Residential Real Estate Market Report

Published Date: 22 January 2026 | Report Code: residential-real-estate

Residential Real Estate Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Residential Real Estate market from 2023 to 2033, offering insights into market size, growth trends, segmentation, regional analysis, and the key drivers shaping the industry landscape.

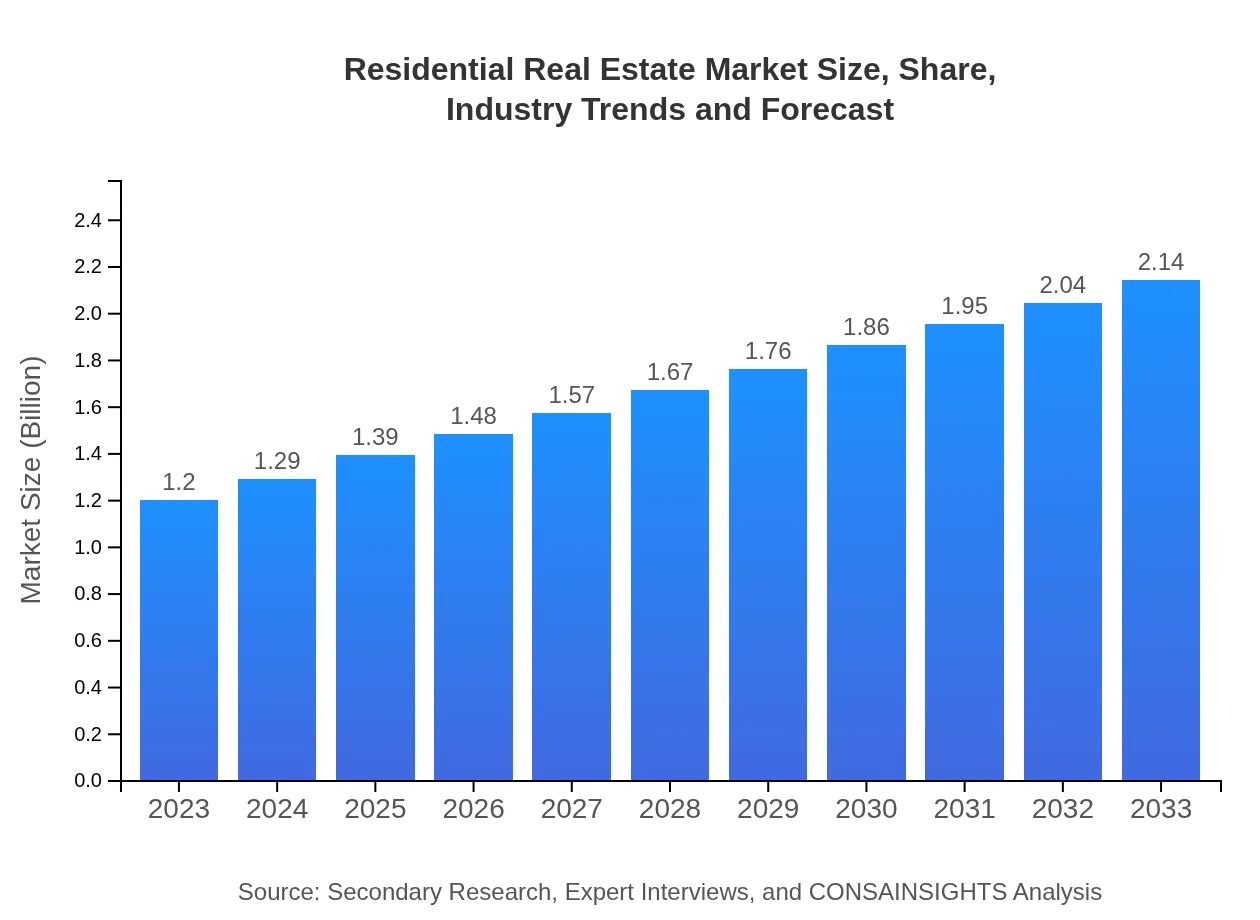

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.20 Trillion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $2.14 Trillion |

| Top Companies | Zillow Group, Realtor.com, Redfin, Century 21 |

| Last Modified Date | 22 January 2026 |

Residential Real Estate Market Overview

Customize Residential Real Estate Market Report market research report

- ✔ Get in-depth analysis of Residential Real Estate market size, growth, and forecasts.

