Ai In Financial Services Market Size

Published Date: 24 January 2026 | Report Code: ai-in-financial-services-market-size

Ai In Financial Services Market Size Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the AI in Financial Services market. It includes insights on market size, growth trends, segmentation, regional dynamics, technological innovations, product performance, and influential global leaders. The forecast period extends from 2024 to 2033, offering in-depth analysis for investors and industry stakeholders. The report highlights key performance drivers and market strategies.

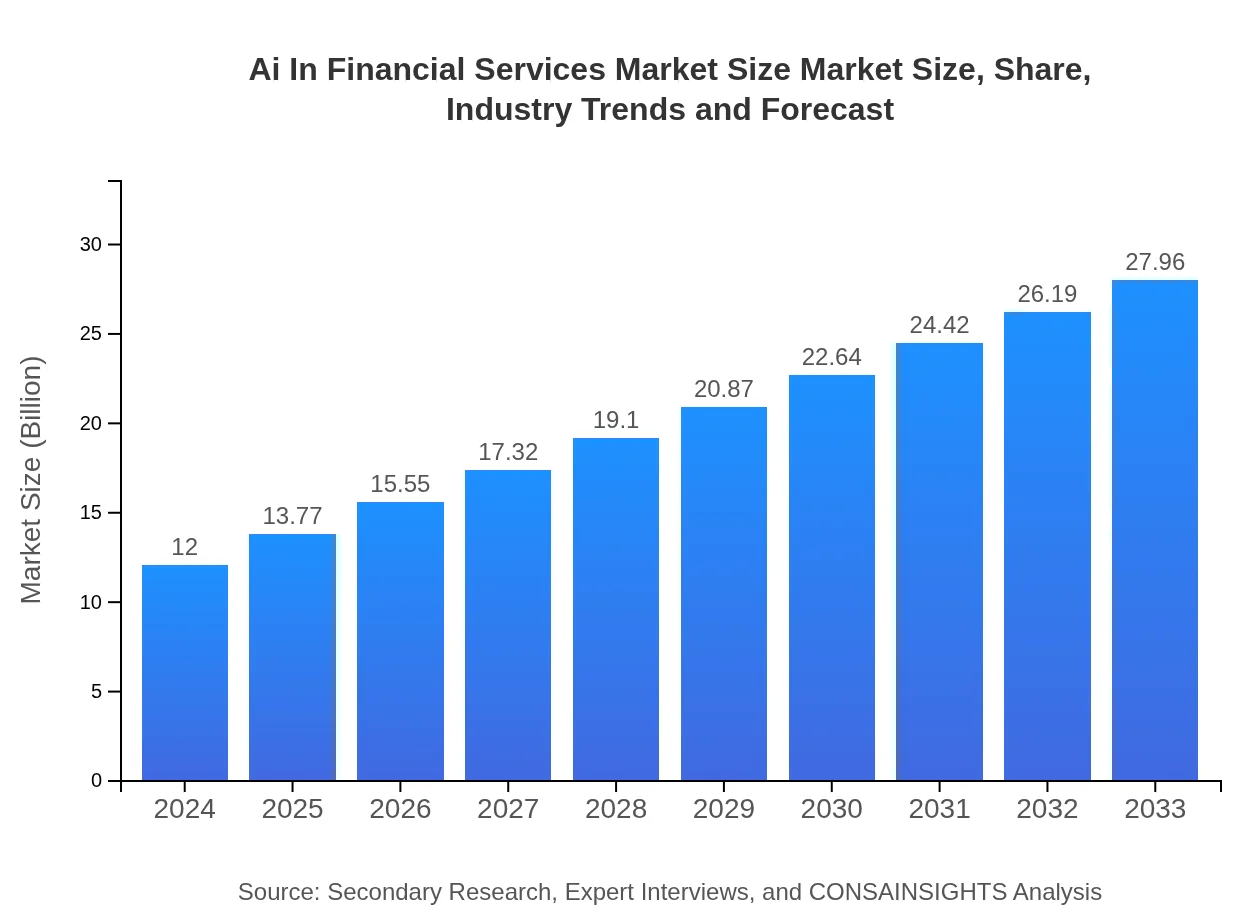

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

| 2024 Market Size | $12.00 Billion |

| CAGR (2024-2033) | 9.5% |

| 2033 Market Size | $27.96 Billion |

| Top Companies | IBM, Accenture, Microsoft |

| Last Modified Date | 24 January 2026 |

Ai In Financial Services Market Size Market Overview

Customize Ai In Financial Services Market Size market research report

- ✔ Get in-depth analysis of Ai In Financial Services Market Size market size, growth, and forecasts.

- ✔ Understand Ai In Financial Services Market Size's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ai In Financial Services Market Size

What is the Market Size & CAGR of Ai In Financial Services Market Size market in 2024?

Ai In Financial Services Market Size Industry Analysis

Ai In Financial Services Market Size Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ai In Financial Services Market Size Market Analysis Report by Region

Europe Ai In Financial Services Market Size:

