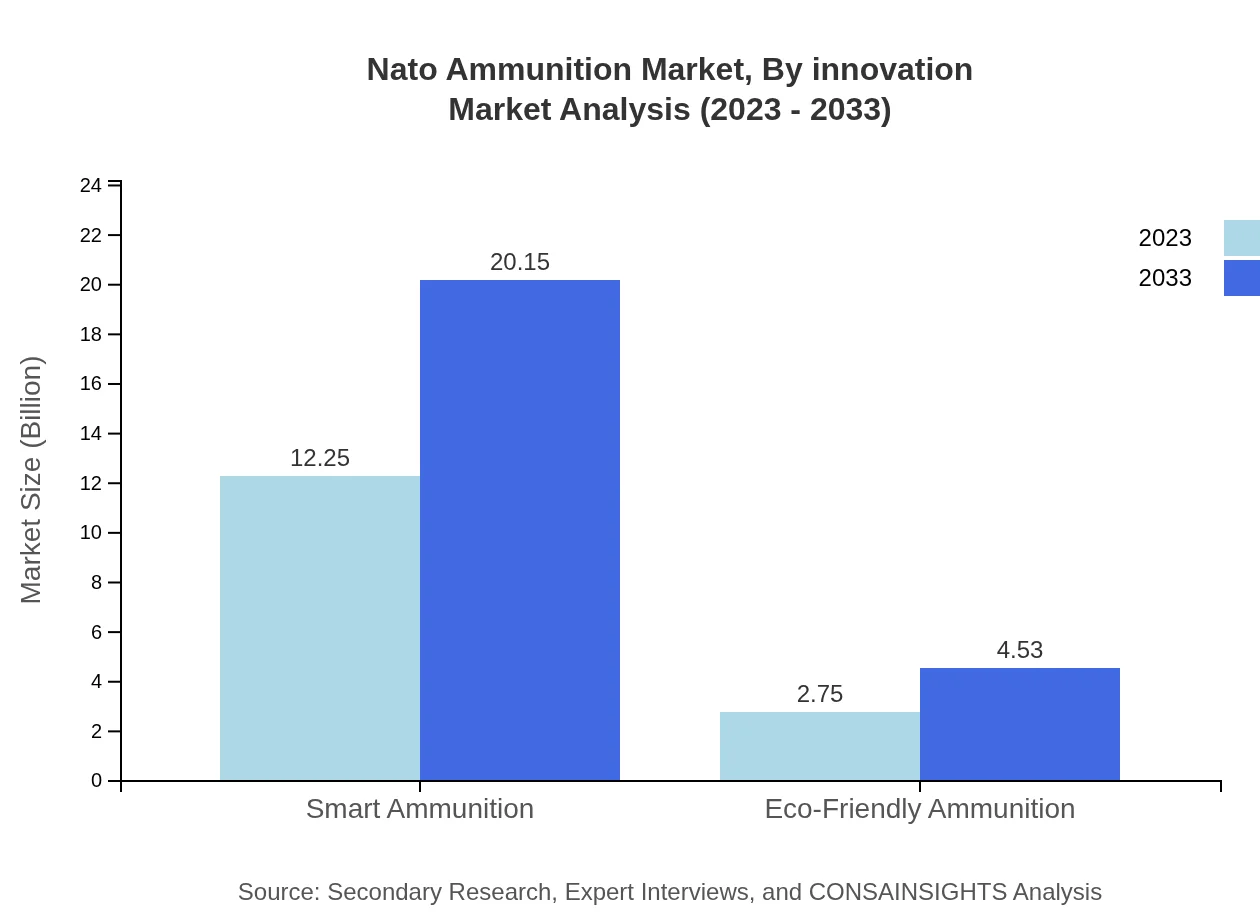

The market reflects innovations such as Smart Ammunition and Eco-Friendly Ammunition. Smart Ammunition constitutes a significant portion, valued at around $12.25 billion in 2023 (81.64% of market share), indicating a shift towards advanced, technology-driven weaponry. Similarly, Eco-Friendly Ammunition is gaining traction, expected to reach $4.53 billion by 2033.

Nato Ammunition Market Analysis By End User

The end-user segment includes Military Use, Law Enforcement, and Civil Defense applications. Military Use remains dominant, valued at $9.81 billion in 2023, while Law Enforcement and Civil Defense continue to show steady growth reflecting increased investment in security and public safety.

Nato Ammunition Market Analysis By Innovation

Innovations in NATO ammunition focus on traditional and modern manufacturing techniques. Traditional Methods remain prevalent, holding 81.64% of the market share, while Modern Techniques are expected to grow, driven by increasing demand for eco-friendly and advanced munitions.

NATO Ammunition Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in NATO Ammunition Industry

General Dynamics Ordnance and Tactical Systems:

A leading provider of advanced ammunition systems, contributing significantly to NATO forces through R&D and innovation in munitions.Northrop Grumman:

Specialized in precision munitions and defense systems, Northrop Grumman plays a crucial role in enhancing the capabilities of NATO's military operations.BAE Systems:

A global defense, aerospace, and security company that offers a range of ammunition solutions that meet NATO standards.Thales Group:

An international electronics and systems group providing innovative ammunition solutions tailored for NATO forces.Rheinmetall AG:

A key player in the ammunition market, Rheinmetall AG specializes in military technology and ammunition manufacturing for NATO.We're grateful to work with incredible clients.

FAQs

What is the market size of NATO Ammunition?

The NATO-ammunition market is valued at $15 billion in 2023, with an anticipated CAGR of 5% over the next decade, projecting substantial growth in demand and production capabilities by 2033.

What are the key market players or companies in the NATO Ammunition industry?

Key players in the NATO-ammunition industry include major defense contractors and manufacturers specializing in munitions supply, with numerous partnerships and collaborations enhancing their distribution and innovation capabilities globally.

What are the primary factors driving the growth in the NATO Ammunition industry?

Growth in the NATO-ammunition industry is driven by increased military spending, geopolitical tensions, technological advancements in ammunition capabilities, and a consistent focus on defense preparedness among member nations.

Which region is the fastest Growing in the NATO Ammunition market?

North America is the fastest-growing region, projected to grow from $5.52 billion in 2023 to $9.09 billion in 2033, driven by heightened military investments and modernization initiatives.

Does ConsaInsights provide customized market report data for the NATO Ammunition industry?

Yes, ConsaInsights provides customized market report data tailored to specific client needs in the NATO-ammunition industry, ensuring relevance and actionable insights for strategic decision-making.

What deliverables can I expect from this NATO Ammunition market research project?

Deliverables from the NATO-ammunition market research project include comprehensive market analysis, regional growth forecasts, competitive landscape assessments, and detailed data by segments and applications.

What are the market trends of NATO Ammunition?

Current market trends indicate a shift towards eco-friendly ammunition, smart munitions technology, and increased demand from civilian defense sectors, reflecting a broader industry adaptation to environmental and technological advancements.