Coronary Guidewires Market Report

Published Date: 31 January 2026 | Report Code: coronary-guidewires

Coronary Guidewires Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Coronary Guidewires market from 2023 to 2033, including market size, growth trends, segment analysis, and regional insights. It aims to equip stakeholders with actionable data for strategic decision-making.

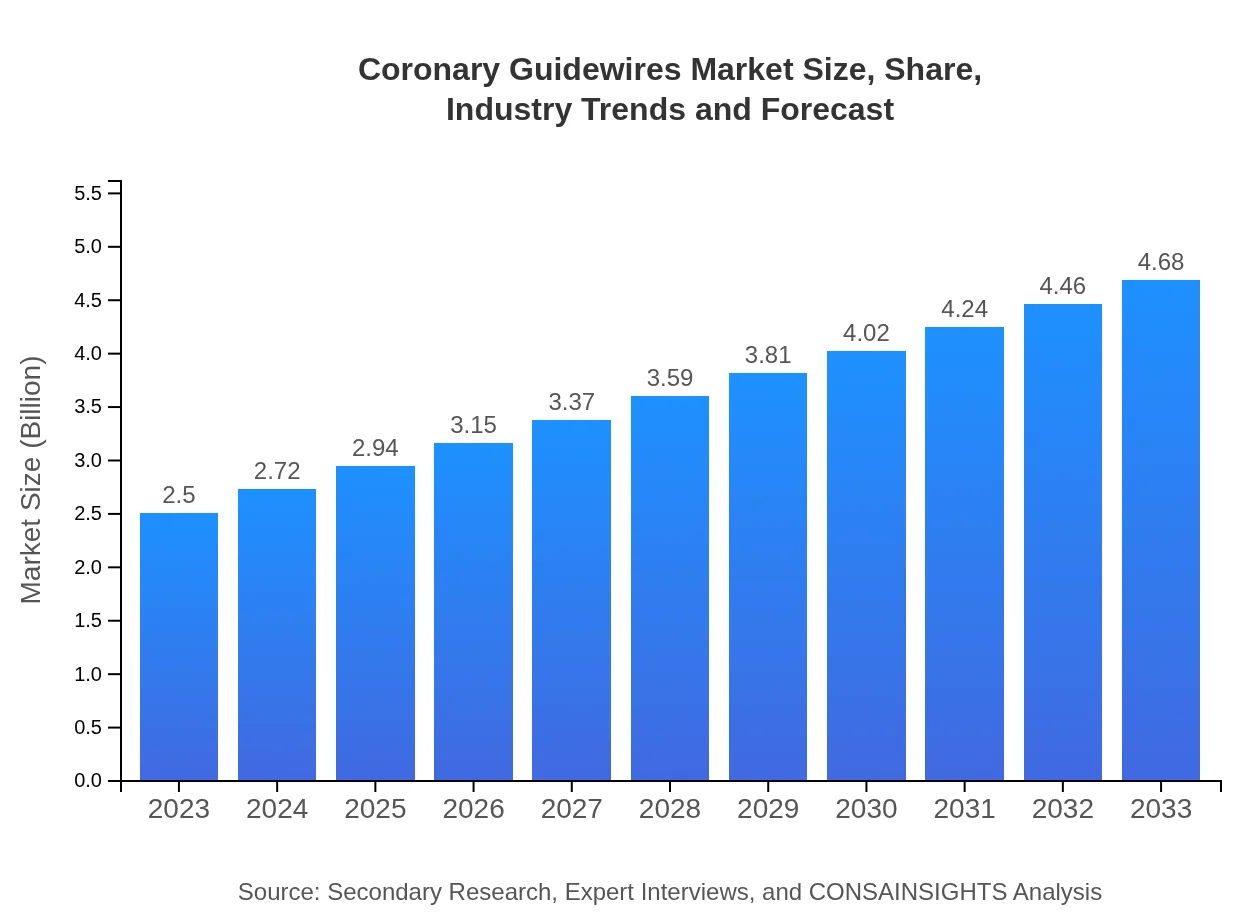

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 6.3% |

| 2033 Market Size | $4.68 Billion |

| Top Companies | Boston Scientific, Medtronic , Abbott Laboratories, Terumo Corporation |

| Last Modified Date | 31 January 2026 |

Coronary Guidewires Market Overview

Customize Coronary Guidewires Market Report market research report

- ✔ Get in-depth analysis of Coronary Guidewires market size, growth, and forecasts.

