Ai In Insurance Market Size

Published Date: 24 January 2026 | Report Code: ai-in-insurance-market-size

Ai In Insurance Market Size Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report analyzes the artificial intelligence (AI) market within the insurance industry spanning 2024 to 2033. It provides in-depth insights into market size, growth rate, segmentation, regional performances, industry challenges, and emerging trends. Key developments in technology integration and operational efficiency are highlighted to aid strategic decision-making. The report also offers predictive analytics and actionable insights.

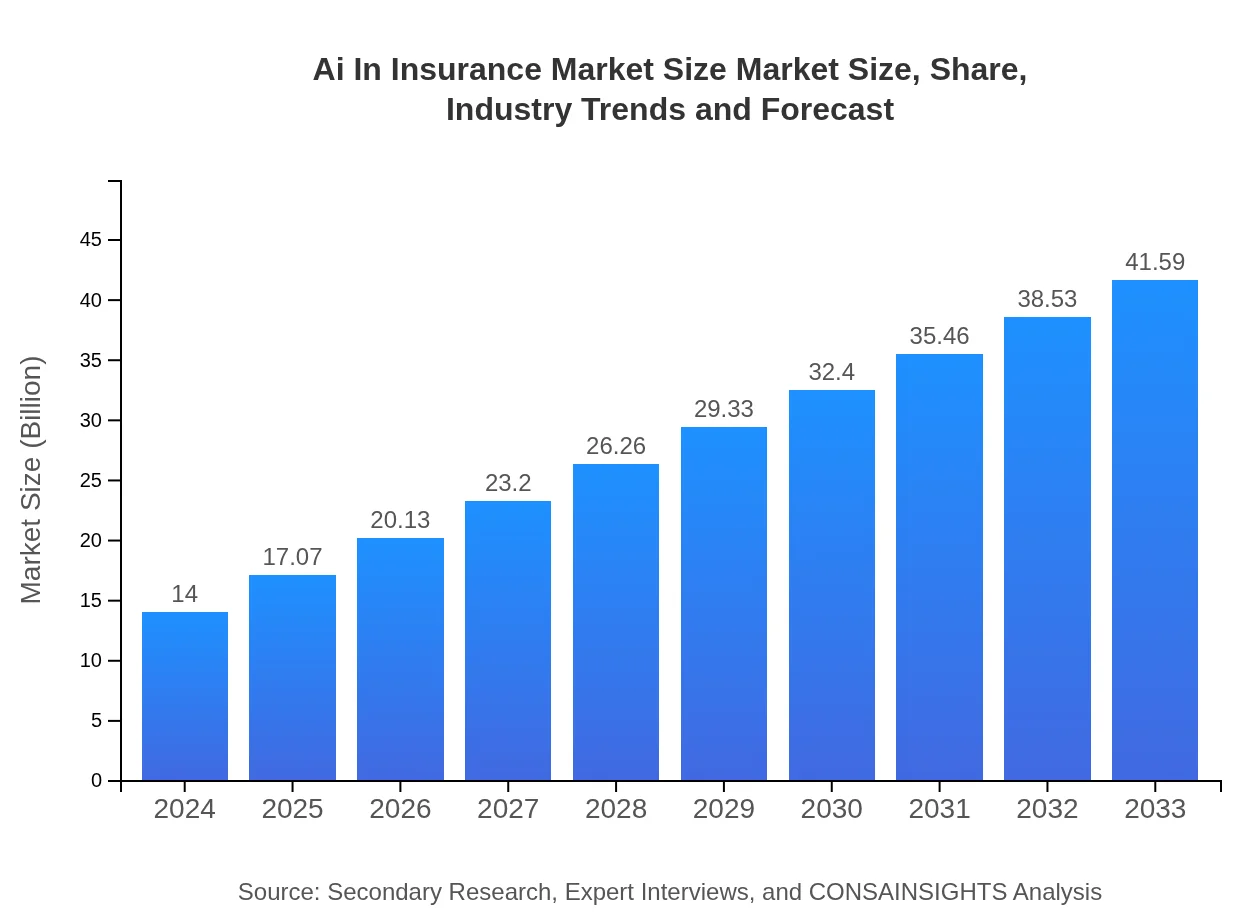

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

| 2024 Market Size | $14.00 Billion |

| CAGR (2024-2033) | 12.3% |

| 2033 Market Size | $41.59 Billion |

| Top Companies | Company Alpha, Company Beta |

| Last Modified Date | 24 January 2026 |

Ai In Insurance Market Size Market Overview

Customize Ai In Insurance Market Size market research report

- ✔ Get in-depth analysis of Ai In Insurance Market Size market size, growth, and forecasts.

