Ai In Investment Management

Published Date: 24 January 2026 | Report Code: ai-in-investment-management

Ai In Investment Management Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report provides an in-depth analysis of the Ai In Investment Management market, covering key insights, performance metrics, and future forecasts from 2024 to 2033. The analysis encompasses market size, growth trends, regional breakdown, segmentation, and technological innovations, offering a holistic view of the industry’s evolving landscape and anticipated developments.

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

| 2024 Market Size | $1.50 Billion |

| CAGR (2024-2033) | 7.2% |

| 2033 Market Size | $2.86 Billion |

| Top Companies | AlphaFinTech Solutions, InvestAI Global, Quantum Investment Technologies |

| Last Modified Date | 24 January 2026 |

Ai In Investment Management Market Overview

Customize Ai In Investment Management market research report

- ✔ Get in-depth analysis of Ai In Investment Management market size, growth, and forecasts.

- ✔ Understand Ai In Investment Management's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ai In Investment Management

What is the Market Size & CAGR of Ai In Investment Management market in 2024?

Ai In Investment Management Industry Analysis

Ai In Investment Management Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ai In Investment Management Market Analysis Report by Region

Europe Ai In Investment Management:

The European market, with figures expanding from 0.37 in 2024 to 0.71 in 2033, is characterized by advanced technological infrastructure and progressive regulatory policies that foster innovation. European financial institutions are increasingly embracing AI to optimize investment strategies and improve risk management practices. Collaborative efforts between regulatory bodies and technology companies are setting high standards for data privacy and security, thereby reinforcing the growth trajectory of AI in investment management.Asia Pacific Ai In Investment Management:

In Asia Pacific, the adoption of Ai In Investment Management is gaining rapid momentum. With market figures rising from 0.30 in 2024 to an anticipated 0.58 by 2033, the region’s expanding financial markets and progressive regulatory frameworks drive demand for innovative AI solutions. Increased investments in fintech and rising awareness of digital trading platforms support this upward trend. Regional governments are actively endorsing technological developments, positioning Asia Pacific as a hotspot for innovation in investment management.North America Ai In Investment Management:

North America remains a dominant player in the Ai In Investment Management market, where the market size is poised to grow from 0.57 in 2024 to 1.09 by 2033. The region benefits from a mature financial ecosystem, high investment in research and development, and a robust pipeline of AI innovations. Prominent venture capital activity and strategic collaborations between fintech companies and traditional financial institutions reinforce North America’s leadership position.South America Ai In Investment Management:

South America is emerging as a promising market with increased interest in sophisticated investment tools. Despite lower initial figures, the region is forecasted to witness steady growth in AI adoption, driven by modernization efforts within financial institutions. The market is evolving with improved digital infrastructure and regulatory reforms that seek to balance innovation with risk management, paving the way for enhanced AI integration in investment management practices.Middle East & Africa Ai In Investment Management:

In the Middle East and Africa, the market is evolving steadily, with anticipated growth from 0.14 in 2024 to 0.26 in 2033. Although still in its nascent stages compared to other regions, factors such as rising economic diversification, increased digital penetration, and proactive government initiatives are driving interest in AI-powered investment solutions. These regions are expected to benefit significantly from tailored technology integration, which addresses unique market challenges and enhances competitive positioning.Tell us your focus area and get a customized research report.