- ✔ Understand Coronary Guidewires's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Coronary Guidewires

What is the Market Size & CAGR of Coronary Guidewires market in 2023?

Coronary Guidewires Industry Analysis

Coronary Guidewires Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Coronary Guidewires Market Analysis Report by Region

Europe Coronary Guidewires Market Report:

The European market is projected to grow from $0.78 billion in 2023 to $1.45 billion by 2033. Increasing procedural volumes and favorable reimbursement policies are driving demand, particularly in Germany, France, and the UK.Asia Pacific Coronary Guidewires Market Report:

In 2023, the Coronary Guidewires market in the Asia Pacific region is valued at $0.46 billion, projected to grow to $0.86 billion by 2033. The growth is fueled by increasing healthcare expenditures, rising population, and improvements in healthcare infrastructure, particularly in countries like China and India.North America Coronary Guidewires Market Report:

North America leads the market with an estimated value of $0.92 billion in 2023, expected to increase to $1.71 billion by 2033. The region benefits from advanced healthcare infrastructure, high prevalence of cardiac diseases, and significant investments in medical technologies.South America Coronary Guidewires Market Report:

The South American market for Coronary Guidewires was valued at $0.15 billion in 2023, with an anticipated increase to $0.28 billion by 2033. Factors such as growing incidence rates of coronary diseases and the expanding presence of multinational corporations are contributing to this growth.Middle East & Africa Coronary Guidewires Market Report:

In the Middle East and Africa, the Coronary Guidewires market accounts for $0.20 billion in 2023, expected to reach $0.37 billion by 2033. Growth in this region is supported by rising healthcare investments and a focus on improving cardiovascular care.Tell us your focus area and get a customized research report.