- ✔ Understand Ai In Insurance Market Size's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ai In Insurance Market Size

What is the Market Size & CAGR of Ai In Insurance Market Size market in 2024?

Ai In Insurance Market Size Industry Analysis

Ai In Insurance Market Size Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ai In Insurance Market Size Market Analysis Report by Region

Europe Ai In Insurance Market Size:

Europe exhibits steady advancement in the AI in Insurance space, with market value expected to rise from $3.59 billion in 2024 to $10.67 billion in 2033. Regulatory support and digital transformation initiatives are major contributors to this sustained growth.Asia Pacific Ai In Insurance Market Size:

In Asia Pacific, the market is evolving rapidly with significant investments in digital infrastructure and innovative AI solutions. The region is anticipated to grow from $3.04 billion in 2024 to approximately $9.04 billion in 2033, driven by proactive digitization initiatives and strong governmental support for technology integration.North America Ai In Insurance Market Size:

North America leads the AI in Insurance market with robust early adoption reflected by a 2024 market size of $4.95 billion, projected to surge to $14.71 billion by 2033. A mature technological ecosystem, high consumer demand, and continuous innovation are key growth drivers here.South America Ai In Insurance Market Size:

South America, albeit modest with a market size of $1.01 billion in 2024, is set for dynamic expansion reaching around $3.00 billion by 2033. Increasing focus on digital transformation and regulatory improvements are fostering a favorable growth environment in the region.Middle East & Africa Ai In Insurance Market Size:

The Middle East and Africa region is experiencing gradual but positive growth, with market figures increasing from $1.40 billion in 2024 to approximately $4.16 billion by 2033. Investments in AI coupled with modernization initiatives are driving improved market dynamics in this region.Tell us your focus area and get a customized research report.