- ✔ Understand Residential Real Estate's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Residential Real Estate

What is the Market Size & CAGR of the Residential Real Estate market in 2023?

Residential Real Estate Industry Analysis

Residential Real Estate Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Residential Real Estate Market Analysis Report by Region

Europe Residential Real Estate Market Report:

Europe's market is expected to grow from 0.32 trillion USD in 2023 to 0.57 trillion USD by 2033. Countries like Germany and France witness a robust housing market driven by favorable economic conditions and urbanization trends, although affordability continues to be a pressing issue in metropolitan areas.Asia Pacific Residential Real Estate Market Report:

In the Asia Pacific region, the residential real estate market is anticipated to grow from 0.26 trillion USD in 2023 to 0.46 trillion USD by 2033. Rapid urbanization and supportive government policies are fostering increased residential development. However, markets in countries like China and India face challenges, including regulatory complexities and housing affordability issues.North America Residential Real Estate Market Report:

North America stands out with a strong residential real estate market, projected to expand from 0.43 trillion USD in 2023 to 0.76 trillion USD by 2033. Key factors include low mortgage rates, strong job growth, and suburban migration. However, the market faces headwinds from ongoing supply shortages and rising building costs.South America Residential Real Estate Market Report:

The South American residential real estate market is projected to grow from 0.05 trillion USD in 2023 to 0.09 trillion USD in 2033, driven by a growing middle class and increased foreign investment. Brazil and Argentina are leading markets, although economic instability poses risks that could slow growth.Middle East & Africa Residential Real Estate Market Report:

In the Middle East and Africa, the residential real estate market is projected to grow from 0.14 trillion USD in 2023 to 0.25 trillion USD by 2033. The growth is accelerated by the rising urban population and an increase in disposable incomes, particularly in leading cities like Dubai and Johannesburg.Tell us your focus area and get a customized research report.