Europe is rapidly advancing in AI adoption within financial services, with market size rising from 3.58 in 2024 to a projection of 8.34 by 2033. Emphasizing data security, cybersecurity, and innovation, European institutions are reshaping financial ecosystems through strategic collaborations.Asia Pacific Ai In Financial Services Market Size:

In the Asia Pacific region, the market is rapidly expanding as financial institutions embrace digital transformation. Recorded at 2.28 in 2024 and projected to reach 5.32 by 2033, growth is fueled by increased AI investments, supportive governmental policies, and an emerging fintech ecosystem. This region's dynamic economic landscape creates vast opportunities for innovation.North America Ai In Financial Services Market Size:

In North America, the market is robust and technologically advanced. With 4.03 recorded in 2024 and an anticipated growth to 9.40 by 2033, the region benefits from a strong digital infrastructure, high consumer demand, and significant investments in AI, leading to continuous advancements in financial services.South America Ai In Financial Services Market Size:

In South America, particularly Latin America, the market is emerging despite economic fluctuations. With a market size of 0.96 in 2024 expected to grow to 2.25 by 2033, improvements in mobile banking and digital adaptations are driving adoption. Increased regulatory reforms and upgraded digital infrastructures are paving the way for higher AI integration.Middle East & Africa Ai In Financial Services Market Size:

In the Middle East and Africa, the market shows steady growth from 1.14 in 2024 to 2.67 by 2033. Driven by digitization efforts and expanding financial inclusion, these regions are actively investing in AI, fueled by governmental initiatives and an emerging interest in advanced technological solutions.Tell us your focus area and get a customized research report.