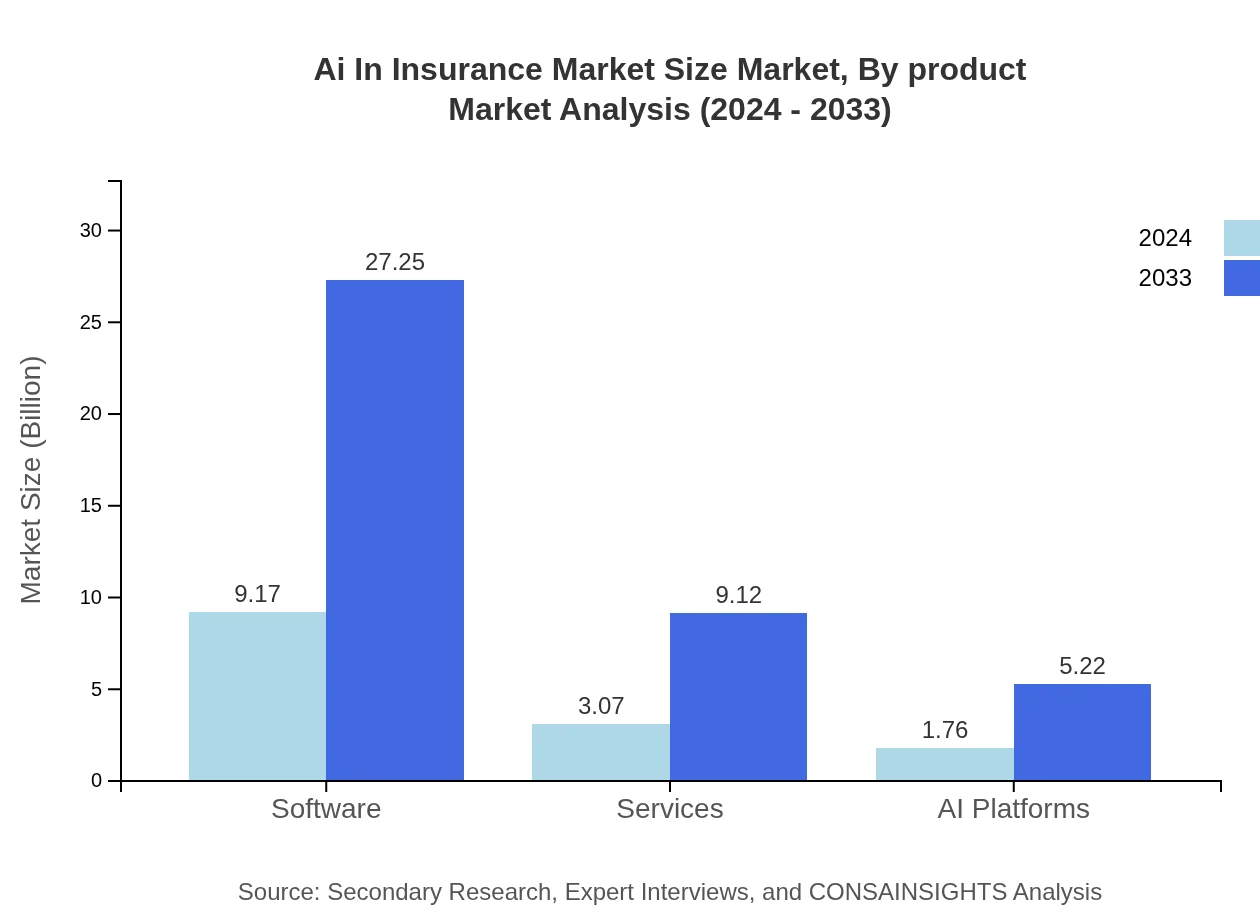

Ai In Insurance Market Size Market Analysis By Product

The ‘by-product’ segment in the AI in Insurance market covers software solutions, service offerings, and dedicated AI platforms. In 2024, software solutions recorded a market size of approximately $9.17 billion with a stable market share of around 65.52%. Complementary service offerings and AI platforms further enhance the overall product mix. As innovations continue and operational demands increase, these products are poised to drive efficiency and revenue growth, making them a cornerstone of digital transformation strategies within the insurance sector.

