Ai In Asset Management

Published Date: 24 January 2026 | Report Code: ai-in-asset-management

Ai In Asset Management Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report on Ai In Asset Management provides a deep dive into market dynamics, key industry insights, forecast trends, and segmented data analysis covering the period from 2024 to 2033. It offers detailed insights on market size, growth rates, regional performance, technology advancements, and strategic market segmentation in the asset management space.

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

| 2024 Market Size | $1.80 Billion |

| CAGR (2024-2033) | 10.2% |

| 2033 Market Size | $4.46 Billion |

| Top Companies | AlphaTech Financial Solutions, FinAI Innovations, InnoAsset Technologies |

| Last Modified Date | 24 January 2026 |

Ai In Asset Management Market Overview

Customize Ai In Asset Management market research report

- ✔ Get in-depth analysis of Ai In Asset Management market size, growth, and forecasts.

- ✔ Understand Ai In Asset Management's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ai In Asset Management

What is the Market Size & CAGR of Ai In Asset Management market in 2024?

Ai In Asset Management Industry Analysis

Ai In Asset Management Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ai In Asset Management Market Analysis Report by Region

Europe Ai In Asset Management:

Europe shows significant potential with the Ai In Asset Management market projected to grow from 0.59 in 2024 to 1.47 by 2033. European markets benefit from high investment in technological innovation, supportive regulatory frameworks, and a mature financial sector. The integration of AI is driving improvements in risk management and operational efficiency, aligning with the region’s ambitious digital transformation goals.Asia Pacific Ai In Asset Management:

In the Asia Pacific region, the Ai In Asset Management market is growing rapidly. In 2024, the market size is valued at approximately 0.33, increasing to 0.83 by 2033. Rapid urbanization, technological adoption, and increased digital transformation initiatives in financial services are driving this growth. Countries in this region are investing in AI to streamline operations and improve customer experiences, making it a hotbed for innovation in asset management.North America Ai In Asset Management:

North America remains a robust and influential market for AI in asset management. The market in this region is forecast to rise from 0.61 in 2024 to 1.51 by 2033, fueled by early adoption, strong investment in AI R&D, and a vibrant ecosystem of technology startups and established financial institutions. Regulatory support, innovation-friendly policies, and high consumer demand for advanced financial services are key factors contributing to this upward trend.South America Ai In Asset Management:

South America is witnessing steady growth in the application of AI solutions in asset management, with market parameters reflecting a modest increase from 0.13 in 2024 to 0.31 in 2033. Economic diversification and efforts to modernize traditional financial practices are key drivers. Despite certain challenges related to regulatory infrastructures, the region is expected to show improved adoption as technology becomes more accessible and integrated across financial institutions.Middle East & Africa Ai In Asset Management:

The Middle East and Africa region is an emerging market in Ai In Asset Management, with market size estimates moving from 0.14 in 2024 to 0.34 by 2033. While adoption is currently in an early phase, increasing investments in digital infrastructure and the rising prominence of fintech in these regions are expected to catalyze growth in AI-powered asset management solutions. The focus on modernizing financial services offers promising opportunities for future expansion.Tell us your focus area and get a customized research report.