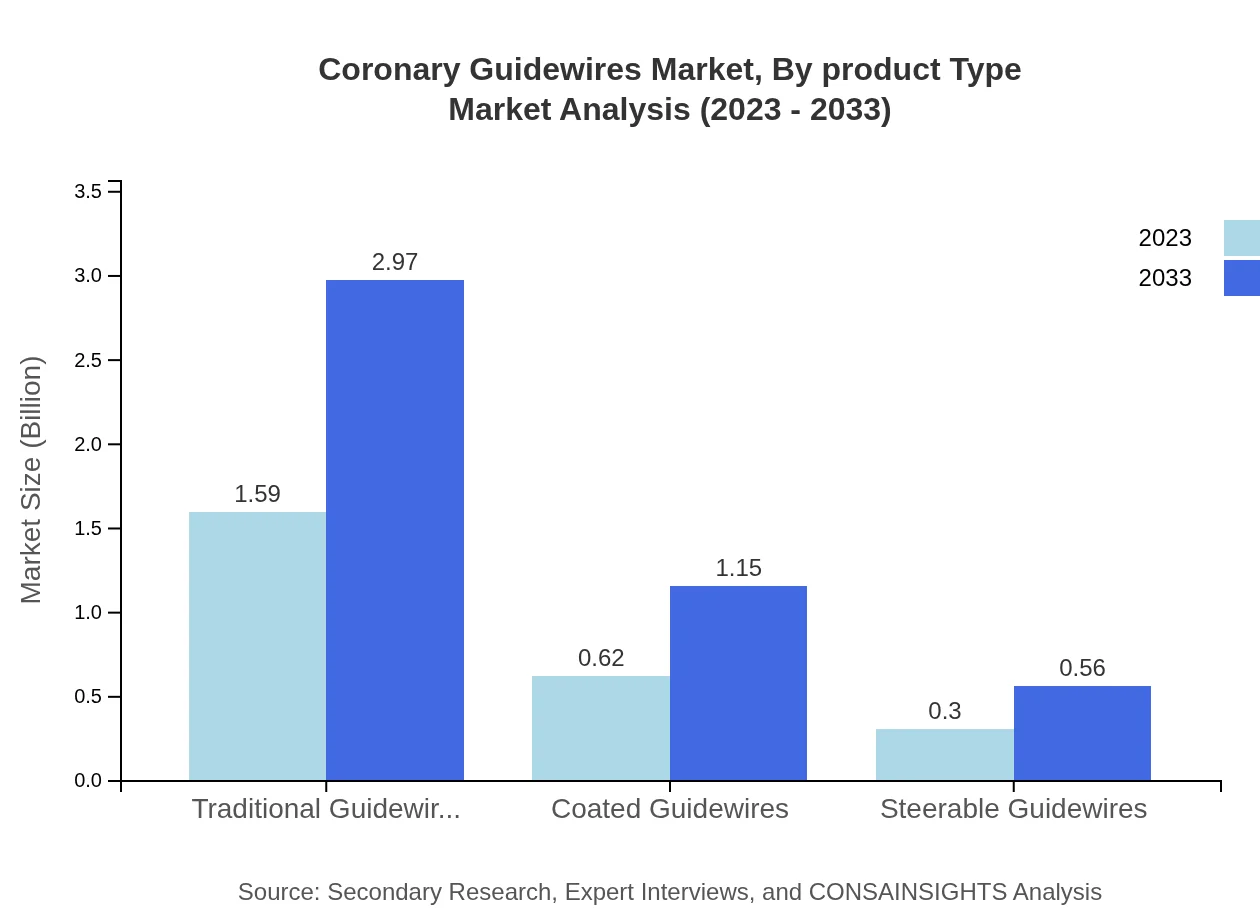

Coronary Guidewires Market Analysis By Product Type

The market is segmented into Traditional Guidewires, Coated Guidewires, and Steerable Guidewires. Traditional Guidewires hold the largest market share, accounting for $1.59 billion in 2023, projected to reach $2.97 billion by 2033. Coated Guidewires follow with a market size of $0.62 billion in 2023, growing to $1.15 billion by 2033, driven by increased demand for smoother navigation through arteries.