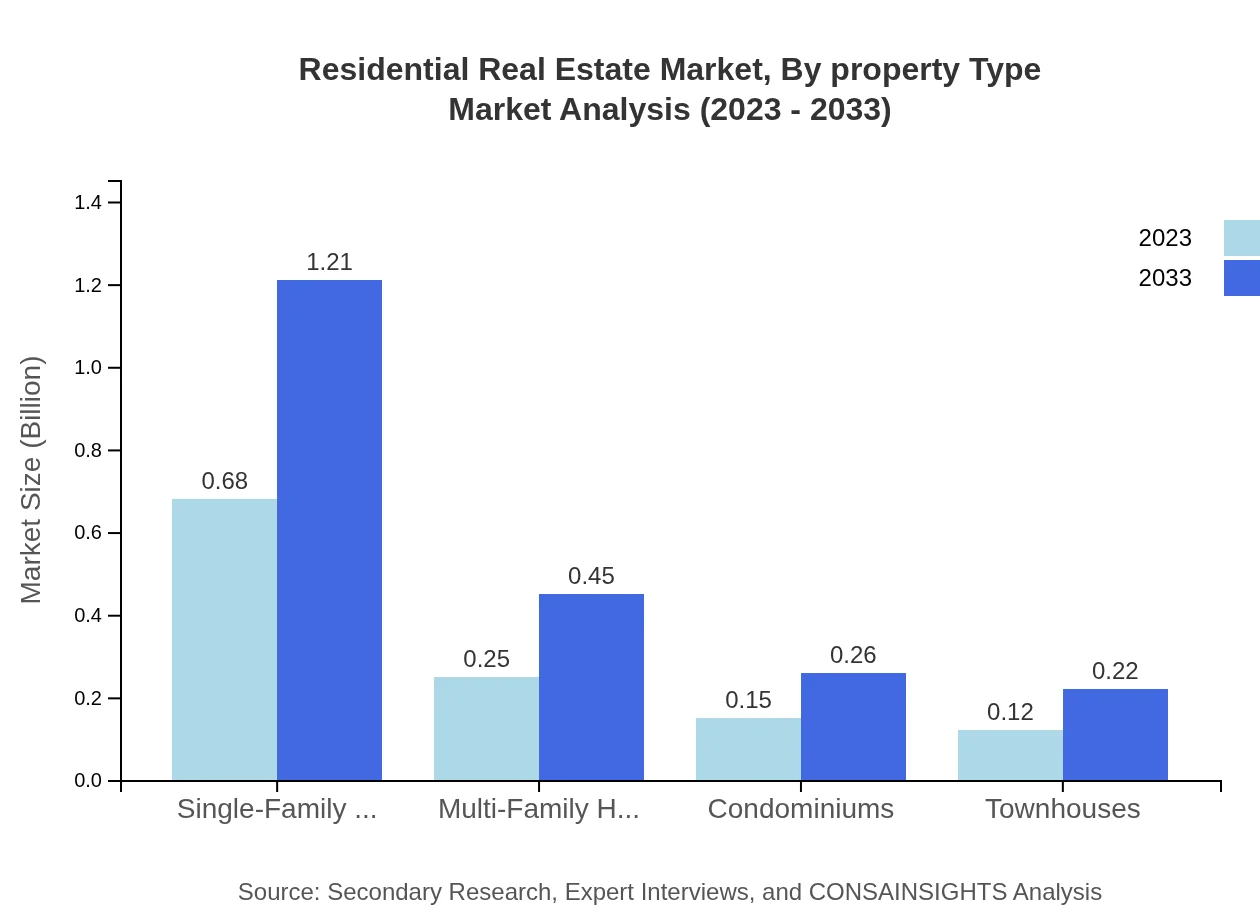

Residential Real Estate Market Analysis By Property Type

The residential real estate market is primarily categorized into several property types: single-family homes, multi-family homes, and condominiums, among others. Single-family homes represent a significant portion, growing from 0.68 trillion USD in 2023 to 1.21 trillion USD by 2033. Multi-family homes and condominiums also show growth, indicating a diverse market catering to varying consumer needs.