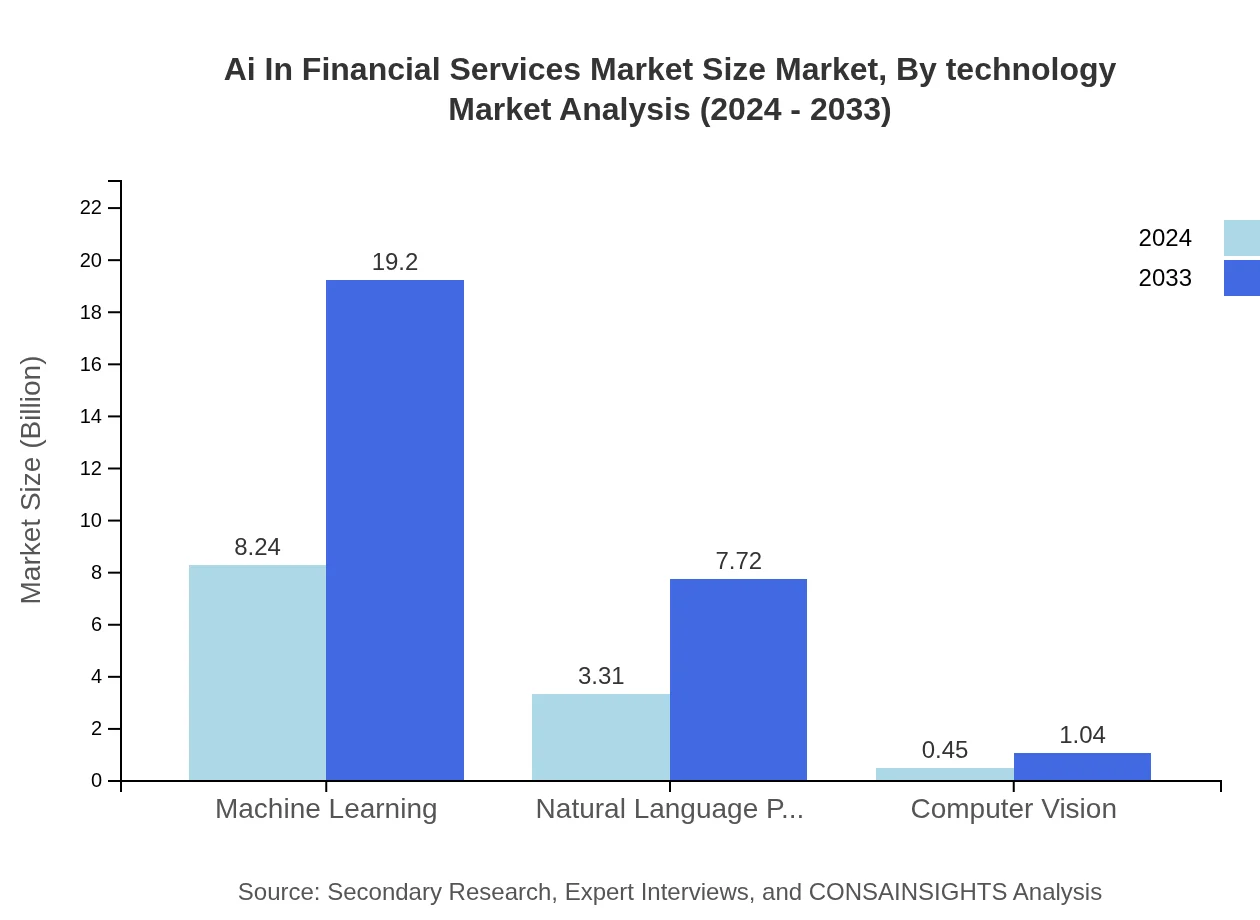

Ai In Financial Services Market Size Market Analysis By Technology

The by-technology segment examines core AI innovations including machine learning, natural language processing, and computer vision. With machine learning market size rising substantially from 8.24 in 2024 to 19.20 in 2033, this segment illustrates the pivotal role of technology in transforming financial operations.