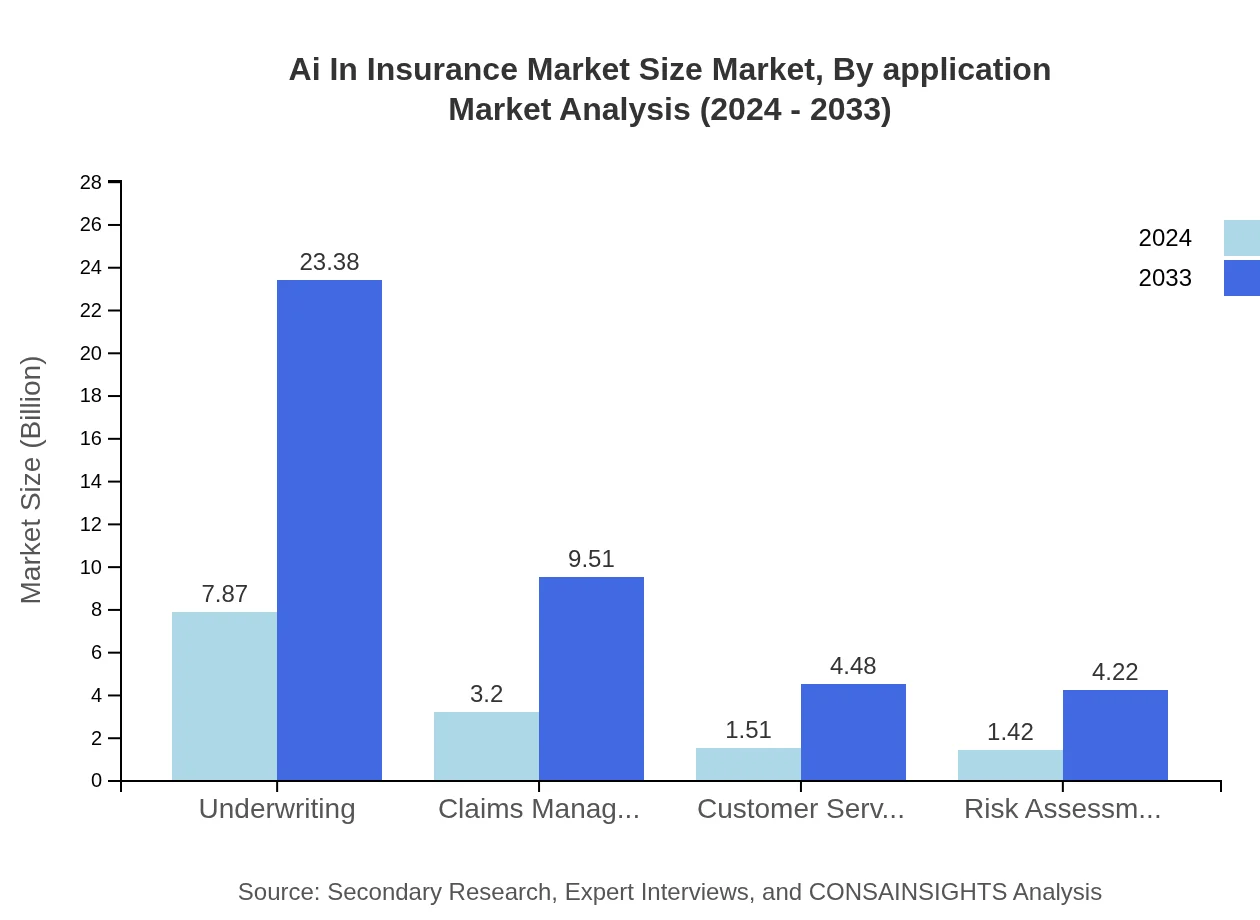

Ai In Insurance Market Size Market Analysis By Application

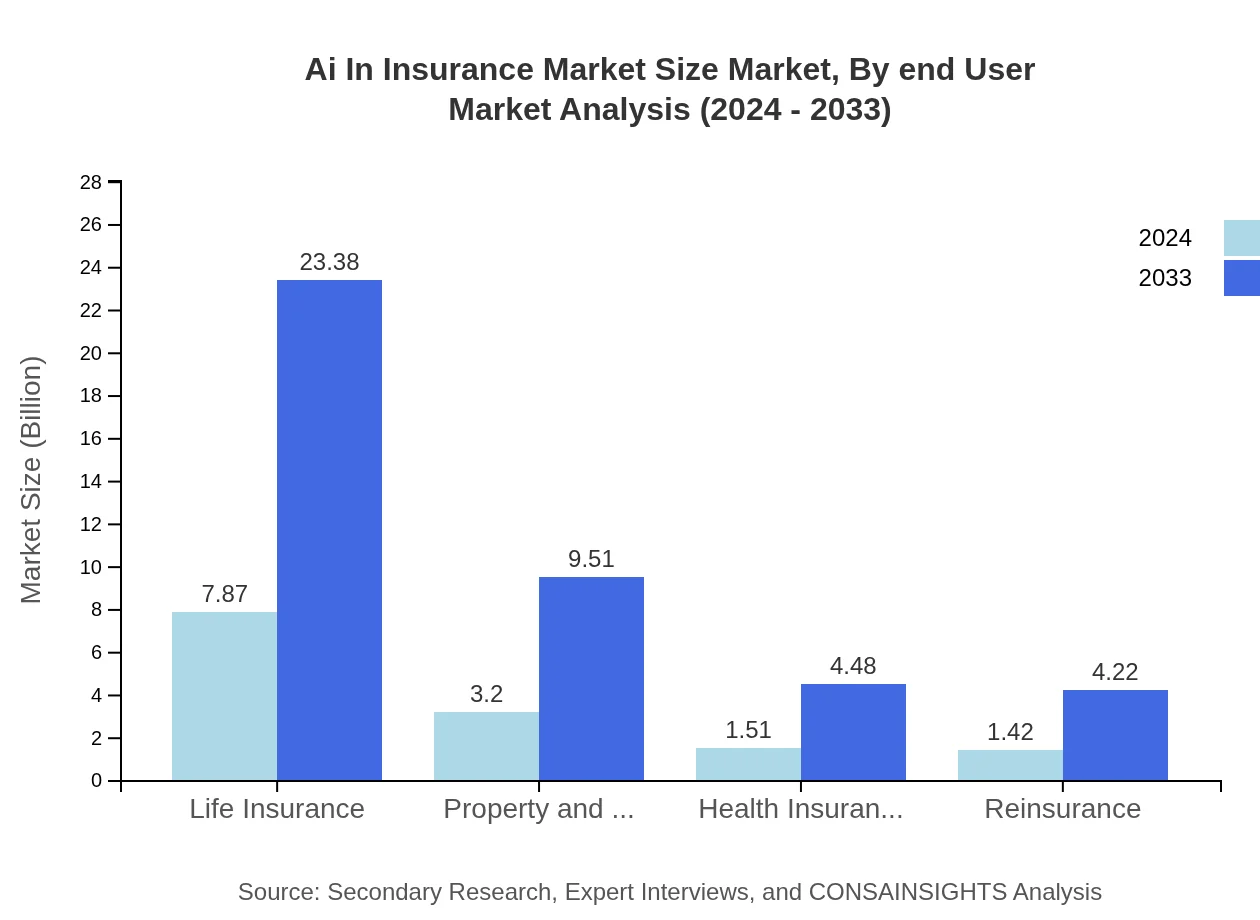

In the ‘by-application’ segment, AI implementations are tailored for diverse insurance sectors such as life insurance, property & casualty, health insurance, and reinsurance. Life insurance applications, for instance, demonstrate strong performance with reliable market figures, while property & casualty segments see enhanced claims automation and risk assessment. Health insurance benefits from improved underwriting and personalized service offerings. The integration of advanced AI models across these applications has streamlined operations and boosted efficiency, showcasing the inherent value of application-specific strategies in the evolving insurance landscape.

