Ai In Wealth Management

Published Date: 24 January 2026 | Report Code: ai-in-wealth-management

Ai In Wealth Management Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report delves into the AI in Wealth Management market, offering in-depth insights, data analysis, and forecast projections for 2024-2033. It covers current market conditions, industry trends, segmentation details, and technological innovations, ensuring that investors and stakeholders gain a nuanced understanding of growth catalysts, challenges, and competitive dynamics.

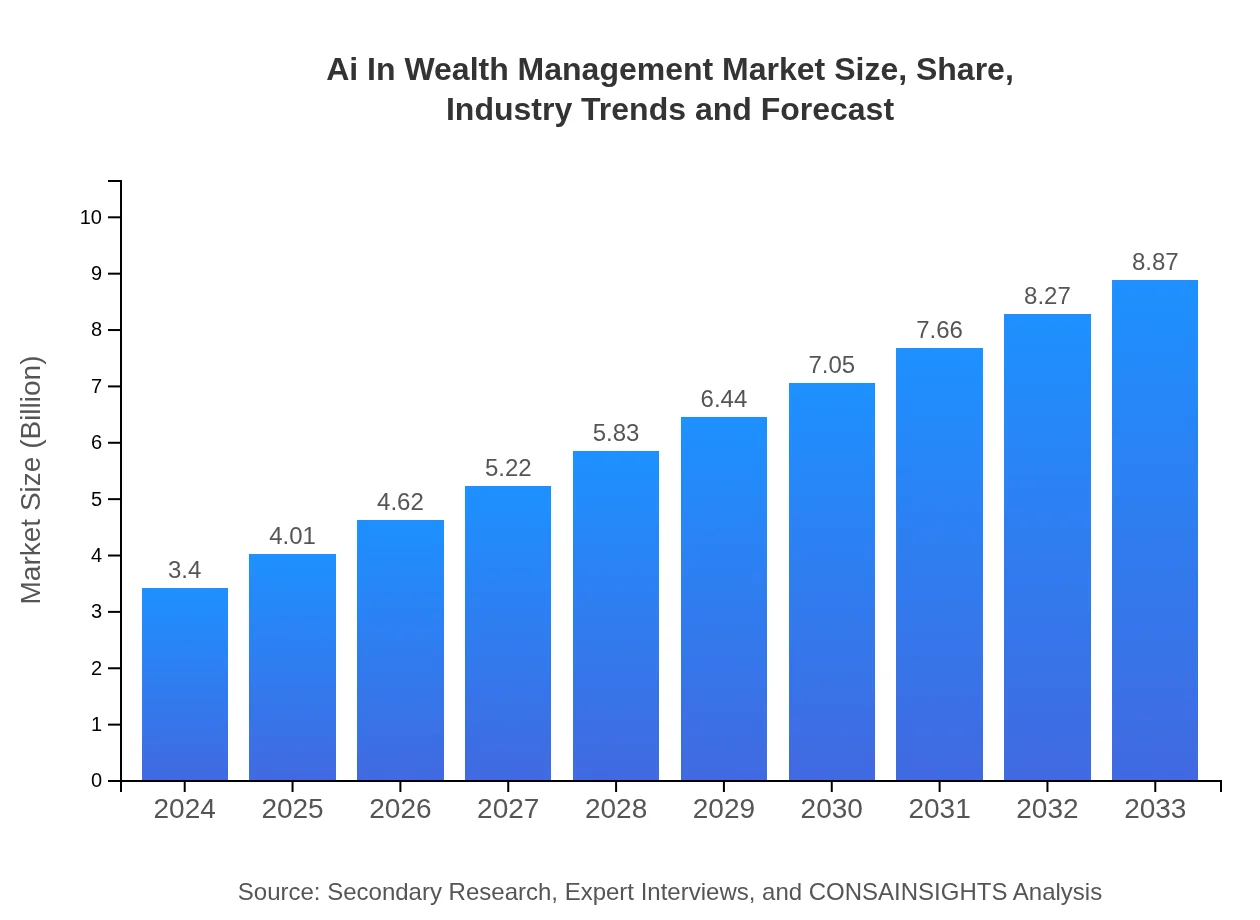

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

| 2024 Market Size | $3.40 Billion |

| CAGR (2024-2033) | 10.8% |

| 2033 Market Size | $8.87 Billion |

| Top Companies | FinTech Innovations Inc., WealthTech Global |

| Last Modified Date | 24 January 2026 |

Ai In Wealth Management Market Overview

Customize Ai In Wealth Management market research report

- ✔ Get in-depth analysis of Ai In Wealth Management market size, growth, and forecasts.

- ✔ Understand Ai In Wealth Management's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ai In Wealth Management

What is the Market Size & CAGR of Ai In Wealth Management market in {Year}?

Ai In Wealth Management Industry Analysis

Ai In Wealth Management Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ai In Wealth Management Market Analysis Report by Region

Europe Ai In Wealth Management:

Europe’s market for AI in Wealth Management is also on a positive trajectory. Starting at 1.09 billion in 2024 and expected to almost triple to 2.84 billion by 2033, the region benefits from a high concentration of financial services companies and tech innovators. European markets are particularly focused on enhancing regulatory compliance and integrating AI for advanced predictive analytics. Progressive government policies and partnerships between traditional banks and fintech startups further accentuate the market’s growth potential.Asia Pacific Ai In Wealth Management:

In the Asia Pacific region, the market is witnessing gradual yet significant growth. Starting with a market size of approximately 0.65 billion in 2024, projections indicate an expansion to 1.69 billion by 2033. Key factors driving growth in this region include rapid digital transformation, increased adoption of fintech innovations, and supportive regulatory policies. Financial institutions are investing in AI technologies to enhance customer engagement and improve service delivery. Emerging economies in this region demonstrate robust potential due to a growing middle class and heightened demand for advanced wealth management solutions.North America Ai In Wealth Management:

North America remains a leading market with a strong foundation in technological innovation. Valued at 1.15 billion in 2024 and with projections to reach 2.99 billion by 2033, the region boasts high levels of investment in AI-driven financial technologies. This growth is largely attributed to advanced research and development, robust financial institutions, and early adoption of AI tools. The region’s mature regulatory environment further supports innovation while ensuring data privacy and security.South America Ai In Wealth Management:

South America exhibits cautious optimism as it embarks on digital transformation in financial services. With a market size of 0.22 billion in 2024 projected to rise to 0.58 billion by 2033, the adoption of AI in wealth management is gradually shifting investor behavior and institutional practices. Despite challenges such as limited digital infrastructure in some areas, the region benefits from a vibrant fintech scene and increasing governmental support, which paves the way for modernization in wealth management practices over the coming decade.Middle East & Africa Ai In Wealth Management:

The Middle East and Africa region, with a current market size of 0.29 billion in 2024 projected to grow to 0.77 billion by 2033, is gradually embracing AI as a tool for improving wealth management practices. Increased digital penetration, a growing number of high net worth individuals, and significant investments in technology infrastructure are spurring market growth. Although the region faces challenges related to economic diversification and regulatory consistency, ongoing digital initiatives and increased interest from global investors signal a promising future for AI-enabled financial services.Tell us your focus area and get a customized research report.