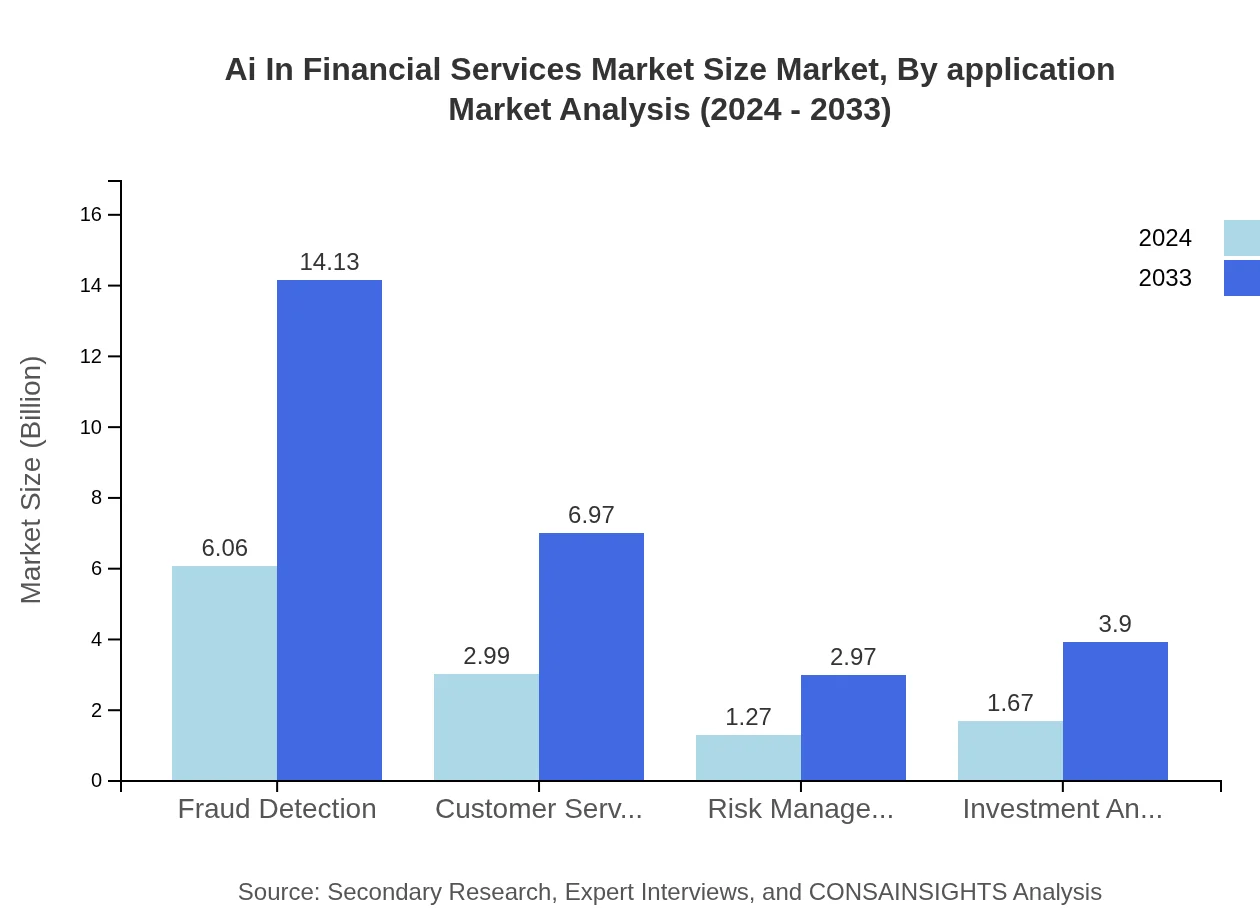

Ai In Financial Services Market Size Market Analysis By Application

The by-application segment centers on AI applications such as fraud detection, customer service automation, risk management, and investment analysis. These applications demonstrate significant market impact, with fraud detection growing from 6.06 in 2024 and expected to expand robustly by 2033, highlighting the value of AI in operational efficiency.