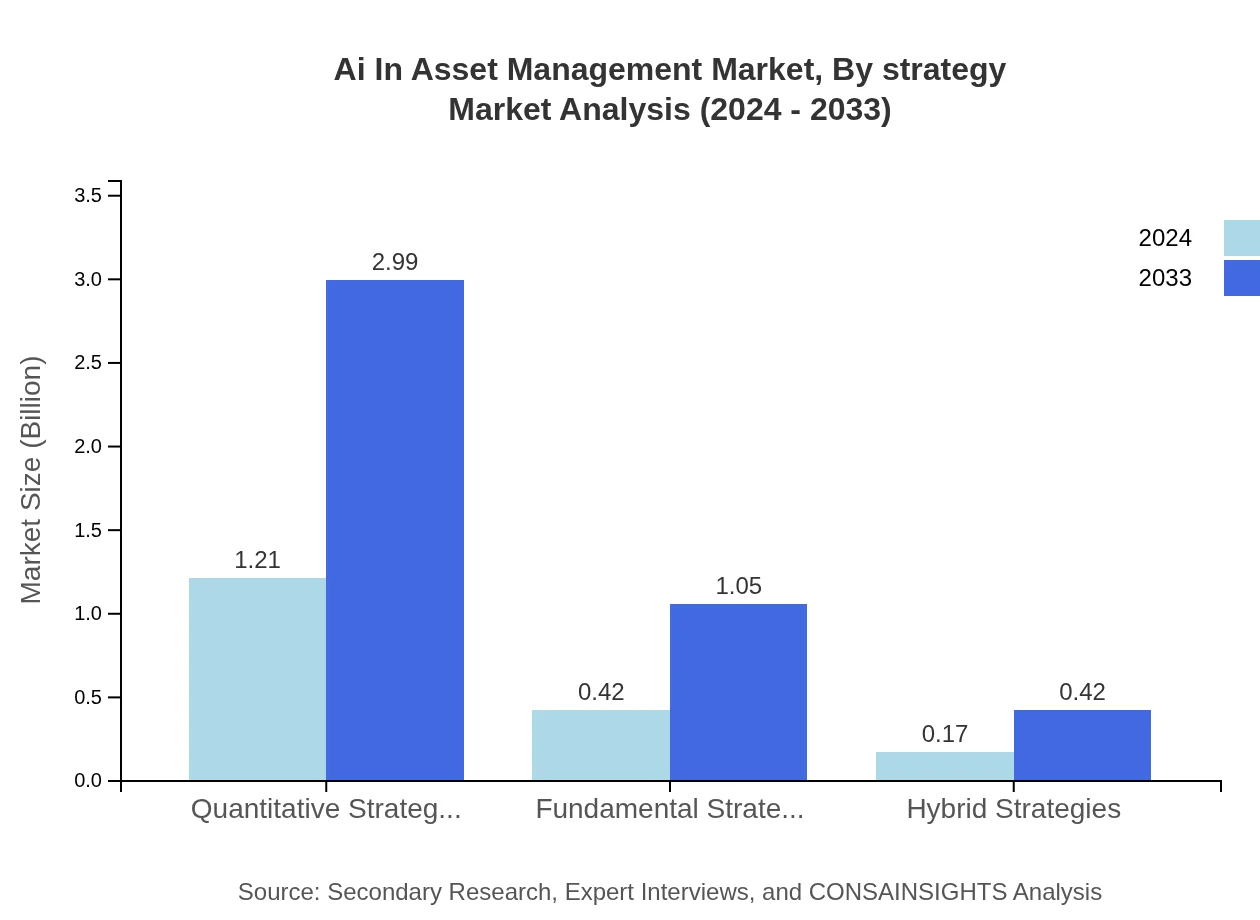

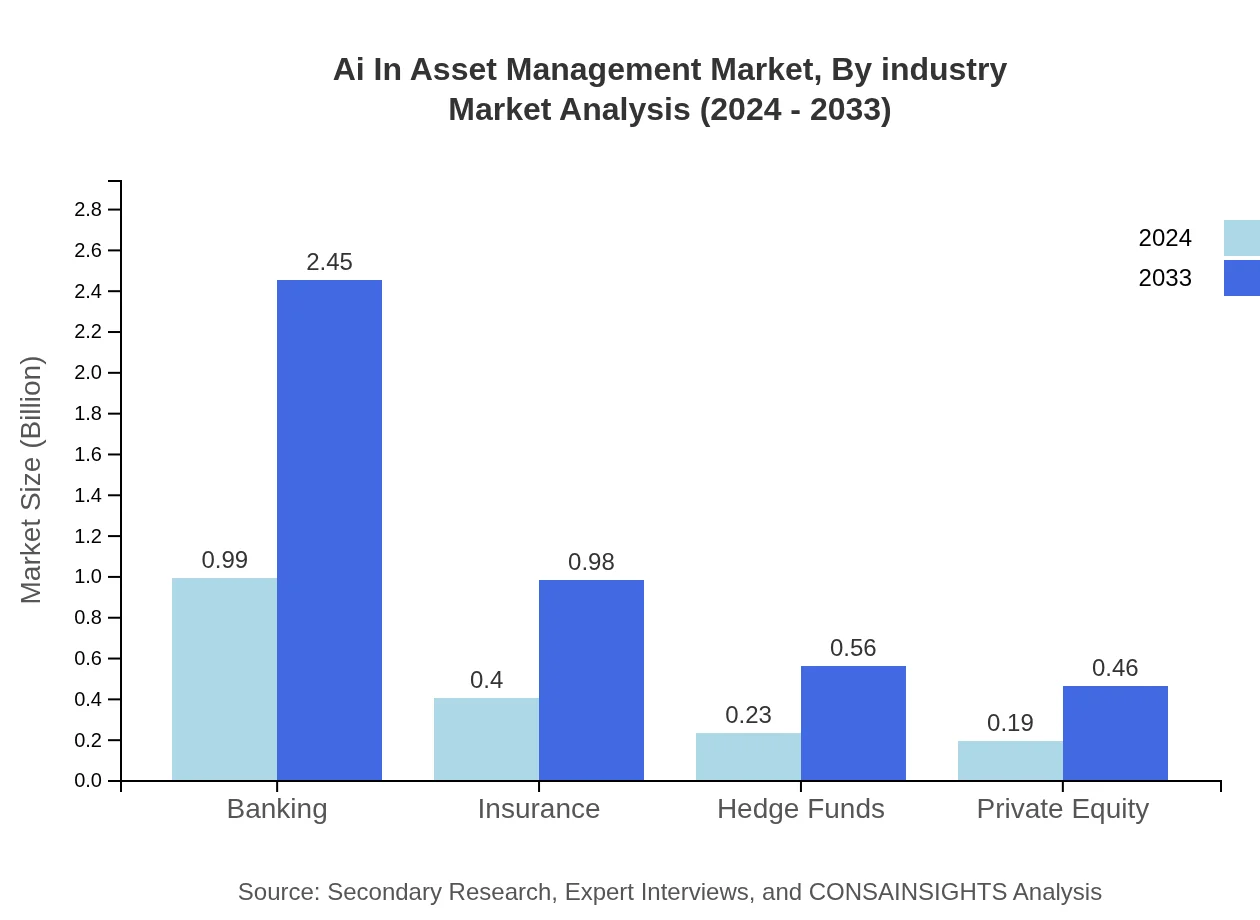

Ai In Asset Management Market Analysis By Strategy

The strategy segment of Ai In Asset Management covers critical areas such as Banking, Insurance, Hedge Funds, and Private Equity. In the banking segment, the market is anticipated to expand significantly from a size of 0.99 in 2024 to 2.45 in 2033, maintaining a steady market share of 55% over the forecast period. Insurance shows similar stability with its market size increasing from 0.40 to 0.98 and holding a 22.07% share. Hedge Funds and Private Equity also reflect similar confidence in growth with sizes moving from 0.23 to 0.56, and 0.19 to 0.46 respectively, accompanied by consistent market shares. Moreover, the incorporation of quantitative strategies, fundamental strategies, and hybrid strategies underlines a trend where data-driven decision-making is becoming central to asset management practices. These strategies, marked by their remarkable capacity for managing risk and creating diversified investment portfolios, continue to reinforce the overall industry momentum.