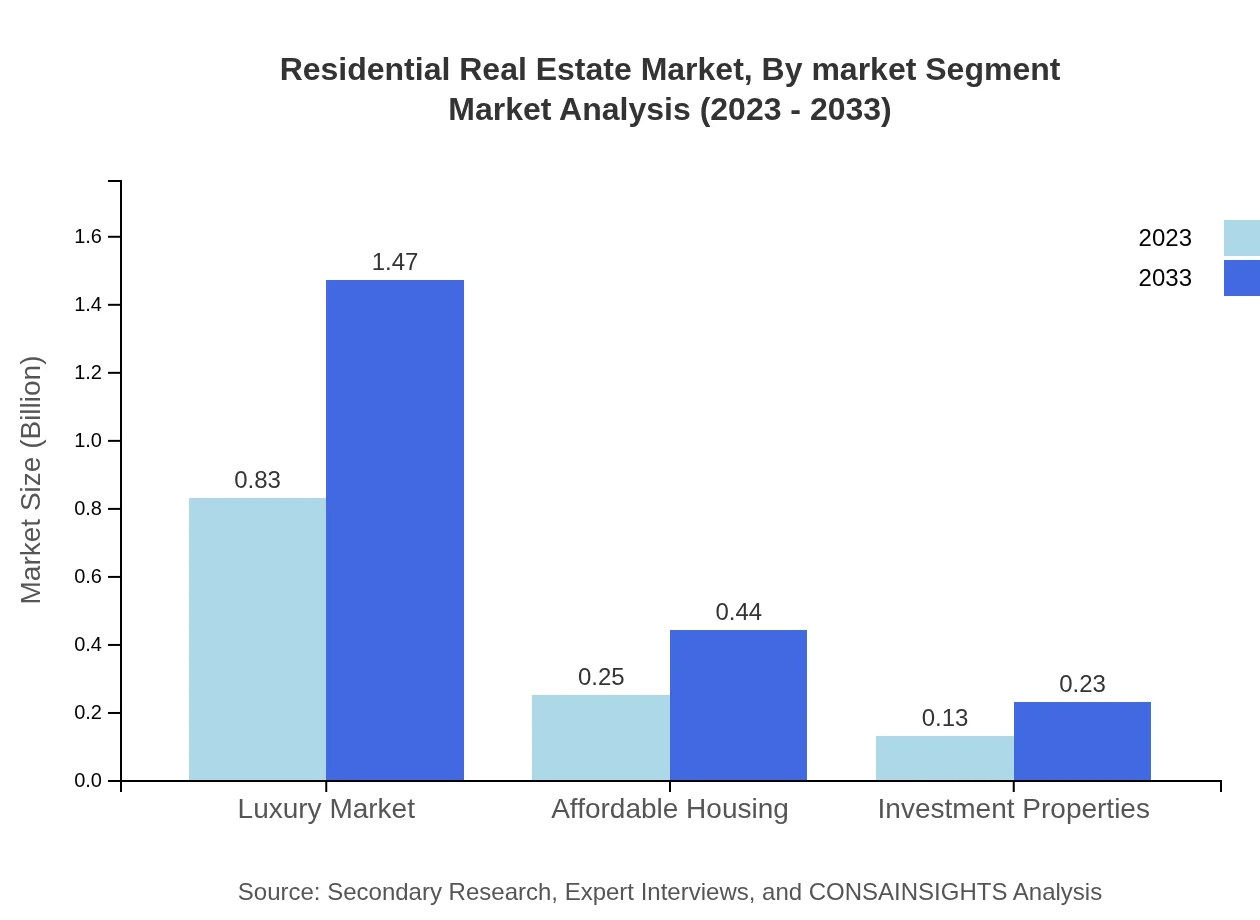

Residential Real Estate Market Analysis By Market Segment

Market segments, such as luxury and affordable housing, play a fundamental role in the overall structure of the residential real estate market. The luxury market is distinguished by significant growth, with a projected increase from 0.83 trillion USD in 2023 to 1.47 trillion USD by 2033, while affordable housing continues to represent a vital part of the social fabric and economic development.