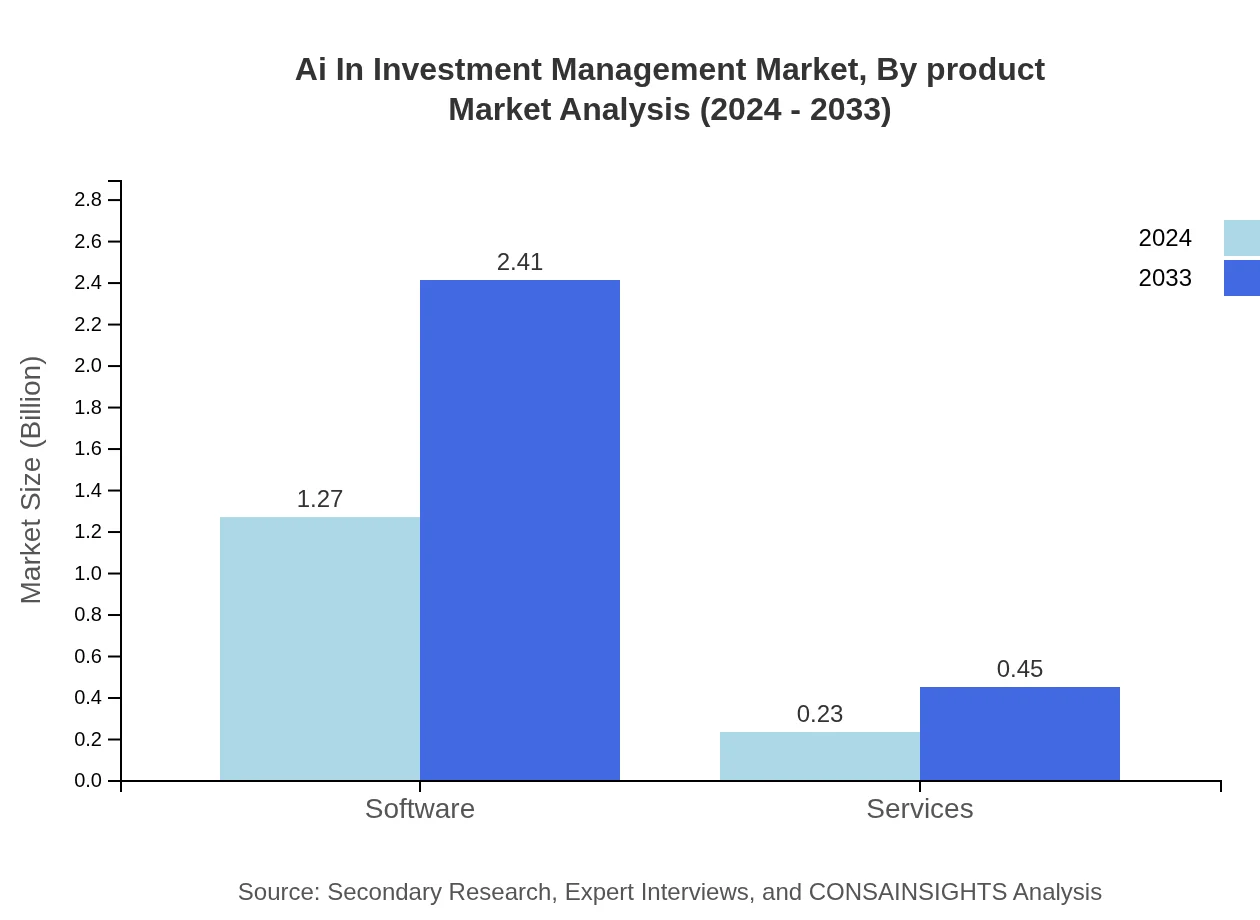

Ai In Investment Management Market Analysis By Product

The by-product segment in Ai In Investment Management primarily focuses on the software and services components. The software component, with a market size increasing from 1.27 in 2024 to 2.41 in 2033, commands a dominant share of 84.37% in both forecasted periods. This segment includes advanced algorithmic trading systems, portfolio optimization tools, and data processing software. In contrast, the services component, though smaller in size—growing from 0.23 to 0.45—is essential in delivering technical support, consultancy, and system integration services. The balance between these product offerings is crucial for meeting varied client needs, ensuring seamless operations, and promoting the overall scalability of the market.