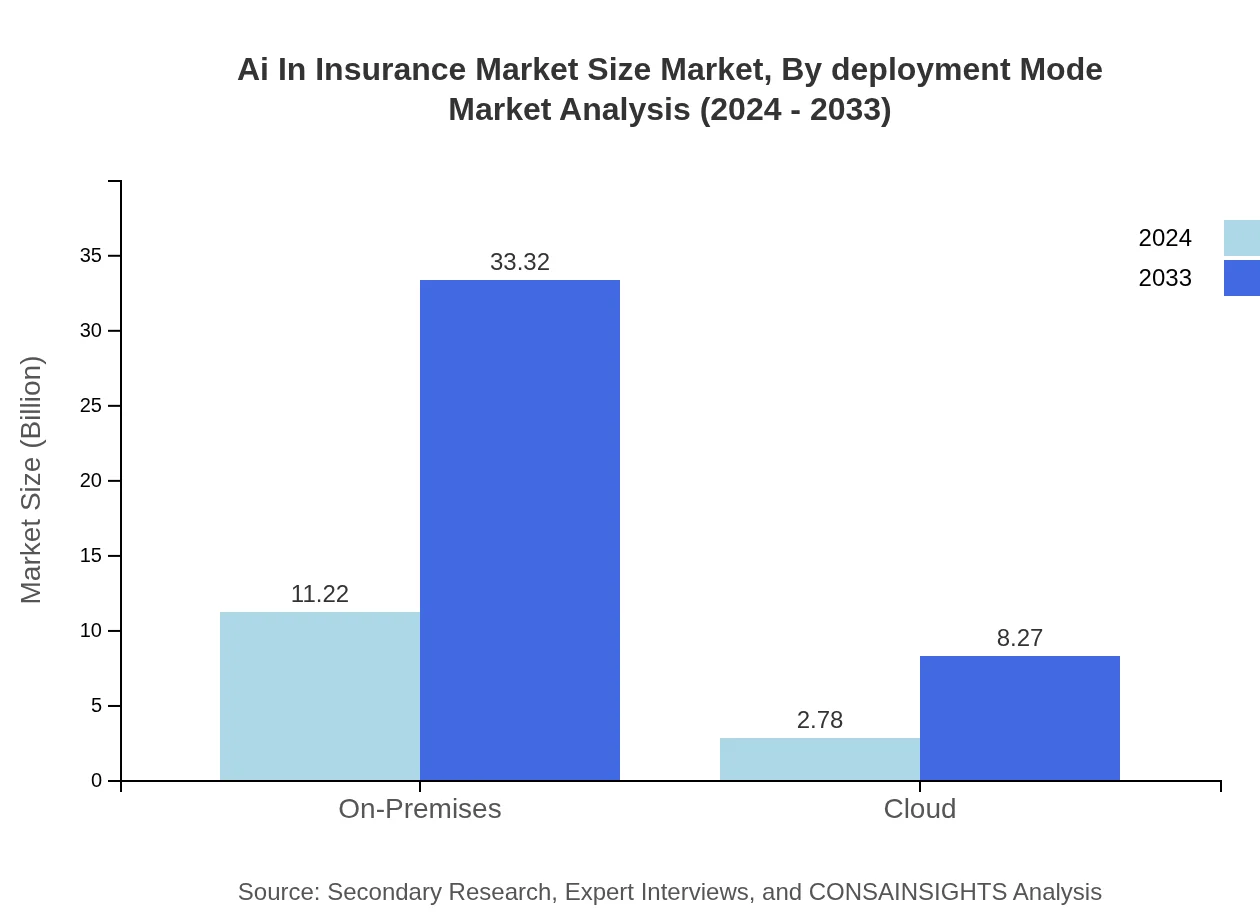

Ai In Insurance Market Size Market Analysis By Deployment Mode

The ‘by-deployment-mode’ segment scrutinizes the evolving trends between on-premises and cloud-based AI solutions. In 2024, on-premises deployments dominated with a market size of around $11.22 billion and a corresponding share of 80.11%, reflecting a preference for custom, secure solutions. Meanwhile, cloud-based deployments, valued at approximately $2.78 billion with a 19.89% share, are gaining momentum due to their scalability and cost efficiency. This balance between traditional and modern deployment strategies underscores the complex decision-making processes influencing digital transformation in the insurance industry.

Ai In Insurance Market Size Market Analysis By End User

The ‘by-end-user’ segment focuses on the broad spectrum of insurance entities that harness AI-driven tools. This includes traditional insurers, reinsurers, brokers, and emerging digital-first insurance firms. These end-users are leveraging advanced AI capabilities to optimize underwriting, claims management, and customer service. Enhanced analytics and predictive models are empowering these organizations to drive efficiency, reduce operational costs, and improve customer engagement. As a result, the end-user segment is critical in facilitating widespread adoption of AI solutions, thereby reshaping traditional business models and contributing significantly to market growth.