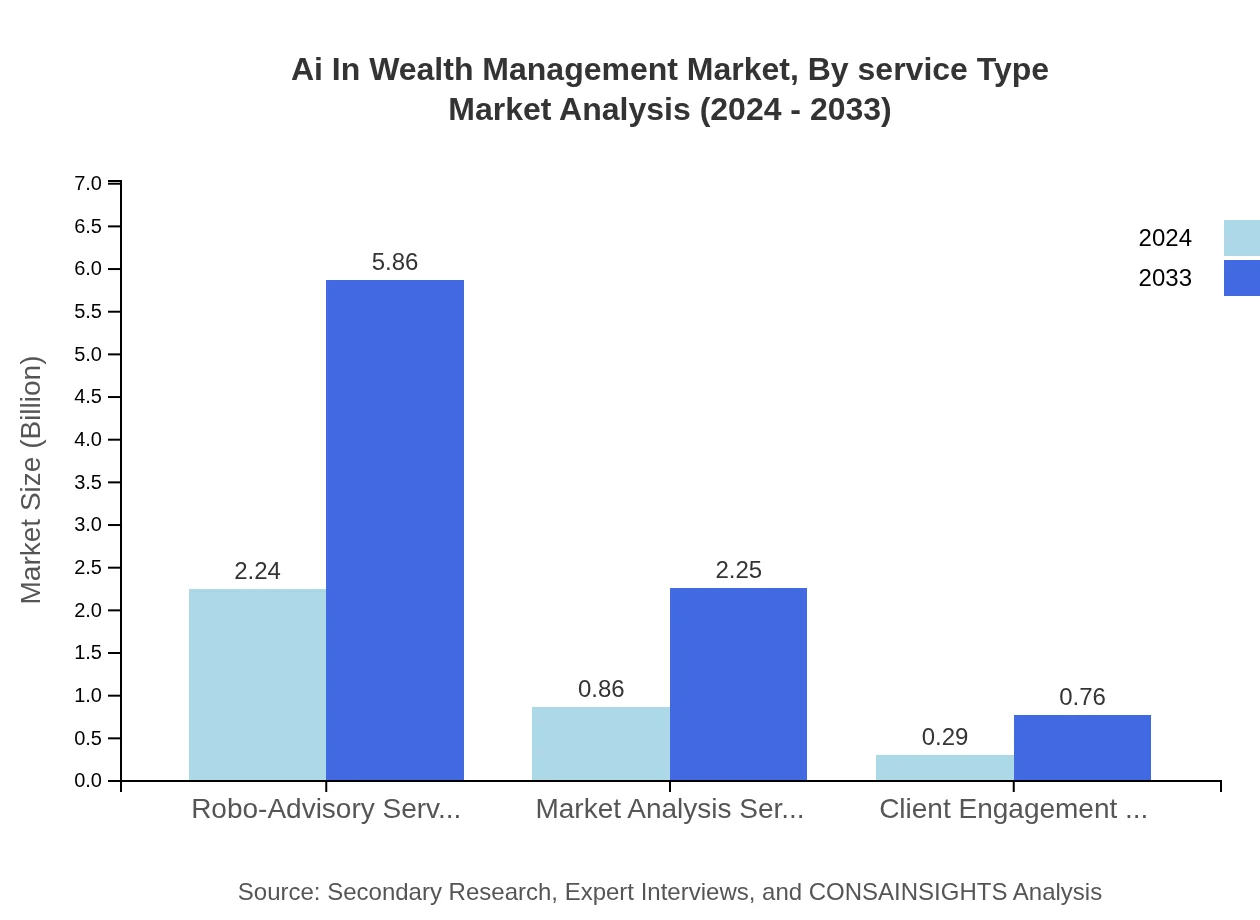

Ai In Wealth Management Market Analysis By Service Type

The service type segmentation of the AI in Wealth Management market includes key components such as robo-advisory services, market analysis services, and client engagement services. Robo-advisory services are revolutionizing wealth management by offering automated, data-driven investment advice with minimal human intervention. Market analysis services combine AI-driven data insights and predictive analytics to monitor market dynamics and facilitate sound investment strategies. Meanwhile, client engagement services leverage natural language processing and interactive interfaces to enhance communication and personalize client experiences. The growth in this segment is supported by the increasing digital transformation of financial services, expanding consumer adoption, and the quest for operational efficiency. Improved user interfaces and the integration of advanced analytics are drawing more institutions to adopt these AI-enabled services, consolidating their role as indispensable tools in the modern wealth management landscape.