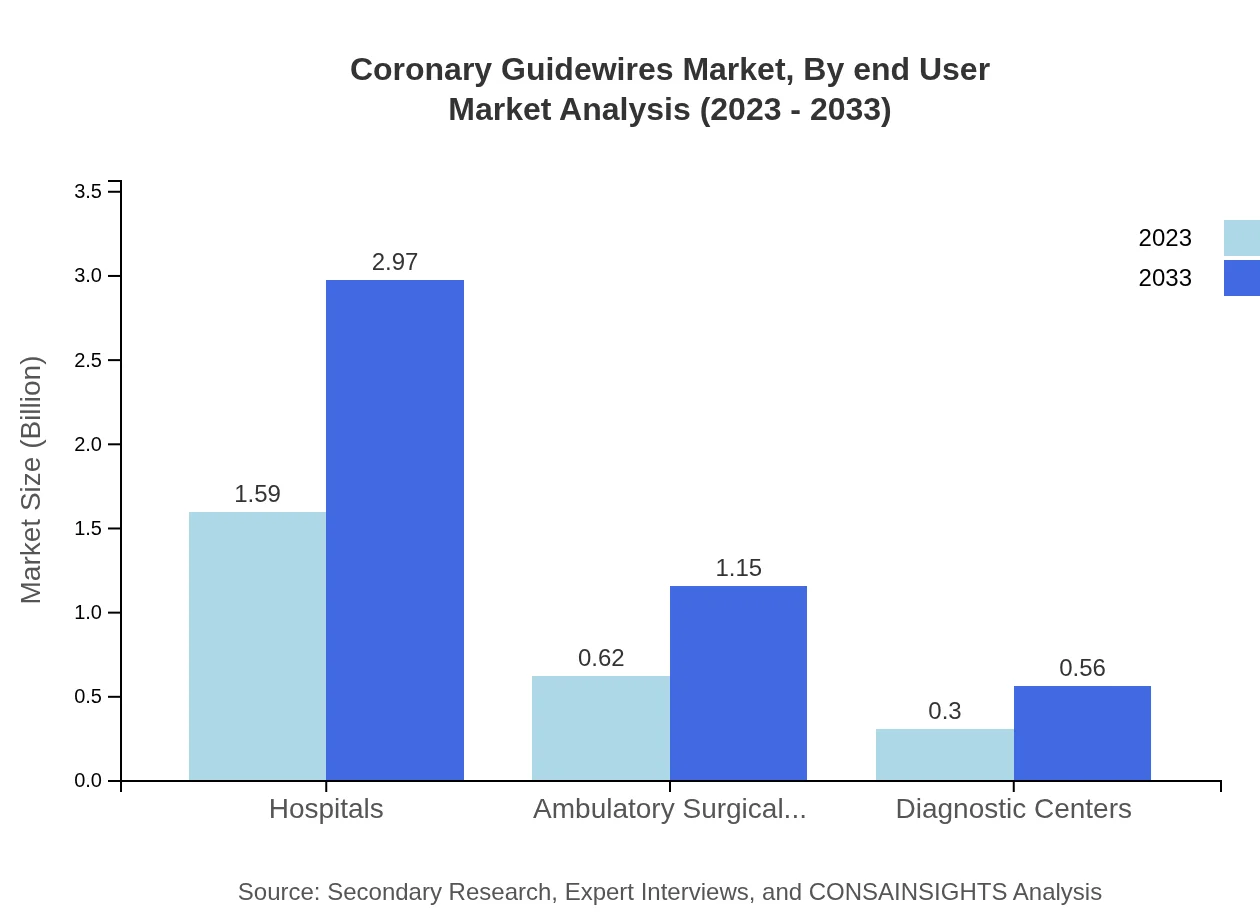

Coronary Guidewires Market Analysis By End User

Hospitals are the primary end-user of Coronary Guidewires, with a market value of $1.59 billion in 2023 and projected to grow to $2.97 billion by 2033. This segment represents a share of 63.46%. Ambulatory Surgical Centers account for $0.62 billion in 2023, expected to rise to $1.15 billion, representing 24.67% of the market.