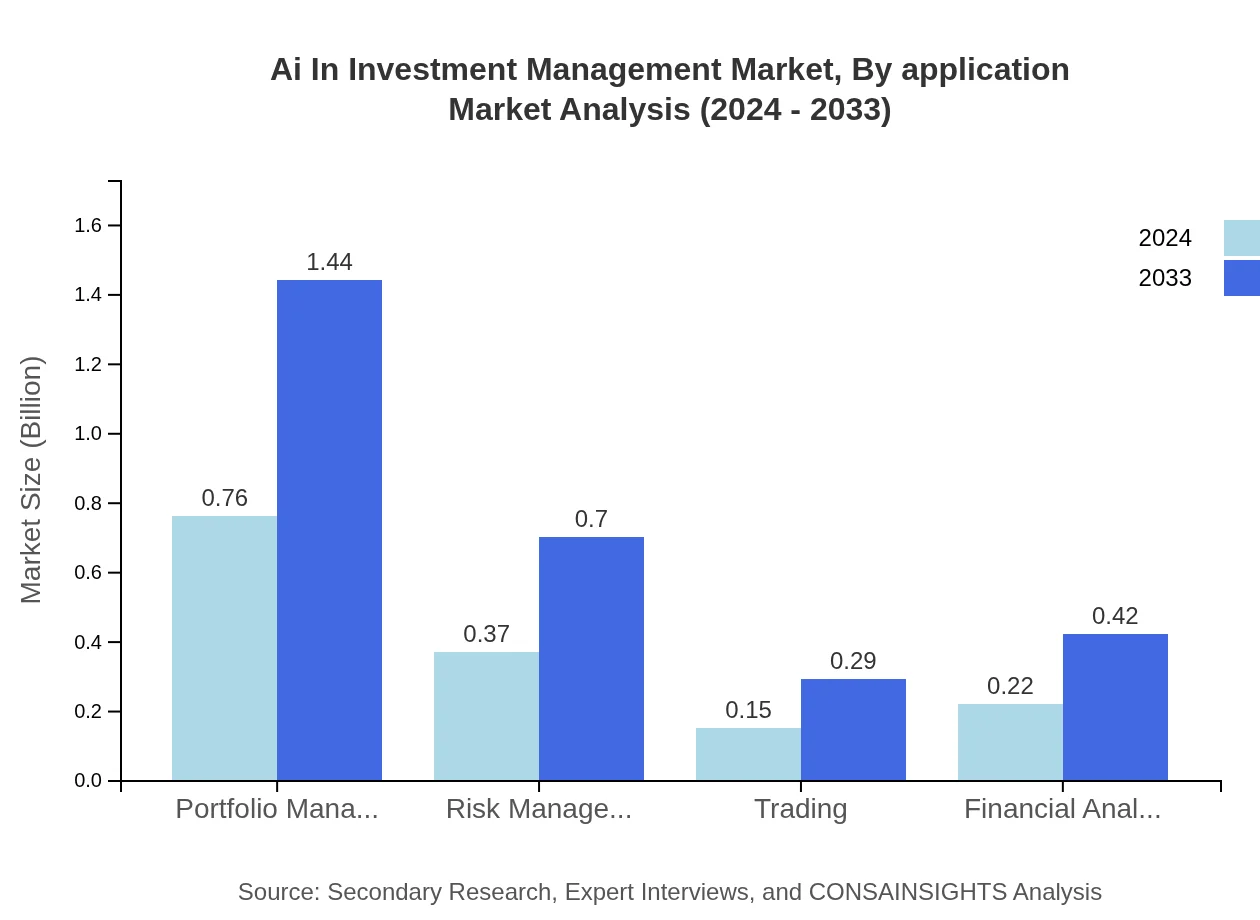

Ai In Investment Management Market Analysis By Application

Application segmentation in the Ai In Investment Management market delves into multiple investment processes including portfolio management, risk management, trading, and financial analysis. Portfolio management, accounting for a market share of 50.52%, leads the application segment. Risk management and trading follow, with shares of 24.65% and 10.03% respectively, while financial analysis constitutes around 14.8% of the application market. These applications are critical in leveraging AI for predictive analytics, automated decision-making, and dynamic risk assessment. Advanced algorithms and machine learning facilitate the accurate analysis of large datasets, enabling investment managers to optimize asset allocation and achieve better returns on investments.