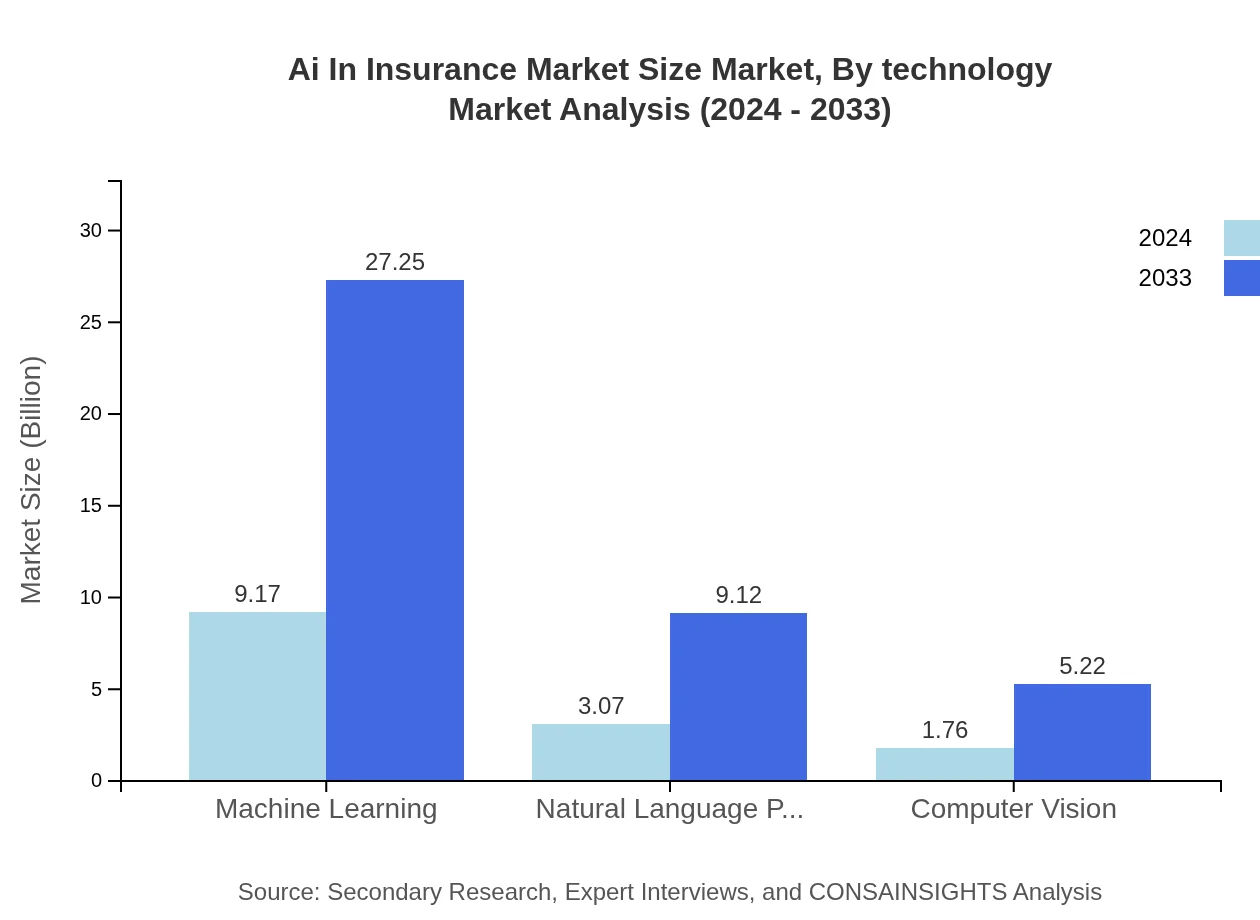

Ai In Insurance Market Size Market Analysis By Technology

The ‘by-technology’ segment dissects the impact of core AI innovations on the insurance industry, focusing on machine learning, natural language processing, and computer vision. Machine learning stands at the forefront, enabling predictive analytics and risk modeling with a substantial market presence. Natural language processing enhances customer interactions and automates service support, while computer vision contributes to more accurate claims verification and fraud detection. Together, these technologies are driving comprehensive digital transformation, enhancing operational efficiency, and offering competitive advantages that are instrumental in redefining the industry’s future landscape.

Ai In Insurance Market Size Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ai In Insurance Market Size Industry

Company Alpha:

Company Alpha leverages state-of-the-art AI algorithms to streamline underwriting, claims processing, and customer service. With a focus on innovation and efficiency, it sets industry benchmarks through robust data analytics and strategic technology partnerships.Company Beta:

Company Beta integrates advanced machine learning and natural language processing in its insurance solutions, delivering enhanced risk profiling and customer engagement. Its commitment to digital transformation and strategic collaborations continuously drives growth and market leadership.We're grateful to work with incredible clients.