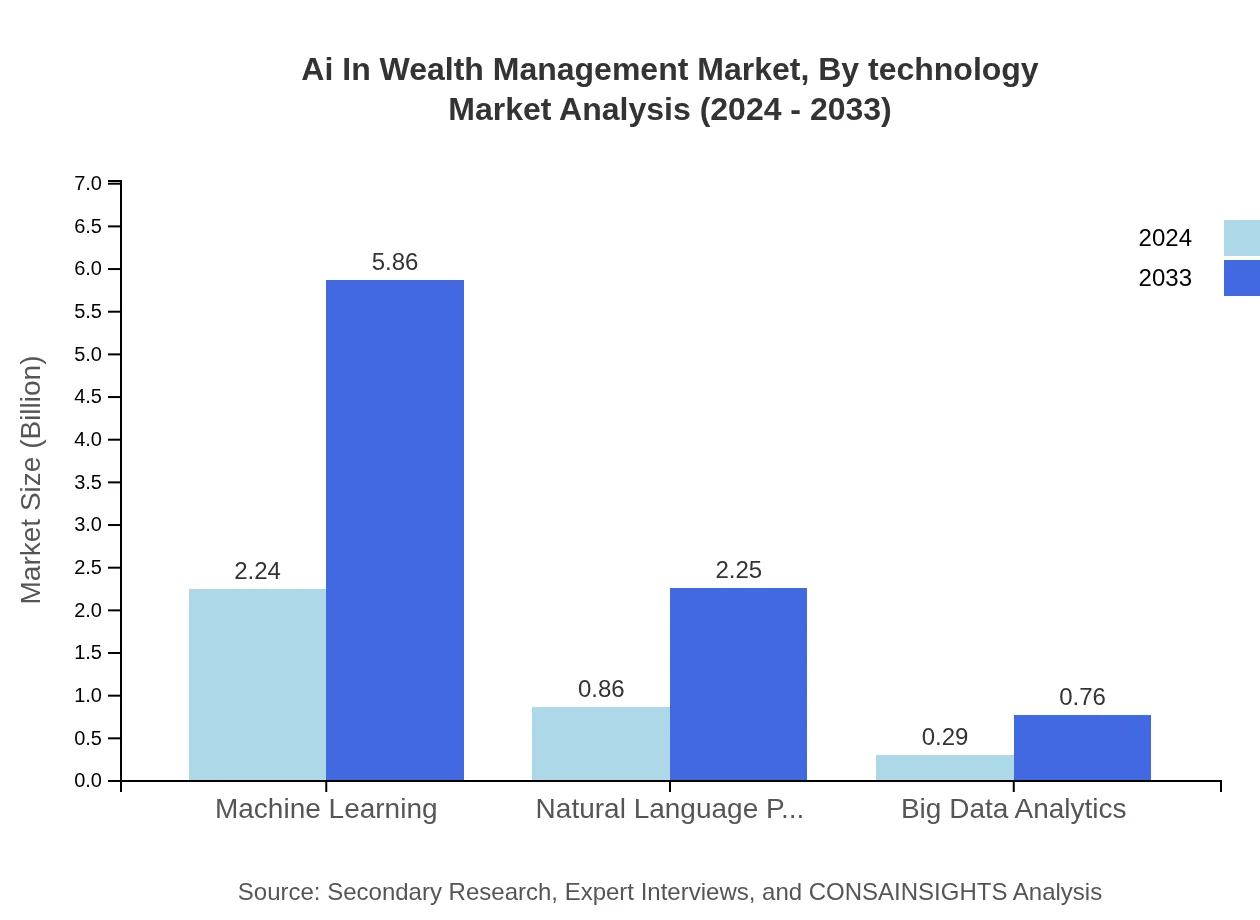

Ai In Wealth Management Market Analysis By Technology

Within the realm of technology, the AI in Wealth Management market is predominantly driven by machine learning, natural language processing, and big data analytics. Machine learning algorithms are at the core of intelligent investment strategies, supporting data interpretation and decision-making processes. Natural language processing facilitates enhanced customer interactions and the automation of routine financial tasks, significantly reducing response times and improving service quality. Big data analytics aggregates extensive, real-time data to generate actionable insights for asset management and risk mitigation. Collectively, these technologies empower financial institutions to refine client strategies, improve forecasting accuracy, and maintain competitive agility. As data volumes continue to grow exponentially, the seamless integration of these technologies will be critical in ensuring that wealth management services are both efficient and adaptable to evolving market complexities.