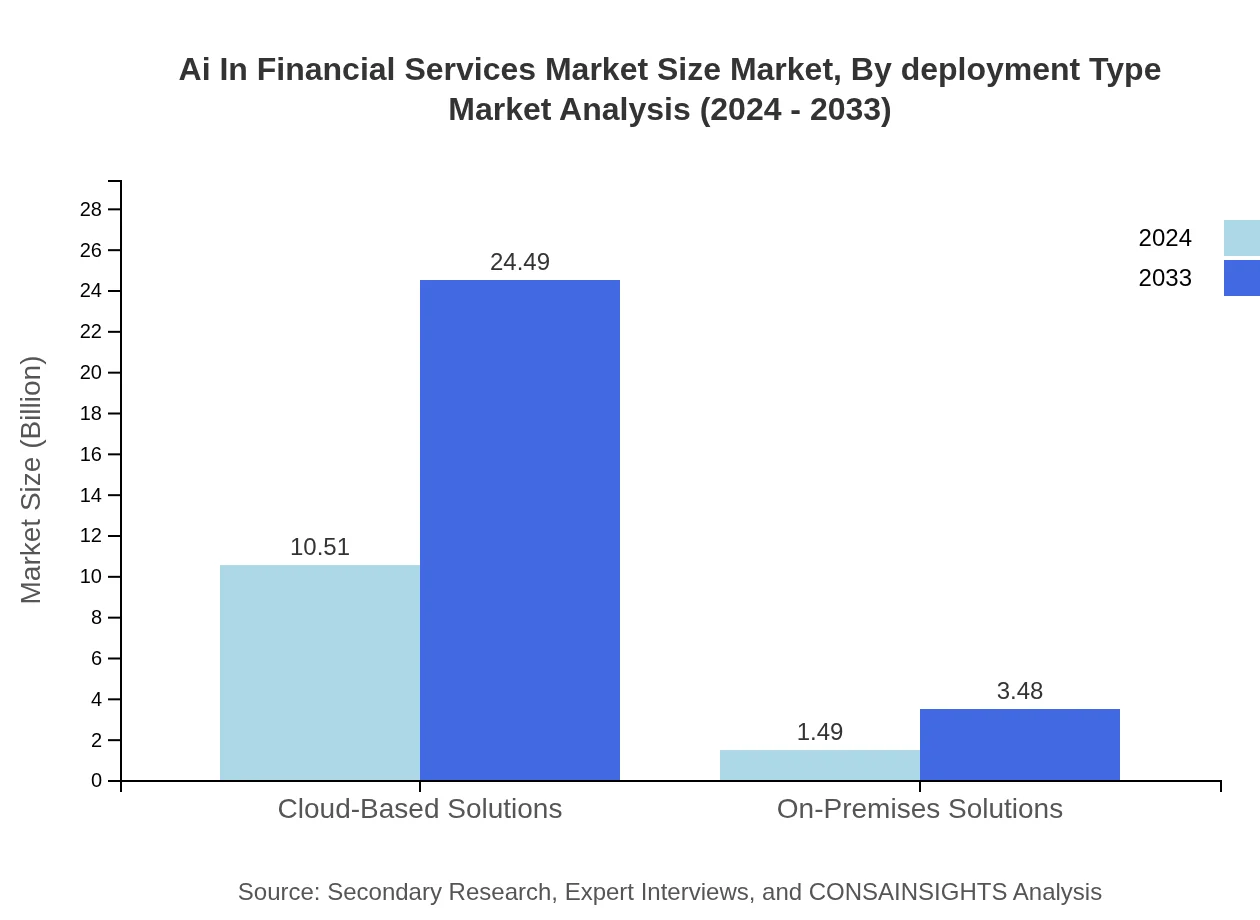

Ai In Financial Services Market Size Market Analysis By Deployment Type

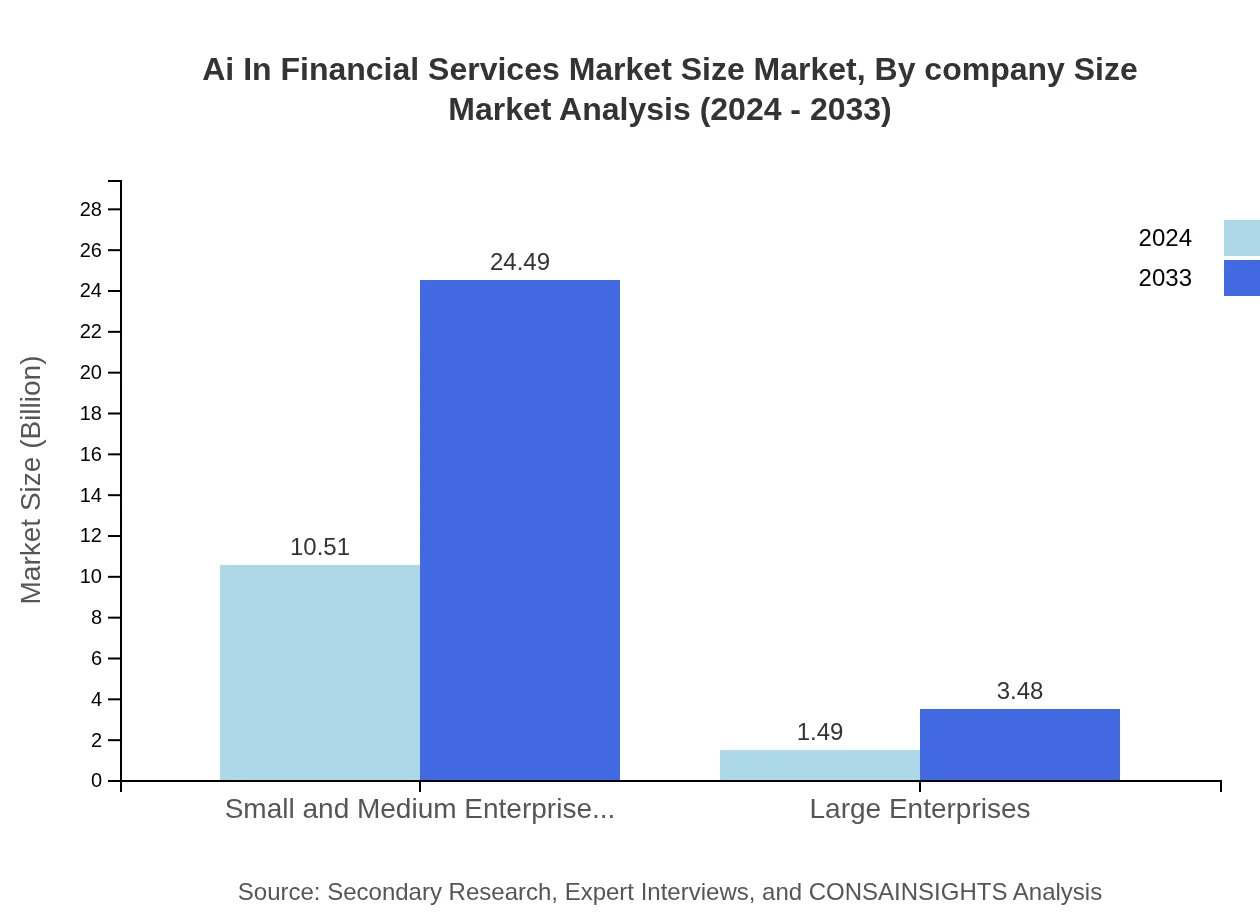

This segment contrasts cloud-based and on-premises deployment models. Cloud-based solutions, with a market size of 10.51 in 2024, dominate due to scalability and cost benefits, while on-premises solutions, though smaller at 1.49, continue to serve clients needing enhanced security. Trends favor cloud adoption.