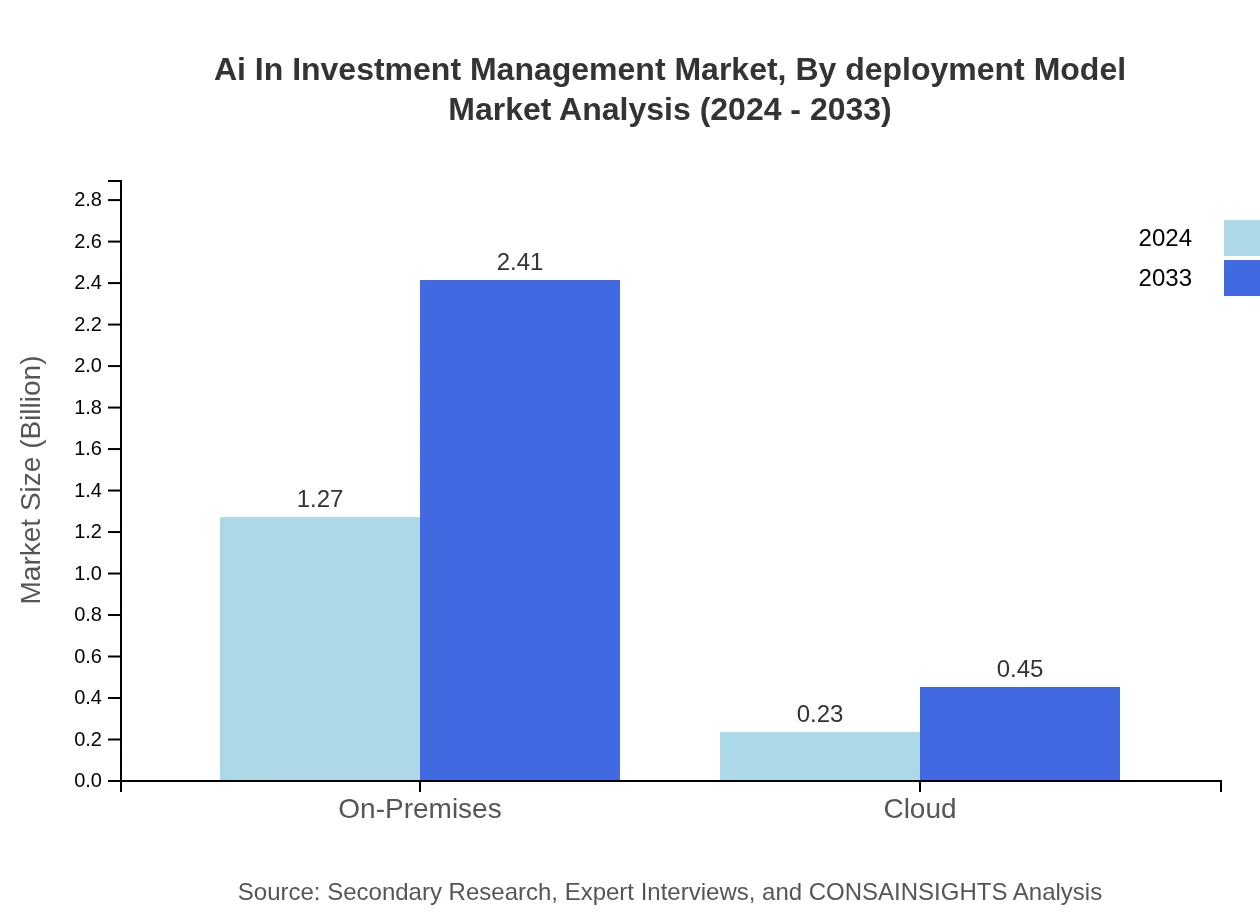

Ai In Investment Management Market Analysis By Deployment Model

The deployment model segmentation identifies two principal categories: on-premises and cloud-based solutions. On-premises solutions have a substantial presence in the market, with a market size of 1.27 growing to 2.41 by 2033 and retaining an 84.37% share. These systems offer enhanced control and security for large financial institutions with rigorous compliance requirements. In contrast, cloud-based models, although smaller—measuring 0.23 rising to 0.45 in size and maintaining a 15.63% share—are gaining popularity due to lower upfront costs, scalability, and rapid deployment. The coexistence of these models caters to diverse organizational needs, balancing legacy infrastructure with innovative, agile solutions that are paramount in today’s fast-paced financial markets.