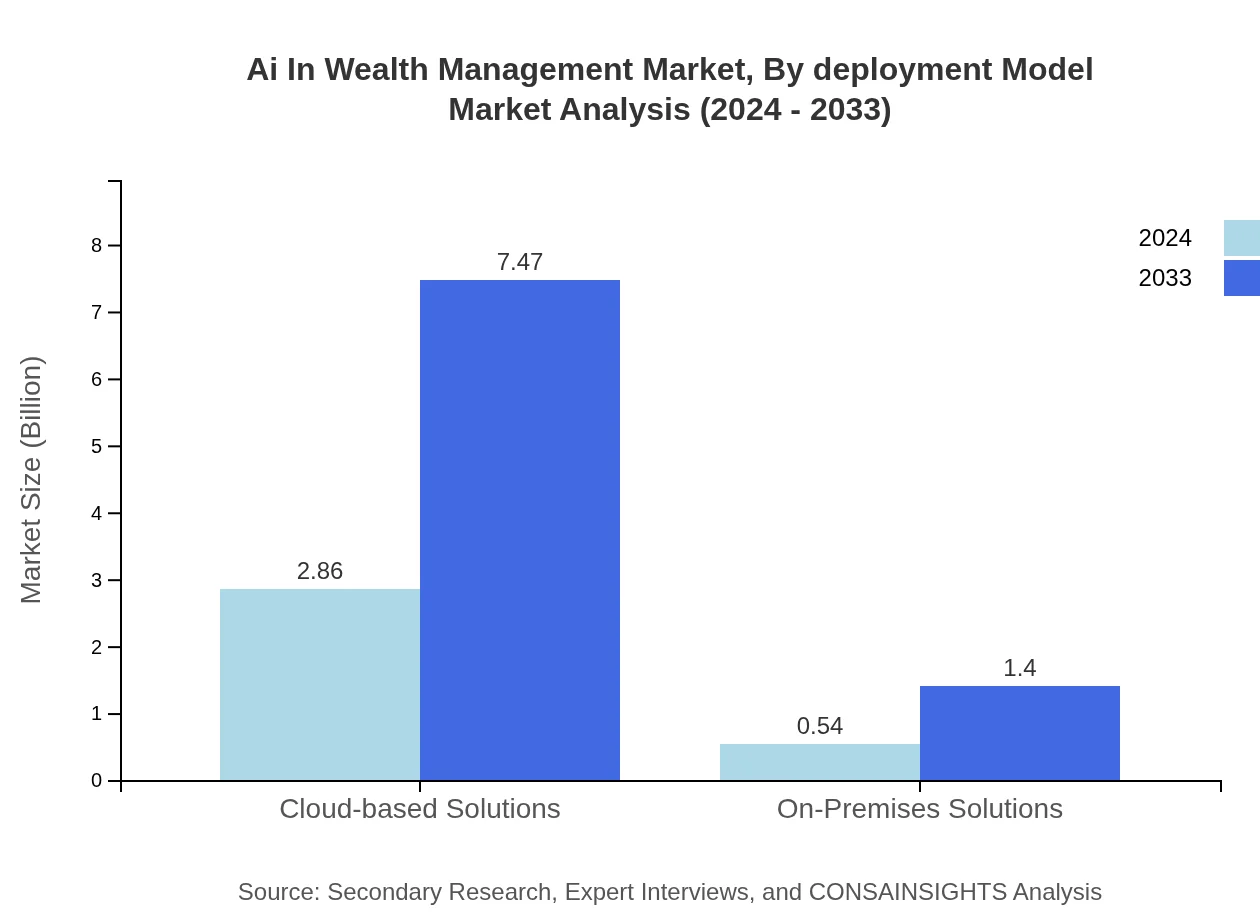

Ai In Wealth Management Market Analysis By Deployment Model

The deployment model segmentation includes cloud-based solutions and on-premises solutions, each offering distinct benefits to wealth management providers. Cloud-based solutions dominate the market with a substantial market share due to their scalability, flexibility, and cost-effectiveness. They allow financial institutions to rapidly deploy AI tools, access real-time data, and ensure continuous updates to software applications without heavy initial investments in hardware infrastructure. In contrast, on-premises solutions offer enhanced control and security, which is critical for organizations with strict data governance and regulatory requirements. Despite generally lower market penetration compared to cloud adoption, on-premises deployment remains a viable option for institutions that prioritize data sovereignty and robust security protocols. The evolving landscape is prompting vendors to offer hybrid solutions, blending the agility of the cloud with the security of on-premises systems, thereby expanding the deployment options available to diverse client requirements.