Ai In Asset Management Market Analysis By Technology

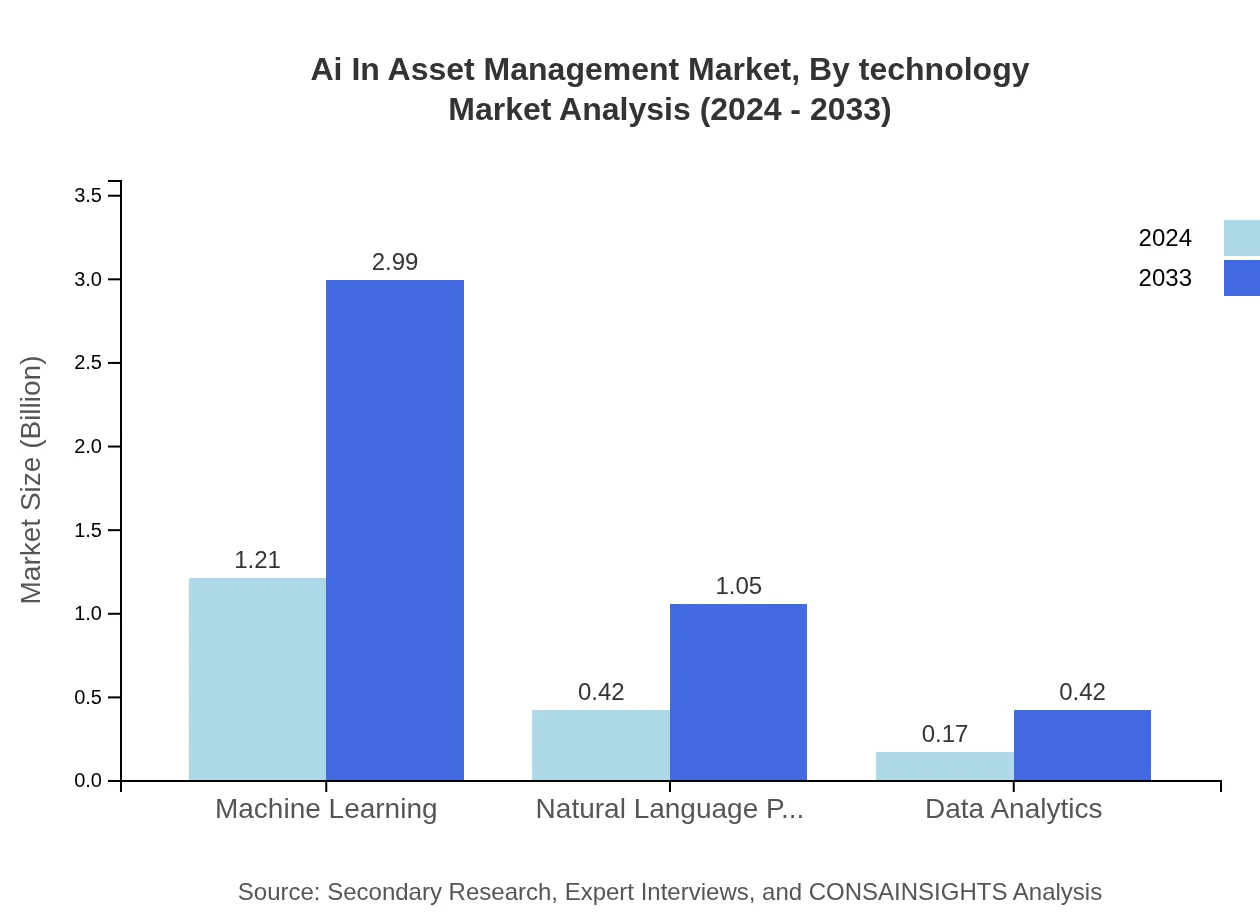

The technology aspect of the Ai In Asset Management market is driven by the rapid advancements in machine learning, natural language processing, and data analytics. Machine learning and natural language processing each show market sizes growing from 1.21 to 2.99 and from 0.42 to 1.05, respectively, and consistently holding significant market shares of 67.09% and 23.55%. Data analytics, although smaller in scale, is essential for transforming unstructured data into actionable insights. This technological evolution is central to refining asset allocation strategies, improving client interactions, and ensuring regulatory compliance. In a competitive environment where technological superiority often determines market leadership, innovations in these areas are projected to create a substantial impact on the efficiency and accuracy of asset management systems.