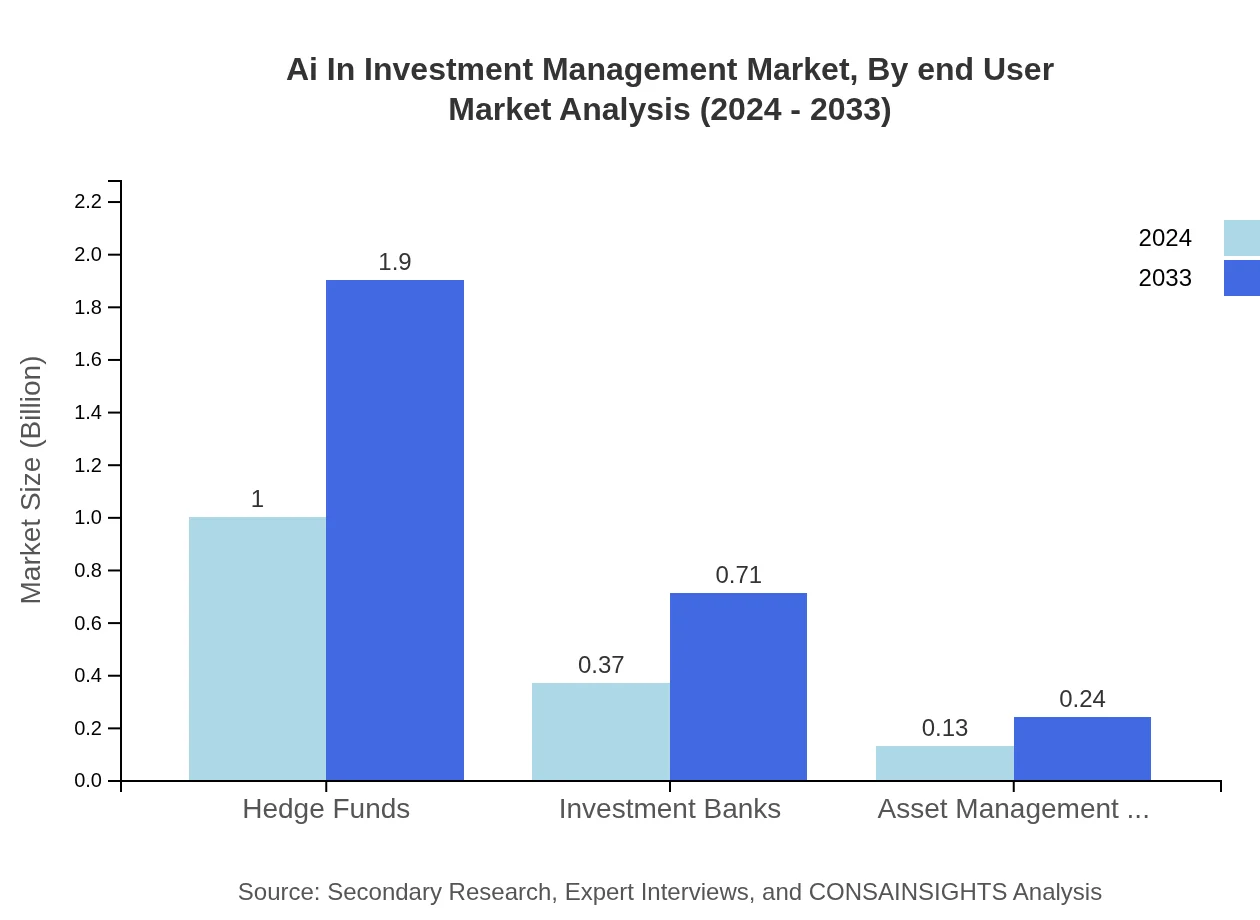

Ai In Investment Management Market Analysis By End User

End-user segmentation in the Ai In Investment Management market is divided among various financial institutions such as hedge funds, investment banks, and asset management firms. Hedge funds, with a robust market size that grows from 1.00 to 1.90 and account for 66.69% of the market share, are at the forefront of adopting AI for enhanced trading strategies and risk profiling. Investment banks, carrying a market share of 24.76%, utilize AI to streamline mergers, acquisitions, and capital market operations. Asset management firms, although representing a smaller segment with an 8.55% share, are increasingly integrating AI-driven analytics to better manage client portfolios. This segmentation underscores the diverse applications of AI across various institutional frameworks, each seeking to harness technology to secure competitive advantages in financial operations.