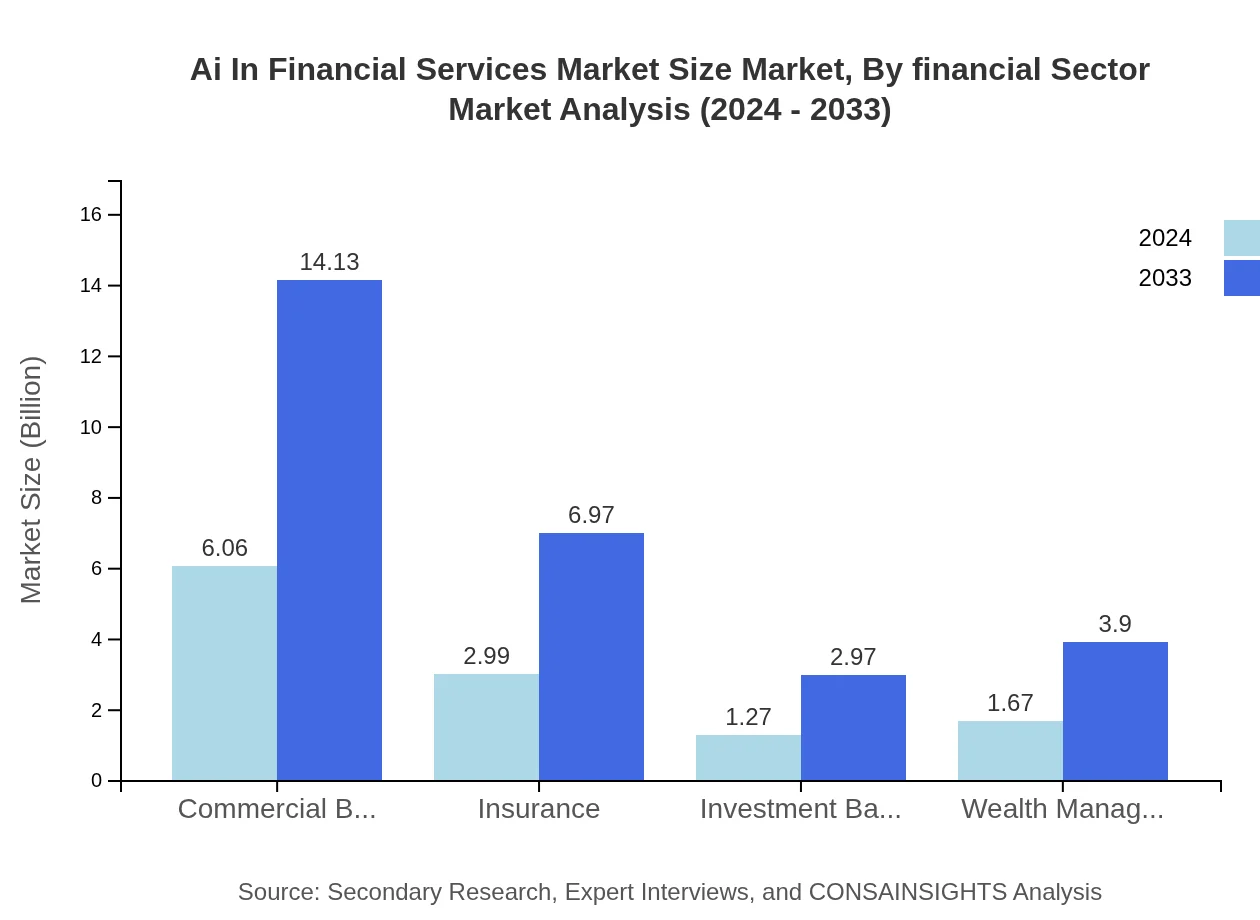

Ai In Financial Services Market Size Market Analysis By Financial Sector

The by-financial-sector analysis reviews the impact of AI in commercial banking, insurance, investment banking, and wealth management. With commercial banking at 6.06 in 2024, financial institutions focus on leveraging AI to optimize risk management and improve customer interactions.

Ai In Financial Services Market Size Market Analysis By Company Size

The by-company-size segment compares SMEs and large enterprises. SMEs capture a larger market share with a size of 10.51 in 2024, demonstrating agile adoption of AI, while large enterprises, though smaller at 1.49, invest in sophisticated solutions. This trend is anticipated to persist under evolving market dynamics.

Ai In Financial Services Market Size Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ai In Financial Services Market Size Industry

IBM:

IBM is a global leader harnessing AI to revolutionize financial services, offering robust analytics and cloud-based platforms for efficient operations and data-driven decision making.Accenture:

Accenture drives innovative AI strategies with its customized solutions tailored for enhancing customer experience and operational resilience in the financial sector.Microsoft:

Microsoft leverages cutting-edge AI and machine learning models to provide seamless integration of digital financial solutions, significantly impacting global digital transformation.We're grateful to work with incredible clients.