Ai In Asset Management Market Analysis By Service Type

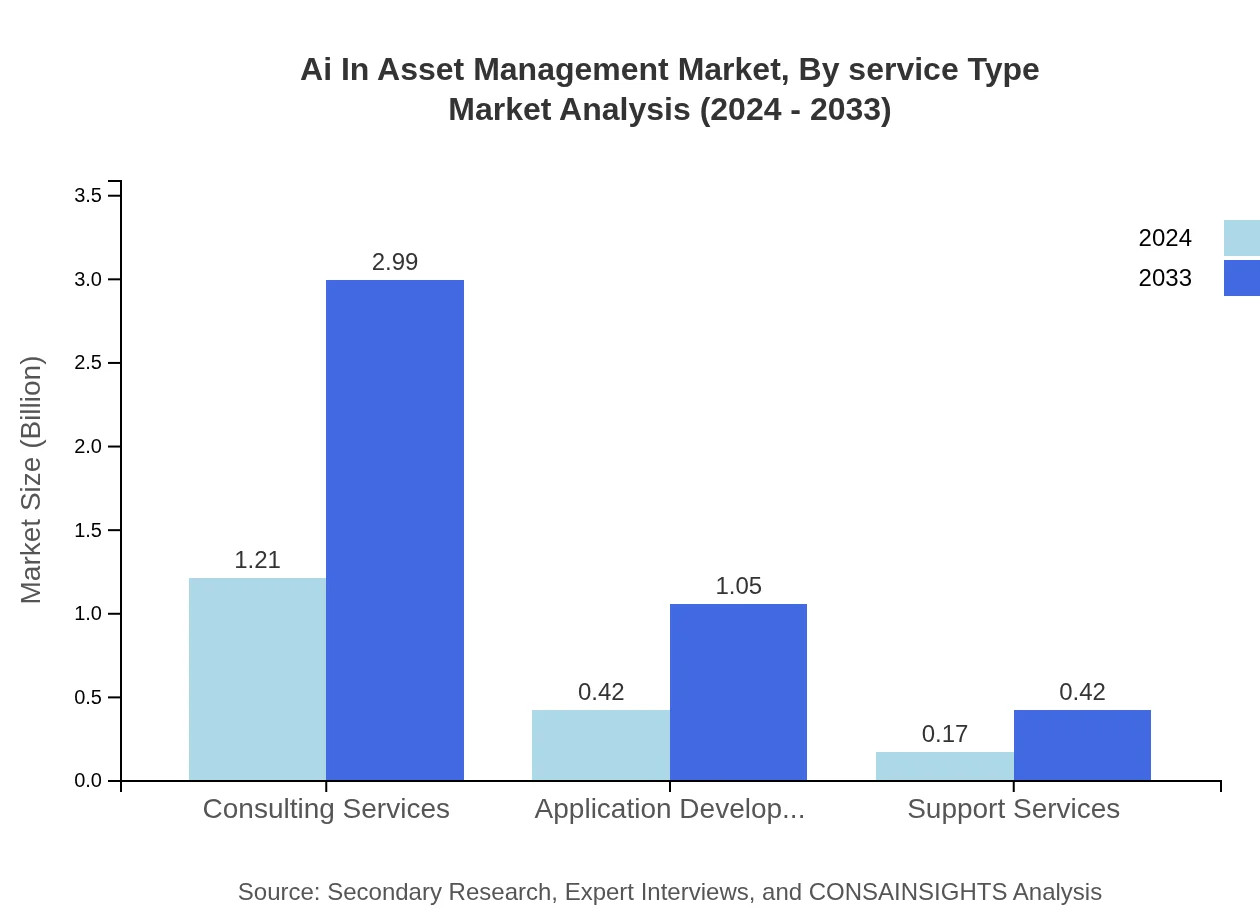

Service type segmentation in the Ai In Asset Management market is segmented primarily into consulting services, application development, and support services. The consulting services segment is fundamental due to its focus on integrating AI with traditional asset management techniques, and is projected to grow, mirroring trends seen in the technology segment. Application development is critical for designing bespoke AI solutions tailored to specific financial needs, while support services ensure continued operational and technical assistance. Together, these service types foster a comprehensive environment that underpins the digital transformation of asset management operations by providing end-to-end solutions that enhance operational efficiency and strategic decision-making.