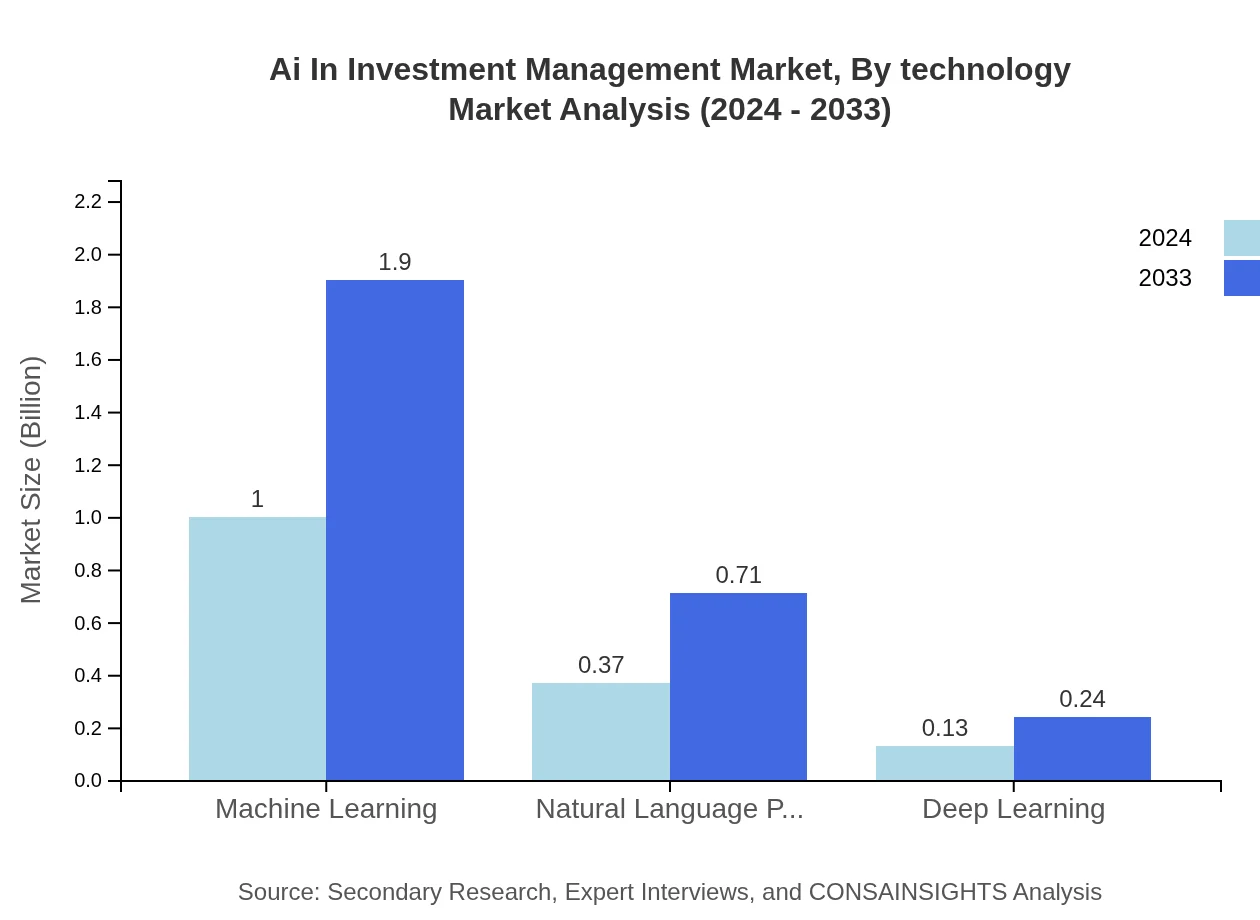

Ai In Investment Management Market Analysis By Technology

The technology segmentation examines the importance of advanced computational techniques in driving industry growth. Key technological components include machine learning, natural language processing, and deep learning. Machine learning, with a market size expanding from 1.00 to 1.90 and commanding a share of 66.69%, is the backbone of AI innovations within investment management. Natural language processing, essential for processing and interpreting financial news and reports, holds a market share of 24.76% with growth aligned with market expansion. Deep learning, though representing a smaller segment at 8.55%, is vital for complex pattern recognition and data analytics tasks. These technologies collectively empower investment managers to deploy predictive models, automate complex analyses, and gain deeper insights into market trends, thereby transforming traditional investment decision processes.

Ai In Investment Management Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ai In Investment Management Industry

AlphaFinTech Solutions:

AlphaFinTech Solutions is a pioneer in integrating advanced AI algorithms within investment management frameworks. Their comprehensive suite of predictive analytics and portfolio management tools have set industry benchmarks for innovation and efficiency, making them a top choice for institutional investors worldwide.InvestAI Global:

InvestAI Global leverages cutting-edge machine learning and deep learning technologies to offer robust risk management and trading solutions. With a global footprint and strong R&D capabilities, they are known for developing highly scalable, cloud-enabled investment platforms that cater to both large financial institutions and boutique funds.Quantum Investment Technologies:

Quantum Investment Technologies specializes in natural language processing and real-time data analytics, empowering analysts to quickly adapt to market changes. Their innovative approach in integrating AI across multiple investment processes positions them as a key influencer in the evolving digital investment landscape.We're grateful to work with incredible clients.

FAQs

What is the market size of AI in Investment Management?