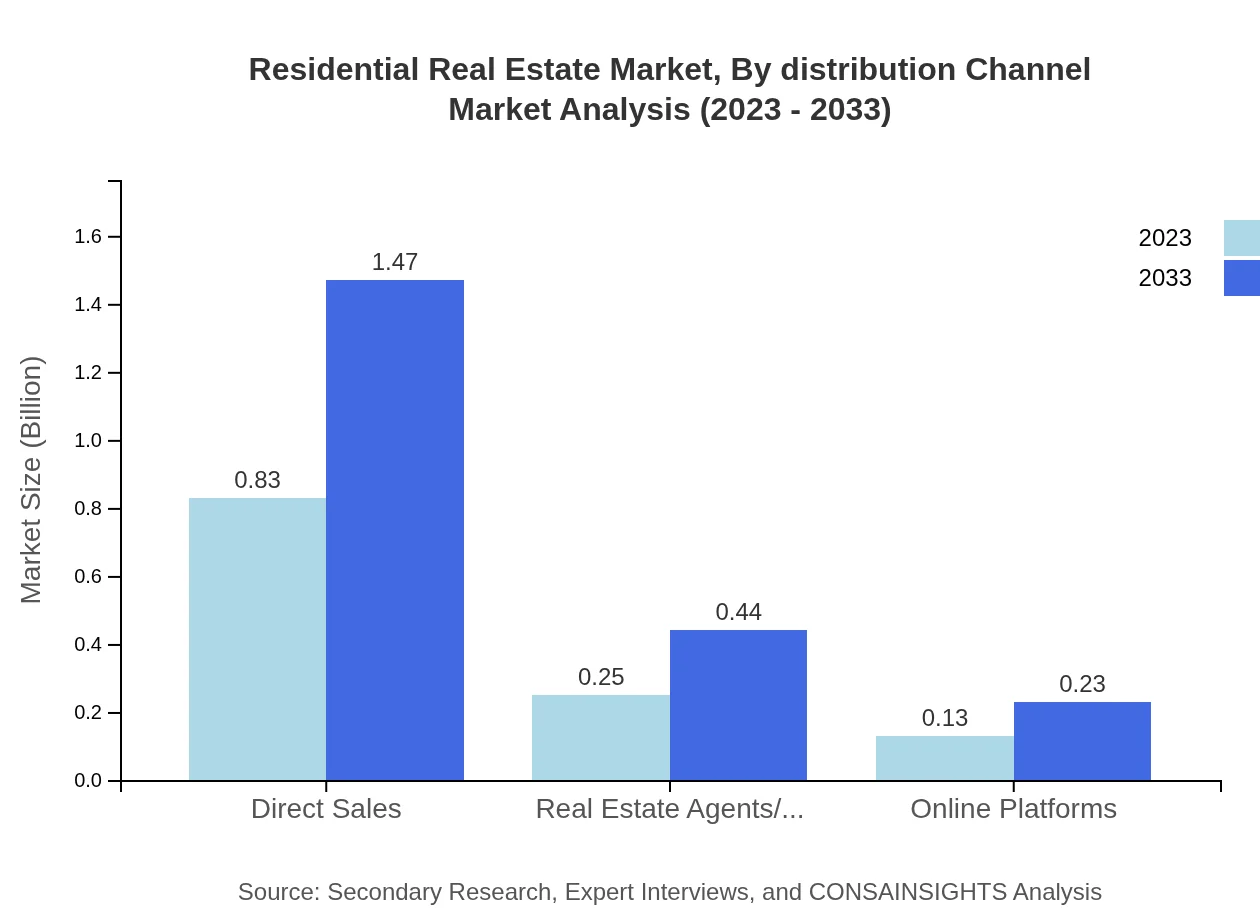

Residential Real Estate Market Analysis By Distribution Channel

Distribution channels, including direct sales, real estate agents/brokers, and online platforms, are critically important for market penetration. Direct sales are expected to retain a strong market share, while online platforms are rapidly gaining traction, responding to modern buyers' preferences for digital engagement.