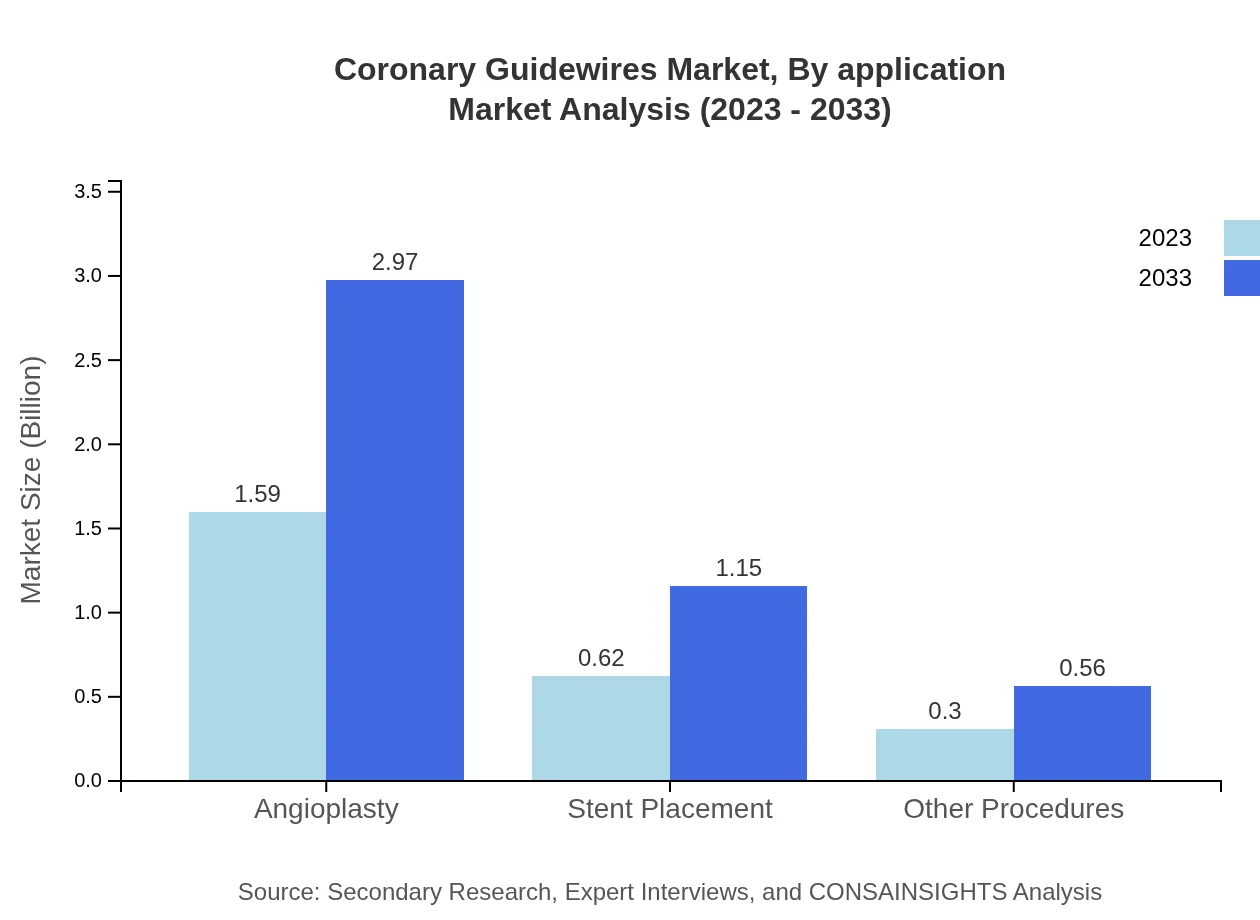

Coronary Guidewires Market Analysis By Application

In terms of application, Angioplasty procedures account for $1.59 billion in 2023 with a growth forecast to $2.97 billion by 2033, implying a significant 63.46% market share, while Stent Placement accounts for $0.62 billion and grows to $1.15 billion, representing 24.67%.