The AI in Investment Management market is projected to reach $1.5 billion by 2024, with a compound annual growth rate (CAGR) of 7.2%. The robustness of this market reflects ongoing advancements in AI technologies enhancing investment strategies.

What are the key market players in the AI in Investment Management industry?

Key players in the AI in Investment Management industry include prominent hedge funds, investment banks, and technology firms that specialize in financial services AI solutions. These companies leverage AI for analytics, risk assessment, and portfolio management.

What are the primary factors driving the growth in the AI in Investment Management industry?

Growth in the AI in Investment Management industry is primarily driven by increasing asset management needs, advancements in machine learning, and the need for enhanced risk management solutions. The desire for improved efficiencies and investment returns also propels this market.

Which region is the fastest Growing in AI in Investment Management?

North America is the fastest-growing region in the AI in Investment Management sector, expected to grow from $0.57 billion in 2024 to $1.09 billion by 2033, driven by strong adoption of AI technologies in financial services.

Does Consainsights provide customized market report data for the AI in Investment Management industry?

Yes, Consainsights offers customized market report data for the AI in Investment Management sector, allowing clients to access tailored insights that meet specific business needs and facilitate informed decision-making.

What deliverables can I expect from this AI in Investment Management market research project?

From this AI in Investment Management market research project, you can expect comprehensive reports including market forecasts, competitive analysis, regional insights, and segmentation data across various AI applications in investment management.

What are the market trends of AI in Investment Management?

Current trends in the AI in Investment Management market include growing uptake of cloud-based solutions, increasing reliance on machine learning for financial analysis, and an upswing in AI-driven risk management strategies, shaping competitive advantages in investment portfolios.