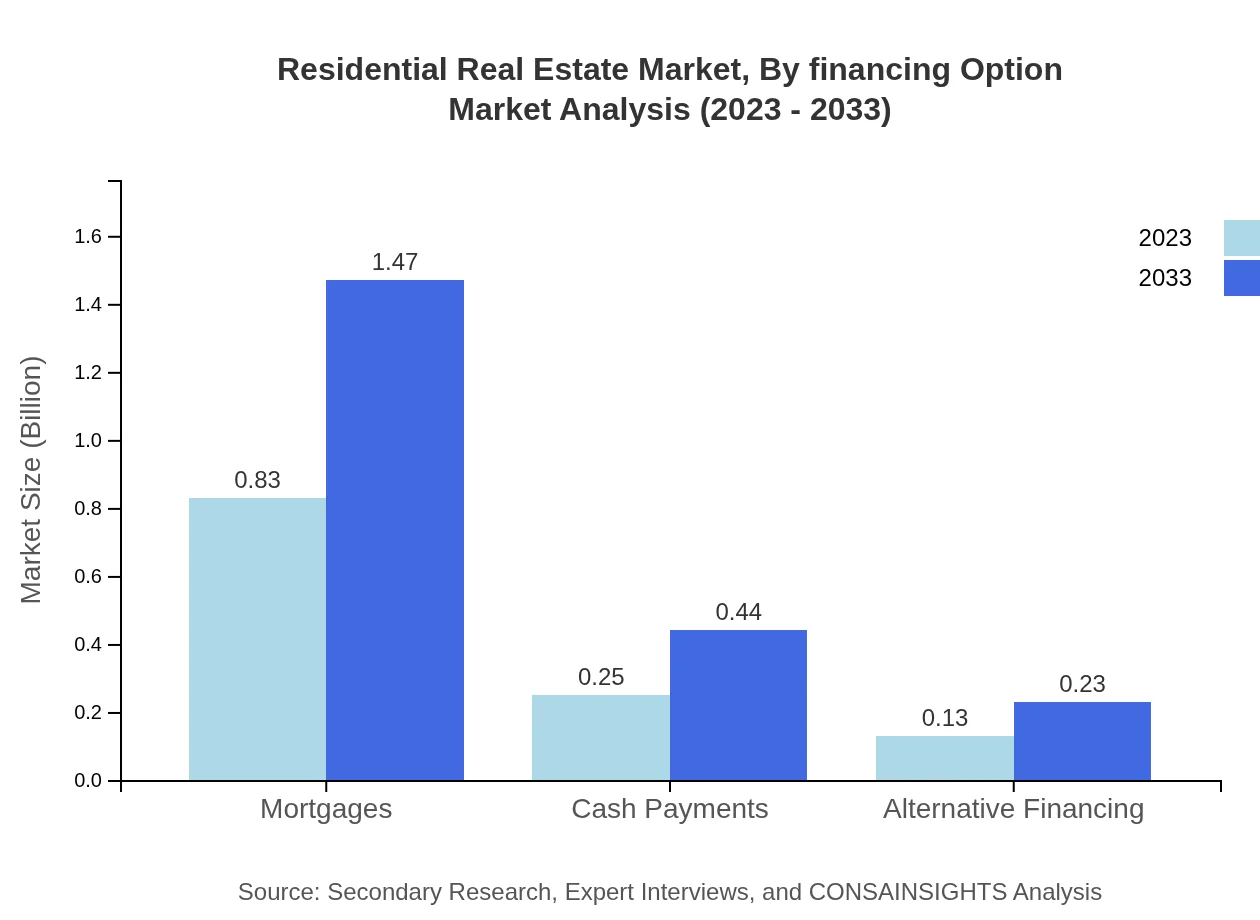

Residential Real Estate Market Analysis By Financing Option

Financing options such as mortgages, cash payments, and alternative financing are essential to how consumers engage with the residential real estate market. Mortgages dominate the financing landscape, accounting for 68.9% of the market in 2023, showing strong consistency in providing access to homeownership.

Residential Real Estate Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Residential Real Estate Industry

Zillow Group:

Zillow is a leading online real estate marketplace that provides information about homes, rentals, and real estate professionals. Its advanced digital platform connects buyers and sellers effectively.Realtor.com:

Realtor.com is a comprehensive online resource for real estate listings, providing data on millions of homes. It offers user-friendly tools to assist buyers and renters in making informed decisions.Redfin:

Redfin is a technology-powered real estate brokerage that provides innovative services and tools, transforming the real estate transaction process for buyers and sellers.Century 21:

Century 21 is one of the most respected and recognizable names in the real estate industry, offering comprehensive services to buyers and sellers across global markets.We're grateful to work with incredible clients.

FAQs

What is the market size of residential real estate?

The residential real estate market is valued at approximately $1.2 trillion in 2023 and is projected to grow at a CAGR of 5.8% through 2033.

What are the key market players or companies in the residential real estate industry?

Key players in the residential real estate market include major real estate agencies, property management firms, and notable online platforms that facilitate property transactions. These firms significantly influence market dynamics and innovation.

What are the primary factors driving the growth in the residential real estate industry?

Growth in the residential real estate industry is primarily driven by increasing urbanization, rising disposable incomes, low mortgage rates, and heightened demand for housing due to population growth and lifestyle changes.

Which region is the fastest Growing in residential real estate?

The North American region is the fastest-growing in the residential real estate market, projected to increase from $0.43 trillion in 2023 to $0.76 trillion by 2033, driven by strong demand for housing.

Does Consainsights provide customized market report data for the residential real estate industry?

Yes, Consainsights offers customized market report data tailored to specific needs within the residential real estate industry, ensuring relevant insights and analyses for diverse clients.

What deliverables can I expect from this residential real estate market research project?

Deliverables from the residential real estate market research include detailed market analysis reports, regional breakdowns, growth forecasts, competitive landscape assessments and segmented data insights.

What are the market trends of residential real estate?

Current market trends in residential real estate include increasing demand for single-family homes, a shift towards affordable housing options, and a rise in the use of technology to facilitate transactions and engagement.