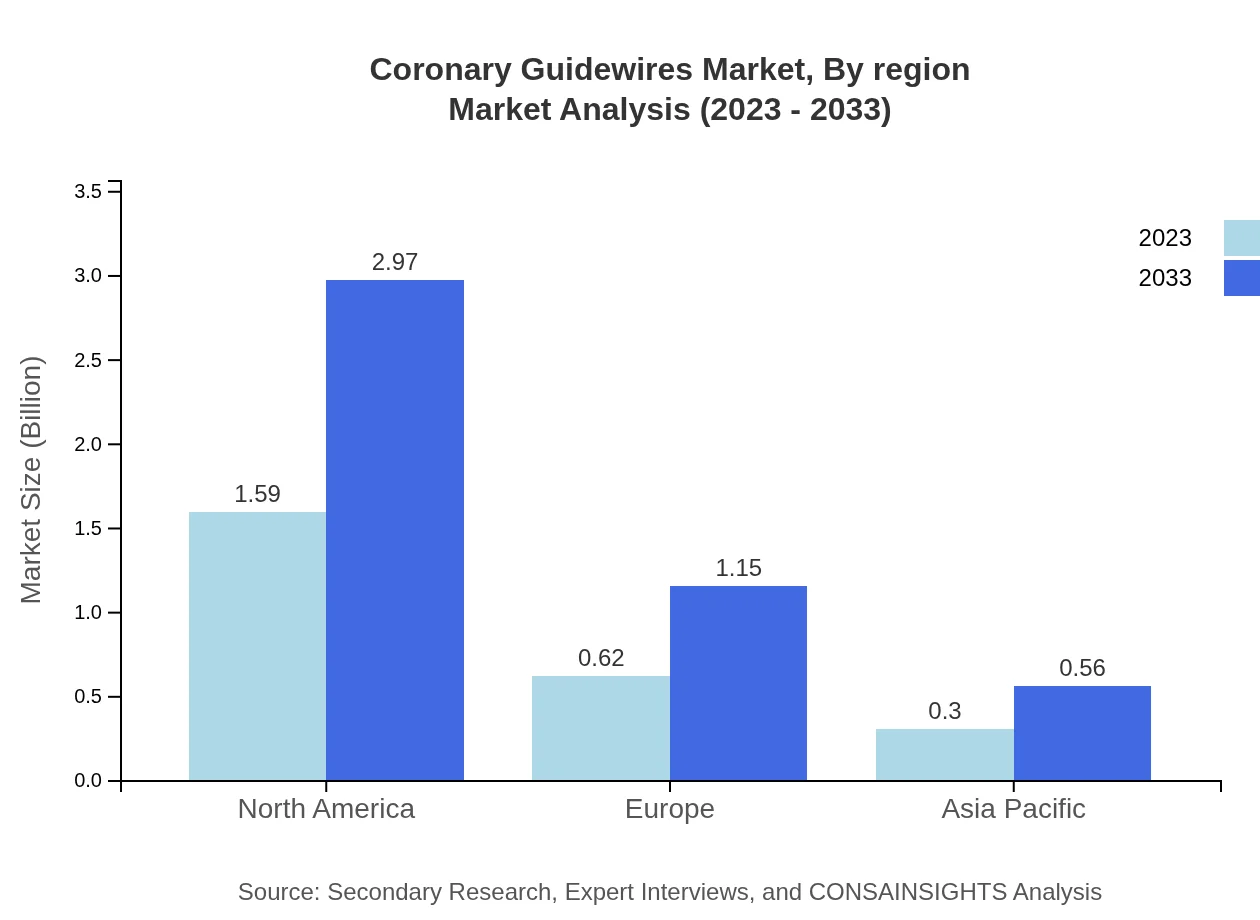

Coronary Guidewires Market Analysis By Region

By region, North America remains the most significant market with sizes of $0.92 billion in 2023 and $1.71 billion in 2033. Europe follows closely, while Asia Pacific is rapidly growing and is expected to contribute significantly as healthcare access improves.