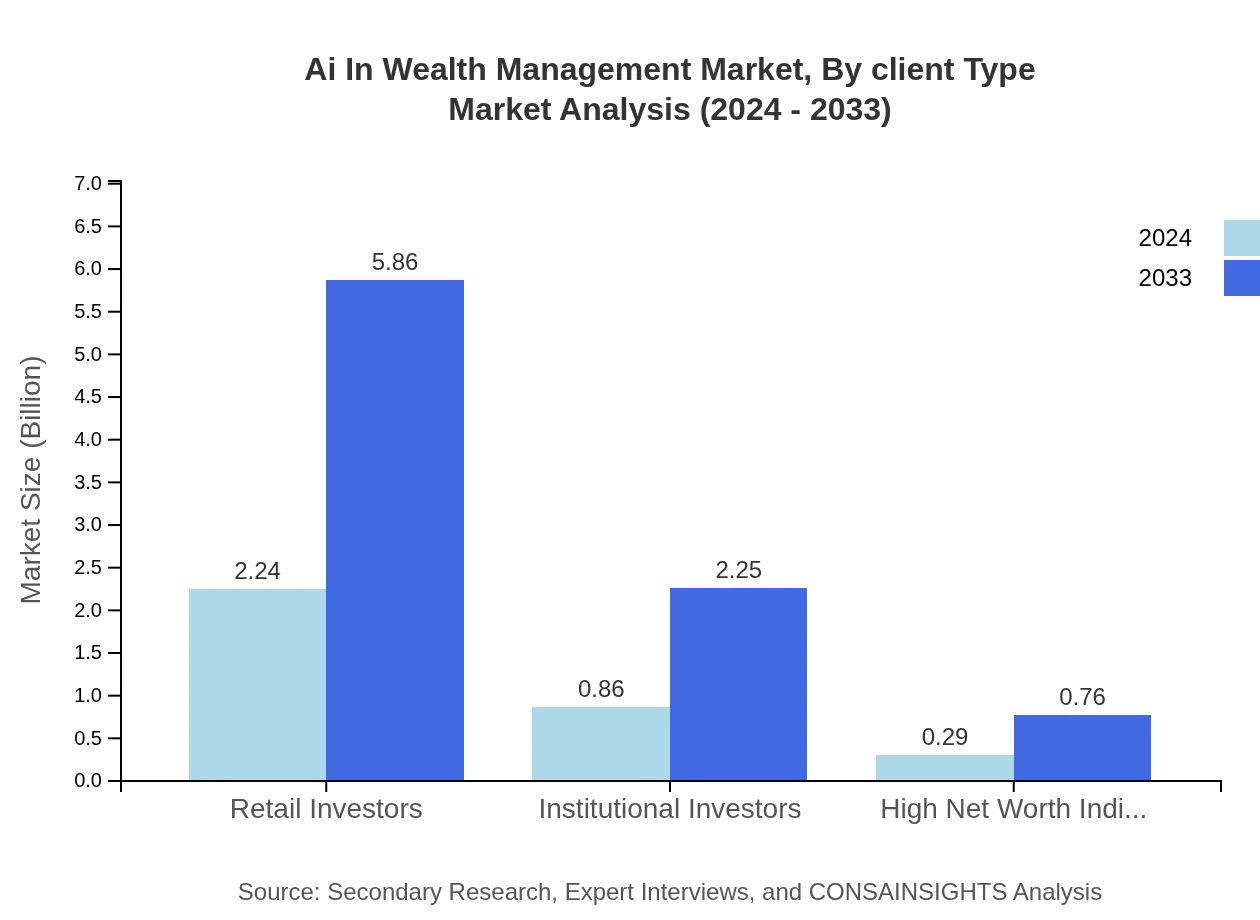

Ai In Wealth Management Market Analysis By Client Type

The client type segmentation categorizes the market into retail investors, institutional investors, and high net worth individuals. Retail investors are increasingly leveraging AI-powered platforms to access previously institutional-grade investment strategies at lower costs, making advanced portfolio management tools more accessible. Institutional investors are adopting AI to process large volumes of market data, enhance risk management, and execute high-frequency trading with improved precision and speed. High net worth individuals are benefitting from bespoke AI-driven advisory services that offer personalized insights and strategies tailored to their complex financial profiles. In all these segments, AI integration facilitates better decision-making through enhanced analytics and real-time data monitoring. This segmentation not only highlights the diverse needs of different investor groups but also underscores the transformative impact of AI technologies, fostering a more dynamic and inclusive wealth management ecosystem.

Ai In Wealth Management Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ai In Wealth Management Industry

FinTech Innovations Inc.:

FinTech Innovations Inc. is a leading provider of AI-powered wealth management solutions, offering cutting-edge algorithms and data analytics tools that support enhanced portfolio optimization and risk management. Their global platform integrates advanced machine learning with client-specific advisory services.WealthTech Global:

WealthTech Global is renowned for its comprehensive AI-driven systems that cater to both institutional and retail investors. The company is at the forefront of digital transformation in financial services, consistently innovating to provide personalized, secure, and efficient wealth management solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of ai In Wealth Management?