Ai In Asset Management Market Analysis By Industry

The industry-focused segmentation highlights the performance and strategic importance of applying AI in diverse sectors such as banking, insurance, hedge funds, and private equity. Banking leads with robust figures and high market shares, bolstered by innovations that simplify customer-facing operations and internal risk management. Insurance is leveraging AI to improve underwriting accuracy and risk assessment, while hedge funds and private equity see AI as a tool for gaining competitive insights and optimizing performance through predictive analytics. This segment-specific focus illustrates how AI is tailored to meet the needs and challenges unique to each industry, facilitating robust growth and improved operational efficiencies.

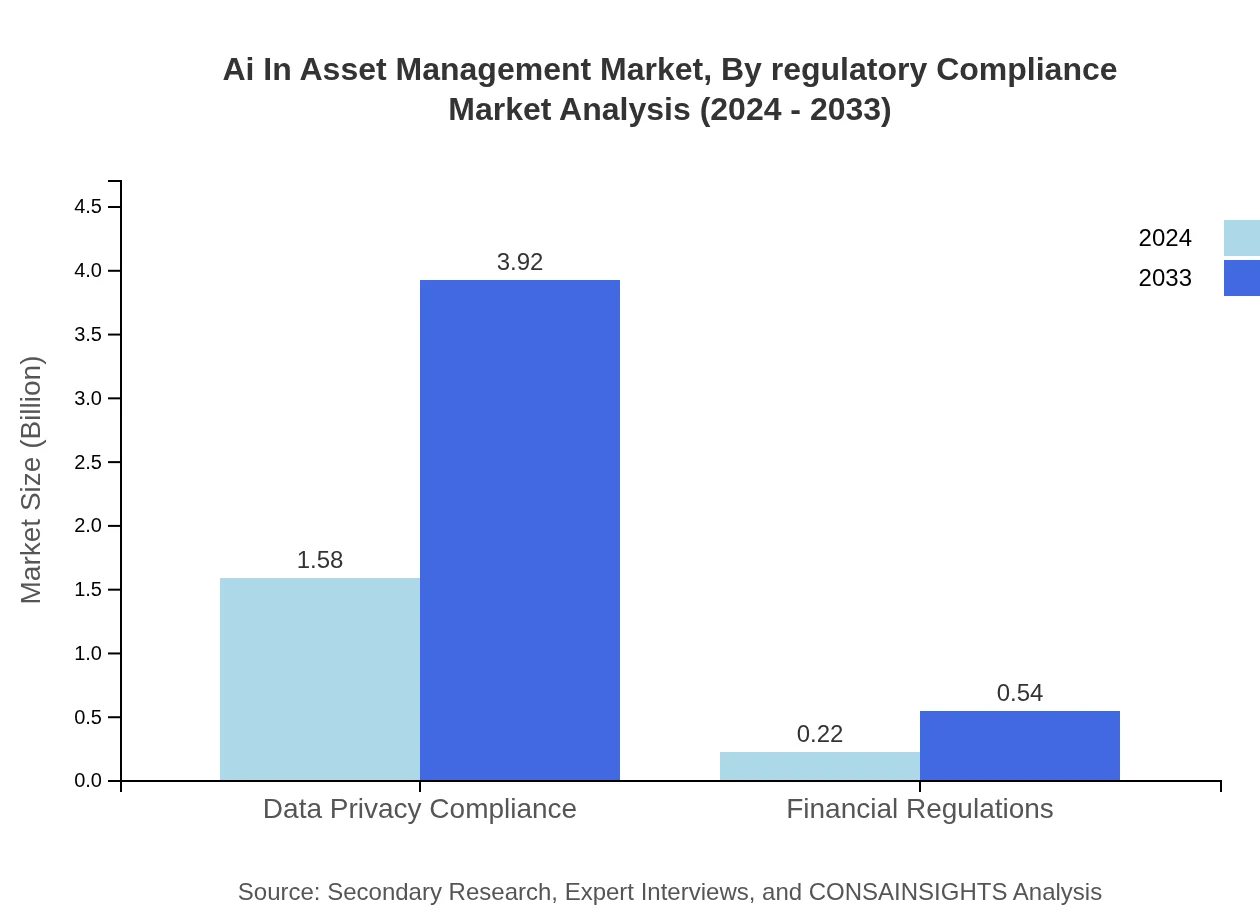

Ai In Asset Management Market Analysis By Regulatory Compliance

Regulatory compliance is increasingly pivotal as asset management firms embrace AI. In this segment, data privacy compliance and financial regulations are key focus areas. Data privacy compliance shows strong market presence with sizes growing from 1.58 to 3.92 while retaining a dominant market share of 87.82%, emphasizing the emphasis on protecting sensitive financial data. Similarly, financial regulations are receiving dedicated attention with market sizes growing from 0.22 to 0.54, ensuring that evolving legal frameworks are seamlessly integrated with technological developments. This adherence to regulatory standards is crucial in building trust, protecting consumer interests, and maintaining industry credibility, thus forming a cornerstone of the overall growth strategy.

Ai In Asset Management Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ai In Asset Management Industry

AlphaTech Financial Solutions:

AlphaTech Financial Solutions is a leader in integrating AI with asset management. The company is known for its cutting-edge machine learning platforms and data analytics tools which help optimize investment portfolios and streamline risk management.FinAI Innovations:

FinAI Innovations leverages artificial intelligence to drive automation in asset management. With a strong focus on natural language processing and advanced analytics, FinAI provides comprehensive digital solutions to bolster decision-making and operational efficiencies in the financial sector.InnoAsset Technologies:

InnoAsset Technologies is renowned for its innovative approach to deploying AI in asset management. The company offers bespoke solutions that integrate predictive analytics and automated workflows, thereby enhancing precision and strategic asset allocation for global financial institutions.We're grateful to work with incredible clients.

FAQs

What is the market size of AI in Asset Management?

The AI in Asset Management market is projected to grow from $1.8 billion in 2024, with a robust CAGR of 10.2%, reaching new heights in the coming years. This growth reflects increasing adoption across various financial sectors.

What are the key market players or companies in the AI in Asset Management industry?

Key players in the AI in Asset Management industry include major financial institutions, innovative fintech companies, and technology providers specializing in asset management solutions, ensuring a competitive landscape that drives ongoing technological advancements.

What are the primary factors driving the growth in the AI in Asset Management industry?

Factors driving growth include enhanced data analytics capabilities, increasing demand for automation, improved risk management strategies, and the necessity to comply with financial regulations, all of which are facilitated by AI technology.

Which region is the fastest Growing in the AI in Asset Management?

North America is expected to lead in the AI in Asset Management market, projected to grow from $0.61 billion in 2024 to $1.51 billion by 2033, showcasing a significant development trajectory ahead of other regions.

Does ConsaInsights provide customized market report data for the AI in Asset Management industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the AI in Asset Management industry, ensuring relevant insights and actionable intelligence to drive strategic decisions.

What deliverables can I expect from this AI in Asset Management market research project?

Expect comprehensive deliverables including detailed market analysis, forecasts, competitive landscape assessments, regional insights, and segment-wise evaluations, providing a holistic view of the AI in Asset Management space.

What are the market trends of AI in Asset Management?

Trends include increasing reliance on machine learning and data analytics, heightened focus on data privacy compliance, and the growing use of hybrid and fundamental strategies, underscoring a shift towards more intelligent investment methodologies.