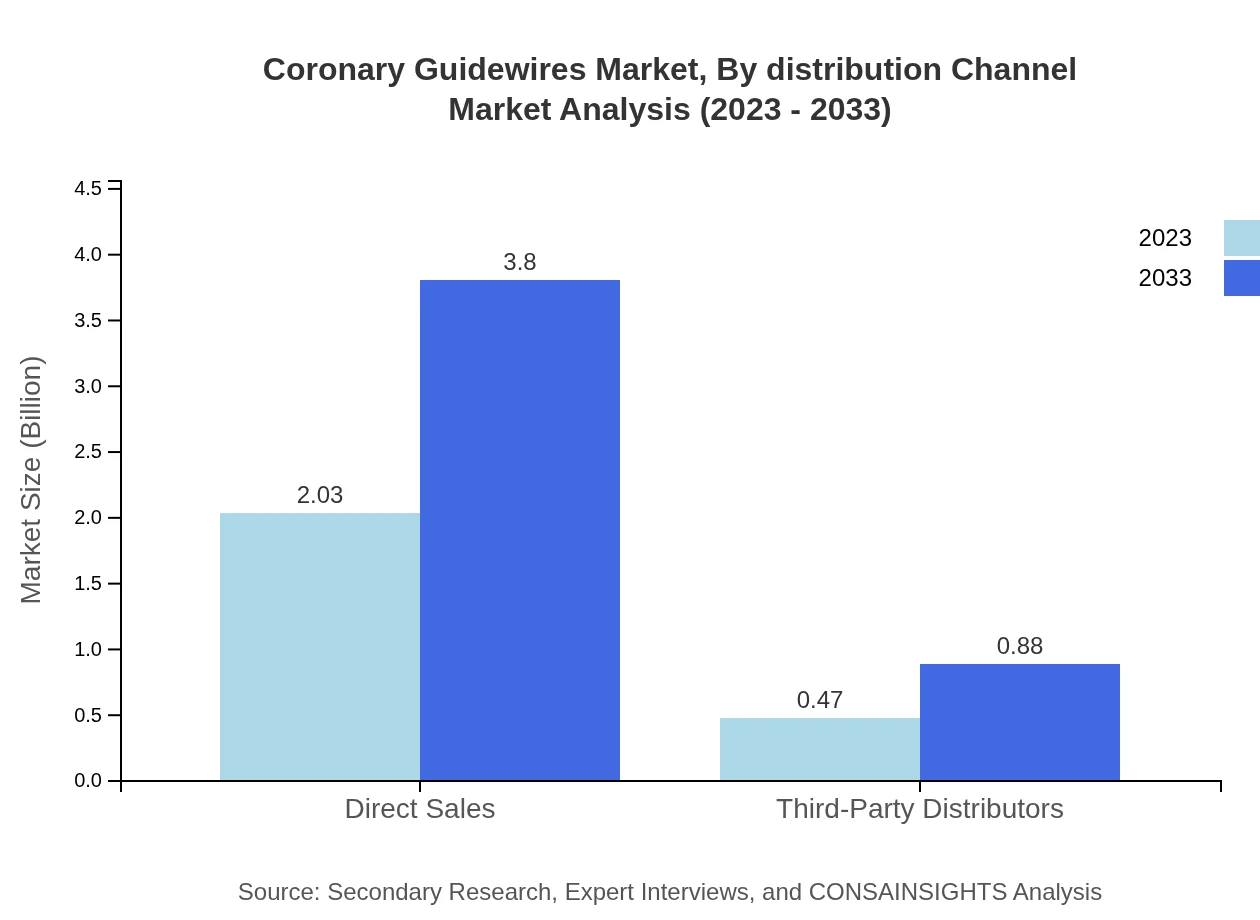

Coronary Guidewires Market Analysis By Distribution Channel

Direct Sales dominate with $2.03 billion in 2023 and 81.15% market share, while Third-Party Distributors account for $0.47 billion, indicating a trend towards direct relationships between manufacturers and healthcare providers.

Coronary Guidewires Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Coronary Guidewires Industry

Boston Scientific:

A leading global medical technology company, Boston Scientific specializes in the development of innovative medical devices including advanced coronary guidewires enhancing the efficiency of cardiac procedures.Medtronic :

Medtronic is known for its commitment to transforming healthcare through technological advancements, providing a range of coronary guidewires that enhance surgical outcomes and patient care.Abbott Laboratories:

Abbott focuses on advancing medical device technology, contributing to the coronary guidewire sector with products that facilitate minimally invasive cardiac interventions.Terumo Corporation:

A prominent player in the global medical device market, Terumo is recognized for its innovative coronary guidewire solutions that improve navigability within complex vascular structures.We're grateful to work with incredible clients.

FAQs

What is the market size of coronary guidewires?

The global coronary guidewires market is currently valued at approximately $2.5 billion and is projected to grow at a CAGR of 6.3% from 2023 to 2033, indicating significant expansion in this critical medical device sector.

What are the key market players or companies in the coronary guidewires industry?

Key players in the coronary guidewires market include Boston Scientific, Medtronic, Abbott Laboratories, and Johnson & Johnson, among others. These companies are pivotal in driving innovations and enhancing the quality of coronary interventions.

What are the primary factors driving the growth in the coronary guidewires industry?

Major drivers of growth include increasing cardiovascular disease prevalence, technological advancements in guidewire design, and expanded healthcare access. Additionally, the rising aging population significantly influences the demand for effective coronary interventions.

Which region is the fastest Growing in the coronary guidewires market?

The North American region is expected to witness the fastest growth in the coronary guidewires market, with market size projected to increase from $0.92 billion in 2023 to $1.71 billion by 2033, reflecting a surge in healthcare spending.

Does ConsaInsights provide customized market report data for the coronary guidewires industry?

Yes, ConsaInsights specializes in providing customized market reports tailored to specific needs within the coronary guidewires industry, ensuring clients receive relevant data for informed decision-making.

What deliverables can I expect from this coronary guidewires market research project?

Deliverables include comprehensive reports with market analysis, forecasts, competitive landscape insights, regional segment data, and trends, enabling stakeholders to strategize effectively in the coronary guidewires market.

What are the market trends of coronary guidewires?

Current market trends include the growing preference for steerable and coated guidewires, increasing focus on minimally invasive procedures, and advancements in material technology to enhance guidewire performance and patient outcomes.