The AI in Wealth Management market is projected to reach $3.4 billion by 2033, growing from a baseline figure, with a compound annual growth rate (CAGR) of 10.8%, indicating robust expansion in this sector driven by technological advancements.

What are the key market players or companies in this ai In Wealth Management industry?

Key players in the AI in Wealth Management industry include technology giants, financial service firms, and startups focusing on leveraging AI for investment strategies, client engagement, and risk management, marking a diverse competitive landscape.

What are the primary factors driving the growth in the ai In Wealth Management industry?

Growth in the AI in Wealth Management industry is driven by the increasing adoption of big data analytics, enhanced customer experience expectations, and the push for more personalized investment solutions that AI technologies facilitate.

Which region is the fastest Growing in the ai In Wealth Management?

North America is the fastest-growing region in the AI in Wealth Management market, projected to grow from $1.15 billion in 2024 to $2.99 billion by 2033, highlighting a significant opportunity for innovation and investment in this sector.

Does ConsaInsights provide customized market report data for the ai In Wealth Management industry?

Yes, ConsaInsights offers customized market report data tailored to client needs in the AI in Wealth Management industry, enabling businesses to obtain detailed insights specific to their strategic objectives and market conditions.

What deliverables can I expect from this ai In Wealth Management market research project?

Expect comprehensive deliverables including detailed market analysis reports, sector trends, competitor insights, growth forecasts, and actionable recommendations that will support strategic decision-making in the AI in Wealth Management sector.

What are the market trends of ai In Wealth Management?

Current market trends include the rise of robo-advisory services, increased use of cloud-based solutions, and growing emphasis on personalized client engagement strategies powered by AI-driven insights and analytics.